DIpil Das

Chow Tai Fook Jewellery Group

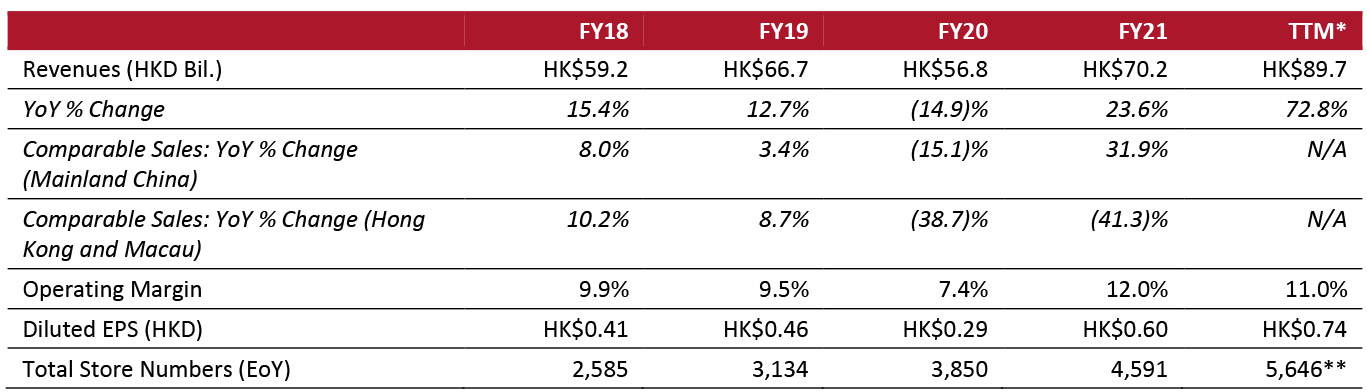

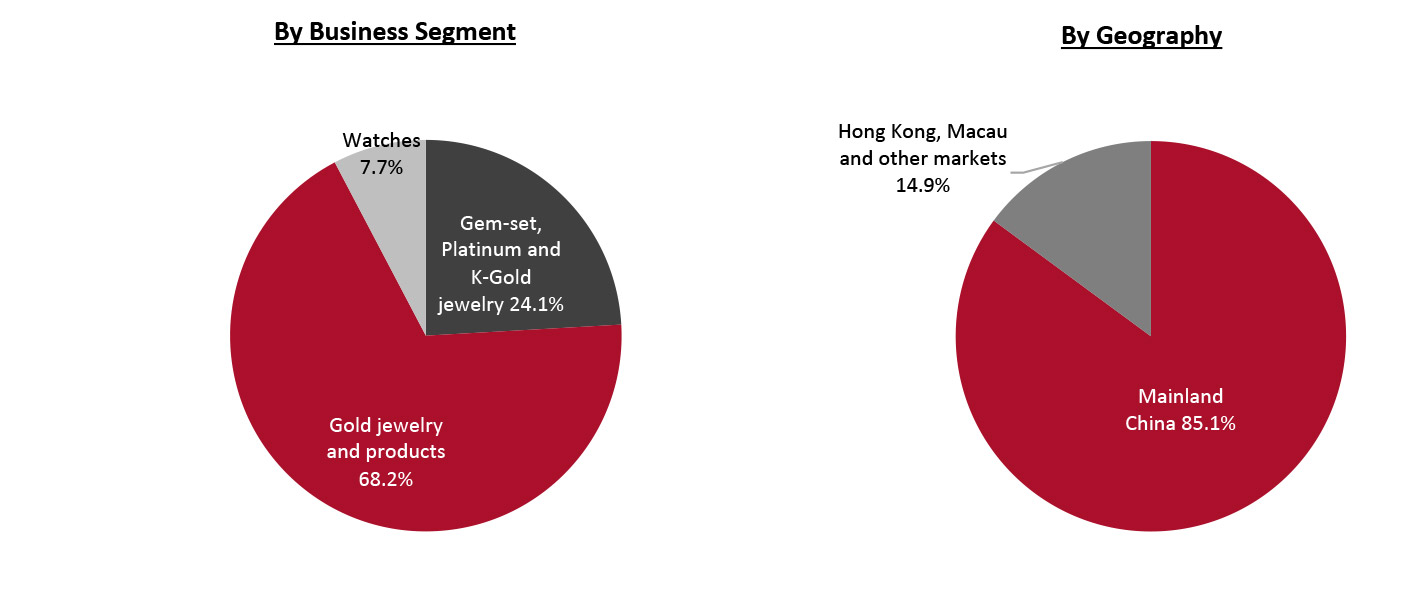

Sector: Luxury Countries of operation: Operates stores in China, Japan, Malaysia, Taiwan, Vietnam and the US, and services customers worldwide via its website and major online retailers, such as Tmall, JD.com and Vipshop Key product categories: Jewelry and watches Annual Metrics [caption id="attachment_148802" align="aligncenter" width="701"] Last fiscal year end: March 31, 2021

Last fiscal year end: March 31, 2021 *Trailing 12 months ended September 30, 2021

**Numbers as of December 31, 2021 [/caption] Summary Headquartered in Hong Kong, Chow Tai Fook Jewellery Group is a manufacturer and retailer of jewelry, and a distributor of major watch brands, such as Rolex. It was founded in 1929 and now operates in 10 countries, with its largest presence in Mainland China, where it has over 5,500 stores. The group also has 77 stores in Hong Kong, 19 in each Macau and Taiwan, a smaller network in several other Asian countries, including Japan, Malaysia and Vietnam, and one store in the US. The group retails under six banners—Chow Tai Fook Jewellery, CTF Watch, Enzo, Hearts On Fire, Monologue and SoInLove—offering jewelry in gem-set, platinum and karat gold (k-gold) ranges for the high-end and premium consumer segments. In the US, the group has established Chow Tai Fook North America (CTFNA) to manage the wholesale distribution of its jewelry brands Hearts On Fire and Mémoire. The entity also offers customized specialty collections in the diamond and fine jewelry segments, as well as private-label offerings. Company Analysis Coresight Research insight: China—and Asia more widely—are primed for luxury consumption growth for various reasons: repatriation of consumption prompted by prolonged restrictions on international travel, high luxury purchase appetite and a youthful and discerning consumer segment with rising disposable incomes. Chow Tai Fook has experienced solid growth through the pandemic, except for fiscal 2020—the second half of which overlapped with Chinese lockdowns. We believe two key aspects are working in the company’s favor to drive future growth: it has aptly positioned most of its stores in lower-tier cities with a growing aspirational consumer segment and jewelry has strong growth potential in 2022.

| Tailwinds | Headwinds |

|

|

- Expand its retail network to grow its presence and get closer to customers. In fiscal 2022, the group plans to open 700 Chow Tai Fook banner stores in Mainland China, with an upgrade planned for stores in tier one and two cities.

- Observe how domestic travel and landlord negotiations in Hong Kong and Macau develop before deciding on the future of 10 to 15 stores.

- Focus on countries with a greater level of domestic consumption in the near term, planning expansions when there are no threats to international travel.

- Enhance its digital channels with better use of data to drive richer in-store and online customer experiences.

- Continue to deploy in-store digital kiosks, where customers can browse and find the location of products they are looking for, shortening search times.

- Offer options to customize jewelry, ready for delivery within 24 hours, through a digital platform called D-ONE.

- Roll out all these smart retail initiatives to more stores in fiscal 2022.

Company Developments

Company Developments

| Date | Development |

| February 28, 2022 | Chow Tai Fook enters a one-year, renewable supply agreement with Mountain Province Diamonds Inc., a major partner in the Gahcho Kue Diamond Mine, the world’s largest diamond mind. The terms of the agreement state that Chow Tai Fook “will purchase a selected range of rough diamonds from Mountain Province.” |

| November 29, 2021 | Chow Tai Fook implements K Dollar Program, a joint cooperation with New World Development to encourage repeat purchases, in all Hong Kong stores. |

| May 20, 2021 | Chow Tai Fook announces a strategic partnership with trade association The Natural Diamond Council, to advocate the value of natural diamonds to Chinese consumers. |

| March 26, 2021 | Chow Tai Fook redesignates Executive Director (ED) Sai-Cheong Chan as MD of Mainland China. Redesignates group MD Kent Siu-Kee Wong MD, Corporate and Hong Kong, Macau and Overseas. Appoints Sonia Cheng Chi-Man from a non-executive director to an ED. |

| November 2, 2020 | Chow Tai Fook launches a diamond grading certification system in partnership with Goldway Technology Limited, powered by artificial intelligence and blockchain technologies. The AI engine uses deep learning from analyzing over 20 million diamond images to assess the quality of diamonds and provide a grade, making it more efficient than humans. |

- Henry Cheng Kar-Shun—Chairman

- Kent Siu-Kee Wong—MD, Corporate and Hong Kong, Macau and Overseas

- Bobby Liu Chun-Wai—GM of the Mainland China Management Centre and Executive Director

- Danita On—Director of Investor Relations and Corporate Communication

- Hamilton Ping-Hei Cheng—Joint Company Secretary and ED

- Sai-Cheong Chan—MD of Mainland China and ED

Source: Company reports/S&P Capital IQ