albert Chan

[caption id="attachment_68303" align="aligncenter" width="674"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

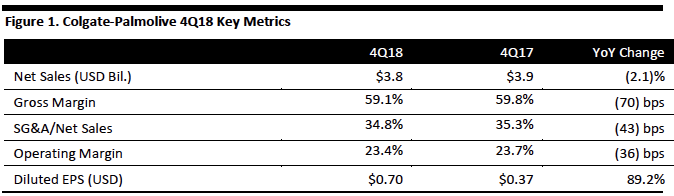

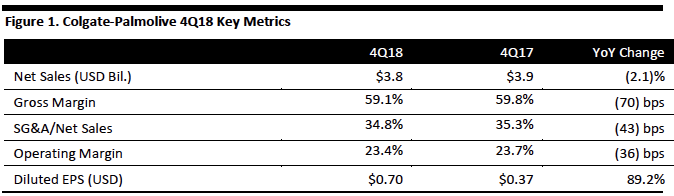

Colgate-Palmolive reported net sales of $3.81 billion for the three months ended December 31, 2018, down 2.1% year over year but ahead of the consensus estimate of $3.78 billion recorded by StreetAccount. Group organic sales, which exclude the effects of currency movements, acquisitions and divestments, increased 2.0%. Operating income came in at $900 million, down 3.6% year over year. Gross margin decreased 70 basis points to 59.1% and operating margin fell 36 basis points to 23.4%.

The company said it “global growth and efficiency program” helped grow diluted earnings per share to $0.70, an increase of 89.2% compared to the previous year. Management said that the company’s focus on innovation, advertising and product expansions into new channels and markets also played a role in driving organic growth.

Segment Review

Colgate-Palmolive is divided into Hill’s Pet Nutrition and oral, personal and home care, which is further divided into five regions — Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. The company’s strategy of raising prices and acquisitions amid higher overhead expenses and material costs is paying off. Colgate-Palmolive’s strong results were driven by its North America oral, personal and home care segments along with worldwide Hill’s Pet Nutrition segment.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Colgate-Palmolive reported net sales of $3.81 billion for the three months ended December 31, 2018, down 2.1% year over year but ahead of the consensus estimate of $3.78 billion recorded by StreetAccount. Group organic sales, which exclude the effects of currency movements, acquisitions and divestments, increased 2.0%. Operating income came in at $900 million, down 3.6% year over year. Gross margin decreased 70 basis points to 59.1% and operating margin fell 36 basis points to 23.4%.

The company said it “global growth and efficiency program” helped grow diluted earnings per share to $0.70, an increase of 89.2% compared to the previous year. Management said that the company’s focus on innovation, advertising and product expansions into new channels and markets also played a role in driving organic growth.

Segment Review

Colgate-Palmolive is divided into Hill’s Pet Nutrition and oral, personal and home care, which is further divided into five regions — Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. The company’s strategy of raising prices and acquisitions amid higher overhead expenses and material costs is paying off. Colgate-Palmolive’s strong results were driven by its North America oral, personal and home care segments along with worldwide Hill’s Pet Nutrition segment.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Colgate-Palmolive reported net sales of $3.81 billion for the three months ended December 31, 2018, down 2.1% year over year but ahead of the consensus estimate of $3.78 billion recorded by StreetAccount. Group organic sales, which exclude the effects of currency movements, acquisitions and divestments, increased 2.0%. Operating income came in at $900 million, down 3.6% year over year. Gross margin decreased 70 basis points to 59.1% and operating margin fell 36 basis points to 23.4%.

The company said it “global growth and efficiency program” helped grow diluted earnings per share to $0.70, an increase of 89.2% compared to the previous year. Management said that the company’s focus on innovation, advertising and product expansions into new channels and markets also played a role in driving organic growth.

Segment Review

Colgate-Palmolive is divided into Hill’s Pet Nutrition and oral, personal and home care, which is further divided into five regions — Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. The company’s strategy of raising prices and acquisitions amid higher overhead expenses and material costs is paying off. Colgate-Palmolive’s strong results were driven by its North America oral, personal and home care segments along with worldwide Hill’s Pet Nutrition segment.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Colgate-Palmolive reported net sales of $3.81 billion for the three months ended December 31, 2018, down 2.1% year over year but ahead of the consensus estimate of $3.78 billion recorded by StreetAccount. Group organic sales, which exclude the effects of currency movements, acquisitions and divestments, increased 2.0%. Operating income came in at $900 million, down 3.6% year over year. Gross margin decreased 70 basis points to 59.1% and operating margin fell 36 basis points to 23.4%.

The company said it “global growth and efficiency program” helped grow diluted earnings per share to $0.70, an increase of 89.2% compared to the previous year. Management said that the company’s focus on innovation, advertising and product expansions into new channels and markets also played a role in driving organic growth.

Segment Review

Colgate-Palmolive is divided into Hill’s Pet Nutrition and oral, personal and home care, which is further divided into five regions — Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. The company’s strategy of raising prices and acquisitions amid higher overhead expenses and material costs is paying off. Colgate-Palmolive’s strong results were driven by its North America oral, personal and home care segments along with worldwide Hill’s Pet Nutrition segment.

- Latin America: The company’s Latin America segment posted net sales of $900 million, down 9.1% year over year due to volume declines in Brazil and Argentina and the negative impact of foreign exchange rates. Organic sales were up 1.0% year over year. Operating income decreased 16% year over year due to higher raw and packaging material costs.

- Asia Pacific: The Asia Pacific segment recorded net sales of $600 million, down 6.3% year over year due to volume declines in the Greater China region, decreased pricing and the negative impact of foreign exchange. Organic sales were down 1.0% year over year. Operating income decreased 20% year over year due to higher raw and packaging material costs, higher overhead expenses and higher advertising spend.

- Africa/Eurasia: The Africa/Eurasia segment recorded net sales of $200 million, down 4.9% year over year due to volume declines in Turkey and South Africa and negative foreign exchange impact. Organic sales were up 4.0% year over year. Operating income decreased 11% year over year due to higher raw and packaging material costs, higher overhead expenses and increased advertising spend.

- North America: The North America segment recorded net sales of $800 million, up 5.1% year over year due to professional skin care acquisitions, increased pricing and volume growth. Organic sales were up 0.5% year over year. Operating income decreased 2% year over year due to higher raw and packaging material costs, higher overhead expenses and increased amortization of intangible assets due to professional skin care acquisitions.

- Europe: The Europe segment recorded net sales of $600 million, down 2.6% year over year due to decreased pricing and the negative impact of foreign exchange rates. Organic sales were up 1.0% year over year. Operating income increased 1% year over year thanks to the company’s cost savings initiatives and lower overhead.

- Hill’s Pet Nutrition: The worldwide Hill’s Pet Nutrition segment recorded net sales of $600 million, up 6.2% year over year due to volume gains in the US and Western Europe and increased pricing. Organic sales were up 8.0% year over year. Operating income increased 9% year over year due the company’s cost-saving initiatives and lower overhead expenses.

- Oral, personal and home care in China will gradually improve and return to positive growth year over year in second half of 2019.

- Colgate-Palmolive sees headwinds from foreign exchange, raw material costs and regional issues such as the “yellow vest” protests in France.

- Colgate-Palmolive will strive to improve 2019 organic sales through three key areas: Driving its core business through innovation and brand building; using innovation to grow product categories; and, expanding the product reach to new markets and via new channels.