DIpil Das

Each month, our Consumer Tech Briefing discusses developments in the world of technology. This month, we focus on wearables—considering recent data on the scale and composition of the market, as well as exploring a range of products and use cases.

Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Source: Statista/Coresight Research[/caption]

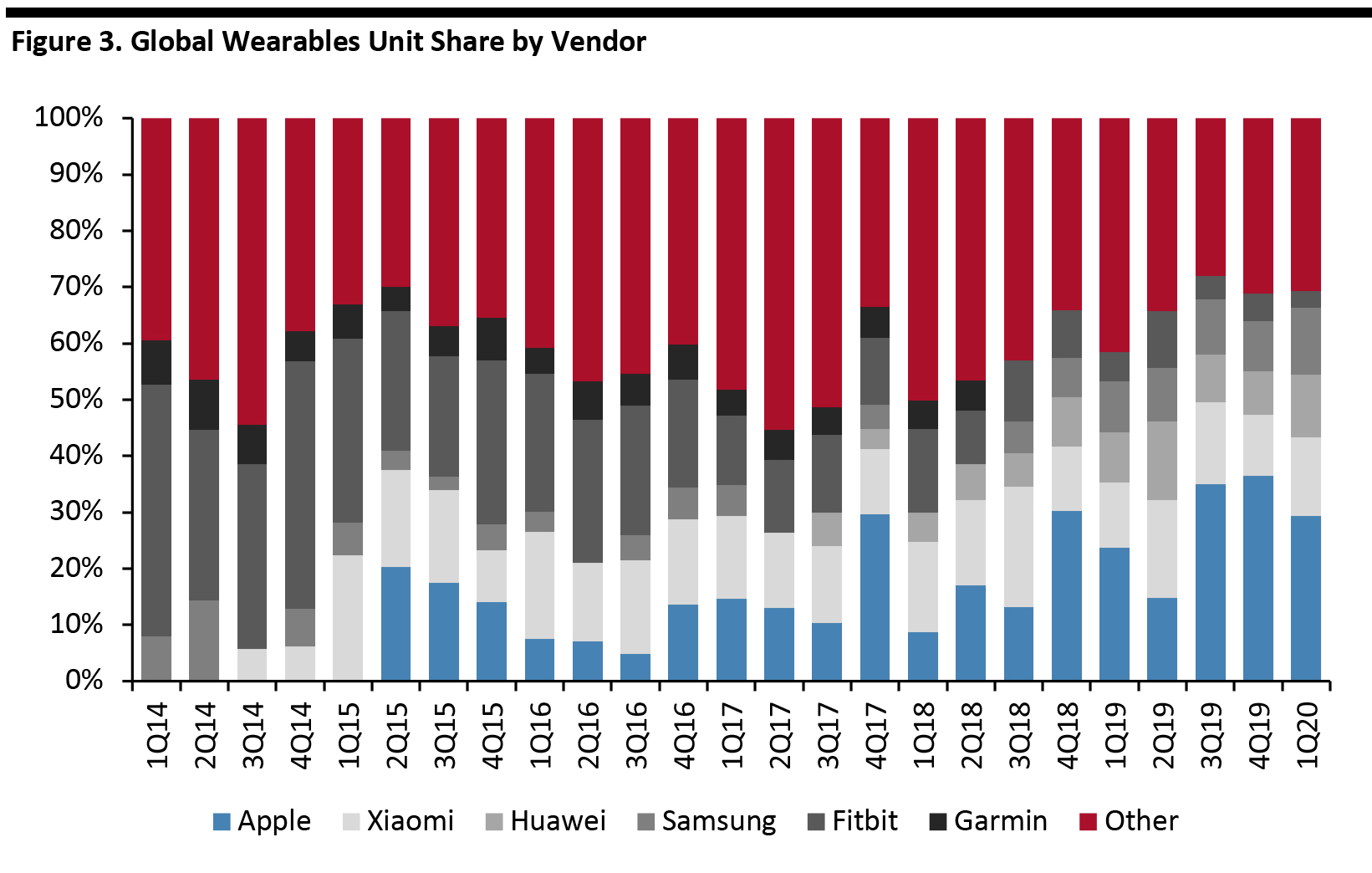

The figure below shows the global market share by unit through the second quarter of fiscal year 2020 for major wearable consumer-electronics products, including earwear (i.e. headphones), wristbands, smartwatches and other items. We see that the top six vendors dominate the wearables market, accounting for nearly two-thirds of the market by unit volume.

[caption id="attachment_113711" align="aligncenter" width="700"]

Source: Statista/Coresight Research[/caption]

The figure below shows the global market share by unit through the second quarter of fiscal year 2020 for major wearable consumer-electronics products, including earwear (i.e. headphones), wristbands, smartwatches and other items. We see that the top six vendors dominate the wearables market, accounting for nearly two-thirds of the market by unit volume.

[caption id="attachment_113711" align="aligncenter" width="700"] Source: IDC [/caption]

Source: IDC [/caption]

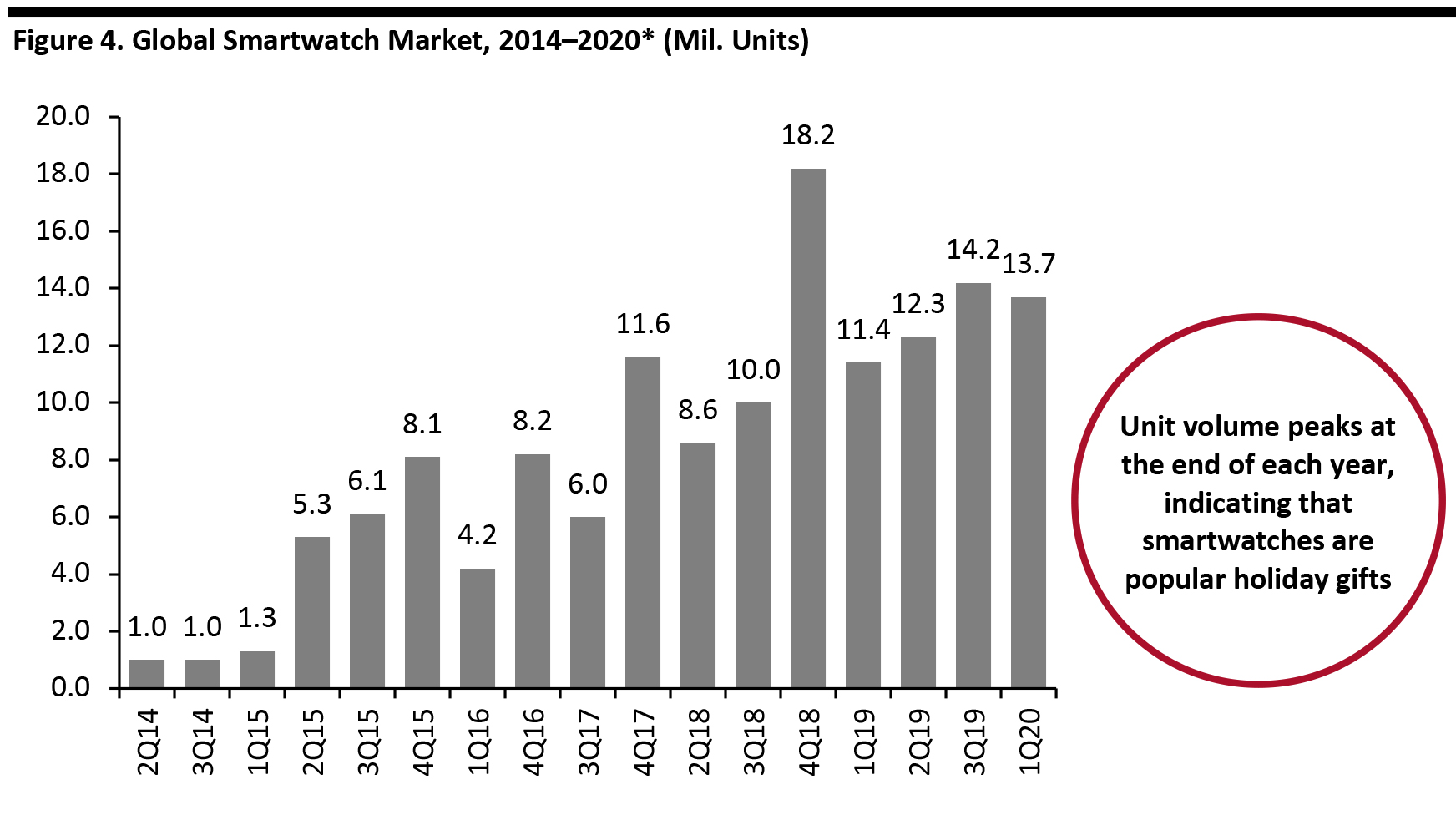

*Includes only the quarters for which data are available

*Includes only the quarters for which data are available

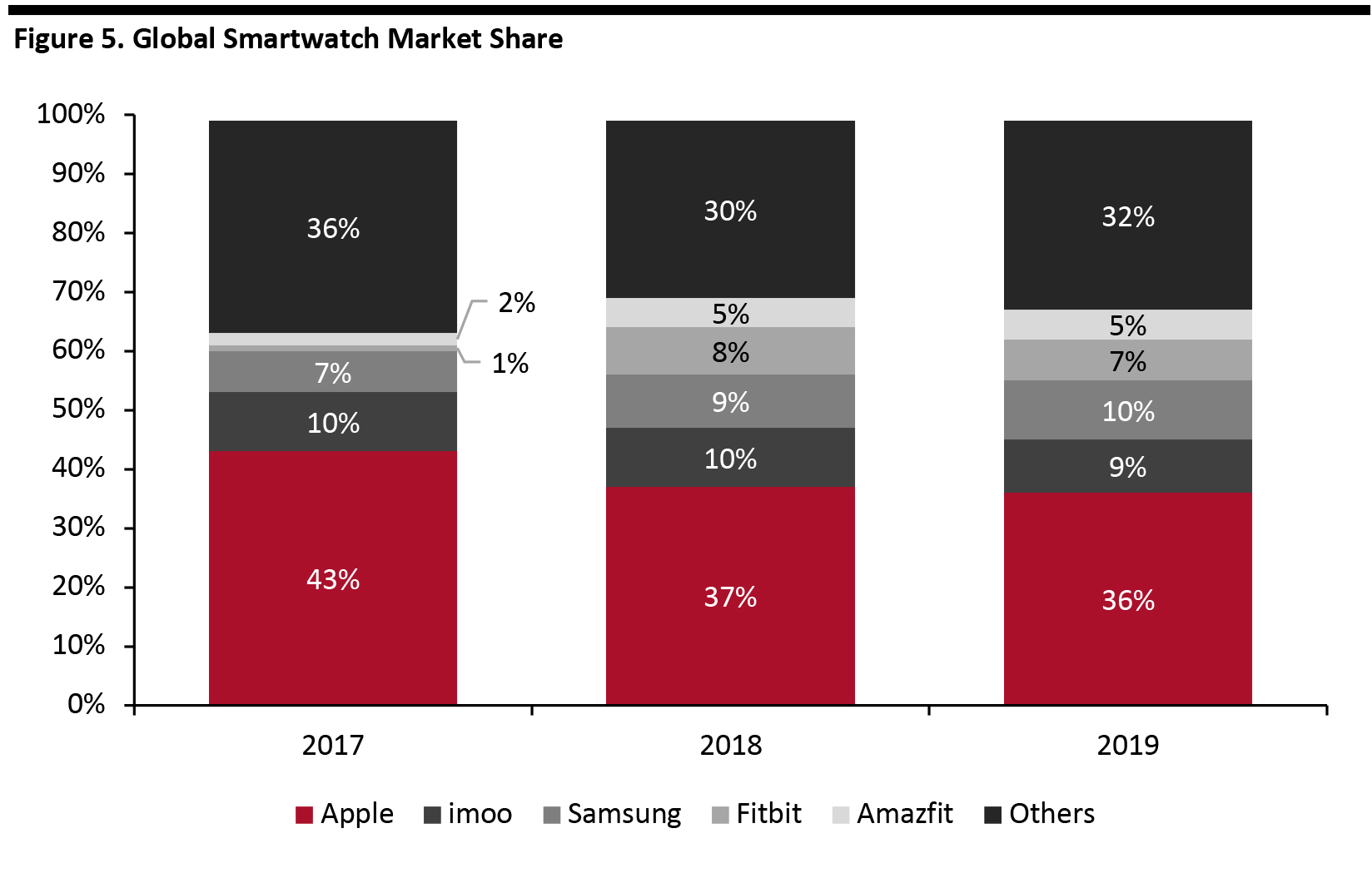

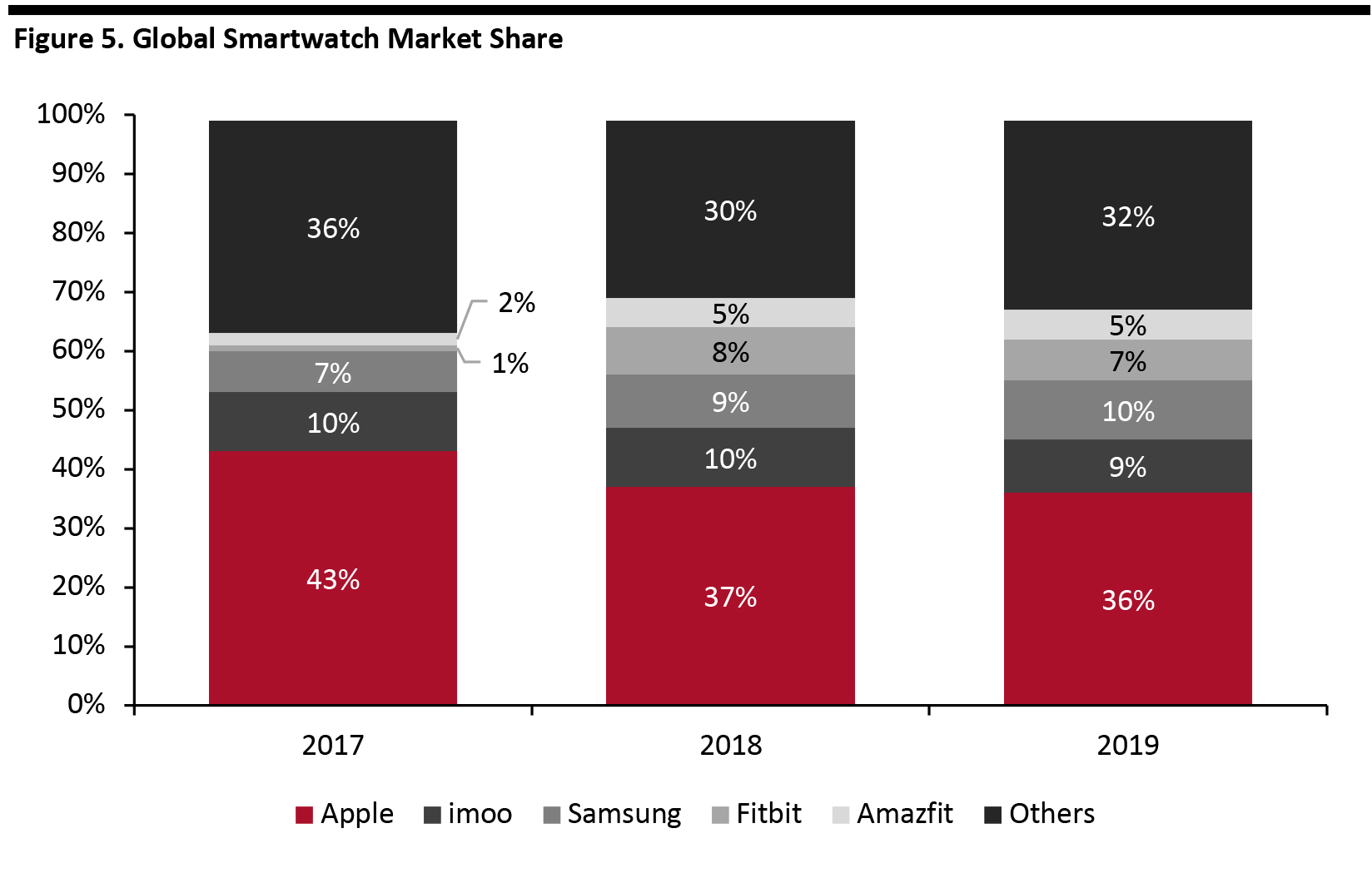

Source: Strategy Analytics [/caption] Figure 5 shows the global smartwatch market share by year for 2017–2019. Apple is the market leader by a large margin, although its share has eroded over time as new vendors have penetrated the market. [caption id="attachment_113713" align="aligncenter" width="700"] Source: Counterpoint Research [/caption]

Apple Continues To Innovate

Apple has launched new features, particularly in relation to health and wellness, with each new version of its smartwatch—one of the key reasons behind its leadership of the market. The most recent Apple Watch Series 5 added several new features:

Source: Counterpoint Research [/caption]

Apple Continues To Innovate

Apple has launched new features, particularly in relation to health and wellness, with each new version of its smartwatch—one of the key reasons behind its leadership of the market. The most recent Apple Watch Series 5 added several new features:

ScanWatch

ScanWatch

Source: Withings [/caption] Source: Statista [/caption]

With consumers required to quarantine at home, the outbreak of Covid-19 triggered a jump in the number of purchases of computer-gaming hardware. However, while demand increased, supply-chain bottlenecks related to the pandemic created component shortages, which slowed the production of VR headsets. Facebook is reportedly increasing production of Oculus headsets by 50% in 2020 compared to 2019, to a total of around 2 million units.

Health and Wellness

Health and wellness-related wearables have become increasingly relevant to US consumers in recent times. In addition to the coronavirus pandemic, one of the driving forces behind the growing interest in wearables is the skyrocketing cost of health care in the US; the modest cost of a wearable device to track a condition often pales in comparison to the cost of treating it. The wide variety of type sensors available enable the monitoring of multiple conditions by measuring different metrics. The focus on health and wellness also extends beyond avoiding illness to feeling as good as possible. We discuss some examples of innovations in wearable health and wellness products below.

Source: Statista [/caption]

With consumers required to quarantine at home, the outbreak of Covid-19 triggered a jump in the number of purchases of computer-gaming hardware. However, while demand increased, supply-chain bottlenecks related to the pandemic created component shortages, which slowed the production of VR headsets. Facebook is reportedly increasing production of Oculus headsets by 50% in 2020 compared to 2019, to a total of around 2 million units.

Health and Wellness

Health and wellness-related wearables have become increasingly relevant to US consumers in recent times. In addition to the coronavirus pandemic, one of the driving forces behind the growing interest in wearables is the skyrocketing cost of health care in the US; the modest cost of a wearable device to track a condition often pales in comparison to the cost of treating it. The wide variety of type sensors available enable the monitoring of multiple conditions by measuring different metrics. The focus on health and wellness also extends beyond avoiding illness to feeling as good as possible. We discuss some examples of innovations in wearable health and wellness products below.

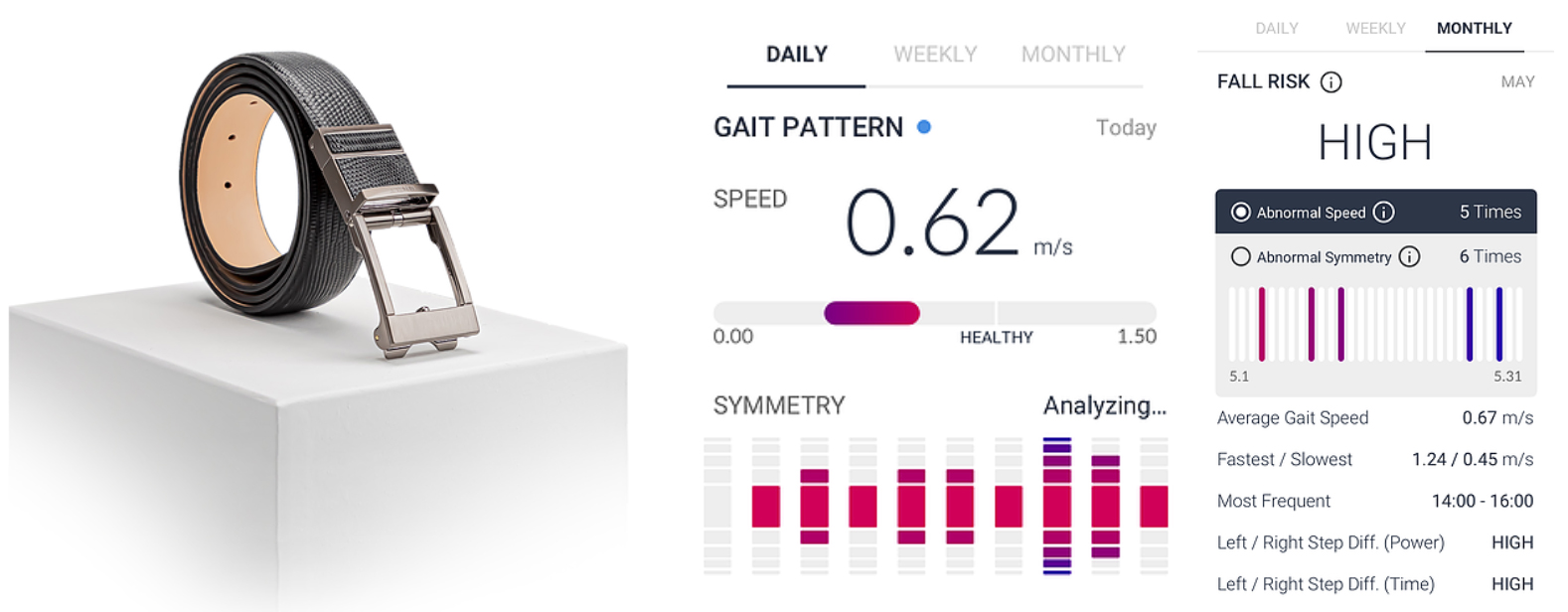

Welt Smart Belt Pro and Gait Analysis

Welt Smart Belt Pro and Gait Analysis

Source: Welt [/caption] Source: Xenoma [/caption]

Source: Xenoma [/caption]

Source: Beddr [/caption]

Source: Beddr [/caption]

Source: Lizn[/caption]

Source: Lizn[/caption]

Source: Whistle [/caption]

Wearables of the Future

Source: Whistle [/caption]

Wearables of the Future

What’s the Story?

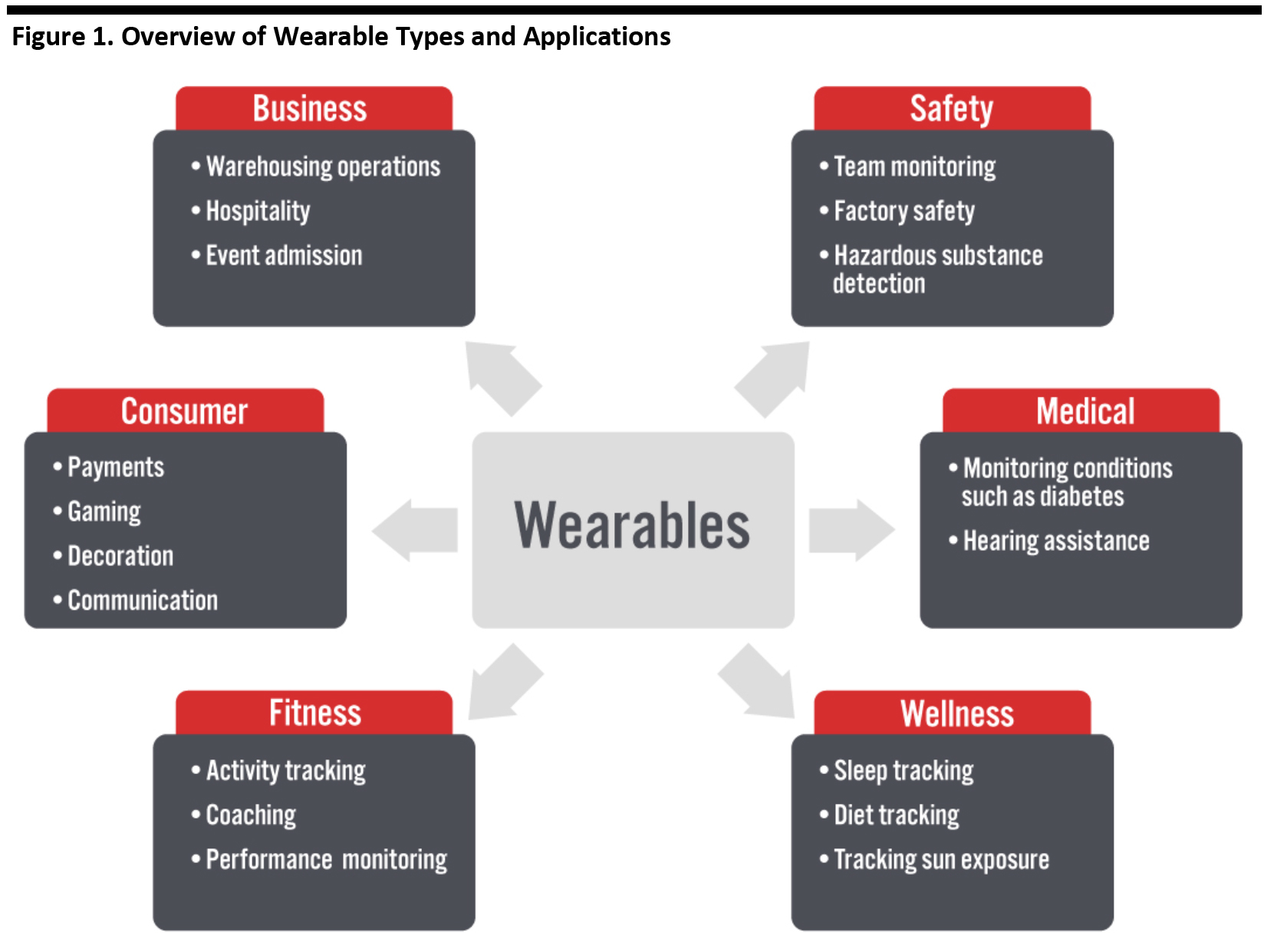

While the wristwatch is arguably the first example of wearable tech—introduced in the 16th century—wearables became a major smart technology around the time that the Apple Watch was launched in 2015. The best applications of wearable tech so far are focused on everyday activities, such as telling time, making payments and most importantly, monitoring health and wellness—in addition to security, medical and industrial uses.Why It Matters

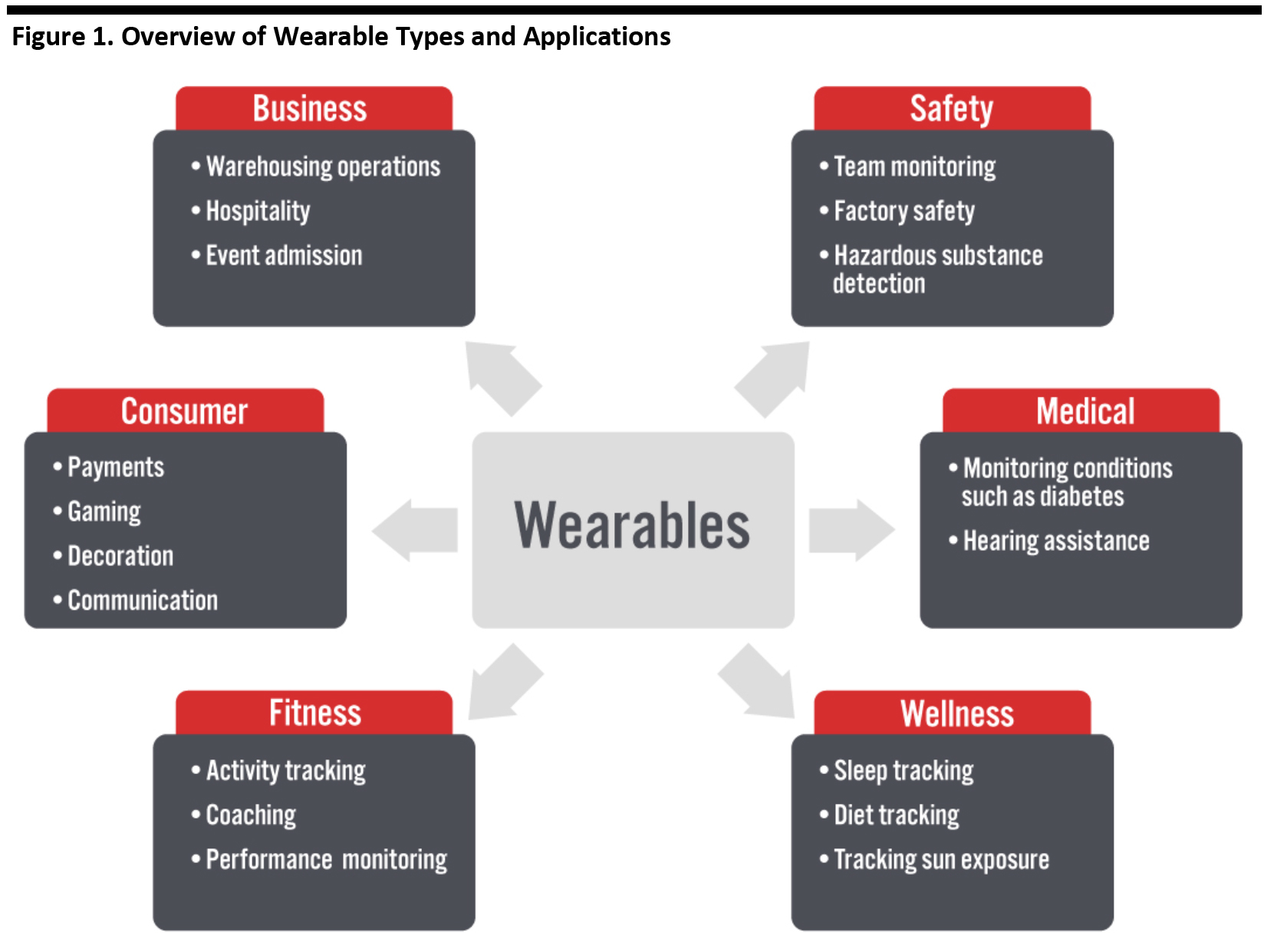

Thus far, no “killer app” for wearables has emerged, and there is currently still space for an indispensable product to be designed. The portability and versatility of current wearable tech products make them suited for a wide variety of applications, as depicted in Figure 1. [caption id="attachment_113709" align="aligncenter" width="700"] Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Wearable Tech Insights

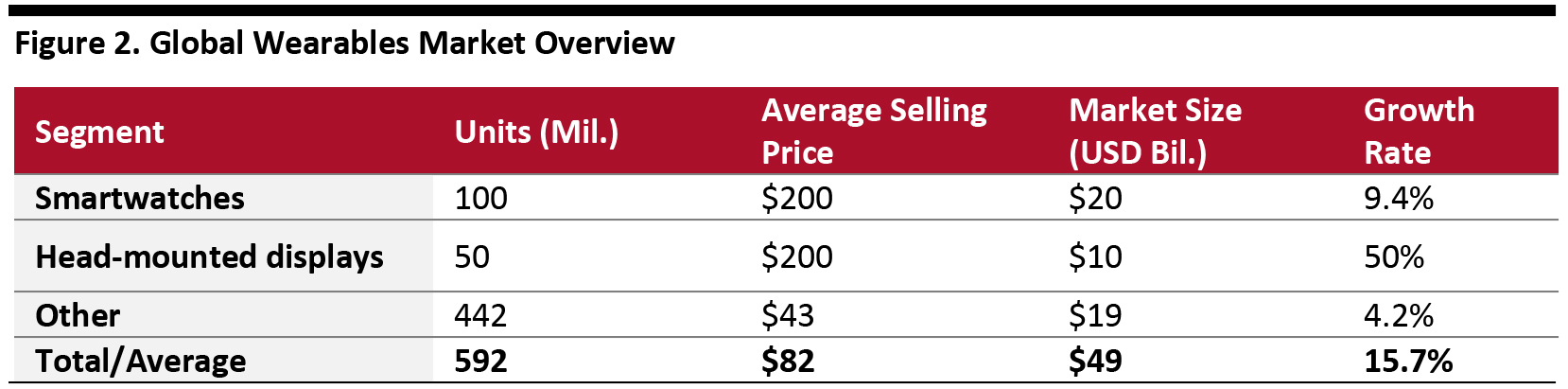

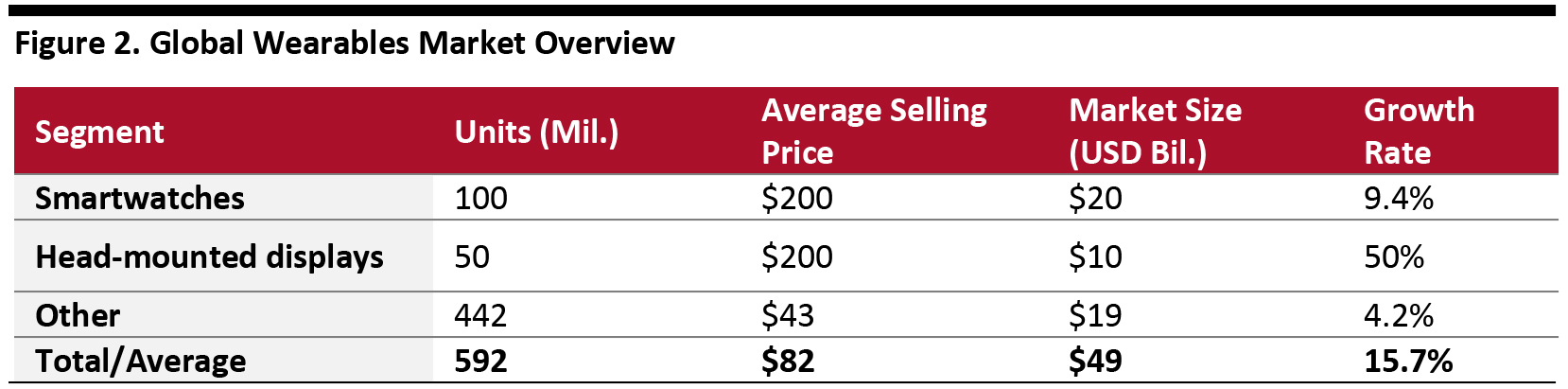

Wearables Market Overview Estimated at nearly $50 billion in 2020, the global market for wearables is growing at 15.7%—driven by expansion in head-mounted displays and VR headsets in particular. Smartwatches and other wearables each account for approximately 40% of the market, with head-mounted displays accounting for the remaining 20%. The global market breakdown is shown in Figure 2. [caption id="attachment_113710" align="aligncenter" width="700"] Source: Statista/Coresight Research[/caption]

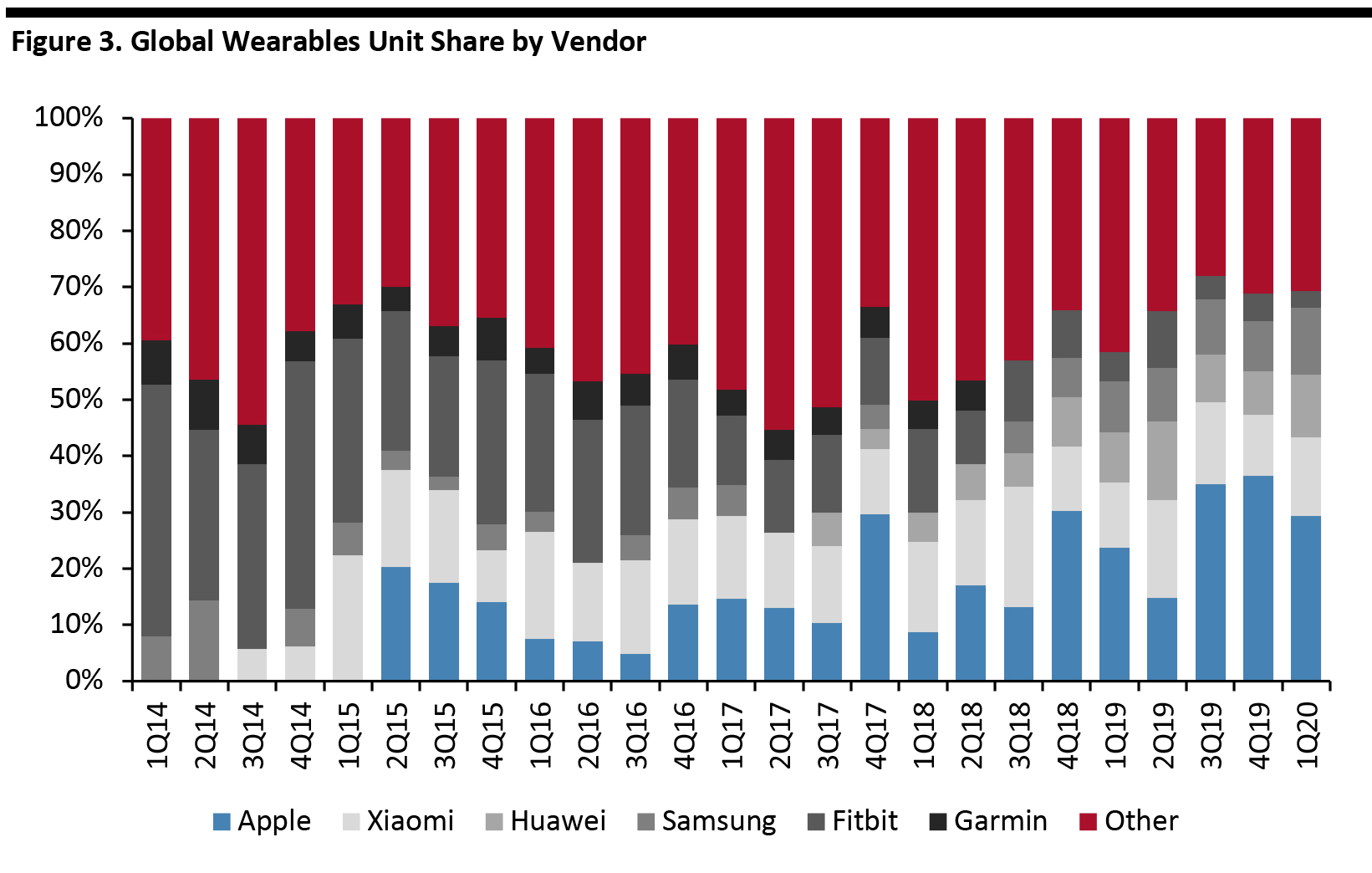

The figure below shows the global market share by unit through the second quarter of fiscal year 2020 for major wearable consumer-electronics products, including earwear (i.e. headphones), wristbands, smartwatches and other items. We see that the top six vendors dominate the wearables market, accounting for nearly two-thirds of the market by unit volume.

[caption id="attachment_113711" align="aligncenter" width="700"]

Source: Statista/Coresight Research[/caption]

The figure below shows the global market share by unit through the second quarter of fiscal year 2020 for major wearable consumer-electronics products, including earwear (i.e. headphones), wristbands, smartwatches and other items. We see that the top six vendors dominate the wearables market, accounting for nearly two-thirds of the market by unit volume.

[caption id="attachment_113711" align="aligncenter" width="700"] Source: IDC [/caption]

Source: IDC [/caption]

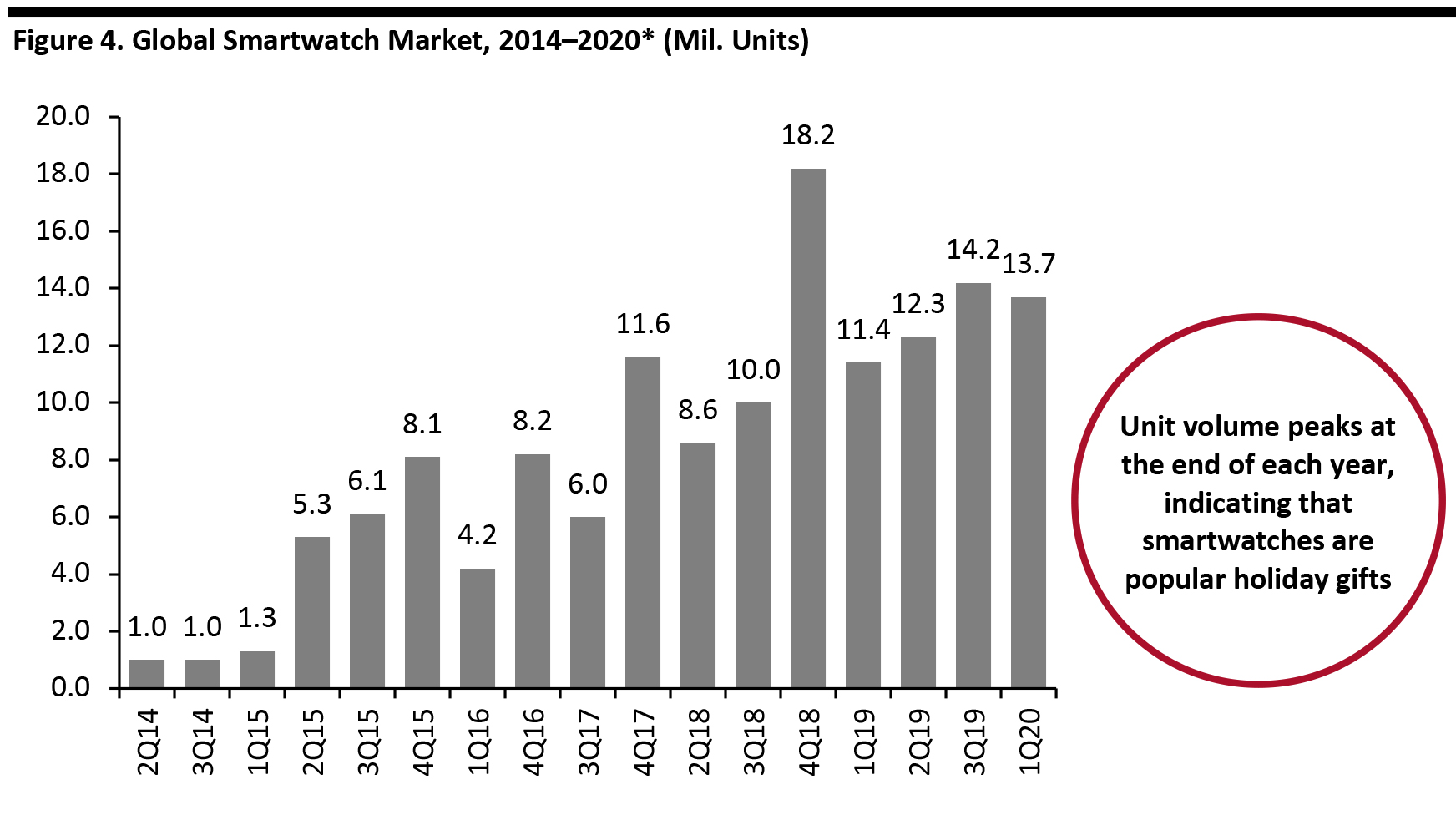

- Smartwatches

*Includes only the quarters for which data are available

*Includes only the quarters for which data are available Source: Strategy Analytics [/caption] Figure 5 shows the global smartwatch market share by year for 2017–2019. Apple is the market leader by a large margin, although its share has eroded over time as new vendors have penetrated the market. [caption id="attachment_113713" align="aligncenter" width="700"]

Source: Counterpoint Research [/caption]

Apple Continues To Innovate

Apple has launched new features, particularly in relation to health and wellness, with each new version of its smartwatch—one of the key reasons behind its leadership of the market. The most recent Apple Watch Series 5 added several new features:

Source: Counterpoint Research [/caption]

Apple Continues To Innovate

Apple has launched new features, particularly in relation to health and wellness, with each new version of its smartwatch—one of the key reasons behind its leadership of the market. The most recent Apple Watch Series 5 added several new features:

- Heart rate monitoring/ECG (electrocardiogram)

- Menstrual-cycle tracking

- Breathing tracking

- Noise-level tracking

- Sleep tracking

- Blood pressure tracking

- Blood oxygen detection

- Mental health features

- Additional fitness features for dance, strength training and cool-downs

ScanWatch

ScanWatch Source: Withings [/caption]

- VR Headsets

Source: Statista [/caption]

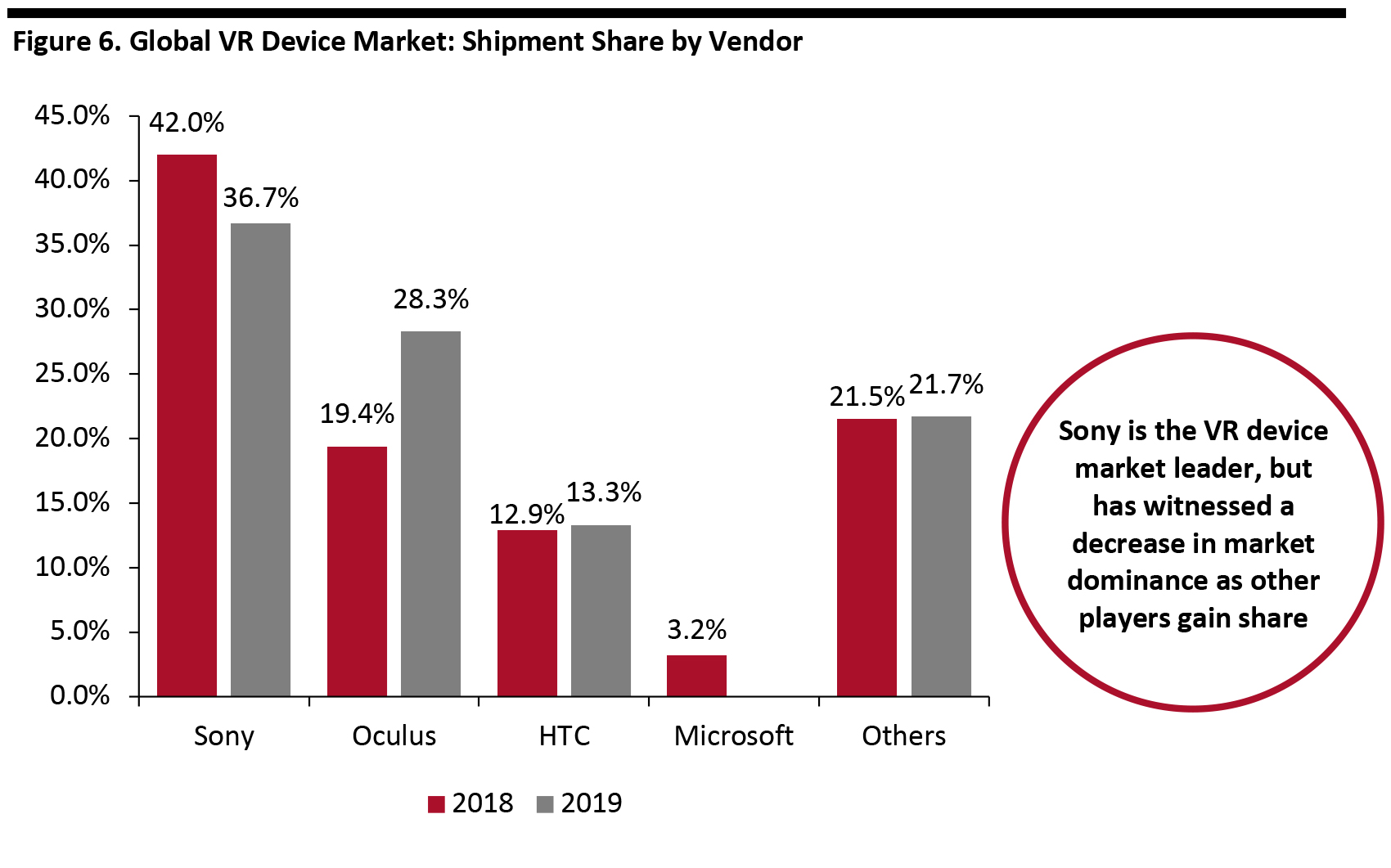

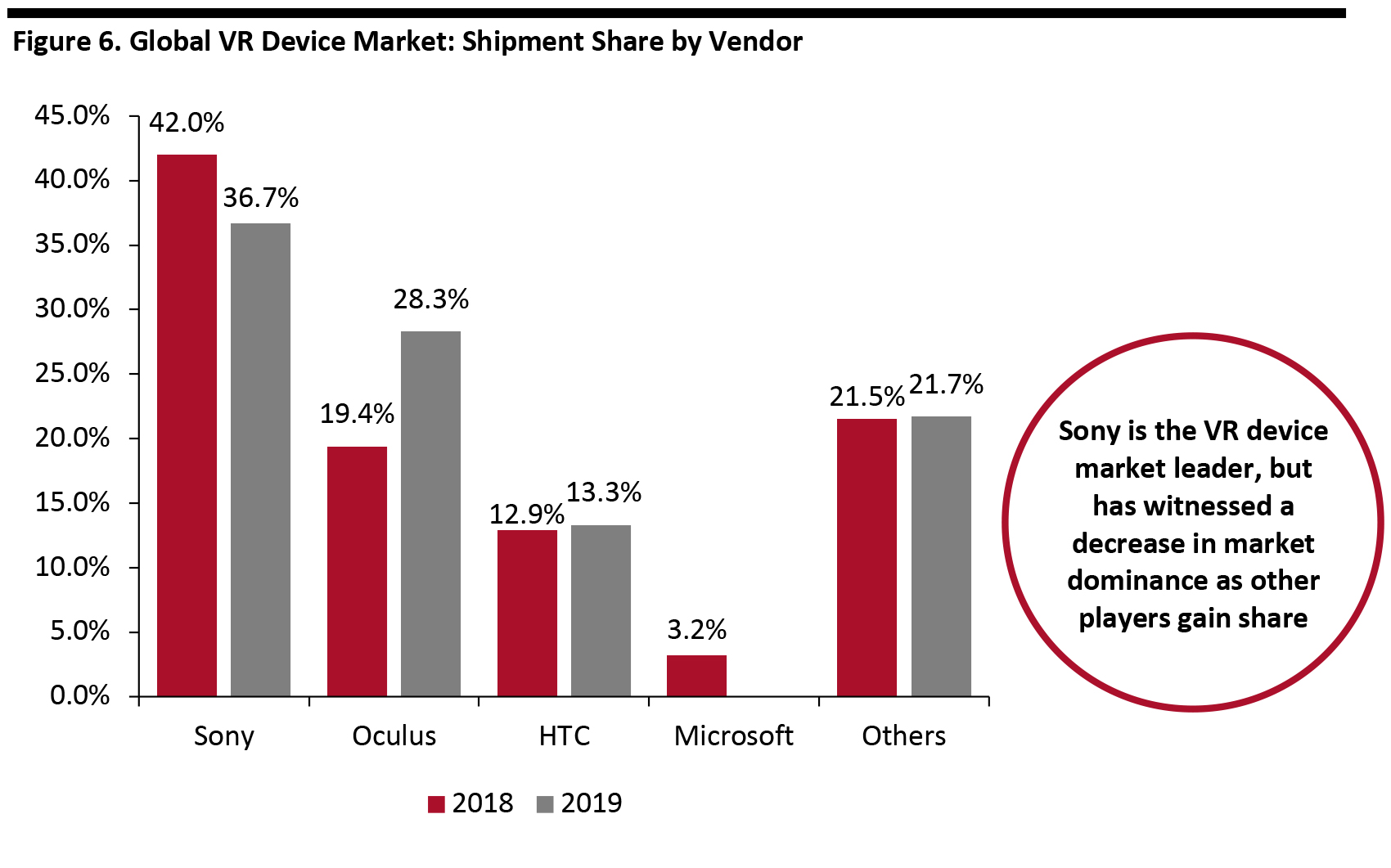

With consumers required to quarantine at home, the outbreak of Covid-19 triggered a jump in the number of purchases of computer-gaming hardware. However, while demand increased, supply-chain bottlenecks related to the pandemic created component shortages, which slowed the production of VR headsets. Facebook is reportedly increasing production of Oculus headsets by 50% in 2020 compared to 2019, to a total of around 2 million units.

Health and Wellness

Health and wellness-related wearables have become increasingly relevant to US consumers in recent times. In addition to the coronavirus pandemic, one of the driving forces behind the growing interest in wearables is the skyrocketing cost of health care in the US; the modest cost of a wearable device to track a condition often pales in comparison to the cost of treating it. The wide variety of type sensors available enable the monitoring of multiple conditions by measuring different metrics. The focus on health and wellness also extends beyond avoiding illness to feeling as good as possible. We discuss some examples of innovations in wearable health and wellness products below.

Source: Statista [/caption]

With consumers required to quarantine at home, the outbreak of Covid-19 triggered a jump in the number of purchases of computer-gaming hardware. However, while demand increased, supply-chain bottlenecks related to the pandemic created component shortages, which slowed the production of VR headsets. Facebook is reportedly increasing production of Oculus headsets by 50% in 2020 compared to 2019, to a total of around 2 million units.

Health and Wellness

Health and wellness-related wearables have become increasingly relevant to US consumers in recent times. In addition to the coronavirus pandemic, one of the driving forces behind the growing interest in wearables is the skyrocketing cost of health care in the US; the modest cost of a wearable device to track a condition often pales in comparison to the cost of treating it. The wide variety of type sensors available enable the monitoring of multiple conditions by measuring different metrics. The focus on health and wellness also extends beyond avoiding illness to feeling as good as possible. We discuss some examples of innovations in wearable health and wellness products below.

- Smart Belts

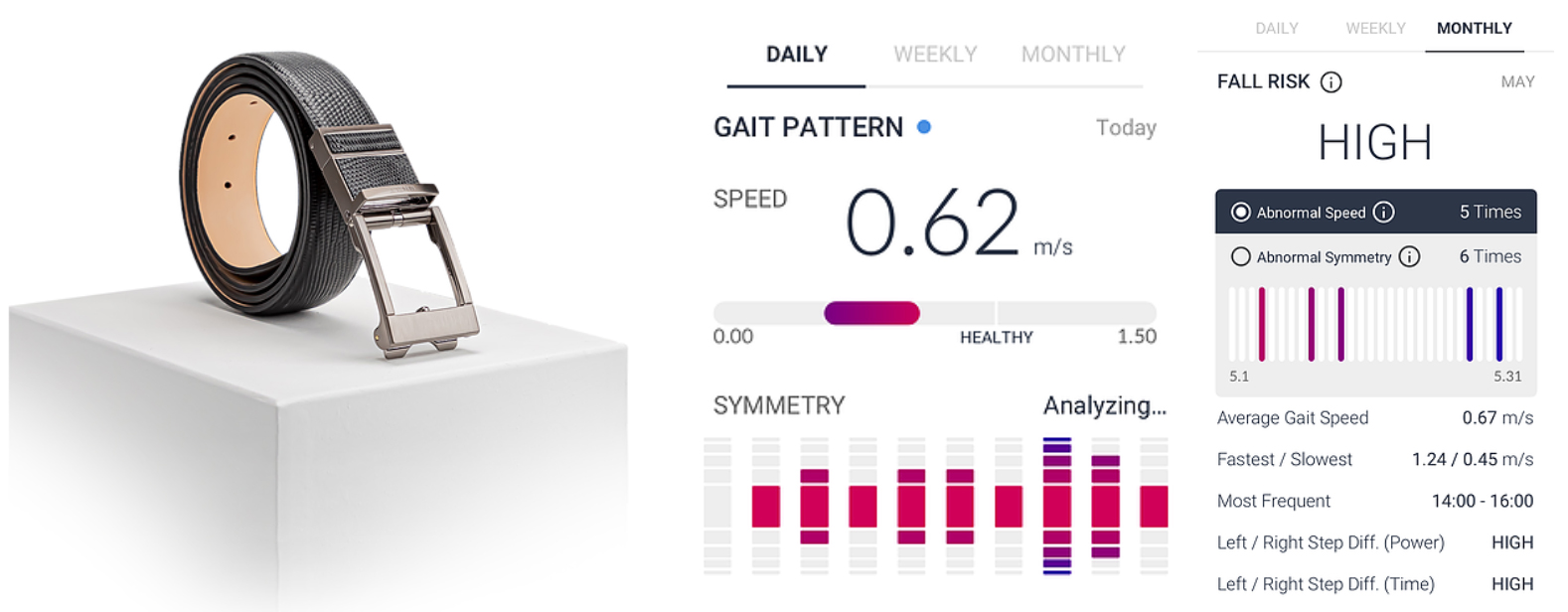

Welt Smart Belt Pro and Gait Analysis

Welt Smart Belt Pro and Gait Analysis Source: Welt [/caption]

- Smart Pajamas

Source: Xenoma [/caption]

Source: Xenoma [/caption]

- Sleep Devices

Source: Beddr [/caption]

Source: Beddr [/caption]

- Hearing Assistance

Source: Lizn[/caption]

Source: Lizn[/caption]

- Pet Wellness

Source: Whistle [/caption]

Wearables of the Future

Source: Whistle [/caption]

Wearables of the Future

- Will Smart Glasses Make a Comeback?

- Rumored Future Apple Wearables

What We Think

The wearables market has passed the hype stage and has delivered several major new global product categories—such as smartwatches and VR headsets. Many of its most useful applications are industry and safety/security. There is also much innovation in wearable products in the health and wellness space. Growing consumer interest in feeling good, rather than just staying healthy, has sparked a boom in new gadgets that can monitor our every function, particularly sleep and exercise. These health and wellness wearable can vastly improve the quality of life for people with conditions that require monitoring, such as diabetes. The steady improvement in computing, sensor and wireless communication technologies is likely to engender new and previously unimagined categories of wearables that will continue to improve our everyday lives. We outline some other examples of wearables and the implications of this growing global market below: Implications for Brands/Retailers- Brands can add technology to apparel to increase functionality. For example, like the smart apparel example discussed above, Visjax have designed smart cycling jackets that contain embedded LED lighting to make cyclists more visible to motorists.

- Brands can embed technology for consumer information purposes. Activewear maker Spyder has embedded near-field communications technology in its ski jackets that provides real-time snow reports and local maps.

- Brands can also include technology for product authentication and identification purposes. RFID (radio-frequency identification) tags can be embedded in apparel for loss prevention, and to verify authentic items and identify counterfeits. Other applications include tagging high-value items, such as luxury goods, to identify their owners for admission to VIP events.

- Wearables can be used for entry, identification, commerce and many other functions in malls and at events. For example, Disney uses MagicBands at its theme parks for seamless entry into the parks, for ride entry and to speed up purchases by eliminating cash usage. These bands have more functions than the typical band worn at concerts for cashless purchases—they include a processor and wireless communications capabilities.

- Technology vendors face the endless task of making devices smaller, lighter and more battery-efficient.

- Competing with the market-leading Apple Watch is challenging, as it gains new capabilities with every new version and absorbs functionality from other wearable categories, such as fitness bands.

- Finally, vendors must deal with a diverse number of sensors and potential metrics used for health and wellness tracking, in addition to the challenge of finally finding the “killer app” for wearables.