About the Coresight Matrix

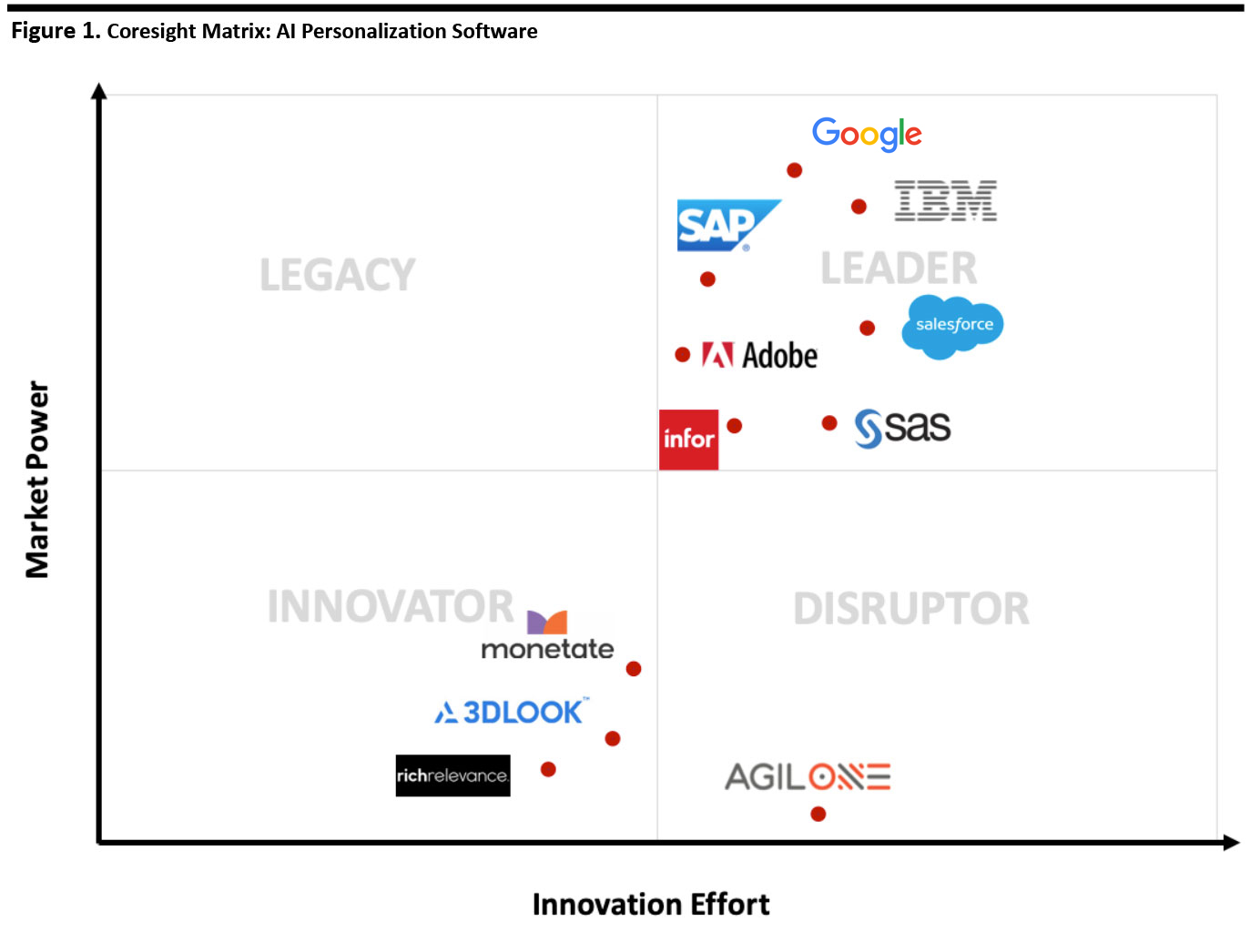

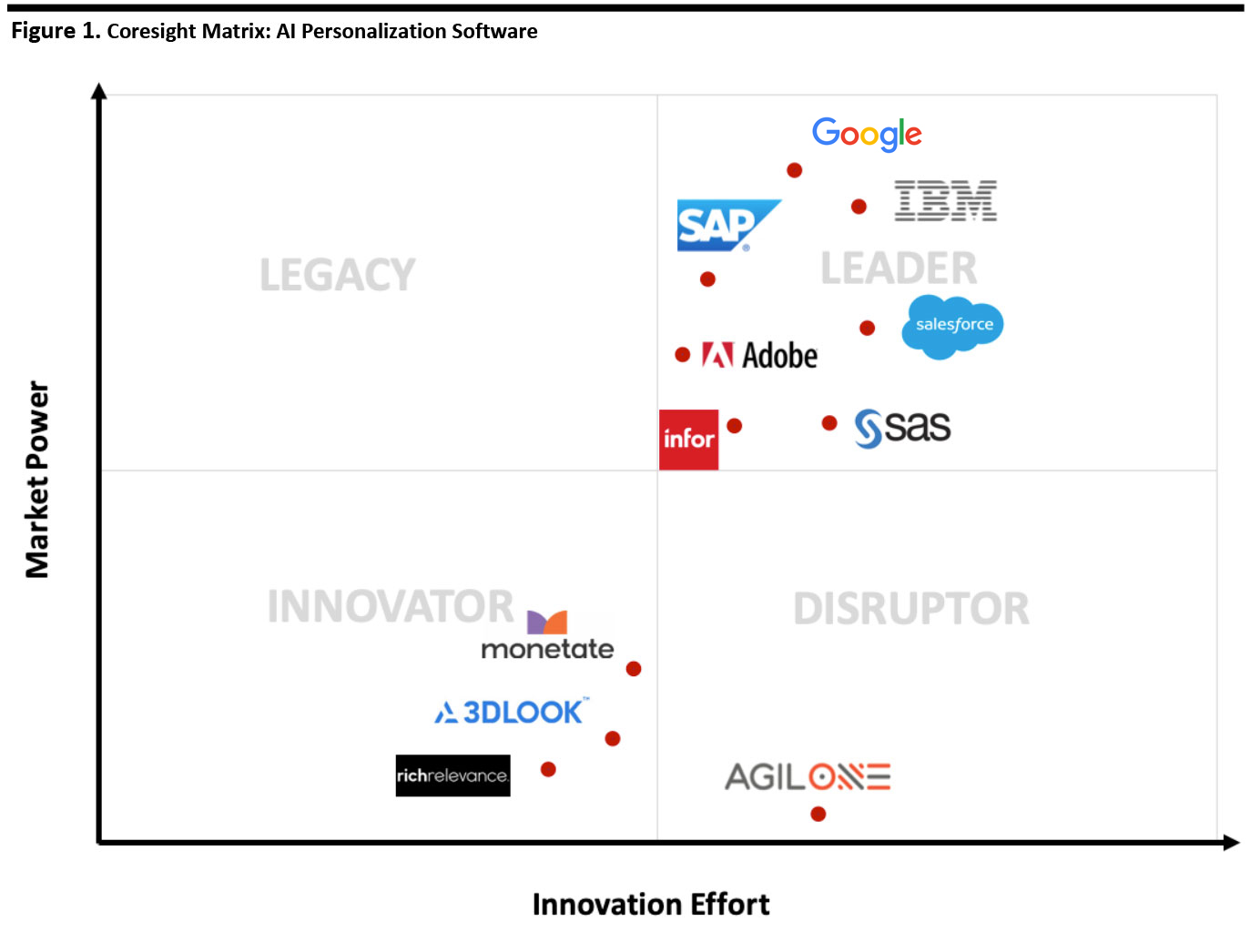

This report highlights the Coresight Matrix, which is designed to help readers better understand essential segments and key players in retail technology.

From our work with clients from large companies to small startups, we discovered many need information on cutting-edge retail-technology, such as computer vision, visual reality, augmented reality and mass customization. Leading retailers want to know who the key players in the market are, which firms are driving improvements in these technologies, which startups might be the next rising stars and which startups big companies should consider working with.

The Coresight Matrix helps answer those questions, by leveraging our expertise at the intersection of retail and technology, supported by our proprietary qualitative data analysis. We identify, evaluate and then position key players within the selected market based on two criteria:

- Innovation Effort: How much effort and progress the company has made to improve its products, technology and innovation strategy in general.

- Market Power: Where the company sits in the industry now and how much impact it could have in the market.

Later in this report, we include a market overview and provide more details about our methodology. The figure below presents our matrix for AI personalization software. The companies in our matrix represent large technology and software firms, retailers and startup vendors that work with retailers and other companies. Due to the emerging nature of the sector, companies occupy the leader, innovator and disruptor quadrants – there are no legacy players.

[caption id="attachment_99480" align="aligncenter" width="700"]

Source: Grata Data/company reports/Coresight Research

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Adobe, Google, IBM, Salesforce and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detail the companies featured in the top right corner of the Matrix, which have market power and are leaders in the space.

Adobe’s

Adobe’s Experience Cloud uses its Sensei machine-learning technology to create AI personalization, including predictive analytics (anomaly detection, contribution analytics and segment compare), management and personalization (adding metadata to assets, recommending offers and generating different copy versions) and optimizing ad spending. Adobe Target uses Sensei to offer experimentation and learning, content optimization and rules-based personalization.

AgilOne

AgilOne offers a customer data platform for enterprises that aims to unify all data in one system to drive customer and prospect interactions. Its platform aims to create a single view of the customer, creating a single identity with clean data, comprising a 360-degree profile of all events, campaigns and transactions. The platform is powered by analytics and customer machine learning to enable customer data activation and orchestration for outbound marketing systems, addressable media systems, CRM and customer experience systems.

Google’s

Google’s Recommendations AI platform, part of the Google Cloud, aims to offer personalized product recommendations at scale, taking data product catalog data and customer data, which works through a prediction application program interface (API) to generate recommendations at customer touchpoints. The platform adapts to real-time changes in customer behavior and variables such as assortment, pricing and special offers and boasts increases in click-through rates, conversions, recommendation-driven revenue and revenue per visit.

IBM

IBM offers three main products for personalized marketing which support rules-based personalization on one flexible platform, offering real-time responses and AI-powered personalization and content management. IBM Watson Real-Time Personalization enables visual management, targeted delivery and enhanced personal customer experiences, driven by AI. The IBM Watson Content Hub consists of a software-as-a-service (SaaS)-based platform for marketers to offer digital experiences. The IBM Universal Behavior Exchange connects an entire marketing ecosystem to develop a complete picture of customer behavior via data management.

Infor

Infor leverages its Coleman AI platform to create personalized experiences. Its AI platform enables data exploration and simplified machine-learning modeling, automation of routine tasks and its Coleman Digital Assistant uses natural language and voice recognition to drive automation within the enterprise.

Monetate

Monetate (which recently announced an agreement to be acquired by cloud-commerce company Kibo) offers personalization software for consumer-facing brands. Its AI-powered personalization engine enables brands to connect all their data sources to make intelligent decisions and create a more relevant and personalized customer experience.

RichRelevance

RichRelevance (to be acquired by Manthan Software) leverages AI technology to bridge the experience gap between marketing and commerce to help create memorable experiences that speak to individuals at scale, in real time and across the customer lifecycle.

Salesforce

Salesforce leverages its Einstein AI technology within its Commerce Cloud to offer memorable customer experiences and automate merchandising. Einstein Product Recommendations offers relevant, customized recommendations to shoppers, even unknown ones. The Predictive Sort functionality automatically tailors search and category pages based on every move the shopper makes, even micro-movements on mobile devices. Commerce Insights offers a dashboard to analyze shopper metrics with easy visual tools. Einstein Search Dictionaries learn popular new terms and recommend synonyms.

SAP’s

SAP’s Marketing Cloud offers dynamic customer profiling, marketing planning and performance measurement, orchestration of audiences, campaigns and journeys, with account-based marketing and marketing analytics. The marketing analytics module employs machine learning to gain better insights into customer behavior for the purpose of generating personalized customer engagements.

SAS

SAS offers AI solutions (including visual data mining and machine learning, natural language processing, computer vision and forecasting and optimization) as well as customer-intelligence tools that offer analytical marketing powered by predictive analytics and machine learning. Customers use SAS tools to predict customer conversion, which is used to generate personalized offers, as well as follow-up offers after cart abandonment. With neural networks, which analyze data from clickstream behavior, length of stay on certain pages, one retailer could identify 60% of visitors, enabling increased relevancy of displayed banners, greater customer satisfaction and revenue.

3DLook

3DLook offers a mobile app using AI-powered mobile scanning solution for e-commerce companies. The app uses advanced computer vision algorithms, 3D geometry and neural networks to accurately measure the human body from two photos taken on a mobile device, enabling consumers to find the right size and fit. Better fits enable e-commerce companies to increase conversion, decrease returns and improve customer engagement.

Other Coresight RetailTech 20 companies not included in the matrix and engaged in developing AI tools for personalization include:

- Amazon AWS AI Services offers image and video analysis, natural language, personalized recommendations, virtual assistants and forecasting to applications. Amazon Personalize is a machine-learning service that combines activity data from an application such as clicks, page views, signups and purchases with an inventory of items to recommend, such as news articles, products, videos and music, plus demographic data. The platform will process, examine and screen the data, select the right algorithms, and train and optimize a customized personalization model.

- Microsoft offers solutions within its Azure cloud-computing platform. Personalizer is an AI service that prioritizes content, layouts and conversations with no machine-learning expertise required. Microsoft also offers an architecture for developing personalized marketing solutions that leverages many of the company’s platforms, including its machine learning studio.

- NCR’s SmartAssist uses machine vision primarily to detect theft and fraud during the checkout process, but the same platform can also identify customers who are experiencing difficulties during self-checkout.

- Oracle’s Adaptive Intelligent Apps for Marketing include AI apps for the customer experience (CX) which create personalized recommendations for a single product or a set of products, based on data-science models running on commerce data, clickstream data and data from the Oracle Cloud. Its machine-learning models predict the combination of send-time, channel and message for each customer that offers the best performance.

- Tencent conducts AI research and development through three main arms. Tencent AI Lab has 70 AI scientists and 300 engineers focused on applications in games, social media, content and platform AI. Its YouTu Lab concentrates on leveraging large datasets collected from its social-media platforms. WeChat AI is developing new AI technologies in speech recognition, natural language processing, computer vision, data mining and machine learning.

Other companies engaged in AI personalization solutions include Accenture and Apple.

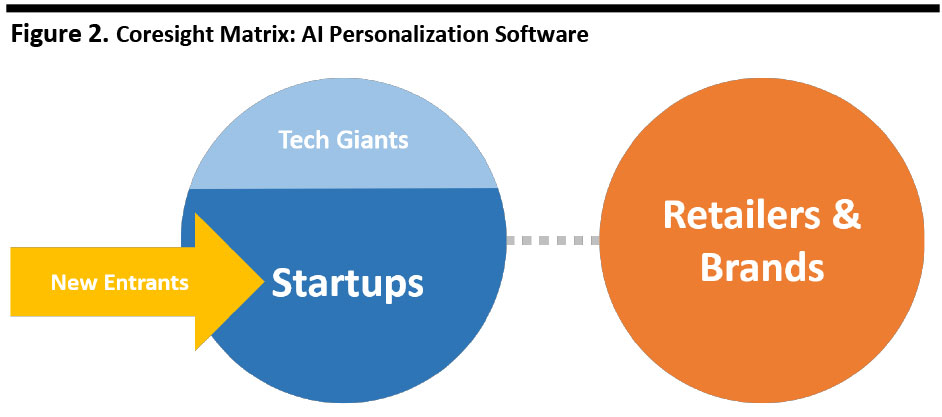

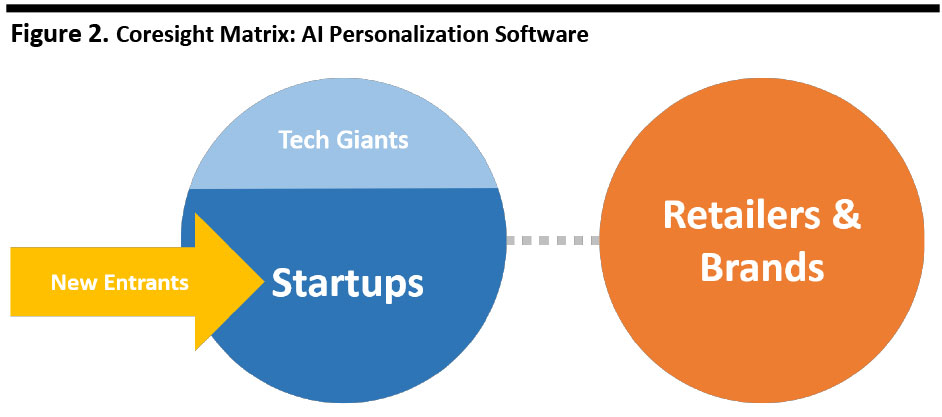

Large Versus Small Companies

Large companies increasingly recognize the enormous amount of technology developed by startups, and large retailers are likely to continue to acquire and form partnerships with startups for the foreseeable future. Companies across multiple sectors have launched collaborative efforts to gather disruptive new ideas, harness new technologies and achieve competitive edge.

[caption id="attachment_99464" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Retailers will increasingly rely on AI personalization software as they seek to develop personalized offers and promotions in an increasingly competitive retail environment. This robust market segment is likely to launch a healthy crop of innovators entering the supply-chain software analytics space.

AI Personalization Segment Overview

AI and its subset, machine learning, excel at pattern recognition and running algorithms that adapt and improve over time to incorporate new data, eliminating the need for constant human intervention.

In retail, AI can be used to:

- Understand customers better.

- Provide enhanced services.

- Offer a more seamless shopping journey.

- Entertain the customer during the shopping experience.

- Improve efficiency and enhance competitiveness.

AI/machine-learning technology enables compelling applications in marketing, where algorithms can consider customers’ purchase history, web pages visited, social media, interests and other data, to develop algorithms to generate personalized marketing messages that improve over time and are more likely to resonate with consumers.

Consumers are bombarded with and reject large numbers of marketing materials, so there is an enormous opportunity to develop targeted messages that can achieve a higher acceptance rate of being consumed. These personalized messages can be transmitted on websites, via physical displays, on social media or via e-mail.

Other AI marketing applications include generating personalized offers using chatbots to provide immediate service.

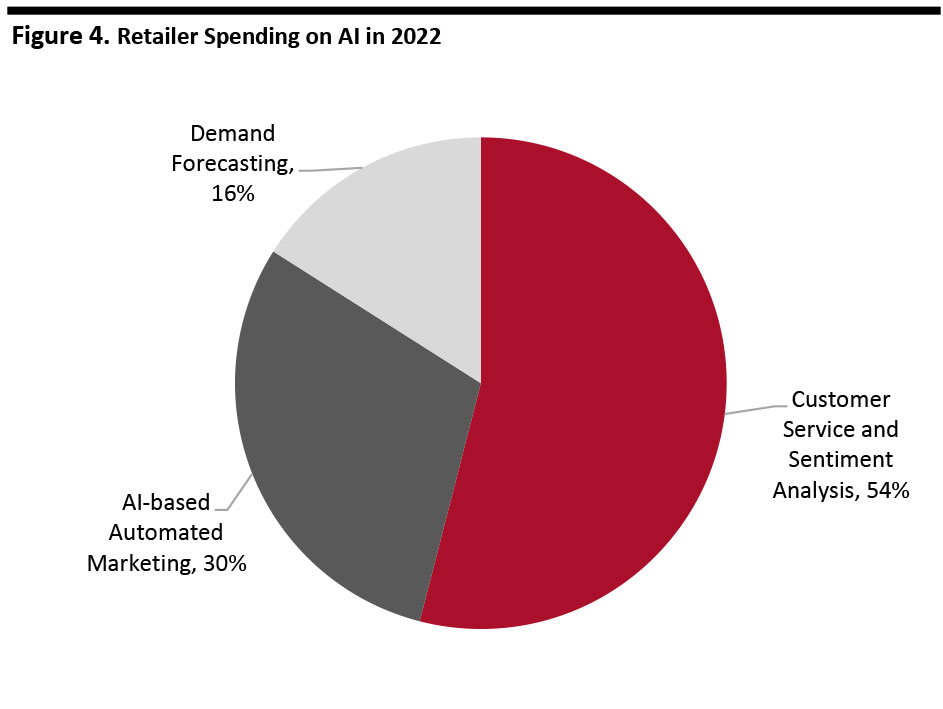

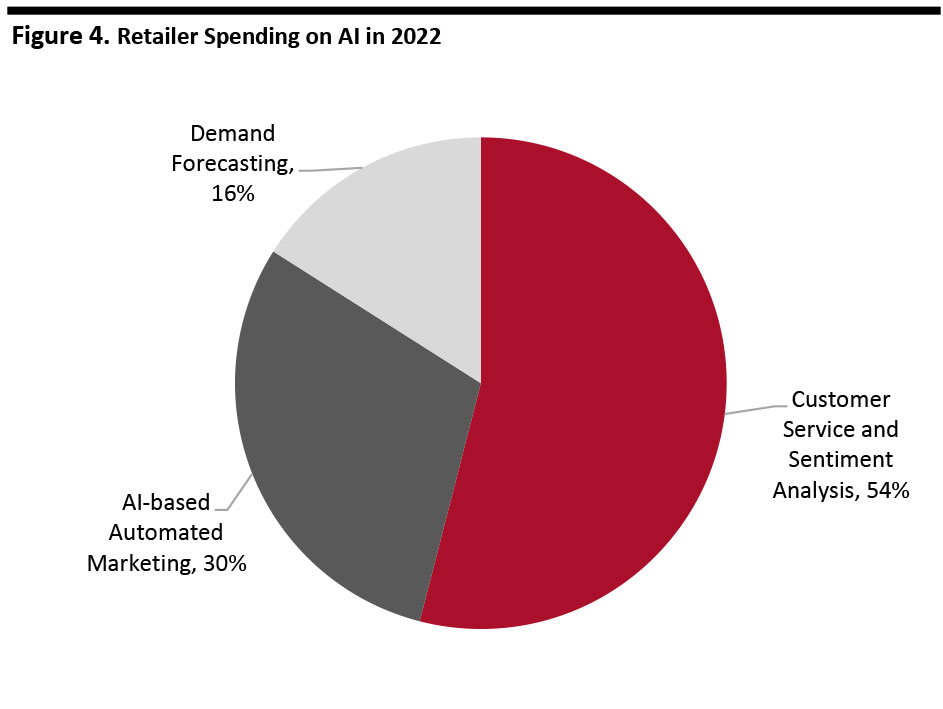

Figure four shows forecasted retailer spending on AI in three areas: customer service and sentiment analytics; automated marketing and demand forecasting – which form a virtuous circle: customer analytics create insights, which can be used to target automated marketing, and demand forecasting can drive the supply chain to satisfy that demand.

Market Overview: AI Personalization

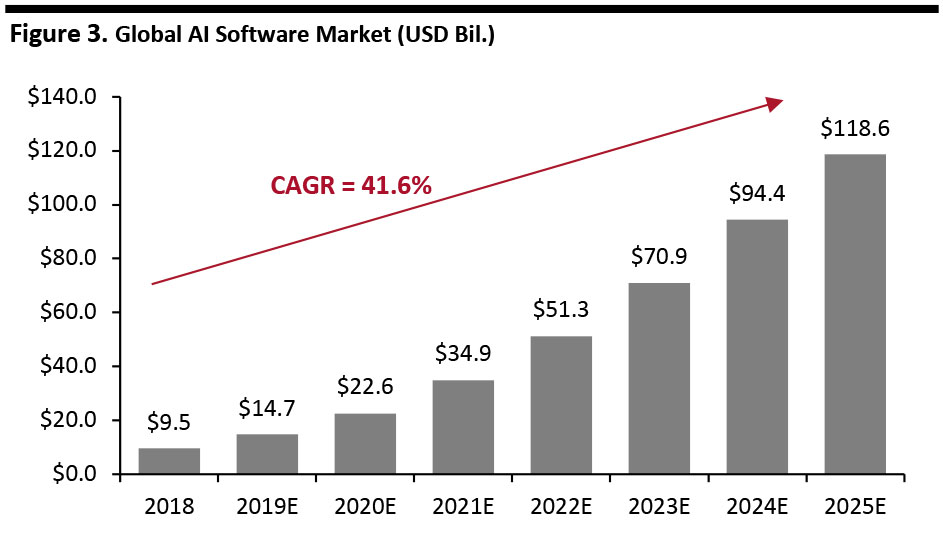

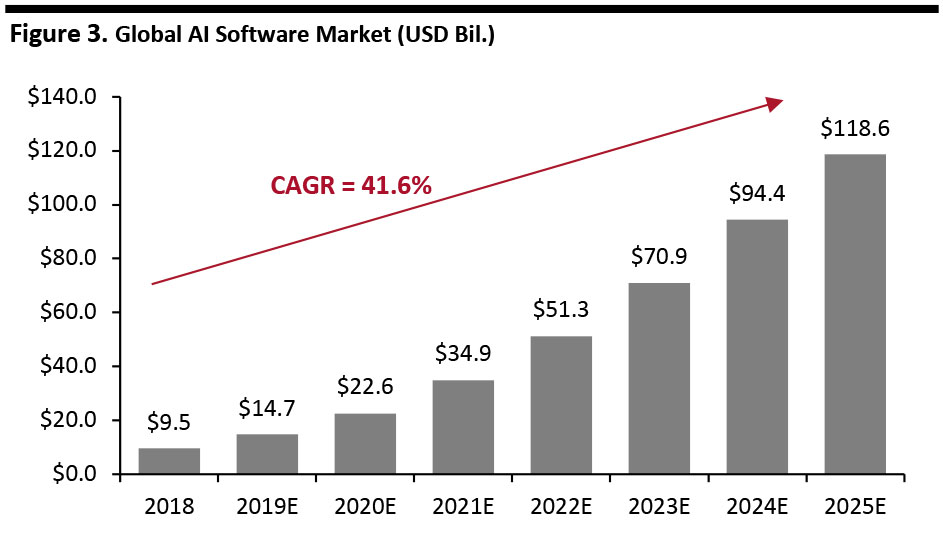

The global AI software market is estimated at $14.7 billion this year, growing at a 41.6% CAGR through 2025, based on estimates from Tractica.

[caption id="attachment_99465" align="aligncenter" width="700"]

Source: Tractica/Coresight Research

Source: Tractica/Coresight Research[/caption]

Within that market, the global AI personalization market is fragmented and is estimated at $450 million in 2019E, growing at a 14% CAGR during 2019E-2022E, based on estimates from Technavio.

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down retail AI spending in 2022E, we see that customer service and sentiment analysis are expected to account for more half of retailer spending on AI, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_99466" align="aligncenter" width="700"]

Source: Juniper Research

Source: Juniper Research[/caption]

How We Create the Coresight Matrix

Coresight Research rates companies based on proprietary quantitative and qualitative analysis methods to demonstrate market trends, such as direction, maturity and participants. By leveraging our analysts’ expertise in the intersection of retail and technology supported by key data sources, we developed a methodology to determine the top platforms offering computer vision-based solutions to enhance the product search experience.

We evaluate companies based on two criteria: innovation effort and market power. This is what we found:

Innovation effort (X axis): Coresight Research assesses companies’ innovation effort by evaluating product development, algorithm optimization, application expansion and technical research, looking at areas such as company patent filings and human capital investment. We normalize our innovation effort rating scores based on selected companies’ backgrounds, so smaller startups can compete with larger industry leaders on our matrix.

The values on the X-axis are a function of the company’s innovation intensity (based on patents and public-company information) plus a subjective evaluation of the company’s technological innovation in the subject area.

Market power (Y axis): Coresight Research assesses companies’ market power using two major metrics: value appropriation and value creation. Under value appropriation, we evaluate companies’ ability to operate efficiently and effectively, and to secure customers. Under value creation, we assess companies’ ability to make customers react to products efficiently and effectively and to create an emotional experience for customer engagement. In addition, we consider companies’ backgrounds and factors such as funding, market position and number of employees.

The values on the Y-axis are a function of the company’s revenue or a suitable proxy.

After evaluation, we place each company into one of four quadrants: Leader, Disruptor, Legacy or Innovator, as follows:

Leader companies have high market power and high innovation effort. Generally, they possess a strong industry background with enough funding and technical ability to conduct research and develop cutting-edge products and algorithms. We see their effort and progress as bringing products and team to the next level through further investment and development. We expect them to continue leading the market. These companies demonstrate a clear understanding of market needs, they are innovators and thought leaders and tend to have a presence in several geographical regions with a broad platform to support clients.

Disruptor companies have a high level of innovation effort. They have a strong core business team and a good reputation in this specific market. Most are highly specialized in the field and have a clear understanding of market needs. On the normalized matrix, we sometimes find companies in the disruptor quadrant have even higher innovation effort scores than industry leaders, due to disruptors’ highly focused effort and market understanding. These companies have the potential to become leaders as they build more credible market positions and gain resources to sustain continued growth.

Legacy companies hold large market share. The companies generally have a good market position and reputation in the industry but may have only recently started developing technology in this specific field. They have the funding and capability to develop a strong business, but may still be looking for the right strategy, and have the potential to move to the leader quadrant.

Innovator companies have high growth potential. Most are in the process of improving algorithms and technologies and are expanding the applications of existing products. They are seeking funding and have the potential to move to the disruptor quadrants.

For Further Information

Please refer to the following Coresight Research reports.

AI in Retail: Applications Across Customer-Facing Functions

AI in Retail: What Retailers Are Doing with AI

AI in Retail: What Startups Are Doing with AI

Innovator Intelligence: 3DLOOK

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Adobe, Google, IBM, Salesforce and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detail the companies featured in the top right corner of the Matrix, which have market power and are leaders in the space.

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Adobe, Google, IBM, Salesforce and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detail the companies featured in the top right corner of the Matrix, which have market power and are leaders in the space.

Infor leverages its Coleman AI platform to create personalized experiences. Its AI platform enables data exploration and simplified machine-learning modeling, automation of routine tasks and its Coleman Digital Assistant uses natural language and voice recognition to drive automation within the enterprise.

Infor leverages its Coleman AI platform to create personalized experiences. Its AI platform enables data exploration and simplified machine-learning modeling, automation of routine tasks and its Coleman Digital Assistant uses natural language and voice recognition to drive automation within the enterprise.

Monetate (which recently announced an agreement to be acquired by cloud-commerce company Kibo) offers personalization software for consumer-facing brands. Its AI-powered personalization engine enables brands to connect all their data sources to make intelligent decisions and create a more relevant and personalized customer experience.

Monetate (which recently announced an agreement to be acquired by cloud-commerce company Kibo) offers personalization software for consumer-facing brands. Its AI-powered personalization engine enables brands to connect all their data sources to make intelligent decisions and create a more relevant and personalized customer experience.

Salesforce leverages its Einstein AI technology within its Commerce Cloud to offer memorable customer experiences and automate merchandising. Einstein Product Recommendations offers relevant, customized recommendations to shoppers, even unknown ones. The Predictive Sort functionality automatically tailors search and category pages based on every move the shopper makes, even micro-movements on mobile devices. Commerce Insights offers a dashboard to analyze shopper metrics with easy visual tools. Einstein Search Dictionaries learn popular new terms and recommend synonyms.

Salesforce leverages its Einstein AI technology within its Commerce Cloud to offer memorable customer experiences and automate merchandising. Einstein Product Recommendations offers relevant, customized recommendations to shoppers, even unknown ones. The Predictive Sort functionality automatically tailors search and category pages based on every move the shopper makes, even micro-movements on mobile devices. Commerce Insights offers a dashboard to analyze shopper metrics with easy visual tools. Einstein Search Dictionaries learn popular new terms and recommend synonyms.

SAP’s Marketing Cloud offers dynamic customer profiling, marketing planning and performance measurement, orchestration of audiences, campaigns and journeys, with account-based marketing and marketing analytics. The marketing analytics module employs machine learning to gain better insights into customer behavior for the purpose of generating personalized customer engagements.

SAP’s Marketing Cloud offers dynamic customer profiling, marketing planning and performance measurement, orchestration of audiences, campaigns and journeys, with account-based marketing and marketing analytics. The marketing analytics module employs machine learning to gain better insights into customer behavior for the purpose of generating personalized customer engagements.

Source: Coresight Research[/caption]

Retailers will increasingly rely on AI personalization software as they seek to develop personalized offers and promotions in an increasingly competitive retail environment. This robust market segment is likely to launch a healthy crop of innovators entering the supply-chain software analytics space.

Source: Coresight Research[/caption]

Retailers will increasingly rely on AI personalization software as they seek to develop personalized offers and promotions in an increasingly competitive retail environment. This robust market segment is likely to launch a healthy crop of innovators entering the supply-chain software analytics space.

Source: Tractica/Coresight Research[/caption]

Within that market, the global AI personalization market is fragmented and is estimated at $450 million in 2019E, growing at a 14% CAGR during 2019E-2022E, based on estimates from Technavio.

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down retail AI spending in 2022E, we see that customer service and sentiment analysis are expected to account for more half of retailer spending on AI, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_99466" align="aligncenter" width="700"]

Source: Tractica/Coresight Research[/caption]

Within that market, the global AI personalization market is fragmented and is estimated at $450 million in 2019E, growing at a 14% CAGR during 2019E-2022E, based on estimates from Technavio.

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down retail AI spending in 2022E, we see that customer service and sentiment analysis are expected to account for more half of retailer spending on AI, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_99466" align="aligncenter" width="700"] Source: Juniper Research[/caption]

Source: Juniper Research[/caption]