Nitheesh NH

The Clorox Company

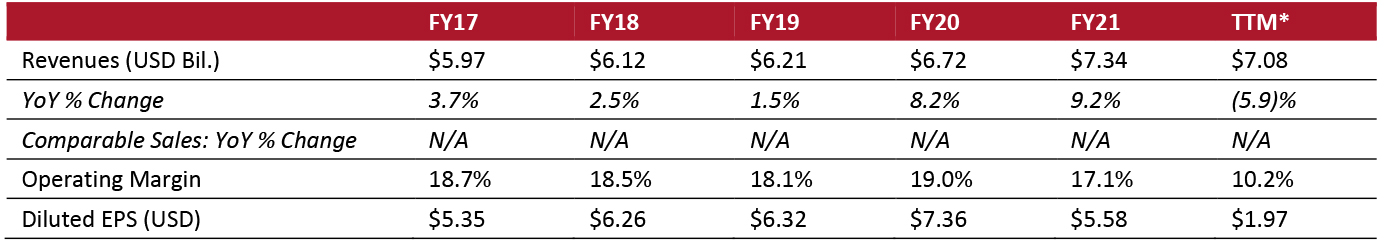

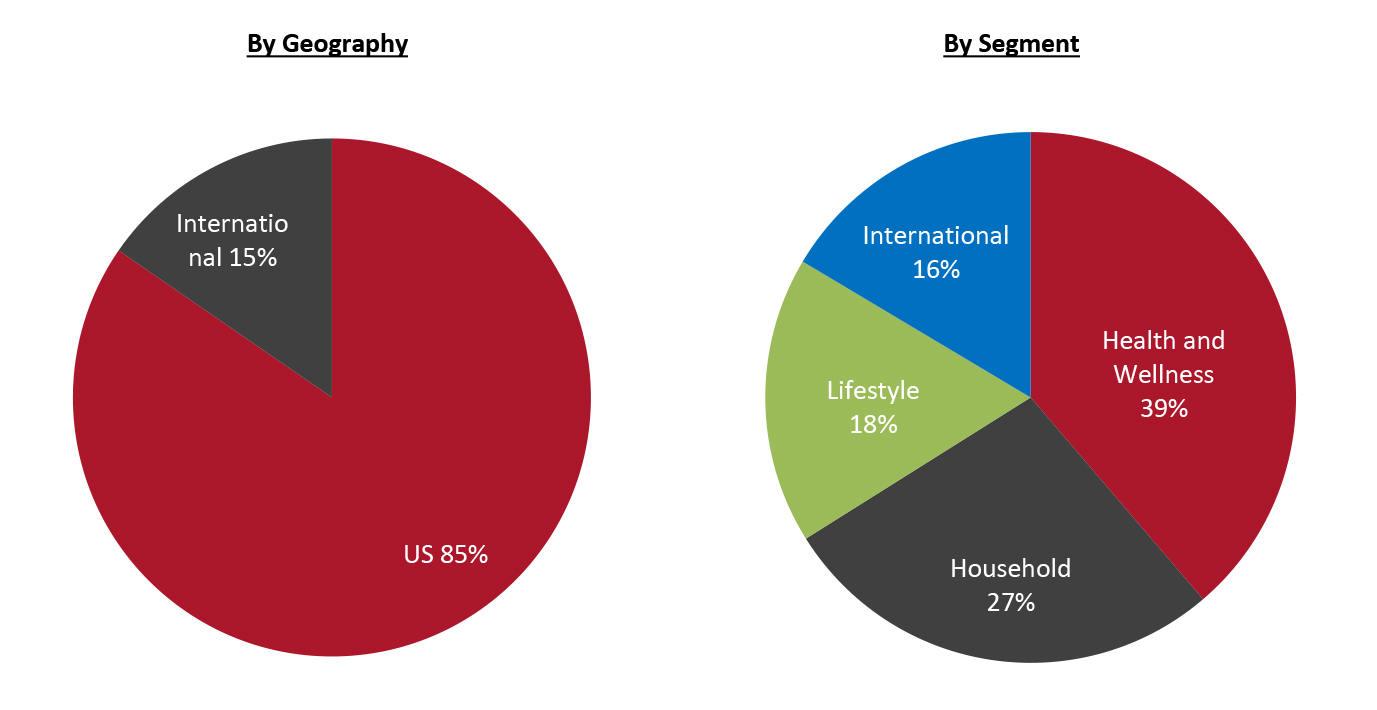

Sector: CPG Countries of operation: Argentina, Australia, Canada, Chile, Colombia, Costa Rica, Ecuador, Greater China (China, Hong Kong), Mexico, New Zealand, Panama, Peru, Puerto Rico, South Africa, South East Asia (Malaysia and Philippines), South Korea, the United Arab Emirates, the United Kingdom, the United States and Uruguay Key product categories: Bags and wraps, digestive health products, food, grilling products, homecare and household products, natural personal care products, water-filtration systems and filters Annual Metrics [caption id="attachment_148693" align="aligncenter" width="700"] Fiscal year ends on June 30

Fiscal year ends on June 30 *Trailing 12 months ended December 31, 2021. [/caption] Summary Founded in 1913 and headquartered in Oakland, California, Clorox is an international manufacturer of consumer products that operates under four segments: health and wellness, household, lifestyle and personal care, and international. Under health and wellness, the company operates the brands Clorox, Clorox2, Formula 409, Pine-Sol, Liquid-Plumr, Scentiva and Tilex. Its household segment includes the brands Fresh Step, Glad, Kingsford, Kingsford Match Light, Scoop Away and Ever Clean. Its lifestyle and personal care segment’s primary brands are Brita, Burt’s Bees and Hidden Valley. The country operates in over 20 countries in the regions of Africa, Asia, Latin America, the Middle East and North America. Company Analysis Coresight Research insight: Clorox’s strategy is centered on recovering its margins following a weak second quarter in 2021. Consumer demand for its products remains high, but the company is struggling to protect its margins from high inflation and supply chain issues. To combat this, the company is taking temporary measures to contract third-party manufacturers and enter the spot market to overcome volatility in its primary carrier market. While these measures will increase costs for the company, they will ensure higher inventories and prioritize consumer demand.

| Tailwinds | Headwinds |

|

|

- Move towards third-party manufacturers, which will be gradually replaced by in-house manufacturers.

- Move into the spot market, which run 50% to 75% higher than primary carriers, due to elevated demands for trucks and driver shortages. The move is temporary and the company hopes to return to the primary carrier market once demand settles.

- Continue to build value in the back half of the year through its pricing and cost-savings program.

*Trailing 12 months ended Dec 31, 2021.[/caption]

Company Developments

*Trailing 12 months ended Dec 31, 2021.[/caption]

Company Developments

| Date | Development |

| Feb 3, 2022 | 2Q2022: Clorox plans to use 3rd party manufacturers and enter the spot market in order to increase inventory and weather supply chain issues in 2022. |

| Dec 2, 2021 | Clorox aims to take pricing actions for 70% of its portfolio. |

| Nov 3, 2021 | Clorox is experiencing high volatility in consumer demand ranging from +20% to -5%. |

| Nov 1, 2021 | 1Q2022: Clorox announced pricing on 50% of its portfolio due to rising resin prices and transport prices. |

| Oct 31, 2021 | FQ1 2022: Clorox is prioritizing its investments in innovation and high ROI advertising to drive differentiation and capitalize on consumer loyalty that was built during the pandemic. |

| Aug 3, 2021 | 4Q2021: Clorox is experienced faster-than-expected moderating demand for cleaning and disinfecting products. |

| Jun 9, 2021 | Clorox plans to spend $100-$125 million more in 2021 in advertising as a way to invest into consumer loyalty, which has grown as a result of pandemic. |

| Jun 2, 2021 | Clorox expects its health and wellness segment to moderate in the long term, but remain at a higher level than pre-pandemic. |

| Jun 2, 2021 | Clorox expects supply will return to 100% by the end of Q1. |

- Matthew John Shattock—Chairman of the Board

- Linda Rendle—CEO and Director

- Kevin B. Jacobsen—Executive VP and CFO

- Eric H. Reynolds—Executive VP and COO

- Lisah Burhan—Head of Investor Relations

Source: Company reports/S&P Capital IQ