DIpil Das

Introduction

Convenience stores have been evolving from a stop-to-shop for soda and snacks to a one-stop destination for all household needs. According to the National Association of Convenience Stores (NACS), US convenience stores’ in-store sales increased by 8.9% in 2018. Growth was even higher in China, where total convenience-store sales surged by 19% in 2018, as reported by China Chain Store & Franchise Association (CCFA). Today, convenience stores are stepping up their food offerings and improving food quality, making them a growing threat to fast casual and quick-service restaurants. Convenience stores are also expanding their value-added services and introducing new store formats to drive consumer traffic. In this report, we take a look at what convenience-store operators in Japan and China and the US are doing to diversify their offerings.Convenience Stores Are Placing a Greater Emphasis on Foodservice

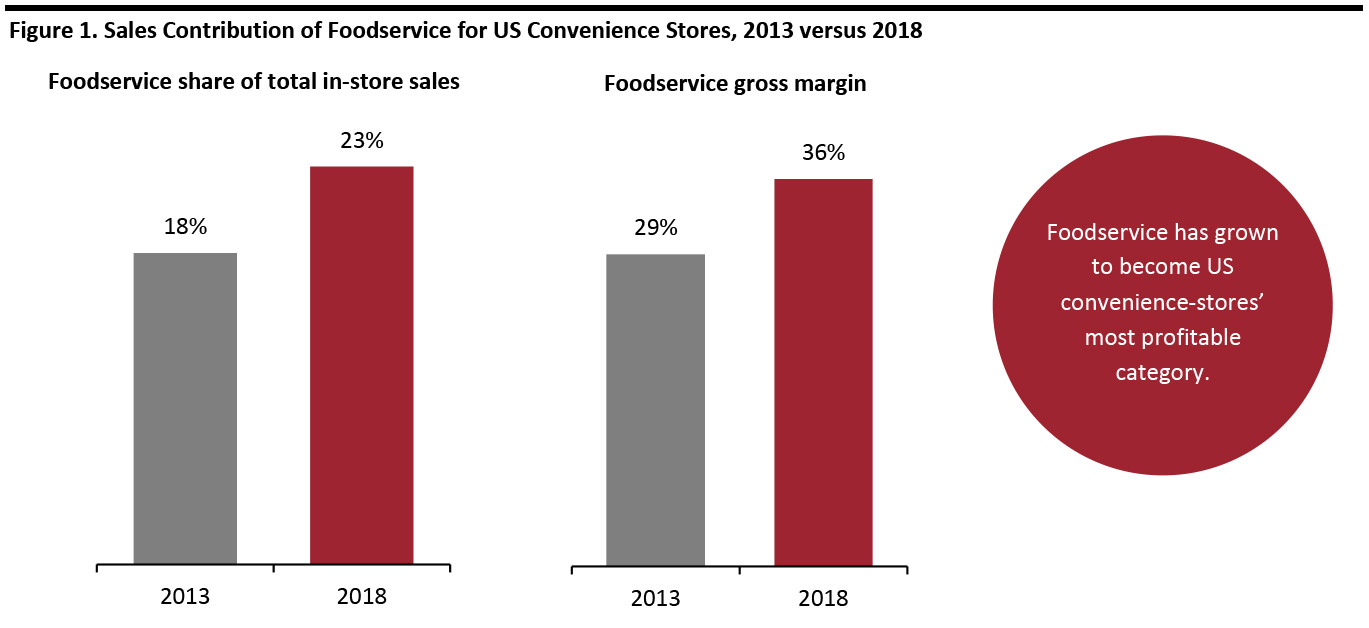

Convenience stores have been shifting focus from gas and tobacco sales to foodservice, partly due to a lower cigarette-smoking rate among US adults alongside stable gas prices. Providing in-store foodservice is a cost-effective approach to attract new customers and drive sales. In the US, foodservice sales accounted for 23% of total in-store sales for convenience stores, up from 18% five years earlier, according to NACS. [caption id="attachment_101226" align="aligncenter" width="700"] Source: NACS/Coresight Research[/caption]

As convenience stores continue to expand their offerings and improve the quality of their foodservice, more consumers are choosing to grab meals there. According to an April 2019 survey by tech company GasBuddy, 56% of Americans purchase meals from convenience stores at least once a month, and 75% of Americans believe that convenience-store foodservice has improved in the past five years. Younger generations purchase food from convenience stores most frequently. A convenience store consumer study conducted in fall 2018 by AlixPartners showed that the primary purpose of going to a convenience store for 37% of millennials is for foodservice.

Today, convenience stores offer specialty coffees, premium shakes, made-to-order sandwiches and salads, hot soups and pizzas—meaning that they can compete with quick-service restaurants. In addition, a growing consumer focus on healthy living is pushing convenience stores to expand their “better-for-you” selections, which are healthy, low-calorie foods made in house with locally sourced ingredients.

Source: NACS/Coresight Research[/caption]

As convenience stores continue to expand their offerings and improve the quality of their foodservice, more consumers are choosing to grab meals there. According to an April 2019 survey by tech company GasBuddy, 56% of Americans purchase meals from convenience stores at least once a month, and 75% of Americans believe that convenience-store foodservice has improved in the past five years. Younger generations purchase food from convenience stores most frequently. A convenience store consumer study conducted in fall 2018 by AlixPartners showed that the primary purpose of going to a convenience store for 37% of millennials is for foodservice.

Today, convenience stores offer specialty coffees, premium shakes, made-to-order sandwiches and salads, hot soups and pizzas—meaning that they can compete with quick-service restaurants. In addition, a growing consumer focus on healthy living is pushing convenience stores to expand their “better-for-you” selections, which are healthy, low-calorie foods made in house with locally sourced ingredients.

- Alimentation Couche-Tard is striving to enhance its fresh food and beverage offerings globally. The company is improving its Simply Great Coffee program through the addition of coffee machines that provide freshly ground and brewed coffee in North American stores—over 9,000 machines were installed in 4,000 locations in fiscal year 2019. Alimentation Couche-Tard has also introduced baked-on-site pastries in stores in the US and Quebec, Canada, resulting in higher bakery sales. The company is using Holiday Stationstores—a convenience-store chain it acquired in 2017—to launch six foodservice pilot programs, such as healthier options. In Europe, Circle K has launched a Mexican menu in seven markets.

- Casey’s General Stores, the US’s fourth-largest convenience-store chain, is known for its made-from-scratch pizza. The company is continuing to expand its food offerings, including made-to-order sub sandwiches (which are available in 68.1% of its stores), breakfast items and donuts. Prepared food items have the highest gross margin among all categories at Casey’s, averaging 62.2% in fiscal year 2019, according to the company’s latest annual report.

Baked-on-site pastries are now offered in Alimentation Couche-Tard’s US convenience stores.

Baked-on-site pastries are now offered in Alimentation Couche-Tard’s US convenience stores. Source: Alimentation Couche-Tard [/caption]

- Global Partners opened its new convenience-store concept Alltown Fresh in New England in 2019. The new brand focuses on fresh and healthy food choices that are organic and locally sourced. The 4,800-square-foot stores are almost twice the size of a typical convenience store and feature all-day breakfasts, made-to-order food items, craft coffee, artisan pastries and a selection of healthy beverages. Alltown Fresh stores have indoor and outdoor seating areas.

- Wawa, a chain of convenience stores along the East Coast of the US, rolled out its new catering service across all stores in May 2019. The pickup service allows shoppers to place customizable orders of a variety of freshly prepared food from Wawa, including breakfast items, sub sandwiches, hot soups and sweets.

- Whole Foods opened its new convenience-store concept, called Whole Foods Market Daily Shop, in New York City in May 2019. The shop’s offerings are focused around pastries and grab-and-go food, with a limited assortment of grocery products.

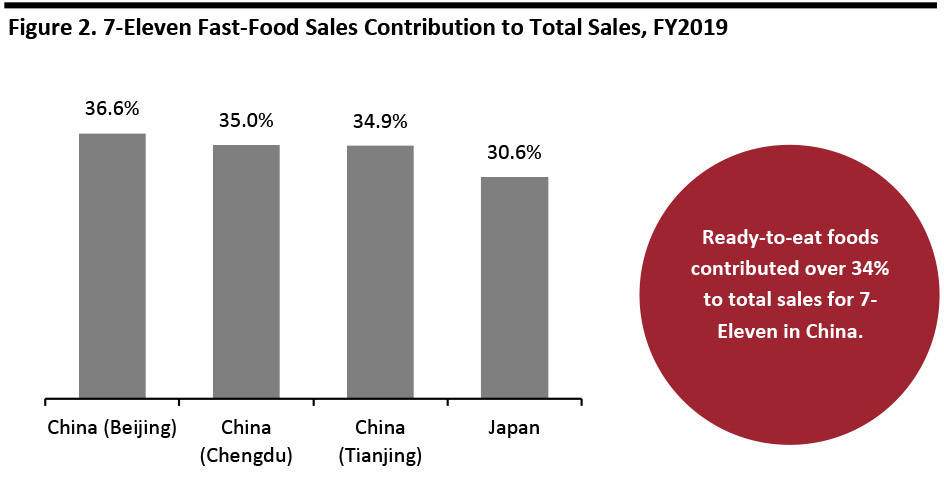

- In addition to common food items such as pork buns, oden (a Japanese stew), sandwiches and sushi, 7-Eleven in China offers 12 hot dishes for customers to build their own boxed meals, with a new menu launching weekly. The convenience-store chain has adopted a combined distribution system for greater efficiency and consistency of food quality across all of its stores. Ready-to-eat foods are driving incremental purchases in snacks and beverages. 7-Eleven in Taiwan provides more localized goods such as tea eggs and even began selling bubble tea and other specialty beverages in 2018.

Source: Seven & i Holdings/Coresight Research[/caption]

Source: Seven & i Holdings/Coresight Research[/caption]

- Bianlifeng started a “buy one, get one free” boxed-lunch promotion in May 2019 for two weeks to attract new customers. The newer convenience-store chain has its own production factory and cold-chain distributors, and it continuously introduces new food items based on consumer insights.

Food offerings at Bianlifeng

Food offerings at Bianlifeng Source: Coresight Research [/caption]

- FamilyMart launched a new line of boxed meals all priced under ¥11 ($1.56) in May 2019—30% lower than previous prices. Through this initiative, the company is aiming to better compete with the soaring food-delivery market in China.

- Lawson updates its ready-to-eat food menu every week in order to meet the changing needs of Chinese consumers. The chain’s most popular products are desserts, driven by younger customers. Lawson produces sugar-free desserts for health-conscious consumers in Eastern China. According to Joshua Zhang, Executive Vice President of Lawson, breakfast items, afternoon-tea desserts and midnight snacks have seen the fastest growth. Breakfast sales, for instance, have experienced double-digit annual growth for the past four years.

Convenience Stores Become More Convenient with Additional Services

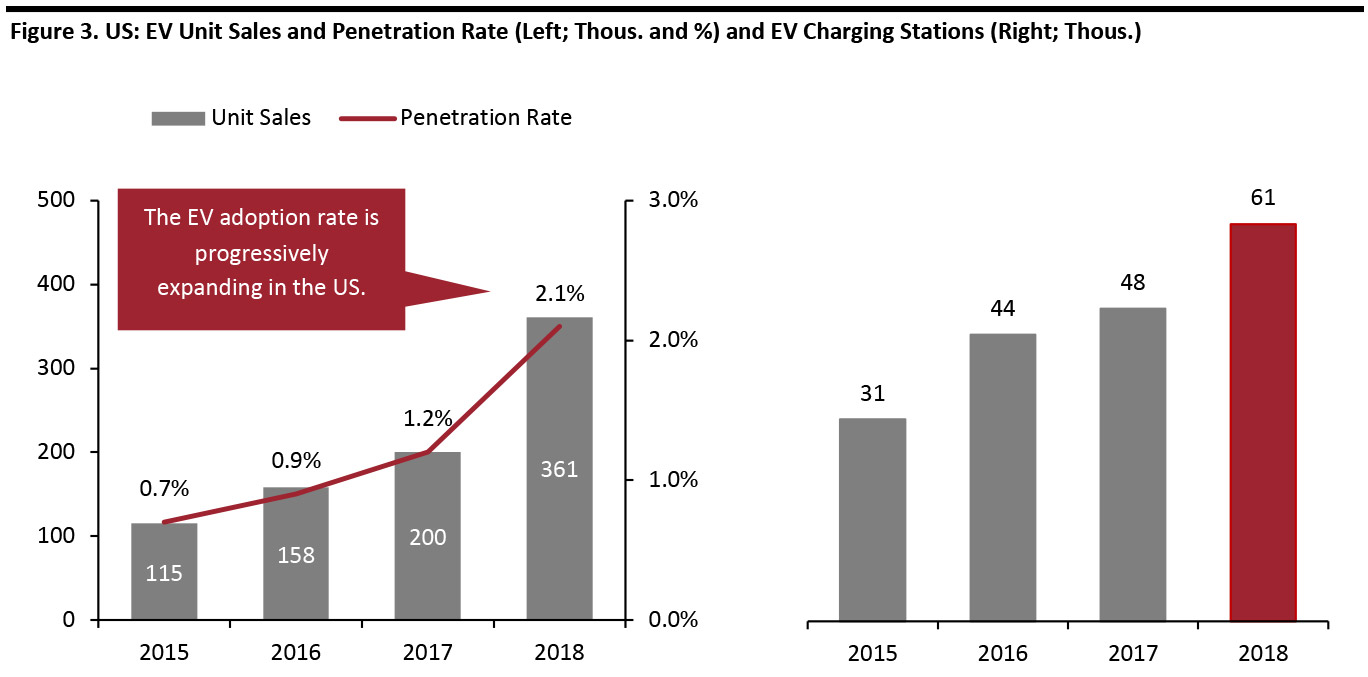

Convenience stores are becoming community gathering points by providing a variety of services beyond fuel and merchandise to meet all household needs. In the US, lottery, car washes and ATMs are three most common services offered by convenience stores. Convenience stores accounted for approximately 68% of all lottery tickets purchased in the US in 2018, according to NACS. Furthermore, the association found that consumers who buy lottery tickets typically have a higher total basket spend than those who don’t. NACS also stated that car washes and ATMs generate average annual sales of $69,000 and $8,750 per store, respectively. EV Charging Stations The EV industry is gradually taking off, with unit sales surging by 80.5% in 2018 from 2017. This is significant because of the US convenience sector’s strong link to gas stations and, so, dependence on fuel purchases. NACS highlighted that 80% of US convenience stores sell fuels in 2018. While the impact of EV on gasoline sales still remain slight, convenience stores are capitalizing the opportunity by adding EV charging stations. 89% of EV owners said having EV charging stations is important for convenience stores, according to a study by AlixPartners. [caption id="attachment_101241" align="aligncenter" width="700"] Source: McKinsey/Bloomberg New Energy Finance/Coresight Research [/caption]

Volkswagen subsidiary Electrify America has partnered with a number of convenience-store chains—including Casey’s General Stores, Global Partners’ Alltown Fresh and Sheetz—to install EV charging stations at more than 100 locations. Wawa also provides EV charging stations at several of its stores, which are fulfilled by Tesla, and the chain plans to expand this offering to over 30 stores next year.

Financial and Online-to-Offline Services

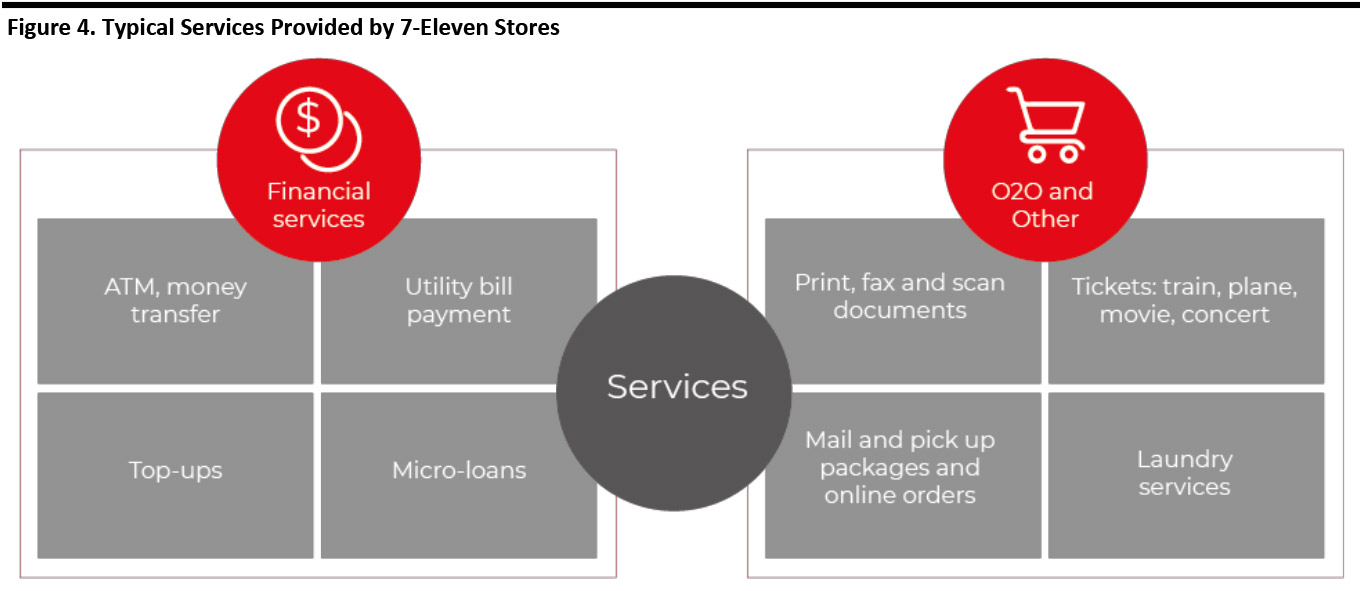

Convenience stores in Asia, particularly in Japan and Taiwan, have become integral to locals’ daily life, not only due to high store density but also the numerous services on offer. Alongside financial services, stores are providing online-to-offline (O2O) services—consumers are able to pay bills, purchase movie tickets, make hotel reservations, ship packages and even drop off clothes for laundry services. These value-added offerings create an additional stream of income for convenience-store chains, as well as help to drive in-store traffic and incremental purchases. Sales from services in FamilyMart Japan contributed 12% to the company’s total sales in 2018.

[caption id="attachment_101231" align="aligncenter" width="700"]

Source: McKinsey/Bloomberg New Energy Finance/Coresight Research [/caption]

Volkswagen subsidiary Electrify America has partnered with a number of convenience-store chains—including Casey’s General Stores, Global Partners’ Alltown Fresh and Sheetz—to install EV charging stations at more than 100 locations. Wawa also provides EV charging stations at several of its stores, which are fulfilled by Tesla, and the chain plans to expand this offering to over 30 stores next year.

Financial and Online-to-Offline Services

Convenience stores in Asia, particularly in Japan and Taiwan, have become integral to locals’ daily life, not only due to high store density but also the numerous services on offer. Alongside financial services, stores are providing online-to-offline (O2O) services—consumers are able to pay bills, purchase movie tickets, make hotel reservations, ship packages and even drop off clothes for laundry services. These value-added offerings create an additional stream of income for convenience-store chains, as well as help to drive in-store traffic and incremental purchases. Sales from services in FamilyMart Japan contributed 12% to the company’s total sales in 2018.

[caption id="attachment_101231" align="aligncenter" width="700"] Source: iyiou/Coresight Research[/caption]

Delivery Services

With more restaurants and retailers partnering with third-party delivery services, convenience stores are also offering delivery services to keep up with rising consumer expectations.

Source: iyiou/Coresight Research[/caption]

Delivery Services

With more restaurants and retailers partnering with third-party delivery services, convenience stores are also offering delivery services to keep up with rising consumer expectations.

- 7-Eleven introduced 30-minute delivery service called 7NOW in late 2017, which is available across 34 regions in the US. This year, the company has added new features: the 7NOW Pins option—introduced in June—enables the delivery of products to hundreds of public places, such as parks, beaches and entertainment venues; and 7Voice—launched in November—allows customers to place orders through the 7NOW app via Google Home and Amazon Echo devices.

Source: 7-Eleven[/caption]

Source: 7-Eleven[/caption]

- Circle K partnered with on-demand delivery company Favor in October 2019 to offer delivery from its 600 locations across Texas, following a successful delivery pilot across the Greater Houston area in July.

- Several convenience stores such as Wawa and QuickTrip have collaborated with third-party delivery services to deliver foodservice items only.

- The on-demand delivery battle is intense in China. The top three foreign chains—7-Eleven, FamilyMart and Lawson—have all partnered with major delivery services Meituan and Ele.me for last-mile delivery. Local brands Bianlifeng and Suning Xiaodian have also started testing their own delivery services.

Convenience Stores Are Testing New Store Formats

Convenience stores are redefining what “convenience” is by introducing new shop-in-shop or themed store concepts to excite consumers and boost in-store traffic.- 7-Eleven introduced its new “Big 7” concept in Taiwan in late 2018, which combines a specialty coffee shop, reading parlor, candy store, beauty counter, bakery and supermarket. The 4,600-square-foot store updates assortments regularly based on consumer insights.

Source: 7-Eleven Taiwan[/caption]

Source: 7-Eleven Taiwan[/caption]

- FamilyMart opened its first laundromat-equipped store in Japan in May 2018 and one in Taiwan in January 2019. The 24-hour self-service laundry machines are intended to attract dual-income families and single-person households to the store. In addition, FamilyMart launched a 24-hour gym on the second floor of its Tokyo store in February 2018, with plans to open 300 more over the next five years.

Source: FamilyMart Japan[/caption]

Source: FamilyMart Japan[/caption]

- Lawson partnered with Bilibili, a Chinese video-streaming website, to open a themed store in Shanghai in 2018, targeting younger consumers. Lawson Japan has transformed some of its stores to cater to the nation’s elderly population by adding a consultation area and pharmacy section.