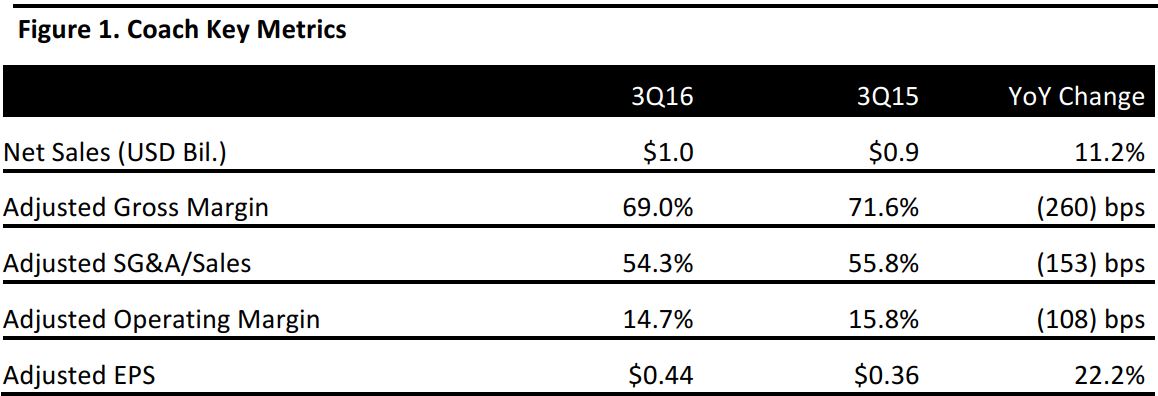

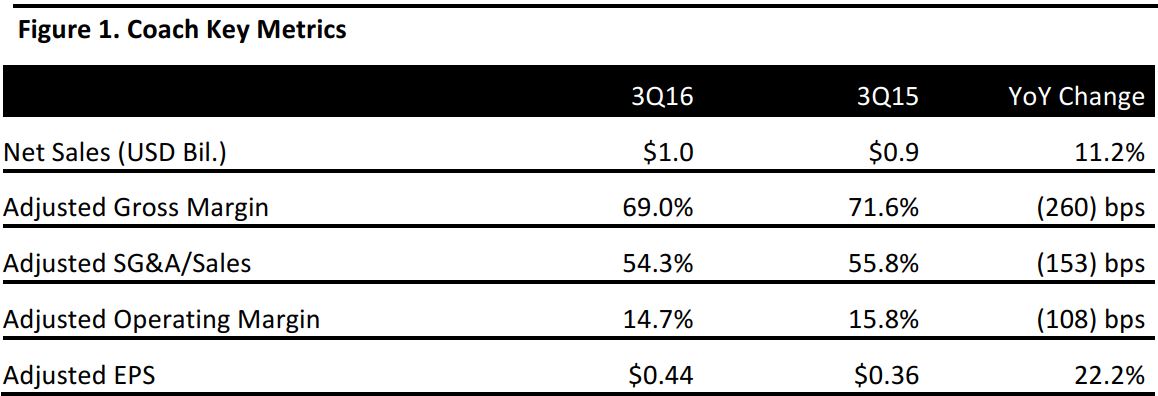

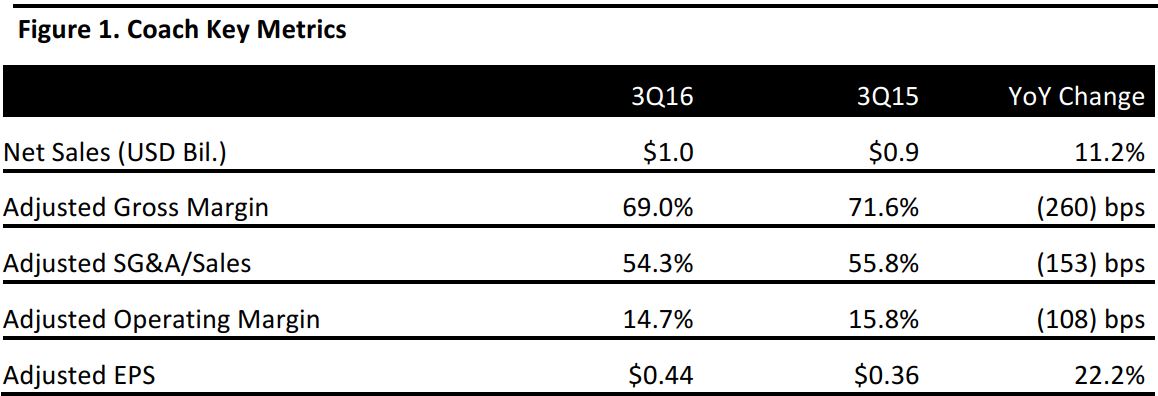

Source: Company reports

3Q16

Coach’s third-quarter 2015 revenues were $1.0 billion, in line with the consensus estimate, as the company’s saw some improvements from its transformation plan it put in place two years ago. Revenues were in line with management’s expectations.

The North American division’s sales for the Coach brand were $499 million, up 1.0% year over year and up 2% on a constant currency basis for the quarter, beating the analysts’ estimate of $481 million. Comparable sales were flat while e-commerce contributed to the sales growth. Department stores sales were down mid-single digits as expected.

The international Coach brand posted solid 5% organic sales growth, or 7% on a constant currency basis. Asia and Europe were the two major growth areas. The strong sales increase from mainland China was partially offset by the decline in Hong Kong and Macau, resulting in a 2% overall increase in China. Europe grew at a double-digit pace, driven by both comp sales and distribution increases.

The Stuart Weitzman brand reported total sales of $79 million for the quarter. Operating income was $7 million, which represents an operating margin of 9.3% on a non-GAAP basis, or $5 million or 5.9% as reported.

GUIDANCE

Looking into 2016, the company reiterated its revenue guidance of up high-single digits. The Coach brand expects revenue growth in the low-single digits, partly driven by positive comps from its North America division for the fourth quarter. Foreign currency is estimated to negatively impact the brand’s top line by 225-250 basis points. Stuart Weitzman is expected to add $340 million to the company’s total revenue for the year and $0.12 to EPS.

In addition to financial guidance, the company also announced a series of cost-saving initiatives, including a global staffing level reduction, replacing technology platforms and upgrading its international supply chain. These initiatives are expected to bring the Coach brand’s operating margin to about 20% by fiscal year 2017.