Source: Company reports/Fung Global Retail & Technology

2Q17 Results

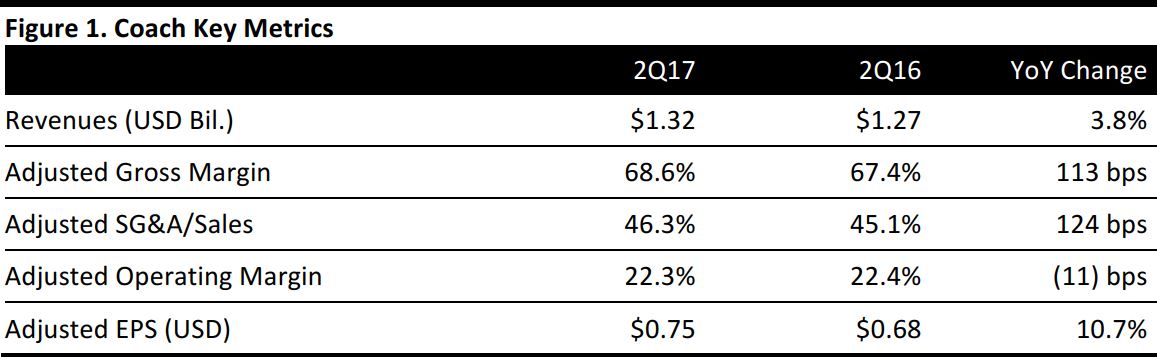

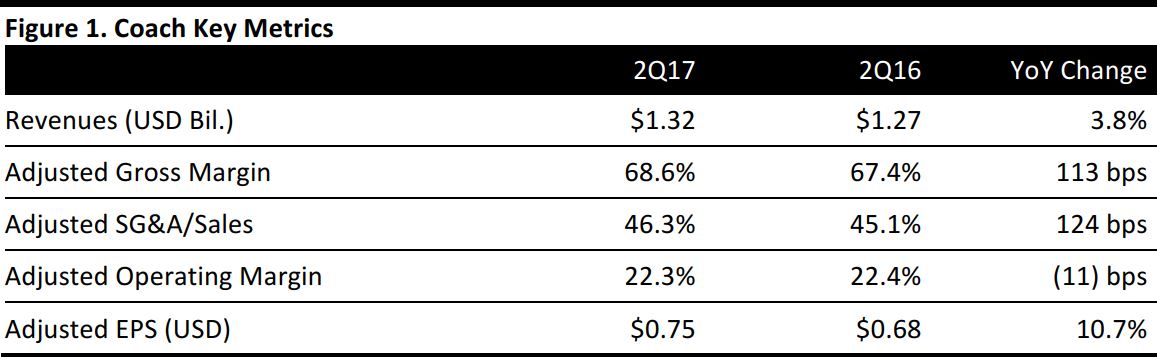

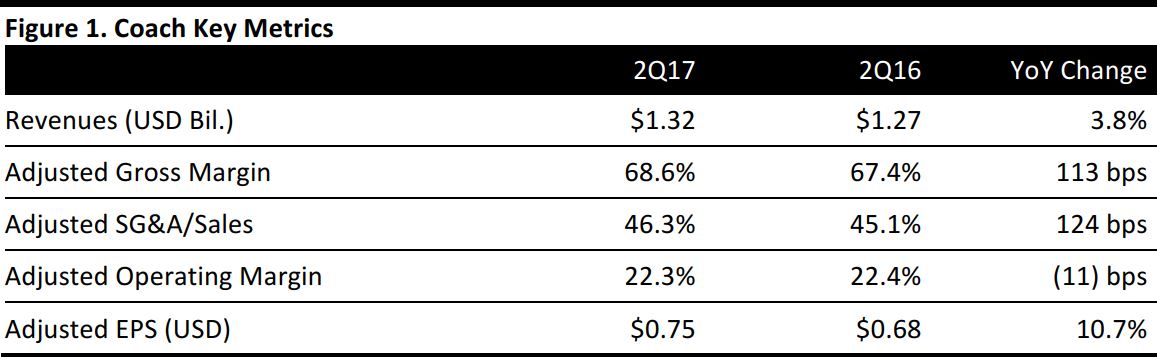

Coach reported fiscal 2Q17 adjusted EPS of $0.75, up from $0.68 in the year-ago quarter, beating the consensus estimate by a penny. Revenues were $1.32 billion, up 3.8% year over year and in line with the consensus estimate. Currency translation helped revenue growth by 40 basis points. However, a strategic decision to elevate the Coach brand’s positioning in the North American wholesale channel through a reduction in promotional events and door closures negatively impacted sales growth by about 100 basis points during the quarter.

Performance by Segment

Net sales for the Coach brand were $1.20 billion, up 2% year over year on a constant currency basis and hurt by 100 basis points due to the above mentioned reasons.

North American Coach brand sales were $744 million, up 2% year over year both as reported and on a constant currency basis. Direct sales increased by 5% and brick-and-mortar comps increased by 4%. Total North American comps increased by 3%, hurt by the impact of e-commerce. Sales at North American department stores declined by approximately 30% on both a point-of-sale and net sales basis, which was expected.

International Coach brand sales were $448 million, up 3% as reported and up 1% on a constant currency basis.

Comps were positive overall in Asia. Mainland China was especially strong, and sales in Hong Kong and Macau improved significantly from previous trends. Sales in Japan increased by 9% in US dollar terms, but decreased by 2% in constant currency, hurt by a decline in Chinese tourist spending. Sales at the remaining directly operated businesses in Asia decreased by low single digits both as reported and on a constant currency basis.

Both total sales and comparable store sales in Europe grew at a double-digit rate, and international wholesale point-of-sale sales increased slightly, driven by strong domestic performance that was offset in part by relatively weaker tourist location results. Net sales into the channel decreased year over year due to shipment timing.

Net sales for the Stuart Weitzman brand totaled $118 million, up 26% year over year, driven by strong growth in directly operated channels and benefiting from a shift in wholesale shipment timing from the first quarter.

Outlook

Coach reduced its revenue guidance based solely on current exchange rates. The company now expects revenue growth in the low single digits. Coach had previously guided for a revenue increase in the low-to-mid-single digits due to an expected negative foreign-currency impact of 50 basis points for the full fiscal year, including over 100 basis points of pressure in the second half. A 1%–3% revenue increase would result in revenues of $4.54–$4.63 billion for FY17, below the consensus estimate of $4.79 billion.

The company is maintaining its operating margin forecast of 18.5%–19.0% for FY17 and still expects double-digit growth in both net income and EPS for the year.