albert Chan

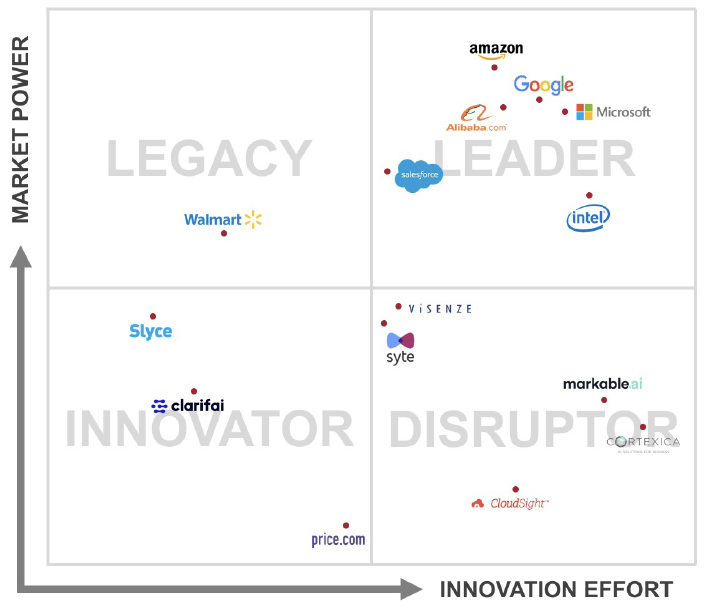

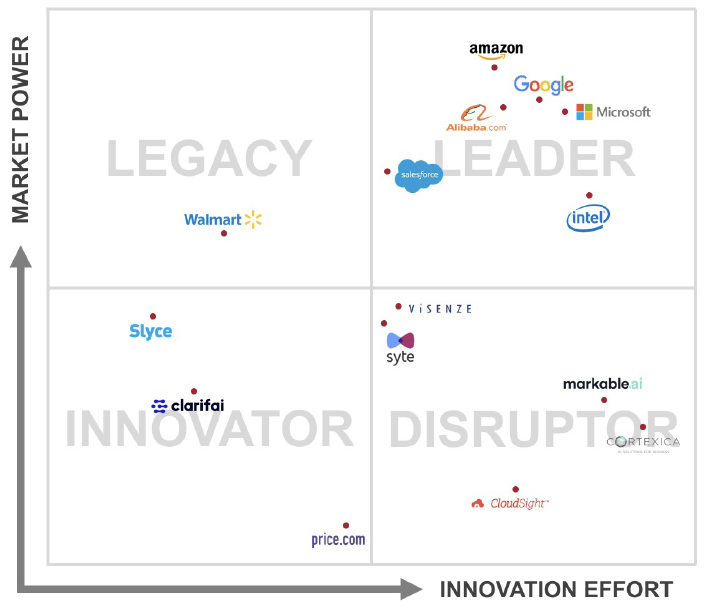

About the Coresight Matrix

With this report, we introduce the Coresight Matrix, a new product designed to help our subscribers better understand a number of segments and key players within the retail-technology industry. Our analysts are seeing the digitalization of the retail world and are helping clients achieve their digitalization and innovation strategies.

From our work with clients across large companies and small startups, we discovered that many need information on cutting-edge retail-technology, such as computer vision, visual reality, augmented reality and mass customization. They want to know who the leading players in the market are, which firms are driving improvements in these technologies, which startups might be the next rising stars and which startups big companies should be looking to work with.

The Coresight Matrix helps to answer those questions, by leveraging our expertise at the intersection of retail and technology, supported by our proprietary qualitative data analysis. We identify, evaluate and then position key players within the selected market based on two criteria:

Source: Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Google, Microsoft, Amazon and Alibaba are already leveraging the power of computer vision technology in their services. Below, we detail the companies featured in the top right corner of the Matrix, representing strong market power and leaders within the space.

Source: Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Google, Microsoft, Amazon and Alibaba are already leveraging the power of computer vision technology in their services. Below, we detail the companies featured in the top right corner of the Matrix, representing strong market power and leaders within the space.

Source: Coresight Research[/caption]

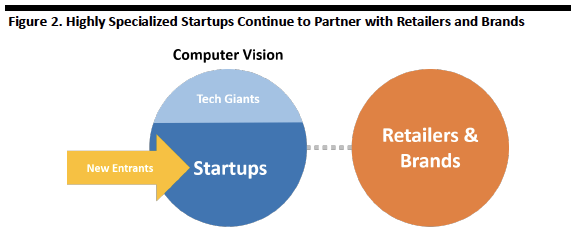

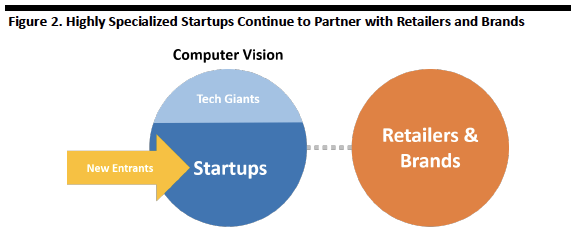

In 2019, we expect more retailers and brands to adopt computer vision through collaboration with startups focusing on this technology. Below, we detail the companies featured in the bottom half of the Coresight Matrix, representing strong innovation effort and disruptors.

Source: Coresight Research[/caption]

In 2019, we expect more retailers and brands to adopt computer vision through collaboration with startups focusing on this technology. Below, we detail the companies featured in the bottom half of the Coresight Matrix, representing strong innovation effort and disruptors.

- Innovation Effort: How much effort and progress the company has made to improve its products, technology and innovation strategy in general.

- Market Power: Where the company sits in the industry now and how much impact it could have in the market.

Source: Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Google, Microsoft, Amazon and Alibaba are already leveraging the power of computer vision technology in their services. Below, we detail the companies featured in the top right corner of the Matrix, representing strong market power and leaders within the space.

Source: Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Google, Microsoft, Amazon and Alibaba are already leveraging the power of computer vision technology in their services. Below, we detail the companies featured in the top right corner of the Matrix, representing strong market power and leaders within the space.

Google’s Lens technology enables smartphone cameras to identify and search for objects based on how they look. It can now recognize more than 1 billion products from Google Shopping, Google’s retail and price comparison portal. The number of products covered quadrupled in the past year. Google Lens is leading the market with its broad application and its ability to analyze whatever content is in the camera at any moment.

Google’s Lens technology enables smartphone cameras to identify and search for objects based on how they look. It can now recognize more than 1 billion products from Google Shopping, Google’s retail and price comparison portal. The number of products covered quadrupled in the past year. Google Lens is leading the market with its broad application and its ability to analyze whatever content is in the camera at any moment.

Microsoft’s Bing Visual Search enriches customers’ shopping experience with visually similar images and products and makes recommendations accordingly. It also identifies barcodes and extracts text information from images. Microsoft Bing is leading the market through its high technical ability to find images that are similar to the composition of the target photo.

Microsoft’s Bing Visual Search enriches customers’ shopping experience with visually similar images and products and makes recommendations accordingly. It also identifies barcodes and extracts text information from images. Microsoft Bing is leading the market through its high technical ability to find images that are similar to the composition of the target photo.

Amazon Rekognition allows customers to identify objects, people, text and activities. Amazon has also leveraged the power of computer vision in building its checkout-free convenience store, Amazon Go. Amazon Rekognition is leading the market through high sentiment analysis capabilities, deep learning algorithms, advanced face comparison and search features.

Amazon Rekognition allows customers to identify objects, people, text and activities. Amazon has also leveraged the power of computer vision in building its checkout-free convenience store, Amazon Go. Amazon Rekognition is leading the market through high sentiment analysis capabilities, deep learning algorithms, advanced face comparison and search features.

In China, computer vision is a key technology supporting Alibaba’s “New Retail” ecosystem, from searching for relevant products to running unstaffed stores. Alibaba is leading the China market by creating a well-rounded artificial intelligence ecosystem in which computer vision is a major focus.

In China, computer vision is a key technology supporting Alibaba’s “New Retail” ecosystem, from searching for relevant products to running unstaffed stores. Alibaba is leading the China market by creating a well-rounded artificial intelligence ecosystem in which computer vision is a major focus.

Source: Coresight Research[/caption]

In 2019, we expect more retailers and brands to adopt computer vision through collaboration with startups focusing on this technology. Below, we detail the companies featured in the bottom half of the Coresight Matrix, representing strong innovation effort and disruptors.

Source: Coresight Research[/caption]

In 2019, we expect more retailers and brands to adopt computer vision through collaboration with startups focusing on this technology. Below, we detail the companies featured in the bottom half of the Coresight Matrix, representing strong innovation effort and disruptors.

Markable.ai provides computer vision-based visual-recognition application programming interfaces (APIs) and software development kits (SDKs) to brands and retailers. Viewers can click or hover over the clothing they see while watching TV shows, movies and other digital media, and Markable generates both exact and visually similar product results. Markable has expertise in applying its technology to the fashion industry.

Markable.ai provides computer vision-based visual-recognition application programming interfaces (APIs) and software development kits (SDKs) to brands and retailers. Viewers can click or hover over the clothing they see while watching TV shows, movies and other digital media, and Markable generates both exact and visually similar product results. Markable has expertise in applying its technology to the fashion industry.

Cortexica provides artificial intelligence based visual search, video analytics and image recognition to retailers, pharmaceutical companies and manufacturing. The company’s findSimilar Fashion software matches images of fashion items and finds similar products within the retailer’s database. Its findSimilar Shoes software can recognize shape, as well as color, pattern, and distinctive marks. Cortexica’s team has a strong background in bio-engineering. The company has built on its innovation, replicating the functionality of parts of the human visual cortex.

Cortexica provides artificial intelligence based visual search, video analytics and image recognition to retailers, pharmaceutical companies and manufacturing. The company’s findSimilar Fashion software matches images of fashion items and finds similar products within the retailer’s database. Its findSimilar Shoes software can recognize shape, as well as color, pattern, and distinctive marks. Cortexica’s team has a strong background in bio-engineering. The company has built on its innovation, replicating the functionality of parts of the human visual cortex.

Syte.ai develops visual search solutions for retailers, publishers, influencers and consumers with a focus on fashion products. Syte.ai works with retailers such as Marks & Spencer, Boohoo, Farfetch, Khol’s, Myntra and Intu. It also partners with Samsung to provide visual search technology. Syte is an outstanding computer vision startup that has worked with leading retailers and is expanding its business.

Syte.ai develops visual search solutions for retailers, publishers, influencers and consumers with a focus on fashion products. Syte.ai works with retailers such as Marks & Spencer, Boohoo, Farfetch, Khol’s, Myntra and Intu. It also partners with Samsung to provide visual search technology. Syte is an outstanding computer vision startup that has worked with leading retailers and is expanding its business.

ViSenze provides AI-based visual search and image recognition solutions that help e-commerce retailers improve revenue and conversions. ViSenze works with retailers such as Rakuten, Uniqlo, Zalora and ASOS. It is supported by MasterCard Startpath and Unilever Foundry. ViSenze is backed by the Japanese ecommerce giant Rakuten and has a close connection to the National University of Singapore. We believe ViSenze has great potential due to its financial and technical capability.

ViSenze provides AI-based visual search and image recognition solutions that help e-commerce retailers improve revenue and conversions. ViSenze works with retailers such as Rakuten, Uniqlo, Zalora and ASOS. It is supported by MasterCard Startpath and Unilever Foundry. ViSenze is backed by the Japanese ecommerce giant Rakuten and has a close connection to the National University of Singapore. We believe ViSenze has great potential due to its financial and technical capability. Slyce, a visual recognition company, has partnered with at least 50 companies, including retailers such as Home Depot, Bed Bath and Beyond, Neiman Marcus and Macy's. Slyce works with many leading players in the retail industry, assisting them to digitalize their businesses.

Slyce, a visual recognition company, has partnered with at least 50 companies, including retailers such as Home Depot, Bed Bath and Beyond, Neiman Marcus and Macy's. Slyce works with many leading players in the retail industry, assisting them to digitalize their businesses.

- Computer vision technology can automatically tag images with many possible words that the algorithms thinks apply to the image.

- Auto tagging eliminates the need to manually tag images, and significantly increases the number of terms per image.

- Visual search technology allows faster identification of similar items that are in stock on a retailer’s website, offering more complete-the-look features that often rely on information that developers input and hard code manually.