DIpil Das

Introduction

What’s the Story? While US consumers are continuing their return to more normal ways of living, shoppers and retailers are now grappling with decades-high overall inflation in consumer prices, which was at 8.6% in May 2022. This inflation has mainly been caused by supply chain bottlenecks. High inflation, including in input costs, is putting increasing pressure on retailers, primarily in terms of handling wage increases and historically high freight and raw material prices. In this report, we discuss how US retailers are addressing inflation costs. We focus on various retail sectors throughout the report, including apparel and footwear specialty retail, beauty retail, department stores, food retail, mass retail and off-price retail.- Please also refer to our Inflation and Apparel report, which discusses how US apparel brands and retailers are addressing inflation costs, published in May 2022.

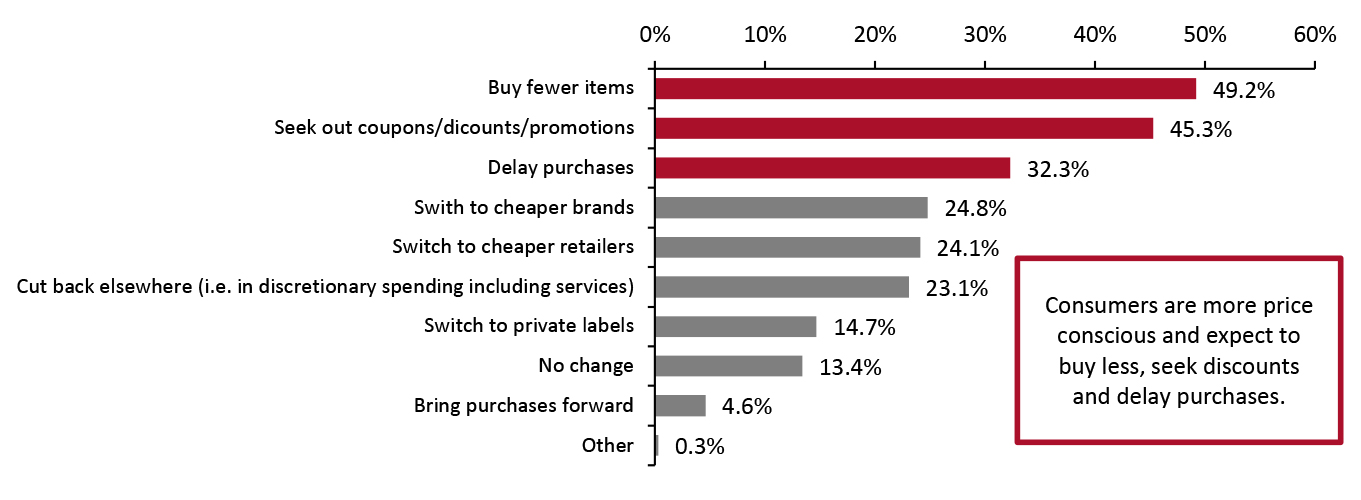

Figure 1. Respondents That Have Noticed Price Increases: How They Have Changed or Expect to Change Their Non-Grocery Shopping Behavior (% Respondents) [caption id="attachment_150093" align="aligncenter" width="700"]

Base: 307 US respondents aged 18+ who noticed recent retail price increases, surveyed on May 2, 2022

Base: 307 US respondents aged 18+ who noticed recent retail price increases, surveyed on May 2, 2022 Source: Coresight Research [/caption]

How US Retailers Are Combating Inflation Costs: Coresight Research Analysis

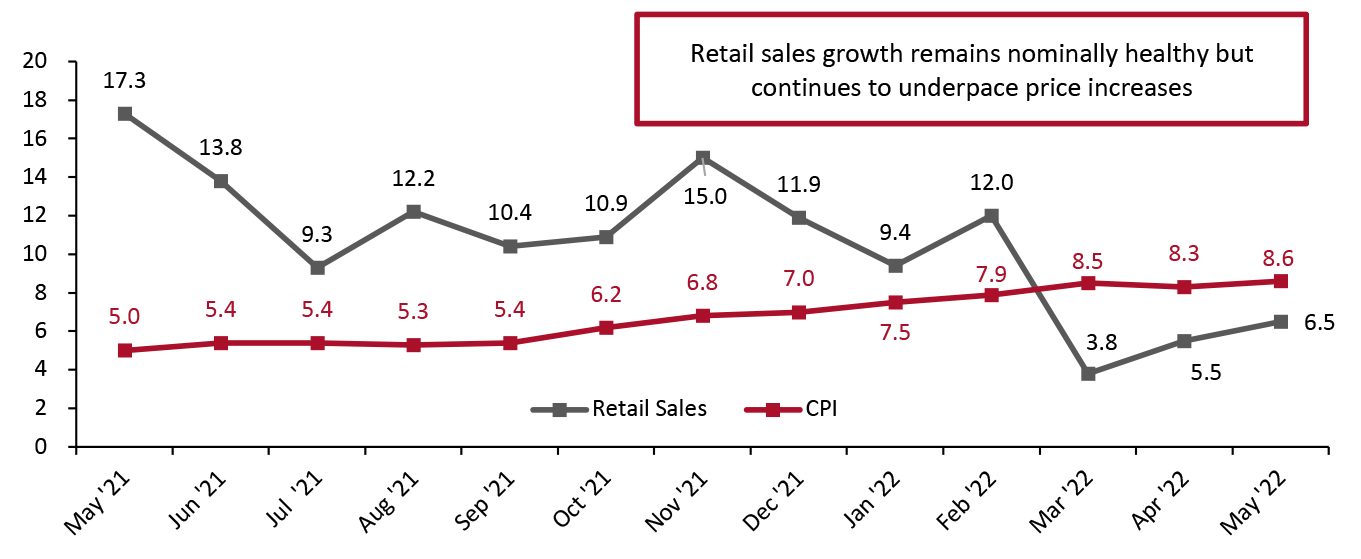

In May, US retail sales grew 6.5% from the previous year, up from April’s 5.5% revised growth, according to the US Census Bureau. The 6.5% growth on top of the 17.3% growth in May 2021 indicates that retail sales are healthy. However, consumer price increases reached a new 40-year high in May, up by 8.6%, despite recent interest rate hikes. We estimate our retail-only inflation metric to have been 7.3% in May. This metric strips out some of the core categories driving overall inflation and focuses on price increases within relevant retail-specific sectors, each of which is weighted to represent their share of total retail sales. With our inferred retail-only inflation metric at 7.3%, 6.5% overall growth in retail sales in May implies consumers are buying fewer items at the store and there was a real-terms sales decline of around 0.8%. We estimate that May was the third consecutive month to see a real-terms total sales decline, year over year. Subsequently, in early June, the University of Michigan consumer sentiment index declined to 50.2, its lowest recorded reading in history, down from 58.7 in May. In addition, on June 15, the US Federal Reserve Bank increased interest rates by 75-basis points, the largest such hike since 1994, and a more aggressive monetary policy action than its previous 50-basis-point hike plan laid out earlier in the year.Figure 2. US: Consumer Price Index vs. Retail Sales (YoY % Change) [caption id="attachment_150094" align="aligncenter" width="701"]

Source: US Census Bureau/US Bureau of Labor Statistics/Coresight Research[/caption]

The substantial rise in prices of raw materials, elevated transportation costs, including higher air and ocean freights, and wage inflation are adding significant cost pressures for retailers across the US.

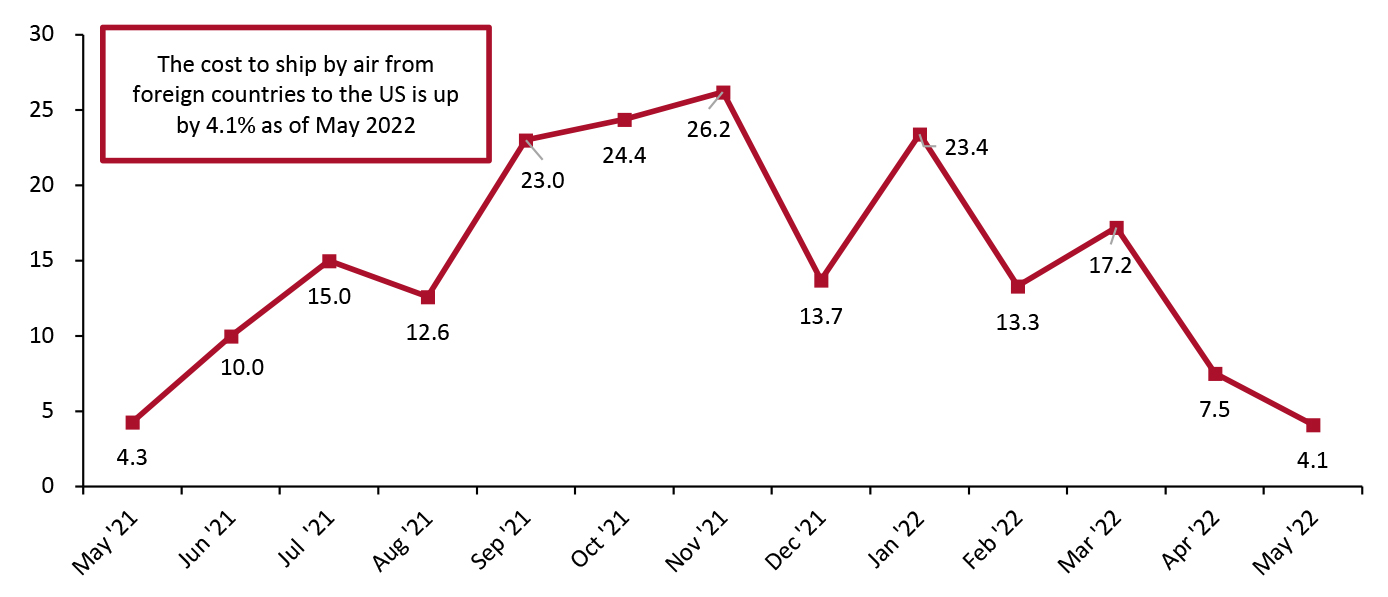

Rising Air Freight Rates

The significant increase in air freight rates has been driving up costs for retailers over the past year. The inbound air freight price index—which measures the monthly price changes of air freight flown from foreign countries into the US on both US and foreign carriers—increased by 4.1% year over year in May 2022 against strong comparatives, although this represents a deceleration from 7.5% growth in April 2022, according to the US Bureau of Labor Statistics.

We expect elevated air freight costs to persist throughout 2022, although with a slight deceleration in growth rates versus 2021—adding to retailers’ input costs.

Source: US Census Bureau/US Bureau of Labor Statistics/Coresight Research[/caption]

The substantial rise in prices of raw materials, elevated transportation costs, including higher air and ocean freights, and wage inflation are adding significant cost pressures for retailers across the US.

Rising Air Freight Rates

The significant increase in air freight rates has been driving up costs for retailers over the past year. The inbound air freight price index—which measures the monthly price changes of air freight flown from foreign countries into the US on both US and foreign carriers—increased by 4.1% year over year in May 2022 against strong comparatives, although this represents a deceleration from 7.5% growth in April 2022, according to the US Bureau of Labor Statistics.

We expect elevated air freight costs to persist throughout 2022, although with a slight deceleration in growth rates versus 2021—adding to retailers’ input costs.

Figure 3. US: Inbound Price Index of International Air Freight (YoY % Change) [caption id="attachment_150095" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

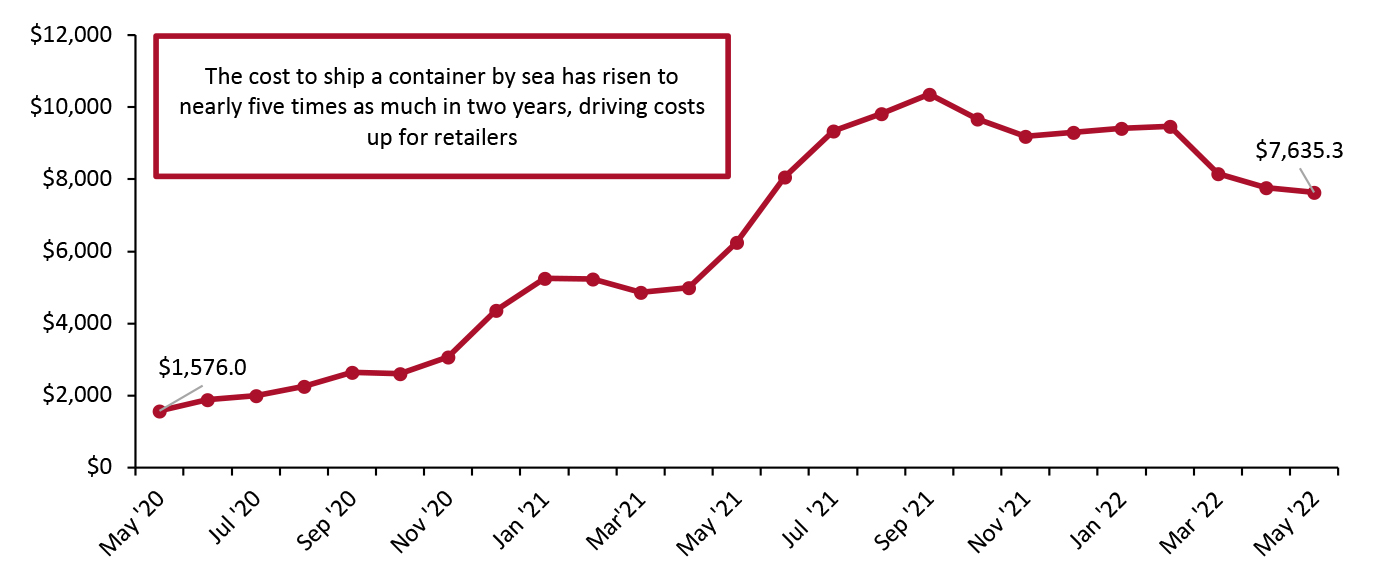

Heightened Ocean Freight Rates

Ocean freight rates have surged in the past two years: as of May 2022, global ocean freight costs have increased by nearly five times since May 2020. Like air freight, we expect elevated ocean freight costs to persist throughout 2022, adding to retailers’ input costs.

Source: US Bureau of Labor Statistics[/caption]

Heightened Ocean Freight Rates

Ocean freight rates have surged in the past two years: as of May 2022, global ocean freight costs have increased by nearly five times since May 2020. Like air freight, we expect elevated ocean freight costs to persist throughout 2022, adding to retailers’ input costs.

Figure 4. Global Container Freight Rate Index (USD) [caption id="attachment_150096" align="aligncenter" width="699"]

Source: Drewry World Container Index/Macromicro.me[/caption]

In the next sections, we focus on US retailers’ key initiatives to combat rising input costs by sector: apparel specialty retail, beauty retail, department stores, food retail, mass retail and off-price retail.

Apparel and Footwear Specialty Retailers: Increasing Retail Prices, Locking Up Product Costs and Diversifying Production Facilities

As we discussed in our May 2022 apparel inflation report, the substantial rise in producer prices of cotton (the most-used textile fabric in the world), elevated transportation costs, including higher air and ocean freights, and wage inflation for apparel sector employees are adding significant cost pressures for US apparel retailers and impacting their margins. In May 2022, inflation in consumer prices for apparel and footwear was up by 5.0% year over year, according to the US Bureau of Labor Statistics.

As detailed in Figure 5 below, apparel specialty retailers have adopted several measures to combat high inflation costs, including increasing retail prices, locking up raw material prices, partnering with supply chain service providers and diversifying their production facilities. Retailers are passing on the increased wholesaling costs by brand owners, such as NIKE and Levi’s—which are increasing prices by 5%–10% when wholesaling to retailers.

Source: Drewry World Container Index/Macromicro.me[/caption]

In the next sections, we focus on US retailers’ key initiatives to combat rising input costs by sector: apparel specialty retail, beauty retail, department stores, food retail, mass retail and off-price retail.

Apparel and Footwear Specialty Retailers: Increasing Retail Prices, Locking Up Product Costs and Diversifying Production Facilities

As we discussed in our May 2022 apparel inflation report, the substantial rise in producer prices of cotton (the most-used textile fabric in the world), elevated transportation costs, including higher air and ocean freights, and wage inflation for apparel sector employees are adding significant cost pressures for US apparel retailers and impacting their margins. In May 2022, inflation in consumer prices for apparel and footwear was up by 5.0% year over year, according to the US Bureau of Labor Statistics.

As detailed in Figure 5 below, apparel specialty retailers have adopted several measures to combat high inflation costs, including increasing retail prices, locking up raw material prices, partnering with supply chain service providers and diversifying their production facilities. Retailers are passing on the increased wholesaling costs by brand owners, such as NIKE and Levi’s—which are increasing prices by 5%–10% when wholesaling to retailers.

Figure 5. Selected US Apparel and Footwear Specialists: Key Pricing and Operational Strategies to Combat Inflation Costs [wpdatatable id=2064 table_view=regular]

Source: Company reports/Coresight Research In the most recent quarter, we saw that all of our covered apparel specialists witnessed year-over-year declines in their gross margins, due to elevated transportation and raw material costs. We identify that many apparel retailers are increasing retail prices, raising the share of full-price sales, lowering promotions, modifying product or channel mix, ensuring inventory optimization and strategically utilizing ocean freight and air freight to offset the impact of inflation on gross margins.

Figure 6. Gross Margin Metrics of Selected US Apparel and Footwear Specialty Retailers [wpdatatable id=2065 table_view=regular]

Source: Company reports Beauty Retailers: Passing On the Increased Wholesaling Costs to Consumers Most beauty retailers are increasing prices to preserve margins amid high inflation and supply chain disruptions—and passing on the increased wholesaling costs by brand owners, such as Estée Lauder and L'Oréal. Brands are increasing prices in the range of 4%–5% when wholesaling to retailers.

Figure 7. Selected US Beauty Retailers: Key Pricing and Operational Strategies to Combat Inflation Costs [wpdatatable id=2066 table_view=regular]

Source: Company reports/Coresight Research To offset the impact of inflation on gross margins, we are seeing that many beauty retailers are increasing retail prices, lowering promotions and ensuring favorable channel or product mix shifts as described in Figure 8 below.

Figure 8. Gross Margin Metrics of Selected US Beauty Retailers [wpdatatable id=2067 table_view=regular]

Source: Company reports Department Stores: Increasing Retail Prices Using Advanced Data Analytics and Elasticity Pricing Models Department stores are passing on some of the costs related to high freights and wages to customers by increasing retail prices in certain categories, such as apparel, including dresses. Department stores are utilizing elasticity pricing models, data analytics and consumer insights to inform their price increases and promotion decisions.

Figure 9. Selected US Department Stores: Key Pricing and Operational Strategies to Combat Inflation Costs [wpdatatable id=2069 table_view=regular]

Source: Company reports/Coresight Research Most of our covered department stores witnessed improvement in gross margins in the latest reported quarter. Department stores are increasing retail prices, raising the share of full-price sales, lowering promotions, ensuring inventory optimization and aiming for a higher inventory turnover to mitigate the effect of rising input prices on gross margins.

Figure 10. Gross Margin Metrics of Selected US Department Stores [wpdatatable id=2070 table_view=regular]

Source: Company reports Food Retailers: Increasing Retail Prices, Using Flexible Procurement Models and Diversifying Supplier Bases US food retailers are witnessing the significant cost pressures from the rise in producer prices of food commodities, elevated transportation and packaging costs and higher wage inflation. In May 2022, consumer prices in food at home were up 11.9% year over year, according to the US Bureau of Labor Statistics. Food retailers are passing over some of the costs to their customers—using data analytics and elasticity pricing models to inform price increase decisions. These retailers are also capitalizing on their flexible purchasing models and diversified supplier bases to manage input costs.

Figure 11. Selected US Food Retailers: Key Pricing and Operational Strategies to Combat Inflation Costs [wpdatatable id=2071 table_view=regular]

Source: Company reports/Coresight Research While assessing the most recent quarter earnings, we found that several food retailers are raising retail prices, decreasing promotions and utilizing a flexible procurement model to reduce the effect of increasing input costs on gross margins.

Figure 12. Gross Margin Metrics of Selected US Food Retailers [wpdatatable id=2072 table_view=regular]

*Operating margin is mentioned as gross margin data for Ahold Delhaize’s US region is not available Source: Company reports Mass Retailers: Increasing Prices, Expanding Supply Chain Capabilities and Growing Private Labels Mass retailers are passing on some of the costs related to raw materials, freight and wages to customers by increasing retail prices in certain categories, including apparel, hardlines and sundries. Mass retailers are also scaling up supply chain capabilities by growing their private fleets, expanding their logistic arms and acquiring new distribution centers. Furthermore, mass retailers are growing their private labels in all daily necessity segments, such as apparel and grocery, to mitigate inflation. Private labels help mass retailers to maintain a price advantage and direct control of supply chains.

Figure 13. Selected US Mass Retailers: Key Pricing and Operational Strategies to Combat Inflation Costs [wpdatatable id=2073 table_view=regular]

Source: Company reports/Coresight Research High input prices significantly impacted the gross margins of mass retailers in the most recent quarter. In order to lessen the impact of inflation on gross margins, these retailers are raising retail prices, reducing markdowns, optimizing inventory, growing private label businesses and expanding their supply chain capabilities.

Figure 14. Gross Margin Metrics of Selected US Mass Retailers [wpdatatable id=2074 table_view=regular]

Source: Company reports Off-Price Retailers: Increasing Retail Prices Strategically While Maintaining Price Gaps from Traditional Retailers Off-price retailers are increasing retail prices tactically, while maintaining price gaps from conventional retailers. As off-price retailers mainly serve lower-income shoppers, they are witnessing a weaker sales trend amid rising retail prices.

Figure 15. Selected US Off-Price Retailers: Key Cost Mitigation Measures [wpdatatable id=2075 table_view=regular]

Source: Company reports Like mass retailers, off-price retailers’ gross margins deteriorated substantially in the most recent quarter, due to the impact of high input costs. Off-price retailers are increasing retail prices, growing the share of full-price sales, slashing promotions, ensuring inventory optimization and targeting a higher inventory turnover to reduce the impact of inflation on gross margins.

Figure 16. Gross Margin Metrics of Selected US Off-Price Retailers [wpdatatable id=2076 table_view=regular]

Source: Company reports

Our Insights on Retailers’ Cost Mitigation Measures and Consumer Expectations

Figure 17. Summary: How US Retailers Are Combating Inflation [wpdatatable id=2077 table_view=regular]

Source: Company reports/Coresight Research

What We Think

US retailers across sectors, such as apparel and footwear specialty retail, beauty retail, department stores, food retail, mass retail and off-price retail, are increasing prices to recover wage increases and historically high freight and raw material prices. We believe this is the right step in the short term to offset some of the impact of inflation on gross margins. However, we believe that the retailers’ recent operational measures, including expanding supply chain capabilities through automation of distribution centers, diversifying supplier bases, enhancing in-house production capabilities and bolstering company-owned logistics facilities, are more significant in preserving and sustaining profitability in the medium term. US retail sales growth remained in the high single digits in May 2022. This is a positive sign that consumers are still spending on retail products, although sales are unlikely to have grown in real terms. Implications for Brands/Retailers- Growing private label penetrations, switching to low-cost suppliers, inventory optimization, automation of distribution centers and bolstering company-owned fleets and logistics services can help retailers to mitigate rising input costs.

- Retailers can use predictive analytics and data science across their businesses to understand their customers, improve inventory assortment and inform price increases while increasing merchandise margins.

- Although many discount retailers and off-price retailers that offer a strong value proposition may attract consumers in an inflationary environment, their core shoppers, which include low-to-moderate income customers, are under substantial economic stress.

- Retailers with a strong brand affinity across various sectors, such as American Eagle Outfitters and Lululemon (apparel sector), Kroger (food) and Ulta Beauty (beauty), are likely to continue to outperform. On the other hand, retailers without a strong differentiating position and brand purpose will struggle to compete in an inflationary environment.