Nitheesh NH

Each month our Consumer Tech Briefing discusses recent developments in the world of technology. This month, we focus on recent developments around content-sharing platforms, amid a potential ban on short-video platform TikTok in the US.

Source: Statista/App Ape[/caption]

The potential ban on TikTok in the US will leave a giant social media void. Major social media companies and rival short-video-sharing platforms are likely going to benefit as users will look to migrate to a different app to create and share their content and build out their presence. A similar pattern occurred in India after the country banned TikTok in June, with social video apps such as Riposo thriving, adding millions of users in a short period.

Facebook Launches Instagram Reels in More than 50 Countries

On August 5, 2020, Facebook-owned Instagram announced that it is bringing its new “Reels” feature to its users in 50 countries, including Australia, India, Japan, the UK and the US. The company has been testing Reels in Brazil since November 2019, in France and Germany since June and in India since July. Incorporated with AR effects, the new feature allows Instagram users to record and edit 15-second multi-clip videos and add music that can be shared with friends and followers and discovered while browsing the app. Instagram Reels is positioned on the app’s bottom menu next to “Story.”

This is not Facebook’s first move into the social video platform market. Facebook had launched a separate app called Lasso in 2018, which was met with a mild response; it was shut down in July 2020. Reels may have more success as it is integrated into the visually focused Instagram ecosystem with which users are already comfortable. The new feature can bring in new users to Instagram and increase the amount of time that people spend on the platform, thus helping it to transition from a photo-sharing app to a fully fledged video entertainment platform.

Several brands have shown early interest in Instagram Reels, including Maybelline, Louis Vuitton, Red Bull and Sephora. A Coresight Research survey conducted in November 2019 found that Instagram is the most popular social media channel for shopping among respondents aged 18–24.

[caption id="attachment_114657" align="aligncenter" width="480"]

Source: Statista/App Ape[/caption]

The potential ban on TikTok in the US will leave a giant social media void. Major social media companies and rival short-video-sharing platforms are likely going to benefit as users will look to migrate to a different app to create and share their content and build out their presence. A similar pattern occurred in India after the country banned TikTok in June, with social video apps such as Riposo thriving, adding millions of users in a short period.

Facebook Launches Instagram Reels in More than 50 Countries

On August 5, 2020, Facebook-owned Instagram announced that it is bringing its new “Reels” feature to its users in 50 countries, including Australia, India, Japan, the UK and the US. The company has been testing Reels in Brazil since November 2019, in France and Germany since June and in India since July. Incorporated with AR effects, the new feature allows Instagram users to record and edit 15-second multi-clip videos and add music that can be shared with friends and followers and discovered while browsing the app. Instagram Reels is positioned on the app’s bottom menu next to “Story.”

This is not Facebook’s first move into the social video platform market. Facebook had launched a separate app called Lasso in 2018, which was met with a mild response; it was shut down in July 2020. Reels may have more success as it is integrated into the visually focused Instagram ecosystem with which users are already comfortable. The new feature can bring in new users to Instagram and increase the amount of time that people spend on the platform, thus helping it to transition from a photo-sharing app to a fully fledged video entertainment platform.

Several brands have shown early interest in Instagram Reels, including Maybelline, Louis Vuitton, Red Bull and Sephora. A Coresight Research survey conducted in November 2019 found that Instagram is the most popular social media channel for shopping among respondents aged 18–24.

[caption id="attachment_114657" align="aligncenter" width="480"] Instagram’s Reels feature

Instagram’s Reels feature

Source: Facebook[/caption] Snapchat Plans To Unveil Music-Powered Feature This Fall Photo-messaging app Snapchat is reportedly testing a new feature that enables users to add officially licensed music tracks to videos. The feature will launch with a curated catalog of music from record labels including Merlin, the National Music Publishers’ Association, Universal Music Publishing Group and Warner Music Group. Users who receive photo messages, called Snaps, from their friends can swipe up to view the song title, artist and album name, allowing them to discover music from emerging and established artists. A “Play This Song” link transfers them to their preferred music streaming platform, such as Apple Music, SoundCloud or Spotify. Although the feature is not designed to compete directly with TikTok, it may bring to Snapchat some of the energy and creativity that users are currently exhibiting on TikTok. Snapchat plans to roll out the music feature in the fall of 2020 for English users. The company kicked off the pilot in Australia and New Zealand on August 3, 2020. In the second quarter of 2020, Snapchat reported that its daily active users grew by 17% year over year, to 238 million globally. The company claimed to have reached 90% of all 13–27-year-olds and 75% of all 13–34-year-olds in the US as of April 2020. Triller Gains over TikTok Misery On August 2, 2020, Los-Angeles based artificial intelligence (AI)-powered social video platform Triller rose to the top of the downloads list across all categories in the App Store in 50 countries, according to data compiled by Sensor Tower. Triller saw the number of user downloads increase by over 20 times compared to the prior week, reaching over 250 million downloads worldwide. Triller’s rapid growth followed a ban on TikTok in India—which caused influencers and users to migrate to Triller—as well as the increasing concerns raised by the US government surrounding TikTok’s use of user data. In addition to its ever-expanding reach, Triller has forged music-licensing partnerships with several top record labels, including Warner Music Group. These partnerships allow users to create content using the robust catalog of music and share it across multiple social platforms without copyright issues. In July, the company showcased its patented AI technology that allows users to easily create professional-looking music videos. [caption id="attachment_114658" align="aligncenter" width="700"] Source: Triller[/caption]

Source: Triller[/caption]

What’s the Story?

On August 6, 2020, President Trump signed an executive order that will block all US transactions with ByteDance, TikTok’s parent company, beginning September 20. The move comes after months of escalating tensions, which saw high-level government officials at the White House warn that the user data collected by TikTok present a national security threat because of Chinese ownership. Although Microsoft confirmed interest in acquiring TikTok’s US operations, it said that discussions are still tentative, and it cannot assure that a transaction will proceed. In light of these complications surrounding TikTok, other social media giants, including Facebook and Snapchat, are upping the competition by introducing their own short-video entertainment services, equipped with enhanced AR and video-editing features. With TikTok potentially out of the game, social media companies and other independent short-video platforms are looking to attract and retain the potential mass exodus of users and influencers from TikTok.Why It Matters

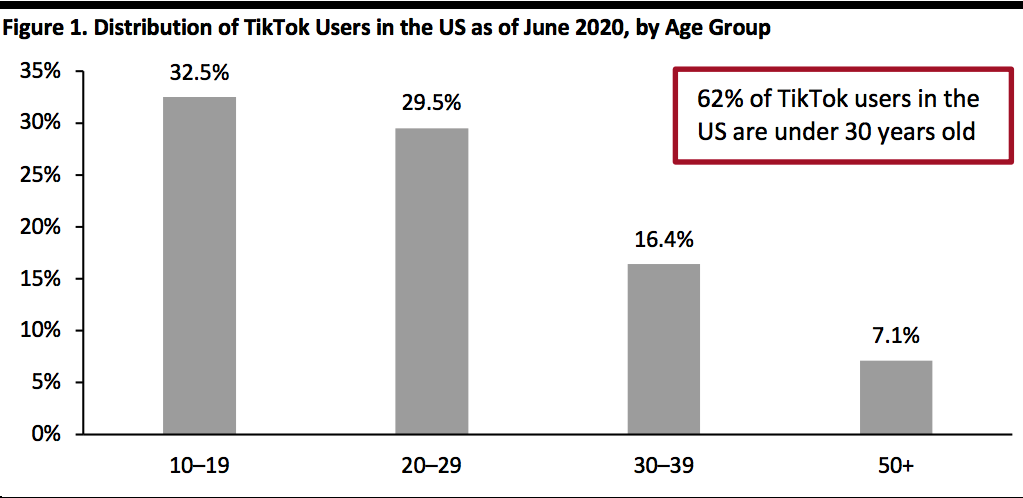

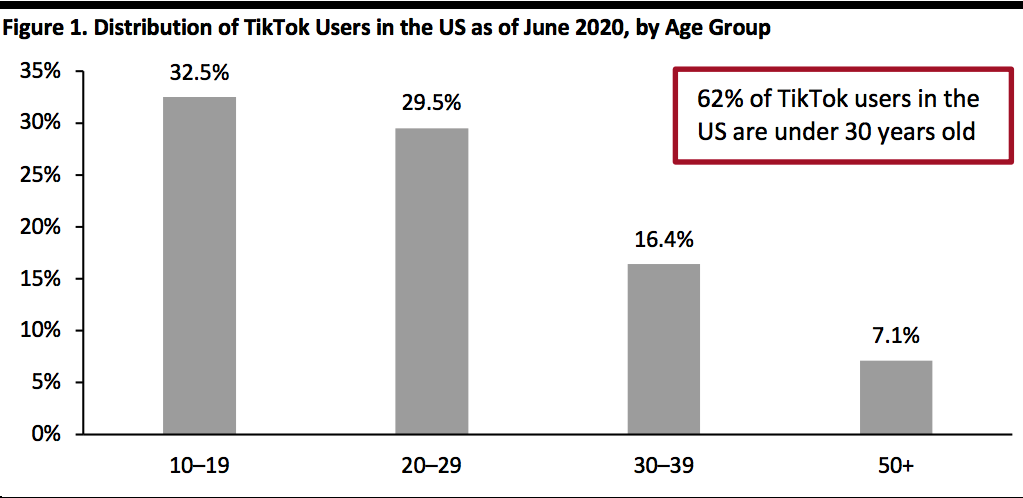

TikTok has seen staggering growth in the US since its debut in 2018. According to social media advertising agency Wallaroo, the number of active TikTok users in the US totals about 85 million as of August 2020, up from 20 million in November 2018. Approximately 62% of users are under the age of 30, with 10–19-year-olds forming the largest age group (32.5%), according to mobile app analytics company App Ape. [caption id="attachment_114656" align="aligncenter" width="700"] Source: Statista/App Ape[/caption]

The potential ban on TikTok in the US will leave a giant social media void. Major social media companies and rival short-video-sharing platforms are likely going to benefit as users will look to migrate to a different app to create and share their content and build out their presence. A similar pattern occurred in India after the country banned TikTok in June, with social video apps such as Riposo thriving, adding millions of users in a short period.

Facebook Launches Instagram Reels in More than 50 Countries

On August 5, 2020, Facebook-owned Instagram announced that it is bringing its new “Reels” feature to its users in 50 countries, including Australia, India, Japan, the UK and the US. The company has been testing Reels in Brazil since November 2019, in France and Germany since June and in India since July. Incorporated with AR effects, the new feature allows Instagram users to record and edit 15-second multi-clip videos and add music that can be shared with friends and followers and discovered while browsing the app. Instagram Reels is positioned on the app’s bottom menu next to “Story.”

This is not Facebook’s first move into the social video platform market. Facebook had launched a separate app called Lasso in 2018, which was met with a mild response; it was shut down in July 2020. Reels may have more success as it is integrated into the visually focused Instagram ecosystem with which users are already comfortable. The new feature can bring in new users to Instagram and increase the amount of time that people spend on the platform, thus helping it to transition from a photo-sharing app to a fully fledged video entertainment platform.

Several brands have shown early interest in Instagram Reels, including Maybelline, Louis Vuitton, Red Bull and Sephora. A Coresight Research survey conducted in November 2019 found that Instagram is the most popular social media channel for shopping among respondents aged 18–24.

[caption id="attachment_114657" align="aligncenter" width="480"]

Source: Statista/App Ape[/caption]

The potential ban on TikTok in the US will leave a giant social media void. Major social media companies and rival short-video-sharing platforms are likely going to benefit as users will look to migrate to a different app to create and share their content and build out their presence. A similar pattern occurred in India after the country banned TikTok in June, with social video apps such as Riposo thriving, adding millions of users in a short period.

Facebook Launches Instagram Reels in More than 50 Countries

On August 5, 2020, Facebook-owned Instagram announced that it is bringing its new “Reels” feature to its users in 50 countries, including Australia, India, Japan, the UK and the US. The company has been testing Reels in Brazil since November 2019, in France and Germany since June and in India since July. Incorporated with AR effects, the new feature allows Instagram users to record and edit 15-second multi-clip videos and add music that can be shared with friends and followers and discovered while browsing the app. Instagram Reels is positioned on the app’s bottom menu next to “Story.”

This is not Facebook’s first move into the social video platform market. Facebook had launched a separate app called Lasso in 2018, which was met with a mild response; it was shut down in July 2020. Reels may have more success as it is integrated into the visually focused Instagram ecosystem with which users are already comfortable. The new feature can bring in new users to Instagram and increase the amount of time that people spend on the platform, thus helping it to transition from a photo-sharing app to a fully fledged video entertainment platform.

Several brands have shown early interest in Instagram Reels, including Maybelline, Louis Vuitton, Red Bull and Sephora. A Coresight Research survey conducted in November 2019 found that Instagram is the most popular social media channel for shopping among respondents aged 18–24.

[caption id="attachment_114657" align="aligncenter" width="480"] Instagram’s Reels feature

Instagram’s Reels featureSource: Facebook[/caption] Snapchat Plans To Unveil Music-Powered Feature This Fall Photo-messaging app Snapchat is reportedly testing a new feature that enables users to add officially licensed music tracks to videos. The feature will launch with a curated catalog of music from record labels including Merlin, the National Music Publishers’ Association, Universal Music Publishing Group and Warner Music Group. Users who receive photo messages, called Snaps, from their friends can swipe up to view the song title, artist and album name, allowing them to discover music from emerging and established artists. A “Play This Song” link transfers them to their preferred music streaming platform, such as Apple Music, SoundCloud or Spotify. Although the feature is not designed to compete directly with TikTok, it may bring to Snapchat some of the energy and creativity that users are currently exhibiting on TikTok. Snapchat plans to roll out the music feature in the fall of 2020 for English users. The company kicked off the pilot in Australia and New Zealand on August 3, 2020. In the second quarter of 2020, Snapchat reported that its daily active users grew by 17% year over year, to 238 million globally. The company claimed to have reached 90% of all 13–27-year-olds and 75% of all 13–34-year-olds in the US as of April 2020. Triller Gains over TikTok Misery On August 2, 2020, Los-Angeles based artificial intelligence (AI)-powered social video platform Triller rose to the top of the downloads list across all categories in the App Store in 50 countries, according to data compiled by Sensor Tower. Triller saw the number of user downloads increase by over 20 times compared to the prior week, reaching over 250 million downloads worldwide. Triller’s rapid growth followed a ban on TikTok in India—which caused influencers and users to migrate to Triller—as well as the increasing concerns raised by the US government surrounding TikTok’s use of user data. In addition to its ever-expanding reach, Triller has forged music-licensing partnerships with several top record labels, including Warner Music Group. These partnerships allow users to create content using the robust catalog of music and share it across multiple social platforms without copyright issues. In July, the company showcased its patented AI technology that allows users to easily create professional-looking music videos. [caption id="attachment_114658" align="aligncenter" width="700"]

Source: Triller[/caption]

Source: Triller[/caption]

What We Think

The demand for social video apps stayed strong during the Covid-19 pandemic, as many Americans took to these platforms in seeking an escape from these turbulent times. The potential ban on TikTok has proved to be the icing on the cake for rival platforms trying to capture a slice of the growing short-video market. We believe that multiple platforms will see a spike in their user base in the coming weeks as TikTok users switch to other platforms. Implications for Brands and Retailers- The expanding pool of TikTok competitors in the wake of current events implies a more fragmented landscape for video-sharing apps, as TikTok’s user base gets distributed among other similar platforms. Brands and retailers will have to re-adjust their social media strategies to take into account the evolving social media landscape and diversify their content offerings to drive customer engagement and market their products.

- The potential ban on TikTok is pushing the app’s users to switch over to a similar alternative to express themselves creatively. Technology vendors will have to continuously evolve their personalization algorithms and other functionalities to match users’ expectations and to retain them in the long term.