albert Chan

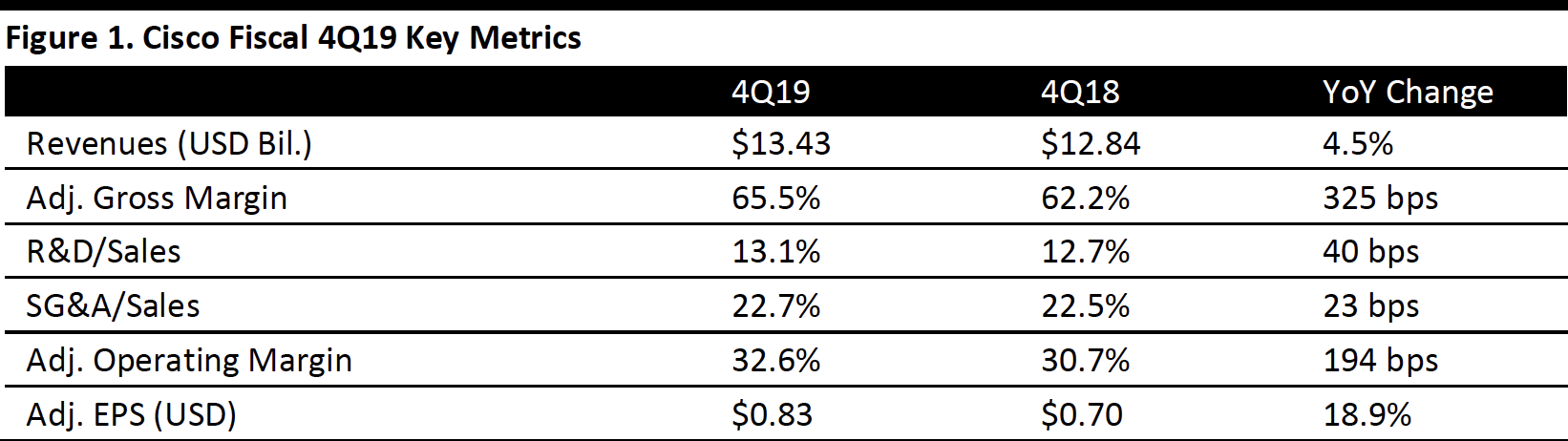

[caption id="attachment_94697" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Cisco reported fiscal 4Q19 revenues of $13.43 billion, up 4.5% and in line with the consensus estimate. Revenues increased 5% excluding the divested SVPSS business.

Adjusted EPS was $0.83, beating the consensus estimate by two cents. GAAP EPS was $0.51, compared to $0.81 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $51.9 billion, up 5.2%. Revenues increased 7% excluding the divested SVPSS business.

Adjusted EPS was $3.10, up 20%. GAAP EPS was $2.61, compared to $0.02 in the year-ago quarter.

Results by Segment

Product revenues were $10.1 billion, up 5% year over year.

Products:

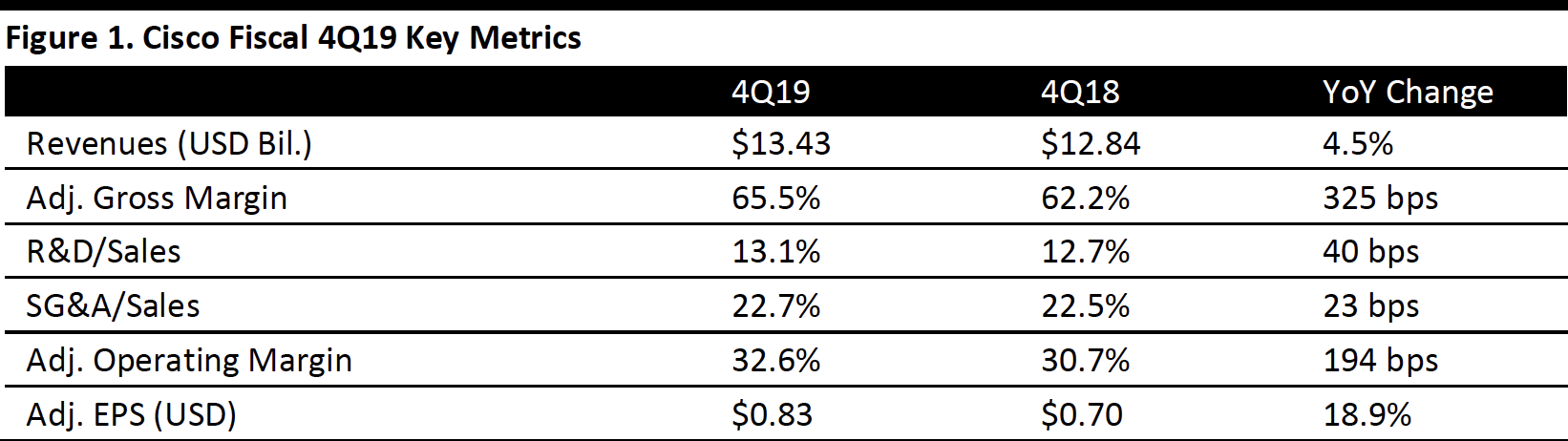

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Cisco reported fiscal 4Q19 revenues of $13.43 billion, up 4.5% and in line with the consensus estimate. Revenues increased 5% excluding the divested SVPSS business.

Adjusted EPS was $0.83, beating the consensus estimate by two cents. GAAP EPS was $0.51, compared to $0.81 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $51.9 billion, up 5.2%. Revenues increased 7% excluding the divested SVPSS business.

Adjusted EPS was $3.10, up 20%. GAAP EPS was $2.61, compared to $0.02 in the year-ago quarter.

Results by Segment

Product revenues were $10.1 billion, up 5% year over year.

Products:

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Cisco reported fiscal 4Q19 revenues of $13.43 billion, up 4.5% and in line with the consensus estimate. Revenues increased 5% excluding the divested SVPSS business.

Adjusted EPS was $0.83, beating the consensus estimate by two cents. GAAP EPS was $0.51, compared to $0.81 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $51.9 billion, up 5.2%. Revenues increased 7% excluding the divested SVPSS business.

Adjusted EPS was $3.10, up 20%. GAAP EPS was $2.61, compared to $0.02 in the year-ago quarter.

Results by Segment

Product revenues were $10.1 billion, up 5% year over year.

Products:

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Cisco reported fiscal 4Q19 revenues of $13.43 billion, up 4.5% and in line with the consensus estimate. Revenues increased 5% excluding the divested SVPSS business.

Adjusted EPS was $0.83, beating the consensus estimate by two cents. GAAP EPS was $0.51, compared to $0.81 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $51.9 billion, up 5.2%. Revenues increased 7% excluding the divested SVPSS business.

Adjusted EPS was $3.10, up 20%. GAAP EPS was $2.61, compared to $0.02 in the year-ago quarter.

Results by Segment

Product revenues were $10.1 billion, up 5% year over year.

Products:

- Infrastructure Platforms revenues were $7.9 billion, up 6% year over year.

- Applications revenues were $1.5 billion, up 11% year over year.

- Security revenues were $714 million, up 14% year over year.

- Other Products revenues were $42 million, down 81% year over year.

- On July 9, 2019, Cisco announced its intention to acquire Acacia Communications, a semiconductor company that develops, manufactures and sells high-speed coherent optical interconnect products, for $2.6 billion in cash. The acquisition is expected to close in the second half of fiscal 2020.

- In the quarter, Cisco continued its business model transition with software subscriptions hitting 70% of total software revenue, up 12 percentage points year-over-year.

- Cisco saw broad-based growth across the majority of its portfolio, led by next-generation enterprise networking solutions. Over the last two years, Cisco has rearchitected its entire networking portfolio to deliver new capabilities through automation.

- Cisco has also added several AI and machine-learning software capabilities to improve network management through automation. Its new AI network analytics capability delivers greater visibility and insights across the entire enterprise network.

- Management commented that Cisco is innovating across every facet of its portfolio, integrating AI, automation, security and assurance into its Nexus switching platforms and its 400-gigabit-per-second offerings.

- Cybersecurity drove another consecutive quarter of double-digit growth

- Cisco is investing in and extending its subscription-based security innovations across all networking domains in today’s Zero Trust environment, extending its ability to detect threats across public clouds and protecting the campus, branch, WAN and data center against threats.

- Throughout the year, Cisco has expanded its family of cloud-security solutions to help secure identity, endpoints and the network, which has led to accelerating customer adoption.

- Cisco’s collaboration business continues to perform well, and the company believes that it is leading the market in integrating AI and ML into its enterprise collaboration portfolio. AI-driven innovations include people insights, facial recognition and WebEx Assistant.

- Cisco recently announced its intention to acquire Voicea, a leading provider of voice-based artificial intelligence solutions, which will enhance the WebEx portfolio with a transcription service combining AI and automated speech recognition.

For the fiscal first quarter, Cisco guided for revenue growth of 0-2% and adjusted EPS of $0.80-0.82, below the $0.83 consensus estimate.

Other Coresight Research- Please see our note on Cisco’s proposed acquisition of Acacia Communications.