Web Developers

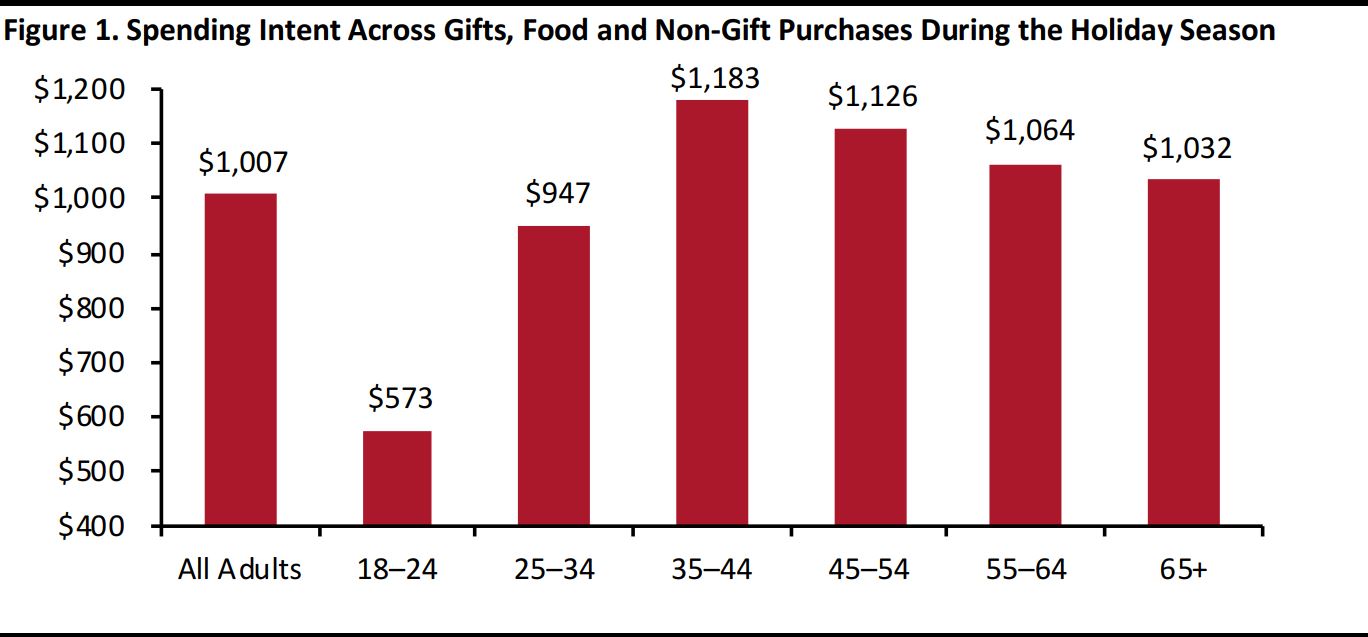

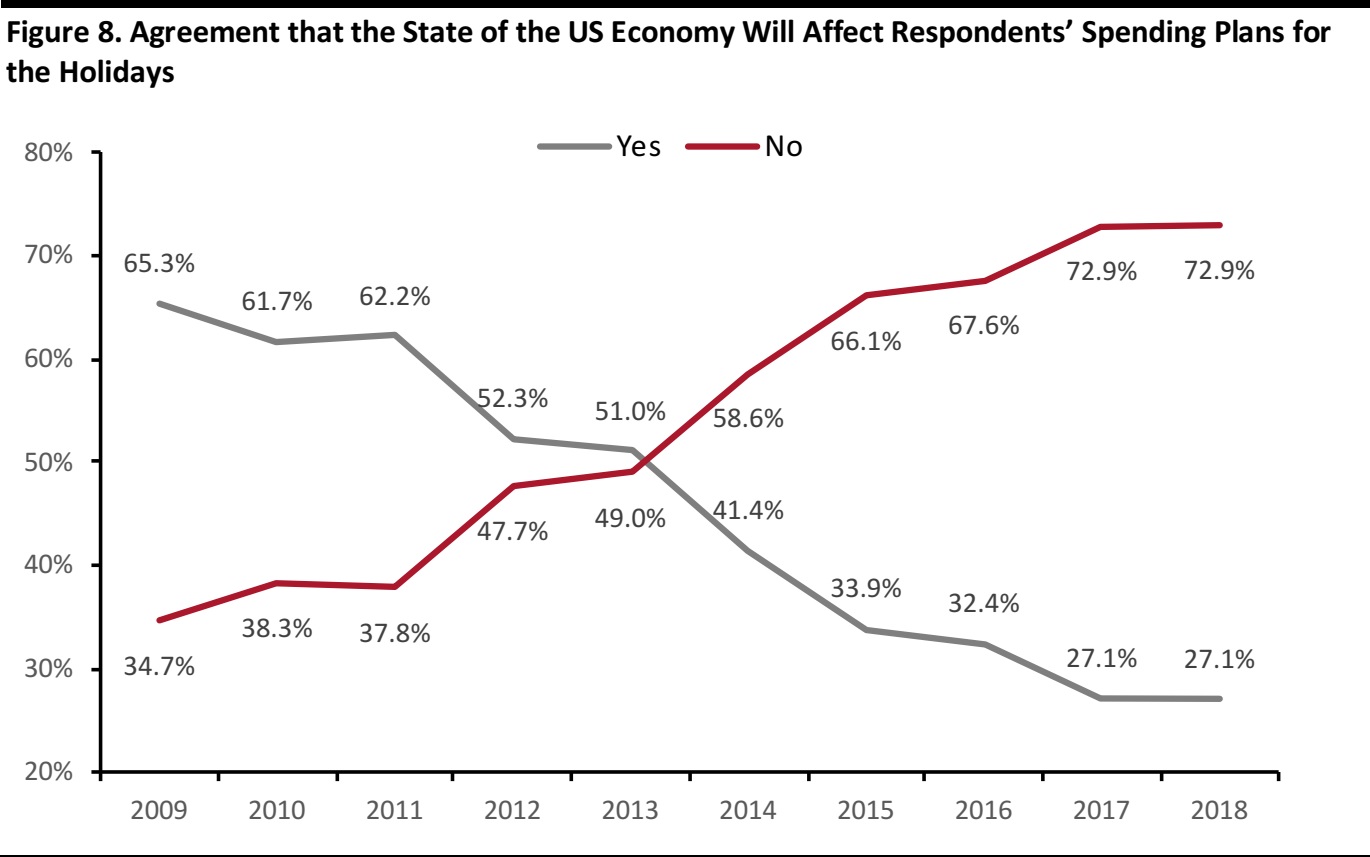

Consumers are set to spend an average of $1,007 this holiday shopping season, or 4.1% more than they planned to spend last year, according to the National Retail Federation’s (NRF’s) annual holiday spending survey, conducted by Prosper Insights & Analytics.We parsed the data and discovered some gems that can help retailers and brands as they plan for the holidays. Since millennials (consumers ages 18–34) account for 23.3% of the population, according to the US Census Bureau, we focused on their spending plans and attitudes heading into the holiday season.

Millennials will not be spending at the same levels as older cohorts this holiday. The 35–44 age group (comprising younger Gen Xers) plans to spend an average of $1,183 this season on gifts, decorations and holiday foods, and non-gift items. Meanwhile, the youngest millennials, who are ages 18–24, plan to spend only about half as much, or $573, on average,and older millennials (ages 25–34) intend to spend $947, on average.

Source: NRF/Prosper Insights & Analytics

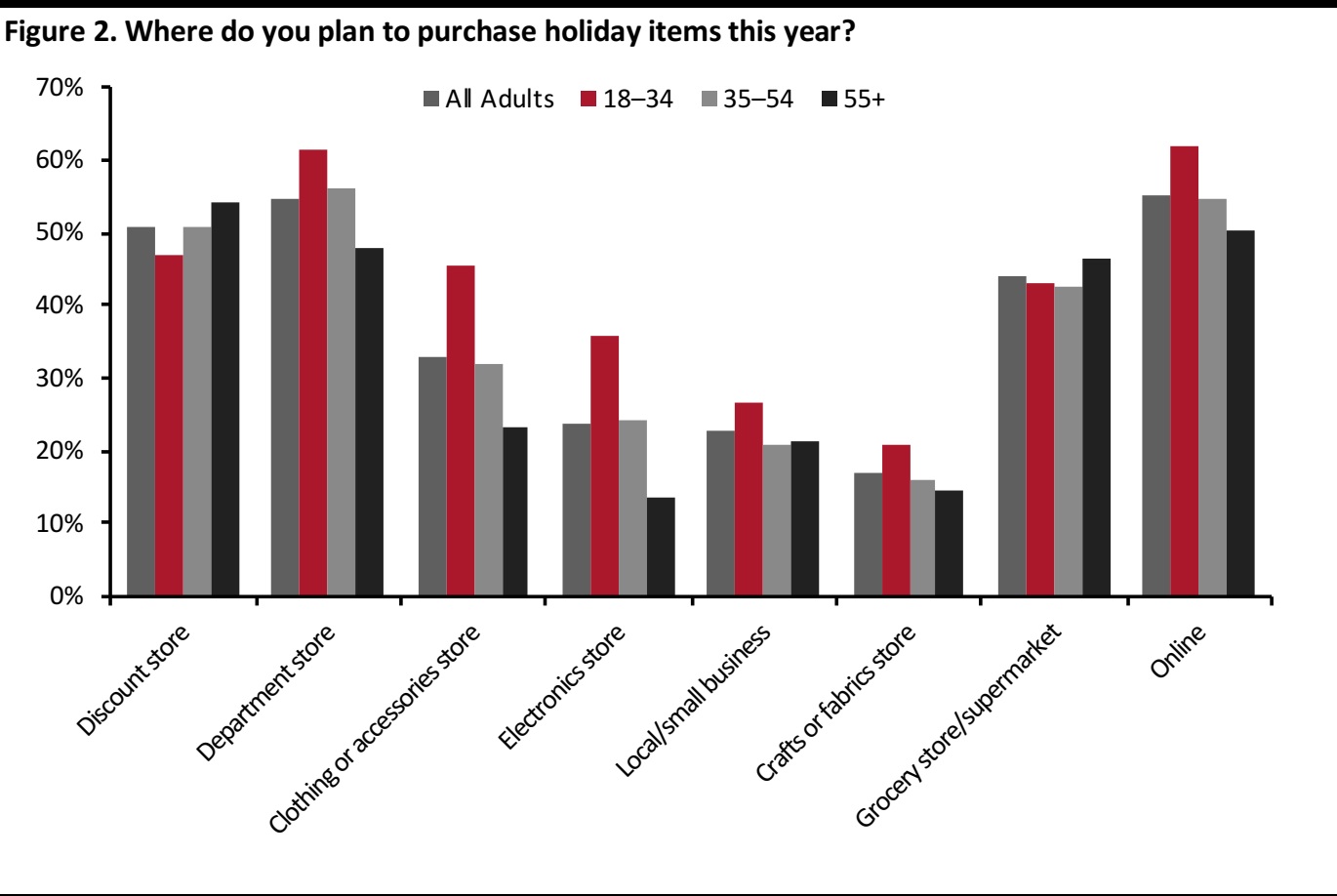

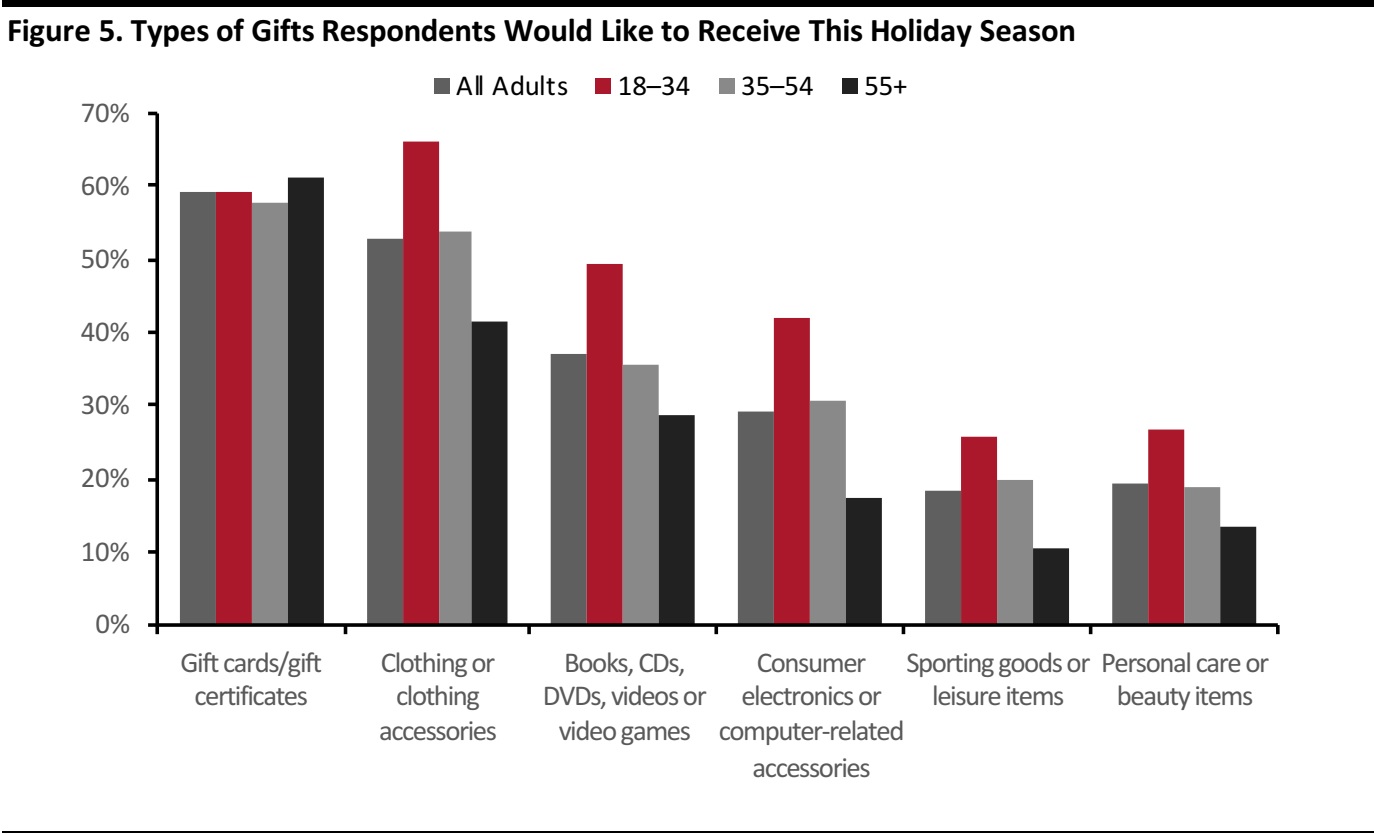

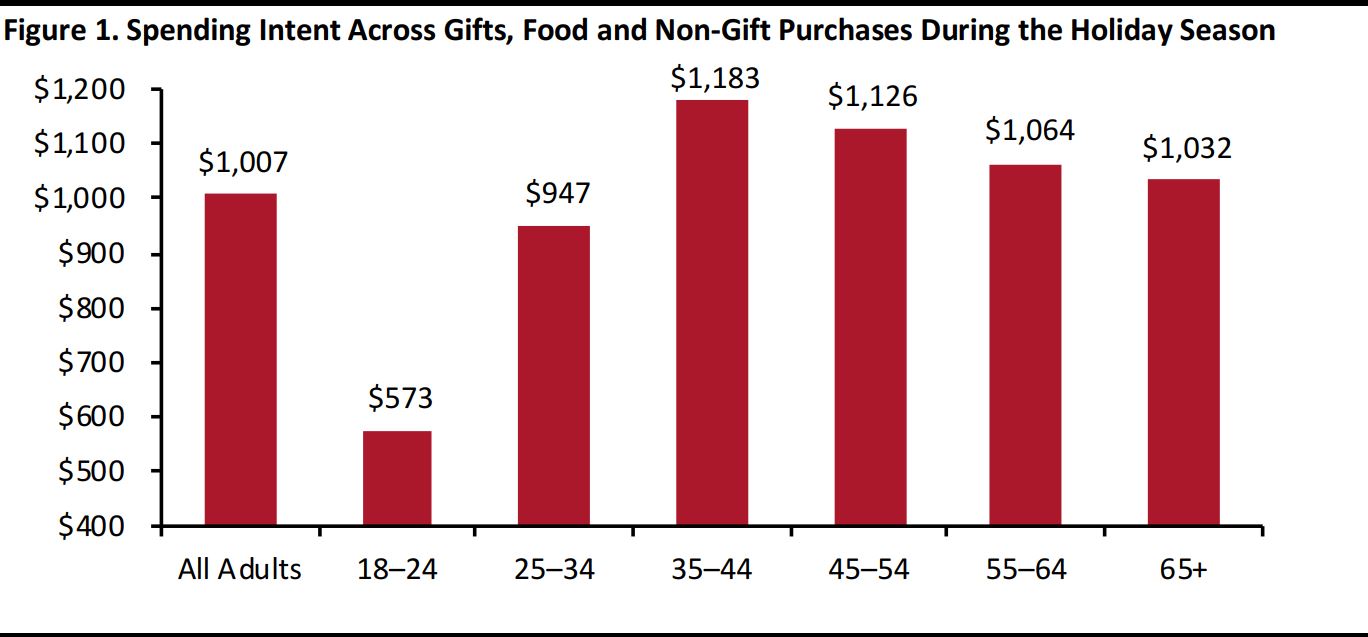

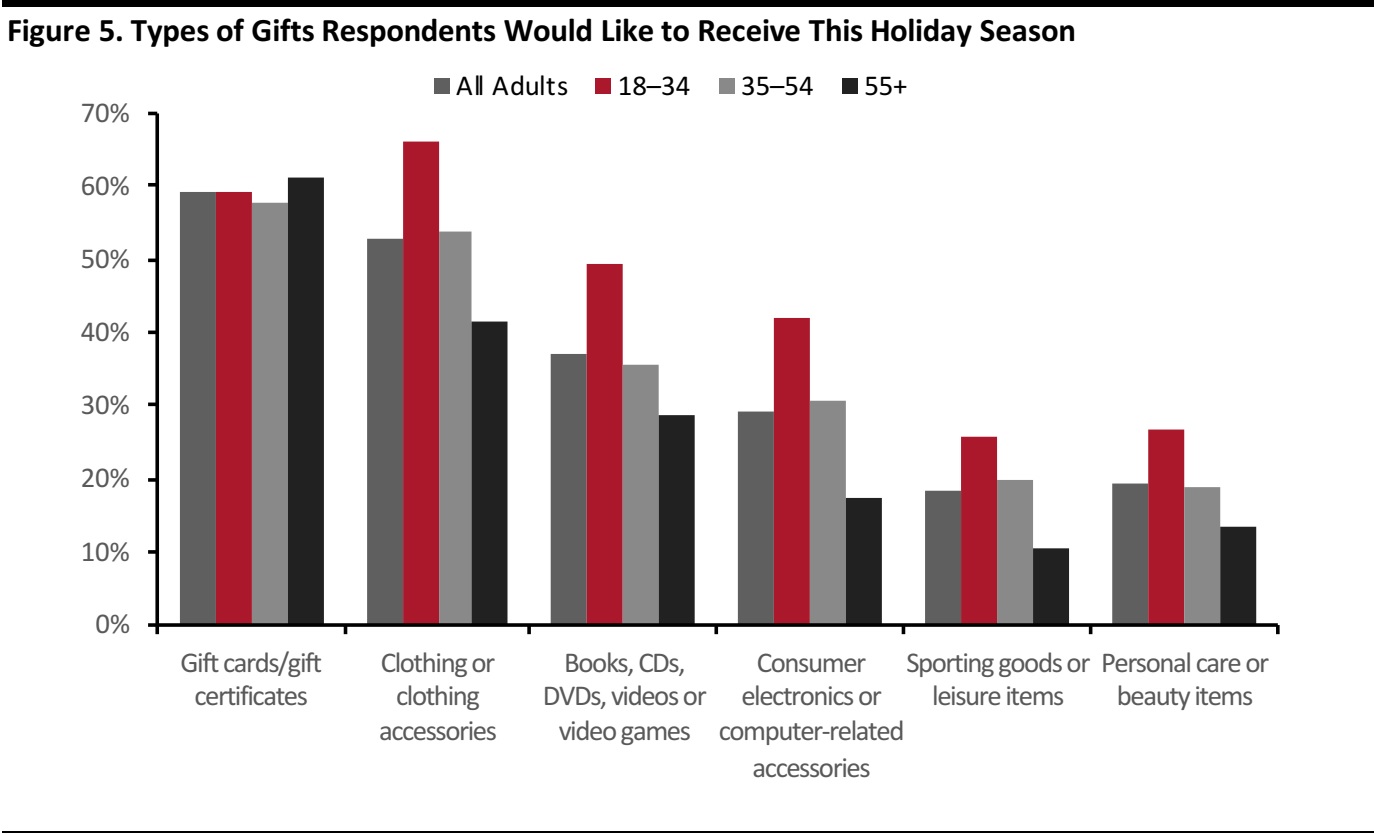

With regard to millennials’ wish lists, 66.3% of 18–34-year-olds surveyed said that apparel is the gift that they would most like to receive this holiday, compared with 53.0% of all adults who cited apparel. Millennials are also more likely than any other cohort to plan to take advantage of sales and discounts during the holiday shopping season and to buy non-gift purchases.Some 72.9% of millennials plan to make non-gift purchases this holiday (versus 59.4% of all adults), and apparel is one of the categories likely to benefit most from this intention. According to the survey, millennials will be visiting clothing and accessories stores at a higher rate than the overall adult population this holiday season, with 45.4% of millennials intending to shop at these stores versus 32.9% of all adults. When buying clothing, millennials place more importance on familiar labels than other age groups do: 57.1% of millennials surveyed cited familiar labels as important when choosing clothing versus 50.1% of all adults. This suggests that the younger cohort is more brand-loyal than generally thought. Not surprisingly, the newest trends and styles are more important to millennials than they are to older shoppers, with 31.1% of millennials claiming newness and style matter versus 19.5% of Gen Xers and 18.7% of adults in total. It’s no surprise that e-commerce is the channel of choice for millennials. Some 61.7% of millennials surveyed said that they plan to shop online this holiday versus 55.2% of all adults surveyed. What may be a surprise is that department stores come in a close second in terms of favorite shopping destinations. Some 61.3% of millennials surveyed cited department stores as an intended holiday shopping destination versus 54.7% of the total adult population. Online shopping may be efficient, but it’s no way to fully experience the holiday season. A trip to a department store could entail a visit to Santa, a holiday tree viewing, listening to live holiday music and seeing festive decorations, all experiential offerings that can’t be replicated online.

Source: Prosper Insights & Analytics

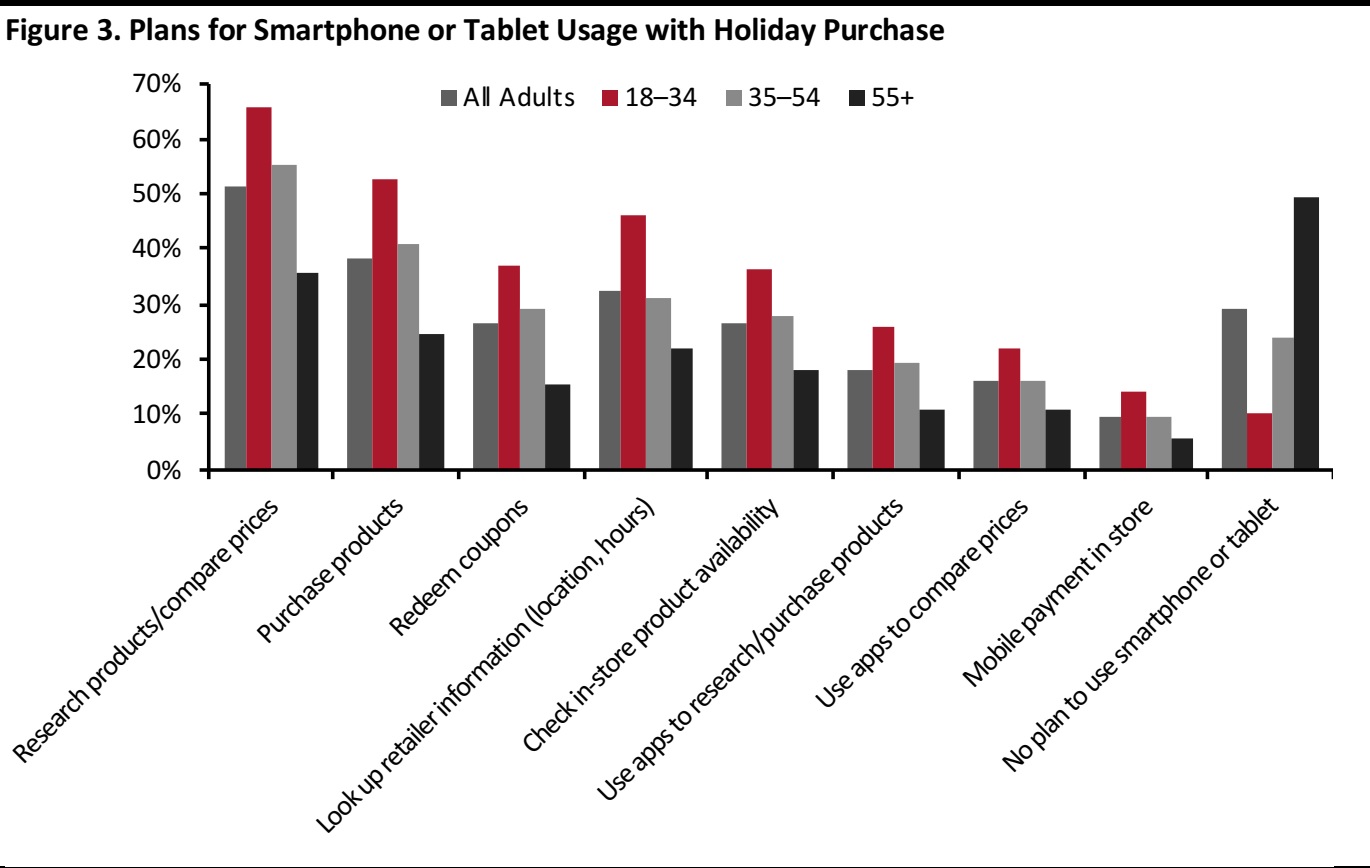

Mobile devices play an important role in holiday shopping, and millennials will use them more regularly this holiday than older demographics will. Consumers plan to use their mobile devices to conduct a variety of functions this holiday, from researching products and prices (65.5% of millennials versus 51.4% of all adults), to purchasing products (52.4% of millennials versus 38.5% of all adults), to looking up retailer information such as store locations and hours (46.1% of millennials versus 32.4% of all adults).Source: Prosper Insights & Analytics

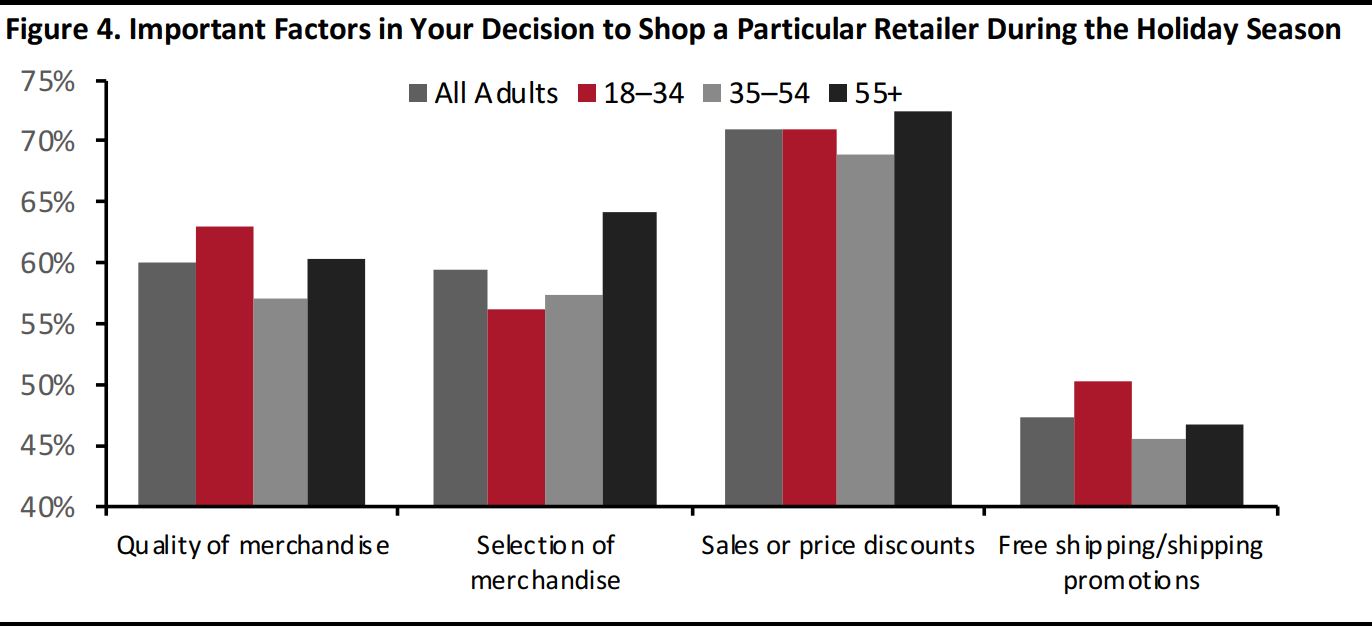

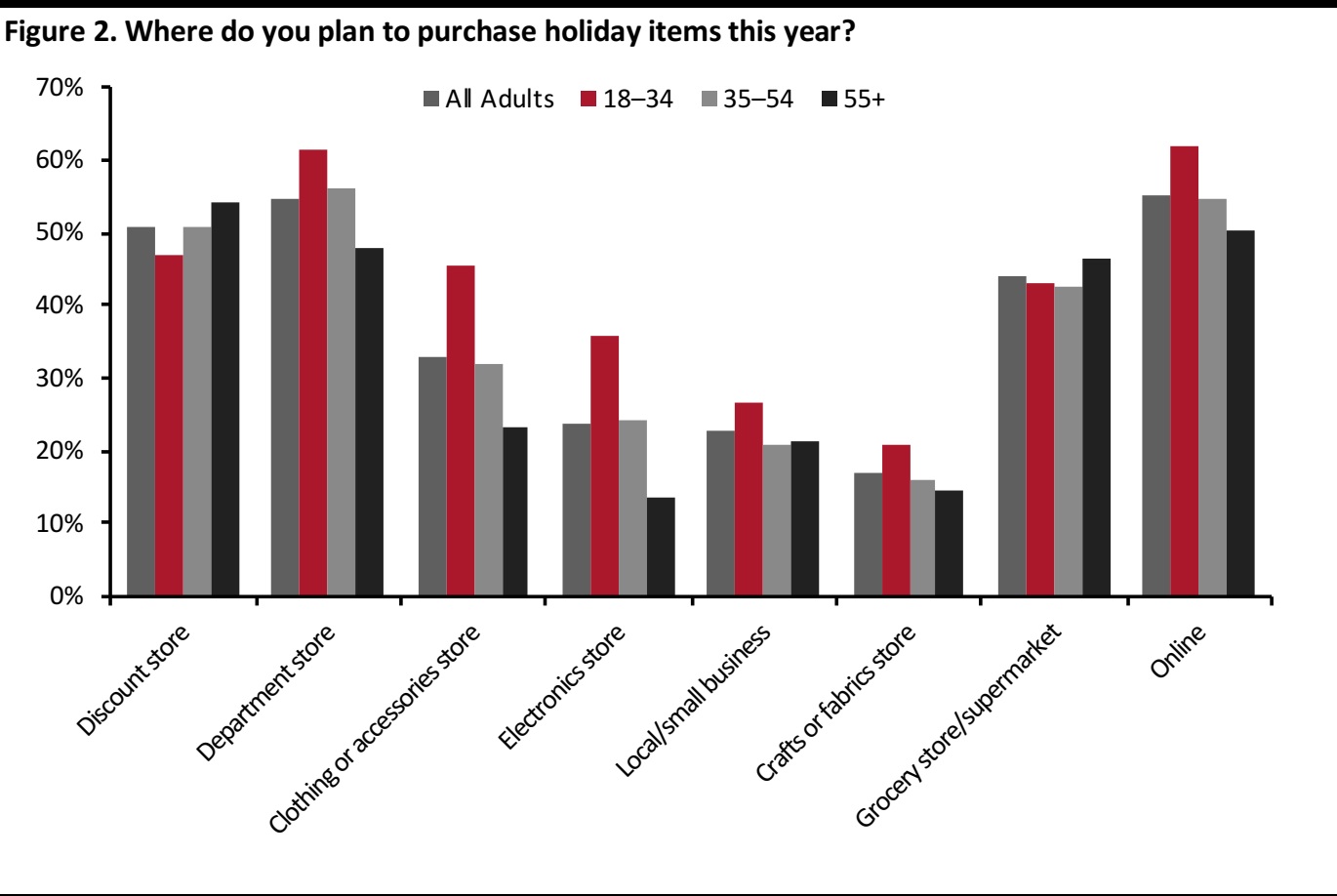

Value Trumps Customer Service When Choosing Retailers This Holiday

Americans will be seeking sales and discounts when they choose a retailer this holiday, and roughly 70% of each age cohort surveyed considers this an important factor. Quality and merchandise selection both trail sales and promotions as likely store traffic drivers. Quality is more important to millennials (63.1%) than it is to older consumers, and selection is more important to baby boomers (64.3%) than it is to younger shoppers. Helpful, knowledgeable customer service will not factor highly in consumers’ decisions about where to shop this holiday: only 25.6% of all adults and 32.0% of millennials cite customer service as an important consideration in choosing where to shop this holiday.

Source: Prosper Insights & Analytics

Among all adults surveyed, gift cards are the most-desired type of gift this holiday, with 59.5% of survey respondents choosing them. This has several implications for retailers: First, not all gift cards are for retailers; some are for hotel stays, a day at a spa, a massage or personal training at a gym. Restaurants ranging from five-star luxury establishments to Starbucks also offer gift cards.And let’s not forget media and entertainment, including iTunes gift cards and movie passes. Retailers can optimize their gift card profitability by refreshing stores immediately after Christmas, when shoppers armed with gift cards are willing to pay full price for new items, but not for the same things they’ve seen in stores since late November.

Source:Prosper Insights & Analytics

Online Holiday Spending

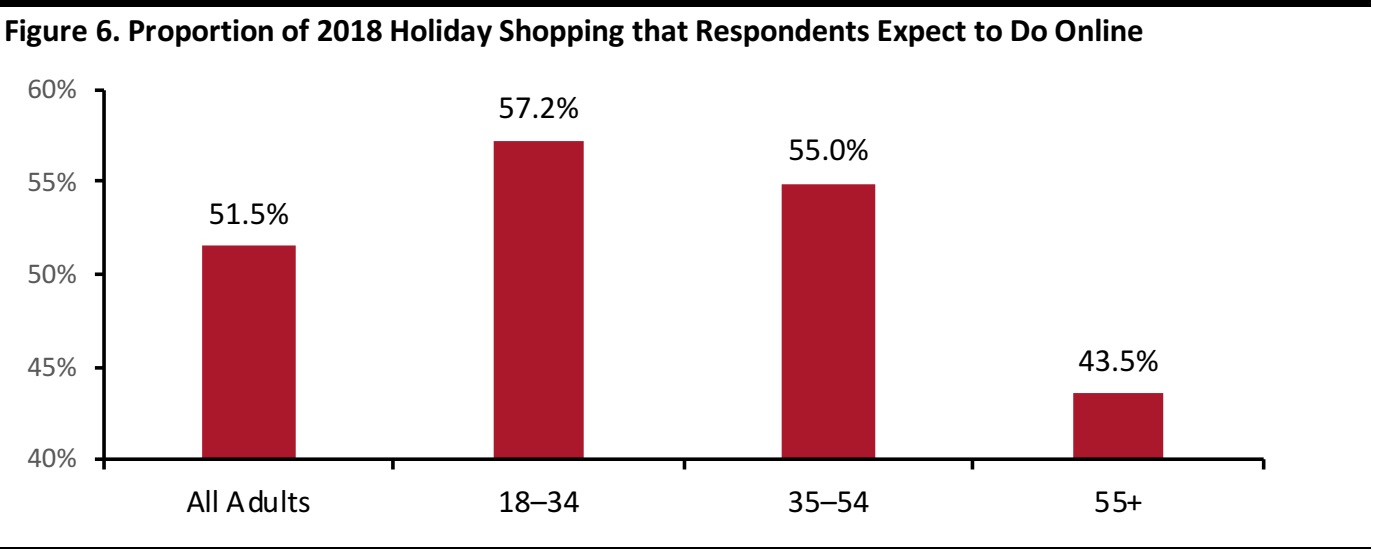

Aside from the oldest age cohort, consumers plan to do half or more of their holiday shopping online this year. Among all adults, the average is 51.5%, but that figure jumpsto 55.0% for Gen Xers and to 57.2% for millennials. We do note, however,that shopping does not equal buying.Source: Prosper Insights & Analytics

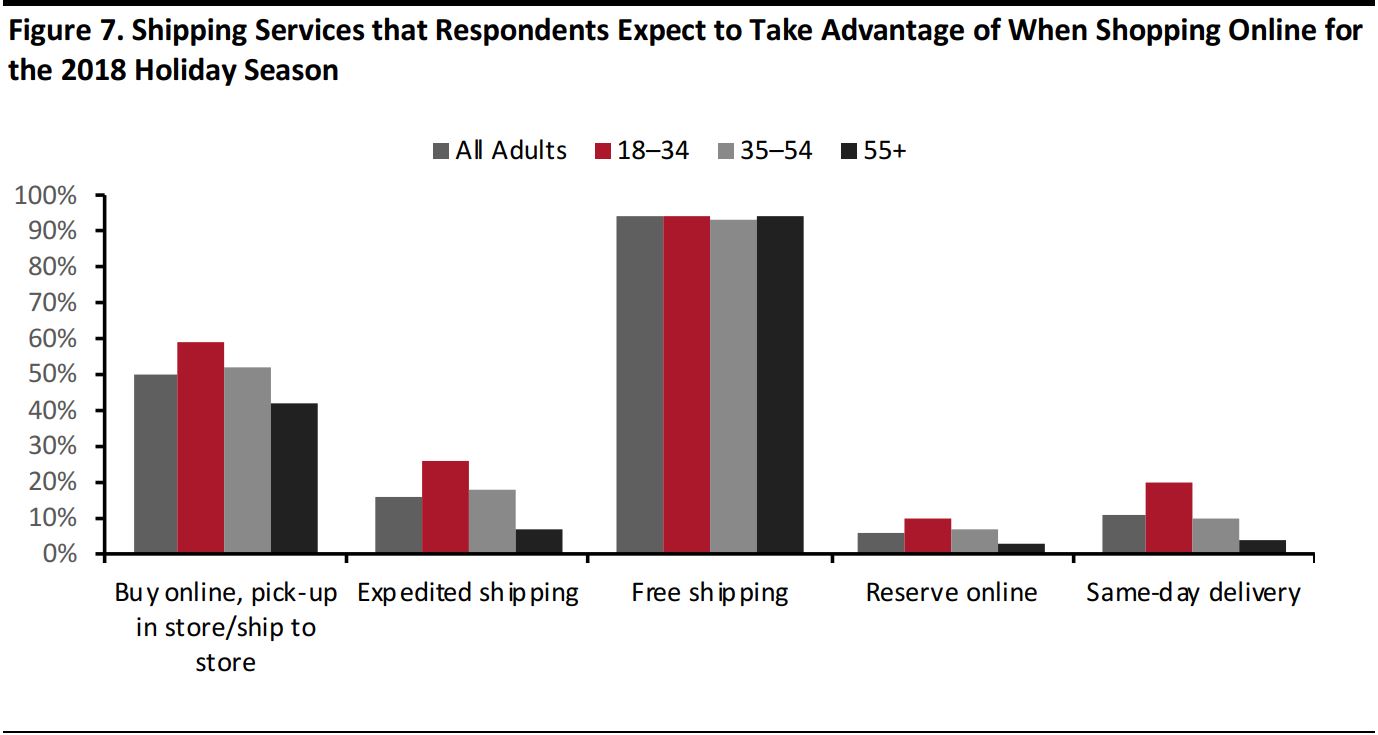

The survey data reveal that free shipping services will be used by nearly all adult shoppers this holiday season, with 93.9% of those surveyed planning to take advantage of free shipping offers. Meanwhile, 58.5% of millennials and just over half of all adults surveyed (50.3%) plan to use buy online, pickup in-store services. Same-day delivery is another option that millennials value more than older cohorts do, with 19.5% of millennials expecting to use this service during the holiday season, versus 10.7% of all adults and 10.2% of GenXers.Source: Prosper Insights & Analytics

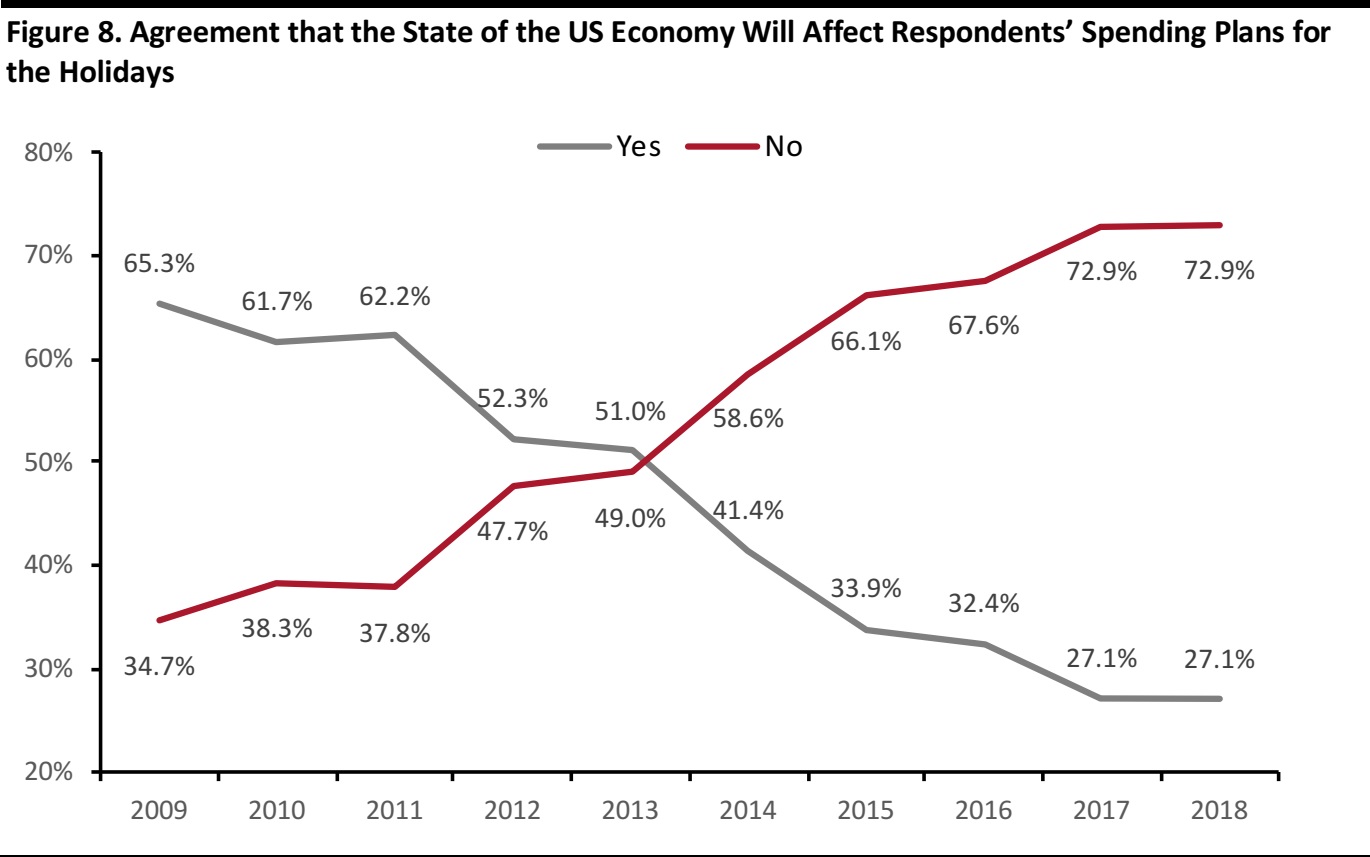

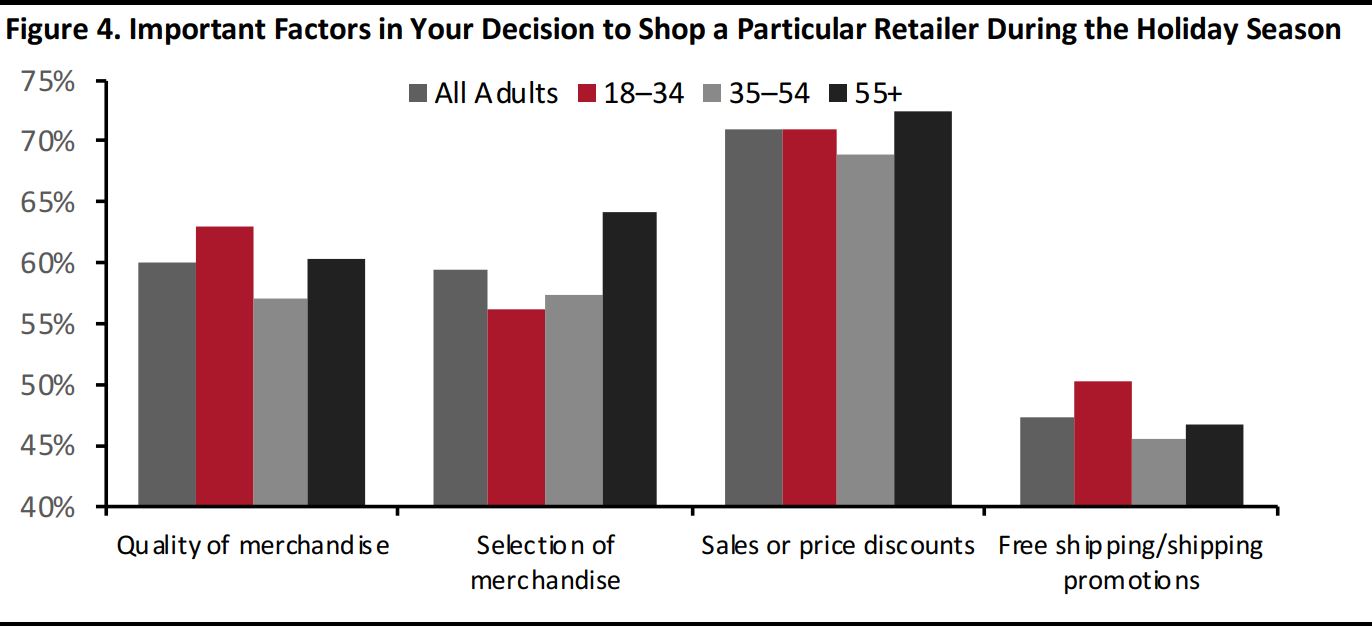

Economic conditions won’t be a deterrent to holiday spending this year: 72.9% of all adults surveyed said that economic conditions will not affect their spending plans. That percentage is in line with 2017’s figure and up greatly from 34.7% in 2009, shortly after the end of the Great Recession, when the question was first included in the survey.