DIpil Das

[caption id="attachment_85570" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

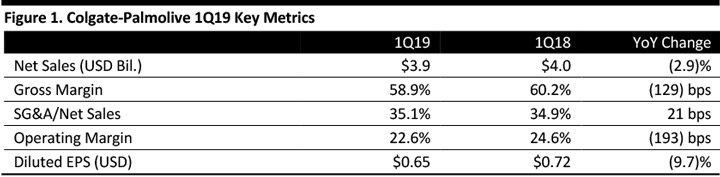

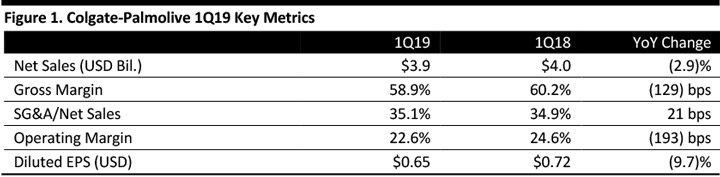

Colgate-Palmolive reported net sales of $3.9 billion for the three months ended March 31, 2019, down 2.9% year over year yet but beating the consensus estimate of $3.86 billion. Organic sales were up 3.0% year over year due to increased volume and pricing. The gross margin decreased 129 basis points to 58.9% due to higher raw material and packaging material costs. The operating margin fell 193 basis points to 22.6%. Diluted EPS decreased 9.7% year over year to $0.65, which was slightly below the consensus estimate of $0.66.

Management said the company’s organic growth in this quarter was led by the company’s toothpaste and Hill’s Pet Nutrition business, with an equal contribution from emerging markets and developed markets.

Segment Review

Colgate-Palmolive is divided into two segments: Hill’s Pet Nutrition and oral, personal and home care. The latter is further divided into five regions: Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. On an organic basis, Colgate-Palmolive delivered both volume and pricing growth for the first time in more than two years in both of its Hill’s Pet Nutrition and oral, personal and home care segments. The company’s strategy of driving core growth through innovation and expanding brands in different markets amid higher overhead expenses and material costs is paying off.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Colgate-Palmolive reported net sales of $3.9 billion for the three months ended March 31, 2019, down 2.9% year over year yet but beating the consensus estimate of $3.86 billion. Organic sales were up 3.0% year over year due to increased volume and pricing. The gross margin decreased 129 basis points to 58.9% due to higher raw material and packaging material costs. The operating margin fell 193 basis points to 22.6%. Diluted EPS decreased 9.7% year over year to $0.65, which was slightly below the consensus estimate of $0.66.

Management said the company’s organic growth in this quarter was led by the company’s toothpaste and Hill’s Pet Nutrition business, with an equal contribution from emerging markets and developed markets.

Segment Review

Colgate-Palmolive is divided into two segments: Hill’s Pet Nutrition and oral, personal and home care. The latter is further divided into five regions: Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. On an organic basis, Colgate-Palmolive delivered both volume and pricing growth for the first time in more than two years in both of its Hill’s Pet Nutrition and oral, personal and home care segments. The company’s strategy of driving core growth through innovation and expanding brands in different markets amid higher overhead expenses and material costs is paying off.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Colgate-Palmolive reported net sales of $3.9 billion for the three months ended March 31, 2019, down 2.9% year over year yet but beating the consensus estimate of $3.86 billion. Organic sales were up 3.0% year over year due to increased volume and pricing. The gross margin decreased 129 basis points to 58.9% due to higher raw material and packaging material costs. The operating margin fell 193 basis points to 22.6%. Diluted EPS decreased 9.7% year over year to $0.65, which was slightly below the consensus estimate of $0.66.

Management said the company’s organic growth in this quarter was led by the company’s toothpaste and Hill’s Pet Nutrition business, with an equal contribution from emerging markets and developed markets.

Segment Review

Colgate-Palmolive is divided into two segments: Hill’s Pet Nutrition and oral, personal and home care. The latter is further divided into five regions: Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. On an organic basis, Colgate-Palmolive delivered both volume and pricing growth for the first time in more than two years in both of its Hill’s Pet Nutrition and oral, personal and home care segments. The company’s strategy of driving core growth through innovation and expanding brands in different markets amid higher overhead expenses and material costs is paying off.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Colgate-Palmolive reported net sales of $3.9 billion for the three months ended March 31, 2019, down 2.9% year over year yet but beating the consensus estimate of $3.86 billion. Organic sales were up 3.0% year over year due to increased volume and pricing. The gross margin decreased 129 basis points to 58.9% due to higher raw material and packaging material costs. The operating margin fell 193 basis points to 22.6%. Diluted EPS decreased 9.7% year over year to $0.65, which was slightly below the consensus estimate of $0.66.

Management said the company’s organic growth in this quarter was led by the company’s toothpaste and Hill’s Pet Nutrition business, with an equal contribution from emerging markets and developed markets.

Segment Review

Colgate-Palmolive is divided into two segments: Hill’s Pet Nutrition and oral, personal and home care. The latter is further divided into five regions: Latin America, Asia Pacific, Africa/Eurasia, North America and Europe. On an organic basis, Colgate-Palmolive delivered both volume and pricing growth for the first time in more than two years in both of its Hill’s Pet Nutrition and oral, personal and home care segments. The company’s strategy of driving core growth through innovation and expanding brands in different markets amid higher overhead expenses and material costs is paying off.

- North America: The North America region for oral, personal and home care recorded net sales of $853 million, with organic sales up 3.5% year over year due to increased volume and higher pricing. Strong sales growth was seen in the toothpaste category driven by Colgate Total SF, Colgate Optic White, Colgate Essentials and Tom’s of Maine, and was also seen in the Elta MD and PCA skin care businesses the company acquired during first quarter of 2018. The operating margin decreased 190 basis points to 29.2% of net sales due to higher logistics costs and higher raw and packaging material costs.

- Latin America: The Latin America region for oral, personal and home care posted net sales of $889 million, with organic sales up 6.0% year over year due to increased volume and higher pricing. The operating margin decreased 330 basis points to 26.1% of net sales due to higher logistics costs, increased advertising investment and higher raw and packaging material costs.

- Europe: The Europe region for oral, personal and home care recorded net sales of $602 million, with organic sales up 0.5% year over year due to volume gains in the United Kingdom and the Nordic region. The operating margin increased 10 basis points to 25.1% of net sales due to the company’s funding-the-growth initiatives and lower overhead expenses. The company’s organic sales growth was partially driven by innovations in oral care.

- Asia Pacific: The Asia Pacific region for oral, personal and home care recorded net sales of $700 million, with organic sales down 2.5% due to volume declines in the Greater China region. In contrast, the company saw strong growth in both volume and pricing in India due to the Colgate Max Fresh and Colgate Vedshakti franchises. The operating margin decreased 280 basis points year over year to 27.0% of net sales due to higher raw and packaging material costs, higher logistics costs and increased advertising investment.

- Africa/Eurasia: The Africa/Eurasia region for oral, personal and home care recorded net sales of $240 million, with organic sales up 7.0% year over year due to volume gains in Russia, North Africa, the Middle East and Turkey. The operating margin decreased 40% basis points to 19.2% of net sales due to higher raw and packaging material costs and increased advertising spend.

- Hill’s Pet Nutrition: The worldwide Hill’s Pet Nutrition segment recorded net sales of $600 million, with organic sale up 6.0% year over year led by growth in e-commerce, pet specialty and farm and feed in the United States. Furthermore, volume and pricing growth were seen in Canada, Europe, Australia, Asia and Latin America. The operating margin decreased 80 basis points to 27.3% of net sales due to higher raw and packaging material costs as well as increased advertising investment.

- The company expects benefits of its pricing and productivity programs to gradually offset increase in raw material costs.

- It projects its advertising spending to be up year over year on both an absolute basis and as a percent of sales.

- It expects its advertising as a percent of sales for the full year to be fairly consistent with the level as in first quarter of fiscal 2019.