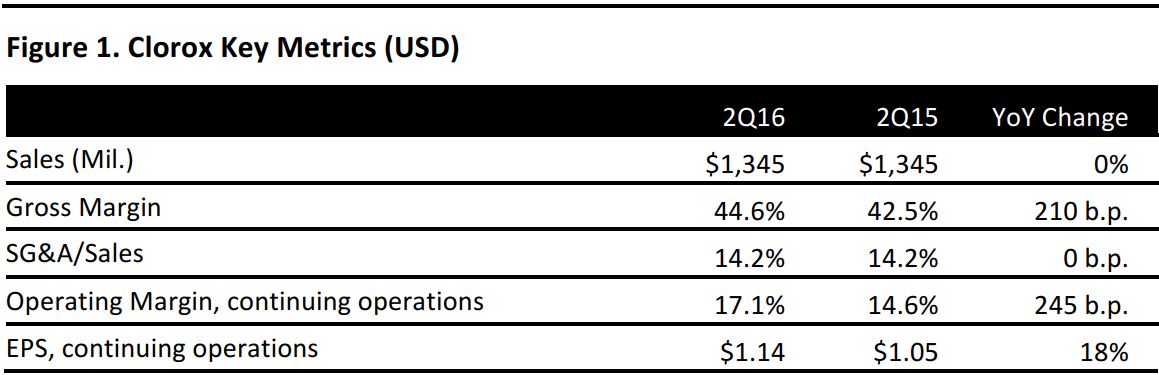

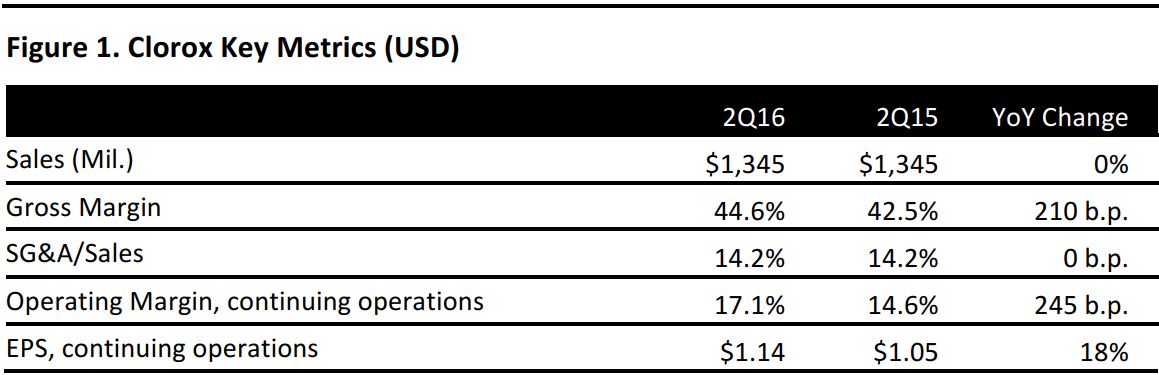

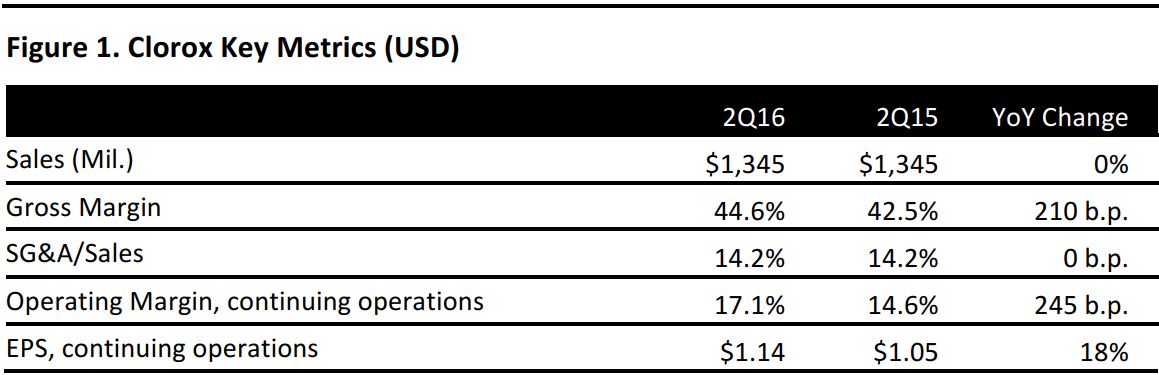

Source: Company reports

Clorox’s flat fiscal 2Q16 sales reflected higher revenues from 1% volume growth and price increases that were offset by currency effects. Volume gains were driven by Home Care and Natural Personal Care, but were partially offset by decreases in Laundry and Water Filtration. The gross margin increased by 210 basis points year over year to 44.6%, due to favorable commodity costs, cost savings and price increases. The increase was partially offset by higher manufacturing and logistics costs and the impact of unfavorable currency rates.

For fiscal 2016, the company maintained its prior revenue guidance of flat-to-1% growth (up 3%–4%, excluding currency) and it raised its EBIT margin guidance to 50–75 basis points (versus up 25–50 basis points previously), due to favorable commodity costs. Margins are expected to be partially offset by higher inflation in international markets, which will increase manufacturing and logistics costs and selling and administrative expenses. This change translates to diluted EPS from continuing operations of $4.75–$4.90 versus the previous outlook of $4.68–$4.83.

Cleaning (Laundry, Home Care and Professional Products) saw 2% volume growth, 2% sales growth and 15% pretax earnings growth. Clorox Disinfecting Wipes showed strong, double-digit growth that was partially offset by lower shipments in Laundry. This was largely due to price increases and volume decreases in Professional Products against a tough comparison. Pretax earnings growth reflected higher sales and favorable commodity costs and cost savings that were partially offset by higher manufacturing and logistics costs.

Household (Bags and Wraps, Charcoal, and Cat Litter) saw flat volume, 1% sales growth and 31% pretax earnings growth. Volume shipments reflected gains in Bags and Wraps and Charcoal, which were offset by decreases in Cat Litter. Pretax earnings growth reflected favorable commodity costs, higher sales and cost savings that were partially offset by higher manufacturing and logistics costs.

Lifestyle (Dressings and Sauces, Water Filtration, and Natural Personal Care) saw 2% volume growth, 2% sales growth and a 1% pretax earnings decrease. Volume growth was driven primarily by Natural Personal Care, which was up by double digits for the second year in a row due to the launch of Burt’s Bees lip color products, strong holiday sales and ongoing strength in facial towelettes. The gains were partially offset by lower shipments in Water Filtration. Pretax earnings decreased largely because of significant investments in new products, but the decline was partially offset by stronger sales growth.

International saw flat volume, a 7% sales decrease and an 8% pretax earnings decrease. Volume was flat largely because of the impact of price increases. Sales decreases were primarily driven by unfavorable foreign currency exchange rates, which were partially offset by price increases and a favorable product mix. Sales grew by 6% on a currency-neutral basis despite slowing economic growth in international markets. The pretax earnings decrease reflected lower sales and higher manufacturing and logistics costs that were primarily driven by continued inflation.