Source: Company reports/Fung Global Retail & Technology

1Q17 RESULTS

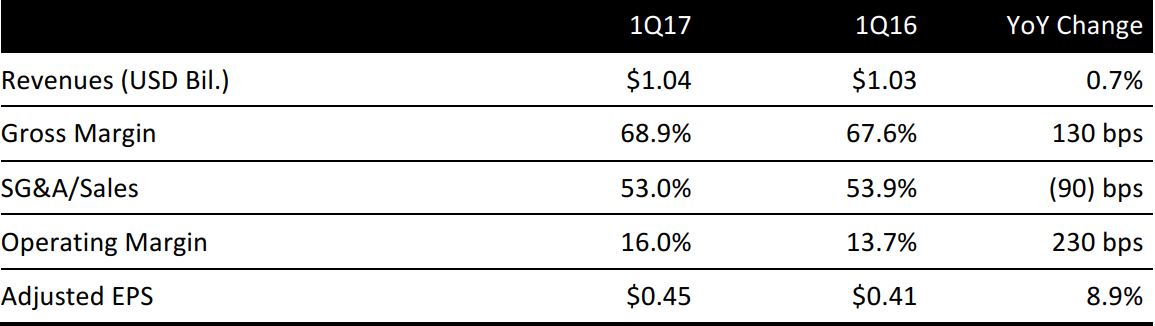

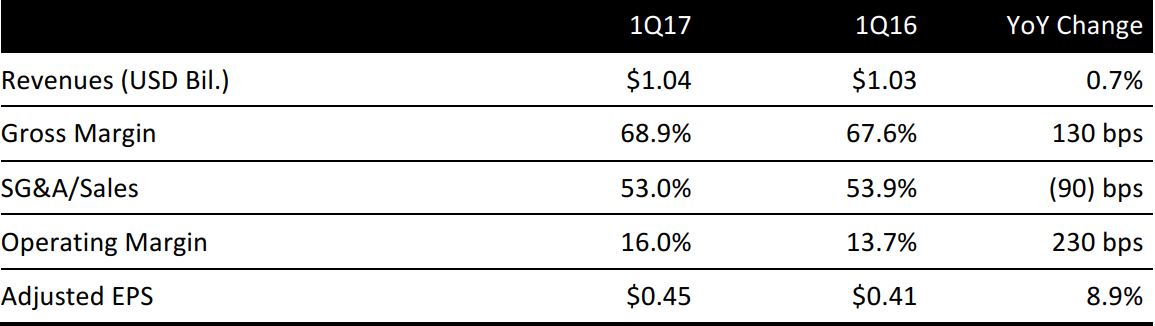

Coach reported 1Q17 revenues of $1.04 billion, up 0.7% year over year but below the consensus estimate of $1.07 billion. Gross profit for the quarter totaled $715 million, an increase of 3% year over year.

Adjusted EPS was $0.45, in-line with the $0.44 consensus estimate and up 8.9% year over year. The company worked to decrease inventory, which totaled $547 million at the end of the quarter, down 5% from $575 million in the year-ago quarter.

BY PRODUCT CATEGORY

E-commerce has been limiting for the company, as other retailers maintain online shops where Coach products are available at a discount. The company is working to limit its promotional stance online. Coach is also working to elevate its brand, and handbags in the $400-plus price bracket now account for 50% of handbag sales, up from about 30% a year ago.

The Stuart Weitzman brand generated $88 million in net sales, up from $87 million in the year-ago quarter, impacted by wholesale shipment timing within the fiscal year.

BY GEOGRAPHIC REGION

In the quarter, revenues decreased by 3% in North America, and increased by 7% internationally.

- North America: Total Coach brand sales decreased by 3% on a reported and constant-currency basis. Brick-and-mortar comparable store sales increased by approximately 4%, while aggregate North American comps increased by approximately 2%, including the negative impact of e-commerce.

- International: International Coach brand sales rose by 7% on a reported and constant-currency basis. Greater China sales increased by 5% along with positive comparable store sales on the Mainland, although this increase was offset by continued weakness in Hong Kong and Macau. In Japan, sales rose by 11% in US dollars, but decreased by 7% in constant currency, impacted by a decline in Chinese tourist spending. Sales in Europe remained strong, growing at a double-digit pace.

OUTLOOK

Coach is maintaining its fiscal year 2017 outlook as previously outlined in August. The company expects revenues to increase by low- to mid-single digits, including an expected benefit of approximately 100–150 basis points from foreign currency, based on current exchange rates.

The company is maintaining its operating margin forecast of 18.5%–19.0% for the full fiscal year.