DIpil Das

What’s the Story?

As the Chinese government encouraged people to stay in place for the holiday, more than 100 million people did not travel home from where they were working. Chinese New Year is typically an occasion when most of the country's rural migrant workers and white-collar workers who live far away from home return to their family homes to celebrate the holiday.

In this report, we discuss retail sales and consumer spending over the recent Chinese New Year holiday, from February 11 to 17—including the impact of changes to typical travel behavior over the festival period this year.

Chinese New Year Review: In Detail

Despite Growth, Holiday Retail Sales Are Yet To Recover to Pre-Pandemic Levels

In the weeks leading up to the holiday, China saw several Covid-19 outbreaks, particularly in the north of the country. Although the Chinese government did not completely ban travel, it implemented Covid-19 testing requirements, which convinced many people to stay put and not travel home to see family over the holiday—a long-established Chinese New Year tradition and distinct from consumers who travel for leisure over the holiday period. According to data from China’s Ministry of Transport and Ministry of Human Resources, more than 100 million people who would typically return home each year to celebrate the festival did not do so this year. Travel for all journey types within the country was down 34.8% year over year from February 11 to 17, according to the Ministry of Transport.

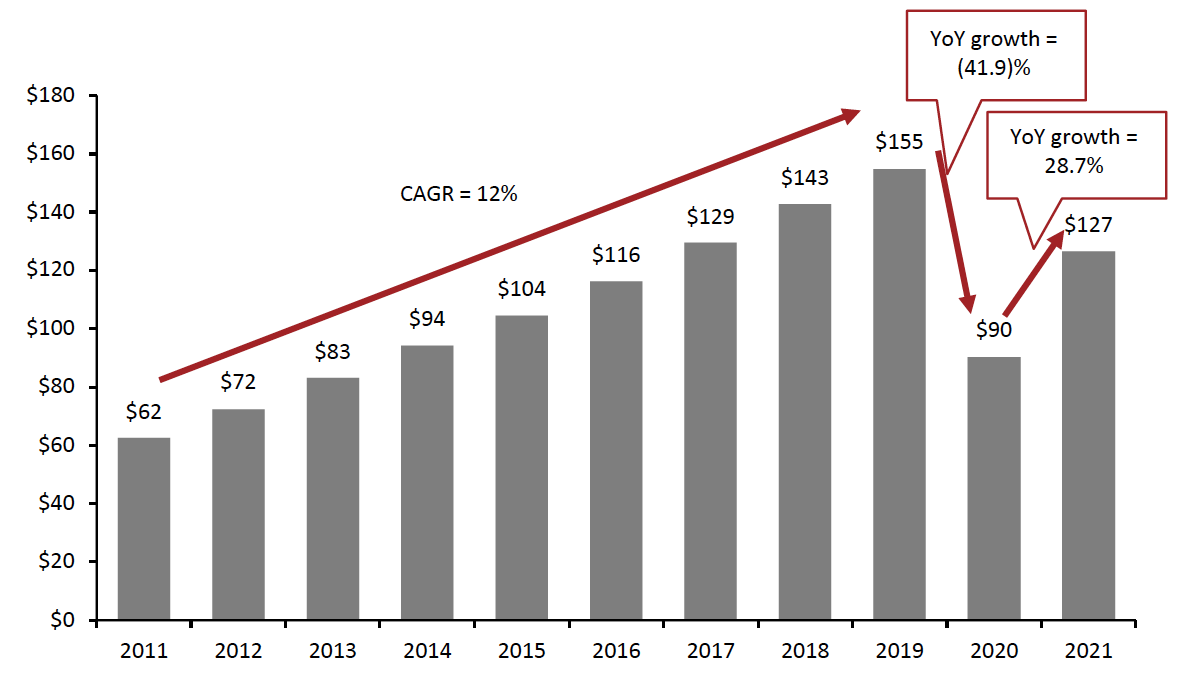

Compared to a turbulent Chinese New Year in 2020, when most retail and food-service businesses were affected by the outbreak of Covid-19, retail and food-service sales in China for the 2021 holiday period grew 28.7% year over year, reaching ¥821 billion ($126.5 billion), according to the Ministry of Commerce.

As shown in Figure 1, spending was still much lower in 2021 than 2019, when all activities (such as retail and travel) were operating as normal and at full capacity. The Covid-19 crisis has also had negative impacts on consumers’ income levels, which likely affected spending this year compared to prior years.

Figure 1. Retail Sales (incl. Food Service) in China over Chinese New Year (USD Bil.)

[caption id="attachment_123762" align="aligncenter" width="700"] USD conversion at constant exchange rate

USD conversion at constant exchange rateSource: China’s Ministry of Commerce/Coresight Research[/caption]

With changes to typical travel behavior over Chinese New Year this year, traditional food spending and consumption habits changed over the festival period. Booming online sales of fully or semi-prepared meals for New Year’s Eve is a new feature of holiday spending for 2021.

- From February 9 to 11, sales on online food-delivery service platform Ele.me more than doubled compared to last year, and sales of semi-prepared New Year’s Eve meals increased by four times year over year.

- Food demand appears to have been driven by traditional regional customs. For instance, as Northern Chinese workers who live in southern China were unable to return home for Chinese New Year, the number of online orders for dumplings—the traditional festival food in northern China—increased significantly in southern cities and provinces such as Guangdong, Shanghai and Zhejiang, while the number of online orders for dumplings in northern cities declined, according to Ele.me.

As many consumers were unable to travel home for Chinese New Year celebrations, we saw an increase in the number of remote orders to send gifts between different cities, likely reflecting fewer consumers traveling to give gifts in person. For example, e-commerce giant JD.com saw a year-over-year increase of 58% in deliveries with different senders and recipients during this year’s holiday period, according to the company.

Several e-commerce platforms teamed up with major logistics companies to provide consumers across the country with uninterrupted logistics services around the holiday period. Around 480 million parcels were delivered nationwide from February 11 to 16, according to broadcaster China Central Television—more than triple the amount delivered in the period last year.

In terms of consumer spending, smart household products were a hit during the holiday. On Tmall, sales of sweeping robots and window cleaning robots increased by more than 100% and 300%, respectively, according to the platform. This builds on the growth trajectory in 2020—gross merchandise value (GMV) for these items on Tmall increased by 19% year over year in its fourth quarter, ended December 30.

Coinciding Holidays: Valentine’s Day Brings Specific Category Sales Growth

With this year’s Chinese New Year holiday also spanning Valentine’s Day, retailers in popular categories for the February 14 holiday, such as beauty products, gold and silver, and jewelry, saw notable sales growth.

Sales of gold and silver and jewelry items by “certain closely monitored enterprises nationwide” (not disclosed by the Chinese Ministry of Commerce) grew 160.8% year over year compared to the same period in 2020. This builds on the growth trajectory for sales in late 2020—retailers of gold and silver and jewelry saw 16.7% year over year growth in October, 24.8% in November and 11.6% in December, according to Ministry of Commerce data on all retailers in China.

JD.com saw the most significant growth over the holiday period in its beauty, jewelry and watches categories. According to the retailer, from February 4 to 14, the sales volume of women’s gold necklaces and gold pendants purchased by male consumers increased by 6.2 times compared to the same period last year. Interestingly, as well as regional influences on consumer spending on food, sales of beauty products indicate regional influences on demand. For instance, on JD.com:

- In northern China, 60% of consumers’ beauty spending was on facial care.

- Consumers in the country’s eastern region spent more on fragrance and makeup products than other beauty products.

- Consumers in southern China spent more on eye creams than other beauty products.

- In central China, men’s cleansing products and lotion were more popular than other beauty products, in terms of money spent.

Local Tourism and Short-Distance Trips Replaced Long-Distance Tours

Following encouragement to stay put for the Chinese New Year holiday this year, many consumers that would have booked long-distance tours turned to local tourist activities and short-distance trips. Popular local tourist activities for the holiday include home city tours, visiting nearby rural areas and enjoying regional folk customs.

According to Alibaba’s online travel platform, Fliggy, the number of local tour bookings for the Chinese New Year increased by more than 660% year over year. The platform also reported that the number of local tours saw a 70% year-over-year increase from February to December 2020, indicating a coronavirus-induced shift toward more local and short-distance travel.

Cities that would typically be deserted during the holiday, as workers travel home to see family during the holiday, were much more lively this year, according to online travel platform Ctrip. As of February 17, the scenic spots in Beijing, Changsha, Chengdu, Chongqing, Guangzhou, Luoyang, Shanghai, Shenzhen, Suzhou and Xi’an had the largest number of bookings for tourist activities compared to other cities in China. These cities are well known for having significant migrant worker populations—with many workers unable to travel home over the holiday, they appear to have turned to local tourist activities to celebrate the New Year festival instead.

[caption id="attachment_123763" align="aligncenter" width="550"] People visiting the Temple of Heaven Park in Beijing on February 17, which would typically be deserted over Chinese New Year

People visiting the Temple of Heaven Park in Beijing on February 17, which would typically be deserted over Chinese New YearSource: Xinhua[/caption]

Duty-Free Shopping Remains a Hit

Duty-free shopping is becoming established as a key feature of holiday spending. Continuing the trend witnessed during China’s National Day holiday in October 2020, duty-free purchases proved popular over the Chinese New Year holiday. The Department of Commerce in Hainan Province, which is famous for its duty-free business, tracked spending at the following nine offshore duty-free stores over the Chinese New Year:

- Haikong Global Boutique (Haikou) Duty Free City

- Haikou Meilan International Airport Duty Free Shop

- Haikou Riyue Plaza Duty Free Shop

- Qionghai Boao Duty Free Shop

- Sanya Fenghuang Airport Duty Free Shop

- Sanya Hailv Duty-Free City

- Sanya Haitang Bay International Shopping Centre

- Sanya International Duty-Free Shopping Park

- Shenmian Haikou Guanlan Lake Duty-Free Shopping City

During the National Day holiday on October 1–7, 2020, four of the above stores together achieved retail sales of ¥1.03 billion ($152.9 million)—an increase of 167% year over year, according to the Ministry of Commerce. The other five stores have all been opened since October, and from February 11 to 17, 2021, sales at Hainan’s nine duty-free stores exceeded ¥1.5 billion ($232 million)—double the sales seen in the same period of 2019.

To attract shoppers, in addition to providing discounts and sales, some duty-free stores also promoted exclusive products and Chinese New Year-themed items. Whisky brand Glenfiddich launched a limited-edition Chinese New Year gift pack, featuring Chinese lanterns to celebrate the occasion. The brand launched a pop-up store in Lagardère Duty Free in Sanya, Hainan.

[caption id="attachment_123764" align="aligncenter" width="550"] Glenfiddich’s Chinese New Year pop-up in Lagardère Duty Free in Sanya, Hainan

Glenfiddich’s Chinese New Year pop-up in Lagardère Duty Free in Sanya, HainanSource: Company website[/caption]

Ahead of the Chinese New Year holiday, on February 2, the Ministry of Finance, the General Administration of Customs and the State Administration of Taxation in China jointly launched a new policy regarding pickup methods for duty-free shopping. With the update, consumers are able to have duty-free goods that they purchase in Hainan delivered to their homes.

What We Think

This year’s Chinese New Year holiday saw retail and food-service sales increase by 28.7% from 2020, but still lag behind pre-pandemic levels in 2019. As major shopping holidays such as Chinese New Year are often used as bellwethers of overall consumer spending/retail sales, this year’s festival indicates that overall consumer spending has not yet fully recovered as the impacts of the Covid-19 crisis persist.

Implications for Brands/Retailers

- For upcoming holidays, local and short-distance trips will likely remain popular. Brands and retailers can expand their physical footprint (i.e., open new stores or pop-up stores) in local attractions.

- Brands and retailers can leverage the duty-free channel to sell their products, especially overseas luxury and beauty brands, which are popular duty-free shopping choices among Chinese consumers.

- Ahead of next year’s festival, brands and retailers should begin promoting Chinese New Year products as early as December, to generate consumer excitement. Themed products could feature the relevant zodiac sign for that year or symbols from Chinese culture relevant to the holiday, such as Chinese lanterns. Read our separate report on retail strategies for international brands and retailers to capitalize on the holiday.