Nitheesh NH

[caption id="attachment_70857" align="aligncenter" width="640"] Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

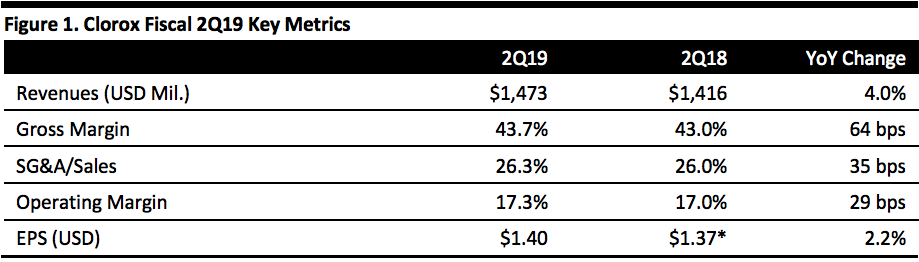

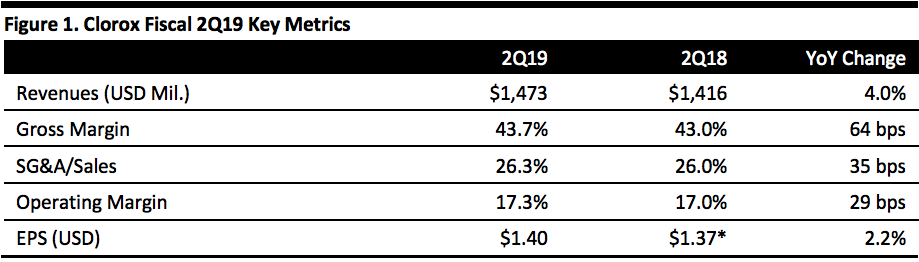

*2Q18 EPS is adjusted for a one-time tax benefit of $0.40[/caption] 2Q19 Results Clorox posted revenue growth of 4%, largely in line with market expectations, while its adjusted EPS of $1.40 beat consensus estimates of $1.30 by 8% in 2Q19, ended December 31, 2018. The company adopted a new pricing strategy for several offerings, including its home care and laundry businesses as part of its 2020 growth strategy. This helped the company manage foreign currency and cost pressures. Performance by Segments

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research*2Q18 EPS is adjusted for a one-time tax benefit of $0.40[/caption] 2Q19 Results Clorox posted revenue growth of 4%, largely in line with market expectations, while its adjusted EPS of $1.40 beat consensus estimates of $1.30 by 8% in 2Q19, ended December 31, 2018. The company adopted a new pricing strategy for several offerings, including its home care and laundry businesses as part of its 2020 growth strategy. This helped the company manage foreign currency and cost pressures. Performance by Segments

- Cleaning: This segment contributed 34% of the company’s 2Q19 revenues and grew 6% year over year, primarily driven by gains in the home care business and new Clorox branded products in the Scentiva line. The growth was also led by double-digit sales increases in the professional products business.

- Household: Revenues and pretax earnings from this segment declined 4% and 15%, year over year, respectively, due to increasing competition in trash bags and distribution losses in food storage products.

- Lifestyle: Segment sales surged 25% year over year, benefitting from the positive impact of dietary and supplement products maker Nutranext, which the company acquired in April 2018, and growth in the natural personal care and dressings and sauces businesses.

- International: Clorox generated about 16% of its 2Q19 revenues outside of the U.S. The company’s international revenues declined 8% year over year, due to the impact of unfavorable foreign currency exchange rates, particularly from the devaluation of the Argentine peso.

- In 2Q19, the company’s operating margin expanded by around 29 basis points year over year to 17.3%.

- Clorox maintained discipline on selling and administrative expenses (excluding advertising and R&D costs), keeping both at 14.3% as a % of total sales in 2Q19, in line with the company’s long-term goal of maintaining it below 14%.

- The company anticipates gross margin will remain flat in FY19 and SG&A expenses (excluding advertising and R&D costs) will stay constant at about 14% of sales.

- For FY19, consensus calls for revenue growth of 3% and EPS growth of 0.8%, year over year.