DIpil Das

About the Coresight Matrix

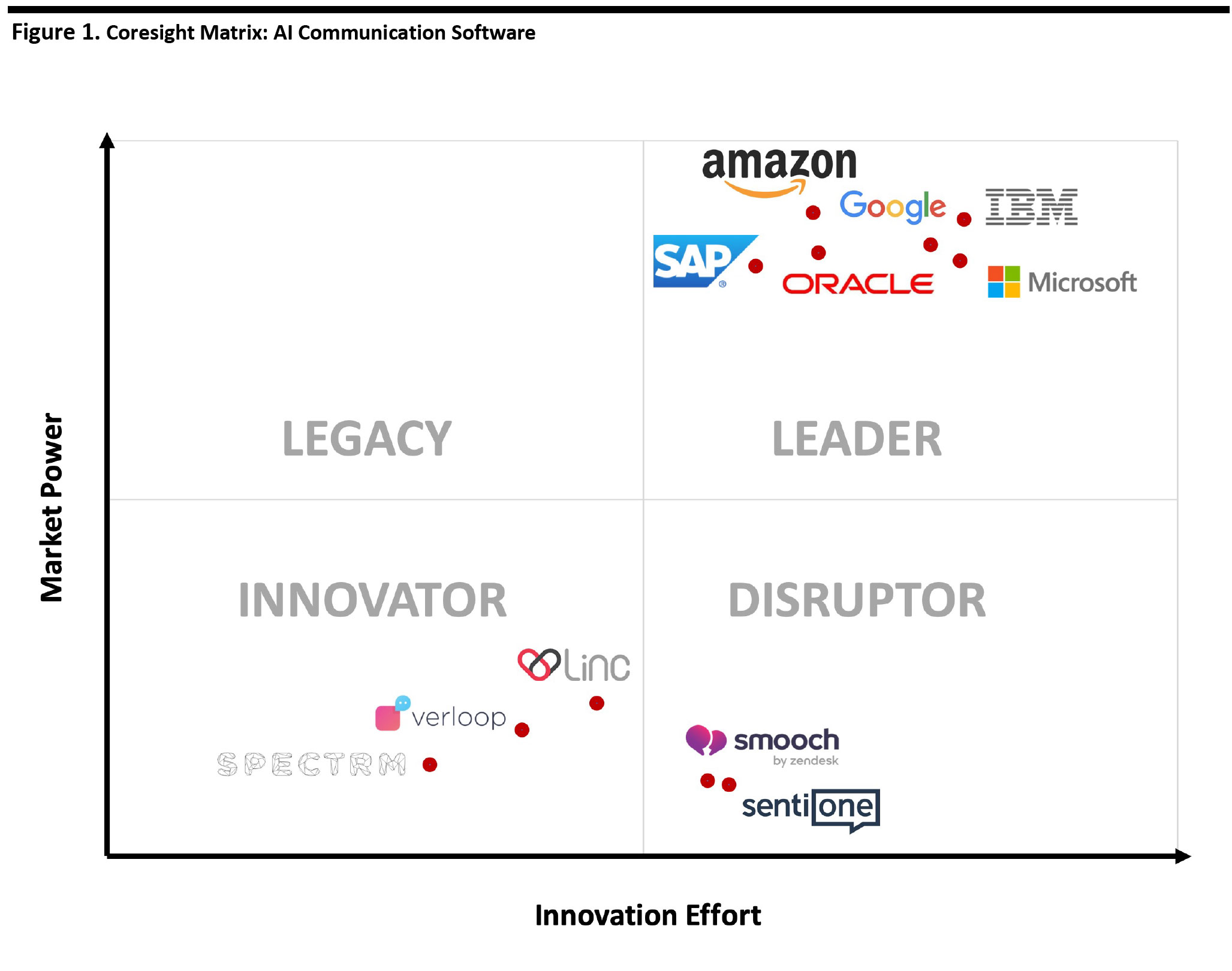

This report highlights the Coresight Matrix, designed to help readers better understand essential segments and key players in retail technology.

From our work with clients from large companies to small startups, we discovered many need information on cutting-edge retail-technology, such as computer vision, visual reality, augmented reality and mass customization. Leading retailers want to know who are the key players in the market, which firms are driving improvements in these technologies, which startups might be the next rising stars and with which startups big companies should consider working.

The Coresight Matrix helps answer those questions, by leveraging our expertise at the intersection of retail and technology, supported by our proprietary qualitative data analysis. We identify, evaluate and then position key players within the selected market based on two criteria:

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

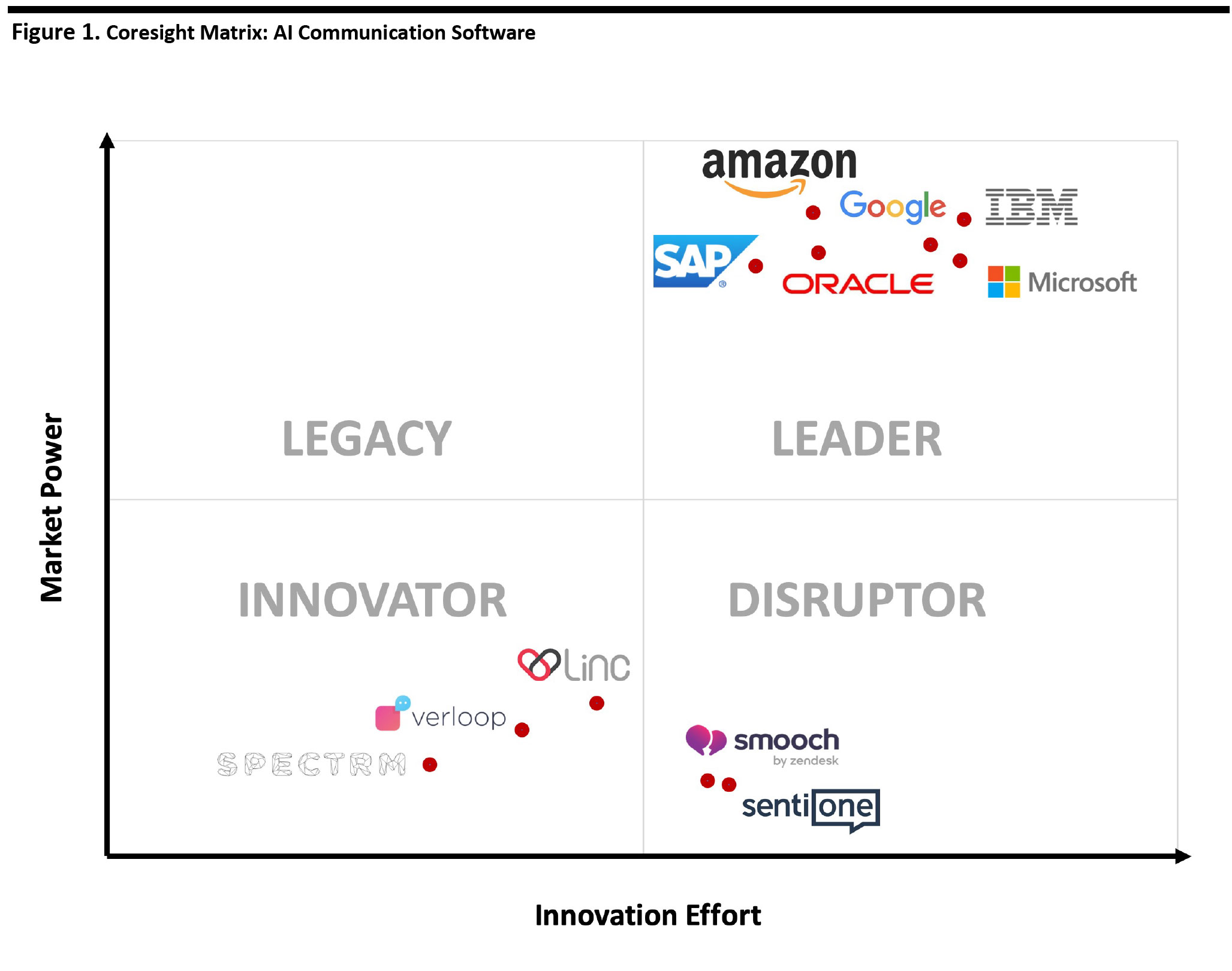

Tech giants such as Amazon, Google, IBM and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detai

l the companies featured in the top right corner of the Matrix: those with market power and which are leaders in the space.

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Amazon, Google, IBM and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detai

l the companies featured in the top right corner of the Matrix: those with market power and which are leaders in the space.

Amazon offers voice-recognition interfaces and functions within Amazon Web Services, with speech analytics, transcription functionality, as well as Alexa for Business, which provides functions for corporate meeting rooms. Amazon Connect provides software for cloud-based contact centers. In the consumer sphere, Amazon Echo devices running its Alexa virtual assistant software dominate the market for smart speakers, with nearly 70% of the market in 2019, according to eMarketer. Alexa commanded 100,000 skills in September 2019, according to Statista.

Amazon offers voice-recognition interfaces and functions within Amazon Web Services, with speech analytics, transcription functionality, as well as Alexa for Business, which provides functions for corporate meeting rooms. Amazon Connect provides software for cloud-based contact centers. In the consumer sphere, Amazon Echo devices running its Alexa virtual assistant software dominate the market for smart speakers, with nearly 70% of the market in 2019, according to eMarketer. Alexa commanded 100,000 skills in September 2019, according to Statista.

Google announced a new chatbot platform called Meena in January 2020, which it claims is the world’s best, having been trained on 40 billion words. The platform represents the company’s latest effort in conversational AI, following its 2016 acquisition of DialogFlow, a conversational user experience platform enabling natural language interactions for devices, applications, and services. Google Assistant devices accounted for more than 31% of the smart-speaker market in 2019, according to eMarketer.

Google announced a new chatbot platform called Meena in January 2020, which it claims is the world’s best, having been trained on 40 billion words. The platform represents the company’s latest effort in conversational AI, following its 2016 acquisition of DialogFlow, a conversational user experience platform enabling natural language interactions for devices, applications, and services. Google Assistant devices accounted for more than 31% of the smart-speaker market in 2019, according to eMarketer.

IBM’s offerings center on its Watson Assistant, which is powered by natural language understanding, can connect to any system or channel and be deployed anywhere using the user’s own data. Users can build their own customized chatbots, and the Watson Assistant can be embedded into voice or web channels for customer-assistance applications. Other Watson capabilities include speech to text, language translation, text classification models, personality insights and a tone of voice analyzer.

IBM’s offerings center on its Watson Assistant, which is powered by natural language understanding, can connect to any system or channel and be deployed anywhere using the user’s own data. Users can build their own customized chatbots, and the Watson Assistant can be embedded into voice or web channels for customer-assistance applications. Other Watson capabilities include speech to text, language translation, text classification models, personality insights and a tone of voice analyzer.

Linc Global offers a customer-care automation platform that combines data (such as order history), commerce workflows and distributed AI to create an automated branded assistant that can serve, engage and sell to customers across numerous channels. The company claims its customer care automation platform solves 70% of inquiries with pre-built automated services, and generates new revenue with contextual product recommendations and campaigns.

Linc Global offers a customer-care automation platform that combines data (such as order history), commerce workflows and distributed AI to create an automated branded assistant that can serve, engage and sell to customers across numerous channels. The company claims its customer care automation platform solves 70% of inquiries with pre-built automated services, and generates new revenue with contextual product recommendations and campaigns.

Microsoft offers several versions of AI chat across its platforms. The company’s offerings on its Azure cloud service platform include machine learning, knowledge mining including cognitive search, and AI apps and agents. Microsoft claims to have achieved human parity in vision (object recognition), speech recognition and language (machine translation.) Cortana is the company’s virtual assistant for consumers and runs on a variety of Microsoft and other hardware.

Microsoft offers several versions of AI chat across its platforms. The company’s offerings on its Azure cloud service platform include machine learning, knowledge mining including cognitive search, and AI apps and agents. Microsoft claims to have achieved human parity in vision (object recognition), speech recognition and language (machine translation.) Cortana is the company’s virtual assistant for consumers and runs on a variety of Microsoft and other hardware.

Oracle’s Digital Assistant is a platform for building AI-powered assistants that connect to backend applications. The company’s platform uses natural language processing and understanding to automate engagements with conversational interfaces that respond instantly, improve user satisfaction and increase efficiency.

Oracle’s Digital Assistant is a platform for building AI-powered assistants that connect to backend applications. The company’s platform uses natural language processing and understanding to automate engagements with conversational interfaces that respond instantly, improve user satisfaction and increase efficiency.

SAP offers an end-to-end bot building platform called Conversational AI. The bots use natural language processing, aiming to enhance customer and employee experience, guide customers to information, answer frequently asked questions and integrate with other SAP products, including Intelligent Robotic Process Automation and Data Intelligence, which offer cloud-based data orchestration and machine-learning services, respectively.

SAP offers an end-to-end bot building platform called Conversational AI. The bots use natural language processing, aiming to enhance customer and employee experience, guide customers to information, answer frequently asked questions and integrate with other SAP products, including Intelligent Robotic Process Automation and Data Intelligence, which offer cloud-based data orchestration and machine-learning services, respectively.

SentiOne provides a multichannel customer-service platform. The platform uses online and social listening data which powers an analytics engine. It also integrates social partnerships with online brand management in online discussions with current and potential customers to improve the customer experience. The platform also uses AI to automate customer service to handle 70% of customer requests with bots that provide instant reaction times.

SentiOne provides a multichannel customer-service platform. The platform uses online and social listening data which powers an analytics engine. It also integrates social partnerships with online brand management in online discussions with current and potential customers to improve the customer experience. The platform also uses AI to automate customer service to handle 70% of customer requests with bots that provide instant reaction times.

Smooch (acquired by Zendesk in May 2019) offers a platform that connects businesses with customers to offer more personalized and human conversations, subsequently renamed Zendesk’s Conversations platform. The platform aims to improve the omnichannel experience by connecting conversations between businesses and customers on any messaging channel: from websites and mobile apps to messaging apps such as WhatsApp and Facebook Messenger.

Smooch (acquired by Zendesk in May 2019) offers a platform that connects businesses with customers to offer more personalized and human conversations, subsequently renamed Zendesk’s Conversations platform. The platform aims to improve the omnichannel experience by connecting conversations between businesses and customers on any messaging channel: from websites and mobile apps to messaging apps such as WhatsApp and Facebook Messenger.

Spectrm offers an end-to-end platform to handle lead acquisition, conversational commerce and insight generation on messaging apps such as Facebook Messenger and WhatsApp. Its enterprise-ready conversational marketing platform can automate conversations to engage and convert customers at scale with an end-to-end chatbot platform.

Spectrm offers an end-to-end platform to handle lead acquisition, conversational commerce and insight generation on messaging apps such as Facebook Messenger and WhatsApp. Its enterprise-ready conversational marketing platform can automate conversations to engage and convert customers at scale with an end-to-end chatbot platform.

Verloop offers an automated customer support and engagement platform that aims to provide a more consistent customer experience with functions such as chatbots for WhatsApp, as well as bots for lead generation, sales automation, customer support and marketing automation.

Other Company Activities

Salesforce announced three new functions that combine voice and its Einstein AI technology at its November 2019 Dreamforce conference. These new functions build on the 2018 Einstein Voice Assistant that provides voice control of CRM actions:

Verloop offers an automated customer support and engagement platform that aims to provide a more consistent customer experience with functions such as chatbots for WhatsApp, as well as bots for lead generation, sales automation, customer support and marketing automation.

Other Company Activities

Salesforce announced three new functions that combine voice and its Einstein AI technology at its November 2019 Dreamforce conference. These new functions build on the 2018 Einstein Voice Assistant that provides voice control of CRM actions:

Source: Coresight Research[/caption]

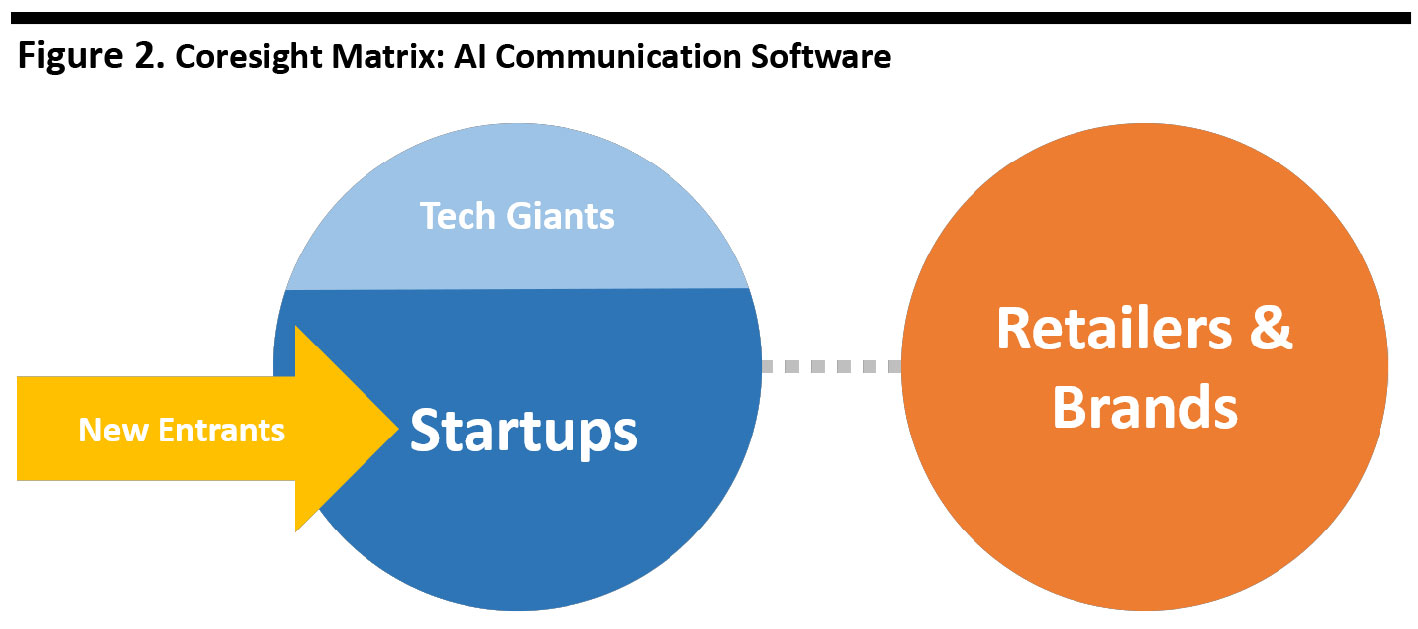

Retailers will increasingly rely on AI communication software as they seek to enhance customer relationships and services, but also cut costs. This robust market segment is likely to launch a healthy crop of innovators into the supply-chain software analytics space.

AI Communication Segment Overview

Rapid advances in the ratio of price-to-computing power, driven by Moore’s Law, have enabled dramatic advances in the power and capabilities of software. These advances, in turn, have enabled huge leaps in artificial intelligence technology which is now being rapidly adopted.

In particular, the machine learning branch of AI excels at pattern recognition and creating algorithms that adapt and improve over time to incorporate new information. These are precisely the tools needed to decode and interpret written and spoken human language.

The concept of natural language processing started in the 1950s, with most early applications focusing on translation and employing hard-coded rules. Computer scientists began applying machine learning to sophisticated understanding of language starting in the 1980s, and deep neural networks and other advanced techniques for understanding meaning started gaining use in the 2010s.

Decades later, the ability of software to understand written human language is approaching that of humans. The website Towards Data Science conducted tests of Google’s new Meena chatbot, and many of the results for interpreting written English approached human ability—and even exceeded that of humans on one test. In addition, the ability of software to understand spoken language reached the 95% threshold of human accuracy in 2017, according to Mary Meeker’s Internet Trends 2018 presentation. Combining the ability to understand spoken words plus their meaning creates the foundation of intelligent, interactive voice-controlled computing that can execute actions for humans.

In addition to understanding words, context is also important. Today’s chatbots can pull consumer data such as purchase history so a consumer can request, “I’d like to return the green sweater I bought last month” and the software can identify the action, the item, the color and the relative date to start the return.

Chatbots are the representation of using natural-language processing to communicate with consumers. Now, they can talk on browsers, smartphones and via e-mail. They enable companies to offer support around the clock and can offload commonly asked questions from human customer-service assistants, freeing them for more value-added tasks a bot cannot handle. Bots can also deepen customer relationships and create additional revenue opportunities.

While the goal of this type of software is not to completely replace humans, they can reduce cost, drive conversion and improve customer service. Linc Global claims its customers realize a 25% customer cost reduction and 32% more repurchases within 40 days using its platform. A study by Oracle found that 80% of businesses surveyed had already implemented or planned to implement chatbots by 2020.

Market Overview: AI Communication

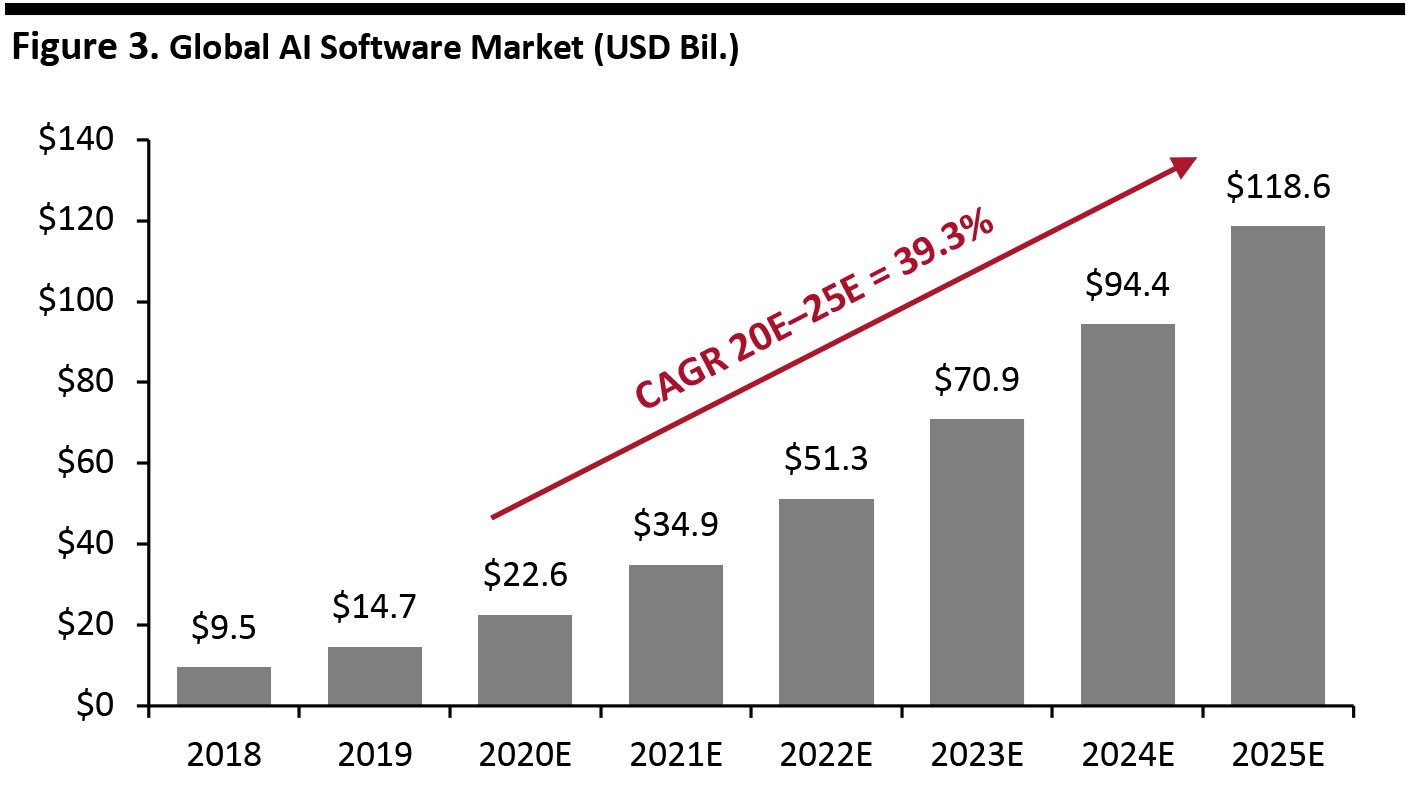

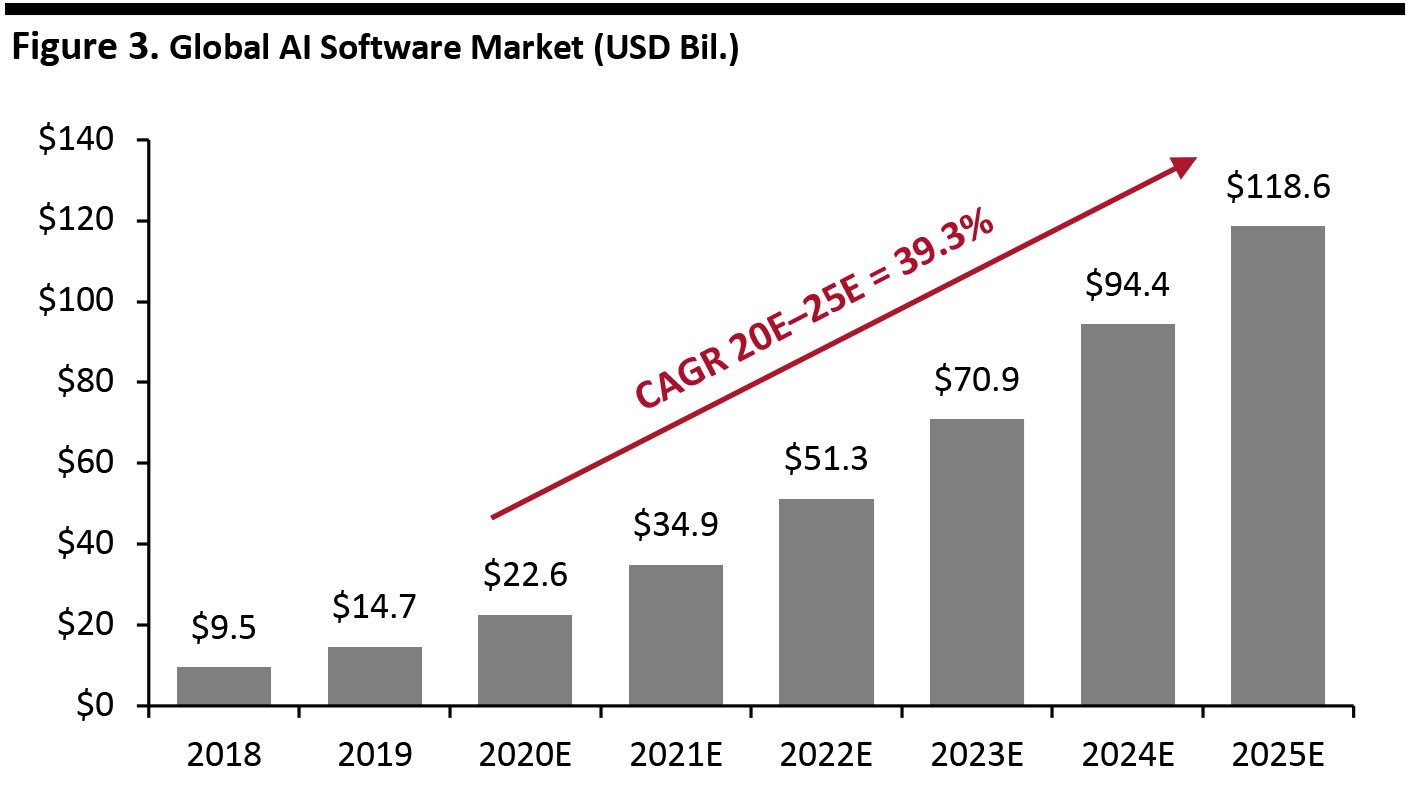

The global AI software market is estimated to be worth $22.6 billion in 2020, growing at a 39.3% CAGR through 2025, based on estimates from Statista.

[caption id="attachment_104115" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Retailers will increasingly rely on AI communication software as they seek to enhance customer relationships and services, but also cut costs. This robust market segment is likely to launch a healthy crop of innovators into the supply-chain software analytics space.

AI Communication Segment Overview

Rapid advances in the ratio of price-to-computing power, driven by Moore’s Law, have enabled dramatic advances in the power and capabilities of software. These advances, in turn, have enabled huge leaps in artificial intelligence technology which is now being rapidly adopted.

In particular, the machine learning branch of AI excels at pattern recognition and creating algorithms that adapt and improve over time to incorporate new information. These are precisely the tools needed to decode and interpret written and spoken human language.

The concept of natural language processing started in the 1950s, with most early applications focusing on translation and employing hard-coded rules. Computer scientists began applying machine learning to sophisticated understanding of language starting in the 1980s, and deep neural networks and other advanced techniques for understanding meaning started gaining use in the 2010s.

Decades later, the ability of software to understand written human language is approaching that of humans. The website Towards Data Science conducted tests of Google’s new Meena chatbot, and many of the results for interpreting written English approached human ability—and even exceeded that of humans on one test. In addition, the ability of software to understand spoken language reached the 95% threshold of human accuracy in 2017, according to Mary Meeker’s Internet Trends 2018 presentation. Combining the ability to understand spoken words plus their meaning creates the foundation of intelligent, interactive voice-controlled computing that can execute actions for humans.

In addition to understanding words, context is also important. Today’s chatbots can pull consumer data such as purchase history so a consumer can request, “I’d like to return the green sweater I bought last month” and the software can identify the action, the item, the color and the relative date to start the return.

Chatbots are the representation of using natural-language processing to communicate with consumers. Now, they can talk on browsers, smartphones and via e-mail. They enable companies to offer support around the clock and can offload commonly asked questions from human customer-service assistants, freeing them for more value-added tasks a bot cannot handle. Bots can also deepen customer relationships and create additional revenue opportunities.

While the goal of this type of software is not to completely replace humans, they can reduce cost, drive conversion and improve customer service. Linc Global claims its customers realize a 25% customer cost reduction and 32% more repurchases within 40 days using its platform. A study by Oracle found that 80% of businesses surveyed had already implemented or planned to implement chatbots by 2020.

Market Overview: AI Communication

The global AI software market is estimated to be worth $22.6 billion in 2020, growing at a 39.3% CAGR through 2025, based on estimates from Statista.

[caption id="attachment_104115" align="aligncenter" width="700"] Source: Statista[/caption]

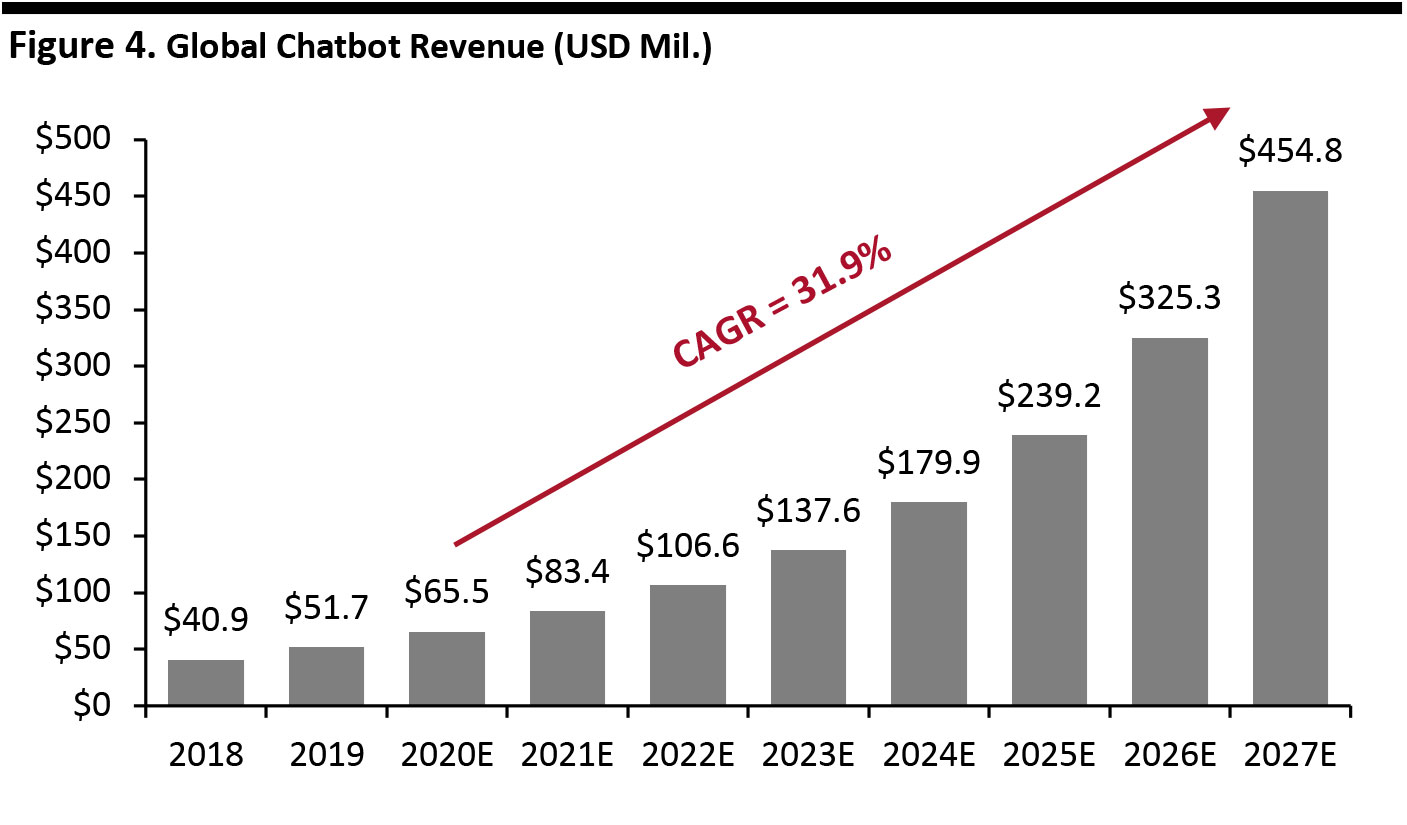

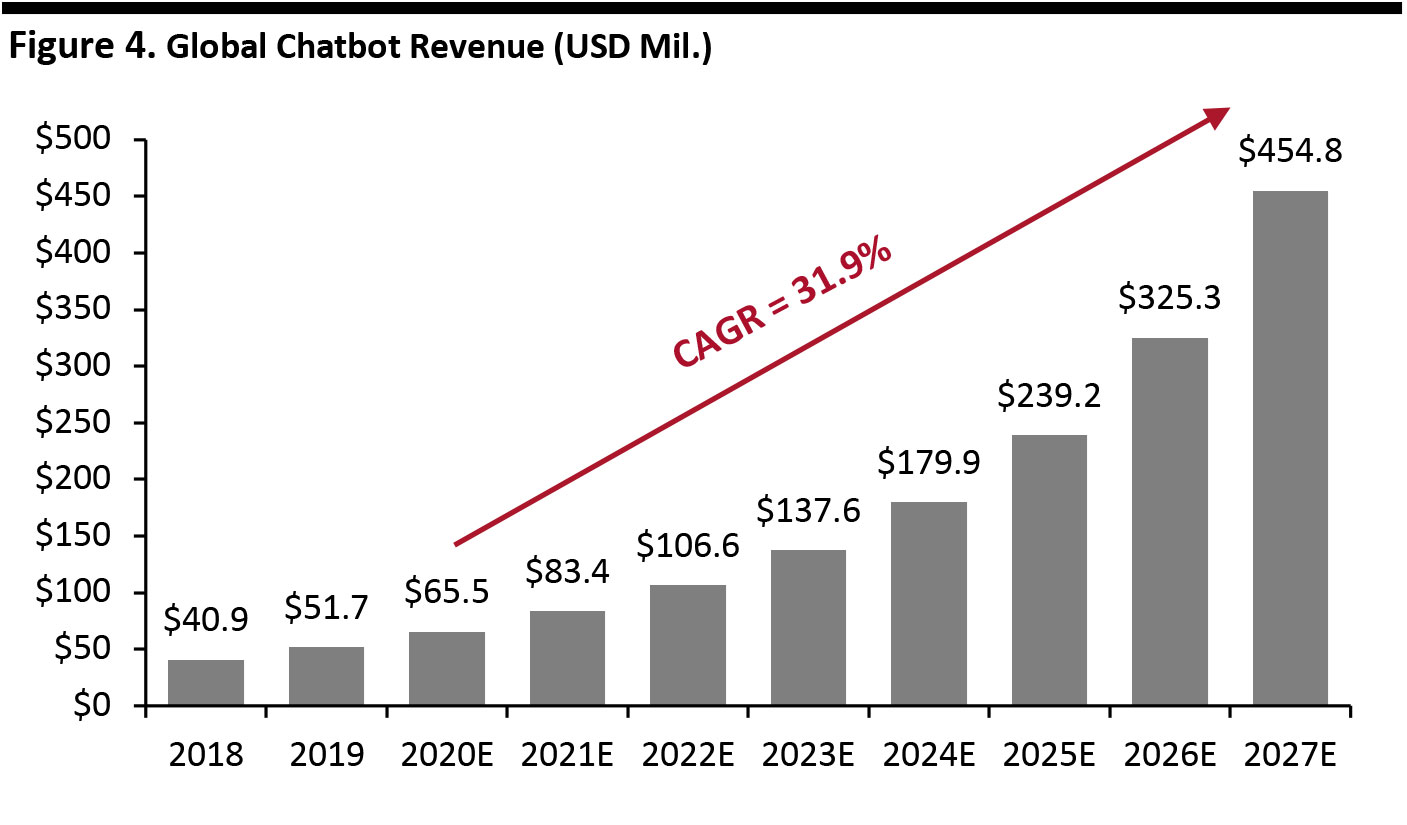

Within that market, the global AI chatbot market is estimated to be worth $65.5 million in 2020 and projected by the Insight Partners to grow at a 31.9% CAGR during 2020E-2027E.

[caption id="attachment_104116" align="aligncenter" width="700"]

Source: Statista[/caption]

Within that market, the global AI chatbot market is estimated to be worth $65.5 million in 2020 and projected by the Insight Partners to grow at a 31.9% CAGR during 2020E-2027E.

[caption id="attachment_104116" align="aligncenter" width="700"] Source: The Insight Partners/Coresight Research[/caption]

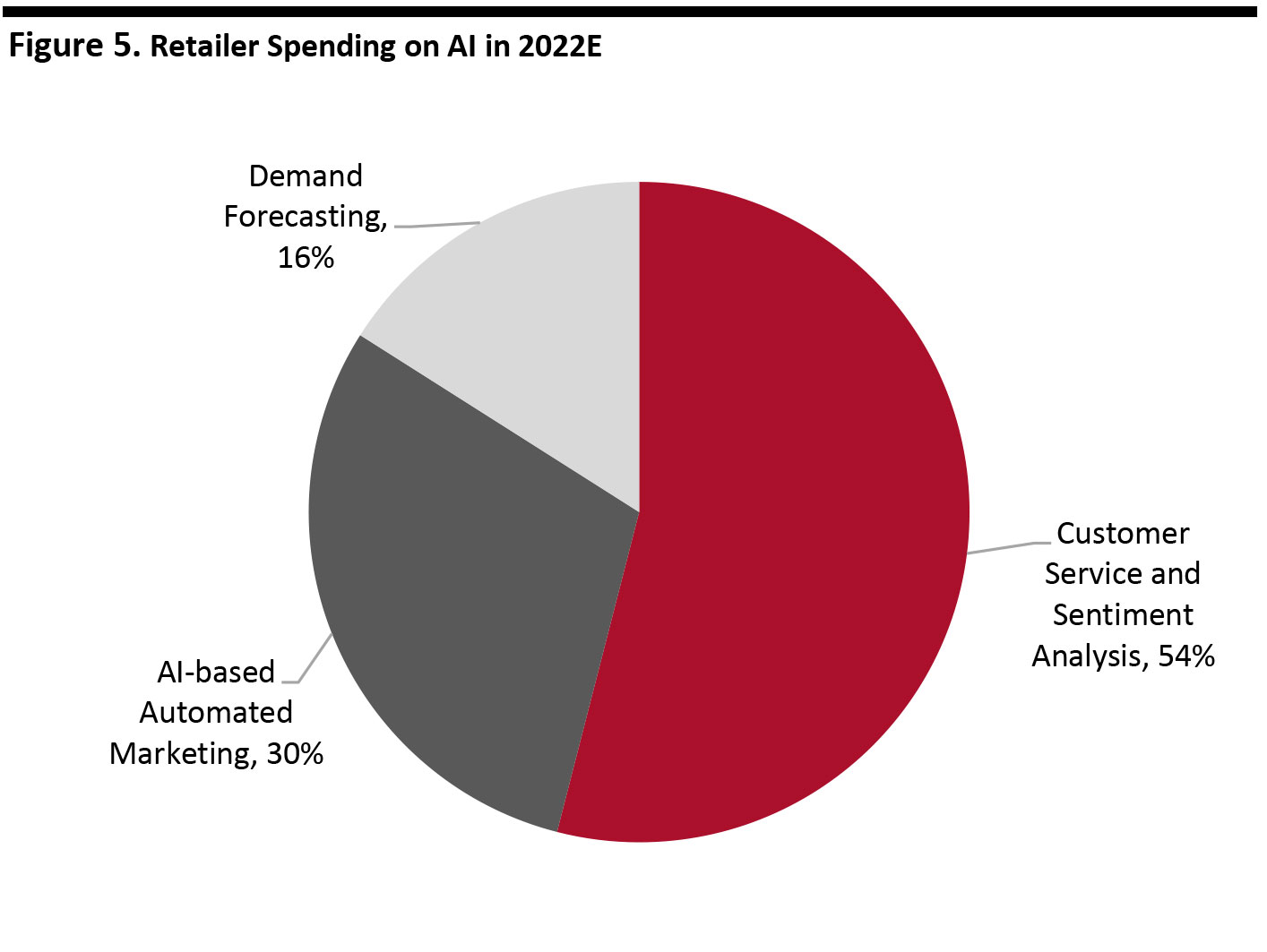

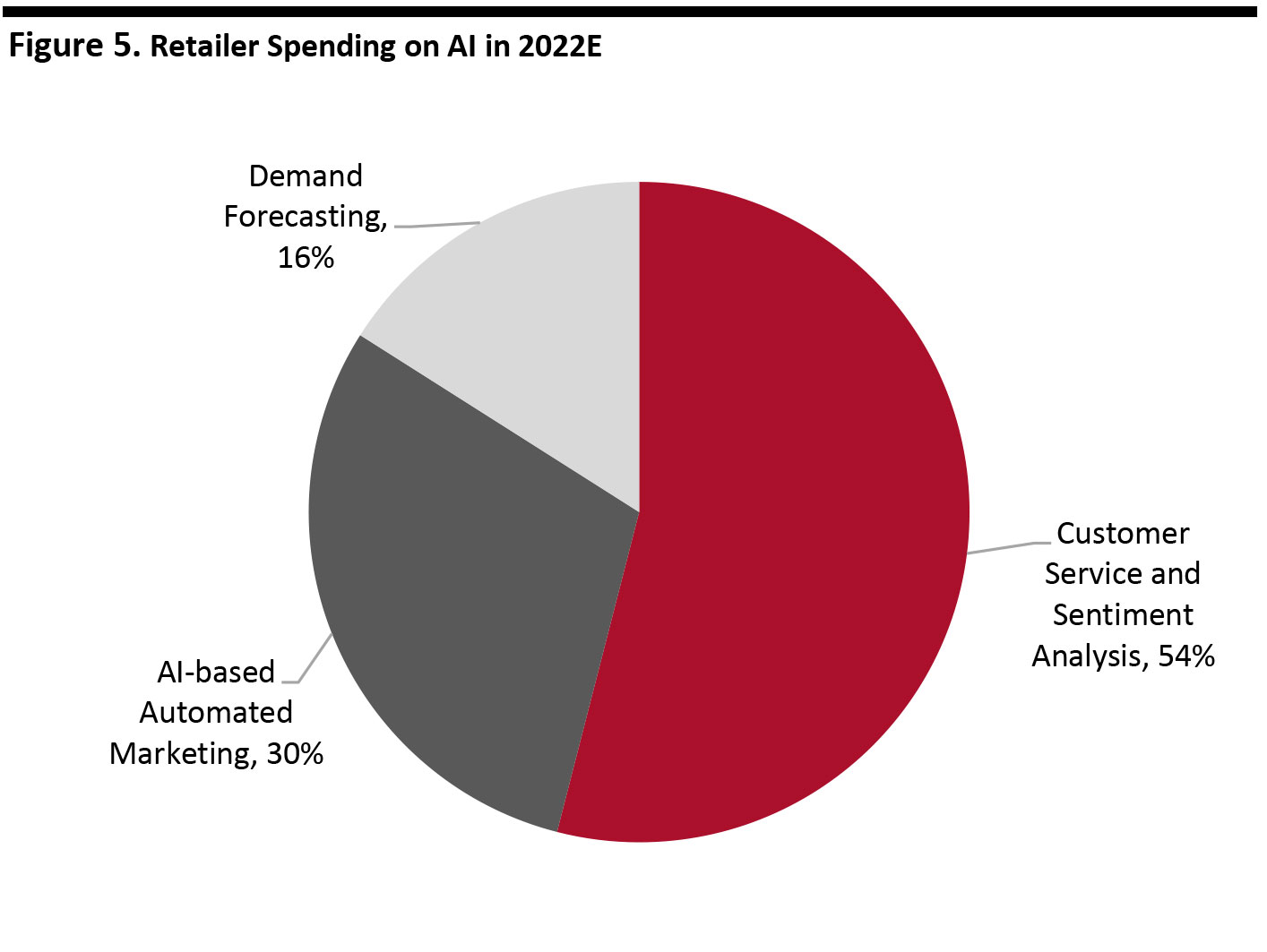

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down estimated retail AI spending in 2022, we see the customer service and sentiment analysis sectors are expected to account for more half of retailer AI spending, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_104117" align="aligncenter" width="700"]

Source: The Insight Partners/Coresight Research[/caption]

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down estimated retail AI spending in 2022, we see the customer service and sentiment analysis sectors are expected to account for more half of retailer AI spending, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_104117" align="aligncenter" width="700"] Source: Juniper Research[/caption]

How We Create the Coresight Matrix

Coresight Research analyzes companies based on proprietary quantitative and qualitative analysis to demonstrate market trends, such as direction, maturity and participants. By leveraging our analysts’ expertise at the intersection of retail and technology, supported by key data sources, we developed a methodology to determine the top platforms offering computer vision-based solutions that enhance the product search experience.

We evaluate companies based on two criteria: innovation effort and market power. This is what we found:

Innovation effort (X axis): Coresight Research assesses companies’ innovation effort by evaluating product development, algorithm optimization, application expansion and technical research, looking at areas such as company patent filings and human capital investment. We normalize our innovation effort rating scores based on selected companies’ backgrounds, so smaller startups can compete with larger industry leaders on our matrix. The values on the X-axis are a function of the company’s innovation intensity (based on patents and public-company information) plus a subjective evaluation of the company’s technological innovation in the subject area.

Market power (Y axis): Coresight Research assesses companies’ market power using two major metrics: value appropriation and value creation. Under value appropriation, we evaluate companies’ ability to operate efficiently and effectively, and to secure customers. Under value creation, we assess companies’ ability to make customers react to products efficiently and effectively and to create an emotional experience for customer engagement. In addition, we consider companies’ backgrounds and factors such as funding, market position and number of employees. The values on the Y-axis are a function of the company’s revenue or a suitable proxy.

After evaluation, we place each company into one of four quadrants: Leader, Disruptor, Legacy or Innovator, as follows:

Leader companies have high market power and high innovation effort. Generally, they possess a strong industry background with enough funding and technical ability to conduct research and develop cutting-edge products and algorithms. We see their effort and progress as bringing products and teams to the next level through further investment and development. We expect them to continue leading the market. These companies demonstrate a clear understanding of market needs, they are innovators and thought leaders and tend to have a presence in several geographical regions with a broad platform to support clients.

Disruptor companies have a high level of innovation effort. They have a strong core business team and a good reputation in this specific market. Most are highly specialized in the field and have a clear understanding of market needs. On the normalized matrix, we sometimes find companies in the disruptor quadrant have even higher innovation effort scores than industry leaders, due to disruptors’ highly focused effort and market understanding. These companies have the potential to become leaders as they build more credible market positions and gain resources to sustain continued growth.

Legacy companies hold large market share. The companies generally have a good market position and reputation in the industry but may have only recently started developing technology in this specific field. They have the funding and capability to develop a strong business, but may still be looking for the right strategy, and have the potential to move to the leader quadrant.

Innovator companies have high growth potential. Most are in the process of improving algorithms and technologies and are expanding the applications of existing products. They are seeking funding and have the potential to move to the disruptor quadrants.

For Further Information

Please refer to the following Coresight Research reports.

Voice Shopping: The Next Driving Force for E-Commerce?

Supply Chain Briefing: Virtual Assistants Bring Speed and Save Costs in the Supply Chain

Source: Juniper Research[/caption]

How We Create the Coresight Matrix

Coresight Research analyzes companies based on proprietary quantitative and qualitative analysis to demonstrate market trends, such as direction, maturity and participants. By leveraging our analysts’ expertise at the intersection of retail and technology, supported by key data sources, we developed a methodology to determine the top platforms offering computer vision-based solutions that enhance the product search experience.

We evaluate companies based on two criteria: innovation effort and market power. This is what we found:

Innovation effort (X axis): Coresight Research assesses companies’ innovation effort by evaluating product development, algorithm optimization, application expansion and technical research, looking at areas such as company patent filings and human capital investment. We normalize our innovation effort rating scores based on selected companies’ backgrounds, so smaller startups can compete with larger industry leaders on our matrix. The values on the X-axis are a function of the company’s innovation intensity (based on patents and public-company information) plus a subjective evaluation of the company’s technological innovation in the subject area.

Market power (Y axis): Coresight Research assesses companies’ market power using two major metrics: value appropriation and value creation. Under value appropriation, we evaluate companies’ ability to operate efficiently and effectively, and to secure customers. Under value creation, we assess companies’ ability to make customers react to products efficiently and effectively and to create an emotional experience for customer engagement. In addition, we consider companies’ backgrounds and factors such as funding, market position and number of employees. The values on the Y-axis are a function of the company’s revenue or a suitable proxy.

After evaluation, we place each company into one of four quadrants: Leader, Disruptor, Legacy or Innovator, as follows:

Leader companies have high market power and high innovation effort. Generally, they possess a strong industry background with enough funding and technical ability to conduct research and develop cutting-edge products and algorithms. We see their effort and progress as bringing products and teams to the next level through further investment and development. We expect them to continue leading the market. These companies demonstrate a clear understanding of market needs, they are innovators and thought leaders and tend to have a presence in several geographical regions with a broad platform to support clients.

Disruptor companies have a high level of innovation effort. They have a strong core business team and a good reputation in this specific market. Most are highly specialized in the field and have a clear understanding of market needs. On the normalized matrix, we sometimes find companies in the disruptor quadrant have even higher innovation effort scores than industry leaders, due to disruptors’ highly focused effort and market understanding. These companies have the potential to become leaders as they build more credible market positions and gain resources to sustain continued growth.

Legacy companies hold large market share. The companies generally have a good market position and reputation in the industry but may have only recently started developing technology in this specific field. They have the funding and capability to develop a strong business, but may still be looking for the right strategy, and have the potential to move to the leader quadrant.

Innovator companies have high growth potential. Most are in the process of improving algorithms and technologies and are expanding the applications of existing products. They are seeking funding and have the potential to move to the disruptor quadrants.

For Further Information

Please refer to the following Coresight Research reports.

Voice Shopping: The Next Driving Force for E-Commerce?

Supply Chain Briefing: Virtual Assistants Bring Speed and Save Costs in the Supply Chain

- Innovation Effort: How much effort and progress the company has made to improve its products, technology and innovation strategy in general.

- Market Power: Where the company sits in the industry now and how much impact it could have in the market.

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Amazon, Google, IBM and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detai

l the companies featured in the top right corner of the Matrix: those with market power and which are leaders in the space.

Source: Grata Data/company reports/Coresight Research[/caption]

Companies Featured in The Matrix

Tech giants such as Amazon, Google, IBM and SAP, as well as a healthy mix of innovators, all compete within the AI personalization software segment.

Below, we detai

l the companies featured in the top right corner of the Matrix: those with market power and which are leaders in the space.

Amazon offers voice-recognition interfaces and functions within Amazon Web Services, with speech analytics, transcription functionality, as well as Alexa for Business, which provides functions for corporate meeting rooms. Amazon Connect provides software for cloud-based contact centers. In the consumer sphere, Amazon Echo devices running its Alexa virtual assistant software dominate the market for smart speakers, with nearly 70% of the market in 2019, according to eMarketer. Alexa commanded 100,000 skills in September 2019, according to Statista.

Amazon offers voice-recognition interfaces and functions within Amazon Web Services, with speech analytics, transcription functionality, as well as Alexa for Business, which provides functions for corporate meeting rooms. Amazon Connect provides software for cloud-based contact centers. In the consumer sphere, Amazon Echo devices running its Alexa virtual assistant software dominate the market for smart speakers, with nearly 70% of the market in 2019, according to eMarketer. Alexa commanded 100,000 skills in September 2019, according to Statista.

Google announced a new chatbot platform called Meena in January 2020, which it claims is the world’s best, having been trained on 40 billion words. The platform represents the company’s latest effort in conversational AI, following its 2016 acquisition of DialogFlow, a conversational user experience platform enabling natural language interactions for devices, applications, and services. Google Assistant devices accounted for more than 31% of the smart-speaker market in 2019, according to eMarketer.

Google announced a new chatbot platform called Meena in January 2020, which it claims is the world’s best, having been trained on 40 billion words. The platform represents the company’s latest effort in conversational AI, following its 2016 acquisition of DialogFlow, a conversational user experience platform enabling natural language interactions for devices, applications, and services. Google Assistant devices accounted for more than 31% of the smart-speaker market in 2019, according to eMarketer.

IBM’s offerings center on its Watson Assistant, which is powered by natural language understanding, can connect to any system or channel and be deployed anywhere using the user’s own data. Users can build their own customized chatbots, and the Watson Assistant can be embedded into voice or web channels for customer-assistance applications. Other Watson capabilities include speech to text, language translation, text classification models, personality insights and a tone of voice analyzer.

IBM’s offerings center on its Watson Assistant, which is powered by natural language understanding, can connect to any system or channel and be deployed anywhere using the user’s own data. Users can build their own customized chatbots, and the Watson Assistant can be embedded into voice or web channels for customer-assistance applications. Other Watson capabilities include speech to text, language translation, text classification models, personality insights and a tone of voice analyzer.

Linc Global offers a customer-care automation platform that combines data (such as order history), commerce workflows and distributed AI to create an automated branded assistant that can serve, engage and sell to customers across numerous channels. The company claims its customer care automation platform solves 70% of inquiries with pre-built automated services, and generates new revenue with contextual product recommendations and campaigns.

Linc Global offers a customer-care automation platform that combines data (such as order history), commerce workflows and distributed AI to create an automated branded assistant that can serve, engage and sell to customers across numerous channels. The company claims its customer care automation platform solves 70% of inquiries with pre-built automated services, and generates new revenue with contextual product recommendations and campaigns.

Microsoft offers several versions of AI chat across its platforms. The company’s offerings on its Azure cloud service platform include machine learning, knowledge mining including cognitive search, and AI apps and agents. Microsoft claims to have achieved human parity in vision (object recognition), speech recognition and language (machine translation.) Cortana is the company’s virtual assistant for consumers and runs on a variety of Microsoft and other hardware.

Microsoft offers several versions of AI chat across its platforms. The company’s offerings on its Azure cloud service platform include machine learning, knowledge mining including cognitive search, and AI apps and agents. Microsoft claims to have achieved human parity in vision (object recognition), speech recognition and language (machine translation.) Cortana is the company’s virtual assistant for consumers and runs on a variety of Microsoft and other hardware.

Oracle’s Digital Assistant is a platform for building AI-powered assistants that connect to backend applications. The company’s platform uses natural language processing and understanding to automate engagements with conversational interfaces that respond instantly, improve user satisfaction and increase efficiency.

Oracle’s Digital Assistant is a platform for building AI-powered assistants that connect to backend applications. The company’s platform uses natural language processing and understanding to automate engagements with conversational interfaces that respond instantly, improve user satisfaction and increase efficiency.

SAP offers an end-to-end bot building platform called Conversational AI. The bots use natural language processing, aiming to enhance customer and employee experience, guide customers to information, answer frequently asked questions and integrate with other SAP products, including Intelligent Robotic Process Automation and Data Intelligence, which offer cloud-based data orchestration and machine-learning services, respectively.

SAP offers an end-to-end bot building platform called Conversational AI. The bots use natural language processing, aiming to enhance customer and employee experience, guide customers to information, answer frequently asked questions and integrate with other SAP products, including Intelligent Robotic Process Automation and Data Intelligence, which offer cloud-based data orchestration and machine-learning services, respectively.

SentiOne provides a multichannel customer-service platform. The platform uses online and social listening data which powers an analytics engine. It also integrates social partnerships with online brand management in online discussions with current and potential customers to improve the customer experience. The platform also uses AI to automate customer service to handle 70% of customer requests with bots that provide instant reaction times.

SentiOne provides a multichannel customer-service platform. The platform uses online and social listening data which powers an analytics engine. It also integrates social partnerships with online brand management in online discussions with current and potential customers to improve the customer experience. The platform also uses AI to automate customer service to handle 70% of customer requests with bots that provide instant reaction times.

Verloop offers an automated customer support and engagement platform that aims to provide a more consistent customer experience with functions such as chatbots for WhatsApp, as well as bots for lead generation, sales automation, customer support and marketing automation.

Other Company Activities

Salesforce announced three new functions that combine voice and its Einstein AI technology at its November 2019 Dreamforce conference. These new functions build on the 2018 Einstein Voice Assistant that provides voice control of CRM actions:

Verloop offers an automated customer support and engagement platform that aims to provide a more consistent customer experience with functions such as chatbots for WhatsApp, as well as bots for lead generation, sales automation, customer support and marketing automation.

Other Company Activities

Salesforce announced three new functions that combine voice and its Einstein AI technology at its November 2019 Dreamforce conference. These new functions build on the 2018 Einstein Voice Assistant that provides voice control of CRM actions:

- Einstein Voice Skills lets companies create custom voice-powered apps to take new approaches to workflows and processes.

- Service Cloud Voice integrates telephony with Service Cloud, unifying phone, digital channels and CRM data. It is also integrated with transcription services, enabling Einstein to provide relevant responses and recommendations.

- Einstein Call Coaching helps managers identify keywords in sales call transcripts so they can coach sales reps for better results.

Source: Coresight Research[/caption]

Retailers will increasingly rely on AI communication software as they seek to enhance customer relationships and services, but also cut costs. This robust market segment is likely to launch a healthy crop of innovators into the supply-chain software analytics space.

AI Communication Segment Overview

Rapid advances in the ratio of price-to-computing power, driven by Moore’s Law, have enabled dramatic advances in the power and capabilities of software. These advances, in turn, have enabled huge leaps in artificial intelligence technology which is now being rapidly adopted.

In particular, the machine learning branch of AI excels at pattern recognition and creating algorithms that adapt and improve over time to incorporate new information. These are precisely the tools needed to decode and interpret written and spoken human language.

The concept of natural language processing started in the 1950s, with most early applications focusing on translation and employing hard-coded rules. Computer scientists began applying machine learning to sophisticated understanding of language starting in the 1980s, and deep neural networks and other advanced techniques for understanding meaning started gaining use in the 2010s.

Decades later, the ability of software to understand written human language is approaching that of humans. The website Towards Data Science conducted tests of Google’s new Meena chatbot, and many of the results for interpreting written English approached human ability—and even exceeded that of humans on one test. In addition, the ability of software to understand spoken language reached the 95% threshold of human accuracy in 2017, according to Mary Meeker’s Internet Trends 2018 presentation. Combining the ability to understand spoken words plus their meaning creates the foundation of intelligent, interactive voice-controlled computing that can execute actions for humans.

In addition to understanding words, context is also important. Today’s chatbots can pull consumer data such as purchase history so a consumer can request, “I’d like to return the green sweater I bought last month” and the software can identify the action, the item, the color and the relative date to start the return.

Chatbots are the representation of using natural-language processing to communicate with consumers. Now, they can talk on browsers, smartphones and via e-mail. They enable companies to offer support around the clock and can offload commonly asked questions from human customer-service assistants, freeing them for more value-added tasks a bot cannot handle. Bots can also deepen customer relationships and create additional revenue opportunities.

While the goal of this type of software is not to completely replace humans, they can reduce cost, drive conversion and improve customer service. Linc Global claims its customers realize a 25% customer cost reduction and 32% more repurchases within 40 days using its platform. A study by Oracle found that 80% of businesses surveyed had already implemented or planned to implement chatbots by 2020.

Market Overview: AI Communication

The global AI software market is estimated to be worth $22.6 billion in 2020, growing at a 39.3% CAGR through 2025, based on estimates from Statista.

[caption id="attachment_104115" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Retailers will increasingly rely on AI communication software as they seek to enhance customer relationships and services, but also cut costs. This robust market segment is likely to launch a healthy crop of innovators into the supply-chain software analytics space.

AI Communication Segment Overview

Rapid advances in the ratio of price-to-computing power, driven by Moore’s Law, have enabled dramatic advances in the power and capabilities of software. These advances, in turn, have enabled huge leaps in artificial intelligence technology which is now being rapidly adopted.

In particular, the machine learning branch of AI excels at pattern recognition and creating algorithms that adapt and improve over time to incorporate new information. These are precisely the tools needed to decode and interpret written and spoken human language.

The concept of natural language processing started in the 1950s, with most early applications focusing on translation and employing hard-coded rules. Computer scientists began applying machine learning to sophisticated understanding of language starting in the 1980s, and deep neural networks and other advanced techniques for understanding meaning started gaining use in the 2010s.

Decades later, the ability of software to understand written human language is approaching that of humans. The website Towards Data Science conducted tests of Google’s new Meena chatbot, and many of the results for interpreting written English approached human ability—and even exceeded that of humans on one test. In addition, the ability of software to understand spoken language reached the 95% threshold of human accuracy in 2017, according to Mary Meeker’s Internet Trends 2018 presentation. Combining the ability to understand spoken words plus their meaning creates the foundation of intelligent, interactive voice-controlled computing that can execute actions for humans.

In addition to understanding words, context is also important. Today’s chatbots can pull consumer data such as purchase history so a consumer can request, “I’d like to return the green sweater I bought last month” and the software can identify the action, the item, the color and the relative date to start the return.

Chatbots are the representation of using natural-language processing to communicate with consumers. Now, they can talk on browsers, smartphones and via e-mail. They enable companies to offer support around the clock and can offload commonly asked questions from human customer-service assistants, freeing them for more value-added tasks a bot cannot handle. Bots can also deepen customer relationships and create additional revenue opportunities.

While the goal of this type of software is not to completely replace humans, they can reduce cost, drive conversion and improve customer service. Linc Global claims its customers realize a 25% customer cost reduction and 32% more repurchases within 40 days using its platform. A study by Oracle found that 80% of businesses surveyed had already implemented or planned to implement chatbots by 2020.

Market Overview: AI Communication

The global AI software market is estimated to be worth $22.6 billion in 2020, growing at a 39.3% CAGR through 2025, based on estimates from Statista.

[caption id="attachment_104115" align="aligncenter" width="700"] Source: Statista[/caption]

Within that market, the global AI chatbot market is estimated to be worth $65.5 million in 2020 and projected by the Insight Partners to grow at a 31.9% CAGR during 2020E-2027E.

[caption id="attachment_104116" align="aligncenter" width="700"]

Source: Statista[/caption]

Within that market, the global AI chatbot market is estimated to be worth $65.5 million in 2020 and projected by the Insight Partners to grow at a 31.9% CAGR during 2020E-2027E.

[caption id="attachment_104116" align="aligncenter" width="700"] Source: The Insight Partners/Coresight Research[/caption]

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down estimated retail AI spending in 2022, we see the customer service and sentiment analysis sectors are expected to account for more half of retailer AI spending, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_104117" align="aligncenter" width="700"]

Source: The Insight Partners/Coresight Research[/caption]

The retail industry is one of the largest spenders on AI, and retail AI spending is projected to grow from $2 billion in 2018 to $7.3 billion in 2022E, a 38.2% CAGR, according to Juniper Research.

In the figure below, which breaks down estimated retail AI spending in 2022, we see the customer service and sentiment analysis sectors are expected to account for more half of retailer AI spending, followed by automated marketing, accounting for more than a third of spending, with demand forecasting in third place.

[caption id="attachment_104117" align="aligncenter" width="700"] Source: Juniper Research[/caption]

How We Create the Coresight Matrix

Coresight Research analyzes companies based on proprietary quantitative and qualitative analysis to demonstrate market trends, such as direction, maturity and participants. By leveraging our analysts’ expertise at the intersection of retail and technology, supported by key data sources, we developed a methodology to determine the top platforms offering computer vision-based solutions that enhance the product search experience.

We evaluate companies based on two criteria: innovation effort and market power. This is what we found:

Innovation effort (X axis): Coresight Research assesses companies’ innovation effort by evaluating product development, algorithm optimization, application expansion and technical research, looking at areas such as company patent filings and human capital investment. We normalize our innovation effort rating scores based on selected companies’ backgrounds, so smaller startups can compete with larger industry leaders on our matrix. The values on the X-axis are a function of the company’s innovation intensity (based on patents and public-company information) plus a subjective evaluation of the company’s technological innovation in the subject area.

Market power (Y axis): Coresight Research assesses companies’ market power using two major metrics: value appropriation and value creation. Under value appropriation, we evaluate companies’ ability to operate efficiently and effectively, and to secure customers. Under value creation, we assess companies’ ability to make customers react to products efficiently and effectively and to create an emotional experience for customer engagement. In addition, we consider companies’ backgrounds and factors such as funding, market position and number of employees. The values on the Y-axis are a function of the company’s revenue or a suitable proxy.

After evaluation, we place each company into one of four quadrants: Leader, Disruptor, Legacy or Innovator, as follows:

Leader companies have high market power and high innovation effort. Generally, they possess a strong industry background with enough funding and technical ability to conduct research and develop cutting-edge products and algorithms. We see their effort and progress as bringing products and teams to the next level through further investment and development. We expect them to continue leading the market. These companies demonstrate a clear understanding of market needs, they are innovators and thought leaders and tend to have a presence in several geographical regions with a broad platform to support clients.

Disruptor companies have a high level of innovation effort. They have a strong core business team and a good reputation in this specific market. Most are highly specialized in the field and have a clear understanding of market needs. On the normalized matrix, we sometimes find companies in the disruptor quadrant have even higher innovation effort scores than industry leaders, due to disruptors’ highly focused effort and market understanding. These companies have the potential to become leaders as they build more credible market positions and gain resources to sustain continued growth.

Legacy companies hold large market share. The companies generally have a good market position and reputation in the industry but may have only recently started developing technology in this specific field. They have the funding and capability to develop a strong business, but may still be looking for the right strategy, and have the potential to move to the leader quadrant.

Innovator companies have high growth potential. Most are in the process of improving algorithms and technologies and are expanding the applications of existing products. They are seeking funding and have the potential to move to the disruptor quadrants.

For Further Information

Please refer to the following Coresight Research reports.

Voice Shopping: The Next Driving Force for E-Commerce?

Supply Chain Briefing: Virtual Assistants Bring Speed and Save Costs in the Supply Chain

Source: Juniper Research[/caption]

How We Create the Coresight Matrix

Coresight Research analyzes companies based on proprietary quantitative and qualitative analysis to demonstrate market trends, such as direction, maturity and participants. By leveraging our analysts’ expertise at the intersection of retail and technology, supported by key data sources, we developed a methodology to determine the top platforms offering computer vision-based solutions that enhance the product search experience.

We evaluate companies based on two criteria: innovation effort and market power. This is what we found:

Innovation effort (X axis): Coresight Research assesses companies’ innovation effort by evaluating product development, algorithm optimization, application expansion and technical research, looking at areas such as company patent filings and human capital investment. We normalize our innovation effort rating scores based on selected companies’ backgrounds, so smaller startups can compete with larger industry leaders on our matrix. The values on the X-axis are a function of the company’s innovation intensity (based on patents and public-company information) plus a subjective evaluation of the company’s technological innovation in the subject area.

Market power (Y axis): Coresight Research assesses companies’ market power using two major metrics: value appropriation and value creation. Under value appropriation, we evaluate companies’ ability to operate efficiently and effectively, and to secure customers. Under value creation, we assess companies’ ability to make customers react to products efficiently and effectively and to create an emotional experience for customer engagement. In addition, we consider companies’ backgrounds and factors such as funding, market position and number of employees. The values on the Y-axis are a function of the company’s revenue or a suitable proxy.

After evaluation, we place each company into one of four quadrants: Leader, Disruptor, Legacy or Innovator, as follows:

Leader companies have high market power and high innovation effort. Generally, they possess a strong industry background with enough funding and technical ability to conduct research and develop cutting-edge products and algorithms. We see their effort and progress as bringing products and teams to the next level through further investment and development. We expect them to continue leading the market. These companies demonstrate a clear understanding of market needs, they are innovators and thought leaders and tend to have a presence in several geographical regions with a broad platform to support clients.

Disruptor companies have a high level of innovation effort. They have a strong core business team and a good reputation in this specific market. Most are highly specialized in the field and have a clear understanding of market needs. On the normalized matrix, we sometimes find companies in the disruptor quadrant have even higher innovation effort scores than industry leaders, due to disruptors’ highly focused effort and market understanding. These companies have the potential to become leaders as they build more credible market positions and gain resources to sustain continued growth.

Legacy companies hold large market share. The companies generally have a good market position and reputation in the industry but may have only recently started developing technology in this specific field. They have the funding and capability to develop a strong business, but may still be looking for the right strategy, and have the potential to move to the leader quadrant.

Innovator companies have high growth potential. Most are in the process of improving algorithms and technologies and are expanding the applications of existing products. They are seeking funding and have the potential to move to the disruptor quadrants.

For Further Information

Please refer to the following Coresight Research reports.

Voice Shopping: The Next Driving Force for E-Commerce?

Supply Chain Briefing: Virtual Assistants Bring Speed and Save Costs in the Supply Chain