EXECUTIVE SUMMARY

In the first of our series on the connected home market, we offer an overview of the market, focusing on key drivers, underlying technologies and major players.

The Internet of Things (IoT) has allowed even inanimate objects to interact with a person or an object around it, and it may not be long before one’s housekeeper is reminiscent of Rosie from

The Jetsons or Jarvis from

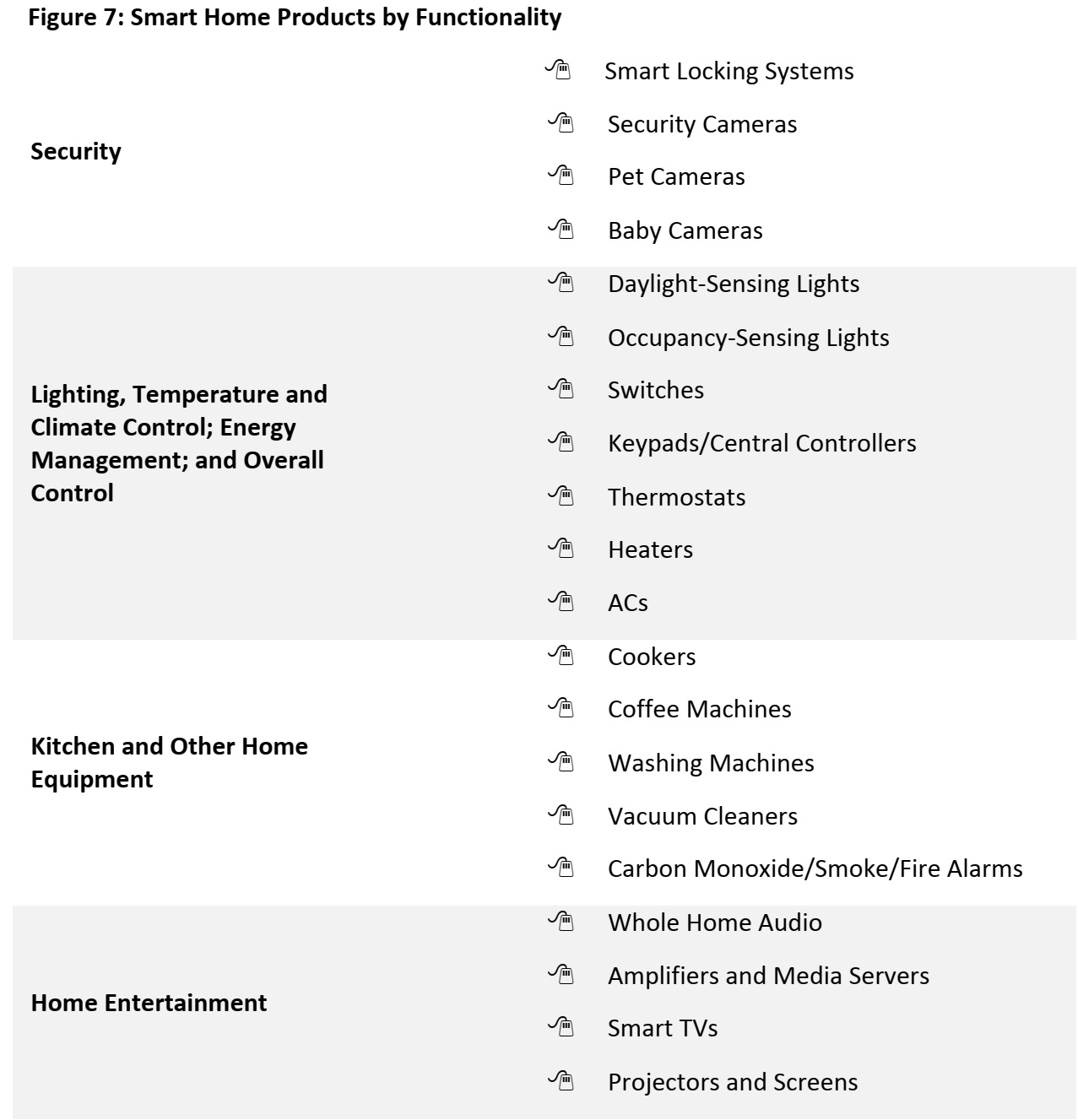

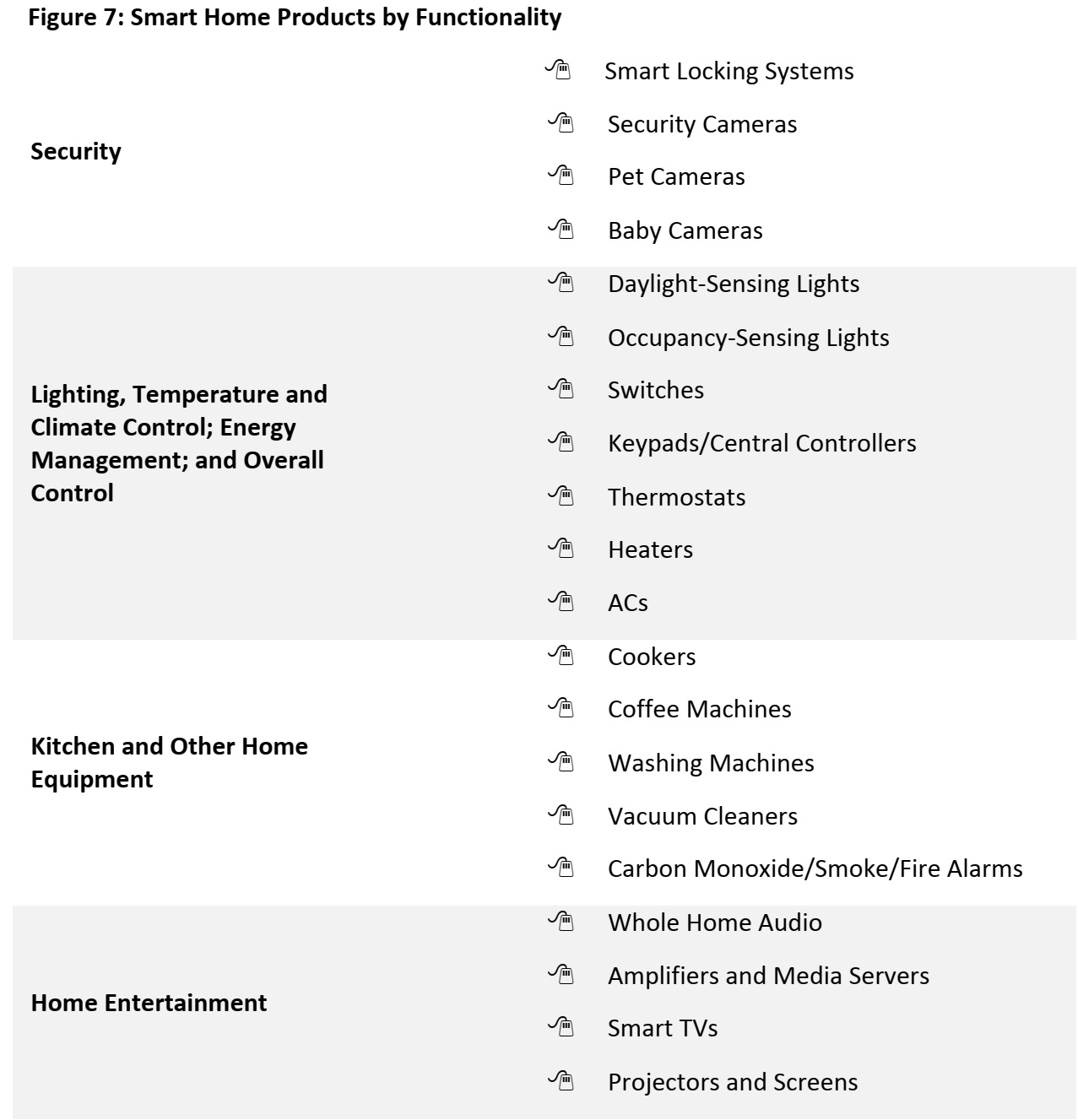

Iron Man. There is a smart device for nearly every aspect of home maintenance, and we have categorized them into four groups for the purposes of this report: home security; lighting, temperature and climate control, energy management, and overall control; kitchen and other home equipment; and home entertainment. The only remaining issues to be resolved in the IoT vertical of connected homes are the interoperability between devices and the cost of adoption.

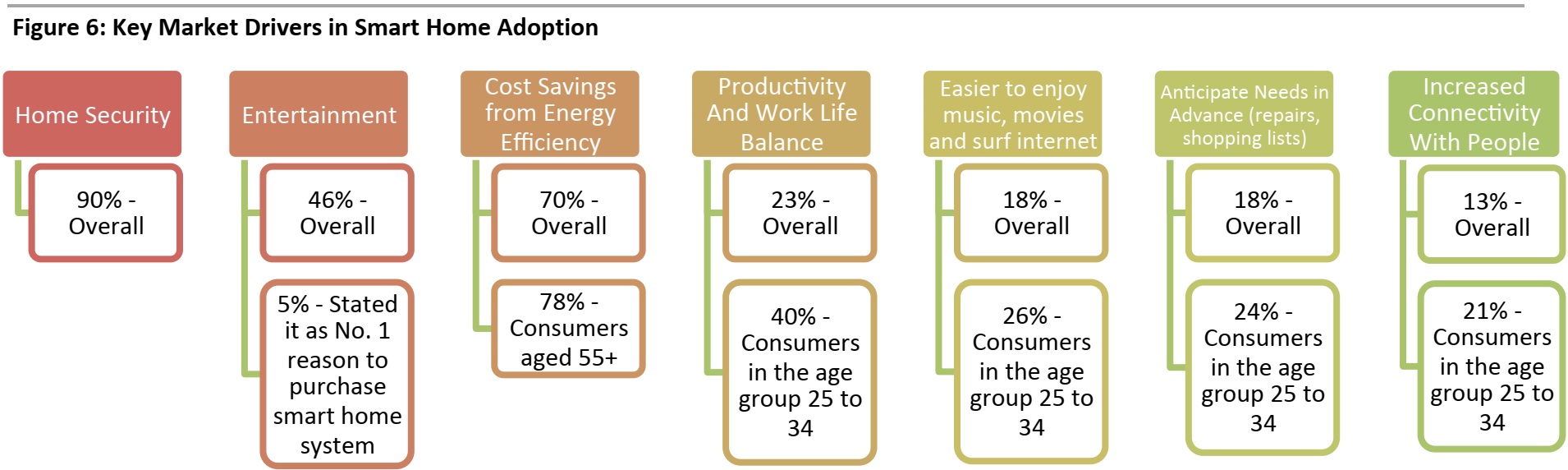

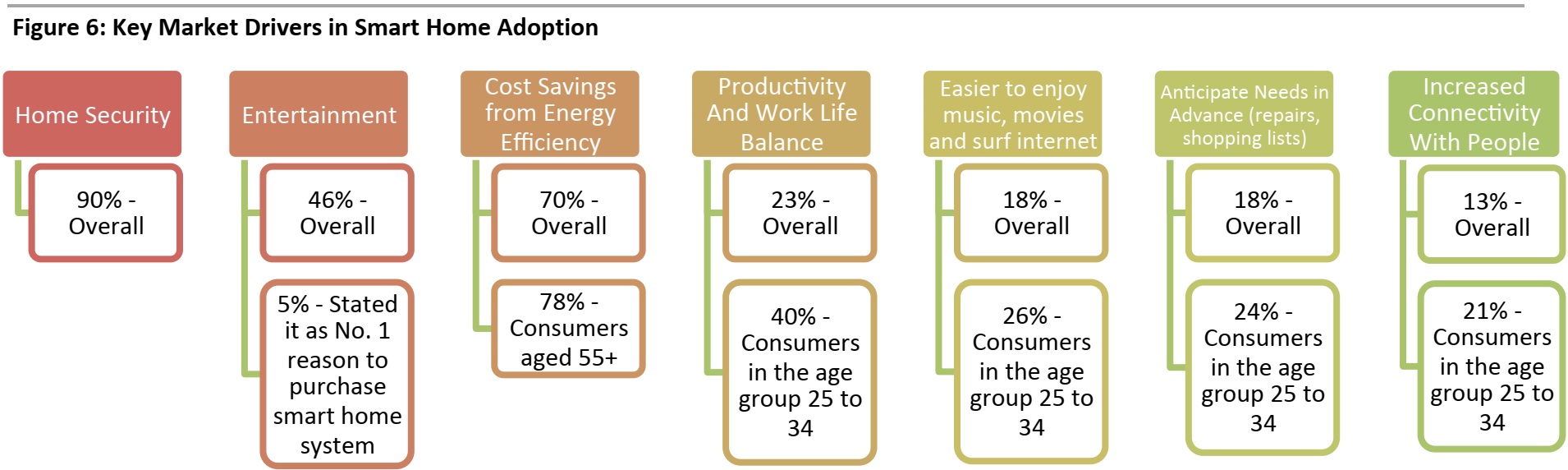

Consumers, across demographics, are excited about owning a smart home, with millennials and Generation X being the most enthusiastic, according to a report by Icontrol Networks. The report found that the key drivers influencing consumers’ decision to adopt a smart home are home security, energy efficiency, cost savings, entertainment, convenience/productivity, connectivity and health monitoring.

Industry bigwigs Samsung and Nest (now owned by Google) joined forces to develop a common platform called Thread, which allows devices to talk to each other seamlessly. And startups such as August, ecobee and Dropcam have developed more efficient and attractive home devices that could displace those made by traditional home automation companies such as Honeywell and Siemens. With the emergence of such startups and an atmosphere rife with competitive collaboration, we might just witness an upheaval in the century-old home automation industry.

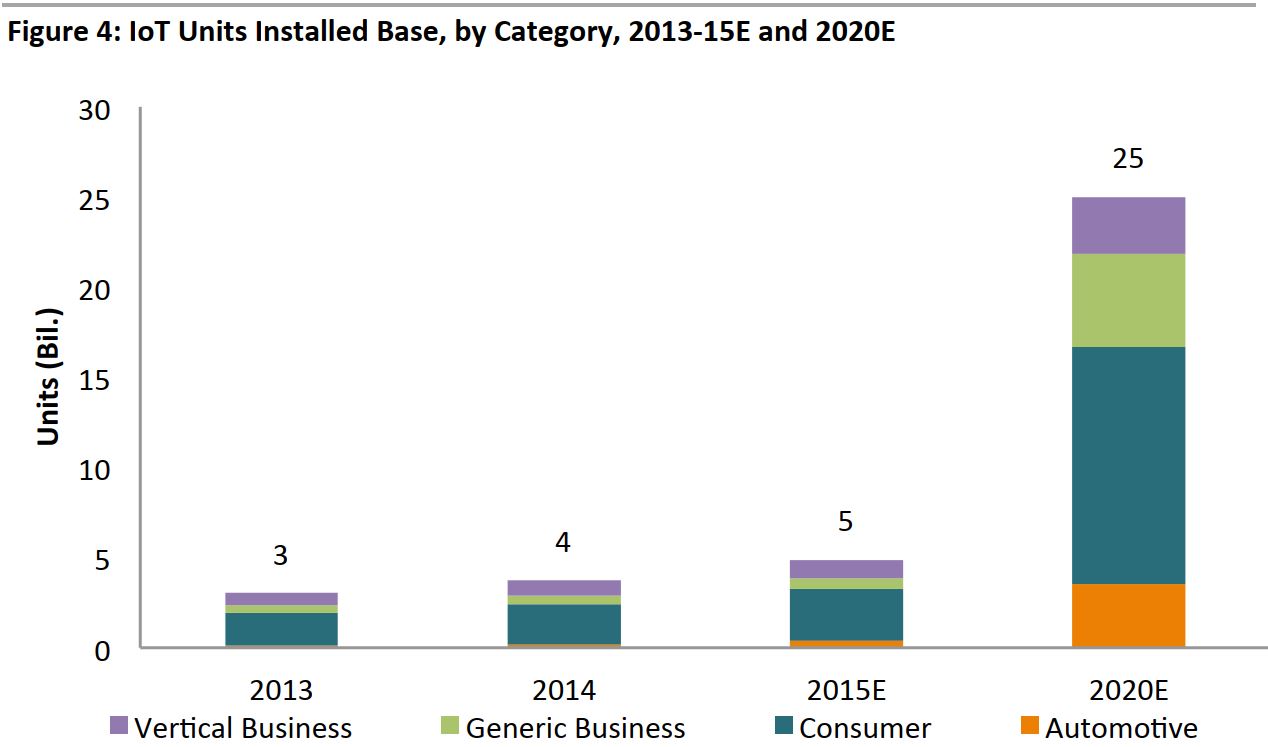

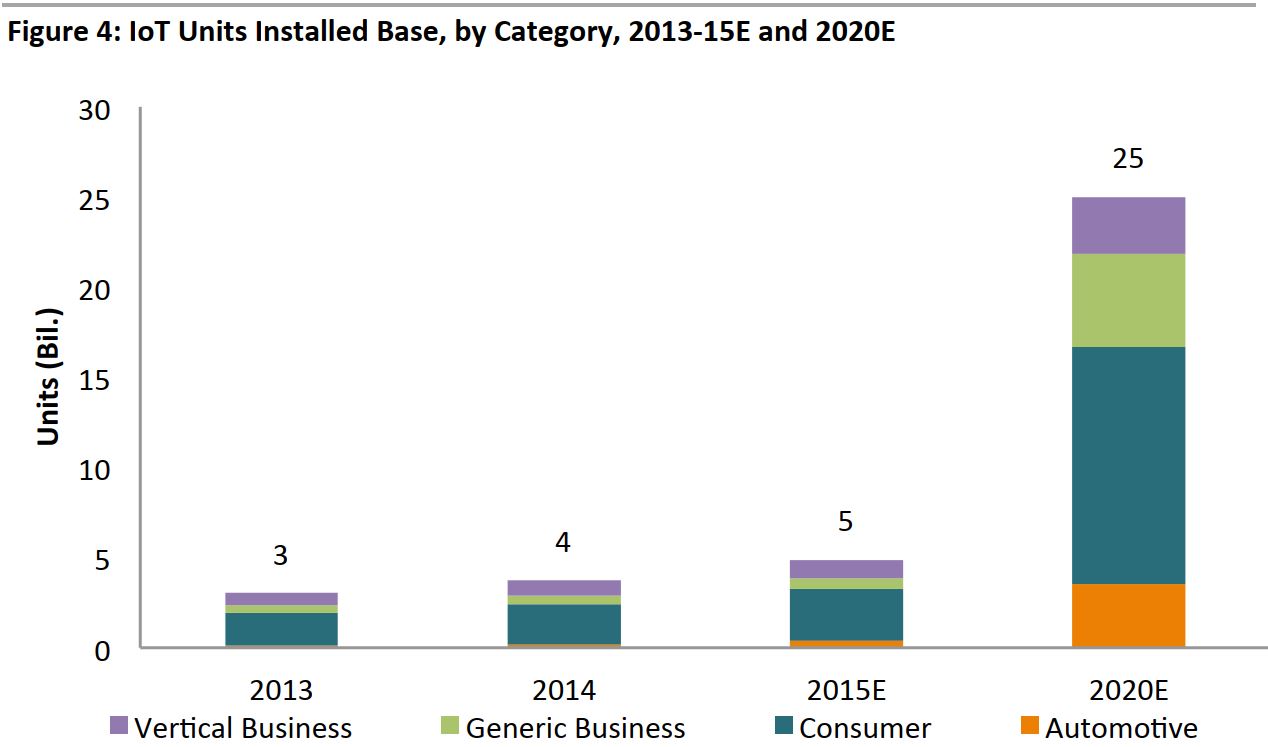

Research firm Gartner predicts that by 2020, there will be approximately 25 billion IoT-enabled devices, 13 billion of them in the consumer electronics segment. With so many units, however, and no common language to unite them all, we might just end up with a lot of noise and no productivity. Individual controls for devices made by different manufacturers will be counterproductive and costly to the consumer. That is why adoption costs are currently high and why mass adoption hinges on the devices being interoperable: consumers will be willing to make big investments in these products only if they all work together well.

What Happens When Your Home Is Smarter than You?

As we are on the brink of a futuristic lifestyle à la

The Jetsons, companies are more driven now than ever before to create intelligent and efficient household devices. You can put the kettle on in the kitchen, tell your thermostat to increase the temperature in the living room, instruct your washing machine to run the smaller load and track your pet with your pet cam, all from a single place. Welcome to the age of the connected home!

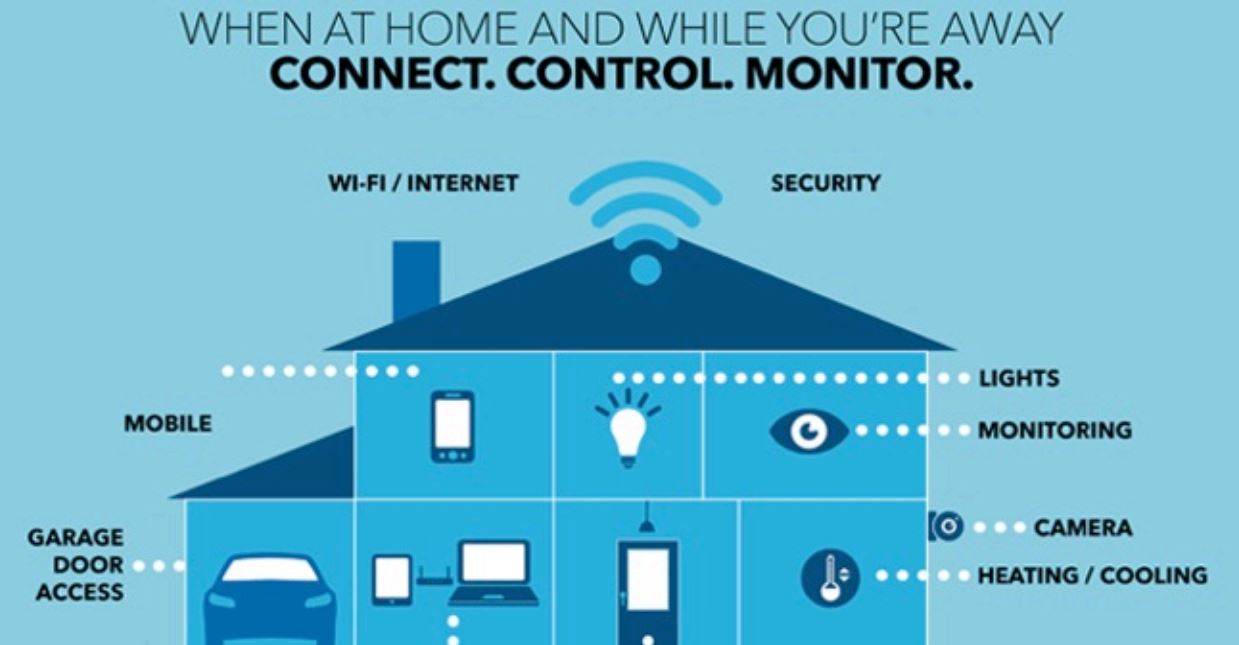

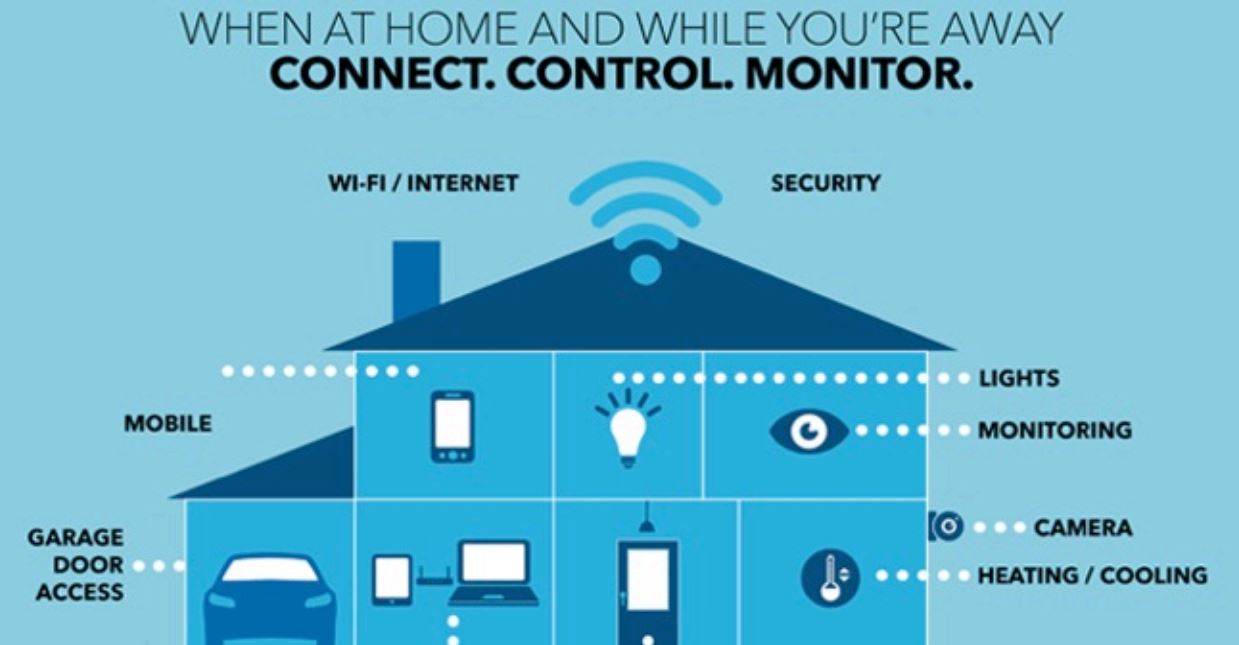

A connected home (or “smart home”) is defined as one where the lights, heating/ventilation/air-conditioning (HVAC), security alarm and other household devices can be automated and remotely controlled by a smartphone, tablet or computer. All the devices are either connected to a wireless hub in the house, which communicates with the homeowner’s devices, or directly communicate with the homeowner’s smartphone. New homes can be built with the additional hard wiring necessary for such technology, and existing homes can be retrofitted in order to make them smart.

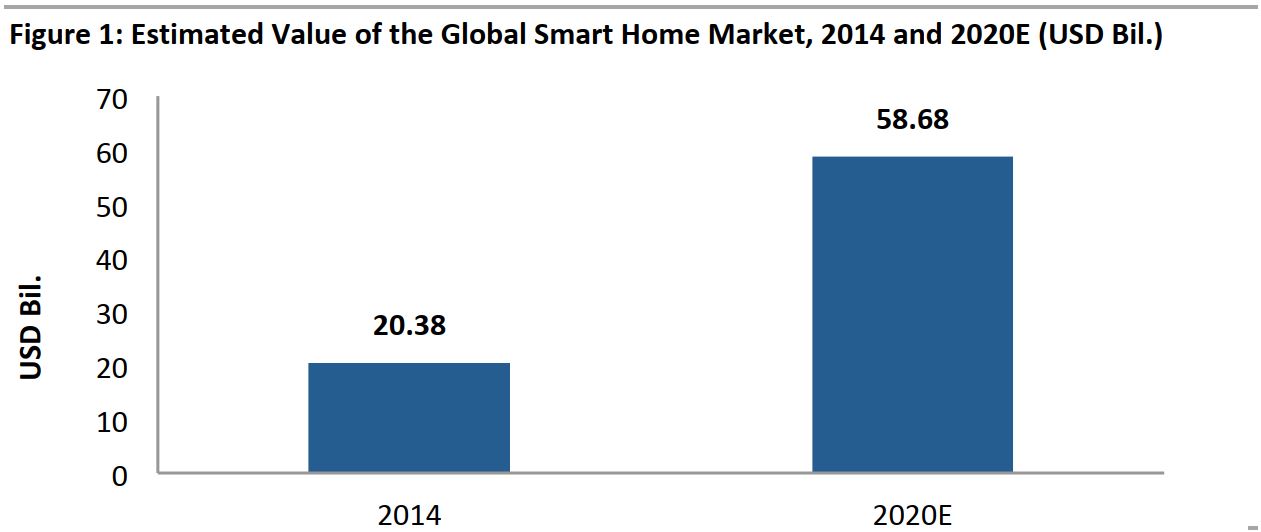

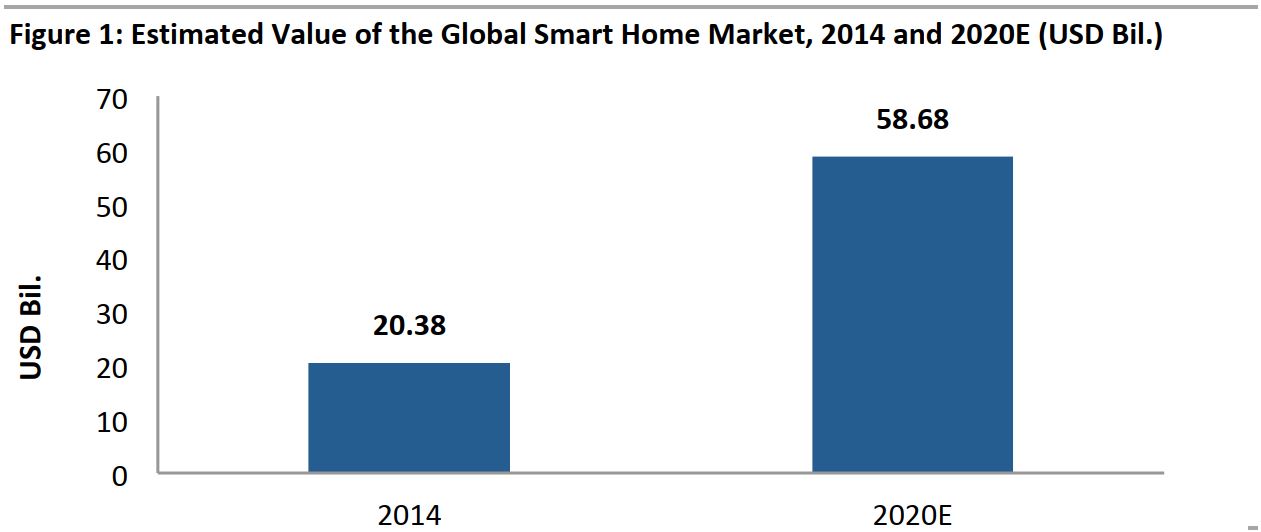

According to recent research from MarketsandMarkets, the value of the global smart home market is expected to touch $58.68 billion by 2020, a near-tripling of its value from 2014. With the enhanced interest in home automation, we expect to see a ripple effect on the many devices and technologies involved.

Source: MarketsandMarkets/FBIC Global Retail & Technology

MAKING THE MOVE: THE REQUIREMENTS FOR A CONNECTED HOME

Home automation requires that the resident have a smartphone and wireless Internet connection at home, as well as a starter kit to wire up the home and connect the devices. Later in this report, we examine some popular products in the smart home devices market that underscore the necessity of these.

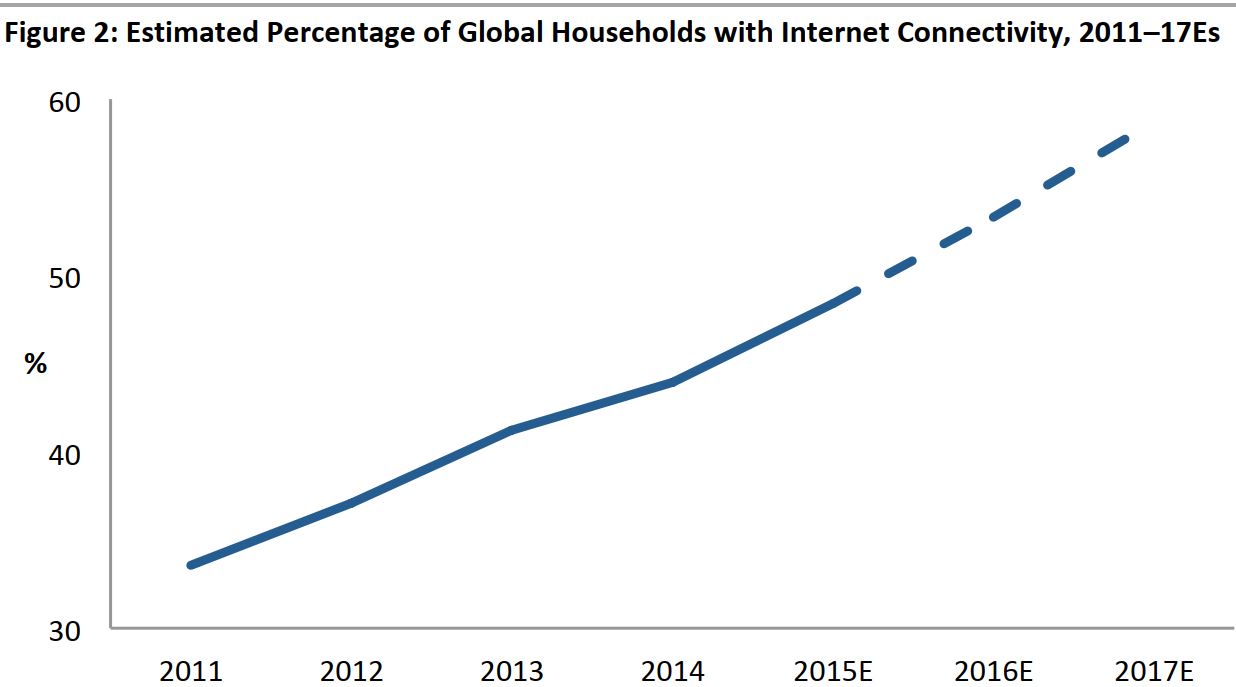

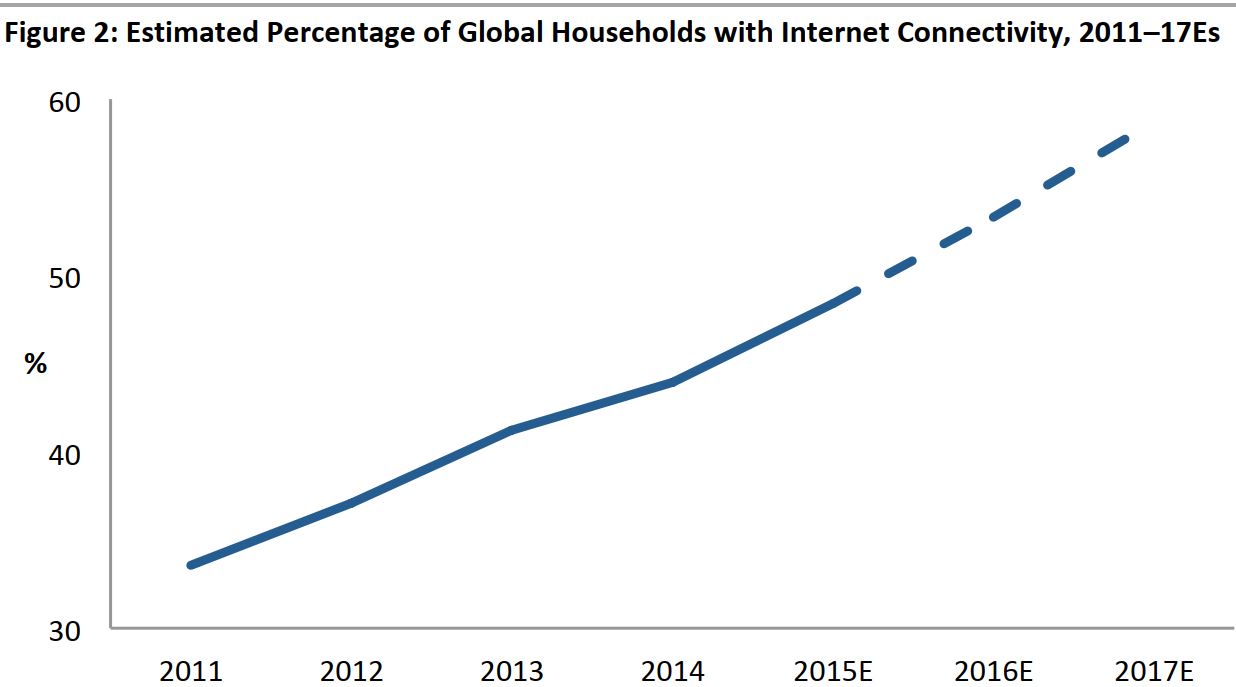

Based on data from the International Telecommunication Union, a specialized body of the UN for information and communication technologies, we predict that the percentage of households with Internet worldwide will touch 59% by 2017. This is a basic forecast that does not consider the evolution of other technologies and economic trends, but there is an increasing demand for Internet connectivity globally.

Source: International Telecommunication Union/FBIC Global Retail & Technology

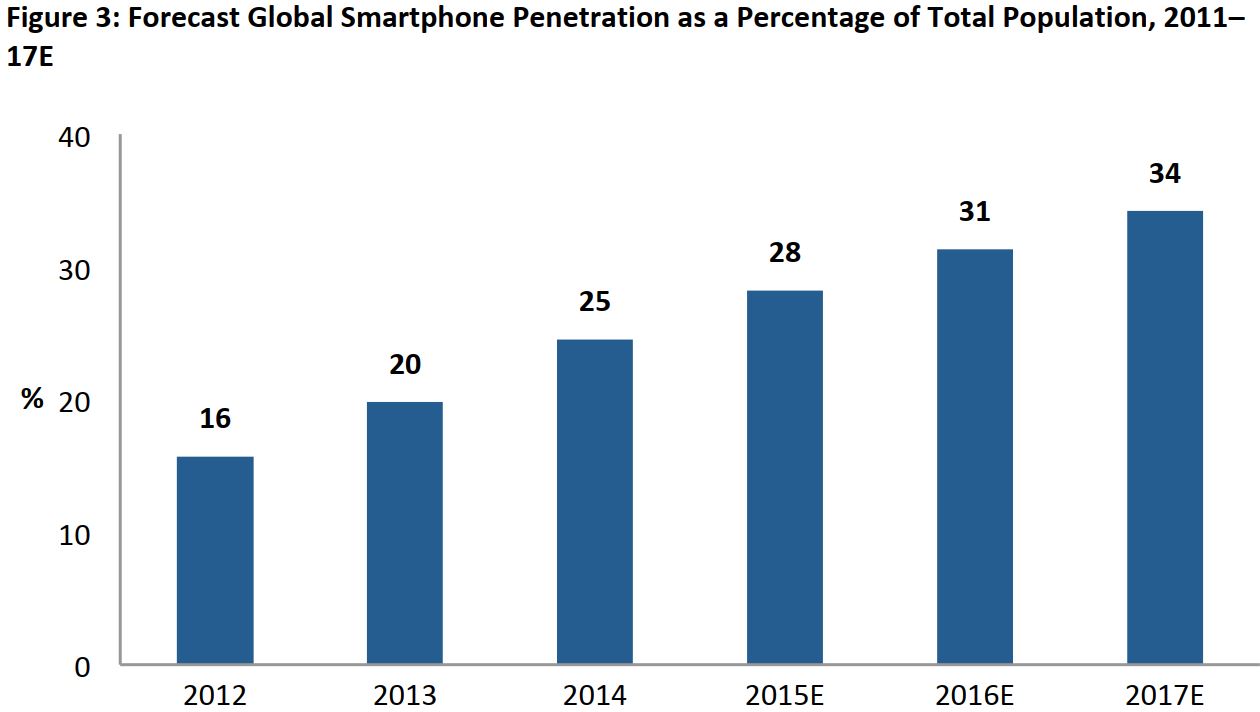

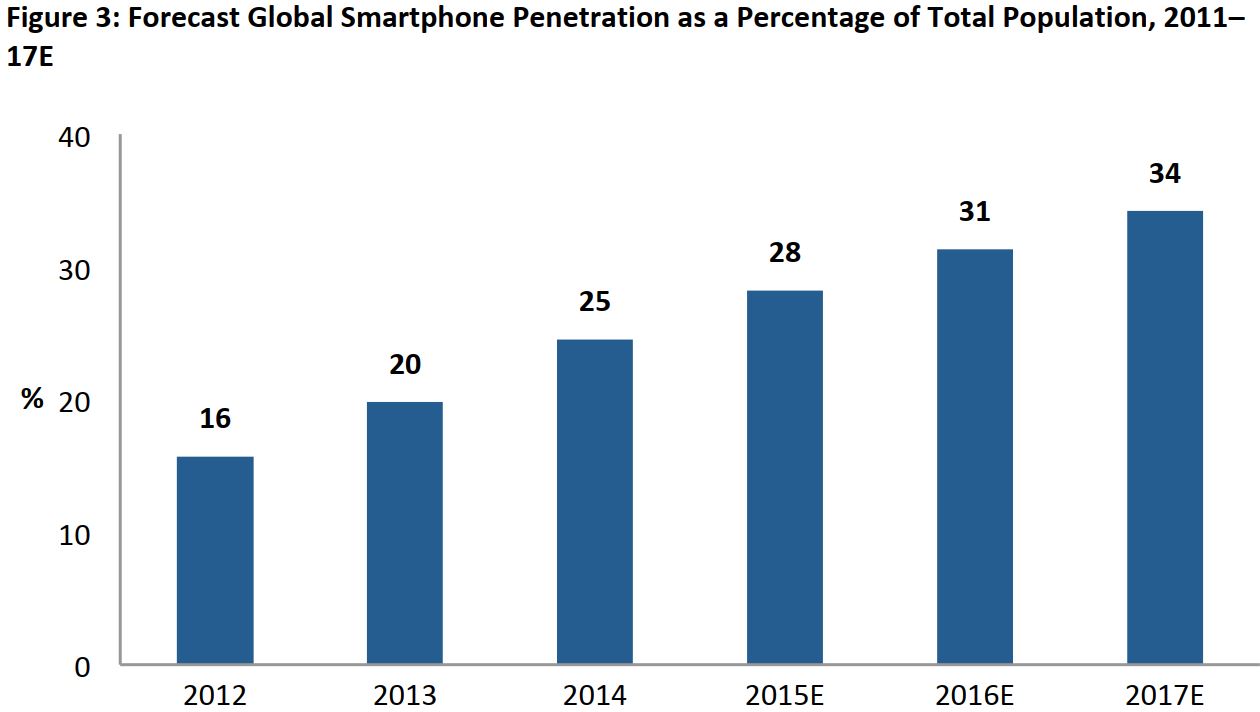

The mobile phone market has also has been growing steadily, and smartphone penetration per capita has grown by nearly 500 basis points each year since 2011. According to eMarketer, 34% of the world’s population is expected to own a smartphone by 2017.

Source: eMarketer/FBIC Global Retail & Technology

THE IOT

While Internet connectivity in homes and smartphones seem to be the driving forces in consumer adoption of smart home devices, it is the devices’ ability to work in sync with each other and improve the consumer experience that will ultimately drive mass-market home automation. The ability of objects to connect to a network, transmit information and interact with their surroundings is now a widely discussed and much-anticipated phenomenon in technology.

Machine to Machine (M2M)

Before IoT can fully evolve, M2M communications need to become seamless across technologies. M2M is a term used to describe technology that allows one machine to interact with another or with a device/cloud connected to a computer, without human interference. Since the IoT can include a wide array of objects (such as a chair or table or even a soda can!) that can interact with a machine, a person or another thing, M2M is commonly viewed as a subset of IoT.

Source: Gartner/FBIC Global Retail & Technology

Gartner has forecasted that the number of IoT installed base units will hit 25 billion by 2020, and in the consumer electronics category alone, the number of units is expected to hit 13 billion. The optimistic prediction is largely justified, considering the number of smart devices that are being injected into the market every day, but what is driving this growth?

According to Goldman Sachs Global Investment Research, apart from smartphones and wireless Internet, there are two main enablers that are driving the faster adoption of IoT: the reduced price of sensors, bandwidth and processing, and the progression of Big Data analytics. (Big Data is a wide-ranging term for data sets that are too large to be captured and processed through traditional data-processing applications.) As the price of Internet connectivity has become cheaper, Internet speeds have increased, and the raw materials used to manufacture technology cost less than they used to. So, it is now more convenient and cost-effective for inventors and developers to churn out new devices. Also, IoT devices can gather user data more easily than can traditional methods, so the prospect of harnessing Big Data through these means could further drive IoT growth.

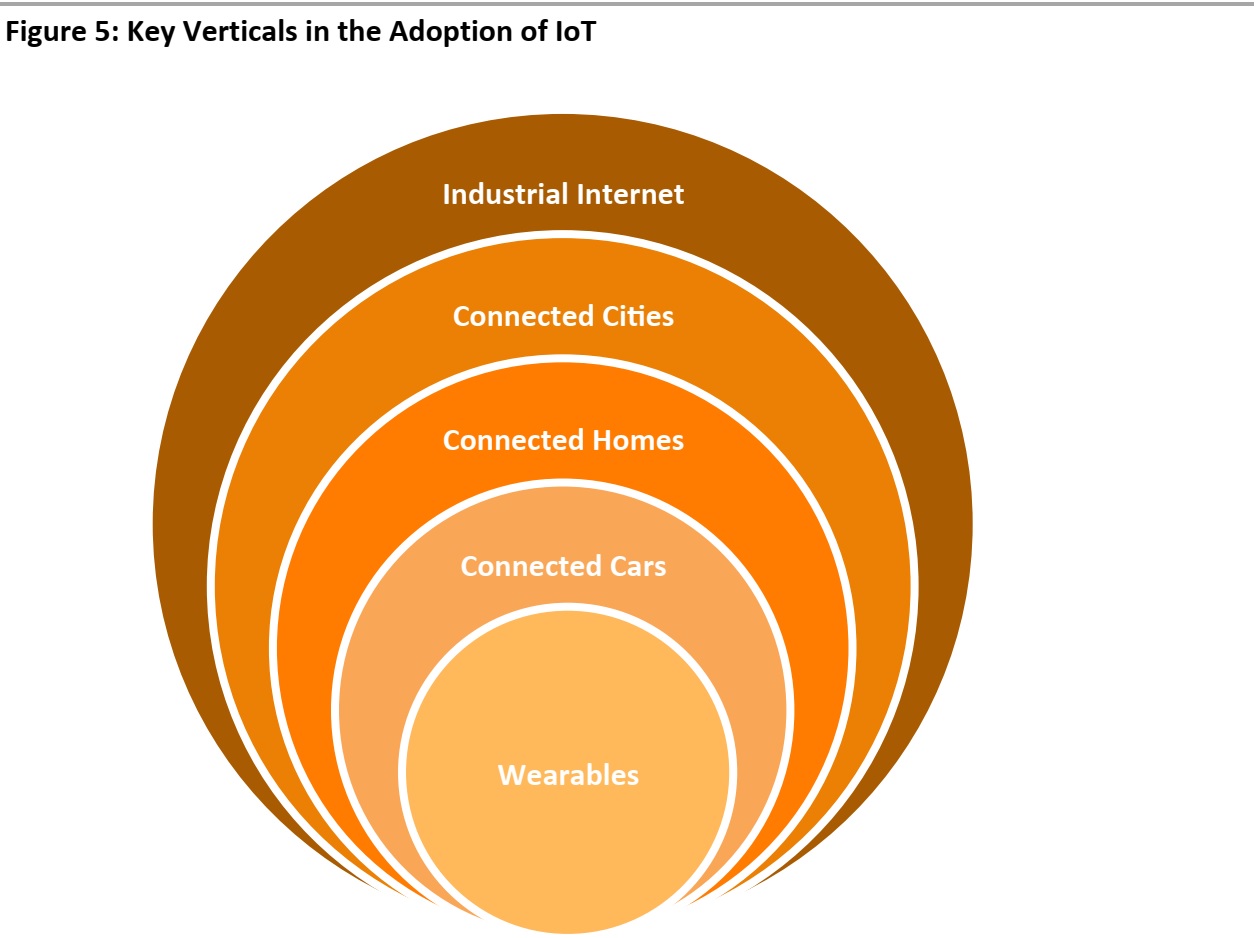

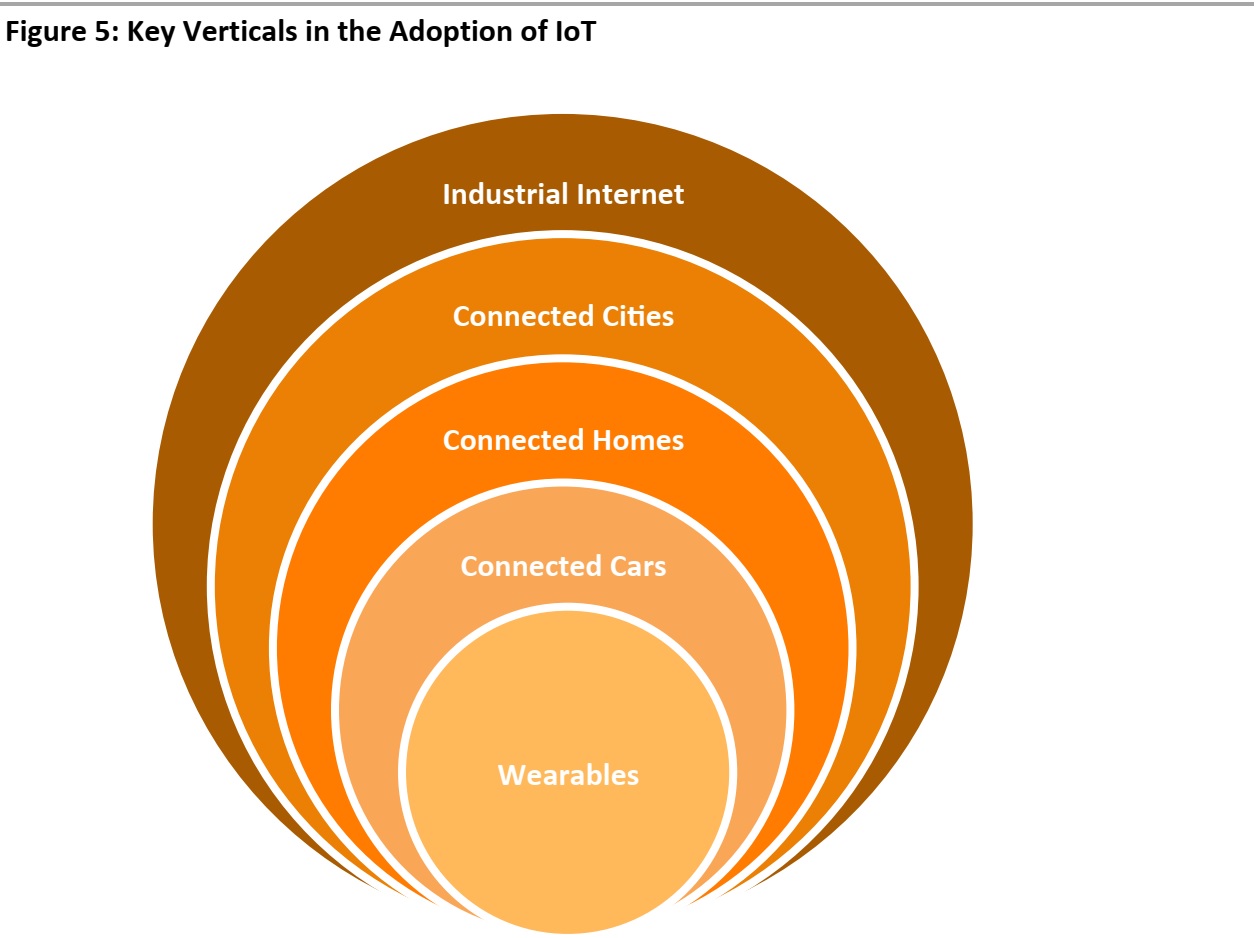

Currently, the IoT can be broadly categorized into five niche markets: wearables, connected cars, connected homes, connected cities and the industrial Internet. Though these are distinct verticals, there are several crossover opportunities in the market that manufacturers can exploit by working together. Companies such as Samsung and Apple are already making wearables and products for the home.

Source: Goldman Sachs Global Investment Research/FBIC Global Retail & Technology

Millennials Are the Ones Most Interested in a Smart Home

A study conducted jointly by the Consumer Electronics Association and Parks Associates found that 48% of smart-home owners are under age 35. Another study, by Icontrol Networks, confirmed that US consumers ages 25–34 were the most excited about owning a smart home, but that they are also the demographic group most concerned with high adoption costs.

Key Market Drivers in Smart Home Adoption

Home security has emerged as a key driver in smart home adoption. The Icontrol Networks study found that over 90% of respondents to its survey said that home and family security would be a top reason for them to purchase a connected home or adopt a smart home lifestyle. Another factor motivating consumers to purchase a smart home system was the potential cost savings and energy efficiency such a system could provide. Other key drivers included automation in entertainment; increased productivity and work-life balance; the devices’ ability to anticipate needs (by generating shopping lists and repair and maintenance reminders, for example); and interactive features that increase connectivity to people.

Source: Icontrol 2015 State of The Smart Home Report/FBIC Global Retail & Technology

Source: FBIC Global Retail & Technology

The smart home market is flooded with devices for every specific home need. While some manufacturers bank on specialization, others have their brand name to fall back on, and many newcomers are paving the way in innovative, quality devices that outdo those made by traditional household brands. We now examine a few companies and their strategic moves in the smart home market.

HOME AUTOMATION LEADERBOARD

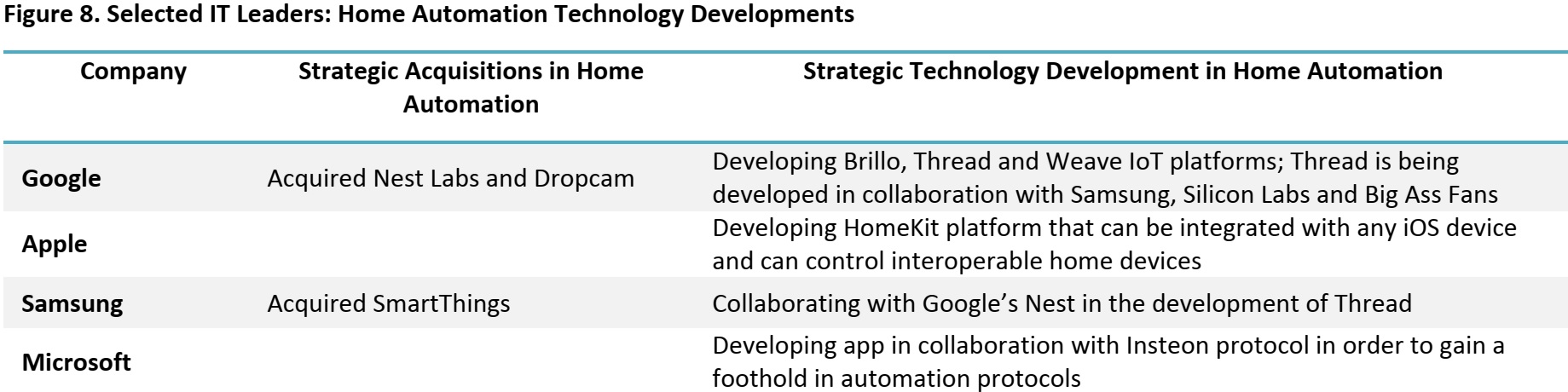

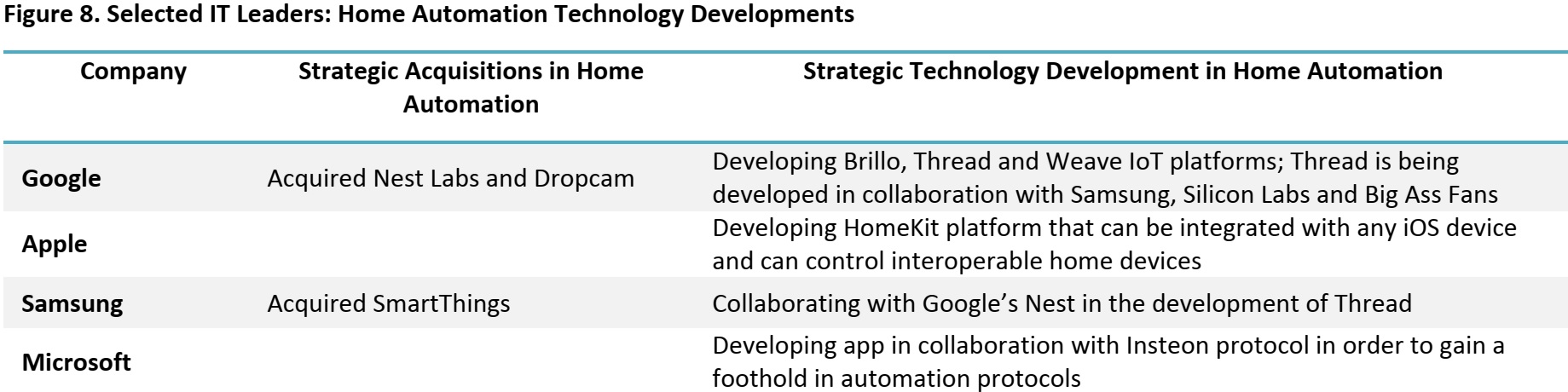

The IT Overlords

Apple, Google, Samsung and Microsoft are companies whose smart home products are perhaps more popular for their high brand awareness than for their specialism in home automation. Though Samsung is one of the leaders in the home appliances market, it is still not a traditional home automation company. These four players have made tactical ventures that give them a competitive advantage over their traditional home automation counterparts.

SmartThings, which makes hubs, client applications and cloud platforms, was founded in 2012. Its home control system connects hundreds of devices in a house, and is one of the most popular in the smart home market. The company was bought by Samsung in 2014, but functions independently. With SmartThings in its portfolio, and a lineup of many other smart products to be launched, Samsung could be a formidable force to watch out for in the smart home space.

Apple’s HomeKit is another eagerly anticipated big-name development. Apple had announced partnerships with manufacturers such as iHome, Haier, Withings, Philips, iDevices, Belkin, Honeywell and Kwikset when it first introduced its HomeKit platform in 2014. It is rumored that several manufacturers have already made their devices iOS compatible so that they can integrate easily with HomeKit when it is released.

Nest Labs, maker of the Nest Learning Thermostat, the Nest Protect smoke/carbon monoxide detector and the Nest Cam, was acquired by Google in 2014 as part of the latter’s plans to become a smart home systems leader. Google is also working on a platform called Thread that will simplify home automation and compete with Apple’s HomeKit. It claims that the platform will be easy to use and can even run on simple, low-powered devices.

Insteon, a home automation technology invented by Smartlabs, enables devices, switches and lights to communicate with each other through power lines and radio frequency communications. Microsoft partnered with Insteon in 2014 in a move to get on board the home automation bandwagon. The companies are working together to develop a universal smart home controller app that has exclusive features for Windows and will run seamlessly across all Microsoft devices.

Source: Google/Apple/Samsung/Microsoft/FBIC Global Retail & Technology

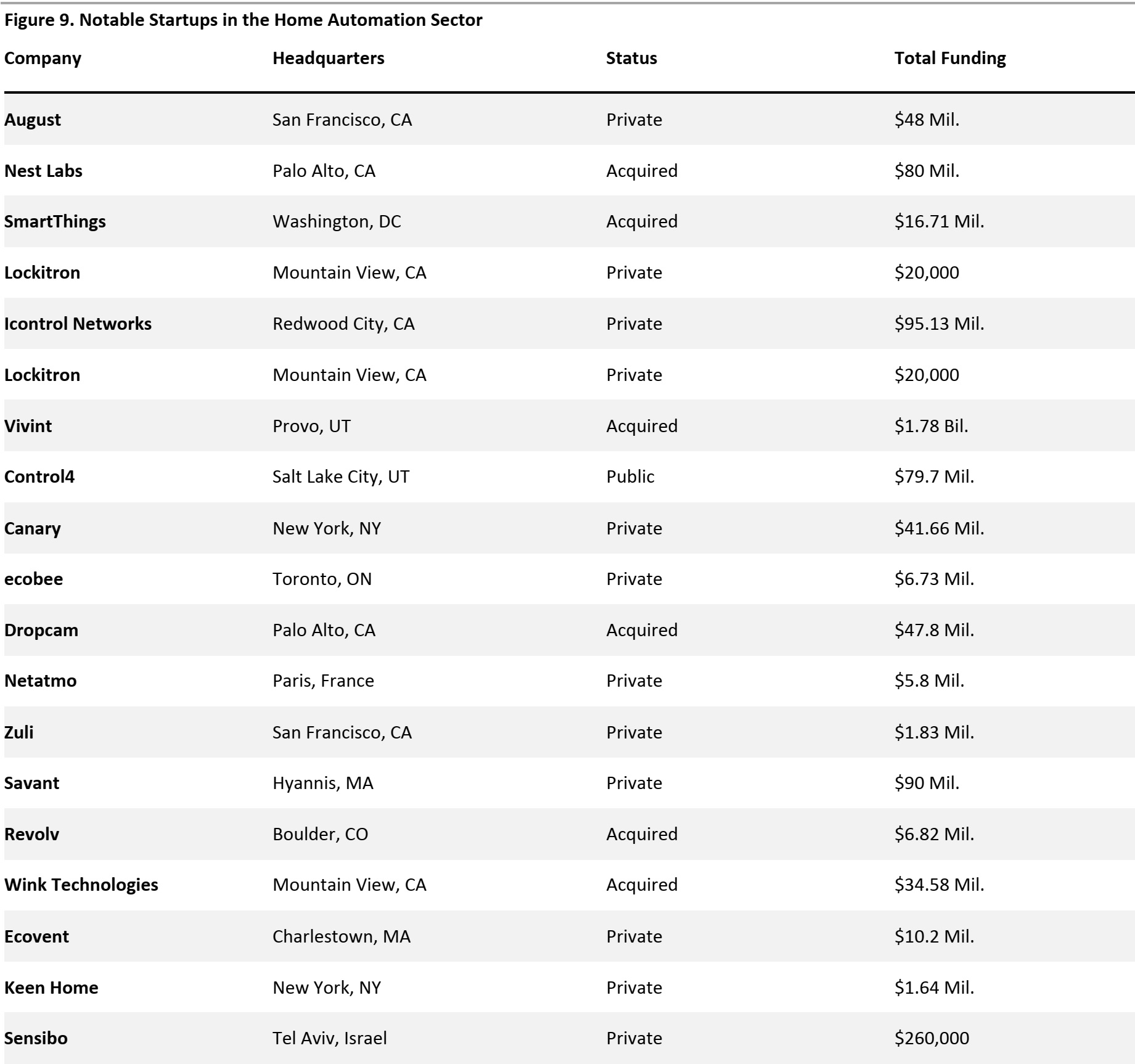

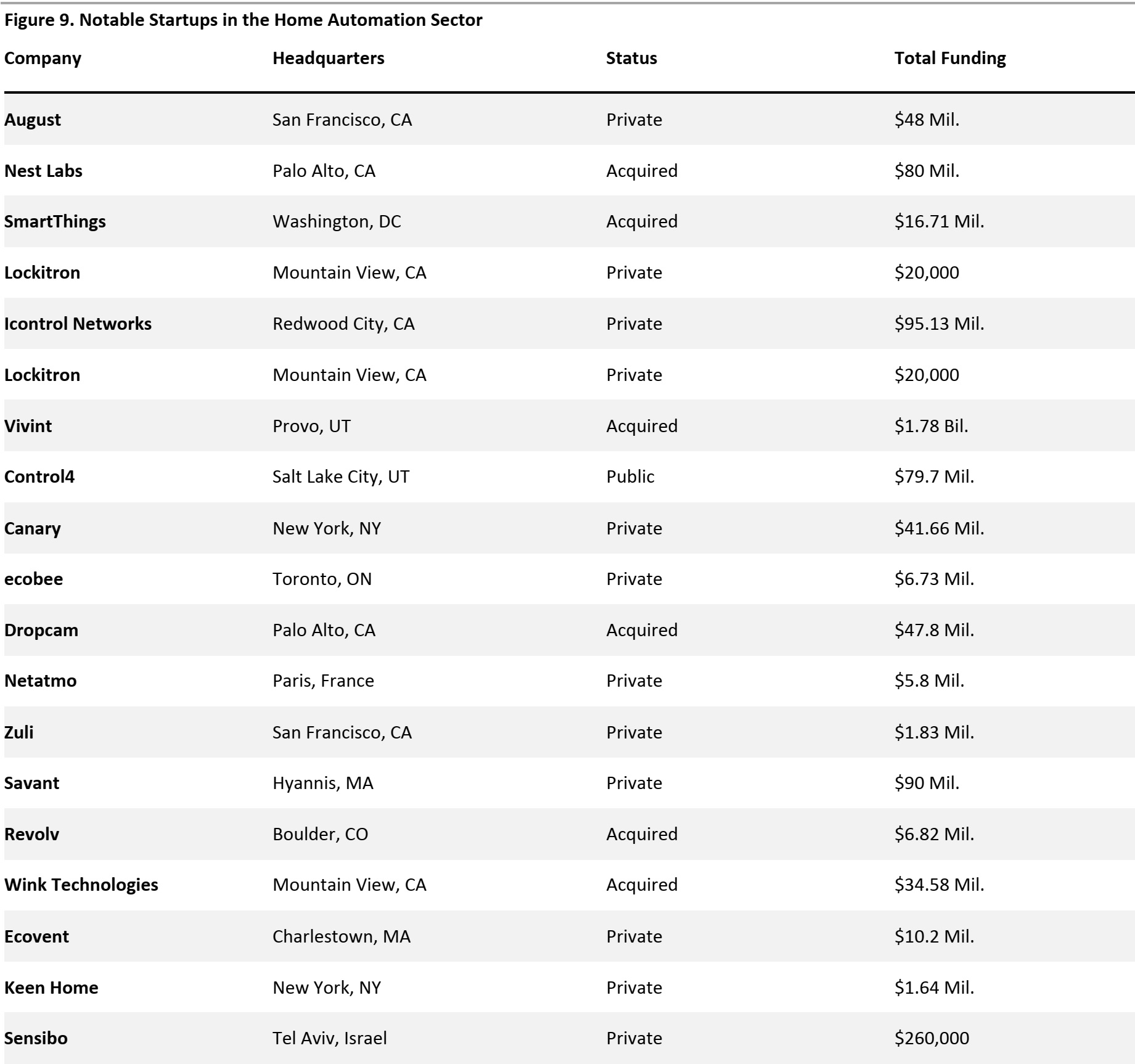

The Newbies

Some of the newer startups that are making a name for themselves in the market are August, Wink, Netatmo, ecobee and Canary. Some of their products will be discussed in detail in future reports. Below is a compilation of their stats, along with those of other notable startups in the sector:

Source: CB Insights

Retailers Venturing into Home Automation

Two companies that have previously not had a presence in home automation have developed products that pave their entry into the market. Staples Connect is a hub with a control app developed by office equipment and stationery giant Staples. Lowe’s, the home improvement company, made a control system called Iris, which has been featured in a number of top 10 lists. Both of these products have been brought to market by firms that were already popular in their own domains.

The Traditionalists

Some of the bigger companies that have been manufacturing and providing automation equipment and services for commercial buildings have expanded into homes as well. HomeSeer sells a range of home controllers and software that allow gadgets around the home to be controlled through one device. Honeywell is a renowned name in engineering, aerospace systems, and the production of machinery for commercial and home use. Its line of home thermostats is quite well recognized in the market. Home Automation is another firm that applies commercial automation technology in the residential market, and Siemens provides home automation and control systems globally for commercial and domestic use. Icontrol Networks, Control4, Fibaro and Vera are some of the other names that are well known for their various home automation and control services.

SAME MESSAGE, DIFFERENT LANGUAGE: HOME AUTOMATION PROTOCOLS AND INTEROPERABILITY

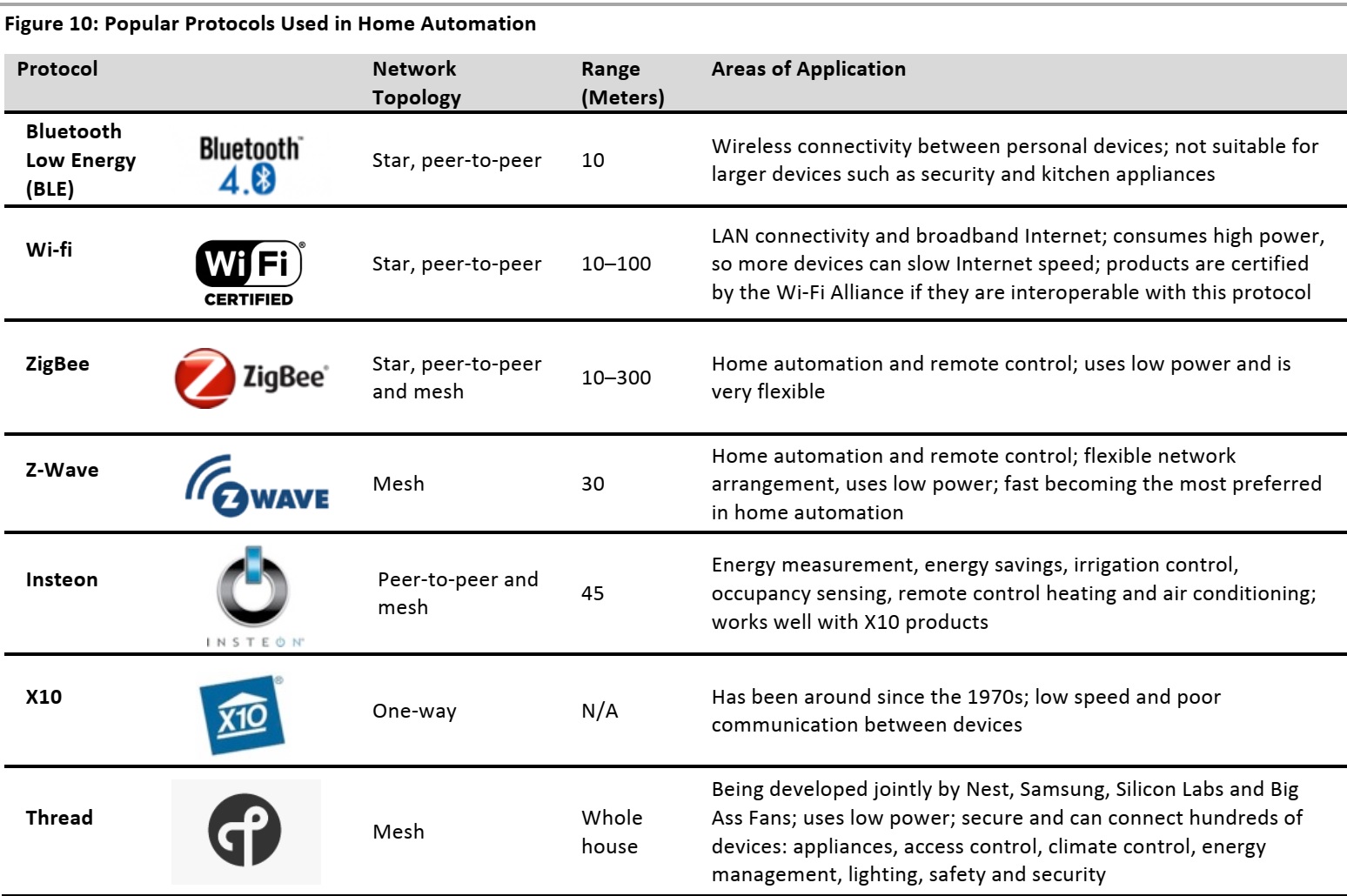

A network protocol is a formal set of conventions and data structure that define how two or more devices exchange information over their network. Before we delve into the exciting world of protocols, there are a few terms that are worth a mention: application program interface (API), network topology and interoperability.

An API is a set of routines, protocols and rules that help build software applications. It allows a programmer to interact with other software programs. In a way, it is a set of rules to allow different kinds of software to talk to each other. An open API allows third-party developers to access it freely and create new products and applications that can be sold or licensed. A closed API will allow only the manufacturer of the product with a said API to develop more products and applications using it.

A network topology is the layout of a network, or the way different devices are connected in a local area network. There are several kinds of layouts that are used for different purposes, including bus, ring, star, tree and mesh layouts. In homes, the most commonly used are the bus, ring and star, but smart devices need to be connected through a mesh network.

A bus is where one device is connected to another in a line, without any interconnections. A ring is where all the devices are connected to each other in the form of a loop. A star has a central device to which all other devices are connected. A mesh has many devices connected to each other. (Imagine a wire mesh and replace the points where the wires meet with devices: this constitutes a mesh network.) A peer-to-peer network is where each device has equal power in the network, unlike a star network, which relies on one hub to send and receive messages.

Interoperability in its basic sense means that different devices are able to interact and communicate with each other without special effort from the user. For example, if a home has a Nest Thermostat, a Samsung washing machine and an Apple iPhone that can connect with each other easily, as if they were made by the same company, they are interoperable.

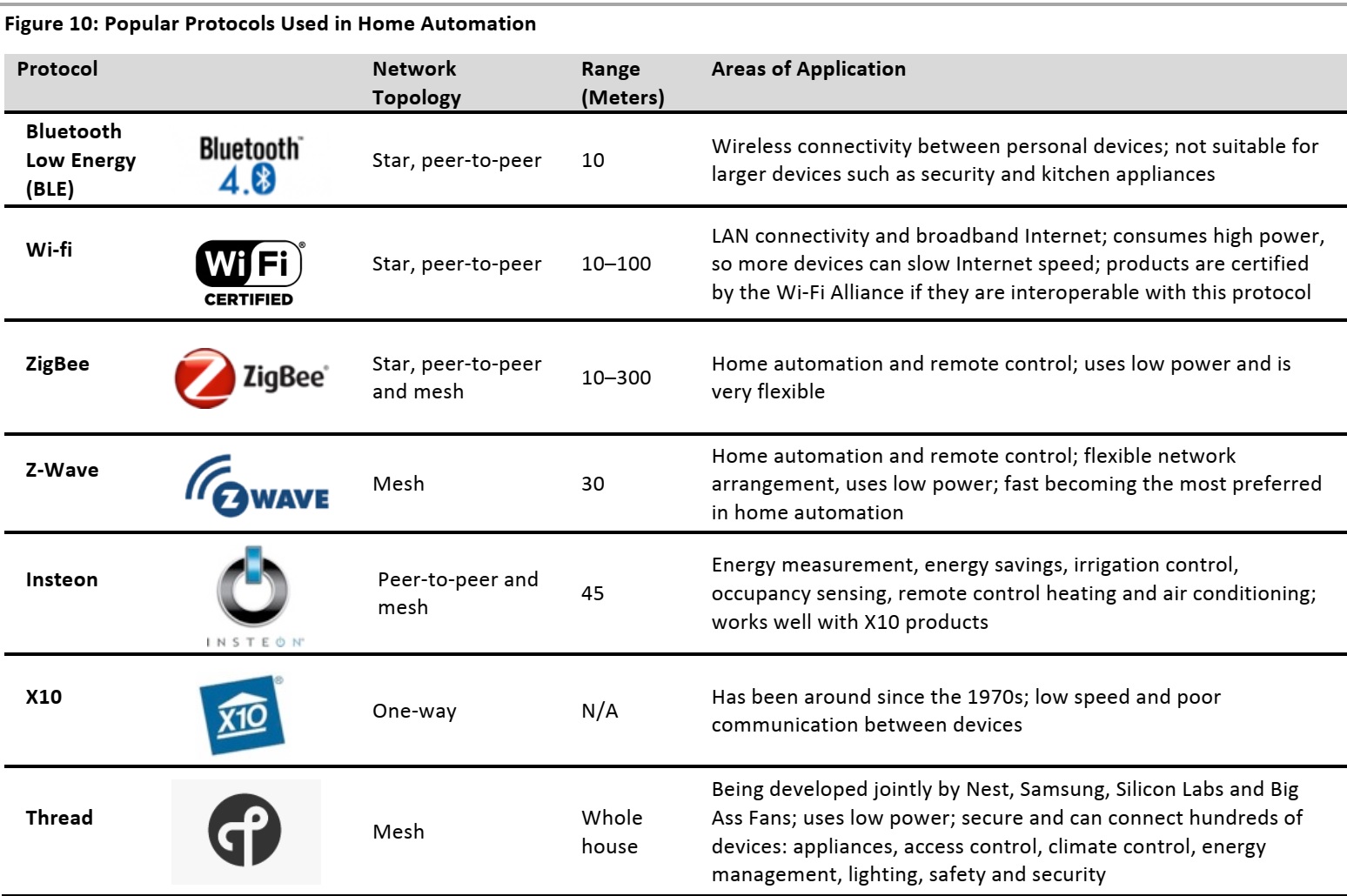

Home automation protocols that are currently popular include Z-Wave, ZigBee and Insteon, largely because of their superiority and sophistication in terms of interoperability.

Popular Communication Protocols Used in Home Automation

Popular Communication Protocols Used in Home Automation

Source: Top Ten Reviews/DigitalTrends/“Smart Home Communication Technologies and Applications: Wireless Protocol Assessment for Home Area Network Resources” by Tiago D. P. Mendes, Radu Godina, Eduardo M. G. Rodrigues, João C. O. Matias and João P. S. Catalão, published July 20, 2015, on www.mdpi.com/journal/energies/Threadgroup.org/FBIC Global Retail & Technology

RISKS/THREATS

Security Breaches

What happens when all your devices are always on, listening to your conversations, monitoring your actions and recording all of it, and then someone manages to hack into your Nest Cam? Devices connected to the Internet or that have a network which can be breached always pose a security threat for their users.

The Fiscal Times published an article, “The New Generation of ‘Genuinely Creepy’ Electronic Devices,” that raised a number of issues that device manufacturers need to address. It mentions the Electronic Privacy Information Center’s concern that many consumers may not be aware that their smart home devices are in fact “spying” on them. Google Chrome and Amazon Echo have specific key words that trigger an action from them, but in order for them to “hear” the key word, they have to be listening in on all conversations.

Samsung’s Smart TV has a built-in microphone that records users’ conversations all the time. The voice-recognition software sends the recorded voice to a third-party to convert it to text. The company has even acknowledged that the recordings are sent unencrypted to a third party, and this includes everything the user might have spoken, including sensitive and personal information.

The Nest Cam and the Canary system save recorded audio and video for a period of time, and any security breach can expose a user’s personal life to a hacker. It is also unclear how much information the companies that manufacture these devices are collecting themselves and using for their own purposes. These are two key concerns of consumers surveyed by Nielsen’s Affinnova: 53% of those surveyed were worried that their data might be distributed without their approval or knowledge, and 51% were concerned that their data might be hacked.

High Energy Costs

Smart home devices advocate energy-saving practices, but if the wrong combination of devices (that use more energy/power) is used, or if the devices have not been configured adequately, they could end up being costly instead of cost-effective.

Dependent on Internet

There have been cases of home automation systems completely shutting off when a home’s Internet/broadband connection is down. Devices that are heavily dependent on the Internet and wi-fi are most at risk if set up with these networks.

Network Interoperability

With so many devices, from so many different manufacturers, flooding the market, there is always a risk that they will not be able to sync with each other. If a user has to control each device individually, it defeats the purpose of home automation. Also, certain protocols limit the number of devices that can be used. And upgrading to devices with a different protocol could be very costly.

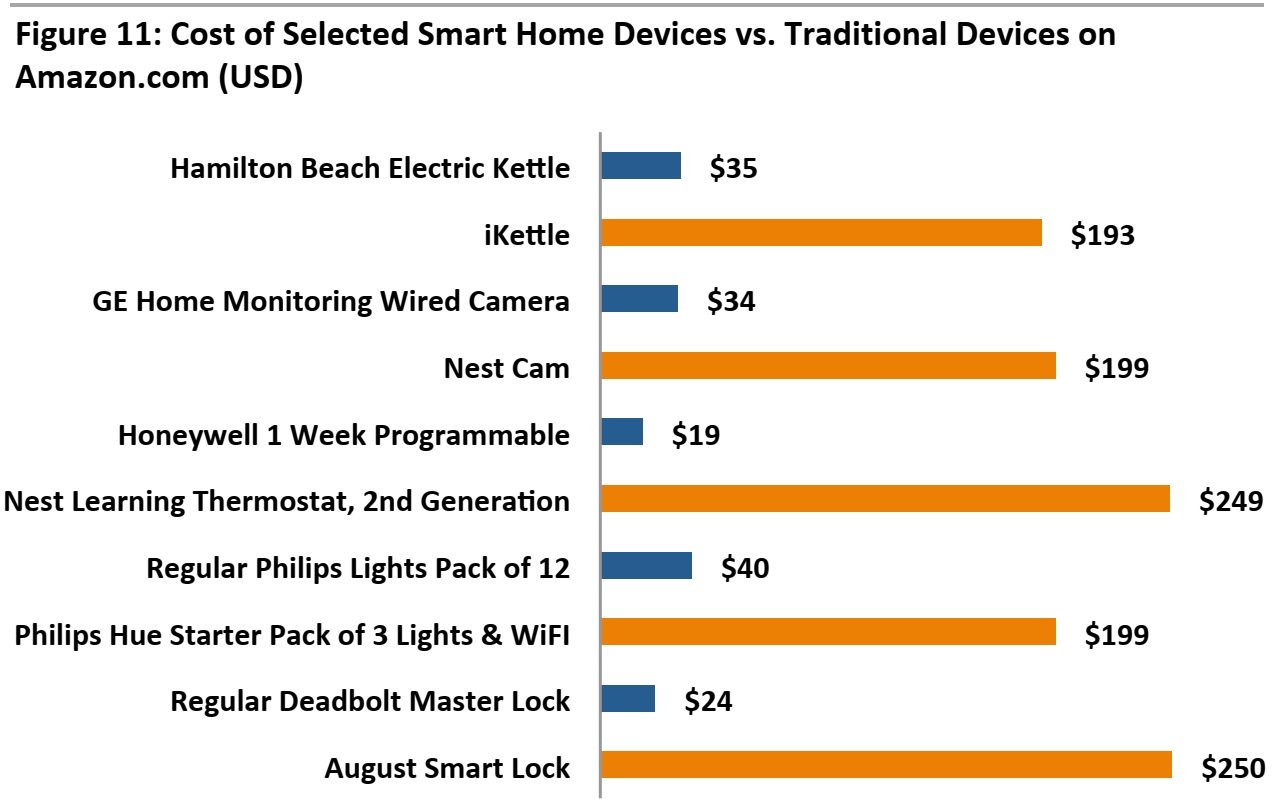

High Adoption Costs

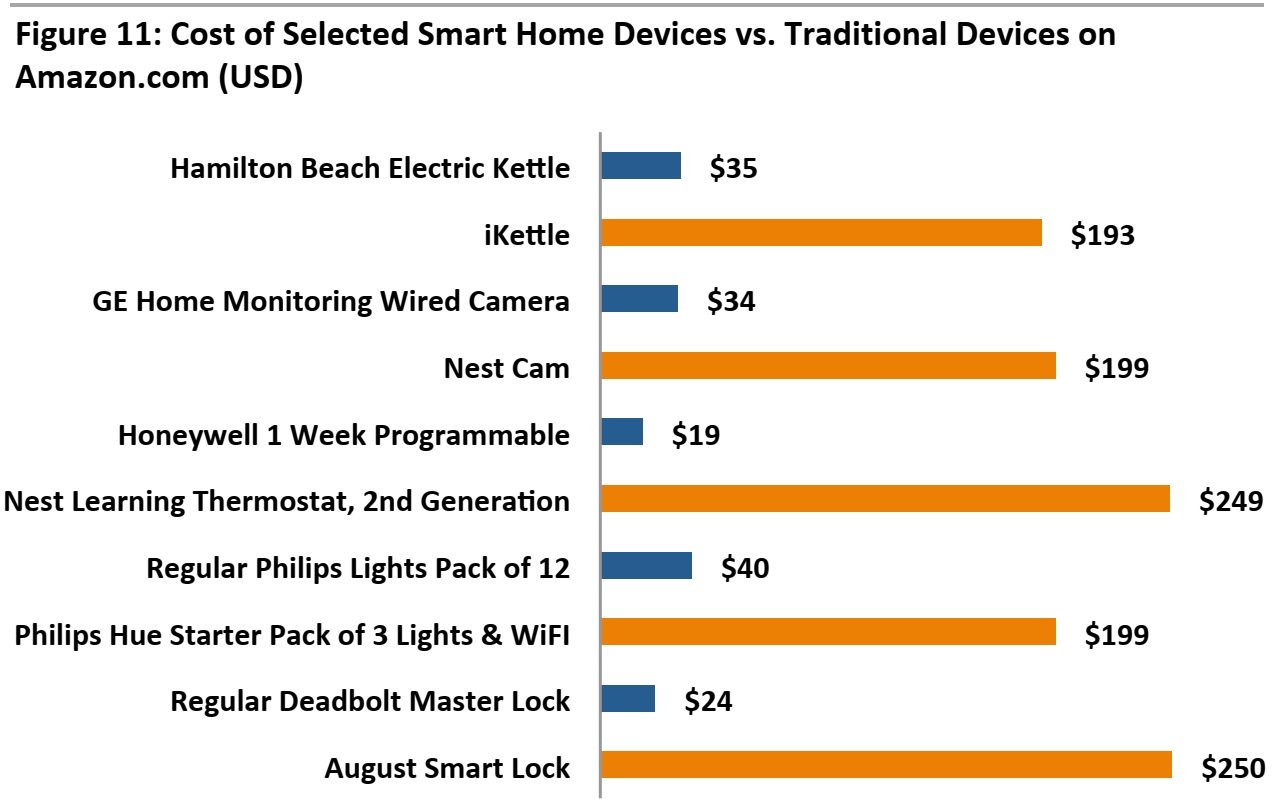

The current costs of smart home devices are much higher than the equivalent non-smart devices on the market.

Source: Amazon.com/FBIC Global Retail & Technology

Added to the individual costs of the devices is the cost of hard wiring or retrofitting the house in which they will be used. Until all this becomes affordable, we might see only a smaller group of consumers adopting connected home technology.

THE WAY AHEAD FOR CONNECTED HOMES

Consumers see many benefits of adopting a smart home system and demand for smart home products will grow in the next few years. The rate of adoption, however, might be slower than some predict until manufacturers address two key matters: interoperability between devices and the cost of adoption. We think manufacturers and developers will likely find a resolution to interoperability sooner rather than later, considering recent acquisitions by the big players, such as Samsung and Google, the development of platforms such as Thread and HomeKit, and the natural competition between these pioneers to create a language that will be “the one” that all devices speak. The resolution of the adoption cost hinges on the industry standardizing itself, which should follow once a single language is established.

KEEP READING FOR MORE ON SMART HOMES

Finally, keep an eye out in the coming weeks for FBIC Global Retail & Technology’s follow-up reports showcasing leading brands and innovating companies in each of the following smart-home categories:

- Home Security

- Lighting, Temperature and Climate Control, Energy Management, and Overall Control

- Kitchen and Other Home Equipment

- Home Entertainment

A connected home (or “smart home”) is defined as one where the lights, heating/ventilation/air-conditioning (HVAC), security alarm and other household devices can be automated and remotely controlled by a smartphone, tablet or computer. All the devices are either connected to a wireless hub in the house, which communicates with the homeowner’s devices, or directly communicate with the homeowner’s smartphone. New homes can be built with the additional hard wiring necessary for such technology, and existing homes can be retrofitted in order to make them smart.

According to recent research from MarketsandMarkets, the value of the global smart home market is expected to touch $58.68 billion by 2020, a near-tripling of its value from 2014. With the enhanced interest in home automation, we expect to see a ripple effect on the many devices and technologies involved.

A connected home (or “smart home”) is defined as one where the lights, heating/ventilation/air-conditioning (HVAC), security alarm and other household devices can be automated and remotely controlled by a smartphone, tablet or computer. All the devices are either connected to a wireless hub in the house, which communicates with the homeowner’s devices, or directly communicate with the homeowner’s smartphone. New homes can be built with the additional hard wiring necessary for such technology, and existing homes can be retrofitted in order to make them smart.

According to recent research from MarketsandMarkets, the value of the global smart home market is expected to touch $58.68 billion by 2020, a near-tripling of its value from 2014. With the enhanced interest in home automation, we expect to see a ripple effect on the many devices and technologies involved.

An API is a set of routines, protocols and rules that help build software applications. It allows a programmer to interact with other software programs. In a way, it is a set of rules to allow different kinds of software to talk to each other. An open API allows third-party developers to access it freely and create new products and applications that can be sold or licensed. A closed API will allow only the manufacturer of the product with a said API to develop more products and applications using it.

A network topology is the layout of a network, or the way different devices are connected in a local area network. There are several kinds of layouts that are used for different purposes, including bus, ring, star, tree and mesh layouts. In homes, the most commonly used are the bus, ring and star, but smart devices need to be connected through a mesh network.

A bus is where one device is connected to another in a line, without any interconnections. A ring is where all the devices are connected to each other in the form of a loop. A star has a central device to which all other devices are connected. A mesh has many devices connected to each other. (Imagine a wire mesh and replace the points where the wires meet with devices: this constitutes a mesh network.) A peer-to-peer network is where each device has equal power in the network, unlike a star network, which relies on one hub to send and receive messages.

Interoperability in its basic sense means that different devices are able to interact and communicate with each other without special effort from the user. For example, if a home has a Nest Thermostat, a Samsung washing machine and an Apple iPhone that can connect with each other easily, as if they were made by the same company, they are interoperable.

Home automation protocols that are currently popular include Z-Wave, ZigBee and Insteon, largely because of their superiority and sophistication in terms of interoperability.

An API is a set of routines, protocols and rules that help build software applications. It allows a programmer to interact with other software programs. In a way, it is a set of rules to allow different kinds of software to talk to each other. An open API allows third-party developers to access it freely and create new products and applications that can be sold or licensed. A closed API will allow only the manufacturer of the product with a said API to develop more products and applications using it.

A network topology is the layout of a network, or the way different devices are connected in a local area network. There are several kinds of layouts that are used for different purposes, including bus, ring, star, tree and mesh layouts. In homes, the most commonly used are the bus, ring and star, but smart devices need to be connected through a mesh network.

A bus is where one device is connected to another in a line, without any interconnections. A ring is where all the devices are connected to each other in the form of a loop. A star has a central device to which all other devices are connected. A mesh has many devices connected to each other. (Imagine a wire mesh and replace the points where the wires meet with devices: this constitutes a mesh network.) A peer-to-peer network is where each device has equal power in the network, unlike a star network, which relies on one hub to send and receive messages.

Interoperability in its basic sense means that different devices are able to interact and communicate with each other without special effort from the user. For example, if a home has a Nest Thermostat, a Samsung washing machine and an Apple iPhone that can connect with each other easily, as if they were made by the same company, they are interoperable.

Home automation protocols that are currently popular include Z-Wave, ZigBee and Insteon, largely because of their superiority and sophistication in terms of interoperability.

Popular Communication Protocols Used in Home Automation

Popular Communication Protocols Used in Home Automation

What happens when all your devices are always on, listening to your conversations, monitoring your actions and recording all of it, and then someone manages to hack into your Nest Cam? Devices connected to the Internet or that have a network which can be breached always pose a security threat for their users.

The Fiscal Times published an article, “The New Generation of ‘Genuinely Creepy’ Electronic Devices,” that raised a number of issues that device manufacturers need to address. It mentions the Electronic Privacy Information Center’s concern that many consumers may not be aware that their smart home devices are in fact “spying” on them. Google Chrome and Amazon Echo have specific key words that trigger an action from them, but in order for them to “hear” the key word, they have to be listening in on all conversations.

Samsung’s Smart TV has a built-in microphone that records users’ conversations all the time. The voice-recognition software sends the recorded voice to a third-party to convert it to text. The company has even acknowledged that the recordings are sent unencrypted to a third party, and this includes everything the user might have spoken, including sensitive and personal information.

The Nest Cam and the Canary system save recorded audio and video for a period of time, and any security breach can expose a user’s personal life to a hacker. It is also unclear how much information the companies that manufacture these devices are collecting themselves and using for their own purposes. These are two key concerns of consumers surveyed by Nielsen’s Affinnova: 53% of those surveyed were worried that their data might be distributed without their approval or knowledge, and 51% were concerned that their data might be hacked.

What happens when all your devices are always on, listening to your conversations, monitoring your actions and recording all of it, and then someone manages to hack into your Nest Cam? Devices connected to the Internet or that have a network which can be breached always pose a security threat for their users.

The Fiscal Times published an article, “The New Generation of ‘Genuinely Creepy’ Electronic Devices,” that raised a number of issues that device manufacturers need to address. It mentions the Electronic Privacy Information Center’s concern that many consumers may not be aware that their smart home devices are in fact “spying” on them. Google Chrome and Amazon Echo have specific key words that trigger an action from them, but in order for them to “hear” the key word, they have to be listening in on all conversations.

Samsung’s Smart TV has a built-in microphone that records users’ conversations all the time. The voice-recognition software sends the recorded voice to a third-party to convert it to text. The company has even acknowledged that the recordings are sent unencrypted to a third party, and this includes everything the user might have spoken, including sensitive and personal information.

The Nest Cam and the Canary system save recorded audio and video for a period of time, and any security breach can expose a user’s personal life to a hacker. It is also unclear how much information the companies that manufacture these devices are collecting themselves and using for their own purposes. These are two key concerns of consumers surveyed by Nielsen’s Affinnova: 53% of those surveyed were worried that their data might be distributed without their approval or knowledge, and 51% were concerned that their data might be hacked.