Nitheesh NH

Consumers’ payment habits continue to change apace, and the current coronavirus environment is serving to accelerate the development and adoption of alternative payment technologies in the retail industry. For example, on March 27, 2020, Walmart updated its self-checkout system to enable a complete contactless experience using Walmart Pay.

The Covid-19 pandemic is likely to have driven up in-store contactless transactions globally, while the shift to e-commerce is inherently impacting how and where shoppers make payments. We expect consumer preferences for contactless and e-commerce options to persist post Covid-19.

The Rise of Contactless Payments

The use of mobile payment services in the US is growing: The total number of proximity mobile payment users in the country is set to increase by 8.4% to 69.4 million in 2020, according to market research firm eMarketer—the equivalent of 30.6% of US smartphone users. This growth is being fueled by increasing acceptance of such technology by retailers and other merchants. Today, almost all new point-of-sale systems include near-field communication technology, which enables contactless payments.

Apple Inc. is a leader in contactless payments. According to eMarketer, 30.3 million people in the US used the Apple Pay platform to make proximity mobile payments in 2019, making it the most-used system last year—followed by Starbucks (25.2 million users), Google Pay (12.1 million) and Samsung Pay (10.8 million).

Contactless payment systems have also been widely adopted outside of the US. On March 25, 2020, Mastercard reported that 75% of all Mastercard transactions across Europe are contactless, and announced its commitment to increasing the limits for contactless payments across 20 European countries. This move is intended to increase shoppers’ peace of mind in the current coronavirus environment by enabling them to use contactless payments more often, as it would be accepted for higher-value transactions—thus reducing required contact while shopping to minimize the risk of contracting the virus.

Contactless payment technology is particularly prevalent in China, where many consumers—especially the young, urban demographic—no longer carry wallets, because nearly every retailer accepts mobile payments. The Alipay and WeChat Pay mobile payment platforms each have over 1 billion active accounts, as of May 2020.

China’s Central Bank Tests Digital Currency

The People’s Bank of China (the nation’s central bank) is currently piloting the government-run Digital Currency Electronic Payment program, having rolled it out in the cities of Chengdu, Shenzhen, Suzhou and Xiong’an in April 2020. According to central bank officials, the test is part of preparation for the 2022 Winter Olympics in Beijing, and the digital currency—which has features similar to cryptocurrencies—is not planned to be issued nationwide in the near term.

As part of the pilot, some civil servants in Suzhou will receive half of their transport subsidy in May 2020 in the form of digital currency, which requires an app to initiate the transfer. Users can deposit the currency into their existing bank accounts or spend it at designated merchants. In addition, transactions can be made between people that are in close proximity to each other without them needing to access the Internet, allowing users to exchange “money” without sharing digital information.

As we highlighted earlier in this report, Chinese consumers have widely embraced mobile payment options as an alternative to using paper currency—even before the coronavirus outbreak. This digital currency pilot program represents a major milestone for the nation in moving toward a cashless society.

[caption id="attachment_110005" align="aligncenter" width="520"] China’s new digital currency, which is currently being tested in a government-run program

China’s new digital currency, which is currently being tested in a government-run program

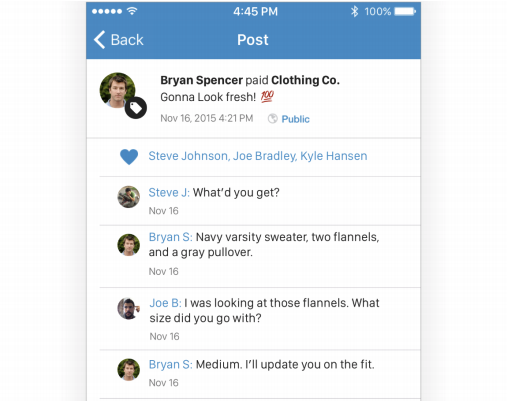

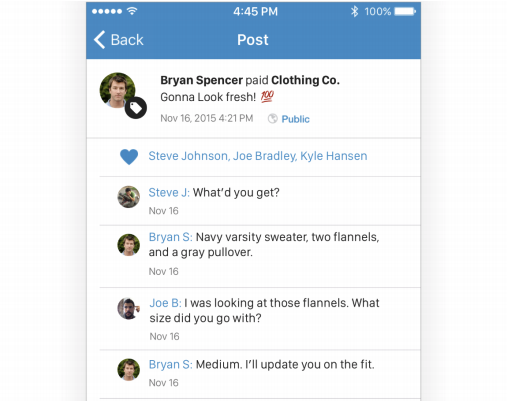

Source: Xiong’an E-Life on WeChat[/caption] Facebook Adapts Its Libra Project following Initial Resistance Facebook first announced its cryptocurrency project, Libra, in June 2019 but received initial resistance from regulators to introducing the cryptocurrency. Four months after the announcement, a US congressional hearing on Libra led to the project being paused. The company agreed not to proceed without regulatory blessing, which was followed by the loss of several partners, including Mastercard and Visa. However, the coronavirus pandemic has resulted in increased demand for online transactions. Libra Association, an independent organization based in Switzerland and founded by Facebook, announced on April 16, 2020 that it had applied for a payment system license from the Swiss Financial Market Supervisory Authority. Facebook is considering taking a scaled-down approach to the project, offering stable coins backed by just one nation’s currency. Originally, Facebook pitched Libra as a global digital payment system, but it will now become more like a standard payment service (similar to PayPal), easing concerns that Libra would compete with the US dollar as a global currency. Ongoing Growth for Venmo Venmo is a mobile payment platform owned by PayPal, which has been growing quickly over the past few years. The total payment volume on Venmo increased by 65% to $102 billion globally in 2019, according to PayPal. Due to greater interest in, and higher use of, online and contactless payments, Venmo increased its person-to-person transfer limits in April 2020—from $2,999.99 to $4,999.99 per week. Originally, online payment solutions company Braintree bought Venmo for $26.2 million in 2012, and then PayPal acquired Braintree for $800 million in 2013. The app began as a digital wallet that enabled users to transfer funds to others using their mobile phones—for example, many young people used the app to split utility or dinner bills among friends. In June 2018, the company added debit card functionality, issuing physical cards to account holders. Venmo users could not previously make a direct transaction on apps such as Uber, but the new functionality enabled Venmo to be used as a method of payment for millions of physical and online merchants. Brands and retailers can now also offer Venmo as a payment option through PayPal’s online checkout process. One differentiator of the Venmo payment system is its social commerce feature, which allows users to share information about their retail purchases with their network of real-life friends within the app. [caption id="attachment_110006" align="aligncenter" width="420"] Social commerce feature in Venmo

Social commerce feature in Venmo

Source: Venmo[/caption] Facial Recognition Introduced as a Payment Method in Asia Electronics firm LG is testing a facial recognition payment service at its headquarters in South Korea. The technology combines artificial intelligence and blockchain technology, using facial recognition devices that check the identity of employees and access the blockchain-based community currency on the cloud. Employees can use community currency to make contactless payments at the on-premises restaurant. Similarly, multinational technology company Alibaba rolled out a “smile to pay” feature through its Alipay app with select merchants in China in 2019. Wirecard Teams Up with Stampay To Offer Contactless Payment Solutions As part of its international Covid-19 initiative, digital financial services provider Wirecard has recently began working with Stampay, a mobile payment specialist based in Germany, to offer two contactless payment options via the stampayGO platform—enabling retailers and restaurants to offer cashless delivery and takeaway options during the pandemic. The first option, Pay-by-Link (Click & Pay), allows customers to pay for their order upfront through a payment link via WhatsApp, SMS, email or social media. The second option, Scan & Pay, generates a QR code that customers scan to pay when receiving their order. Merchants do not need to install new payment terminals or systems; they can set up the app on any smartphone. Key Insights Retailers must prepare for a future of contactless payments and frictionless checkouts. Since the outbreak of the coronavirus, many businesses have ceased accepting cash as payment in order to reduce the risk of spreading the virus. Customers are also reluctant to handle cash, making contactless payments through smart devices a more appealing option. As physical stores reopen in nonessential sectors, major chains are likely to emphasize contactless payment options. A further benefit to retailers is that digital payment platforms can likely provide an additional source of data to retailers to help them improve the customer experience, including through social commerce. As more consumers get used to contactless payment services and as shoppers’ expectations of digitally driven transactions rise, consumers are likely to expect more frictionless checkout processes both online and offline over the longer term.

China’s new digital currency, which is currently being tested in a government-run program

China’s new digital currency, which is currently being tested in a government-run programSource: Xiong’an E-Life on WeChat[/caption] Facebook Adapts Its Libra Project following Initial Resistance Facebook first announced its cryptocurrency project, Libra, in June 2019 but received initial resistance from regulators to introducing the cryptocurrency. Four months after the announcement, a US congressional hearing on Libra led to the project being paused. The company agreed not to proceed without regulatory blessing, which was followed by the loss of several partners, including Mastercard and Visa. However, the coronavirus pandemic has resulted in increased demand for online transactions. Libra Association, an independent organization based in Switzerland and founded by Facebook, announced on April 16, 2020 that it had applied for a payment system license from the Swiss Financial Market Supervisory Authority. Facebook is considering taking a scaled-down approach to the project, offering stable coins backed by just one nation’s currency. Originally, Facebook pitched Libra as a global digital payment system, but it will now become more like a standard payment service (similar to PayPal), easing concerns that Libra would compete with the US dollar as a global currency. Ongoing Growth for Venmo Venmo is a mobile payment platform owned by PayPal, which has been growing quickly over the past few years. The total payment volume on Venmo increased by 65% to $102 billion globally in 2019, according to PayPal. Due to greater interest in, and higher use of, online and contactless payments, Venmo increased its person-to-person transfer limits in April 2020—from $2,999.99 to $4,999.99 per week. Originally, online payment solutions company Braintree bought Venmo for $26.2 million in 2012, and then PayPal acquired Braintree for $800 million in 2013. The app began as a digital wallet that enabled users to transfer funds to others using their mobile phones—for example, many young people used the app to split utility or dinner bills among friends. In June 2018, the company added debit card functionality, issuing physical cards to account holders. Venmo users could not previously make a direct transaction on apps such as Uber, but the new functionality enabled Venmo to be used as a method of payment for millions of physical and online merchants. Brands and retailers can now also offer Venmo as a payment option through PayPal’s online checkout process. One differentiator of the Venmo payment system is its social commerce feature, which allows users to share information about their retail purchases with their network of real-life friends within the app. [caption id="attachment_110006" align="aligncenter" width="420"]

Social commerce feature in Venmo

Social commerce feature in VenmoSource: Venmo[/caption] Facial Recognition Introduced as a Payment Method in Asia Electronics firm LG is testing a facial recognition payment service at its headquarters in South Korea. The technology combines artificial intelligence and blockchain technology, using facial recognition devices that check the identity of employees and access the blockchain-based community currency on the cloud. Employees can use community currency to make contactless payments at the on-premises restaurant. Similarly, multinational technology company Alibaba rolled out a “smile to pay” feature through its Alipay app with select merchants in China in 2019. Wirecard Teams Up with Stampay To Offer Contactless Payment Solutions As part of its international Covid-19 initiative, digital financial services provider Wirecard has recently began working with Stampay, a mobile payment specialist based in Germany, to offer two contactless payment options via the stampayGO platform—enabling retailers and restaurants to offer cashless delivery and takeaway options during the pandemic. The first option, Pay-by-Link (Click & Pay), allows customers to pay for their order upfront through a payment link via WhatsApp, SMS, email or social media. The second option, Scan & Pay, generates a QR code that customers scan to pay when receiving their order. Merchants do not need to install new payment terminals or systems; they can set up the app on any smartphone. Key Insights Retailers must prepare for a future of contactless payments and frictionless checkouts. Since the outbreak of the coronavirus, many businesses have ceased accepting cash as payment in order to reduce the risk of spreading the virus. Customers are also reluctant to handle cash, making contactless payments through smart devices a more appealing option. As physical stores reopen in nonessential sectors, major chains are likely to emphasize contactless payment options. A further benefit to retailers is that digital payment platforms can likely provide an additional source of data to retailers to help them improve the customer experience, including through social commerce. As more consumers get used to contactless payment services and as shoppers’ expectations of digitally driven transactions rise, consumers are likely to expect more frictionless checkout processes both online and offline over the longer term.