Web Developers

Introduction

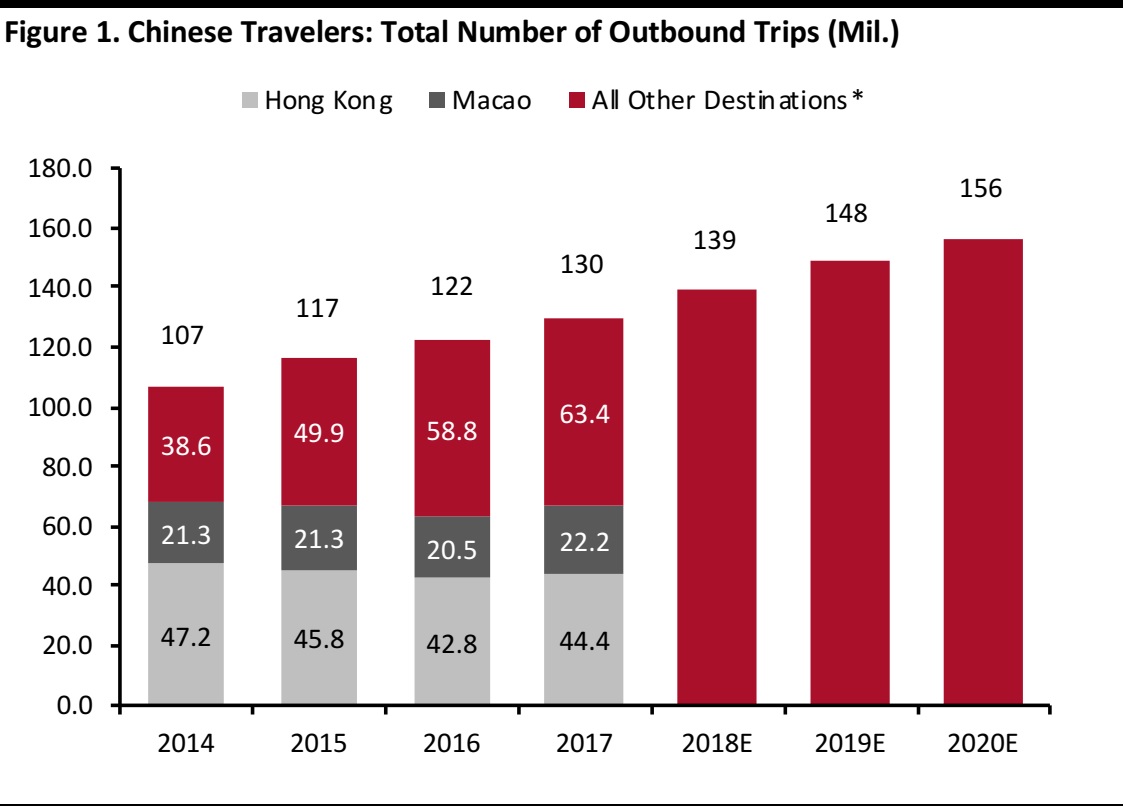

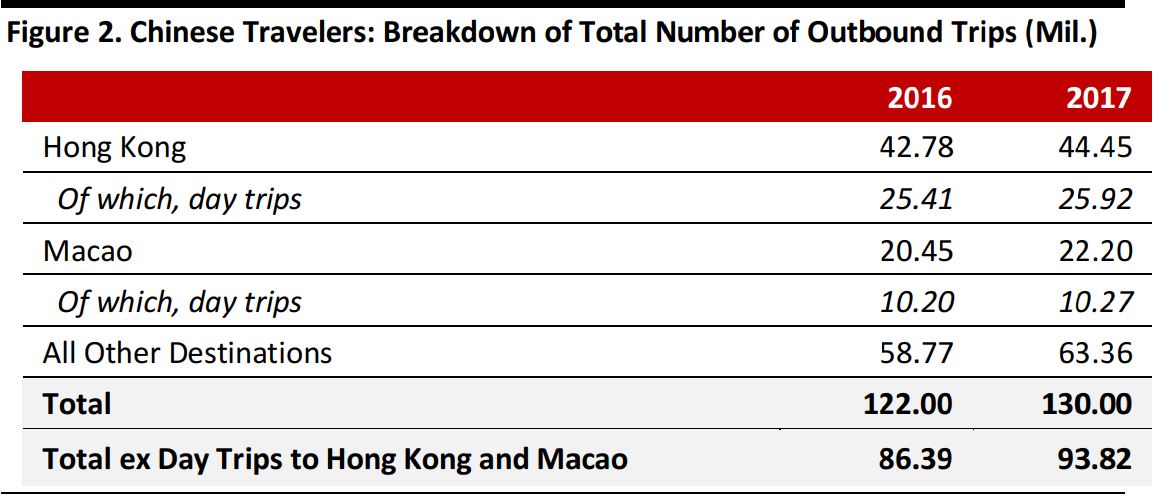

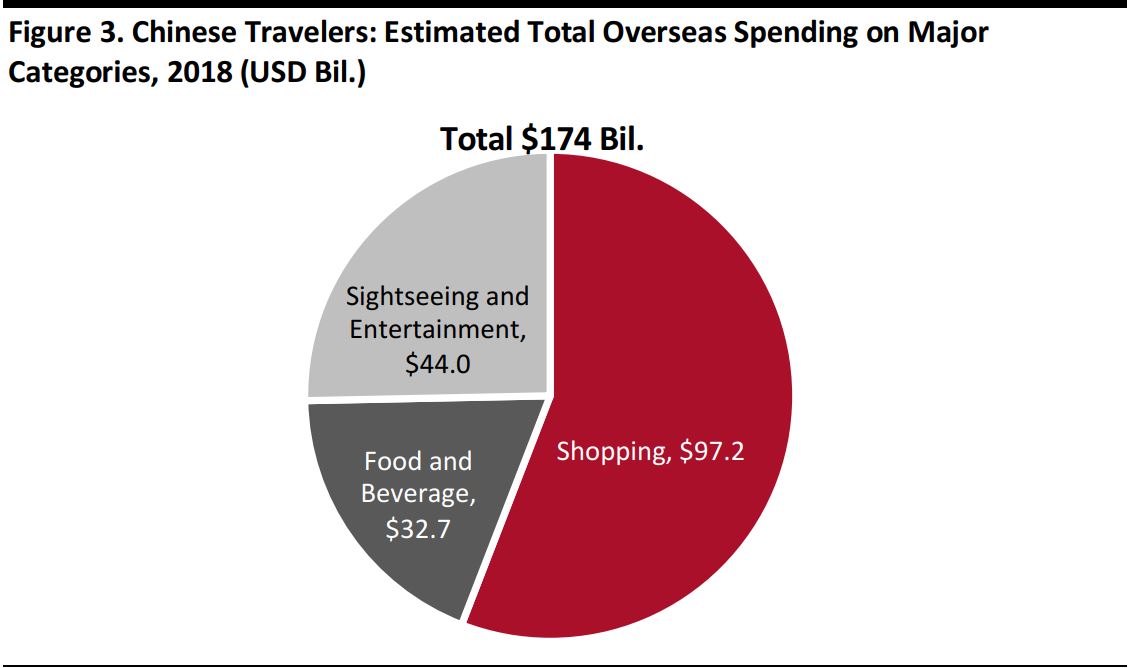

For at least the past decade, China’s tourists have been pouring into shops worldwide and pumping hundreds of billions of dollars through retailers’ and service providers’ cash registers. But there are signs that Chinese travelers’ appetite for spending, and particularly for spending on retail purchases, may have peaked. Our fourth annual survey of Chinese outbound tourists,undertaken in partnership with China Luxury Advisors, reveals a sharp slowdown in spending per trip—with retail purchases bearing the brunt of the decline—even as continued growth in the number of outbound trips is supporting total overseas spending. Chinese tourists made 130 million outbound trips last year, a 7% increase year over year, according to Ctrip and the China National Tourism Administration (CNTA)—although that total falls to 94 million once we exclude day trips to Hong Kong and Macao. If we strip out those day trips, our data suggest that Chinese tourists spent a total of $174 billion (¥1,131 billion)across shopping, food and beverage purchases, and sightseeing and entertainment in overseas markets in the 12 months ended June 2018.This compares with an estimated $195 billion (¥1,268 billion) in the prior 12-month period, and our latest survey found that spending per trip declined meaningfully versus the prior year. In this report, we wrap up the results of our in-depth, July 2018 survey of Chinese outbound travelers, which asked respondents about these and other topics:- How many trips they took in the past year and which countries they visited.

- What products they bought at retail, what types of stores they shopped and what services were important to them when choosing among retailers.

- How much they spent on shopping, food and beverages, and sightseeing and entertainment on their most recent trip abroad.

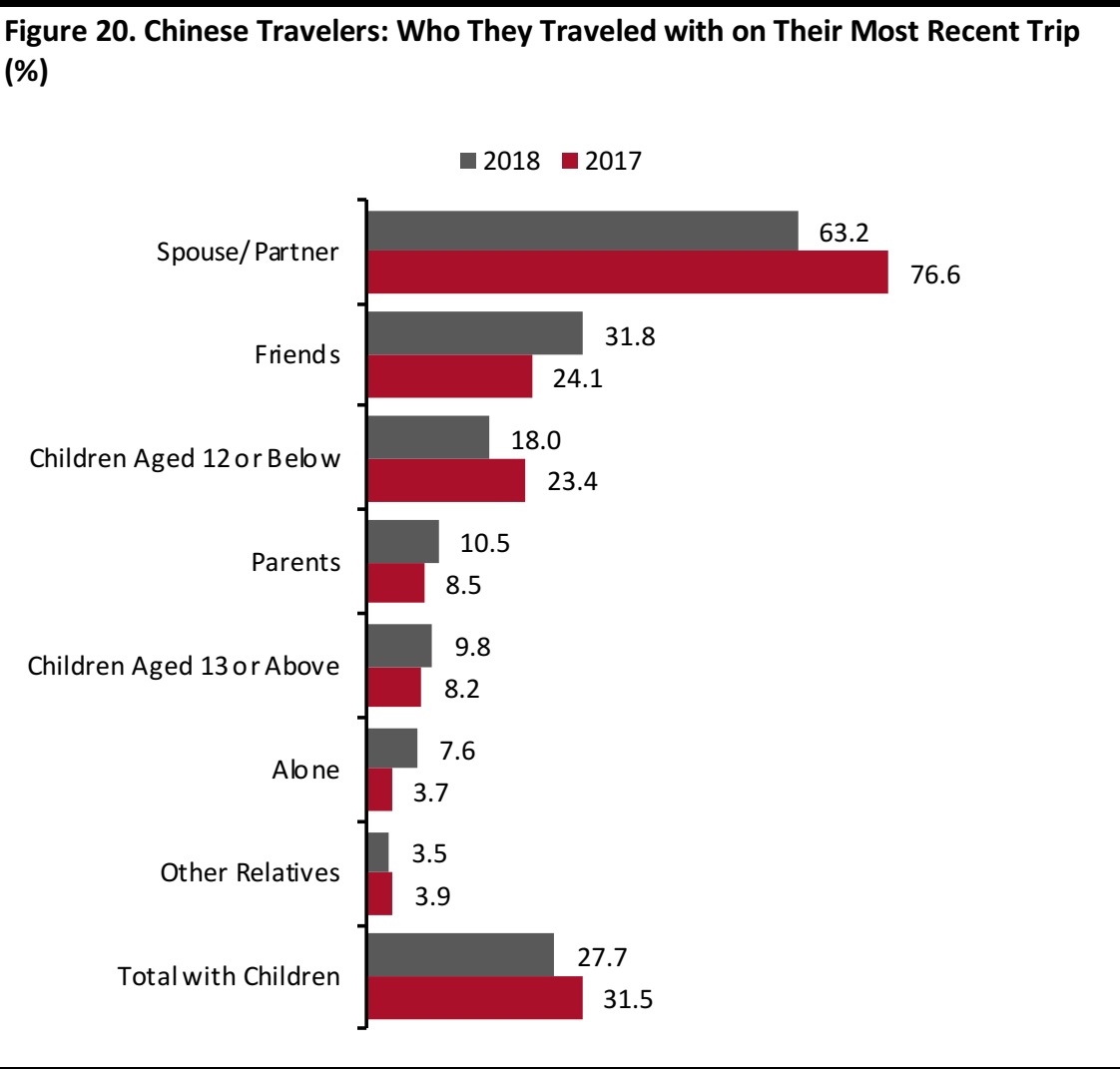

- Who they traveled with, what kind of trip they booked (e.g., group versus independent) and what factors were important to them when choosing a destination.

- Their plans for purchasing luxury goods overseas and domestically in the coming months.

- How they used their smartphone and what they used the WeChat app for on their latest overseas trip.

Survey Methodology

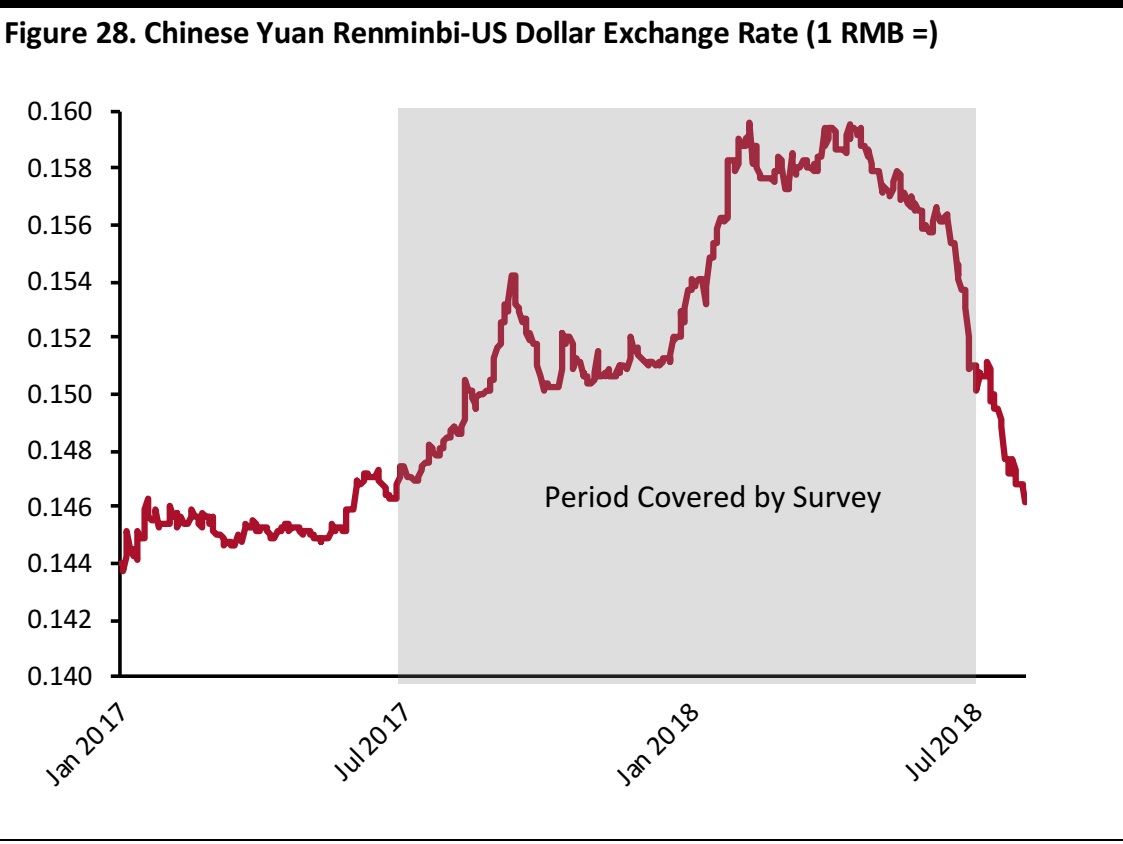

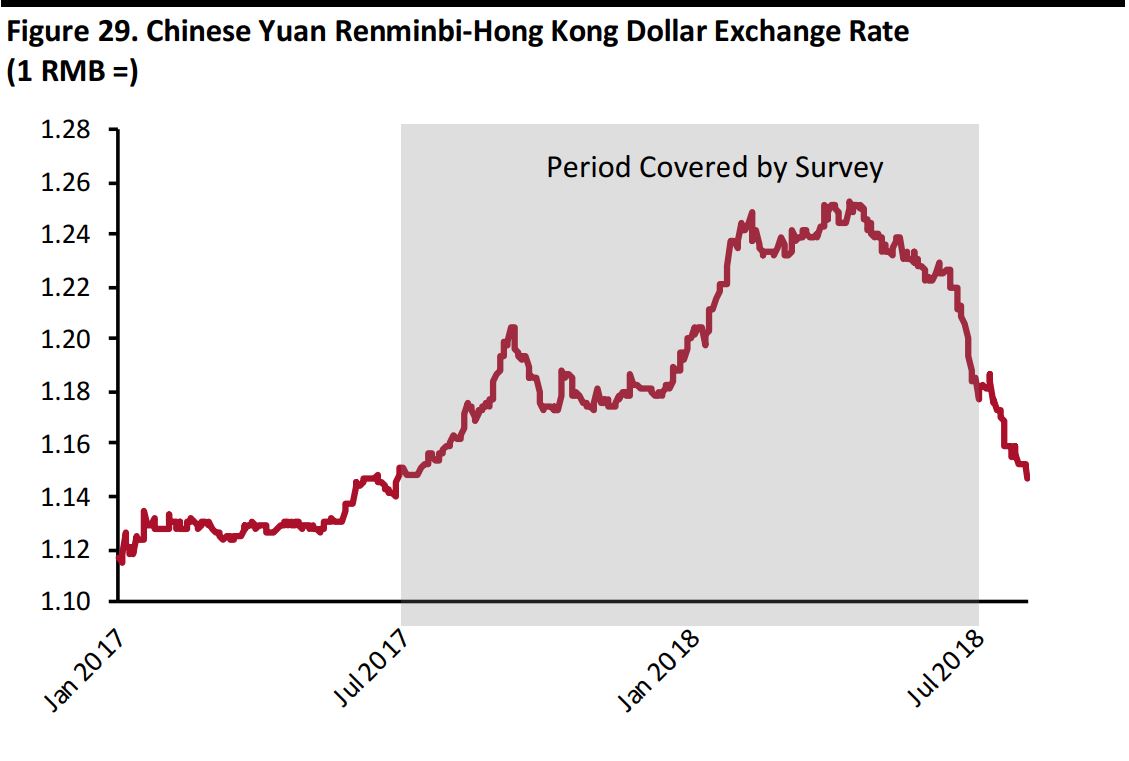

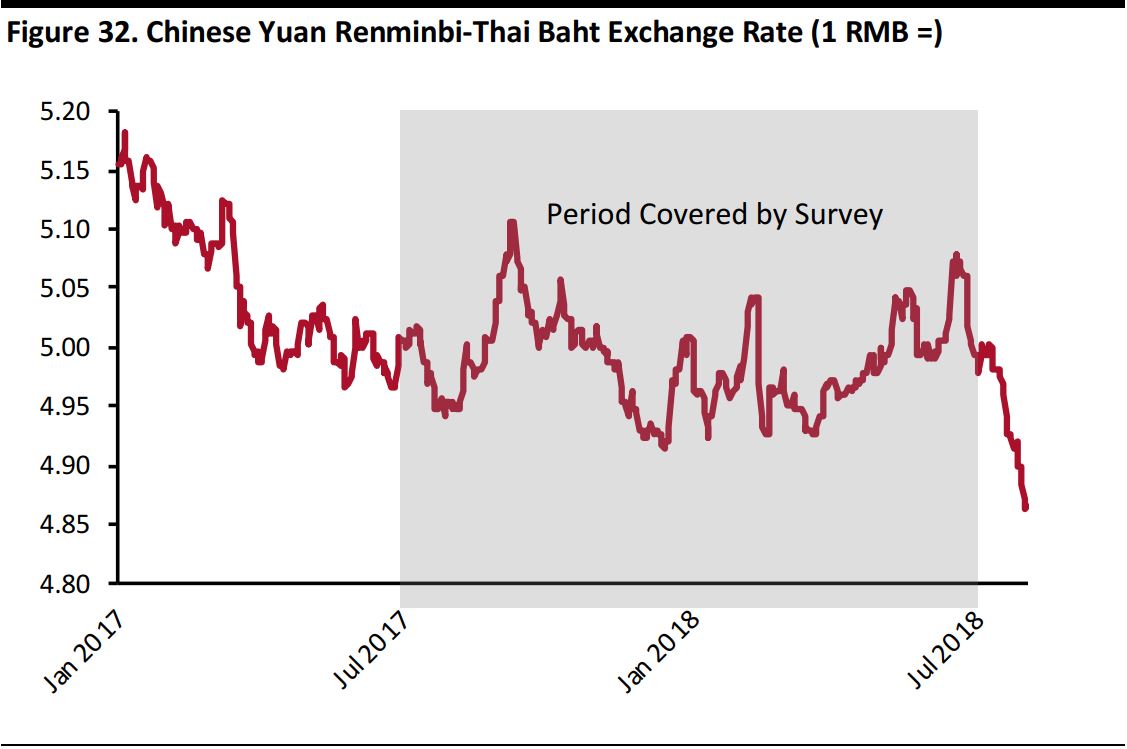

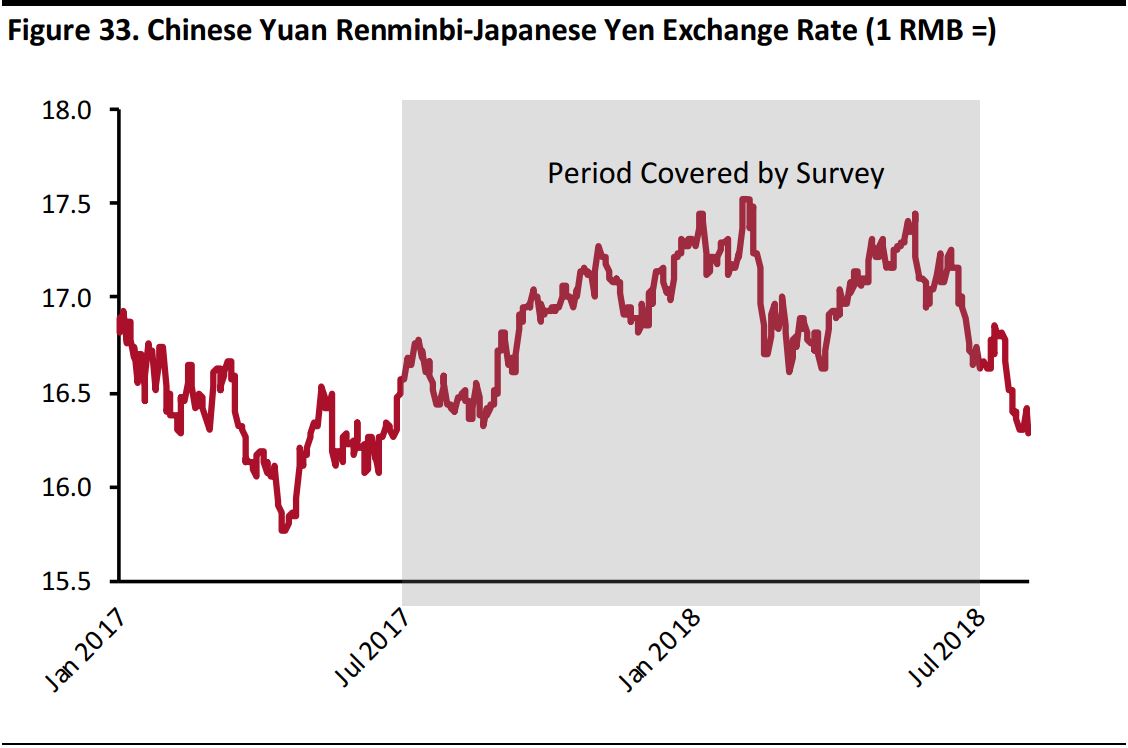

We surveyed 895 Chinese Internet users who had spent at least one night on a trip outside Mainland China in the past 12 months.Those trips included business and leisure trips, although we asked some of our questions only of those who had taken leisure trips. Our survey panel was demographically weighted to be representative of the 18–59 age group;it does not represent the views of travelers ages 60 and older. We conducted our survey in early July 2018, and many questions asked respondents to provide answers based on their travel in the past year (in practice, July 2017–June 2018). Throughout this report, we make comparisons to last year’s survey findings: our survey last year was undertaken in late May–early June 2017 and the respondent profile was comparable to this year’s. We provide annual exchange rate data in an appendix. For conversions from Chinese yuan renminbi to US dollars, we have used an exchange rate of ¥1 = $0.1538.Six Takeaways from Our 2018 Survey

1. Millennials Are Driving Changes in the Travel Market

Millennials—those in their 20s and 30s—are changing the nature of the Chinese outbound travel market:- They take more trips. Travelers in the 18–29 and 30–39 age groups took an average of 2.3 trips in the past year, versus 2.1 for all travelers surveyed.

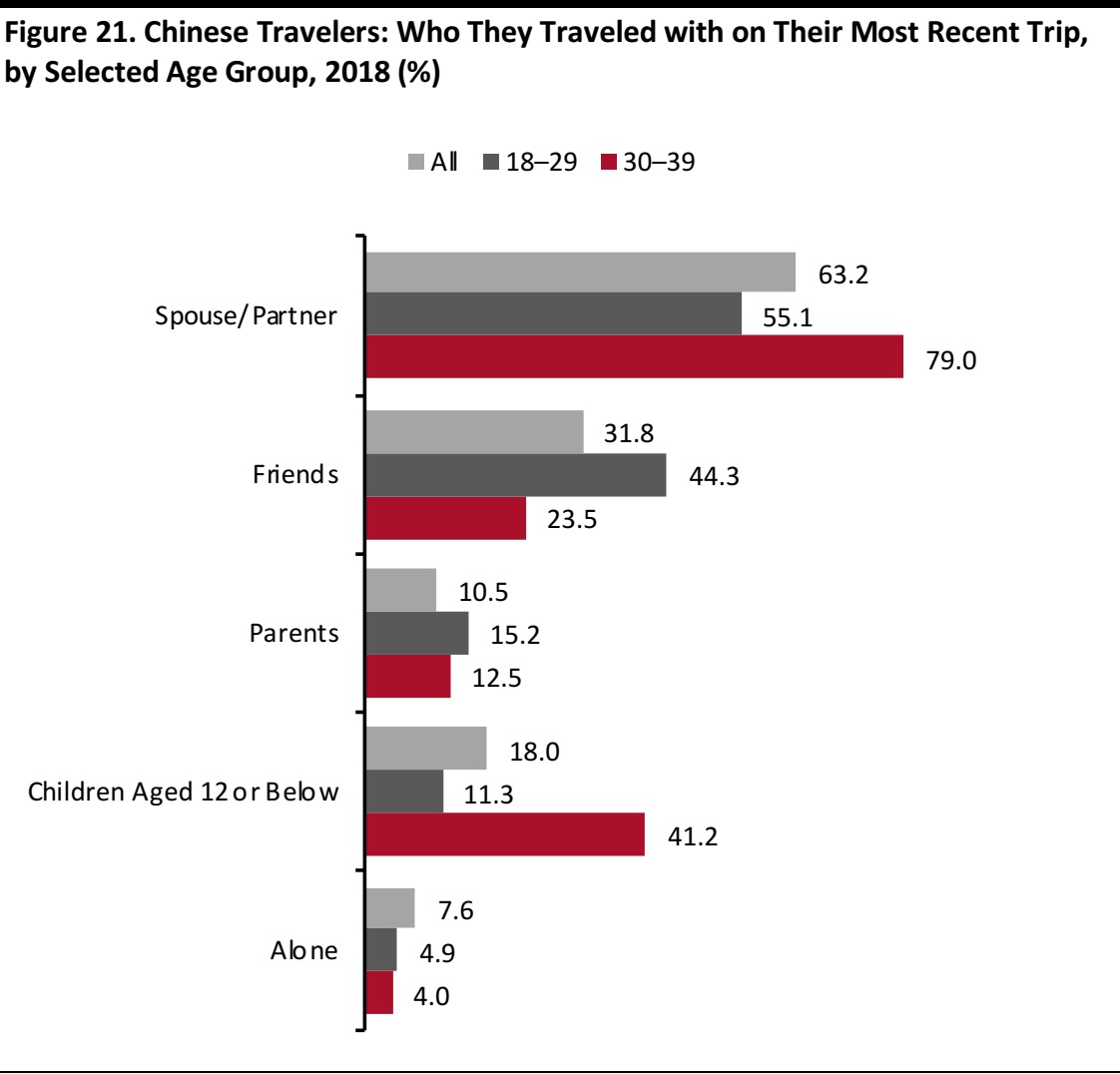

- They are traveling more with friends. This year’s survey found that fully 44% of respondents ages 18–29 took their most recent trip abroad with friends, up sharply from 27% last year.

- They are more independent. One-third of 18–29-year-olds surveyed expect to make their own travel arrangements for their next trip, compared with 20% of travelers overall. Group travel is far less popular among younger travelers than among their older peers.

- They have different priorities. When picking a destination, climate and exchange rate are less important to younger travelers than they are to the average traveler. Cuisine and shopping variety over index as priorities for millennials.

2. More Trips per Traveler per Year, but Spending per Trip Is Down Sharply

More Chinese people are traveling overseas, but that is not the only factor supporting growth in trip numbers: the number of trips per traveler is creeping up, too.Our survey found that the average Chinese traveler went overseas 2.1 times in the past year, up from 2.0 in our previous year’s survey. Residents of tier-one cities are driving this increase. Travelers from tier-one cities took an average of 2.3 trips in the past 12 months, up from 2.0 in last year’s survey. Travelers from cities in other tiers took an average of 2.0 trips in the past 12 months, up more marginally, from 1.9 trips in last year’s survey. That increase in frequency of trips is helping to offset a decline in average spending per trip. Our survey this year recorded a major, 18% fall in total per-trip spending across shopping, food and beverages, and sightseeing and entertainment. This decline was driven by a recorded 24% fall in average spending on shopping per trip, suggesting that shopping is becoming less popular among Chinese tourists traveling abroad. We think that enhanced cross-border e-commerce options and greater price parity for goods between China and other countries are likely contributing to this decline in average overseas spending. More frequent overseas travel also dovetails with an erosion of average retail spending per trip, as travelers’ budgets and shopping lists both have limits. Moreover, we think a shift toward spending on leisure services and experiences rather than on goods is contributing to the disproportionate decline in overseas retail spending. Nevertheless, we estimate that Chinese tourists spent a total of $174 billion(¥1,131 billion) in overseas markets in the 12 months ended June 2018, making these consumers a highly valuable demographic for retailers.3. Demand for Prestige Beauty Products Looks Buoyant

Overseas retail spending per trip may have peaked, but demand for overseas beauty purchases—especially prestige beauty products—looks solid. We expect this to underpin international retail demand from Chinese travelers.- Beauty was neck and neck with apparel as the most-bought retail category in this year’s survey.The proportion of travelers buying beauty items abroad jumped from 66.2% in last year’s survey to 71.5% in this year’s. Apparel, in contrast, slid in popularity.

- Some 56% of survey respondents who said that they expect to travel again in the coming months plan to increase their overseas spending on luxury beauty, making it the top luxury category for higher overseas spending. Clothing was the second-most-popular luxury category for higher overseas spending, with 43% of respondents saying that they expect to spend more on it.

- Demand for overseas luxury beauty items is disproportionate to overall demand for the category. When we asked what luxury categories respondents expected to spend more on within China in the coming months, beauty slumped to third place, with only 29% saying that they expect to up their spending on the category. The message is that the prestige beauty category continues to see strong overseas demand.

4. More Independent Travelers

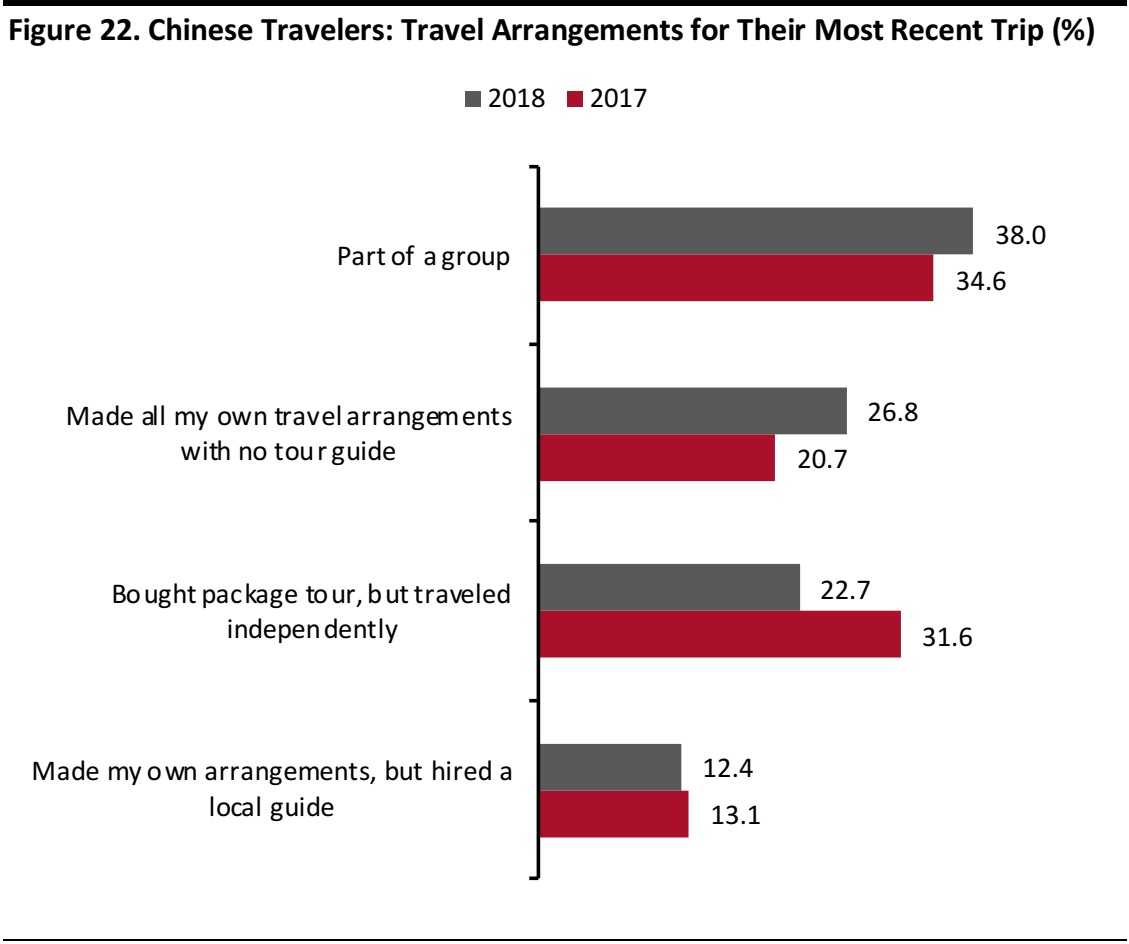

Group travel remains popular among Chinese tourists, although a majority now travel independently.Among those who choose not to travel in a group, fully independent travel is growing more popular at the expense of package tours.- This year, our survey recorded a slump in the proportion of respondents who had bought a package tour for their latest trip, from 31.6% last year to 22.7%.

- We saw a surge in the proportion of respondents who had made all their own arrangements and traveled completely independently (without a tour guide) on their latest trip, from 20.7% last year to 26.8% this year. That bumped independent travel ahead of package tours as the second-most-popular option after group travel.Travelers from tier-one cities are leading the charge in independent travel.

- We also saw a decline in the proportion of travelers going overseas with a spouse/partner or with young children, and a jump in the proportion opting to travel with friends. Almost one-third of those we surveyed this year traveled with friends on their latest trip, versus less than one-quarter of those we surveyed last year.And,as we noted above, young travelers fueled this trend. Solo travelers also grew share in this year’s survey.

5. Venturing to Less Traditional Asian Destinations

Chinese tourists are not only traveling more independently, but also taking a more adventurous approach to destinations. Japan has traditionally been a hot spot for Chinese tourists, but our survey recorded a meaningful decline in Japan’s share of China’s outbound market. We think that this trend indicates that more experienced, sophisticated travelers are turning to less traditional travel destinations in Asia. These alternatives include Vietnam, which saw an uptick in traveler share in our survey and whose tourist agency has reported strong growth in inbound numbers of visitors from China. In the near term, we may see growth in some destinations moderate as Chinese traveler numbers to South Korea bounce back following political tensions in 2017. South Korea saw Chinese visitor numbers more than halve in 2017, but they have rebounded strongly in recent months. Longer term, however, the greater independence and adventurousness of Chinese travelers—especially younger travelers from tier-one cities—should support the out performance of a number of emerging Asian hotspots.6. Mobile Is a Necessity for Chinese Travelers

Our survey underscored the central role that the mobile channel plays for Chinese tourists. Retailers and service providers must be able to deliver information, booking capability, shopping experiences and payment options via mobile, including through apps such as WeChat.- Nearly 100% of survey respondents said that they had used their smartphone on their latest trip. The top reason for using a smartphone while overseas was to find directions and maps.

- Similarly, more than 99% of respondents used WeChat on their latest trip. Travelers used the app for shopping and sharing: almost half had used it to pay for items when shopping and nearly one-third had used it to pay at a restaurant.

- When we asked travelers what influenced their choice of retailers overseas, some 63% said that the ability to pay by mobile was a factor. Mobile payment jumped from the eighth-most-important factor in choosing where to shop in last year’s survey to the third-most important in this year’s survey.

Traveler Numbers: Nearly 140 Million Trips Expected This Year

Before we discuss our survey findings, we first review top-line figures on the Chinese outbound tourist market. *Includes Hong Kong and Macao from 2018 onward

Data include day trips, such as to Hong Kong and Macao

Source: Ctrip/CNTA/Coresight Research

*Includes Hong Kong and Macao from 2018 onward

Data include day trips, such as to Hong Kong and Macao

Source: Ctrip/CNTA/Coresight Research

Chinese travelers made 130 million trips outside Mainland China in 2017, according to Ctrip and CNTA, up 7% year over year. Hong Kong and Macao accounted for just over half of this total, which includes day trips to these destinations.

We expect a rebound in the number of tourists heading to South Korea to boost growth in total trip numbers this year and into 2019. South Korea accounted for 7 million trips by Chinese tourists in 2016; that figure fell to just over 3 million in 2017, but we have seen a strong recovery in recent months.

In 2016, CNTA forecast that the Chinese outbound trip total would reach 150 million in 2020. That target looks likely to be exceeded.

Source: Ctrip/CNTA/Hong Kong Tourism Board/Government of Macao Statistics and Census

Service/Coresight Research

Source: Ctrip/CNTA/Hong Kong Tourism Board/Government of Macao Statistics and Census

Service/Coresight Research

Last year, very roughly half of all Chinese travelers’ visits to Hong Kong and to Macao were day trips rather than conventional vacations involving an overnight stay. Once we strip those day trips out, total Chinese outbound tourist vacation trips totaled just under 94 million in 2017, up 8.6% year over year.

Excludes day trips to Hong Kong and Macao. Our estimates do not adjust for travelers under age 18, who are included in total traveler numbers but excluded from the per-trip spending estimates generated by our survey and who may be expected to spend less per trip.

Source: China Luxury Advisors/Coresight Research

Excludes day trips to Hong Kong and Macao. Our estimates do not adjust for travelers under age 18, who are included in total traveler numbers but excluded from the per-trip spending estimates generated by our survey and who may be expected to spend less per trip.

Source: China Luxury Advisors/Coresight Research

We estimate that Chinese tourists spent a total of $174 billion (¥1,131 billion) in overseas markets in the 12 months ended June 2018. At constant exchange rates, that total is down from an estimated $195 billion (¥1,268 billion) in the prior 12-month period. As we discuss later, our survey respondents reported a significant drop in per-trip spending in the last 12 months.

Our figures are based on our latest survey, which found that the average per-trip expenditure was $1,854 (¥12,051) across the shopping, food and beverages, and sightseeing and entertainment categories. Our figures exclude lodging and travel services. Our latest figures represent spending undertaken on the 93.8 million personal trips involving a stay of at least one night outside Mainland China in 2017 (the latest full-year data that correspond to the period of our survey) and therefore excludes pending by day-trippers to Hong Kong and Macao.

The United Nations World Tourism Organization (UNWTO) estimates that tourist spending by outbound Chinese travelers across all expenditure categories totaled $258 billion in 2017, up 4.7% year over year at constant exchange rates. China leads the world in spending by tourists, per the UNWTO, with the US in second place at $135 billion in 2017. The UNWTO’s definition includes all expenditures by outbound tourists in another country, including expenditures on services such as lodging.

Average Number of Trips Is Creeping Up

In this and subsequent sections, we review the findings of our survey of Chinese travelers. Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

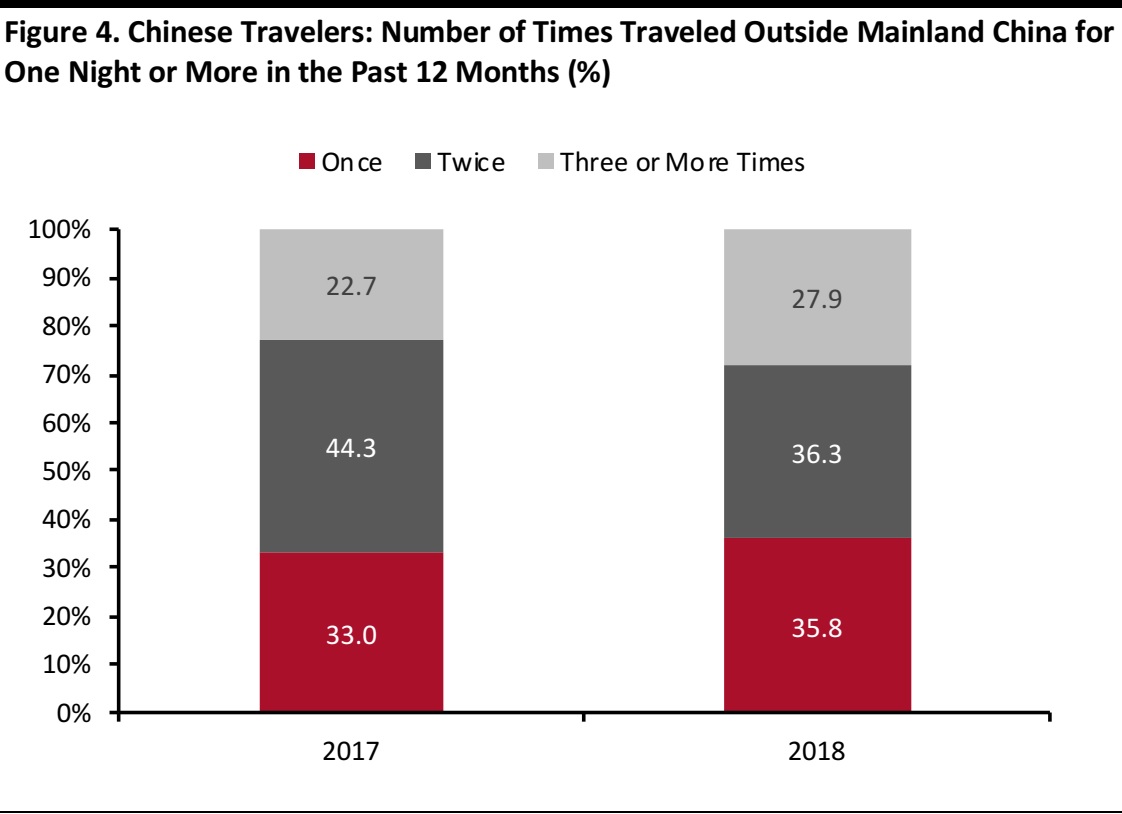

We begin our survey results roundup with a review of how many trips respondents said they had taken in the past year. Their responses revealed polarizing trends: compared with those surveyed last year, more travelers surveyed this year said that they had taken either one trip or three trips or more and fewer said that they had taken two trips.

Despite the increase in the number of travelers saying that they had taken just one trip, the mean number of overseas trips per traveler crept up to 2.1 in the past year, versus 2.0 in our survey a year earlier.

Our survey specifically asked respondents about trips involving a stay of one night or more, so the figures exclude day trips, such as to Hong Kong or Macao.

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

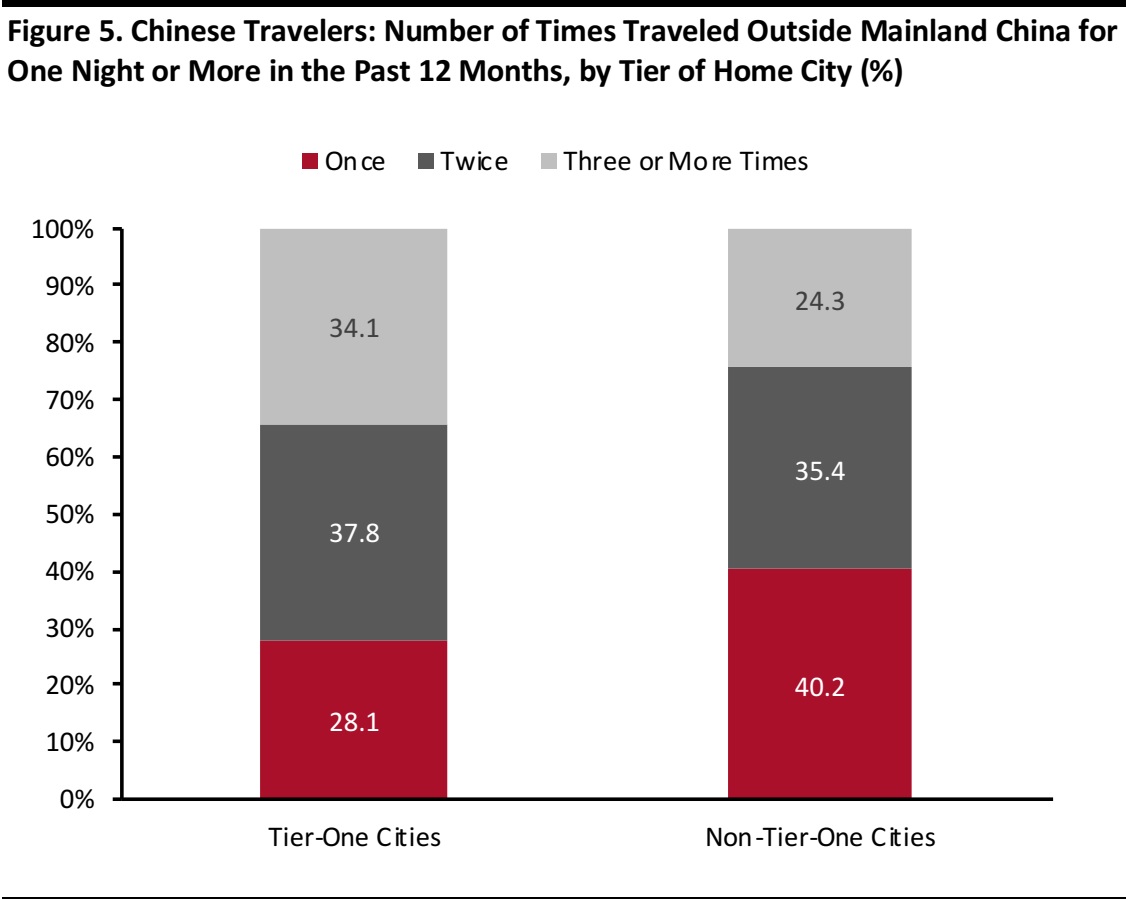

Residents of tier-one Chinese cities are considerably more likely than their peers in lower-tier cities to take multiple trips per year.

In the past year, travelers from tier-one cities took an average of 2.3 trips, while travelers from cities in other tiers took an average of 2.0 trips. Our survey last year recorded averages of 2.0 trips for tier-one city dwellers and 1.9 trips per year for lower-tier city dwellers,suggesting that the gap between tier-one and non-tier-one travelers is growing.

This change was fueled by a leap in the proportion of travelers from tier-one cities who said that they had made three or more trips in the year: that proportion jumped by 13 percentage points,from 21% in 2017 to 34% in 2018. The proportion of travelers from lower-tier cities who said that they had taken three or more trips rose much more modestly, from 21% in 2017 to 24% in 2018.

Where They Go: Travelers Are Switching Among Destinations in Asia

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

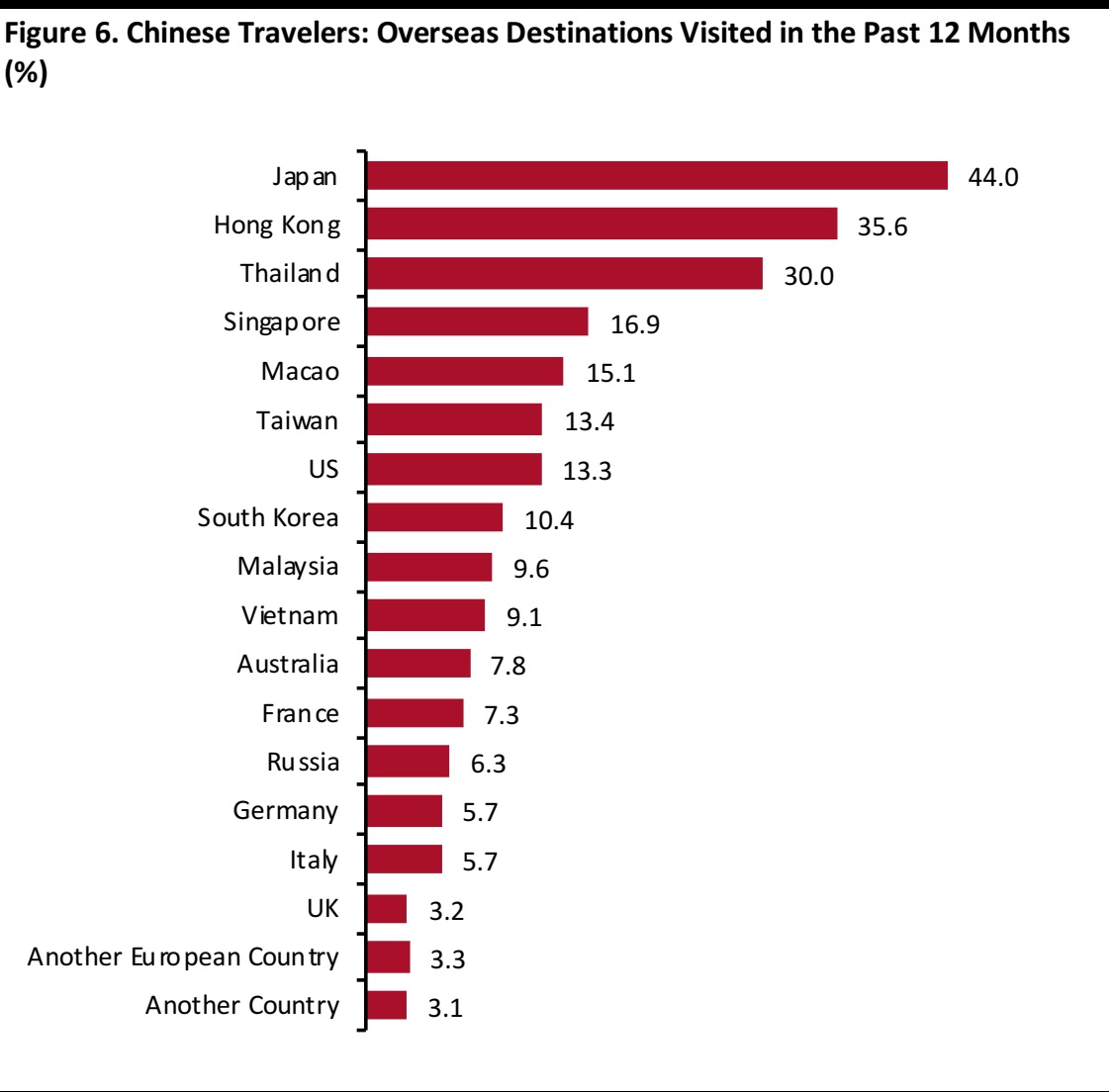

In this year’s survey, Japan was again the most popular destination for Chinese travelers, and Asian countries continued to dominate the rankings. In total, 89% of travelers surveyed had visited Asian destinations in the past 12 months, down from 94% last year. The Asia total included an aggregate 39% of respondents who had visited Hong Kong or Macao this year, down only slightly from 40% last year.

Some 21% of those we surveyed had visited Europe this year, versus 16% last year, and these totals include 15% who had visited Western Europe (France, Germany, Italy or the UK) this year versus 13% last year.

The year-over-year story pointed to a changing mix of Asian destinations. A major decline in Chinese outbound trips to South Korea appears to have added impetus to the growing share captured by Thailand, Taiwan, Malaysia and Vietnam.

Japan’s relative popularity as a destination fell over the past year, according to our survey, despite the renminbi strengthening versus the yen. We see Japan losing share of total Chinese outbound trips as more experienced, sophisticated travelers turn to less traditional destinations. We note that Japan’s total inbound visits from China continued to rise in absolute terms in calendar year 2017, according to the Japan National Tourism Organization.

South Korea saw Chinese visitor numbers fall sharply due to political tension with China during the 12-month period covered by our survey. The proportion of respondents visiting the country fell from 27% last year to 10% this year. However,South Korea has seen a strong recovery in tourist numbers in recent months: in the three months ended July 2018, Chinese tourist arrivals to South Korea were up 64% year over year, according to data from the Korea Tourism Organization.

The previous decline in journeys to South Korea surely supported an increase in the proportion of respondents who had visited Thailand (up from 23% last year to 30% this year), Malaysia (rising from 8% last year to almost 10% this year) and Vietnam (up from 5% to 9%). Vietnam appears to be benefiting particularly from Chinese travelers’ shift toward less traditional destinations. In the three months ended July 2018, total Chinese inbound arrivals to Vietnam were up 27% year over year, according to the Vietnam National Administration of Tourism.

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

*France, Germany, Italy and the UK

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

*France, Germany, Italy and the UK

Source: China Luxury Advisors/Coresight Research

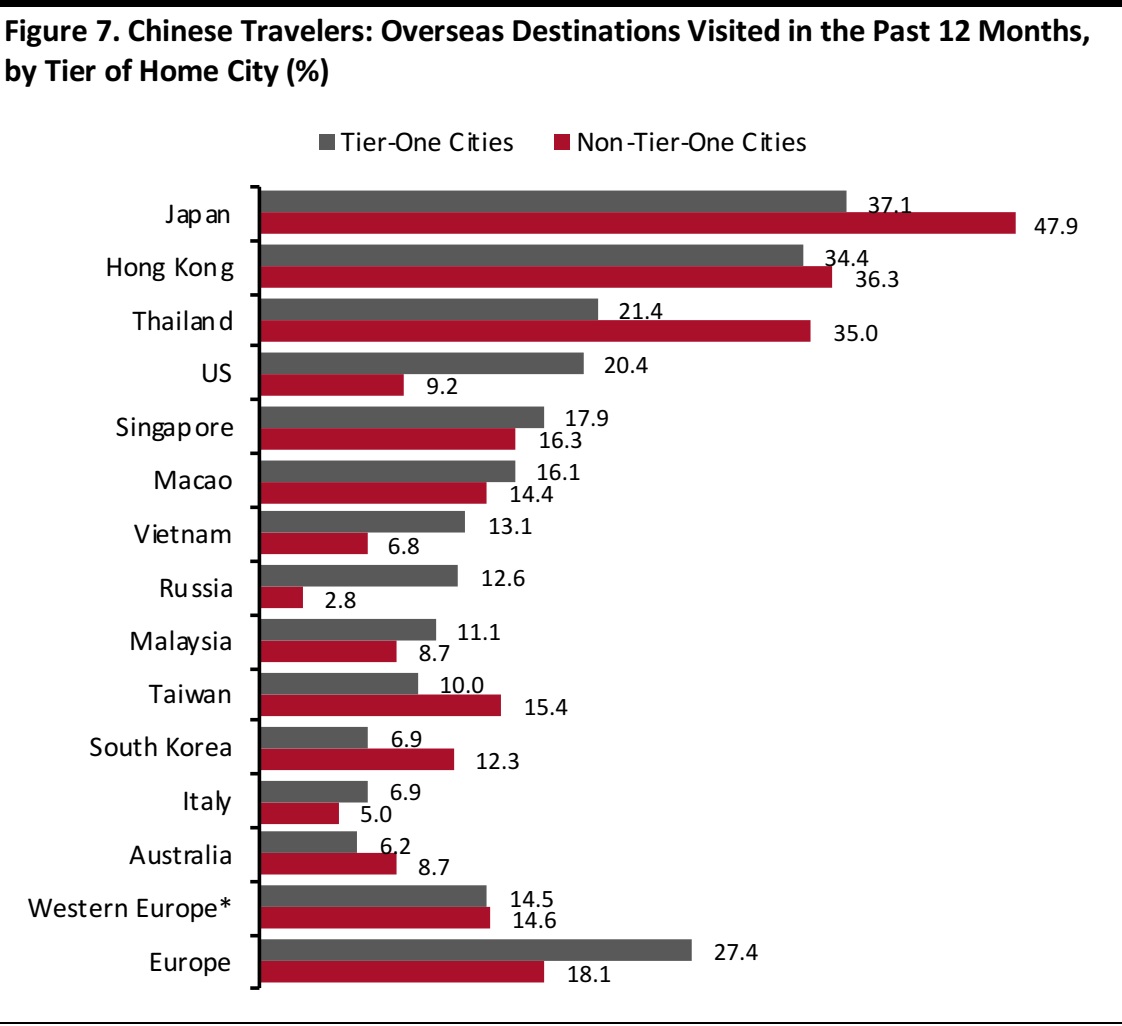

Residents of tier-one cities in China are driving the shift toward nontraditional destinations. Our survey recorded a major decline in the percentage of travelers from tier-one cities who visited Japan, from 58% last year to 37% this year. Meanwhile, tier-one residents are driving growth in travel to locations such as Vietnam and Malaysia. Some 13% of tier-one travelers visited Vietnam in the past year, up sharply from 5% in the preceding year. We saw a similar jump for Malaysia.

Residents of lower-tier cities are generally more likely than their tier-one peers to travel to traditionally popular destinations in Asia, such as Japan, Hong Kong and Thailand. Travelers who live in tier-one cities over index on travel to the US, but we see no such pattern for travel to Western Europe.

What’s Important in a Destination?

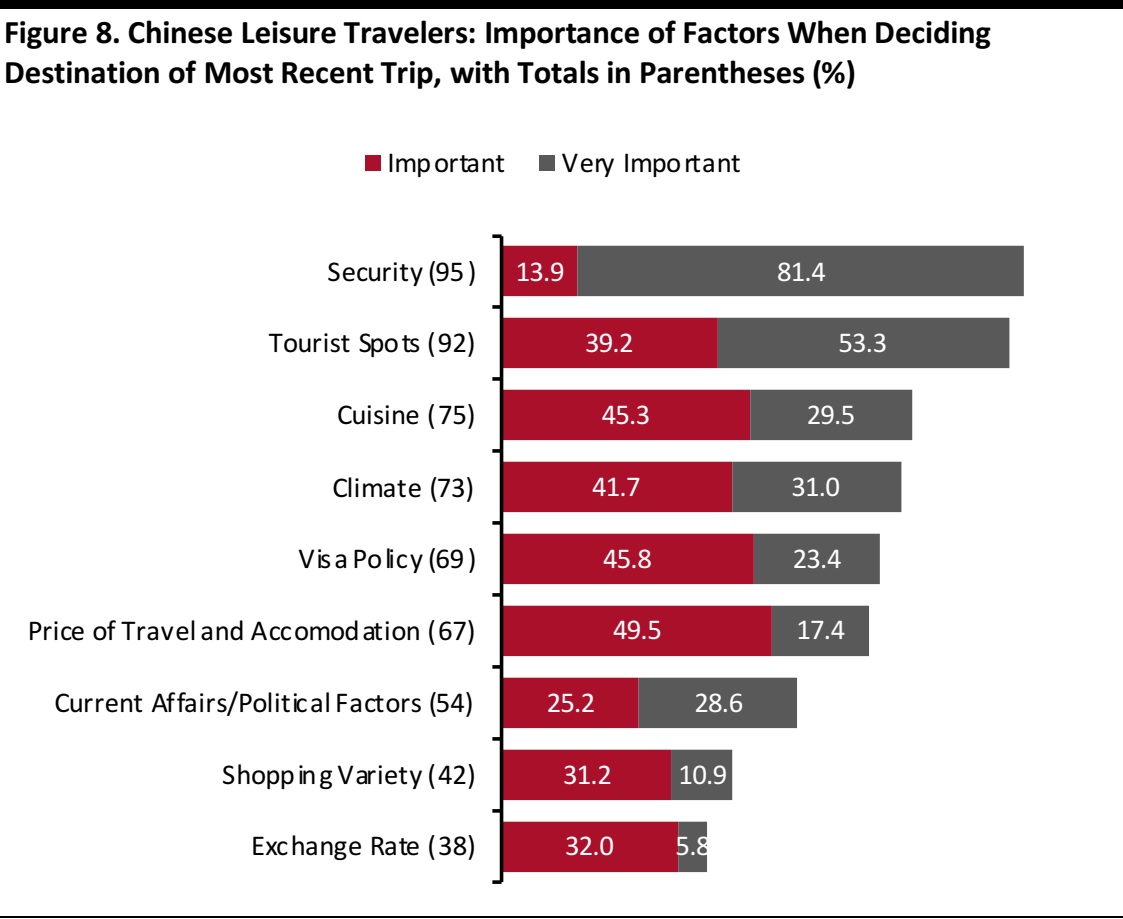

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Although Chinese travelers typically spend big on shopping when they travel, survey respondents ranked the exchange rate as the least important factor when deciding on a travel destination. This option ranked as the least important factor in our 2017 survey, too.

Shopping variety’s importance in influencing choice of destination declined meaningfully year over year, from 69% to 42%. As we show elsewhere in this report, Chinese shoppers slashed their per-trip overseas retail spending in the past year, and the decline in importance of shopping variety underscores an apparent shift away from shopping as a key travel activity.

The 95% of respondents citing security as important or very important was in line with the results of last year’s survey.

How They Spend: Big Decline in Retail Spending per Trip

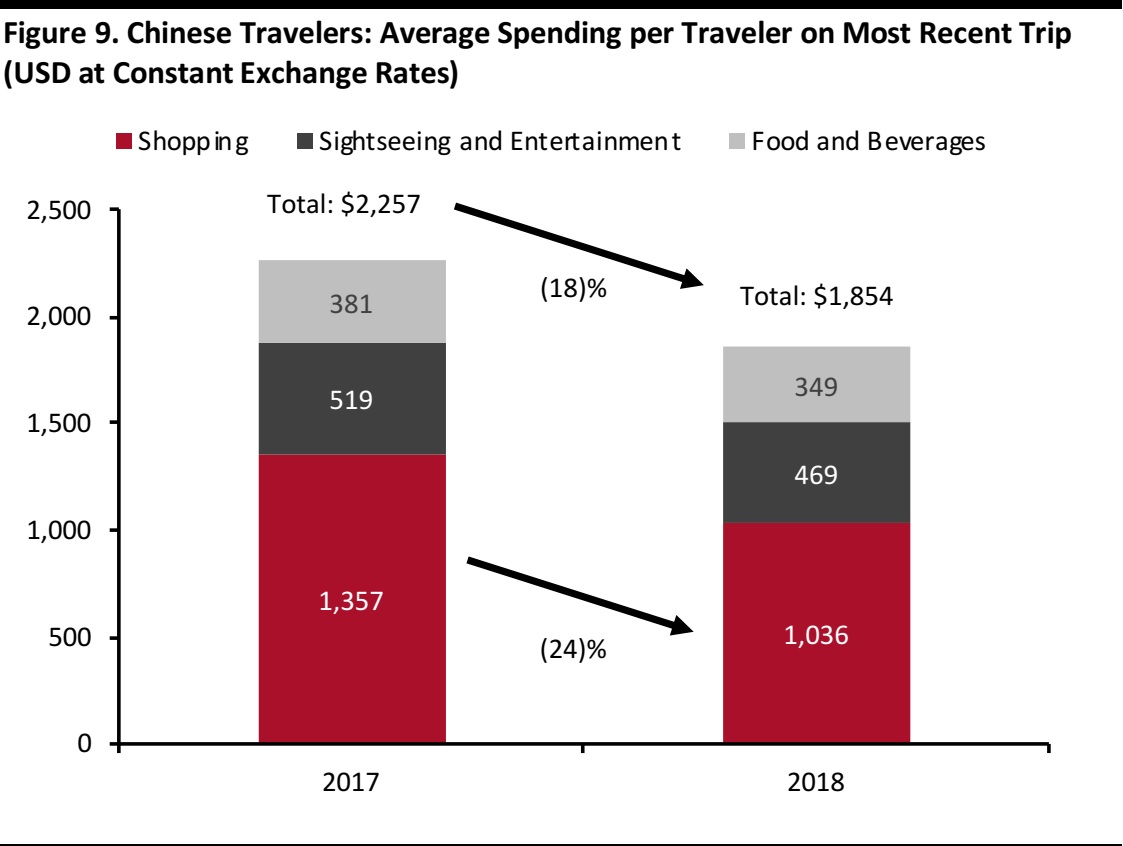

Data for both years were calculated using exchange rates for the period July 1, 2017–June 30, 2018.

Source: China Luxury Advisors/Coresight Research

Data for both years were calculated using exchange rates for the period July 1, 2017–June 30, 2018.

Source: China Luxury Advisors/Coresight Research

A major finding of our survey is that Chinese travelers slashed their average overseas spending per trip in the last year.

Our survey found that total per-trip spending across shopping, sightseeing and entertainment, and food and beverages was down 18%, to $1,854 (¥12,051). Chinese travelers made the biggest cut in shopping expenditures, with spending at retail down 24% year over year, to $1,036 (¥6,734).

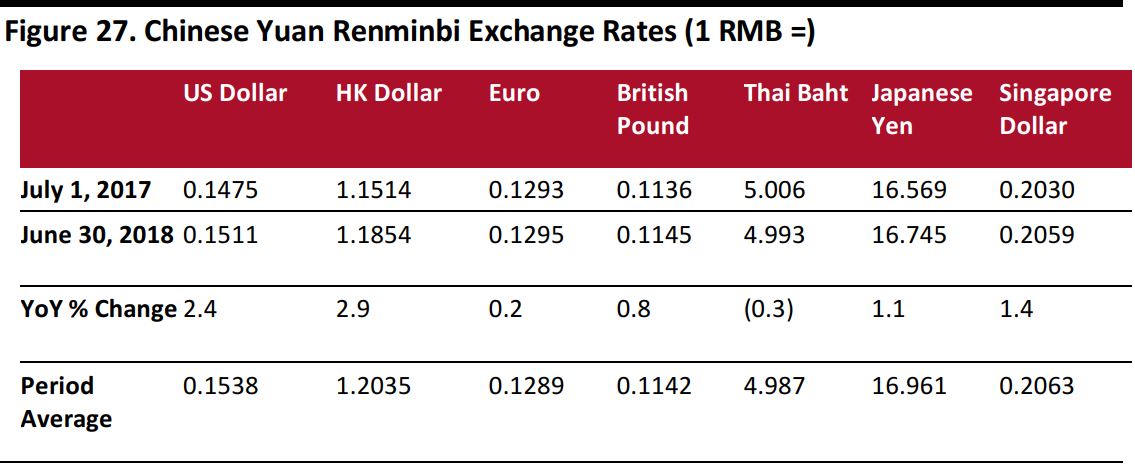

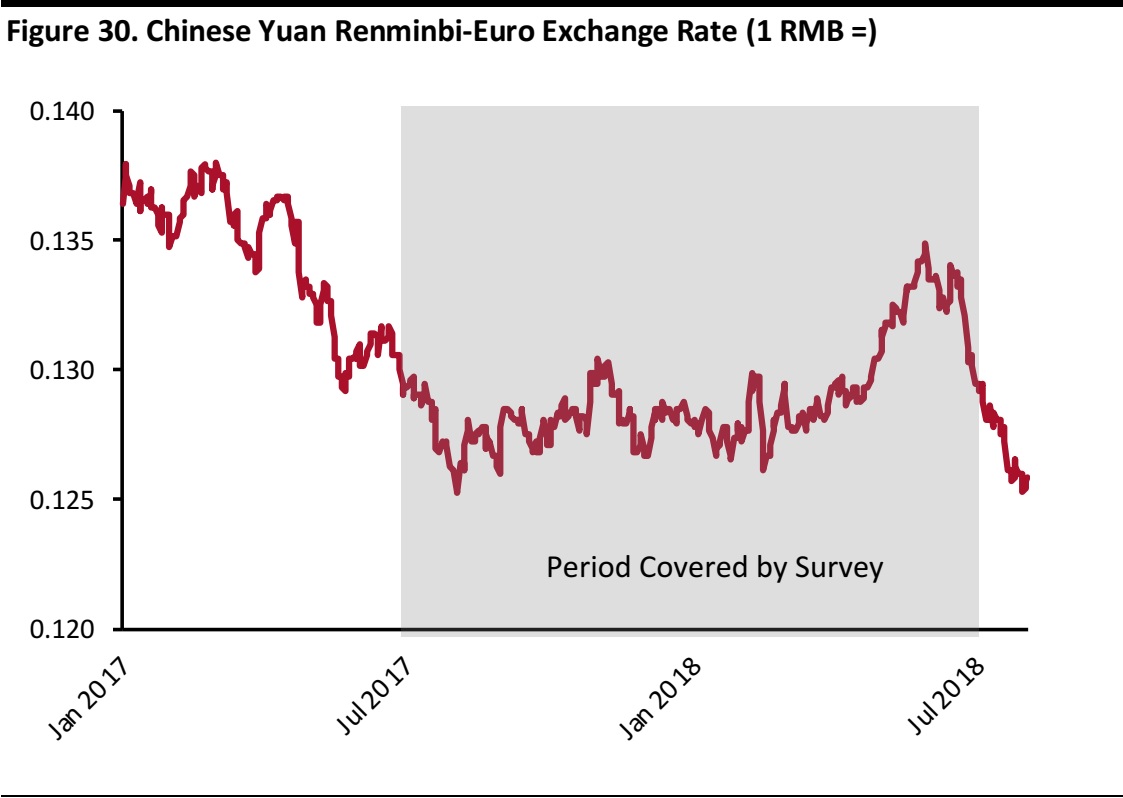

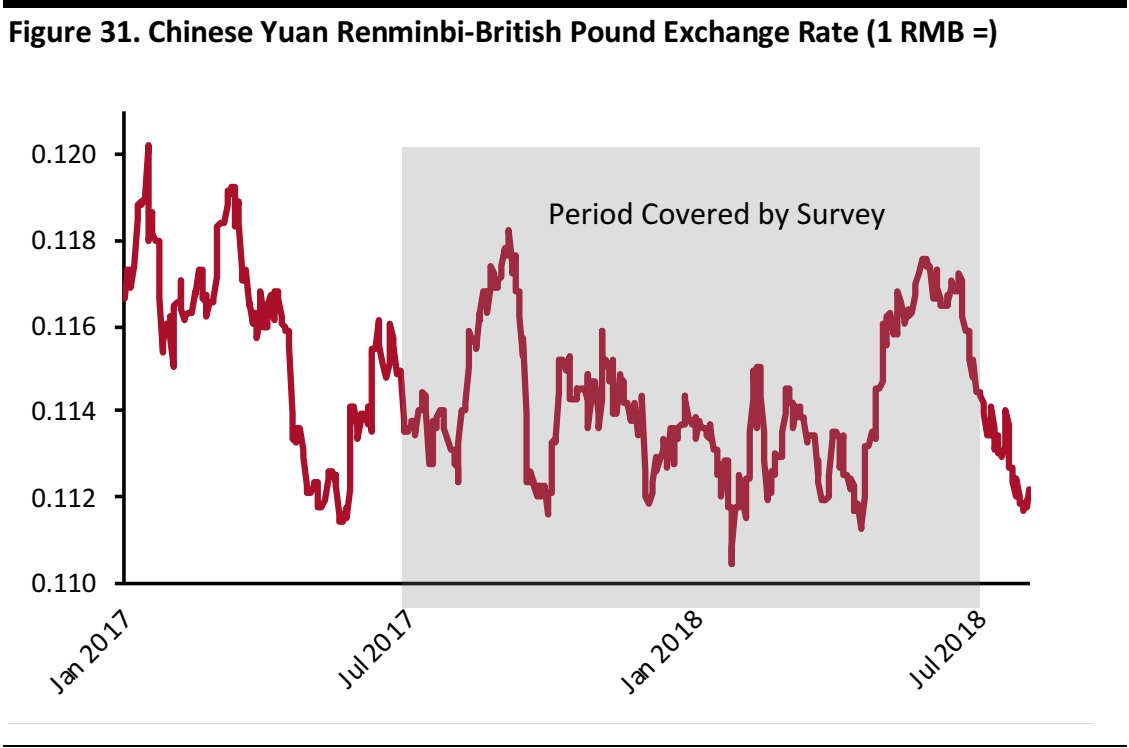

The strengthening of the renminbi against the US dollar, the Hong Kong dollar, the Japanese yen and the Singapore dollar may account for some of these declines (we asked survey respondents how much they spent in renminbi terms on their most recent trip). This strengthening means that Chinese travelers visiting the US, Hong Kong, Japan and Singapore would need to spend slightly less to achieve the same experiences, which may have softened experiential spending a little. However, a strong renminbi would conventionally be expected to support more liberal overseas retail spending.

We think that a number of factors contributed to the sharp decline in reported spending on shopping:

- A more experienced body of travelers, including a prominent millennial segment, shifted some spending from goods to services and experiences.

- The ongoing expansion of cross-border e-commerce in China is making more goods easily available at home, reducing Chinese consumers’ need to buy when overseas.

- Global brands have tended to reduce the price disparities among goods they sell in China versus elsewhere, reducing the appeal of buying those goods abroad.

- A loss of value in the Chinese stock markets and trade war threats may have had an adverse affect on discretionary spending overseas.

- Our figures are per-trip averages and the average number of trips per person crept up last year: shoppers with a finite shopping list are therefore likely to spend a little less on each trip.

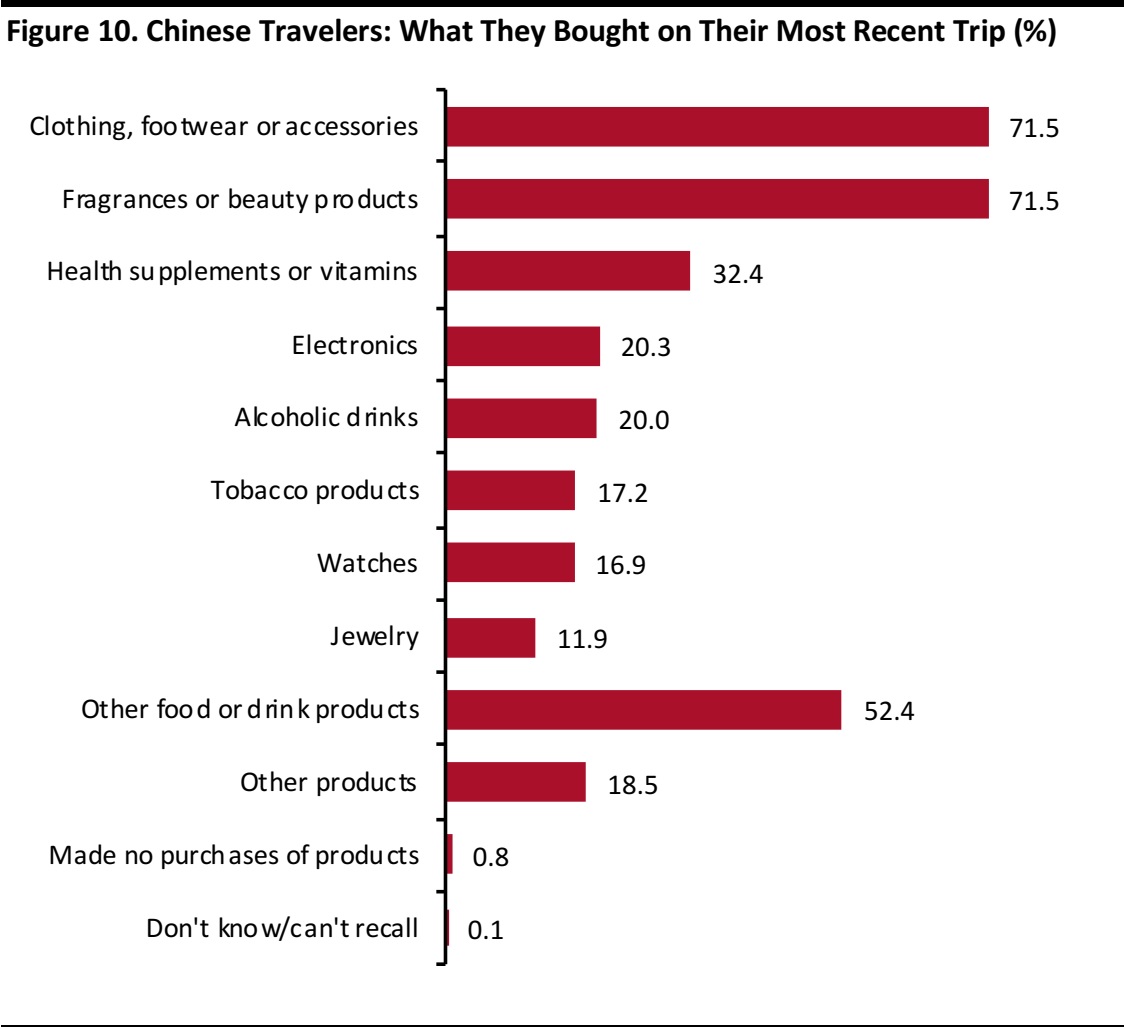

What They Buy

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

In this year’s survey, the apparel and beauty categories were neck and neck in terms of number of respondents who said that they had bought such items on their most recent trip: for each of these categories, seven in 10 travelers surveyed said that they had bought such items on their most recent trip abroad. Prestige beauty looks set to cement its position as the most in-demand category for overseas purchases. As we discuss later, when we asked what luxury categories Chinese travelers expect to spend more on when traveling overseas in the future, beauty ranked at the top, comfortably ahead of apparel.

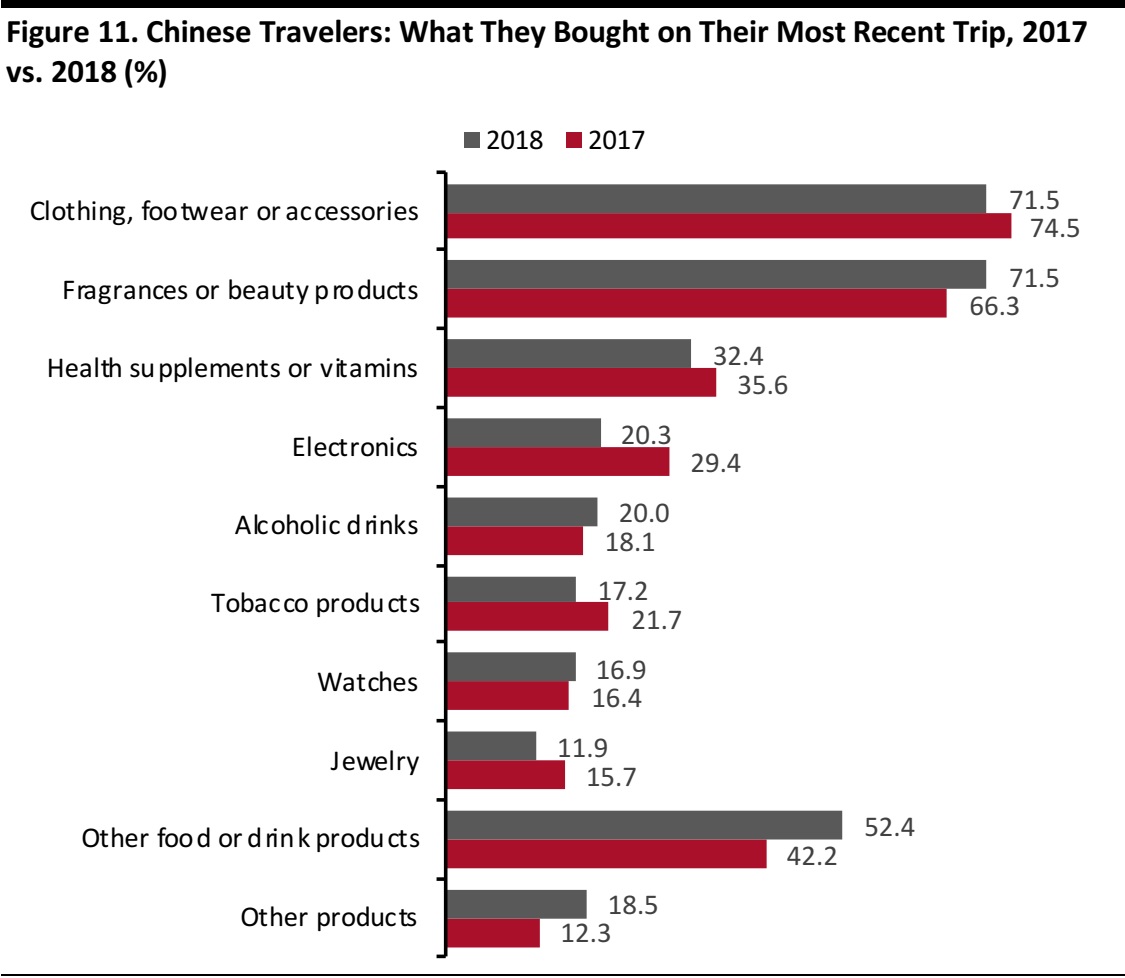

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Compared with last year’s survey, fragrances and beauty products gained in popularity in terms of which categories respondents purchased on their most recent trip, while apparel slid back a little.

Declines in purchases of jewelry and electronics—both of which are big-ticket categories—may partly account for the overall drop in recorded shopping expenditure in the past year.

The proportion of travelers purchasing health supplements and vitamins declined a touch from last year, possibly because cross-border e-commerce provides price-conscious shoppers with an increasing choice of alternatives in these categories. Overseas beauty demand may be proving more resilient due to a lower level of price sensitivity among consumers of prestige beauty brands.

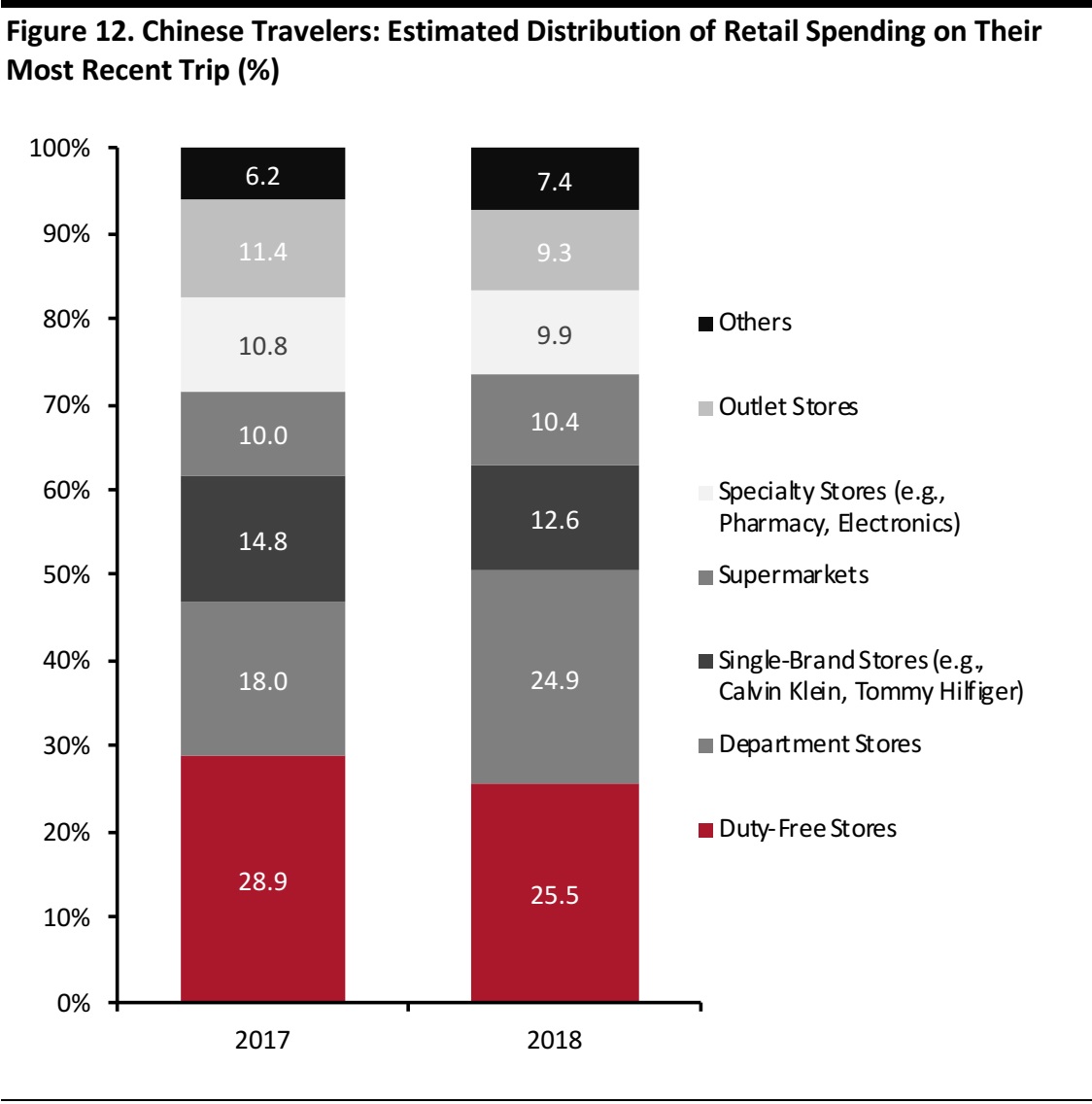

Shops They Buy From: Duty Free Is Losing Share

Totals may not sum due to rounding

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Totals may not sum due to rounding

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Our survey found that duty-free stores were again the top format for overseas shopping among Chinese outbound travelers. However, the format lost share of spending year over year, while department stores’ share of spending grew by almost seven percentage points.

Some of the changes in the types of stores respondents frequented may be due to shifts in travel destinations:for example, trips to South Korea were down versus the previous year, while trips to Malaysia, Thailand and Vietnam were up. However, our annual surveys have recorded a consistent year-over-year decline in duty free’s share of spending: two years ago, our survey found that duty-free stores captured 32.2% of Chinese travelers’ spending, but that share fell to 28.9% last year and 25.5% in this year’s survey.

We think better-informed consumers are likely discovering alternatives to duty-free stores through shopping apps such as Little Red Book and peer-to-peer tools such as WeChat. We also see one-stop shopping destinations such as upmarket department stores and premium malls catering to Chinese shoppers’ demand for convenience, as these shoppers may not only be looking to purchase items for themselves when traveling abroad, but also for goods to resell, products bought on behalf of friends and family,and items to give as gifts.

Meanwhile, more retailers are marketing themselves better to Chinese consumers, such as through WeChat, and adding enhanced services, such as UnionPay or mobile payment options and immediate discounts for international travelers.These offerings should support their efforts to capture more of Chinese tourists’ retail spending.

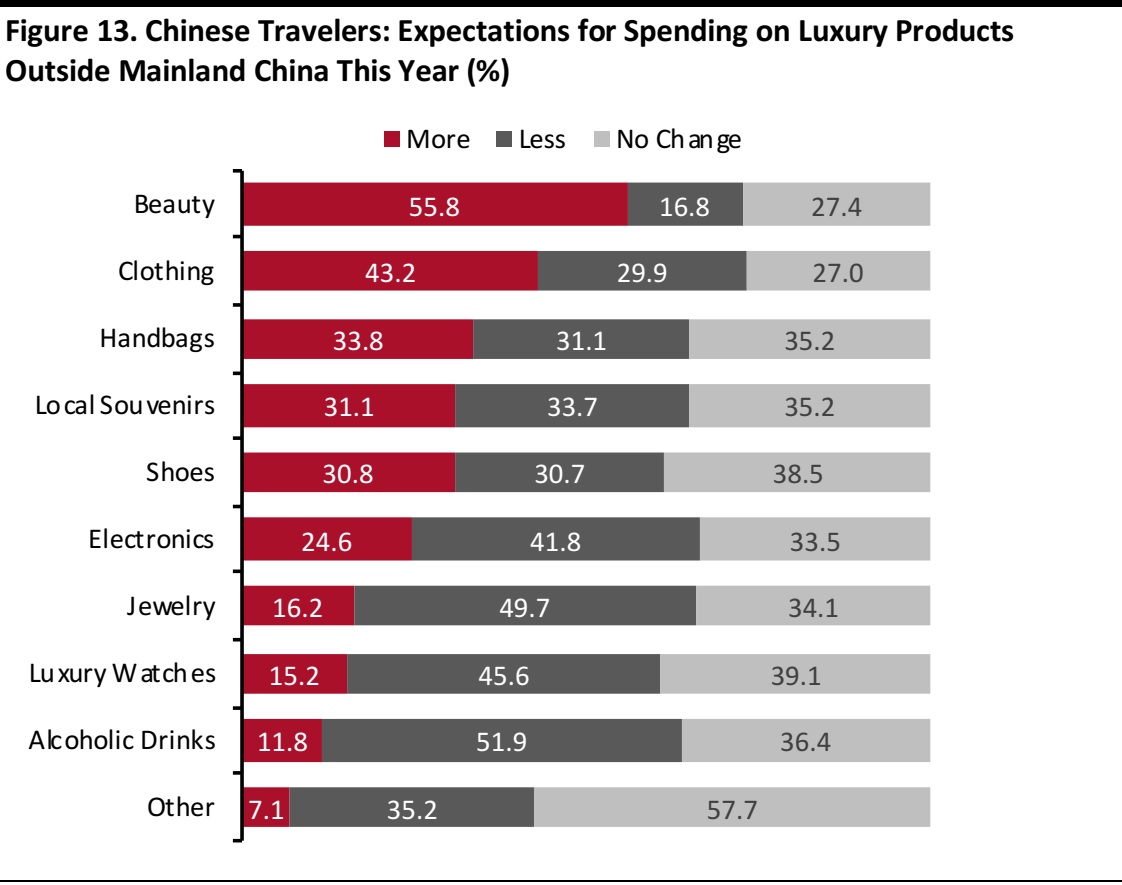

Luxury Spending Plans Suggest Beauty Buoyancy

Totals may not sum due to rounding

Base: 692 Internet users ages 18+ who had taken a trip outside Mainland China in the past 12 months and who expect to travel overseas again before the end of 2018

Source: China Luxury Advisors/Coresight Research

Totals may not sum due to rounding

Base: 692 Internet users ages 18+ who had taken a trip outside Mainland China in the past 12 months and who expect to travel overseas again before the end of 2018

Source: China Luxury Advisors/Coresight Research

We asked those survey respondents who expect to travel overseas again in the coming months (“e.g., before the end of the year,” per our survey) how their overseas spending on luxury goods categories would likely change. The data suggest that the beauty category will be the big winner, and that it could pull ahead of apparel as the most-bought category on Chinese travelers’ overseas trips.

In aggregate, respondents indicated an intention to cut back on overseas purchases of hard luxury goods (jewelry and watches): almost half expect to spend less on such items, while only 16% expect to spend more on jewelry and 15% expect to spend more on watches. We show the net positive/negative results for each category below.

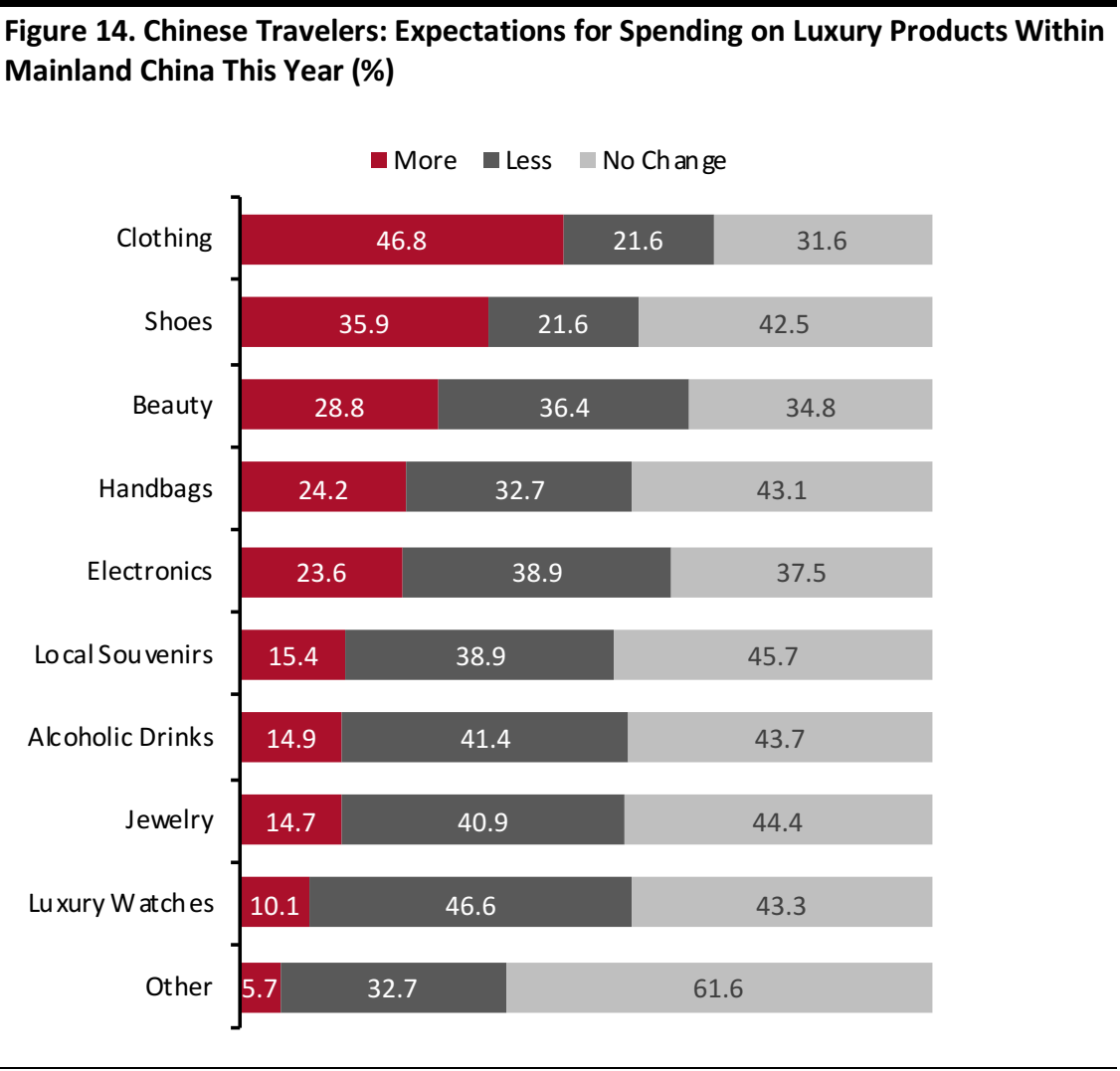

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

We also asked respondents what luxury goods they expected to buy within China in the coming months. The findings confirm that beauty over indexes on overseas purchases versus in-country purchases: the category is in first place in terms of expected higher overseas spending, but falls to third place in terms of expected higher domestic spending.

As with overseas purchases, many more survey respondents expect to spend less on jewelry and watches within China in coming months than expect to spend more on them.

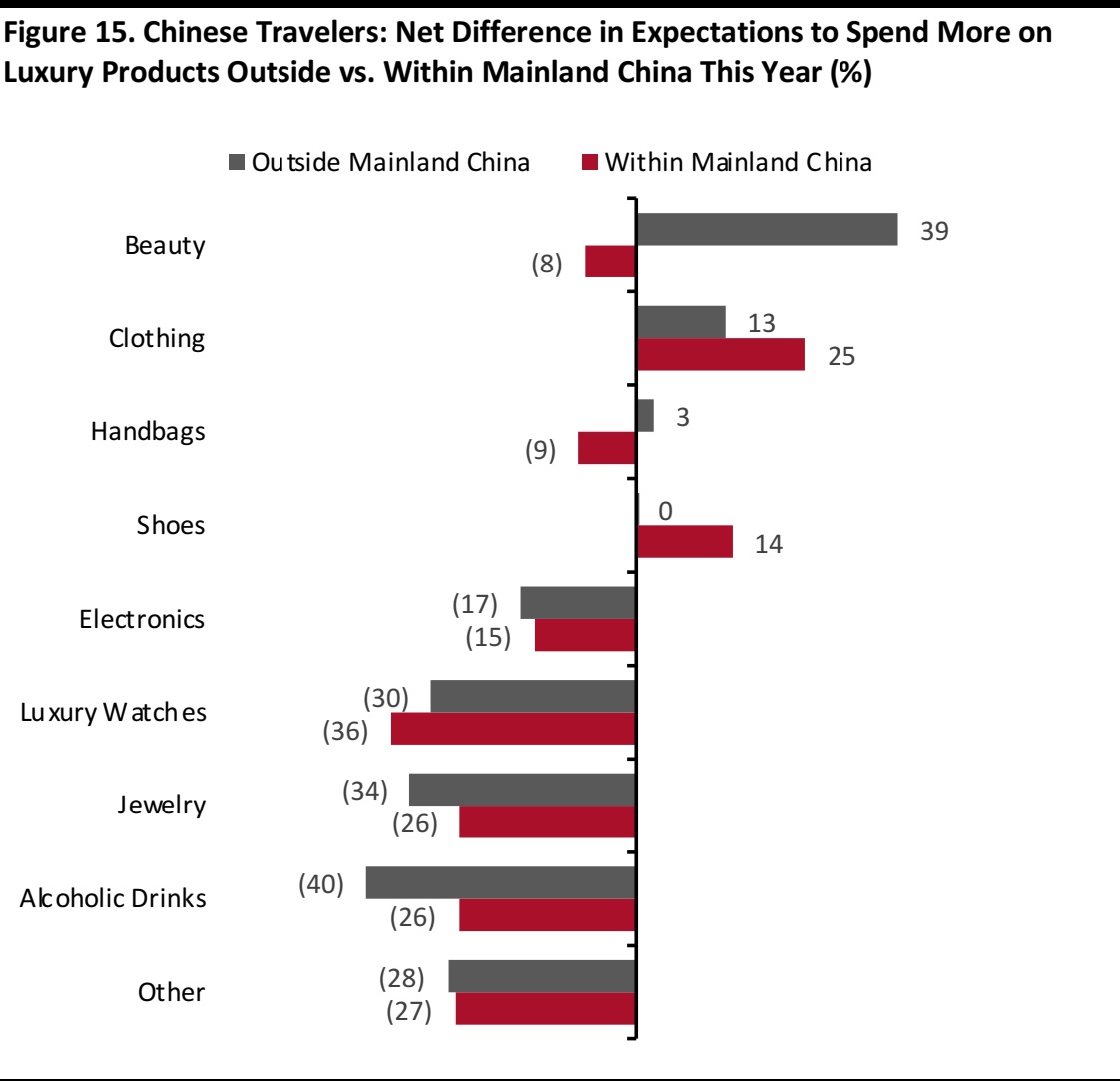

Base: 895 Internet users ages 18+ who had taken a trip outside Mainland China in the past 12 months, including 692 who expect to travel overseas again before the end of 2018

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users ages 18+ who had taken a trip outside Mainland China in the past 12 months, including 692 who expect to travel overseas again before the end of 2018

Source: China Luxury Advisors/Coresight Research

The chart above shows the net difference in the proportion of respondents expecting to spend more on each category in the coming months, split by overseas and within Mainland China. It illustrates the resilience of overseas beauty demand, which suggests that the expansion of cross-border e-commerce is not notably dampening Chinese consumers’ enthusiasm for shopping for beauty items while traveling abroad.

The data show anticipated declines in both domestic and overseas purchases of hard luxury goods, alcoholic drinks and electronics in the coming months.

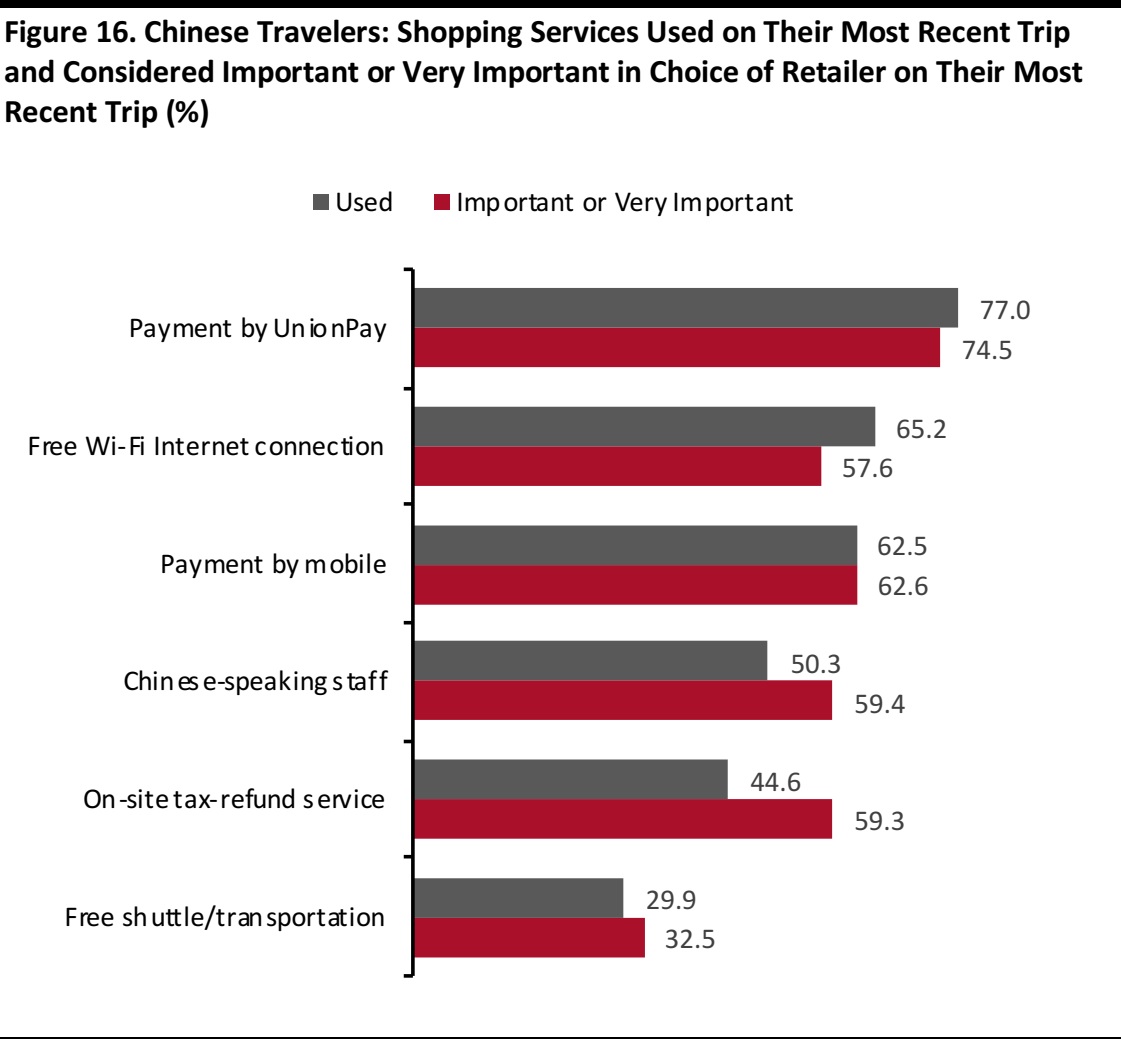

Services Considered Important and Services Used

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Payment options and Wi-Fi connectivity are the most-used and most-desired shopping services among Chinese travelers we surveyed. Survey results showed that there is a gap between usage and importance of Chinese-speaking staff and usage and importance of on-site tax-refund services, which suggests that there are opportunities for more retailers to provide these services.

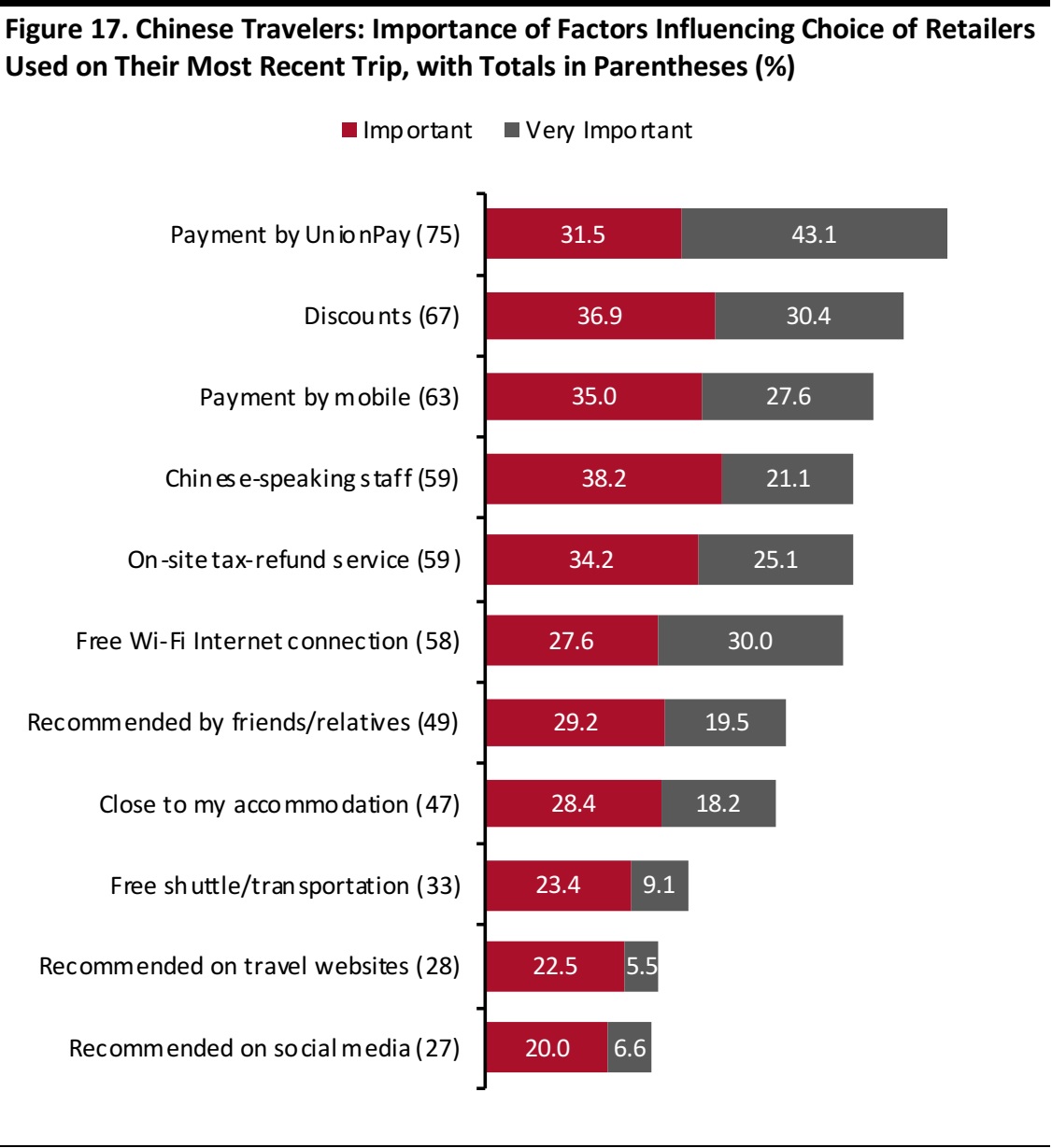

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

In terms of factors influencing where Chinese travelers choose to shop when abroad, the ability to pay by mobile jumped from the eighth-most-important factor in last year’s survey to the third-most-important factor in this year’s survey. Social media recommendations made no such jump: like last year, these ranked as the least important factor influencing respondents’ decisions on where to shop.

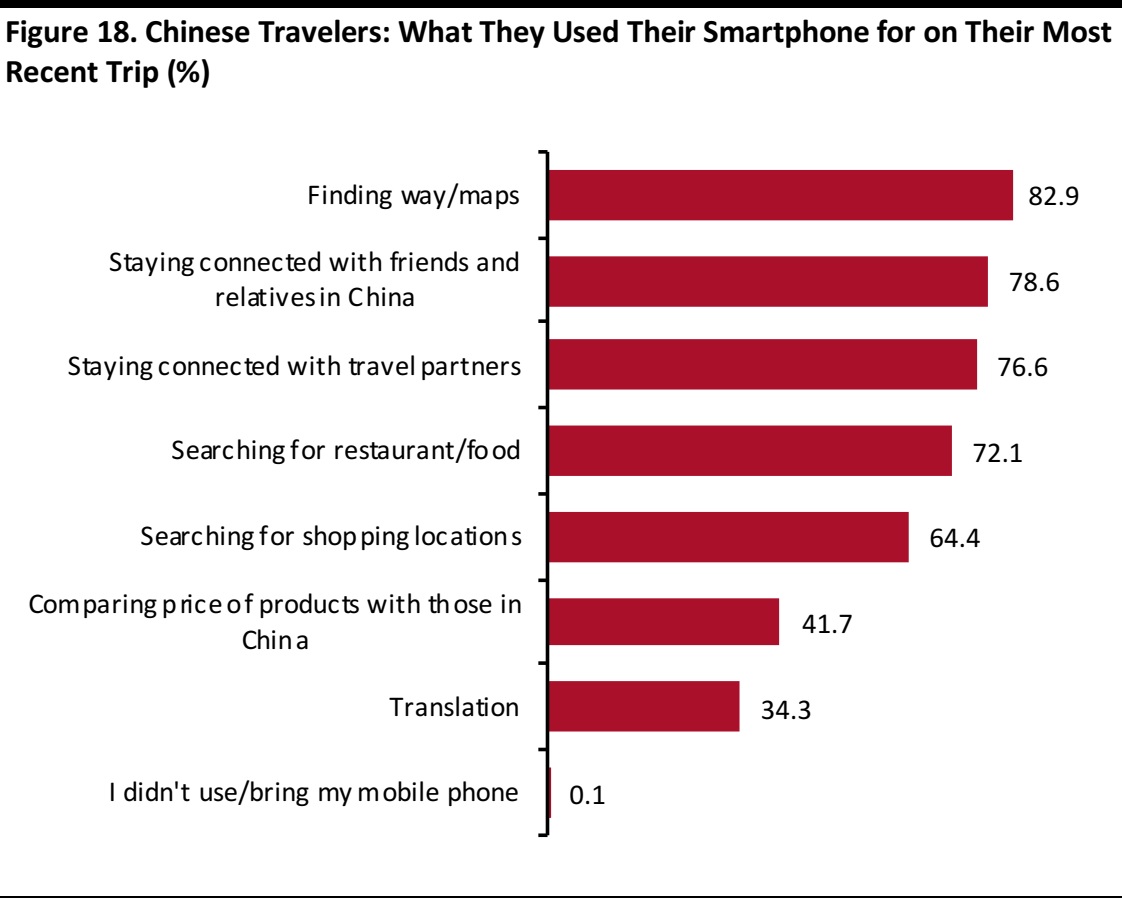

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Chinese consumers rely heavily on their smartphones when traveling, especially to search for information. High percentages of respondents said that they had used their phone to find maps and to search for food and shopping destinations on their most recent trip abroad. And a sizeable 41.7% of those surveyed said that they had used their phone to compare prices abroad with those in China.

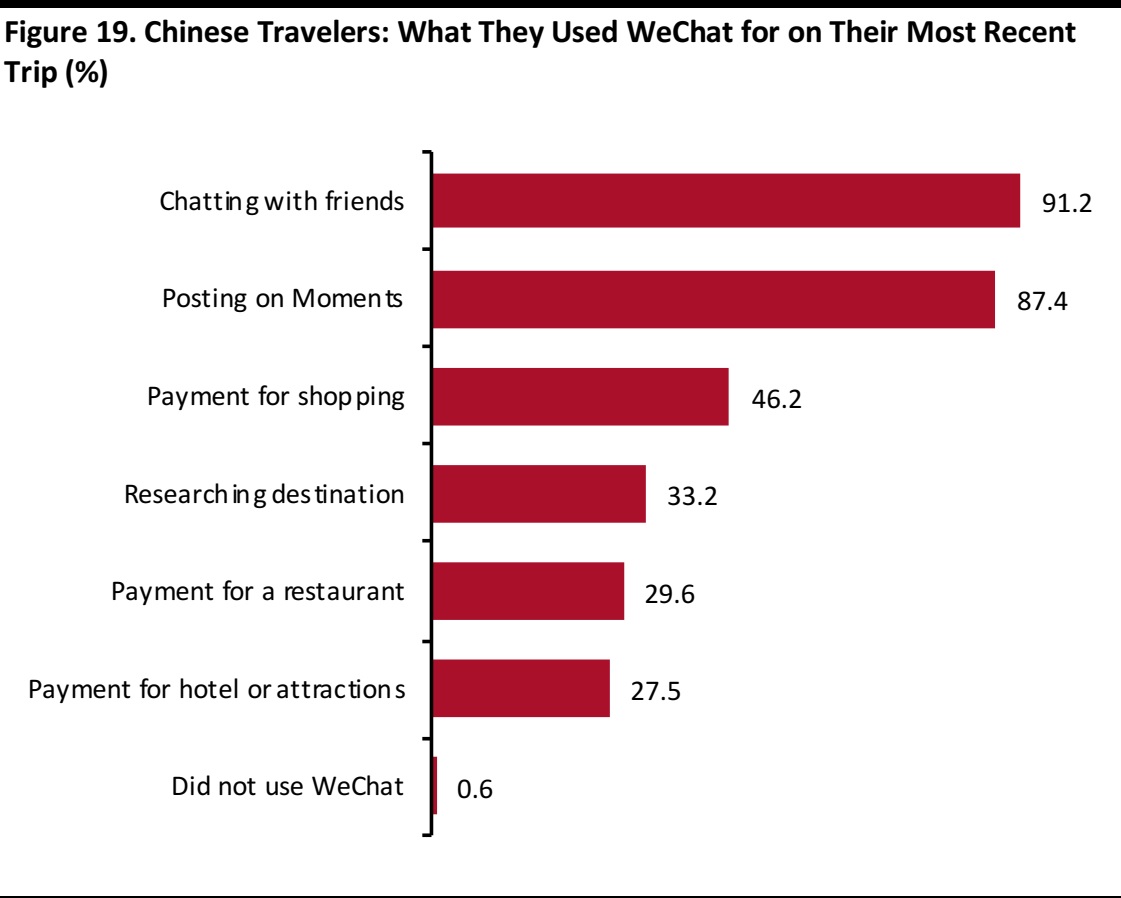

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 895 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

More than 99% of survey respondents said that they had used the WeChat app on their latest trip overseas, and sharing and shopping dominated their usage. Almost half of those surveyed said that they had used WeChat to pay when shopping and nearly one-third said that they had used it to pay at a restaurant. WeChat is rolling out payment services to retailers in Western countries including the US and the UK this year, and we expect to see more major retailers in tourist hotspots sign up to offer payment by WeChat.

How They Travel

Base: Internet users who had taken a leisure trip outside Mainland China in the past 12 months

(853 in 2018 and 733 in 2017)

Source: China Luxury Advisors/Coresight Research

Base: Internet users who had taken a leisure trip outside Mainland China in the past 12 months

(853 in 2018 and 733 in 2017)

Source: China Luxury Advisors/Coresight Research

Our survey suggests that there has been an increase in the number of Chinese travelers going overseas with friends and a decline in the number traveling in traditional family groups—i.e., with a spouse/partner and children. Residents of tier-one cities and younger age groups led the shift away from traveling with a spouse/partner and toward traveling with friends in the past year.

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Chinese travelers ages 18–29 are much more likely than the average traveler to take trips with friends, and this option looks to have grown in popularity: some 44% of 18–29-year-olds surveyed said that they had traveled with friends this year, compared with 27% of those surveyed last year.

However, many older millennials—those in their 30s—will have already established families and, so, are much more likely than the average traveler to plan trips that include young children and a spouse or partner.

Base: Internet users who had taken a leisure trip outside Mainland China in the past 12 months

(853 in 2018 and 733 in 2017)

Source: China Luxury Advisors/Coresight Research

Base: Internet users who had taken a leisure trip outside Mainland China in the past 12 months

(853 in 2018 and 733 in 2017)

Source: China Luxury Advisors/Coresight Research

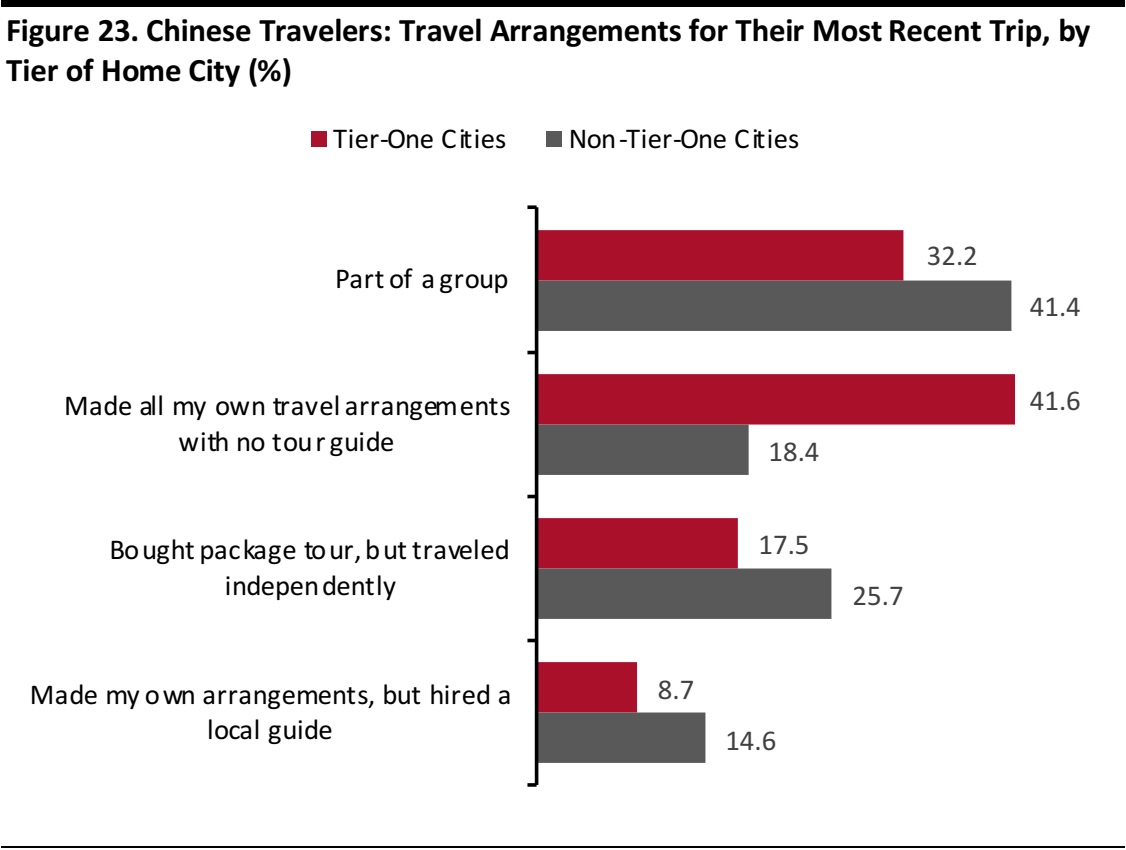

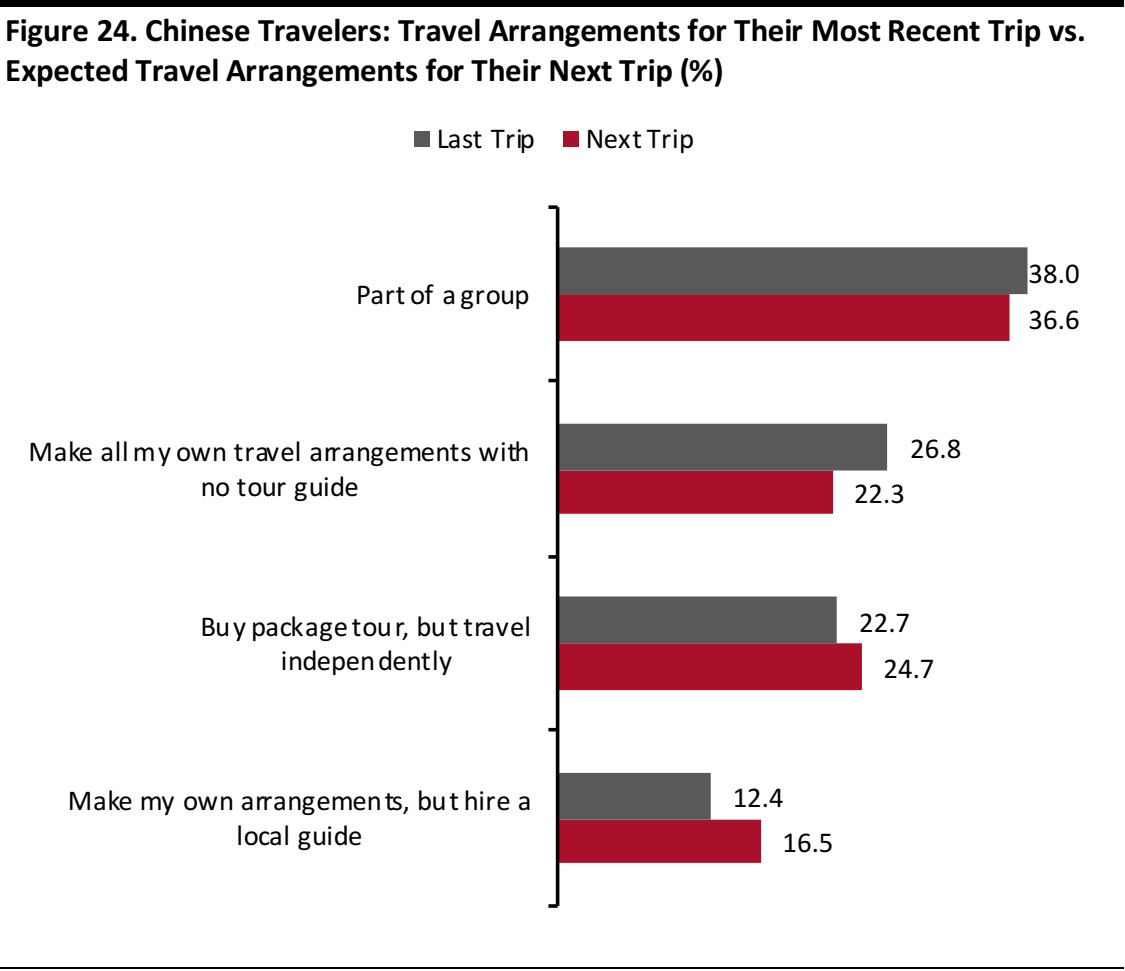

Group travel is alive and well, although independent travel options are offering greater competition. Fully 38% of those we surveyed said that they had taken their most recent leisure trip as part of a group, up from around 35% last year.This year-over-year increase was solely driven by residents of non-tier-one cities, who showed an increased propensity to travel in groups.

However, package tours look to be in decline, and our latest survey found that making all travel arrangements independently is now a more popular option than a package tour. Travelers from tier-one cities are leading this switch to independent travel.

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months

Source: China Luxury Advisors/Coresight Research

Our survey confirms that travelers from tier-one cities are more independent in nature than travelers from lower-tier cities. A large body of the growing middle class comprises lower-tier-city residents.These consumers are less experienced international travelers than their tier-one counterparts, and they tend to prefer group travel due to concerns over safety and language barriers.

Year over year, we saw similar shifts among travelers from tier-one and lower-tier cities, although the shift to independent travel was much more pronounced among those from tier-one cities: for example, we saw a 14-percentage-point increase in the number of tourists from tier-one cities who made their own travel arrangements and traveled without a guide, versus a three-percentage-point increase among those from lower-tier cities.

Planning Their Next Trip

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months and 692 Internet users who expect to take a trip outside Mainland China in the coming months, excluding those who answered “Not Decided Yet”

Source: China Luxury Advisors/Coresight Research

Base: 853 Internet users who had taken a leisure trip outside Mainland China in the past 12 months and 692 Internet users who expect to take a trip outside Mainland China in the coming months, excluding those who answered “Not Decided Yet”

Source: China Luxury Advisors/Coresight Research

We also asked those respondents who expect to travel again soon about how they are likely to travel on their next trip. The proportion of travelers planning to go on a group trip is down only slightly versus those who traveled with a group on their most recent trip.

Base: 692 Internet users who expect to take a trip outside Mainland China in the coming months, excluding those who answered “Not Decided Yet”

Source: China Luxury Advisors/Coresight Research

Base: 692 Internet users who expect to take a trip outside Mainland China in the coming months, excluding those who answered “Not Decided Yet”

Source: China Luxury Advisors/Coresight Research

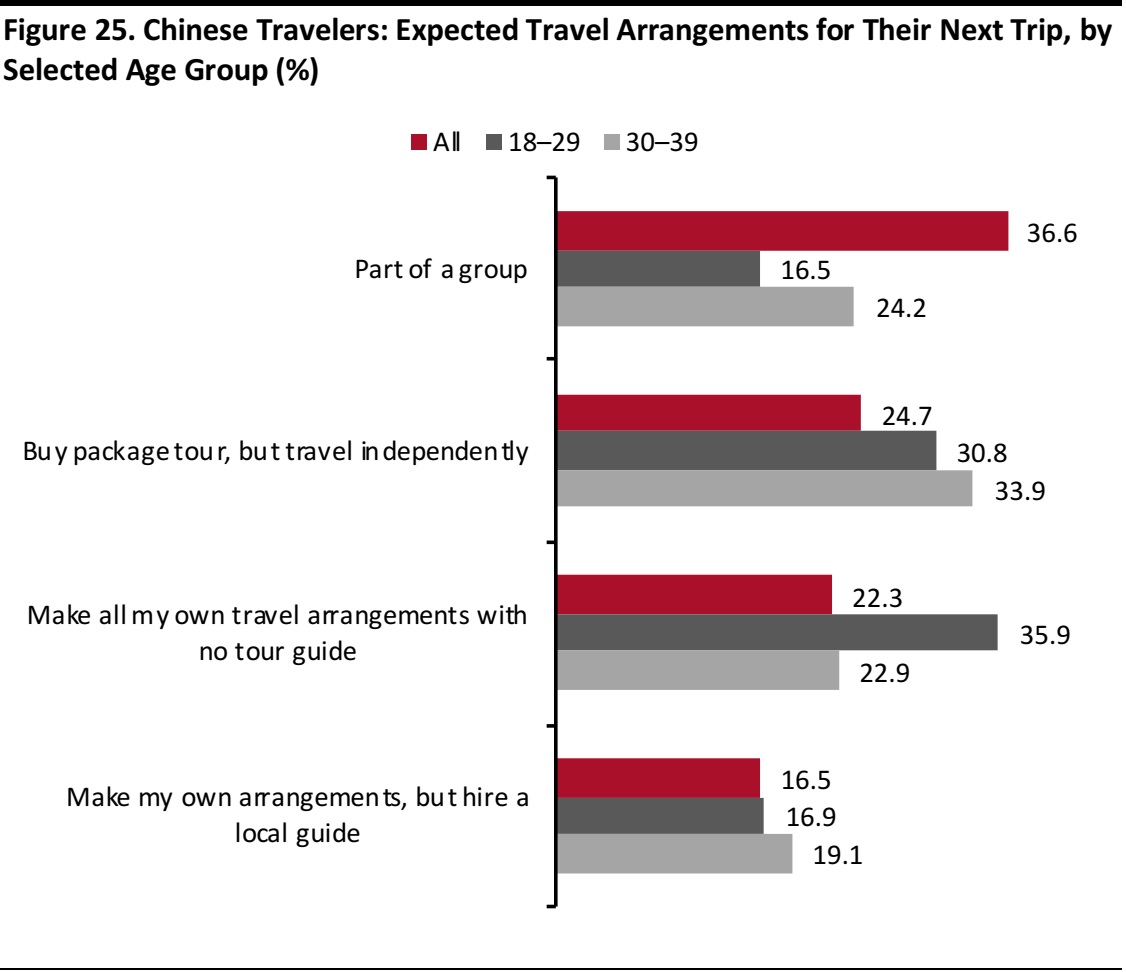

Younger travelers are much more likely than the average traveler to buy a package tour but then travel independently and to make their own arrangements for independent travel.They are much less likely than the average traveler to go on group trips.

Base: 692 Internet users who expect to take a trip outside Mainland China in the coming months

Source: China Luxury Advisors/Coresight Research

Base: 692 Internet users who expect to take a trip outside Mainland China in the coming months

Source: China Luxury Advisors/Coresight Research

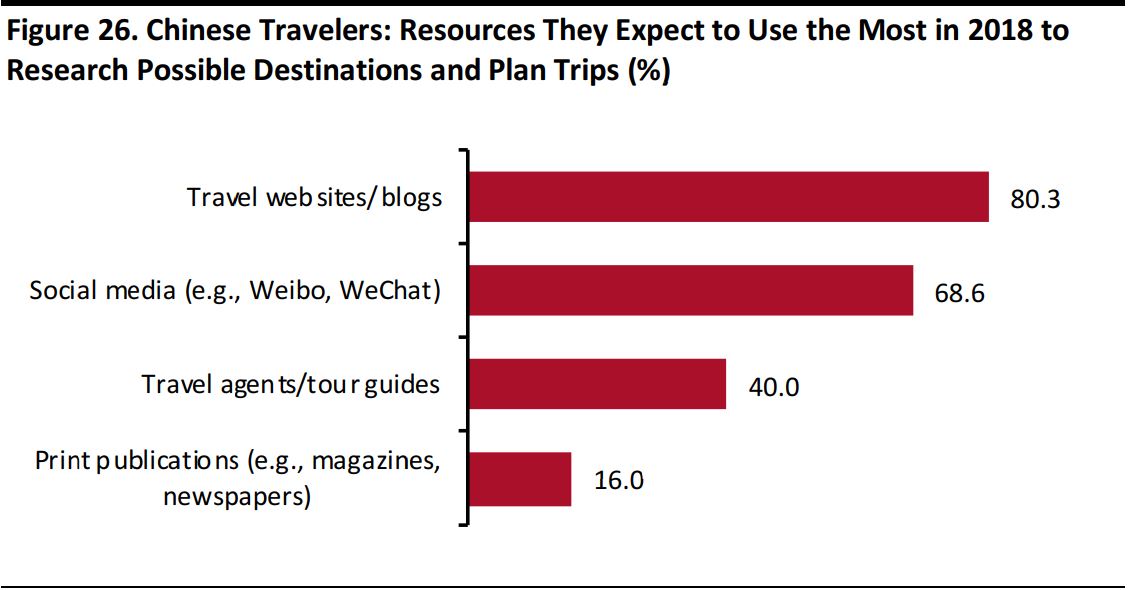

Online sources of travel information are displacing traditional sources and enabling the greater adventurousness and independence of Chinese travelers.

Key Recommendations

Chinese tourists are switching their spending away from pure shopping to adventures, local cuisines, and new and interesting activities. While these travelers will still shop for themselves and for their friends and family, their interests and travel patterns are quickly broadening and changing their travel behavior and destinations. As the nature of Chinese outbound travel shifts, it is important for shopping destinations to continue to adapt their Chinese consumer strategies. Our top recommendations for the year ahead include:- Assess your business from a perspective of group travelers versus independent travelers. Split your forecasts and initiatives into two different groups, and adapt your marketing and services accordingly. Does your location rely heavily on one type of traveler or the other? Given the outlook for group versus individual travel outlined above, make sure that your business strategy is realistic and that your marketing initiatives are aligned with the changing nature of the traveler profile.

- Ensure that information about your destination is available on digital channels and in Chinese. Assess whether your website is easily accessible to travelers in both Mainland China and the destination country. And don’t forget to have a mobile version of your website!

- Make full use of WeChat. While most destinations view WeChat as a social media platform, it is much more than that. Retailers and tourist destinations can create a mini website via the menu on WeChat and an “app within an app” using WeChat’s Mini Program functionality. They can also advertise to overseas tourists or locals via WeChat’s new ad-targeting features, engage users in-store and enable payment with WeChat Pay. WeChat has improved its search capability and more than 99% of travelers use it to search for shopping destinations while traveling, so it is crucial that retailers and shopping centers use WeChat as more than just a social media platform.

- Highlight unique products that are local in nature or not available in China. As global branded products become more affordable and available in China, it is increasingly important to provide special products that are unique to the destination, limited in nature or not available in China. Chinese tourists are no longer buying based on price differences alone, so retailers must give them other reasons to shop overseas.

Case Study: Outlet Centers

Chinese tourists have a very high propensity to shop at outlet stores, particularly when traveling to Europe and North America, where the retail outlet market is highly developed. Accordingly, outlet centers were some of the first retailers to actively target Chinese consumers shopping abroad. Outlet operators are now quite adept at marketing to Chinese tourists and they are in a prime position to witness the ongoing development of this consumer group. We spoke with executives from two outlet centers, one in Europe and one in the US, to learn about how they are targeting Chinese shoppers, how shopping patterns are shifting and their outlook for the market. VIA Outlets, a network of 11 outlet shopping centers throughout Europe, has seen success by focusing on Chinese tourists, particularly at the company’s Prague and Amsterdam locations. At VIA’s Batavia Stad Amsterdam fashion outlet center, key components of the program include:- Hiring Chinese-speaking staff: The company hired a native Chinese speaker for its tourism team to directly engage the Chinese audience and the investment is generating high ROI.

- Using Chinese social media: Batavia Stad runs its own Weibo and WeChat social media channels, allowing the shopping center to connect directly with Chinese travelers and residents in the Netherlands.

- Engaging Chinese influencers: Batavia Stad is engaging Netherlands-based Chinese influencers such as model/stylist Yoyo and other stylists and makeup artists to provide unique and relevant content to their fans. The outlet center also invited several fashion and beauty influencers to host a styling event that was livestreamed via an influencer on the Yizhibo platform, positioning Batavia Stad as a relevant resource for fashion advice.

- Engaging with the Chinese travel industry: Batavia Stad’s team has built relationships with the Chinese travel industry by visiting China for sales missions and by participating in travel trade shows in the country.

Craig Realty/Citadel Outlets

Craig Realty operates a network of outlet centers in the US that have focused on Chinese shoppers for several years. Cynthia Schmitt, Director of International Sales and Marketing at the company’s Citadel Outlets center in Los Angeles, said that “Chinese shoppers are very important to our organization. The Chinese shopper is woven into the centers’ shopper demographic fabric.” At Citadel Outlets, Craig Realty’s ongoing efforts to target Chinese travelers include:- Establishing a presence in China: The outlet center has established a marketing office in China that helps the company publish content on Chinese social media channels such as Weibo and WeChat, build relationships with China-based travel companies, and host familiarization trips with VIP travel industry professionals.

- Offering signage and materials in Chinese and hiring Chinese-speaking staff: Citadel Outlets has invested in Chinese-language collateral, a Chinese website, Chinese on-site signage (in the customer service and tour bus drop-off areas) and Chinese-speaking staff at customer service and in key stores.

- Catering to tour groups: Citadel Outlets recognizes the importance that face-to-face engagement plays in Chinese culture, and it treats its Chinese customers to a warm, welcoming experience. For example, the center offers these guests access to its VIP lounge and even a welcome message in Chinese on its large-screen LED. An ambassador from the center greets every tour bus, providing guests with amenities such as a savings card and a gift/shopping bag. The company also provides meeting and conference attendees with exclusive programs and offers.

- Offering “China Ready” tenant customer service training programs: Citadel Outlets hosts China-Ready training for its tenants to provide them with information, updates and guidance on market trends, shopping behavior and preferences, payments, promotions, and staffing in order to ensure that tenants see maximum success with Chinese customers.

Case Study: Mobile Payments

China is rapidly evolving from a predominately cash economy to a mobile cashless society. January 2017 data from the Cyberspace Administration of China showed that 469 million Chinese users were registered on a mobile payment platform and that the total number of registered users had risen by 31.2% year over year. The China Internet Network Information Center, another government bureau that collects usage data, indicated that mobile payment usage in transactions rose from 57.7% at the end of 2016 to 67.5% at the end of 2017. With a combined share of more than 90% of the mobile payment market, Alipay and WeChat Pay are working on developing payment infrastructure outside China to serve China’s outbound tourists around the world. Mobile payment adoption has been fastest in Asia, particularly in Japan, but more and more destinations around the world are offering the option. Duty-free retailer International Shoppes recently began to accept mobile payments in its stores in the US. In order to better serve Chinese tourists, International Shoppes engaged third-party payment provider Citcon to implement mobile payment across its shop locations. “Before working with Citcon, we had enough transactions that were cancelled or didn’t go through [that] it got our attention. There’s nothing worse than having to tell a customer we can’t complete their purchase,” said Matthew Greenbaum, VP of Business Development for International Shoppes. Without the ability to accept mobile payments, International Shoppes was missing out on potential revenue from the valuable Chinese tourist consumer base. “We try with everything we do to make the customer experience better. In regards to Chinese consumers, they’ve been a huge focus for us because they’ve been driving an outside ratio of purchases. They are some of the biggest spenders that we have, and it’s really important we understand what these customers want and what their expectations are,” Greenbaum added. With stand-alone mobile payment devices, International Shoppes is able to process transactions within seconds and reduce payment friction. After implementing mobile payment via Alipay and WeChat Pay, the duty-free retailer noticed a significant drop in declined transactions from Chinese consumers. LVMH-owned DFS is another duty-free retailer that has implemented mobile payment in key locations, and to similar success. Many stand-alone retailers, department stores and malls are following suit, quickly implementing new mobile payment options to accommodate the changing needs of Chinese travelers shopping abroad.Appendix: Exchange Rates

Source: S&P Capital IQ

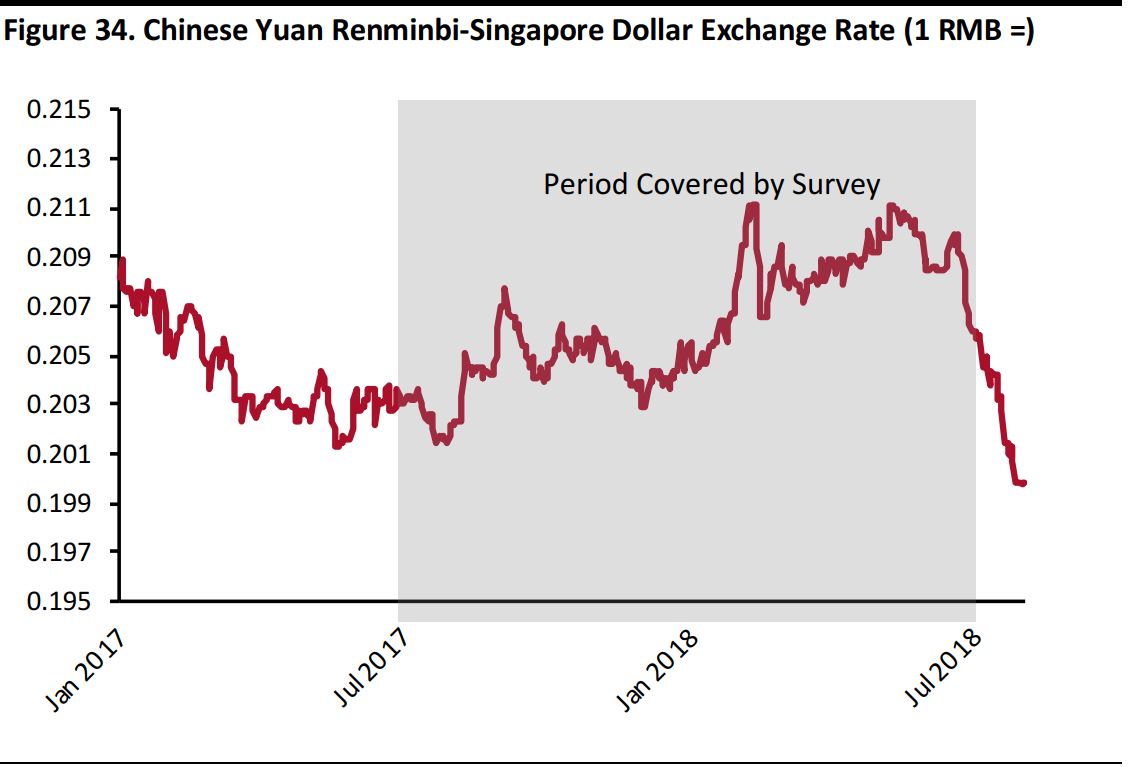

In the year under review, the renminbi strengthened against the US dollar and the Hong Kong dollar and, less so, against the Japanese yen and the Singapore dollar.

Source: S&P Capital IQ

Source: S&P Capital IQ

Source: S&P Capital IQ

Source: S&P Capital IQ

Source: S&P Capital IQ

Source: S&P Capital IQ