DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

4Q19 Results

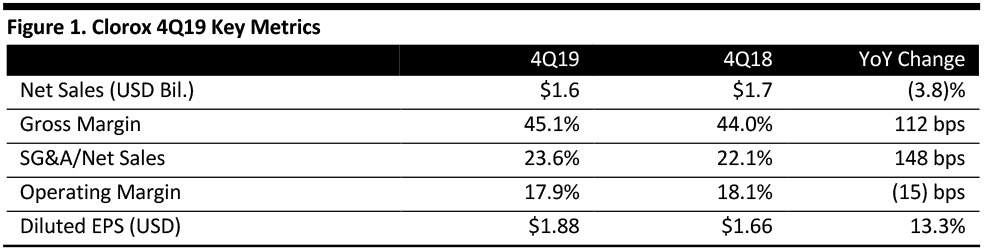

Clorox reported net sales of $1.6 billion for the three months ended June 30, 2019, down 3.8% year over year, missing the consensus estimate of $1.7 billion. The decrease in net sales was a result of lower sales volume and unfavorable foreign exchange rates, especially in Argentina.

Gross margin increased 112 basis points to 45.1% from 44.0% in the same period last year. Diluted EPS increased 13.3% year over year to $1.88 from $1.66, benefitting from US tax reform and a higher gross margin. Diluted EPS beat the consensus estimate of $1.83.

In fiscal year 2019, Clorox reported sales growth of 1% to $6.2 billion and a 1% increase in diluted EPS to $6.32.

Segment Review

- Cleaning: In the quarter, the cleaning segment recorded net sales of $530 million, up 3% year over year due to sales growth in all businesses. The professional products business recorded double-digit sales growth while home care hit record quaterly shipments of Clorox disinfecting wipes.

- Household: The household segment recorded net sales of $546 million, down 11% year over year as the charcoal and bags and the wraps businesses experienced lower sales. Charcoal suffered from distribution losses and lower merchandising activity. Bag and wrap sales were affected by wider price gaps and distribution losses.

- Lifestyle: Sales in the lifestyle segment were flat with the year-ago period at $312 million. Strong shipments of Burt’s Bees products, especially the core lip care and face care categories, contributed to the sales growth. The Nutranext dietary supplement brands also grew strongly.

- International: The international segment recorded net sales of $239 million, down 4% year over year primarily due to unfavorable foreign currency exchange rates.

Outlook

The company expects sales growth for fiscal year 2020 ranging from flat to 2% and sales will grow relatively slowly in the first half before it picks up in the second half. This is expected to be driven by continued strong performance in the company’s innovation program.

The company will focus on restoring growth to the charcoal and bags and the wraps businesses in the first quarter to try to drive overall sales growth in the second half of the year along with the contributions from its ongoing innovation program.

The company expects diluted EPS for fiscal 2020 to be in the range of $6.30 to $6.50.