Compagnie Financière Richemont

Sector: Luxury

Countries of operation: China, France, Japan, the UK, the US and over 30 other countries, as well as online

Key product categories: Fashion, jewelry, leather goods, online retail platforms and watches

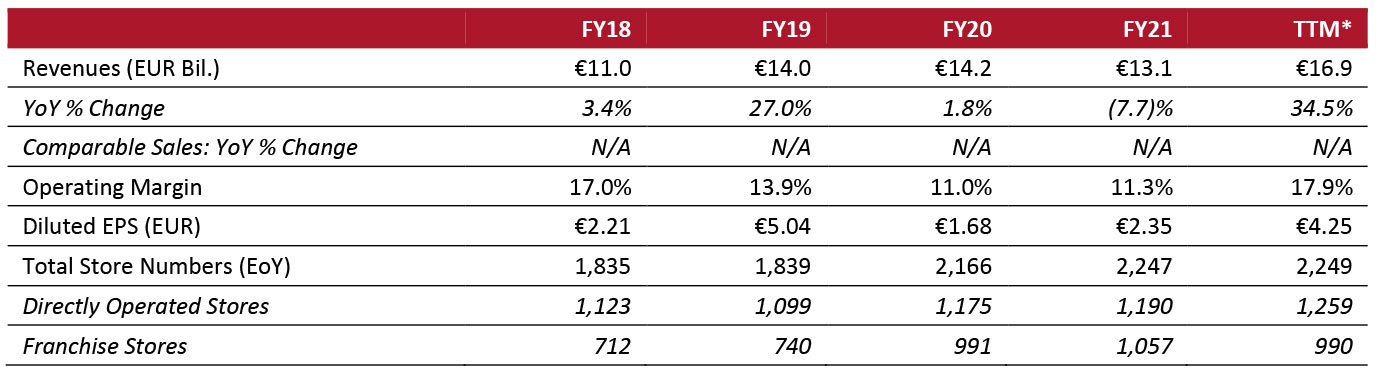

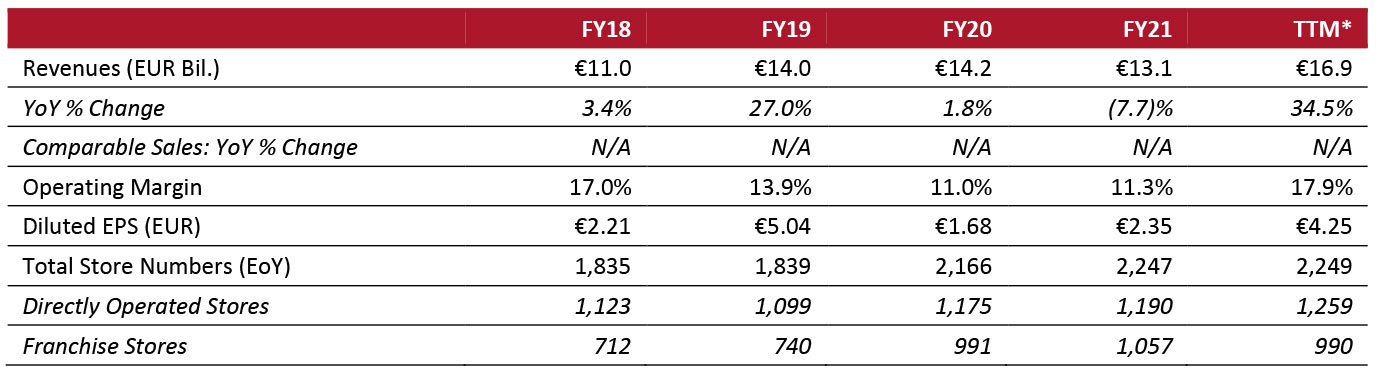

Annual Metrics

[caption id="attachment_148792" align="aligncenter" width="699"]

Last fiscal year end: March 31, 2021

Last fiscal year end: March 31, 2021

*Trailing 12 months ended September 30, 2021 [/caption]

Summary

Richemont is a luxury conglomerate, founded in 1988 and based in Switzerland. It operates in four segments: jewelry houses, specialist watchmakers, online distributors and “others” (writing instruments, clothing and leather goods). Richemont has consolidated its position as a luxury conglomerate with an acquisitive strategy—in 1988, it had six brands under its wing and has since grown its roster to 26 brands, the oldest being watchmaker Vacheron Constantin, established in 1755, and the newest being fashion label AZ Factory, founded in 2021.

As of March 31, 2021, Richemont’s products are sold through 2,247 boutiques, of which 1,190 are directly operated by the company, while the rest are franchised across 38 markets.

Company Analysis

Coresight Research insight: Richemont is an established leader in the hard luxury segment—on average, over the last decade, around 75% of Richemont’s revenues have been from the jewelry and watches categories. However, its position as a leader in hard luxury is being challenged.

Industry leader LVMH, which earns almost five times Richemont’s total revenues, had fallen short of the latter’s share in the jewelry and watches segment—until it acquired Tiffany & Co. in 2021. In the year prior to the acquisition, LVMH’s revenue from jewelry and watches was €3.4 billion ($4.0 billion), whereas Richemont’s watches and jewelry revenue amounted to an aggregate of €9.6 billion ($11.4 billion). In fiscal 2021 (LVMH’s fiscal year ends December 31), however, LVMH’s revenue from jewelry and watches hit €9.0 billion ($10.2 billion), very close to Richemont’s watches and jewelry aggregate revenue of €9.7 billion ($11.0 billion).

While its total revenues may be far off from LVMH’s, Richemont has been more resilient than its industry peers through the pandemic, as most of its product segments—jewelry and watches, which are less season-driven—have performed better than season-driven products, such as clothing and footwear. Moreover, close to one-fifth of its business comes from online distributors, which have done exceptionally well recently due to the consumer shift to e-commerce.

Richemont appears to be well prepared to tide over current industry challenges with little difficulty, considering its mix of businesses.

| Tailwinds |

Headwinds |

- New and aspirational shoppers looking to purchase luxury goods

- Growing segment of youthful consumers with rising incomes

- Demand for timeless, seasonless and durable luxury goods

- Recovery in travel

- Online presence as consumers shift to e-commerce

|

- Economic uncertainty across global markets

- Competition from other luxury brands, specifically LVMH

- Supply-side disruptions and input cost inflation

|

Strategy

- During both its full-year earnings call in May 2021 and half-year update in November 2021, Richemont stated it will focus on the following areas for fiscal 2022:

1. Digital initiatives

- Continue with its accelerated digital strategy, including localizing websites to regions where the group operates. Specifically, the company plans to transform the business models of its brands Net-a-Porter, Mr Porter, YOOX and TheOutnet into hybrid models. Previously, Net-a-Porter ran on a wholesale model and has already introduced a consignment model for some brand partners. At YOOX, it plans to introduce a marketplace model.

2. Customer-centricity

- Connect with local customers through new retail initiatives, such as video call shopping and other digital clienteling initiatives.

- Offer an enhanced online and in-store experience, including “click from store,” which allows customers to place orders in-store with a sales associate if a requested product is not in stock.

3. Strategic partnerships

- Look to partnerships to achieve its various objectives. It stated that it believes in the value of partnerships, pointing to its partnerships with Alibaba and Farfetch, which have allowed it greater access to the burgeoning China luxury market and online luxury shoppers, among other examples.

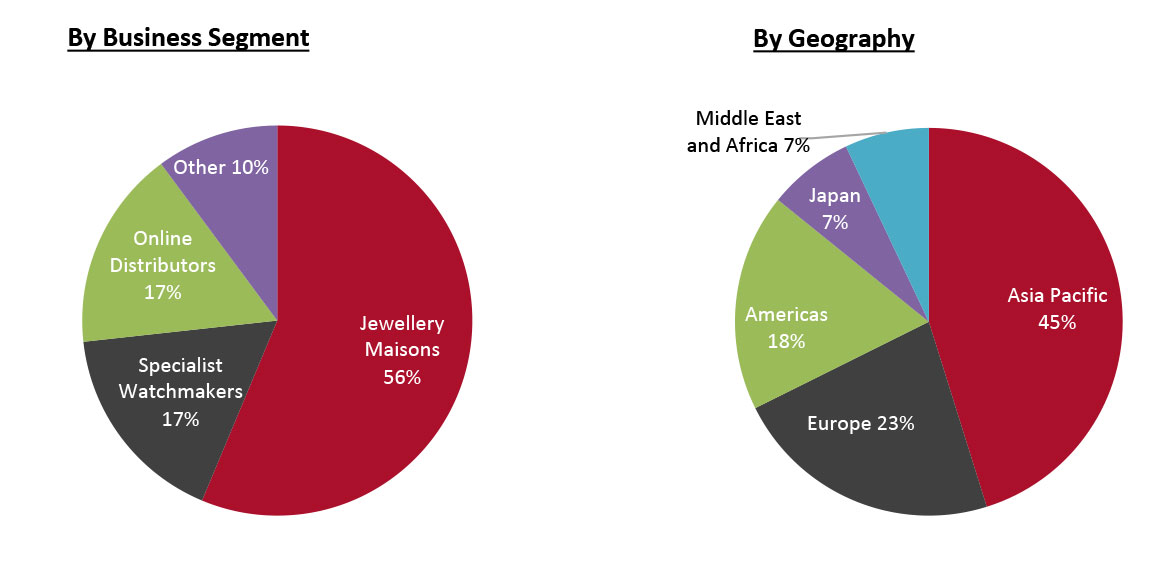

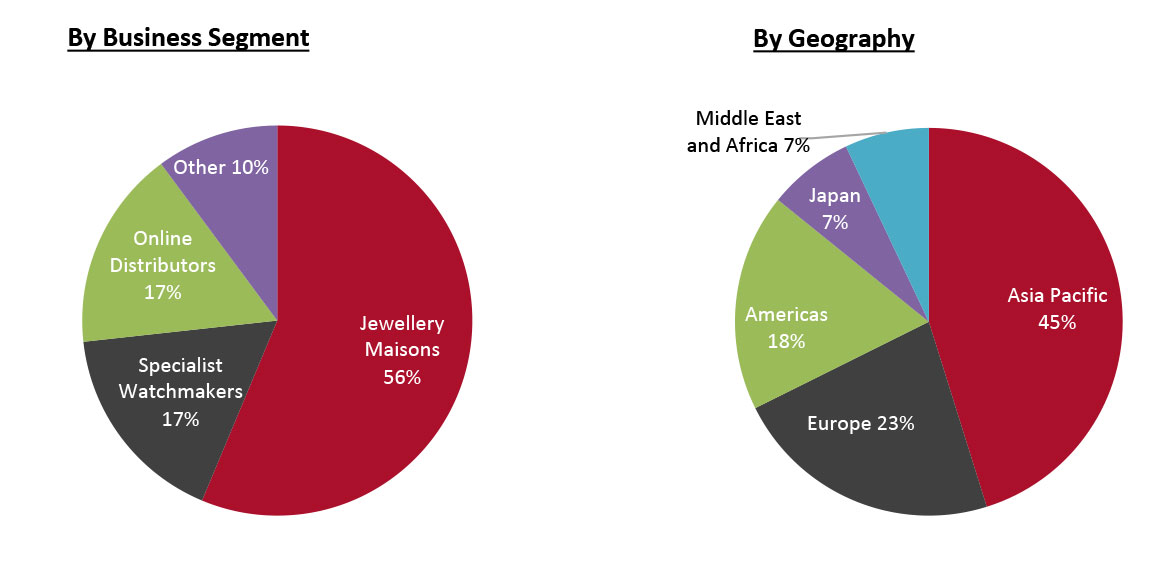

Revenue Breakdown (FY21)

Company Developments

Company Developments

| Date |

Development |

| February 1, 2022 |

Richemont appoints Dr. Bérangère Ruchat as Chief Sustainability Officer, effective February 1, 2022. Prior to this role, Dr. Ruchat was Chief Sustainability Officer at Firmenich. |

| November 12, 2021 |

Richemont announces that it is in advanced talks with Farfetch about several initiatives, including Richemont using Farfetch Platform Solutions (FPS) to power its Maisons and YOOX sites. FPS is a white-label enterprise for luxury companies, which builds and operates e-commerce and technology platforms for luxury brands and retailers, based on the proprietary Farfetch platform. Other initiatives include adding Richemont Maisons to the Farfetch marketplace and Farfetch investing in YOOX as a minority shareholder. |

| October 18, 2021 |

Chloé, a Richemont brand, achieves a B Corp certification—awarded to companies that fulfill strict environmental and social impact criteria. |

| October 1, 2021 |

YOOX, a Richemont brand, partners with Reflaunt, a resale technology provider, to use the latter’s technology to process online returns on Net-a-Porter, Mr Porter and TheOutnet. |

Management Team

- Johann Rupert—Chairman

- Jérôme Lambert—CEO

- Burkhart Grund—CFO

- Dr. Bérangère Ruchat—Chief Sustainability Officer

Source: Company reports/S&P Capital IQ

Last fiscal year end: March 31, 2021

Last fiscal year end: March 31, 2021  Company Developments

Company Developments