DIpil Das

Introduction

What’s the Story? The Chinese New Year (CNY) national holiday, celebrating the Year of the Tiger this year, lasted from January 31 to February 6, 2022, with celebrations continuing until February 15. This year, the festival overlapped with the 2022 Winter Olympics, which was held in Beijing from February 4 to 20. This has had significant impacts on the CNY holiday in terms of lockdown measures, winter sport initiatives, and sales of Winter Olympics merchandise. We explore these impacts in this report as we review Chinese New Year 2022. Why It Matters Although no official revenue data for CNY 2022 has yet been released, we expect retail sales to show significant year-over-year growth, impacted by strong travel, duty-free shopping and gifting trends. The combination of the Spring Festival period (a massive gifting occasion) and the Winter Olympics is also likely to have driven strong growth in the winter sports goods category as well as ice and snow tourism in Northeast China’s Ski resorts.Chinese New Year 2022 Review: Coresight Research Analysis

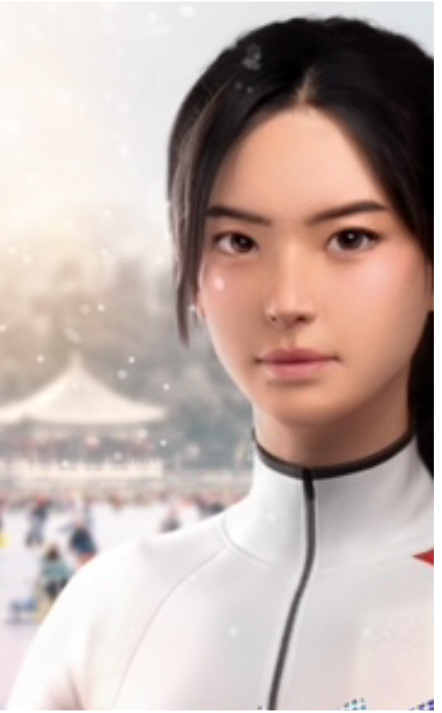

Travel Travel rates are an important factor in retail performance during CNY, as they impact travel retail and accommodation services. The Chunyun period (the Spring Festival travel rush from January 17 to February 25, 2022), is likely to see travel increase for the first time since 2020, with the Chinese Ministry of Transportation predicting a 36% year-over-year rise to 1.18 billion passenger trips. However, this level would be 60% lower than the 3.0 billion trips during Chunyun in pre-pandemic 2019, as a result of Covid-19 travel restrictions (which we discuss below) and continued consumer caution around the virus. During the CNY holiday week, the Ministry of Transport recorded an estimated 130 million trips, a year-over-year increase of 31.7% but still 69.2% below 2019 levels. Winter Olympics Covid-19 Restrictions and Lockdowns The overlap of the 2022 Winter Olympics with CNY resulted in strengthened Covid-19 restrictions that impacted Beijing and surrounding cities. Such restrictions were likely to have impacted CNY celebrations and spending among Chinese consumers. The Olympics added an unprecedented layer of complexity to China’s “Zero-Covid” policy, with a series of local lockdowns and testing procedures as well as tight restrictions on international travel: Ahead of the Olympics, Chinese aviation authorities canceled flights from France, Indonesia, the US and the UAE. These flight suspensions likely limited domestic business and tourism revenues, in addition to the ambitions of foreign sports companies that hoped to capitalize on China’s push to popularize winter sports during the Olympics. Many neighborhoods in the city of Beijing itself were put under lockdown, and families who were potentially exposed to Covid-19 were ordered not to leave their homes. No tickets to the Olympics were available to the general public, as only selected spectators were allowed to attend. Across China, approximately 21 million people were in lockdown through the Olympics (and therefore the CNY period): 5.5 million in Anyang, 1.3 million in Xiong’an (a city close to Beijing), and 14 million in Xi’an. Many other cities in proximity to Beijing, such as Tianjin, were placed under high alert. Sportswear Demand The Winter Olympics ushered in huge demand for winter sportswear and equipment, including as gifts. Chinese President Xi Jinping hoped to inspire “300 million Chinese to participate in winter sports if [China] win[s]” in the Olympics with the aim of building a $150 billion (¥1 trillion) winter sports industry, according to China’s Xinhua news agency. The country has more than 650 ice rinks and 800 ski resorts, according to the National Winter Sports Administrative Center. E-commerce giant and Olympics partner Alibaba is supporting the development of the winter sports industry, and debuted its advanced digital persona, “Dong Dong,” at the Winter Olympics. Equipped with a dynamic personality and human features, Dong Dong helped to promote Olympics merchandise and winter sports equipment. [caption id="attachment_142151" align="aligncenter" width="442"] Dong Dong

Dong Dong Source: Alibaba [/caption] Ski products and figure skates saw year-over-year sales growth of 322% and 533%, respectively, on e-commerce platform JD.com from January 31 to February 4, 2022, according to the company. Sales of ski and skating products rose 180% and 300%, respectively, year over year, on Alibaba’s Tmall marketplace. Ice and snow tourism increased by over 30% year over year during the CNY 2022 festival period, according to Fliggy, China’s online travel agency. Most of the ice and snow tourism was directed toward the northeastern Chinese provinces, which have both skiing and hot-spring attractions. China’s Gen Zers drove this interest, as snow tourism bookings increased by over 80% among this age group, according to the same source. Duty-Free Shopping Duty-free shopping in Hainan continues to attract tourists in great numbers. Days before CNY, Sanya—the city which is home to China’s duty-free shops on Hainan Island—ranked the top choice for hotel bookings during the CNY holiday, driving average nightly prices to one of the highest levels among major Chinese cities, according to Chinese travel site Qunar.com. In total, there were 301,800 shoppers during the holiday week, a 138% year-over-year increase, according to Xinhua. Duty-free sales reached $335 million (¥2.13 billion) during the seven-day CNY holiday, according to the Hainan Provincial Department of Commerce—representing 151% growth compared to the previous record of $254.5 million (¥1.47 billion) set during the seven-day Golden Week in October 2021. The 10 duty-free shops (up from seven last year) feature products from around 720 brands, according to Xinhua. The duty-free format continues to attract international brands: Beauty company L’Oréal recently launched a series of pop-up stores in Sanya’s International Duty-Free Shopping Complex to capitalize on domestic tourism. Improved Logistics for Remote Gifting and Food & Beverage Retail Remote gifting has been increasingly popular in China; 2022 marked the third time that CNY has been impacted by the Covid-19 pandemic, and millennial and Gen Z consumers continued to buy gifts online during the CNY festival period. CNY is one of the biggest gift-giving seasons in China, making logistics during a time of restricted travel even more important. Chinese local on-demand delivery and retail platform Dada Group utilized its autonomous delivery system for its first CNY since the service’s launch in July 2021, providing a one-hour on-demand delivery service to the platform’s consumers and partner businesses, which include over 150,000 offline physical stores across China, according to Dada Group. Rapid delivery services offer remote gifting options for consumers who cannot travel home. They are also essential for food and beverage retail, which requires fast delivery times for perishable goods. Various supermarket chains, such as JD.com’s 7Fresh and Yonghui Superstores, depend on Dada Group’s autonomous deliveries for last-mile delivery services, according to the platform. Popular Gift Products Gift purchases during CNY show that consumers remain concerned with health. Even before the holiday, China’s wellness trend was driving growth of low-sugar and low-calorie products that promote weight loss—and this accelerated the growth of organic and healthy food categories, according to JD.com’s 2021 Food and Beverage Industry Consumption Report. The fastest growing “healthy” products last year included low-calorie cakes, protein bars, chicken breasts, low-fat chocolate, and low-sugar and low-calorie biscuits, which saw year-over-year sales growth rates of between 74% and 587%. JD.com launched special CNY coupons to promote the sale of these trending products and food gift boxes during CNY 2022. Tiger-themed products were another highlight during this year’s CNY: Search volumes for “tiger” rose 874%, year over year, during the Spring Festival, according to Alibaba. On JD.com’s platform, sales of tiger-themed jewelry were 50% higher than sales of ox-themed jewelry last year (2021 was the Year of the Ox), as of February 5, 2022—and tiger-themed designer toys and musical instruments increased tenfold, according to the platform. Stuffed toy versions of Olympic panda mascot Bing Dwen Dwen sold out in seconds upon their launch in February, triggering a resale market that drove prices over $500 per toy.