albert Chan

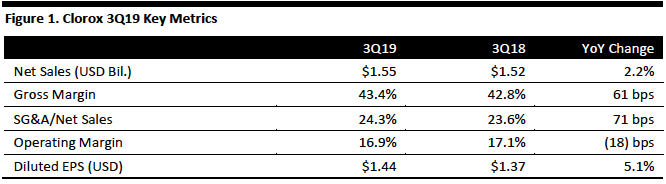

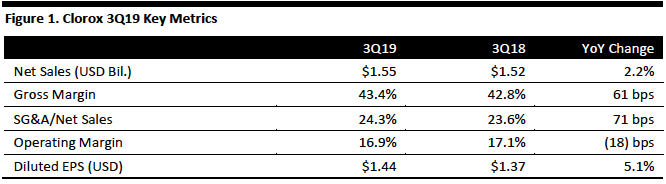

[caption id="attachment_86163" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Clorox reported net sales of $1.55 billion for the three months ended March 31, 2019, up 2.2% year over year, missing the consensus estimate of $1.57 billion. The increase in net sales was driven by the acquisition of Nutranext, a dietary supplements company, in April 2018. Gross margin increased 61 basis points year over year to 43.4% due to price increases and cost savings. Operating margin decreased 18 basis points year over year to 16.9%. Diluted EPS increased 5.1% year over year to $1.44, but fell marginally short of the consensus estimate of $1.45. Management commented that the company executed well against its key strategic priorities, including robust innovation, industry-leading consumer engagement online and cost-justified pricing.

Segment Review

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Clorox reported net sales of $1.55 billion for the three months ended March 31, 2019, up 2.2% year over year, missing the consensus estimate of $1.57 billion. The increase in net sales was driven by the acquisition of Nutranext, a dietary supplements company, in April 2018. Gross margin increased 61 basis points year over year to 43.4% due to price increases and cost savings. Operating margin decreased 18 basis points year over year to 16.9%. Diluted EPS increased 5.1% year over year to $1.44, but fell marginally short of the consensus estimate of $1.45. Management commented that the company executed well against its key strategic priorities, including robust innovation, industry-leading consumer engagement online and cost-justified pricing.

Segment Review

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Clorox reported net sales of $1.55 billion for the three months ended March 31, 2019, up 2.2% year over year, missing the consensus estimate of $1.57 billion. The increase in net sales was driven by the acquisition of Nutranext, a dietary supplements company, in April 2018. Gross margin increased 61 basis points year over year to 43.4% due to price increases and cost savings. Operating margin decreased 18 basis points year over year to 16.9%. Diluted EPS increased 5.1% year over year to $1.44, but fell marginally short of the consensus estimate of $1.45. Management commented that the company executed well against its key strategic priorities, including robust innovation, industry-leading consumer engagement online and cost-justified pricing.

Segment Review

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Clorox reported net sales of $1.55 billion for the three months ended March 31, 2019, up 2.2% year over year, missing the consensus estimate of $1.57 billion. The increase in net sales was driven by the acquisition of Nutranext, a dietary supplements company, in April 2018. Gross margin increased 61 basis points year over year to 43.4% due to price increases and cost savings. Operating margin decreased 18 basis points year over year to 16.9%. Diluted EPS increased 5.1% year over year to $1.44, but fell marginally short of the consensus estimate of $1.45. Management commented that the company executed well against its key strategic priorities, including robust innovation, industry-leading consumer engagement online and cost-justified pricing.

Segment Review

- Cleaning: The cleaning segment recorded net sales of $508 million, down 1.0% year over year due to a significantly milder cold and flu season compared to a year ago, which resulted in lower sales in the wipes and professional products categories. Competition also negatively affected wipes sales. Pre-tax earnings were flat, with lower sales and higher manufacturing and logistics costs offset by cost savings elsewhere and price increases.

- Household: The household segment posted net sales of $489 million, down 0.8% year over year due to widened prices gaps and heightened competitive activity driving a decrease in shipments of bags and wraps. Pre-tax earnings increased 6%, driven mainly by price increases and cost savings.

- Lifestyle: The lifestyle segment recorded net sales of $309 million, up 22.6% year over year due to the acquisition of Nutranext, innovation and brand investments in the natural personal care segment, and a new Brita bottle design that boosted water filtration sales. Pre-tax earnings decreased 7% year over year due to higher manufacturing and logistics costs and ongoing investments to support the integration of Nutranext.

- International: The international segment recorded net sales of $245 million, down 5.4% year over year, due mainly to the devaluation of the Argentine peso. Pre-tax earnings increased 4% year over year, driven by increased pricing, cost savings and the segment’s strong execution of the “Go Lean” strategy, under which the company invested in parts of the business segment that have strong tailwinds and high margins.

- The company expects the household segment to remain competitive, at least in the near term.

- The company expects the e-commerce channel to account for about 8% of total company sales in fiscal year 2019.

- Clorox continues to anticipate advertising and sales promotion spending to be about 10% of total sales.