Colgate-Palmolive Key Metrics

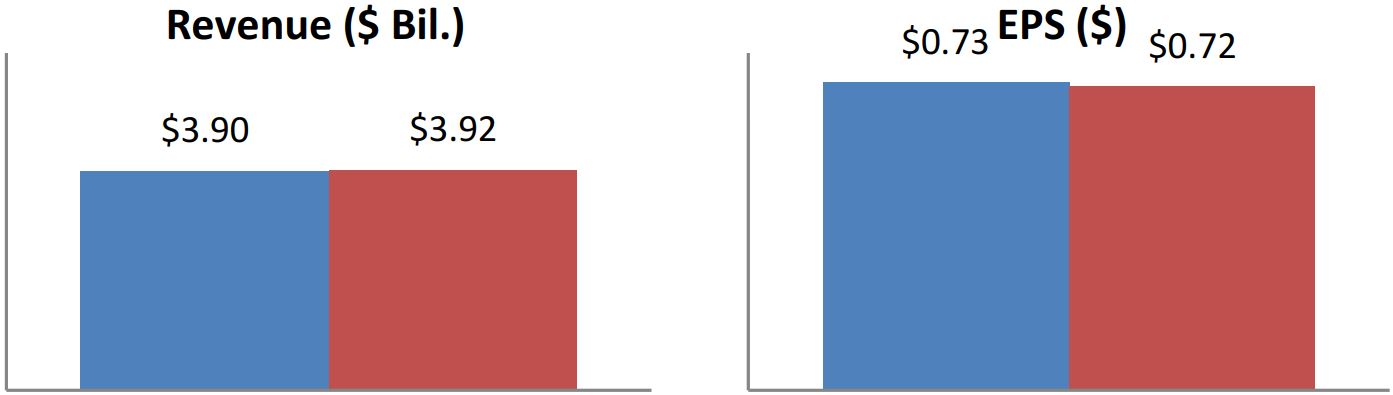

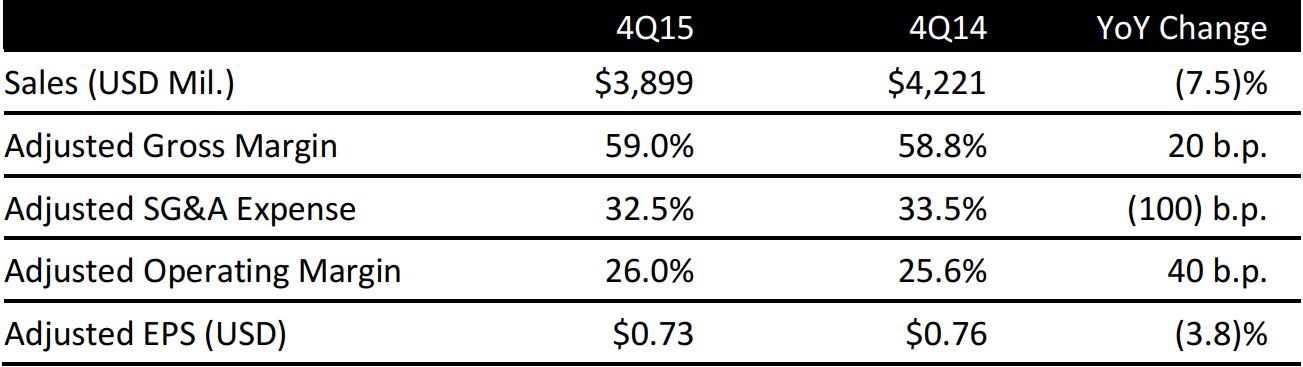

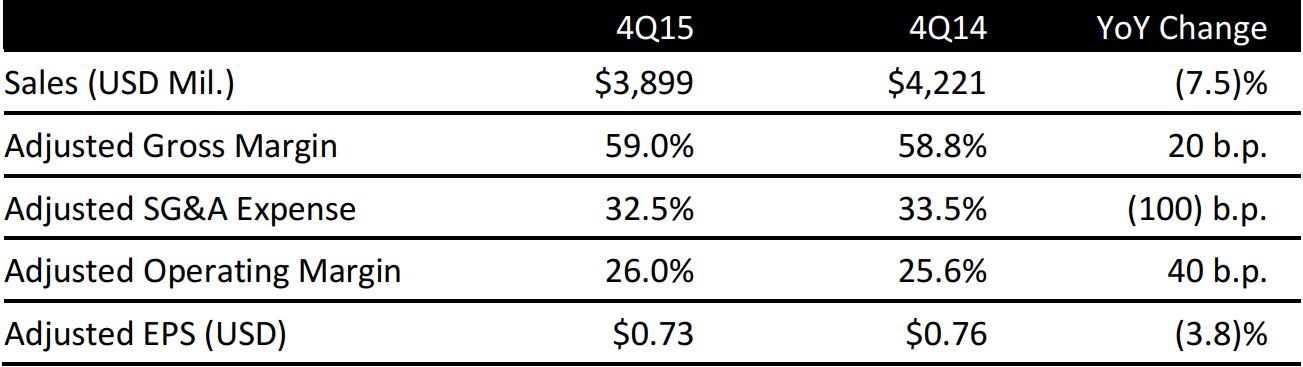

Colgate-Palmolive reported fourth-quarter 2015 revenues of $3.9 billion, down 7.5% from $4.2 billion a year ago. Revenues fell just $22 million short of the consensus estimate. The decrease was driven by flat year-over-year global unit volume, a pricing increase of 4.0% and foreign currency effects that decreased sales by 11.5%. Organic sales were up 5.0%, led by emerging markets, whose sales grew by 6.5% despite challenges in certain countries.

For full-year 2015, global net sales were $16.0 billion, a decline of 7.0% year over year. A 1.5% increase in volume and a 3.0% increase in pricing were more than offset by a negative 11.5% effect from foreign exchange. From continuing operations, unit volume increased by 2.0% and organic sales grew by 5.0%, in line with the company’s 4%–7% target growth rate.

North American sales (20% of sales) increased by 2.5% organically in the quarter, based on a 2.0% increase in unit volume and 0.5% higher pricing, driven by market share gains in toothpaste, manual toothbrushes, mouthwash, liquid hand soap, body wash, liquid cleaners and fabric conditioners. Colgate’s share of the US toothpaste market increased by 0.3 points, to 35.3%, and its share in manual toothbrushes improved by 0.8 points, to 41.2%.

Latin American sales (27% of sales) grew by 9.0% organically, as a 4.0% decrease in unit volume was more than offset by 13.0% higher pricing. Lower volumes in Venezuela and Brazil were partially offset by volume increases in Mexico. The company strengthened its leadership in toothpaste in several countries and maintained its leadership in manual toothbrushes.

Europe/South Pacific (18% of sales) experienced 1.5% organic growth. Excluding the divested laundry detergent business in the South Pacific, volume increased by 4.0%, owing to gains in France, Germany and Australia. Colgate gained market share in several European countries and experienced volume growth in two categories of manual toothbrushes.

Asia (15% of sales) experienced 2.0% organic growth, driven by 2.5% volume growth, which was offset by 0.5% lower pricing. The company continued its leadership in toothpaste in Asia and experienced volume growth in toothbrush, mouthwash, and shampoo and conditioner products.

Africa/Eurasia (6% of sales) experienced a 6.5% organic increase in sales, as 1.5% lower unit volume was offset by 8.0% higher pricing. Lower volumes in Russia and the Central Caucasus region were partially offset by higher volumes in South Africa and Sub-Saharan Africa.

Hill’s Pet Nutrition (14% of sales) experienced 6.0% organic growth, driven by 4.0% higher volume combined with 2.0% higher pricing. Several new products drove volume growth in the US and internationally.

Colgate-Palmolive’s adjusted EPS were $0.73, beating the consensus estimate by a penny and down 4% from $0.76 in the year-ago quarter. The adjusted figure excludes a $1.1 billion charge relating to an accounting change in Venezuela and a $55 million charge from the implementation of a restructuring program in Australia. For the full year, adjusted EPS were $2.81, down 4% from $2.93 in 2014.

The company commented that its leadership of the global toothpaste market expanded in 2015, with its share increasing by 0.5 points, to 44.7%. Its share in manual toothbrushes also expanded, by 1.0 point, to 34.7%.

For 2016, the company expects organic sales growth to be driven by a full product pipeline in all categories and geographies, despite volatility and challenging macroeconomic conditions. The current 2016 consensus revenue estimate of $16.1 billion represents a 0.3% increase. Although management expects gross-margin expansion, it also expects a low-single-digit decline in EPS due to current currency rates. We estimate the company targets an EPS range of $2.83–$2.88 after adding back an expected $0.10 for anticipated Venezuelan accounting charges, as compared to the current consensus estimate of $2.94.

Colgate-Palmolive reported fourth-quarter 2015 revenues of $3.9 billion, down 7.5% from $4.2 billion a year ago. Revenues fell just $22 million short of the consensus estimate. The decrease was driven by flat year-over-year global unit volume, a pricing increase of 4.0% and foreign currency effects that decreased sales by 11.5%. Organic sales were up 5.0%, led by emerging markets, whose sales grew by 6.5% despite challenges in certain countries.

For full-year 2015, global net sales were $16.0 billion, a decline of 7.0% year over year. A 1.5% increase in volume and a 3.0% increase in pricing were more than offset by a negative 11.5% effect from foreign exchange. From continuing operations, unit volume increased by 2.0% and organic sales grew by 5.0%, in line with the company’s 4%–7% target growth rate.

North American sales (20% of sales) increased by 2.5% organically in the quarter, based on a 2.0% increase in unit volume and 0.5% higher pricing, driven by market share gains in toothpaste, manual toothbrushes, mouthwash, liquid hand soap, body wash, liquid cleaners and fabric conditioners. Colgate’s share of the US toothpaste market increased by 0.3 points, to 35.3%, and its share in manual toothbrushes improved by 0.8 points, to 41.2%.

Latin American sales (27% of sales) grew by 9.0% organically, as a 4.0% decrease in unit volume was more than offset by 13.0% higher pricing. Lower volumes in Venezuela and Brazil were partially offset by volume increases in Mexico. The company strengthened its leadership in toothpaste in several countries and maintained its leadership in manual toothbrushes.

Europe/South Pacific (18% of sales) experienced 1.5% organic growth. Excluding the divested laundry detergent business in the South Pacific, volume increased by 4.0%, owing to gains in France, Germany and Australia. Colgate gained market share in several European countries and experienced volume growth in two categories of manual toothbrushes.

Asia (15% of sales) experienced 2.0% organic growth, driven by 2.5% volume growth, which was offset by 0.5% lower pricing. The company continued its leadership in toothpaste in Asia and experienced volume growth in toothbrush, mouthwash, and shampoo and conditioner products.

Africa/Eurasia (6% of sales) experienced a 6.5% organic increase in sales, as 1.5% lower unit volume was offset by 8.0% higher pricing. Lower volumes in Russia and the Central Caucasus region were partially offset by higher volumes in South Africa and Sub-Saharan Africa.

Hill’s Pet Nutrition (14% of sales) experienced 6.0% organic growth, driven by 4.0% higher volume combined with 2.0% higher pricing. Several new products drove volume growth in the US and internationally.

Colgate-Palmolive’s adjusted EPS were $0.73, beating the consensus estimate by a penny and down 4% from $0.76 in the year-ago quarter. The adjusted figure excludes a $1.1 billion charge relating to an accounting change in Venezuela and a $55 million charge from the implementation of a restructuring program in Australia. For the full year, adjusted EPS were $2.81, down 4% from $2.93 in 2014.

The company commented that its leadership of the global toothpaste market expanded in 2015, with its share increasing by 0.5 points, to 44.7%. Its share in manual toothbrushes also expanded, by 1.0 point, to 34.7%.

For 2016, the company expects organic sales growth to be driven by a full product pipeline in all categories and geographies, despite volatility and challenging macroeconomic conditions. The current 2016 consensus revenue estimate of $16.1 billion represents a 0.3% increase. Although management expects gross-margin expansion, it also expects a low-single-digit decline in EPS due to current currency rates. We estimate the company targets an EPS range of $2.83–$2.88 after adding back an expected $0.10 for anticipated Venezuelan accounting charges, as compared to the current consensus estimate of $2.94.

Colgate-Palmolive reported fourth-quarter 2015 revenues of $3.9 billion, down 7.5% from $4.2 billion a year ago. Revenues fell just $22 million short of the consensus estimate. The decrease was driven by flat year-over-year global unit volume, a pricing increase of 4.0% and foreign currency effects that decreased sales by 11.5%. Organic sales were up 5.0%, led by emerging markets, whose sales grew by 6.5% despite challenges in certain countries.

For full-year 2015, global net sales were $16.0 billion, a decline of 7.0% year over year. A 1.5% increase in volume and a 3.0% increase in pricing were more than offset by a negative 11.5% effect from foreign exchange. From continuing operations, unit volume increased by 2.0% and organic sales grew by 5.0%, in line with the company’s 4%–7% target growth rate.

North American sales (20% of sales) increased by 2.5% organically in the quarter, based on a 2.0% increase in unit volume and 0.5% higher pricing, driven by market share gains in toothpaste, manual toothbrushes, mouthwash, liquid hand soap, body wash, liquid cleaners and fabric conditioners. Colgate’s share of the US toothpaste market increased by 0.3 points, to 35.3%, and its share in manual toothbrushes improved by 0.8 points, to 41.2%.

Latin American sales (27% of sales) grew by 9.0% organically, as a 4.0% decrease in unit volume was more than offset by 13.0% higher pricing. Lower volumes in Venezuela and Brazil were partially offset by volume increases in Mexico. The company strengthened its leadership in toothpaste in several countries and maintained its leadership in manual toothbrushes.

Europe/South Pacific (18% of sales) experienced 1.5% organic growth. Excluding the divested laundry detergent business in the South Pacific, volume increased by 4.0%, owing to gains in France, Germany and Australia. Colgate gained market share in several European countries and experienced volume growth in two categories of manual toothbrushes.

Asia (15% of sales) experienced 2.0% organic growth, driven by 2.5% volume growth, which was offset by 0.5% lower pricing. The company continued its leadership in toothpaste in Asia and experienced volume growth in toothbrush, mouthwash, and shampoo and conditioner products.

Africa/Eurasia (6% of sales) experienced a 6.5% organic increase in sales, as 1.5% lower unit volume was offset by 8.0% higher pricing. Lower volumes in Russia and the Central Caucasus region were partially offset by higher volumes in South Africa and Sub-Saharan Africa.

Hill’s Pet Nutrition (14% of sales) experienced 6.0% organic growth, driven by 4.0% higher volume combined with 2.0% higher pricing. Several new products drove volume growth in the US and internationally.

Colgate-Palmolive’s adjusted EPS were $0.73, beating the consensus estimate by a penny and down 4% from $0.76 in the year-ago quarter. The adjusted figure excludes a $1.1 billion charge relating to an accounting change in Venezuela and a $55 million charge from the implementation of a restructuring program in Australia. For the full year, adjusted EPS were $2.81, down 4% from $2.93 in 2014.

The company commented that its leadership of the global toothpaste market expanded in 2015, with its share increasing by 0.5 points, to 44.7%. Its share in manual toothbrushes also expanded, by 1.0 point, to 34.7%.

For 2016, the company expects organic sales growth to be driven by a full product pipeline in all categories and geographies, despite volatility and challenging macroeconomic conditions. The current 2016 consensus revenue estimate of $16.1 billion represents a 0.3% increase. Although management expects gross-margin expansion, it also expects a low-single-digit decline in EPS due to current currency rates. We estimate the company targets an EPS range of $2.83–$2.88 after adding back an expected $0.10 for anticipated Venezuelan accounting charges, as compared to the current consensus estimate of $2.94.