DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

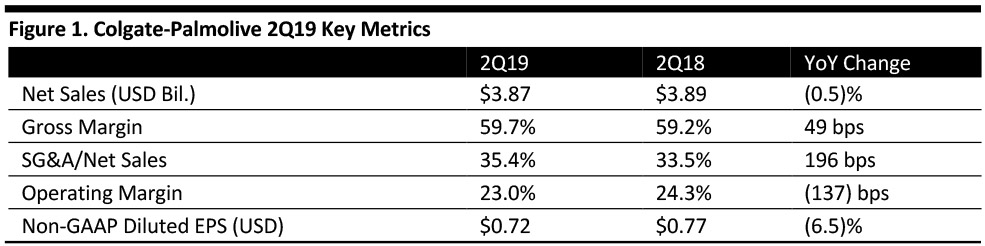

Colgate-Palmolive reported net sales of $3.87 billion for the three months ended June 30, 2019, down 0.5% year over year and below the consensus estimate of $3.88 billion. Organic sales were up 4.0% year over year due to increased volume and pricing. Gross margin increased 49 basis points to 59.7% due to higher pricing and cost savings from the company’s funding-the-growth initiatives. Operating margin fell 137 basis points to 23.0%. Diluted EPS decreased 6.5% year over year to $0.72, which was below the consensus estimate of $0.73.

Management commented that during the quarter, Colgate-Palmolive maintained global leadership of the toothpaste market with a global market share of 41.4% year to date, and also maintained global leadership of manual toothbrushes with a global market share of 31.7% year to date.

Segment Review

Colgate-Palmolive is divided into Hill’s Pet Nutrition and oral, personal and home care, which is further divided into five regions: Latin America, Asia Pacific, Africa/Eurasia, North America and Europe.

- The North America segment recorded net sales of $846 million, with organic sales up 3.0% year over year due to increased volume and increased pricing. In the US, Colgate maintained leadership in the toothpaste category during the quarter with a market share of 34.6% year to date. Operating margin decreased 200 basis points to 30.0% of net sales due to higher logistics costs and increased advertising investment.

- The Latin America segment posted net sales of $929 million, with organic sales up 7.0% year over year due to increased volume and increased pricing. Operating margin decreased 110 basis points to 27.0% of net sales due to higher raw and packaging material costs, higher overhead expenses and increased advertising investment.

- The Europe segment recorded net sales of $588 million, with organic sales up 1.0% year over year due to increased pricing. Operating margin was 25.2%, flat with the year ago period. Colgate maintained its toothpaste leadership in Europe during the quarter, with market share gains in the UK, Italy, Spain, Greece, the Netherlands and Denmark.

- The Asia Pacific segment recorded net sales of $646 million, with organic sales down 1.0% due to volume declines in the Greater China region. That said, Colgate maintained its toothpaste leadership in the Asia Pacific region during the quarter with market share gains in the Philippines, Australia and Pakistan. Operating margin decreased 320 basis points year over year to 26.9% of net sales due to higher overhead expenses and increased advertising investment.

- The Africa/Eurasia segment recorded net sales of $244 million, with organic sales up 9.5% year over year due to volume gains in Russia and the Gulf states and increased pricing. Operating margin increased 200 basis points to 19.3% of net sales due to higher pricing and cost savings from the company’s funding-the-growth initiatives.

- The global Hill’s Pet Nutrition segment recorded net sales of $613 million, with organic sales up 6.0% year over year due to volume gains in the US, South Africa and Western Europe. Operating margin decreased 60 basis points to 27.3% of net sales due to higher raw and packaging material costs.

Outlook

The company maintained its FY19 outlook of expecting net sales to achieve flat to low single-digit growth, but expects growth at the higher end of the range as the company plans to increase investment in its brands, with higher pricing and innovation.

- The company also expressed optimism about expanding its premium skin care portfolio following the agreement to acquire the Filorga skin care business.

- The company continues to plan for a year of gross margin expansion, increased advertising investment and expects a mid-single-digit decline in EPS.