Source: Company reports/FGRT

Fiscal 4Q17 Results

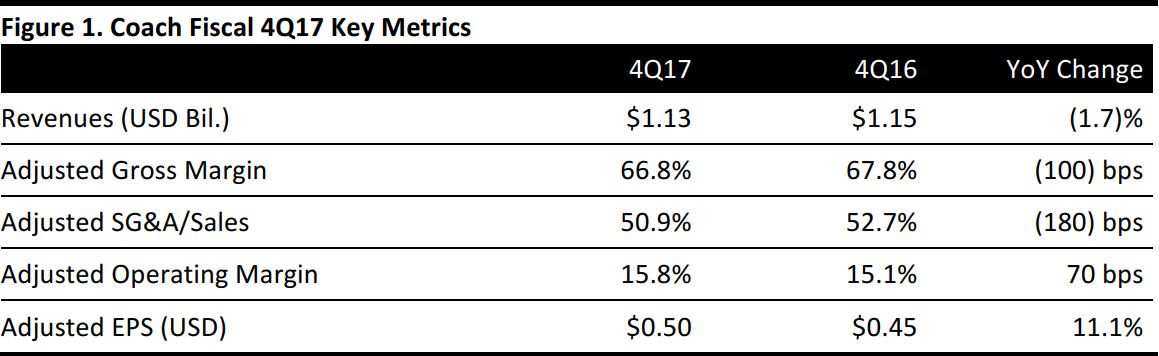

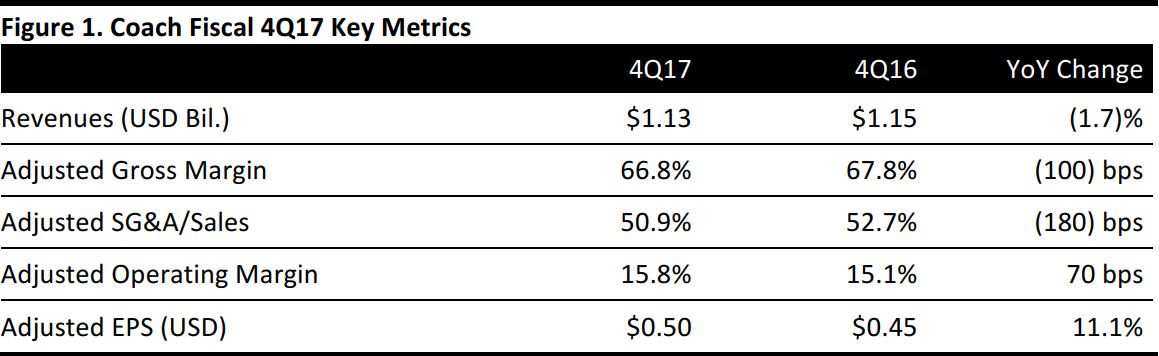

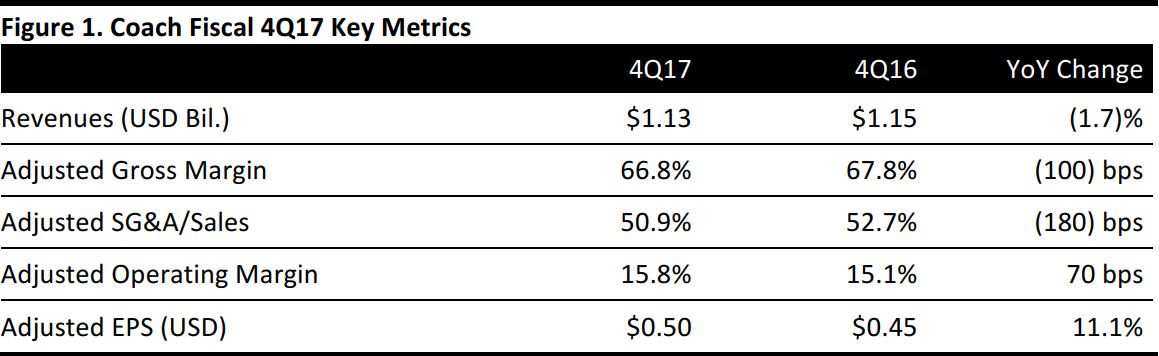

Coach reported fiscal 4Q17 adjusted EPS of $0.50, beating the consensus estimate by a penny and up from $0.45 in the year-ago quarter. Revenues were $1.13 billion, down slightly from $1.15 billion in the year-ago period and below the consensus estimate of $1.15 billion. Excluding the additional week in FY16, sales increased by 6% on a reported basis and by 7% on a constant-currency basis. Store closures and promotion reduction efforts in the Coach brand’s wholesale channel negatively impacted total sales growth by 60 basis points. Currency translation helped revenue growth by 40 basis points.

Management was pleased with the results and highlighted the company’s long-term vision to move from a single-brand retailer to a house of modern luxury lifestyle brands.

Performance by Segment

Net sales for the Coach brand were $1.05 billion, down slightly from $1.07 billion in the year-ago period. Including the additional week in 2016, net sales increased by 5% on a reported basis and by 7% on a constant-currency basis. Comps for the Coach North America business rose by 4%, beating the consensus of 2%. The planned reduction of sales at North American department stores resulted in a 20% net sales reduction. The international business at the Coach brand reported a 6% sales increase in US dollars that was driven by double-digit growth and positive comps in the mainland China business and was partially offset by weakness in the South Korea business.

Net sales for the Stuart Weitzman brand totaled $88 million, up 4.7% year over year. Excluding the additional week in FY16, net sales increased by 15% on a reported basis. The brand reported high SG&A costs year over year, which reflected an increase in store occupancy costs and the company’s strategic investments in its team and infrastructure.

FY17 Results

Net sales for FY17 were $4.49 billion, flat versus FY16. Excluding the additional week, sales increased by 2% on a reported basis. Promotion reduction in the Coach brand wholesale channel and store closures negatively impacted sales growth by 150 basis points in FY17. EPS for the year was $2.09, up 26% from last year’s $1.65.

Outlook

Coach expects revenues for FY18 to increase by about 30% year over year, due to a $1.2 billion revenue addition from the acquired Kate Spade brand and low-single-digit organic growth.

The company expects FY18 EPS of $2.35–$2.40, which represents an increase of approximately 10%–12% for the year and includes low-to mid-single-digit accretion from the acquisition of Kate Spade.

Coach had previously guided for a revenue increase in the low-to-mid-single digits due to an expected negative foreign-currency impact of 50 basis points for the full fiscal year, including over 100 basis points of pressure in the second half. A 1%–3% revenue increase would result in revenues of $4.54–$4.63 billion for FY18, below the consensus estimate of $4.79 billion.

The company is maintaining its operating margin forecast of 18.5%–19.0% for FY18 and still expects double-digit growth in both net income and EPS for the year.