Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

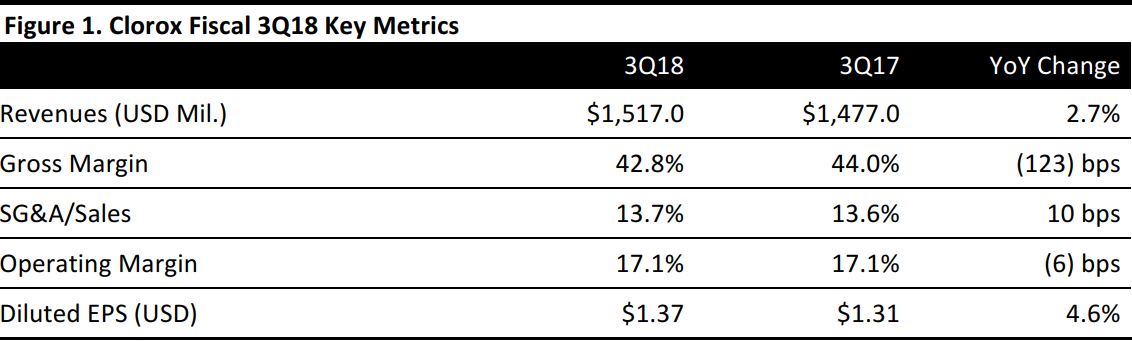

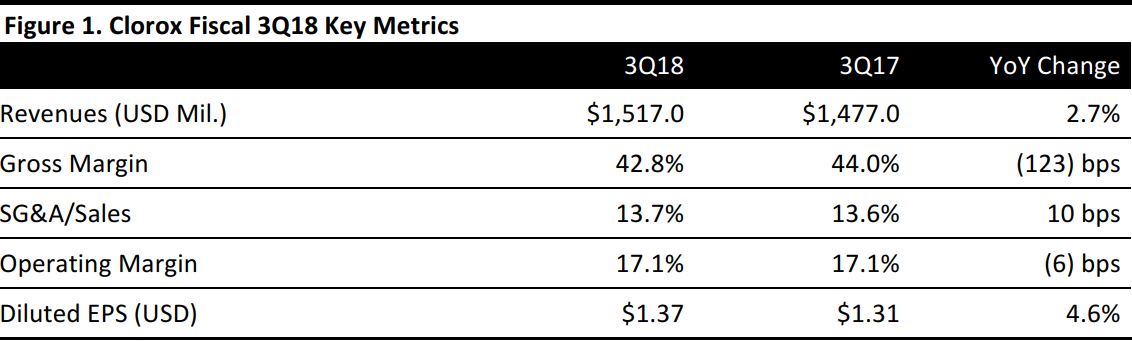

Fiscal 3Q18 Results

Clorox reported fiscal 3Q18 revenues of $1.52 billion, up 2.7% year over year and in line with the consensus estimate. Diluted EPS was $1.37, above the consensus estimate of $1.31 and up 4.6% from the year-ago quarter.

On April 2, 2018, the company completed its acquisition of Nutranext, a health and wellness company that manufactures dietary supplements. Clorox expects the Nutranext acquisition to add “significant scale and breadth” to its dietary supplements offering and to build on its May 2016 RenewLife acquisition, expanding its portfolio further into health and wellness. Management anticipates that Nutranext will represent more than 3% of company sales.

Clorox’s overall sales grew by 2.7% during the quarter and each of the company’s four business segments saw sales increase during the period. Cleaning segment sales increased by 3%, with growth driven by gains in home care, where volume and sales each grew by high single digits on top of double-digit growth in the year-ago quarter. Volume in home care was broad-based, with record quarterly shipments of several Clorox-branded products, including Clorox Disinfecting Wipes.

Sales in the lifestyle segment—which includes dressings and sauces, water filtration, and natural personal care—increased by 2% from the year-ago quarter. The increase reflected record-high shipments of the company’s Hidden Valley bottled dressings and gains in the natural personal care business, primarily from the strength of lip and face care products, supported by innovation. These factors were partially offset by lower shipments of water filtration products.

Sales increased by 4% in the international segment, with growth driven by the benefit of price increases and supported by volume gains due in part to higher shipments in Canada. These factors were partially offset by unfavorable product mix and unfavorable foreign currency exchange rates.

The household segment’s sales increased by 1%, driven by double-digit gains in the cat litter business and supported by the company’s innovation in Fresh Step Clean Paws, which includes a Febreze platform.

Outlook

Clorox raised its FY18 net sales growth guidance to 3% from 1%–3% previously. The company reduced its full-year EPS guidance range to $6.15–$6.30 from $6.17–$6.37 previously.

Management expects the Nutranext acquisition to contribute one point to FY18 sales and to dilute EPS by 7–11 cents, primarily driven by onetime integration costs. The company expects its FY18 effective tax rate to be 22%–23%, down from 23%–24% previously.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research