DIpil Das

What’s the Story?

This report details the results of our sixth annual survey of Chinese overseas tourists’ travel, spending behavior and preferences—with a focus on the impact of Covid-19.Why It Matters

Against the backdrop of Covid-19 interruptions to the travel industry, Chinese outbound tourism has been sluggish this year. Chinese tourists help to fuel consumption across retail and service industries worldwide: We estimate that their total overseas retail spending increased by 11% to an estimated $102 billion (¥701 billion) in the 12 months ended August 2019—prior to the crisis. Our proprietary analysis of Chinese tourists’ travel intentions and attitudes, including how they expect the pandemic to change their travel decisions, informs retailers globally in preparing for the year ahead.Survey Methodology

The Covid-19 crisis prompted us to change the scope of our survey this year. In our previous annual surveys, we have focused on the behaviors and attitudes of Chinese consumers who have traveled overseas in the past year. Due to the near-total shutdown of international travel in 2020, this year we surveyed Chinese consumers who had traveled overseas in the past year as well as Chinese consumers in general: the latter group provided useful insights among consumers who may otherwise have traveled and who experienced cancelations or postponements. We surveyed 770 Chinese Internet users who had spent at least one night on a trip outside of Mainland China in the past 12 months (which is comparable to surveys in previous years), as well as 750 Chinese Internet users as a selection of consumers in general. We conducted our survey in late September and early October 2020, with a focus on the implications of Covid-19 for respondents’ plans for their next overseas trips. As in prior years, a number of questions were based on travel in the past year (September 2019–September 2020), and we make comparisons to last year’s survey findings: Our survey last year was undertaken in September 2019 and the respondent profile was comparable to this year’s base of those who had traveled.Chinese Outbound Tourists Survey 2020

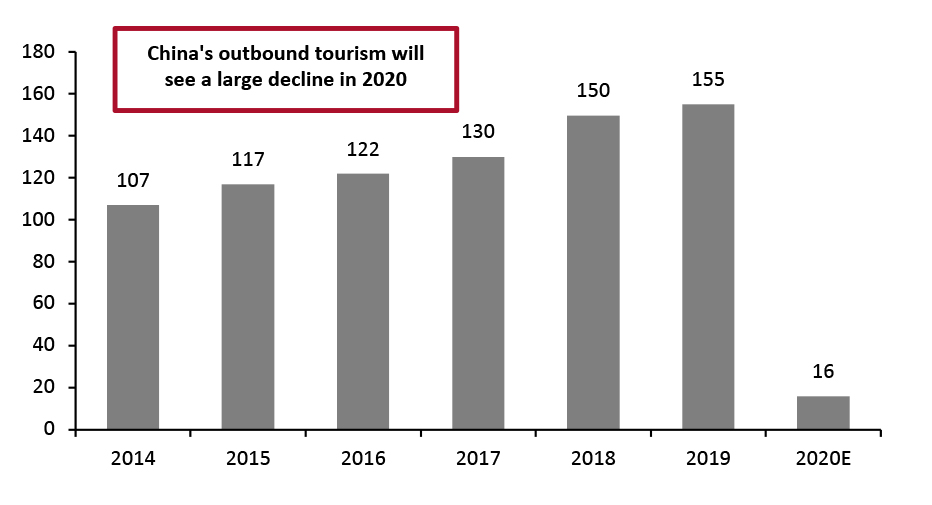

Traveler Numbers: Nearly 16 Million Trips Expected This Year Before we discuss our survey findings, we outline top-line figures on the Chinese outbound tourist market. Chinese travelers made nearly 155 million trips outside of Mainland China in 2019, according to the Chinese Ministry of Culture and Tourism—up 3.3% year over year but slowing from 14.7% growth in 2018. The sharp slowdown was partly due to a decline in trips to Hong Kong and Taiwan linked to political events. However, due to the Covid-19 pandemic, China’s outbound tourist numbers have slumped in 2020. We estimate that the number of outbound trips in 2020 will drop by around 90% to 16 million in 2020, according to data from China Tourism Academy and the Macao Government Tourism Office. Macao (also spelled Macau) is a special administrative region of China for which Mainland Chinese residents need authorization to travel. Since September 23, Macau has reinstated travel visas to tourists from mainland China. During the first seven days of the Golden Week holiday (which took place on October 1–8), the number of mainland visitors to Macau declined by 83.6% year over year, according to the Macao Government Tourism Office. However, looking specifically at each day of the holiday, the year-over-year decline in the number of mainland visitors to Macau improved from 87.5% on the first day to a drop of 66.9% on the seventh day. Travel to Hong Kong remains stagnant, as entry is only permitted to certain groups from Mainland China, such as businesspeople.Figure 1. Chinese Travelers: Total Number of Outbound Trips (Mil.) [caption id="attachment_121155" align="aligncenter" width="725"]

Data includes day trips, such as to Hong Kong and Macau

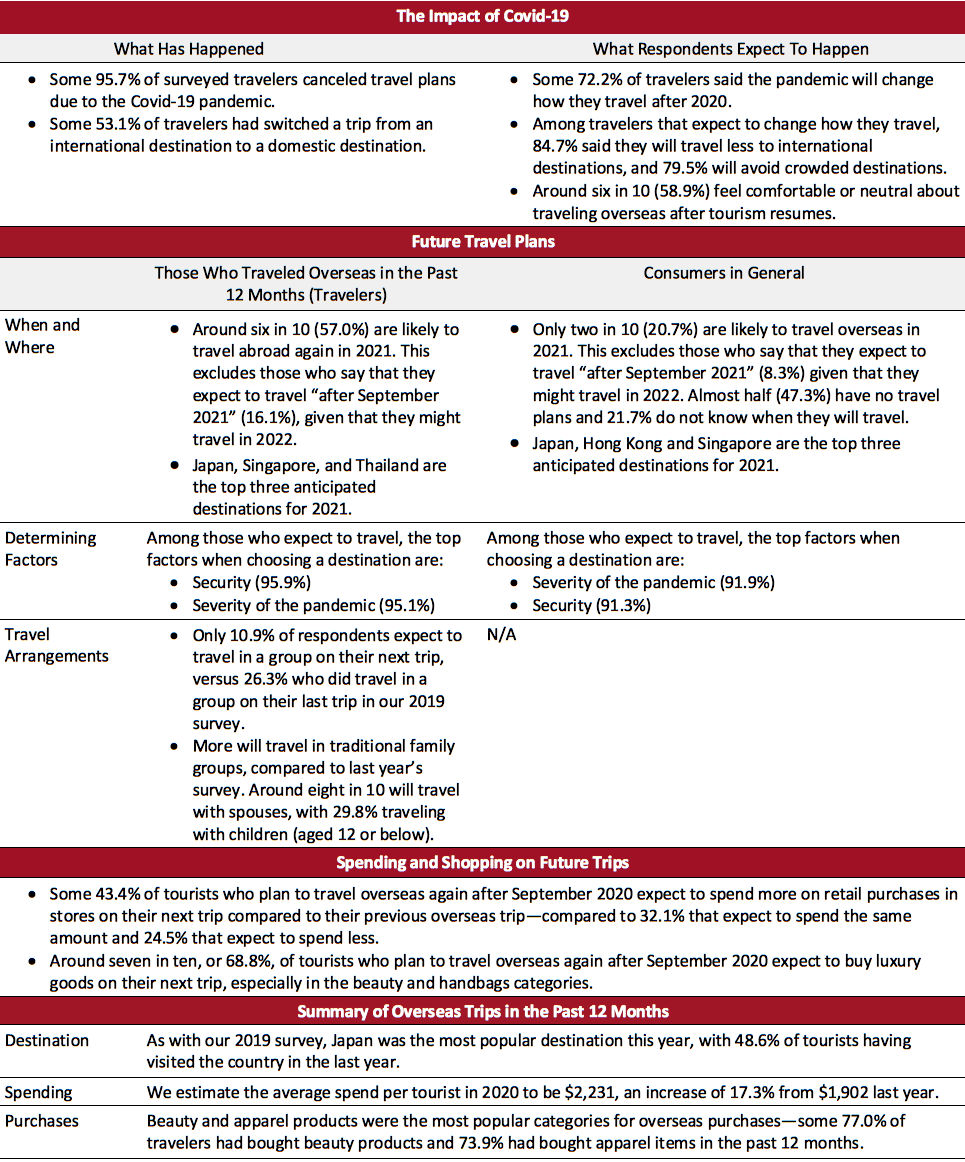

Data includes day trips, such as to Hong Kong and MacauSource: China Tourism Academy/Macao Government Tourism Office/Ministry of Culture and Tourism/Coresight Research [/caption] Key Survey Findings We summarize key findings from our survey in Figure 2 on the impact of Covid-19, future travel plans, spending and shopping on future trips, and overseas trips in the last 12 months among Chinese outbound tourists. We discuss each area in detail later in the report. For some data points in Figure 2, we compare respondents who have traveled overseas in the past 12 months (referred to as “travelers” throughout this report) with our survey group referred to as consumers in general.

Figure 2. Summary of Key Findings [caption id="attachment_121292" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

The Impact of Covid-19

· Travel Plans from the Last Year

We asked respondents if and how the pandemic changed their travel plans over the last year, and how they anticipate it impacting their future travel plans.

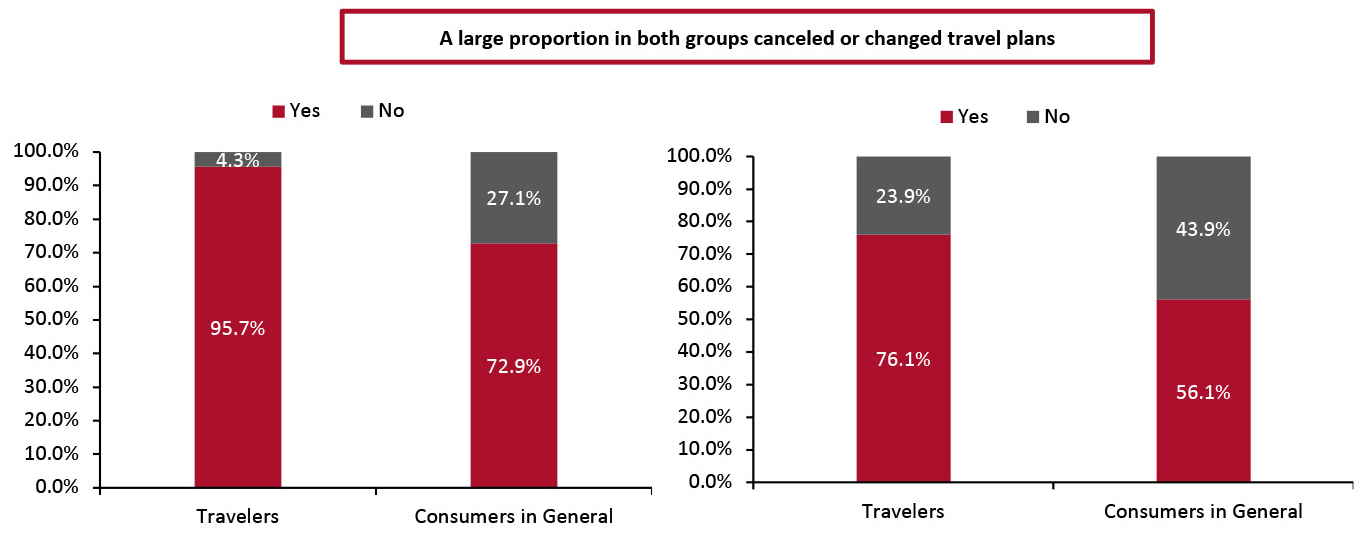

Among those who had traveled in the past 12 months, fully 95.7% of respondents said that they had canceled some travel plans due to the pandemic.

Among the consumers in general group, the proportion was lower, at 72.9%.

Other than canceling plans, 76.1% of those who traveled overseas had changed vacation travel plans or expected trips because of the coronavirus outbreak, versus 56.1% for the consumers in general group. This group may have reported a lower rate of changes to plans because they did not have anything planned.

Out of the consumers in general group, only 15.1% had spent at least one night outside of Mainland China in the past 12 months.

Source: Coresight Research[/caption]

The Impact of Covid-19

· Travel Plans from the Last Year

We asked respondents if and how the pandemic changed their travel plans over the last year, and how they anticipate it impacting their future travel plans.

Among those who had traveled in the past 12 months, fully 95.7% of respondents said that they had canceled some travel plans due to the pandemic.

Among the consumers in general group, the proportion was lower, at 72.9%.

Other than canceling plans, 76.1% of those who traveled overseas had changed vacation travel plans or expected trips because of the coronavirus outbreak, versus 56.1% for the consumers in general group. This group may have reported a lower rate of changes to plans because they did not have anything planned.

Out of the consumers in general group, only 15.1% had spent at least one night outside of Mainland China in the past 12 months.

Figure 3. Travelers vs. Consumers in General: Proportion that Canceled Planned Travel Because of Covid-19 (%) (Left) Proportion that Changed Planned Travel (%) (Right) [caption id="attachment_121199" align="aligncenter" width="725"]

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+

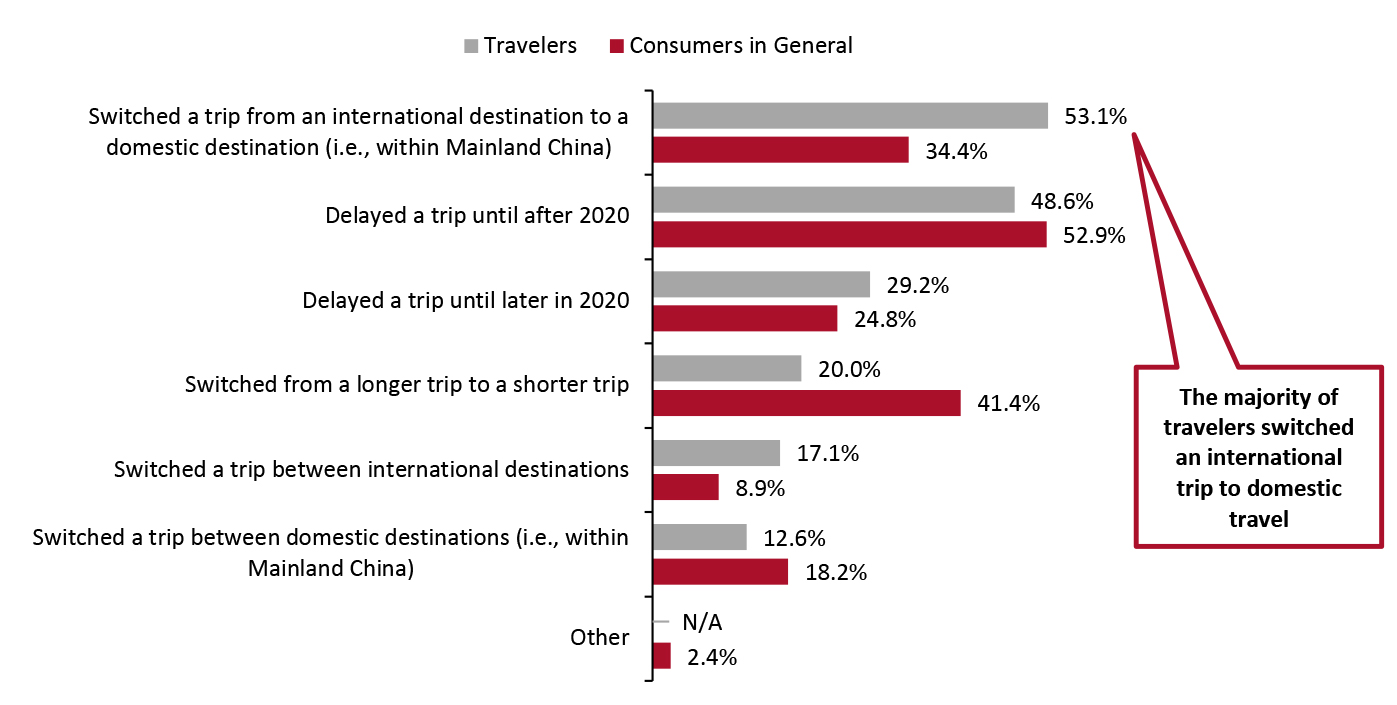

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+ Source: Coresight Research [/caption] Looking at the details of plan changes, the most selected option for those who traveled in the last 12 months was “switched a trip from an international destination to a domestic destination”—with some 53.1% having done so. For consumers in general, the most selected choice was “delayed a trip until after 2020,” with 52.9% having done so. Figure 4 outlines the responses for all approach options provided, with proportions for the two survey groups.

Figure 4. Travelers Who Have Changed Any Vacation Travel Plans vs. Consumers in General Who Have Changed Any Vacation Travel Plans: Approaches to Changing Travel Plans or Expected Trips (%) [caption id="attachment_121158" align="aligncenter" width="700"]

Base: 586 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months and had changed any vacation travel plans or expected trips; and 447 Internet users aged 18+ who changed any vacation travel plans or expected trips

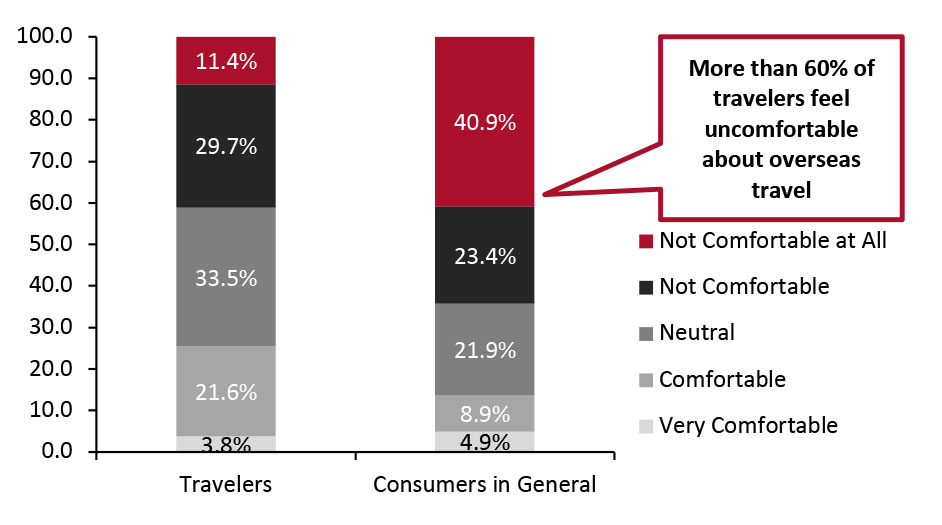

Base: 586 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months and had changed any vacation travel plans or expected trips; and 447 Internet users aged 18+ who changed any vacation travel plans or expected trips Source: Coresight Research [/caption] These findings indicate a significant decrease in outbound travel among Chinese tourists. International brands and retailers that usually sell to Chinese tourists who travel abroad should consider different sales methods, such as focusing on building a presence in China’s domestic market. Against the uncertain backdrop of travel restrictions for the rest of the year and into 2021, we asked respondents how comfortable they would be traveling overseas after restrictions are lifted. Of those who had traveled in the past 12 months, 25.3% reported that they feel either comfortable or very comfortable about traveling overseas following the relaxation of travel restrictions. If we include respondents feeling neutral about travel after restrictions are lifted, this proportion reaches 58.9%. This is significantly higher than 13.8% of the consumers in general group, possibly reflecting greater confidence in future travel overall among those who have taken a trip in the past year. The lower rates of feeling comfortable with international travel among consumers in general could limit the strength of any post-crisis bounce in tourism—as fewer new or occasional travelers are attracted to overseas trips. As we discuss later in the report, over 90% of respondents who expect to travel after September 2020 cite the severity of the pandemic as an important or very important factor when choosing a destination (with a majority saying that it is a very important factor).

Figure 5. Travelers vs. Consumers in General: Proportion That Feel Comfortable About Overseas Travel Once Restrictions Have Been Lifted (%) [caption id="attachment_121212" align="aligncenter" width="725"]

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+

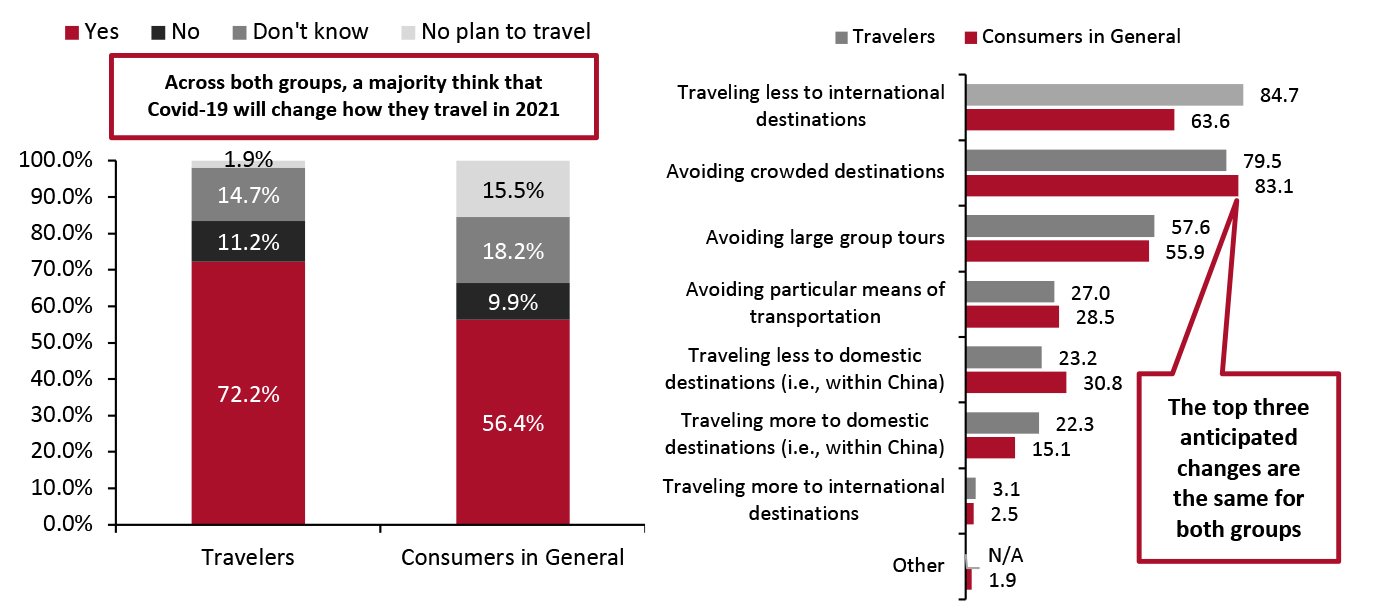

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+ Source: Coresight Research [/caption] · Future Travel We have seen Covid-19 greatly affect the tourism industry in 2020, with impacts likely to continue into 2021. Some 72.2% of Chinese travelers said that the pandemic will change how they travel after 2020, while the figure for consumers in general was 56.4%. Looking into the details about how respondents expect the pandemic to change their travel plans, some 84.7% of travelers said that they will travel less to international destinations—with avoiding crowded destinations coming in as the second option, accounting for 79.5%. This is slightly different for consumers in general, the most popular expectation for changing future travel plans was avoiding crowded destinations—accounting for 83.1%, followed by travel less to international destinations—with 63.6%. Traveling less to international destinations was among the top two options for both groups. These figures indicate significant decreases in Chinese tourists’ outbound travel into 2021. Brands and retailers that would otherwise have sold to Chinese tourists traveling abroad should think of different ways to sell, such as directing their efforts to serving demand within China.

Figure 6. Travelers vs. Consumers in General: Will Covid-19 Change How They Travel After 2020? (%) (Left). Those Who Expect Covid-19 Will Change Their Travel Plans Within the Travelers Group vs. Those Who Expect Covid-19 Will Change Their Travel Plans Within the Consumer in General Group: How the Coronavirus Outbreak May Change Travel Plans After 2020 (%) (Right) [caption id="attachment_121160" align="aligncenter" width="700"]

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+ (left) Base: 556 Internet users aged 18+ who have traveled in the past 12 months and think their travel plans will change after 2020; and 426 Internet users aged 18+ who think their travel plans will change after 2020 (right) Respondents could select more than one option.

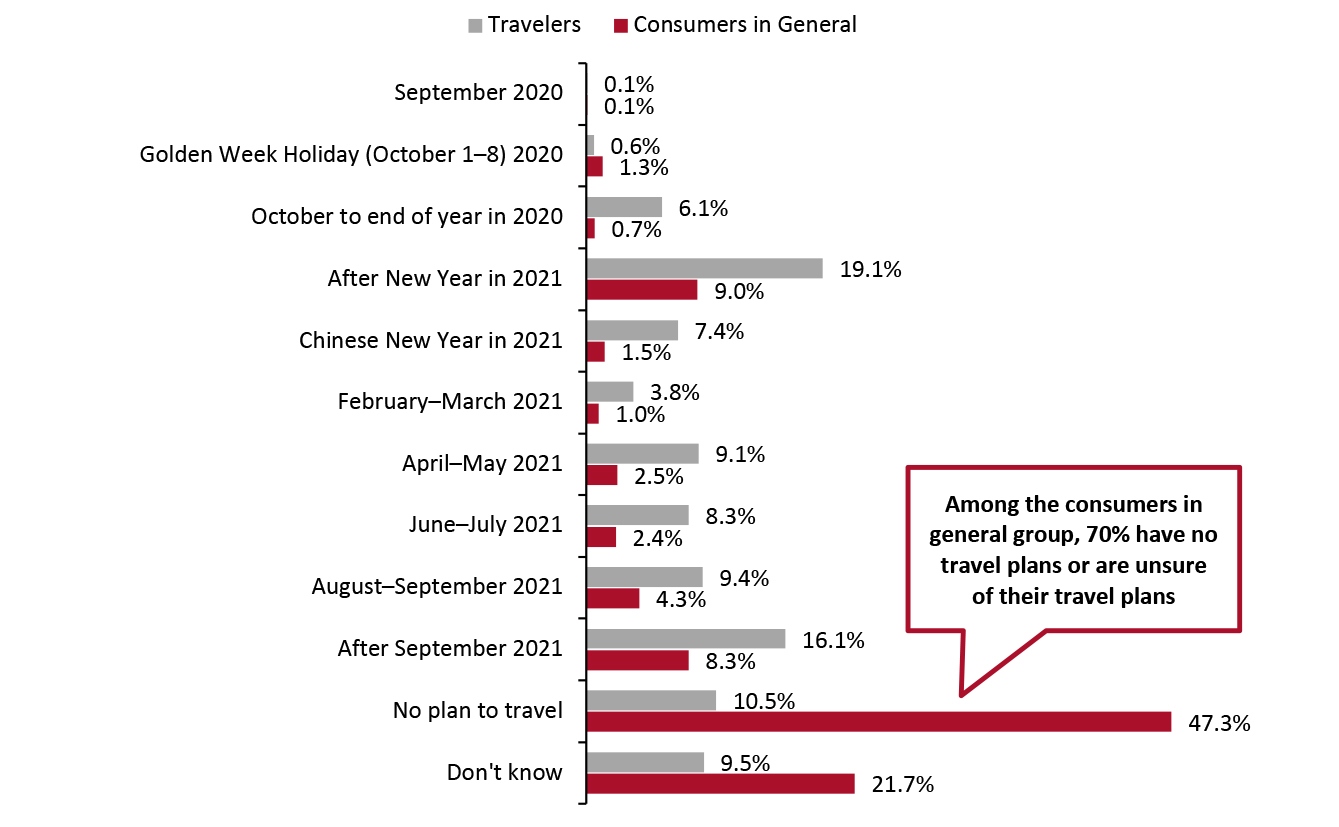

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+ (left) Base: 556 Internet users aged 18+ who have traveled in the past 12 months and think their travel plans will change after 2020; and 426 Internet users aged 18+ who think their travel plans will change after 2020 (right) Respondents could select more than one option. Source: Coresight Research [/caption] Although we have recorded a high percentage of Chinese tourists switching from international to domestic travel, we don’t expect all outbound tourists to maintain a sustained interest in domestic travel. Moreover, Chinese domestic tourism has not fully recovered yet, which indicates why traveling domestic less to domestic destinations was a more frequent option among respondents than traveling more to domestic destinations. Even if a net greater proportion of consumers expect to undertake less domestic travel than they used to, consumers will still be spending and shopping in the country in a context of reduced outbound travel. So, international brands should serve demand within China through the remainder of 2020 and into 2021, as purchases that would have been made overseas are redirected to domestic purchases—especially in categories that have hitherto overindexed on purchases abroad, which will be discussed later. · Future Travel: Destinations and Companions Reflecting a likely greater confidence in traveling overseas again, a larger proportion of those who have traveled in the past 12 months than consumers in general want to travel overseas (again) in the coming year. Around seven in ten (73.2%) from the traveler group said that they expect to travel from 2021. Among the consumers in general group, only three in 10 said that they will travel from 2021. As shown in Figure 7, the traveler group selected two time periods as when they most expect to begin traveling overseas:

- Some 19.1% plan to travel “after the New Year in 2021.”

- Some 16.1% will travel “after September 2021”.

- Around three in 10 said that they expect to travel at some point from 2021.

- The most common response among this group was “no travel plans at all” and “don’t know,” accounting for 47.3% and 21.7%, respectively.

- For the 8.3% who chose “after September 2021,” we expect respondents’ attitudes to fluctuate and imagine that it is unlikely that they will travel in 2021 as they would have chosen the detailed time frames given in the survey. Excluding those who expect to travel after September, around 20.7% expect to travel in 2021.

Figure 7. Travelers vs. Consumers in General: When Respondents Plan To Travel Overseas (%) [caption id="attachment_121161" align="aligncenter" width="725"]

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+

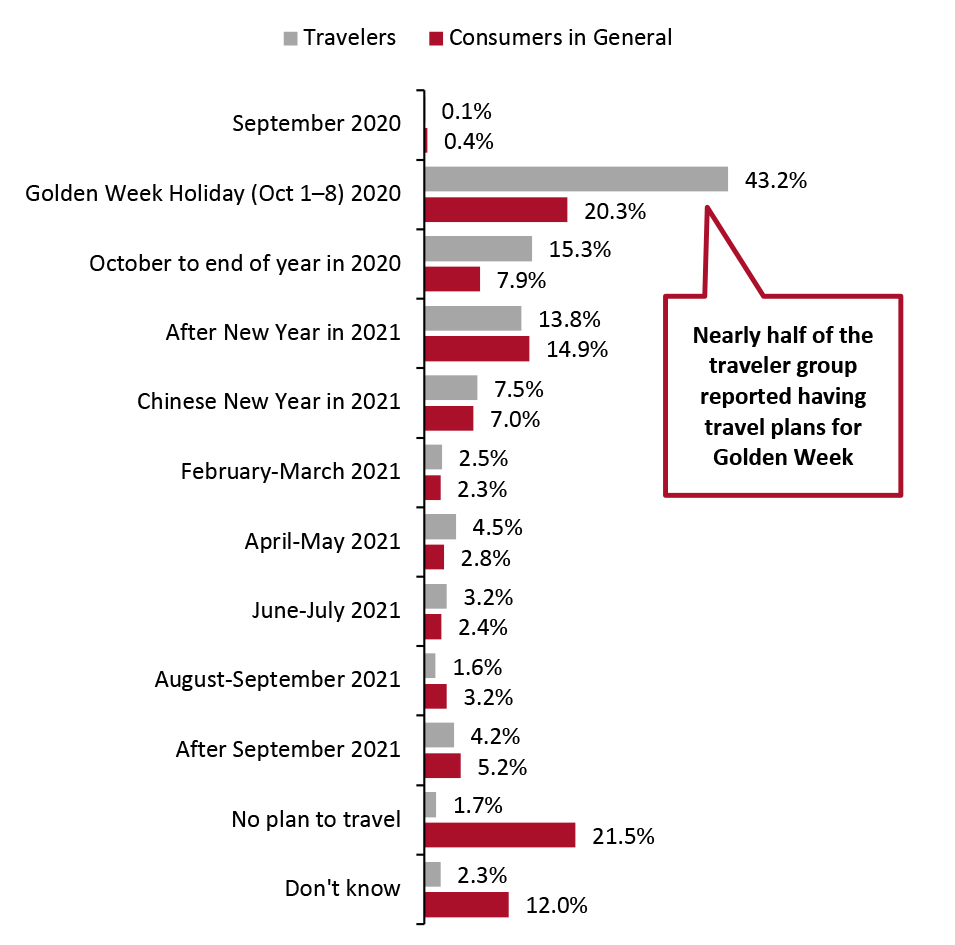

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+ Source: Coresight Research [/caption] Many Chinese tourists have turned to domestic travel for the remainder of 2020. As shown in Figure 8, some 43.2% of those who traveled overseas in the last 12 months chose to travel domestically during China’s National Day holiday, which is known as Golden Week and spans October 1 to 8. Some 15.3% reported that they had plans to travel within the country during the rest of the year after Golden week. In our consumers in general group, 33.5% said that they had no plans to travel or selected the “don’t know” option.

Figure 8. Travelers vs. Consumers in General: When Respondents Plan To Travel Domestically (%) [caption id="attachment_121162" align="aligncenter" width="725"]

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+

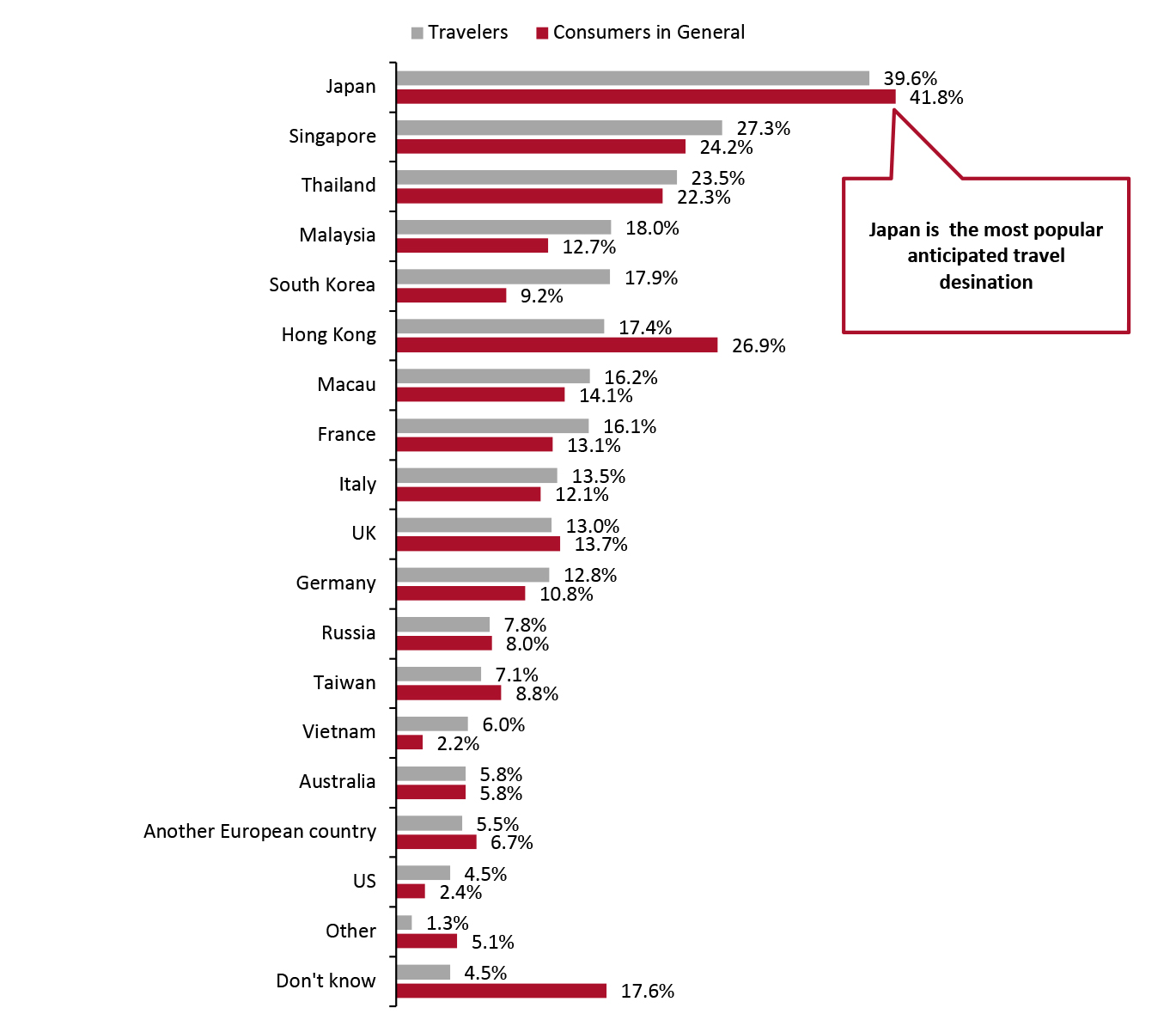

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months; and 750 Internet users aged 18+ Source: Coresight Research [/caption] Our survey indicates that Chinese tourists will look to short-distance overseas trips for their first post-Covid trip. Some 39.6% reported that they will travel to Japan, followed by 27.3% to Singapore and 23.5% to Thailand. Among those in the consumers in general group who expect to travel overseas at one of the time periods outlined in Figure 7, Japan, Hong Kong and Singapore are the top three destinations. Some 41.8% expect to travel to Japan, with 26.9% planning to visit Hong Kong and 24.2% planning to visit Singapore. Given the new wave of coronavirus cases in Hong Kong and Japan in November, it is not clear when China’s travel ban on these two destinations will be lifted.

Figure 9. Travelers Who Plan To Travel Overseas After September 2020 vs. Consumers in General Who Plan To Travel Overseas After September 2020: Destination Choices for Next Overseas Leisure Trips (%) [caption id="attachment_121163" align="aligncenter" width="700"]

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020

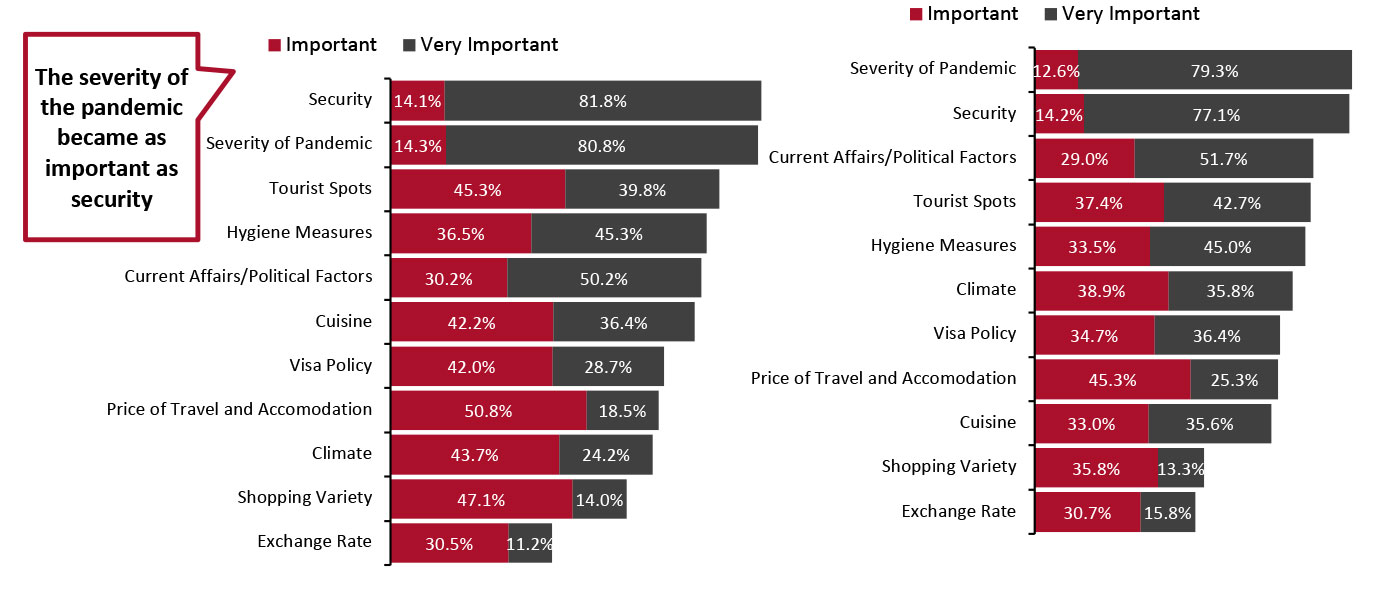

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020 Source: Coresight Research [/caption] · Major Factors in Deciding on a Destination Some 95.9% of travelers cited security as an important or very important, determining factor in deciding a destination, as shown in Figure 10. A close second in determining factors, 95.1% reported the severity of the pandemic as an important or very important factor in their decision on a travel destination. In our survey of consumers in general, 91.9% of those with plans to travel overseas after September 2020 cited the severity of the pandemic as important or very important, followed by security as the second determining factor (91.3%). A new determining factor option in our survey questions this year, the pandemic severity has become as important a decider as the security of the destination. We note that security, tourist spots and cuisine have ranked as the top three factors in deciding on a travel destination across our surveys in 2017, 2018 and 2019. For the traveler group in this year’s survey, security remained an important consideration—the year-over-year drop of one percentage point is not surprising given the current backdrop of coronavirus. Similarly, the tourist spots option was taken over by the severity of the pandemic as a determining factor, declining by seven percentage points compared to last year. The influence of cuisine on decision-making dropped by one percentage point as the newly added hygiene measures option was perceived to be more influential—as was the case for the current affairs/political factors option, which rose by 12 percentage points for the traveler group this year.

Figure 10. Travelers Who Plan To Travel Overseas After September 2020 (Left) vs. Consumers in General Who Plan To Travel Overseas After September 2020 (Right): Determining Factors in Deciding a Destination [caption id="attachment_121209" align="aligncenter" width="725"]

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020

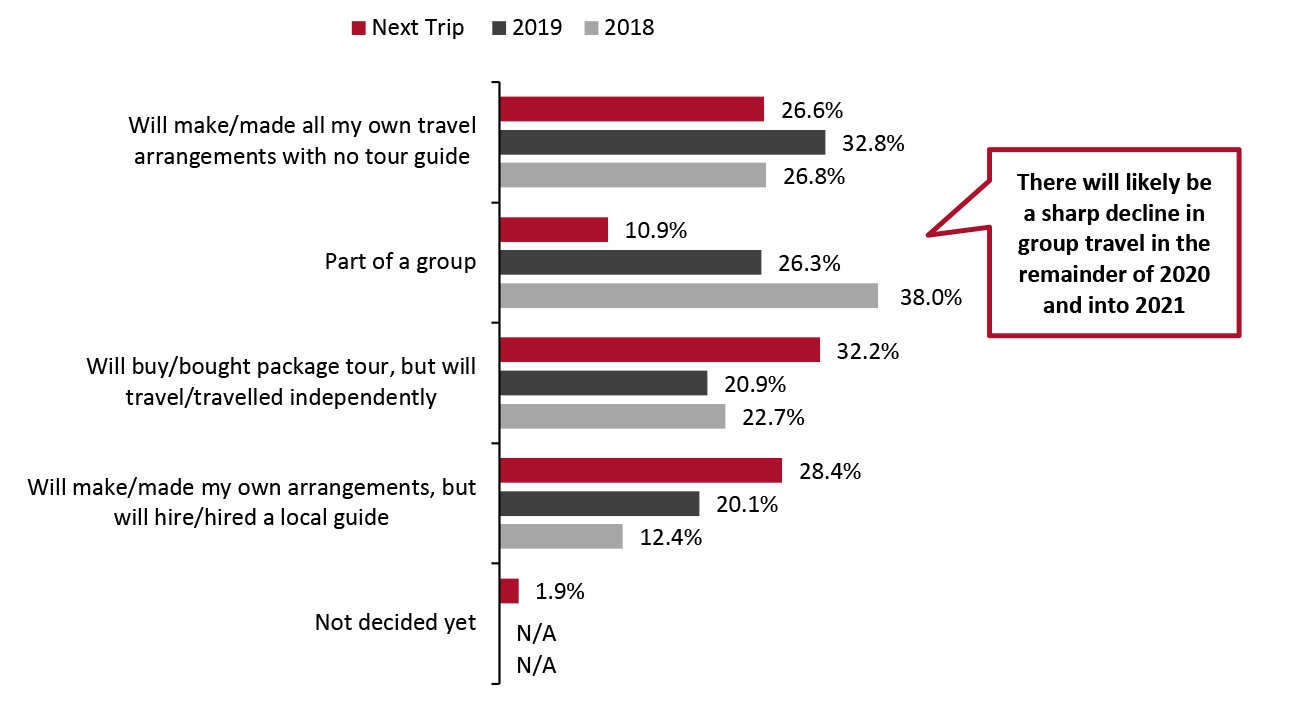

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020 Source: Coresight Research [/caption] · Decline in Group Travel Our survey recorded a sharp decline in Chinese tourists traveling in groups. The 10.9% of respondents who expect to travel in a group after September 2020 year represent a significant decline from the 26.3% that reported having actually done so on their most recent trip in our 2019 survey. This is in line with the expectations we outlined for domestic travel plans among Chinese tourists’ during the Golden Week National Holiday—as small-scale, private and personalized group travel packages gained traction. Reducing group sizes from over ten tourists per tour, many travel agencies in China are now promoting smaller travel groups with an average of three to five people. Small groups can also offer tourists more confidence in travel by reducing coronavirus contacts compared to large groups.

Figure 11. Travelers: Travel Arrangements for Past Trips (2018 and 2019 Surveys) and Next Trip (2020 Survey) (%) [caption id="attachment_121165" align="aligncenter" width="725"]

Base: Internet users aged 18+ who have taken a leisure trip outside Mainland China in the past 12 months (580 in 2020, 871 in 2019 and 853 in 2018)

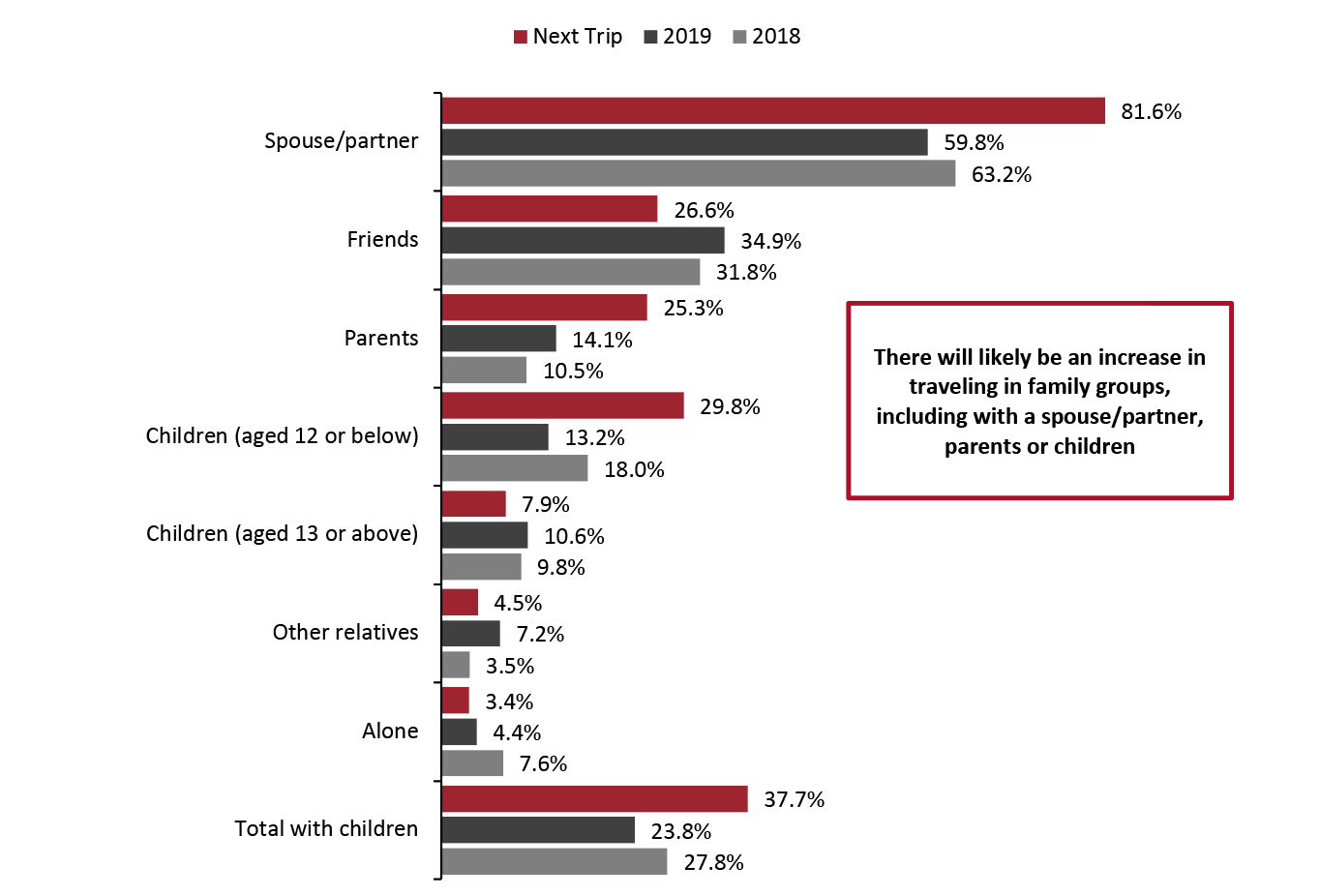

Base: Internet users aged 18+ who have taken a leisure trip outside Mainland China in the past 12 months (580 in 2020, 871 in 2019 and 853 in 2018) Source: Coresight Research [/caption] · Growth in Family Trips Our survey suggests that there will be an increase in the number of respondents traveling in family groups with a spouse/partner and children, on future overseas trips. Around eight in 10 expect to travel with a spouse—up from 59.8% that actually did so when we surveyed in 2019. Some 29.8% expect to travel with children (aged 12 or below)—up from 13.2% that actually did so when we surveyed in 2019. As tourists expect to travel in family groups, tour agencies can organize and promote family tours to meet the change in demand. According to Alitrip, the online travel platform owned by Alibaba Group, family tours were a new theme of the National Day holiday this year.

Figure 12. Travelers: Travel Companions on Past Trips (2018 and 2019 Surveys) and Next Trip (2020 Survey) (%) [caption id="attachment_121166" align="aligncenter" width="700"]

Base: Internet users aged 18+ who have taken a leisure trip outside Mainland China in the past 12 months (580 in 2020, 871 in 2019 and 853 in 2018)

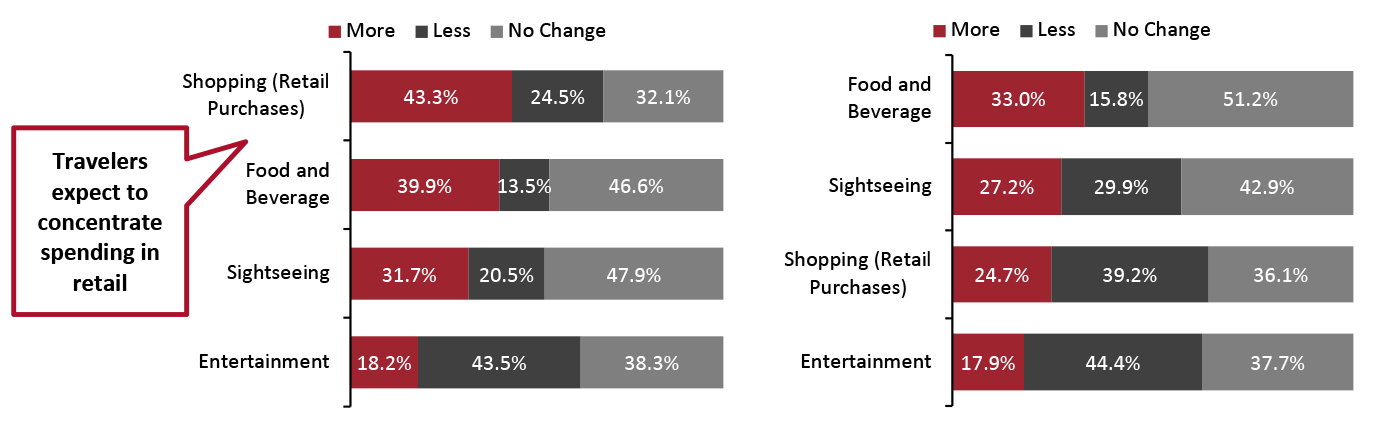

Base: Internet users aged 18+ who have taken a leisure trip outside Mainland China in the past 12 months (580 in 2020, 871 in 2019 and 853 in 2018) Source: Coresight Research [/caption] Spending and Shopping on Future Trips · Retail and Services Some 43.4% of those who have traveled in the last 12 months and plan to travel overseas after September 2020, expect to spend more in retail stores during their next trip versus their previous overseas trip, compared to 32.1% that expect to spend the same and 24.5% that expect to spend less. In comparison, in our consumers in general group, only 24.7% expect to increase their in-store retail spending on their next trip, with some 39.2% reporting that they expect to spend less in retail compared to their most recent overseas trip. Compared to their most recent overseas trip, some 46.6% of Chinese travelers expect to spend the same amount on food and beverage services, while 39.9% will increase their spending. Similarly, in our consumers in general survey, some 51.2% expect to spend the same amount in food and beverage services, while 33.0% will increase their spending. As food services likely face more challenges than retail in providing a safe consumer environment, we expect that recovery in this industry to be prolonged. More respondents expect to cut their spending in entertainment, such as concert or amusement park tickets) compared to those who plan to increase spending. Some 43.5% of the traveler group said that they will cut entertainment spending, versus 18.2% that expect to increase their spending. Whereas in the consumers in general group, some 37.7% expect to spend the same, and 44.4% expect to spend less. As tourists avoid visiting crowded places, entertainment companies can consider shifting their services online rather than face severely reduced traffic or closure. For instance, in March international art fair Art Basel canceled its physical exhibition in Hong Kong and moved to an online platform for the first time. Exhibition partners, such as Gagosian, Hauser & Wirth, and Zwirner Gallery sold works worth several millions in Hong Kong dollarsin just two days.

Figure 13. Travelers Who Plan To Travel Overseas After September 2020 (Left) vs. Consumers in General Who Plan To Travel Overseas After September 2020 (Right): Spending Expectations for Activities on Next Overseas Trip (%) [caption id="attachment_121167" align="aligncenter" width="725"]

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020

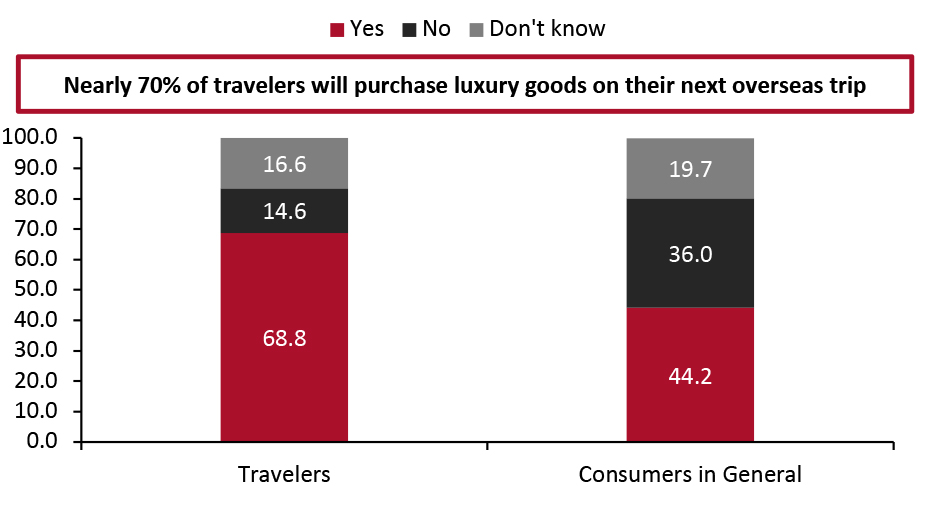

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020 Source: Coresight Research [/caption] · Luxury Goods Some 68.8%, or around seven in 10, of those who have traveled in the last 12 months and plan to travel overseas after September 2020, expect to buy luxury goods during their next trip, versus 14.6% that do not. Among those who expect to travel overseas in our consumers in general group, 44.2% expect to purchase luxury goods, compared to 36.0% that do not plan to. Chinese tourists’ desire for luxury goods is also reflected in growing retail sales in the domestic market given international travel restrictions.

Figure 14. Travelers Who Plan To Travel Overseas After September 2020 (Left) vs. Consumers in General Who Plan To Travel Overseas After September 2020 (Right): Proportion That Plan To Purchase Luxury Goods on Their Next Overseas Trip (%) [caption id="attachment_121168" align="aligncenter" width="725"]

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020

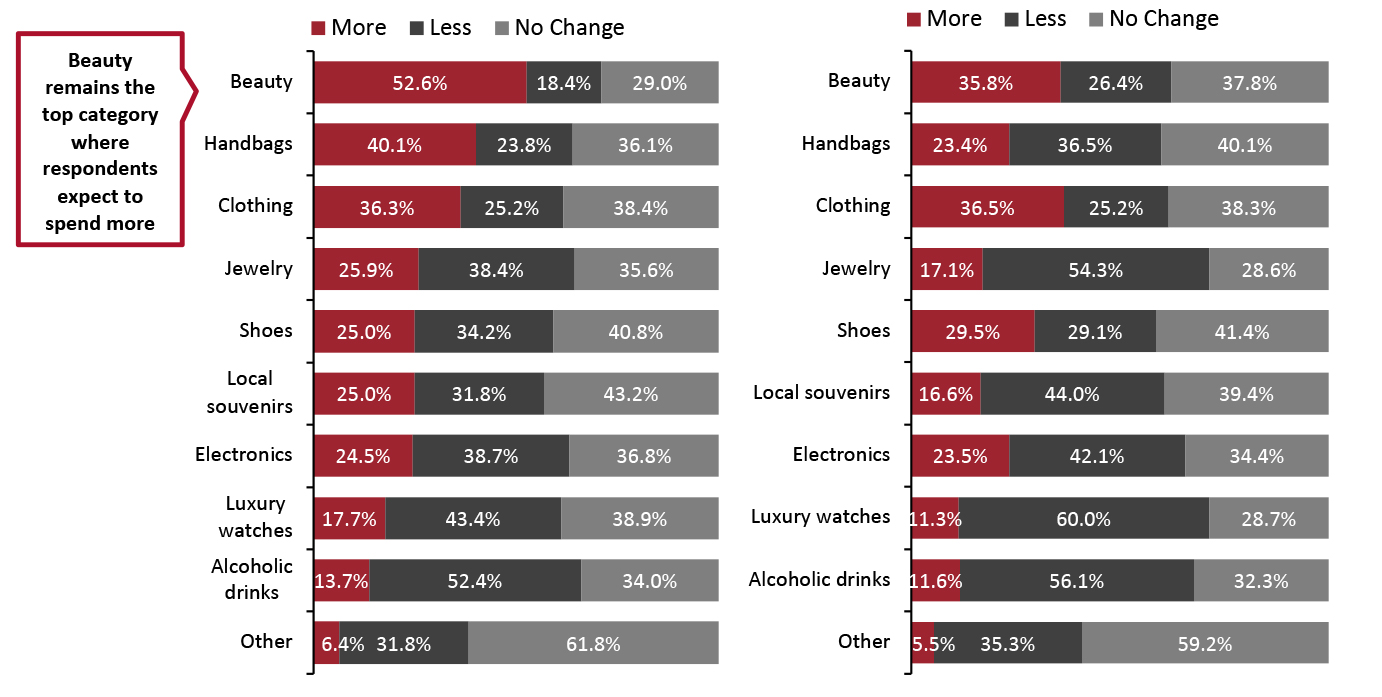

Base: 616 Internet users aged 18+ who have traveled in the past 12 months and plan to travel overseas after September 2020; and 266 Internet users aged 18+ who plan to travel overseas after September 2020 Source: Coresight Research [/caption] Chinese tourists’ luxury spending plans suggest buoyancy in the beauty category for luxury brands. We expect the beauty category to perform strongly, with a lead of 13 percentage points over handbags in terms of spending expectations for next trips overseas among those who have traveled in the last 12 months and plan to travel overseas after September 2020. With the current restrictions on outbound travel, we saw growing sales in international beauty brands within China’s domestic market. Retail sales grew by 18.3% year over year in October, an increase compared to 12.6% growth in 2019, according to the National Bureau of Statistics in China. In aggregate, respondents indicated an intention to cut back on overseas purchases of electronics and watches: Around seven in 10 expect to spend less on such items, while only 24.5% expect to spend more on electronics and 17.7% expect to spend more on watches compared to their last overseas trip. We also asked respondents who had taken a trip outside of Mainland China in the 12 months prior to completing the survey what luxury goods they expect to buy within China.

- Some 36.5% of these expect to spend more in clothing, and 29.5% expect to spend more on shoes during trips taken within China. These figures are higher than overseas spending expectations: Some 36.3% of respondents who have traveled in the past 12 months and plan to buy luxury products on their next overseas trip, expect to spend more on clothing and 25.0% expect to spend more on shoes compared to their most recent previous trip.

- Overseas trips have long been an opportunity for luxury spending by Chinese consumers. As travel slumps and remains depressed in the medium term, we expect large volumes of luxury spend to be redirected to domestic consumption, including through online channels.

- Beauty overindexes on overseas purchases versus in-country purchases: The category comes in top in terms of expected higher overseas spending but falls to second place in terms of expected higher domestic spending.

- As with overseas purchases, many more survey respondents reported that they expect to spend less on watches and alcoholic drinks during trips taken within China.

Figure 15. Travelers That Expect To Buy Luxury Products on Their Next Overseas Trip: Spending Expectations (Left); and Travelers: Spending Expectations for Their Next Trip in Mainland China (Right) (% of Respondents) [caption id="attachment_121169" align="aligncenter" width="725"]

Totals may not sum due to rounding

Totals may not sum due to rounding Base: 424 Internet users aged 18+ who have traveled in the past 12 months and will buy luxury products in their next overseas trip (left); and 770 Internet users aged 18+ who have traveled in the past 12 months (right)

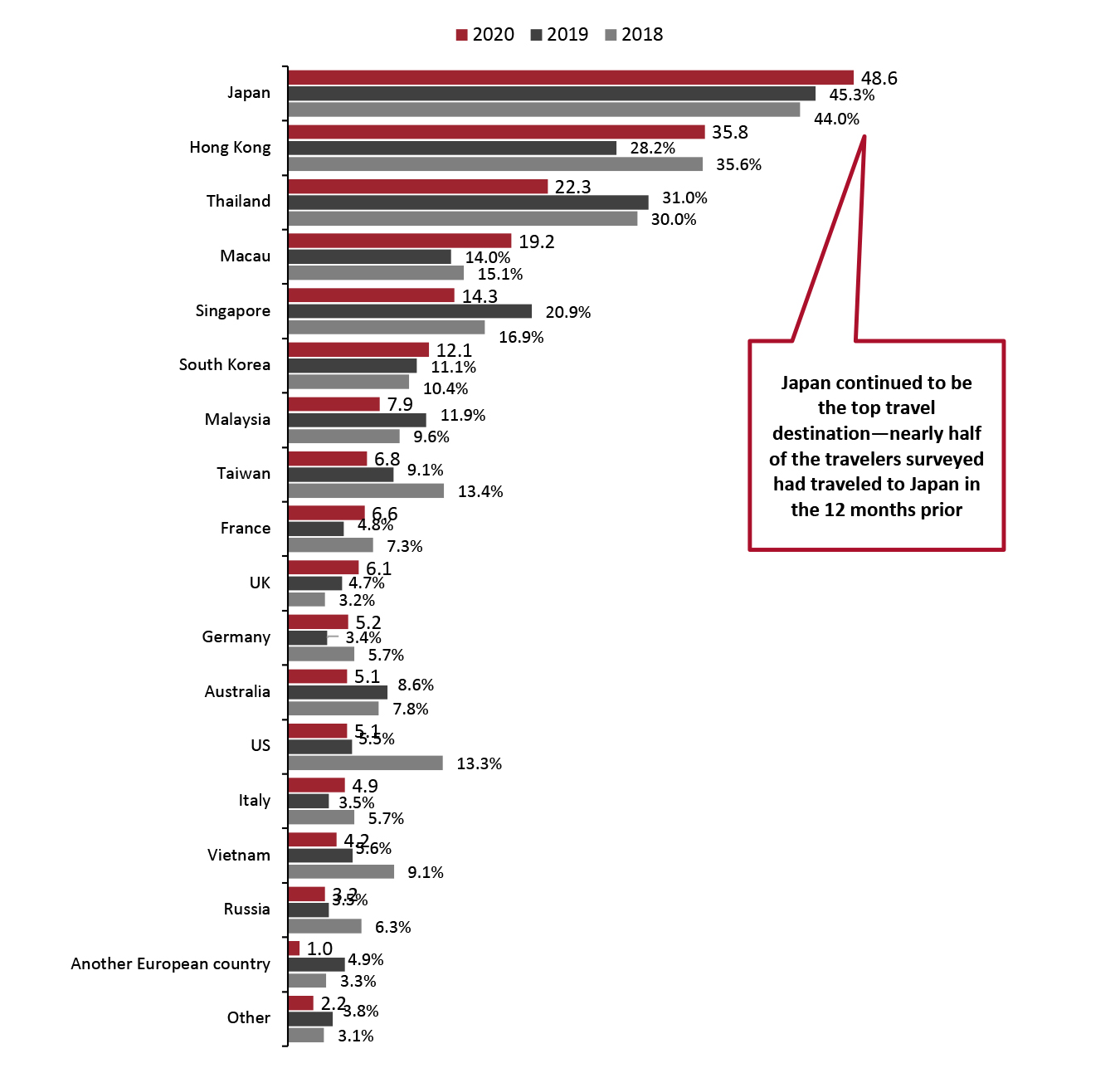

Source: Coresight Research [/caption] Looking Back on Recent Trips · Destinations Japan was the top destination in the past 12 months, with 48.6% of respondents in the travelers group reporting having visited the country. The popularity of the destination among respondents has continually increased, from 45.3% of respondents reporting traveling to Japan in our 2019 survey and 44.0% in our 2018 survey.

Figure 16. Travelers: Proportion That Visited Selected Overseas Destinations in the Past 12 Months (%) [caption id="attachment_121170" align="aligncenter" width="700"]

Base: Internet users ages aged 18+ who have taken a trip outside Mainland China in the past 12 months (770 in 2020, 900 in 2019 and 895 in 2018)

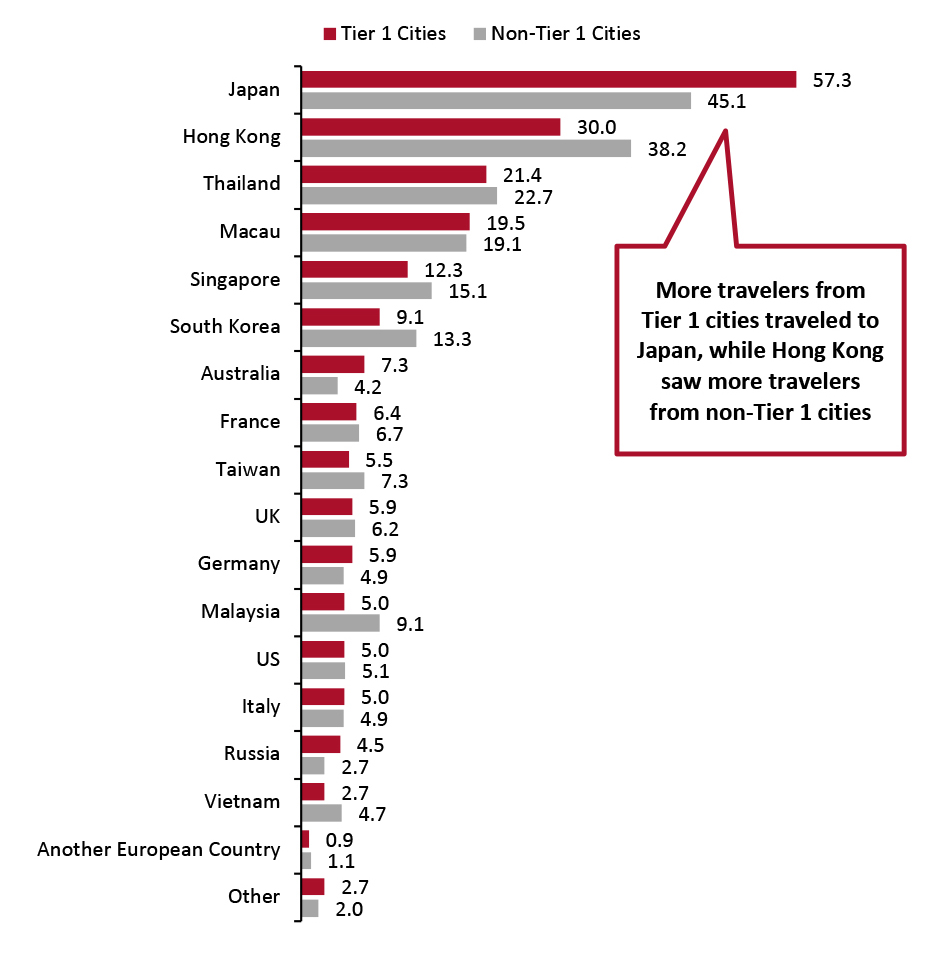

Base: Internet users ages aged 18+ who have taken a trip outside Mainland China in the past 12 months (770 in 2020, 900 in 2019 and 895 in 2018) Source: Coresight Research [/caption] A larger proportion of travelers from Tier 1 cities (57.3%) traveled to Japan, versus those from non-Tier 1 cities (45.1%) in the past 12 months, as shown in Figure 17. In comparison, a larger proportion of travelers from non-Tier 1 cities (38.2%) visited Hong Kong, versus 30.0% of travelers from Tier 1 cities in the past 12 months. Our 2019 survey also showed a similar trend. We expect that this is partly due to the availability of direct flights from Tier 1 cities to Japan, which are usually offered at lower costs than flights from non-Tier 1 cities. Hong Kong may be a more convenient choice for non-Tier 1 cities due to the high-speed train links.

Figure 17. Travelers: Proportion That Visited Selected Overseas Destinations in the Past 12 Months, by Home City Tier (%) [caption id="attachment_121177" align="aligncenter" width="725"]

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months

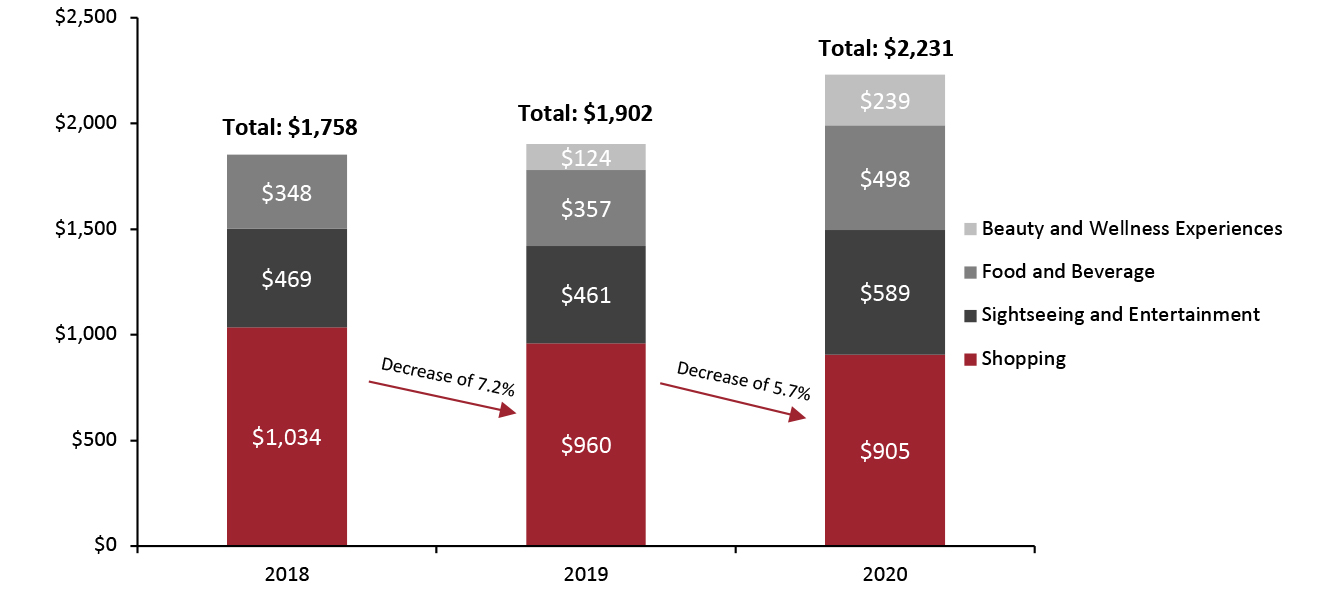

Base: 770 Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months Source: Coresight Research [/caption] · Spending We estimate the average spend per Chinese outbound tourist in 2020 to be $2,231, an increase of 17.3% from $1,902 last year. We calculated the 2020 estimate using the average exchange rate for the period September 1, 2019 to August 31, 2020, as we did for the 2019 survey respectively. The jump in spending is likely partly due to the increasing disposable income of urban residents in 2019, which grew by 7.9% year over year to ¥42,359 ($60,235), according to China’s National Bureau of Statistics. A major finding from our survey is that Chinese tourists continued to cut their average shopping spend per trip—by an estimated 5.7% in 2020 compared to an average 2.3% cut in 2019. The average spending amount in beauty and wellness experiences, food service, and sightseeing and entertainment all increased.

Figure 18. Travelers: Average Spend per Traveler on Their Most Recent Trip (USD at Annual Exchange Rates) [caption id="attachment_121172" align="aligncenter" width="700"]

For 2018, we used the average exchange rate for the period September 1, 2017–August 31, 2018. For 2019, we used the average exchange rate for the period September 1, 2018–August 31, 2019. For 2020, we used the average exchange rate for the period September 1, 2019–August 31, 2020. The Beauty and Wellness Experiences category was added as an option in the 2019 survey.

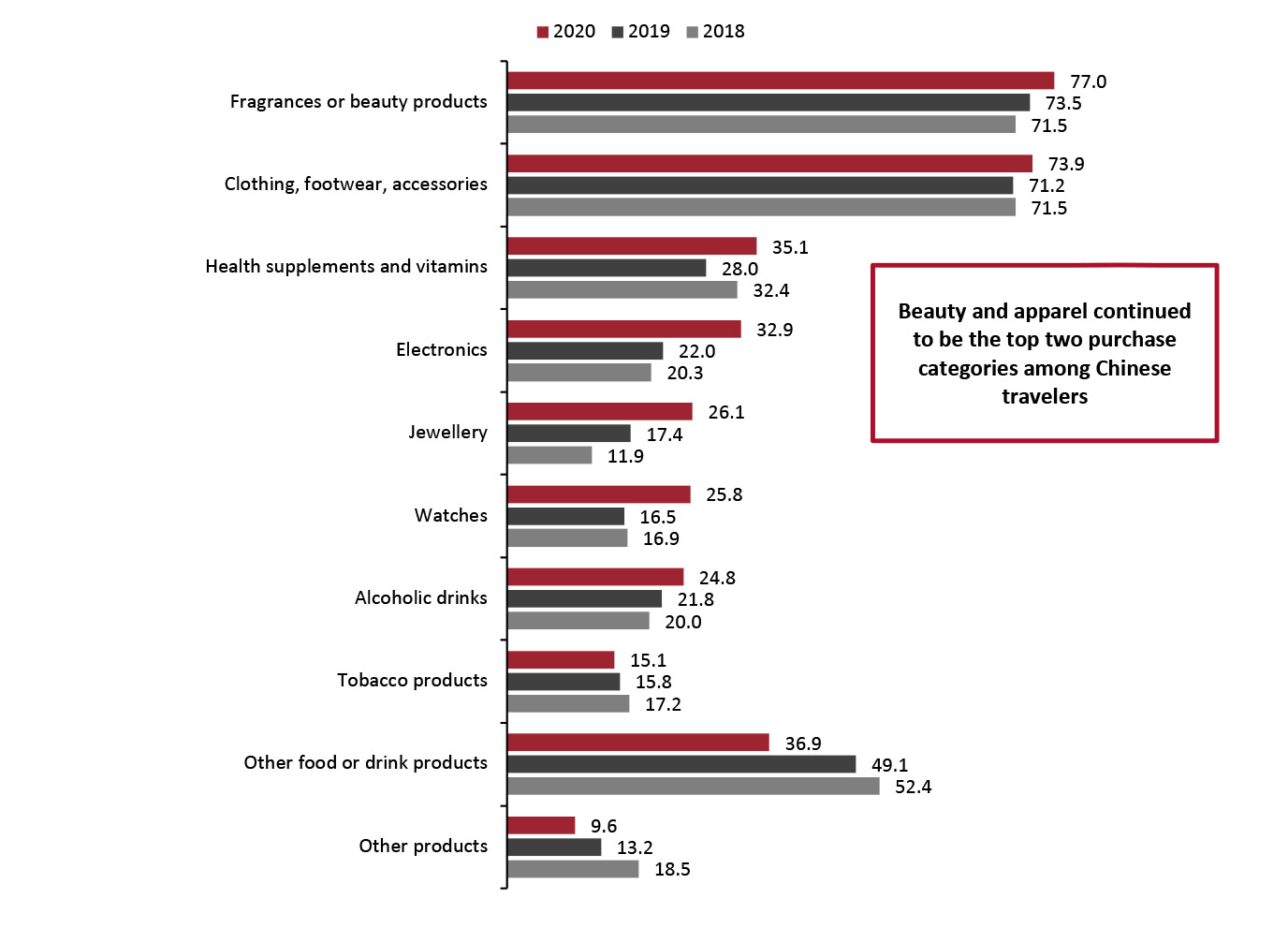

For 2018, we used the average exchange rate for the period September 1, 2017–August 31, 2018. For 2019, we used the average exchange rate for the period September 1, 2018–August 31, 2019. For 2020, we used the average exchange rate for the period September 1, 2019–August 31, 2020. The Beauty and Wellness Experiences category was added as an option in the 2019 survey. Source: Coresight Research [/caption] · Retail Purchases: Popular Categories An increasing number of tourists who traveled overseas in the last 12 months bought beauty and apparel products. Some 77.0% and 73.9% of respondents bought beauty and apparel items respectively in the past 12 months, versus 73.5% and 71.2% in our 2019 survey. The strength of beauty products among Chinese tourists was prominent in their recent overseas trips. But as we have discussed, spending is likely to partly shift to domestic due to reduced outbound travel.

Figure 19. Travelers: Purchase Categories from Their Most Recent Trip (%) [caption id="attachment_121198" align="aligncenter" width="725"]

Base: Internet users aged 18+ who took a trip outside Mainland China in the past 12 months (770 in 2020, 900 in 2019, and 895 in 2018)

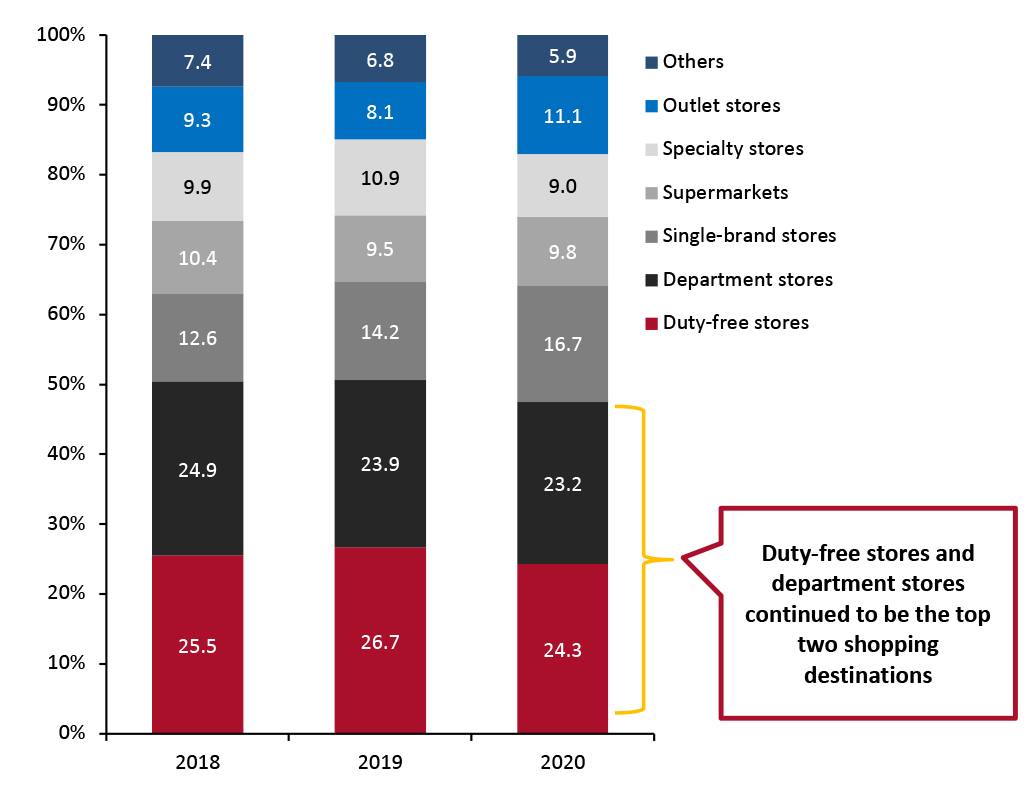

Base: Internet users aged 18+ who took a trip outside Mainland China in the past 12 months (770 in 2020, 900 in 2019, and 895 in 2018) Source: Coresight Research [/caption] Respondents from our travelers group indicated a preference for purchasing products at duty-free shops and shopping centers compared to other store formats—with 24.3% and 23.2% of respondents selected this as their preferred choice, respectively. These figures mark a slight decrease from our 2019 survey, which returned results of 26.7% and 23.9%, respectively. Duty-free shops have been a favorite among consumers for their tax exemptions—with shopping center formats usually offering a wide range of choice and a comfortable shopping environment. The decline of the department store is a trend common to many international markets and it appears to be reflected in visits among Chinese travelers’ visits, too: we have seen this format’s share of tourists’ retail purchases decline in each of our surveys over the past two years.

Figure 20. Chinese Travelers: Estimated Distribution of Retail Spending by Store Format on Their Most Recent Trip (%) [caption id="attachment_121175" align="aligncenter" width="725"]

Totals may not sum due to rounding B

Totals may not sum due to rounding Base: Internet users aged 18+ who have taken a trip outside Mainland China in the past 12 months (770 in 2020, 900 in 2019 and 895 in 2018)

Source: Coresight Research [/caption]

What We Think

Our survey provides detailed insights into the effects of the pandemic on outbound tourism from China.- In the short term, only one-quarter of travelers said that they feel either comfortable or very comfortable about traveling overseas after travel restrictions have been lifted. If we include respondents who feel neutral about overseas travel after restrictions are lifted, that total rises to 58.9%—still a long way off assuring a strong post-crisis recovery in outbound travel from China.

- Potentially impacting the medium term, fully 72.2% of Chinese travelers expect Covid-19 to change how they travel and, of that group, 84.7% expect to travel less to international destinations and 79.5% expect to avoid crowded destinations. So, even once consumers feel confident enough to take a trip, the volume of journeys and the destinations are likely to be affected.

- Yet, demand is there for some international travel—even if it trips are likely to be less frequent more likely to be to short-haul destinations than before the crisis. Our survey found that 73.2% of travelers expect to travel from 2021, with 16.1% reporting that they expect the travel to be after September 2021.

- Chinese tourists’ luxury spending plans suggest buoyancy in the beauty category. Some 52.6% of respondents who expect to buy luxury products on their next overseas trip said that they will spend more on beauty products. Moreover, some 77.0% of those who traveled overseas in the last 12 months bought beauty products. Beauty retailers globally should leverage this opportunity and prepare to meet such demand.

- As we are likely to see depressed rates of international travel for the remainder of 2020 and into 2021, there is an opportunity for international brands and retailers in the domestic market. Respondents in our survey said that they expect to buy more clothing, beauty and shoes in China. Some 36.5% of those who traveled overseas in the last 12 months reported that they expect to buy more apparel, and some 29.5% expect to buy shoes. Brands that would otherwise have sold to Chinese tourists traveling abroad should direct their efforts to serving demand within China. Retailers with an existing Chinese presence should attempt to capture sales of products that consumers would likely have purchased overseas.

- E-commerce presents a greater opportunity than ever in China. While the coronavirus crisis has accelerated structural shifts to e-commerce, it is also redirecting shopping that would have taken place on overseas trips by Chinese travelers to domestic purchases. Through the rest of 2020 and into 2021, we expect this to boost domestic online demand for alcohol, beauty, clothing, footwear, electronics and jewelry—highly popular categories for overseas shopping.

- Specifically, brands and retailers can join Chinese shopping festivals to sell to Chinese consumers.Upcoming festivals and holidays include Christmas, Chinese New Year and International Women’s Day.

- Short-distance and family trips may become the new features of post-Covid overseas travel. Destinations near China may see a greater chance of gaining Chinese tourists. As respondents indicated intentions to travel in family groups, brands and merchants can try to provide facilities that cater for all age ranges to improve customer satisfaction.

- Tourists may prefer contactless shopping experiences as they try to limit exposure to Covid-19 on their travels. Brands and merchants can provide contactless services in stores, such as virtual dressing rooms. In addition, they can also offer delivery services and send purchases to tourists’ accommodation.