DIpil Das

[caption id="attachment_87952" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

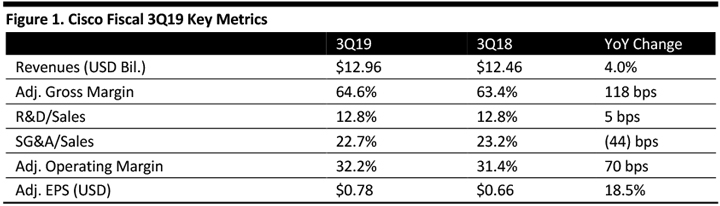

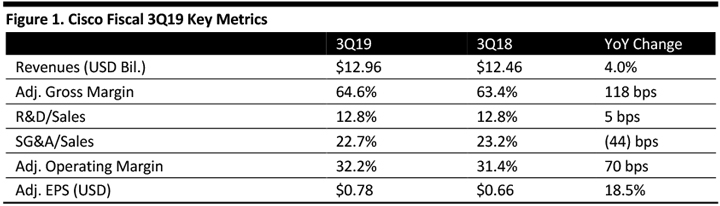

Cisco reported fiscal 3Q19 revenues of $12.96 billion, up 4.0% and above the $12.89 billion consensus estimate. Revenues increased 6% excluding the divested SVPSS business, which contributed $219 million of revenue in the year-ago quarter.

Adjusted EPS was $0.78, beating the consensus estimate by a penny. GAAP EPS was $0.69, compared to $0.56 in the year-ago quarter.

Cisco divested the Service Provider Video Software Solutions business in fiscal 2Q18, and results have been adjusted accordingly.

Results by Segment

Product revenues were $9.7 billion, up 7% year over year.

Products:

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

Cisco reported fiscal 3Q19 revenues of $12.96 billion, up 4.0% and above the $12.89 billion consensus estimate. Revenues increased 6% excluding the divested SVPSS business, which contributed $219 million of revenue in the year-ago quarter.

Adjusted EPS was $0.78, beating the consensus estimate by a penny. GAAP EPS was $0.69, compared to $0.56 in the year-ago quarter.

Cisco divested the Service Provider Video Software Solutions business in fiscal 2Q18, and results have been adjusted accordingly.

Results by Segment

Product revenues were $9.7 billion, up 7% year over year.

Products:

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

Cisco reported fiscal 3Q19 revenues of $12.96 billion, up 4.0% and above the $12.89 billion consensus estimate. Revenues increased 6% excluding the divested SVPSS business, which contributed $219 million of revenue in the year-ago quarter.

Adjusted EPS was $0.78, beating the consensus estimate by a penny. GAAP EPS was $0.69, compared to $0.56 in the year-ago quarter.

Cisco divested the Service Provider Video Software Solutions business in fiscal 2Q18, and results have been adjusted accordingly.

Results by Segment

Product revenues were $9.7 billion, up 7% year over year.

Products:

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

Cisco reported fiscal 3Q19 revenues of $12.96 billion, up 4.0% and above the $12.89 billion consensus estimate. Revenues increased 6% excluding the divested SVPSS business, which contributed $219 million of revenue in the year-ago quarter.

Adjusted EPS was $0.78, beating the consensus estimate by a penny. GAAP EPS was $0.69, compared to $0.56 in the year-ago quarter.

Cisco divested the Service Provider Video Software Solutions business in fiscal 2Q18, and results have been adjusted accordingly.

Results by Segment

Product revenues were $9.7 billion, up 7% year over year.

Products:

- Infrastructure Platforms revenues were $7.5 billion, up 5% year over year.

- Applications revenues were $1.4 billion, up 9% year over year.

- Security revenues were $707 million, up 21% year over year. Management commented that the segment has strong momentum, driven by its world-class product portfolio.

- Other Products revenues were $38 million, down 83% year over year.

- Americas revenues were $7.7 billion, up 9% year over year.

- EMEA (Europe, Middle East and Africa) revenues were $3.3 billion, up 5% year over year.

- APJC (Asia-Pacific, Japan and China) revenues were $1.9 billion, down 4% year over year.

- Characterized revenues, margins, adjusted EPS growth and operating cash flow as strong.

- Commented that the company is fundamentally changing the way customers approach IT infrastructure to address rising IT complexity.

- Completed the most comprehensive enterprise networking product portfolio refresh in company history, across wireline and wireless products and including the new Catalyst 9000 family products.

- Executed well on strategy to drive profitable growth, drive differentiated innovation and transform to offer more software and subscriptions.

- Management commented that the cloud, AI, the Internet of Things, 5G wireless and Wi-Fi 6 are coming together to revolutionize how businesses operate and deliver experiences, and Cisco claims that it is building the only integrated, secure technological foundation to accommodate these technologies. The new technology will enable the secure connection of users and devices from any location. Moreover, Cisco is integrating artificial intelligence and machine learning across the entire portfolio to offer its customers greater insights, creating better and faster business results.

- In Infrastructure Platforms, Cisco has worked over the past several years to integrate intent-based networking across its entire product portfolio, across wired and wireless products and has seen strong traction in its enterprise networking products.

- In the data center, Cisco aims to deliver multi-cloud architectures that offer consistent policy and operations regardless of where the applications or data reside.

- In security, Cisco considers itself the world’s largest cybersecurity company for enterprises and the company is helping enterprises transform their networks for a multi-cloud world.

- In applications, Cisco claims very good execution in collaboration products — customers are always seeking to improve meeting experiences, and cognitive collaboration is quickly becoming a standard and transforming how people work.

- Revenue growth of 4.5%-6.5% year over year to $13.0-$13.3 billion, whose midpoint is below the consensus estimate of $13.29 billion.

- Adjusted EPS of $0.80-$0.82, in line with the $0.81 consensus estimate, and GAAP EPS of $0.66-$0.71.