DIpil Das

Introduction

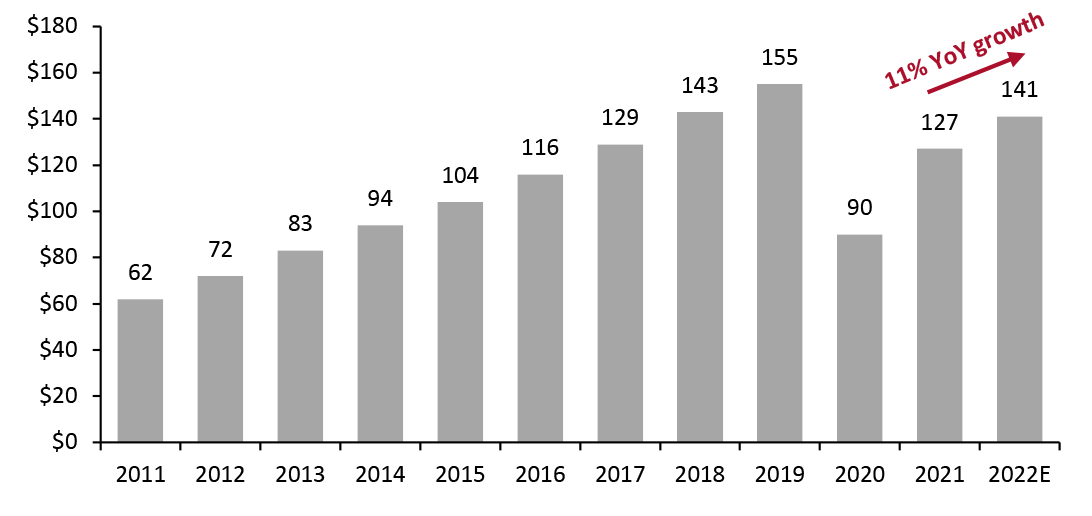

What’s the Story? CNY 2022 starts on February 1, beginning the Year of the Tiger, and celebrations run until February 15. New Year’s Eve, January 31, is the start of a seven-day national holiday in China, which lasts until February 6. Outside China, this holiday is also celebrated in the Southeast Asian countries of Brunei, Indonesia, Malaysia, North Korea, Singapore, South Korea, Thailand and Vietnam. Preparations for the event begin a month before, as people traditionally purchase presents and undertake a major house cleaning to purge their houses of bad luck. Why It Matters CNY is the largest holiday celebration in China, as well as a massive sales opportunity for brands and retailers: The event generated $127 billion in 2021 and we predict it will generate total sales of $141 billion in 2022. Traditionally, Chinese consumers travel back to their hometowns to celebrate CNY with their families and friends. Retail sales during the celebration therefore closely reflect the rate of travel, which provides consumers more opportunities to make purchases and enjoy products in the company of friends and family. Chinese New Year 2022 Preview: Coresight Research Analysis 1. Connecting Retail Predictions to Trends in Travel Covid-19 lockdowns continue to put a damper on retail sales, as travel retail is limited. This had a pronounced effect on CNY 2020, as many small businesses had yet to adapt to the restrictions placed on physical retail. Sales recovered in 2021 as a result of stores and food services digitalizing and improving delivery service options, even as lockdowns became more widespread and travel declined further. Rather than spending on travel, many consumers opted to send gifts to their loved ones during CNY 2021, a trend that is expected to continue this year. We expect total holiday retail and food service sales will grow at a rate of approximately 11% year over year, to reach $141 billion.Figure 1. China: Retail and Food Service Sales During CNY (US Bil.) [caption id="attachment_140086" align="aligncenter" width="700"]

USD conversion at a 2021 constant exchange rate

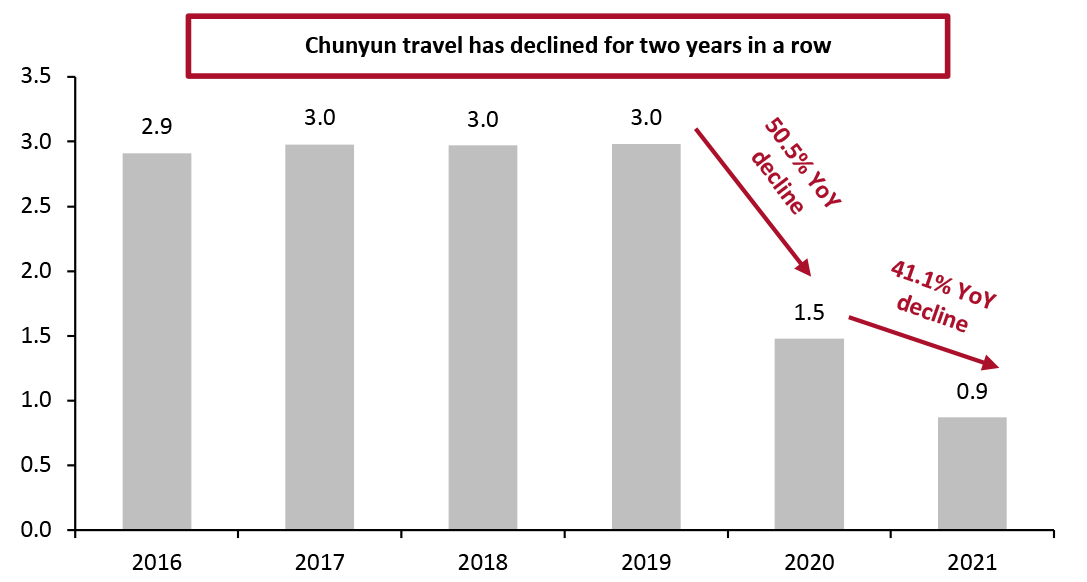

USD conversion at a 2021 constant exchange rate Source: Ministry of Commerce of the People’s Republic of China/Coresight Research [/caption] Since the start of the pandemic in China in January 2020, travel during Chunyun, the 40-day travel period surrounding CNY, has significantly declined year over year for two years in a row, by 50.5% in 2020 and 41.1% in 2021, according to data from China’s Ministry of Transport. Despite these travel declines, 2021 saw a notable recovery in retail—a sign that brands and retailers have succeeded in pivoting to market to the non-traveling consumer.

Figure 2. China: Number of Passengers Undertaking Trips During Chunyun (Bil.) [caption id="attachment_140088" align="aligncenter" width="700"]

Source: China Ministry of Transport[/caption]

We predict that 2022 travel will rise above 2021 levels, given that less of China’s population is currently under lockdown. We expect this will contribute to higher retail and food service sales this CNY, although retail and travel will likely not surpass 2019 levels, as many Covid-19 restrictions remain. Recent retail trends are steady, with year-over-year growth in single digits, slightly below 2021 levels. However, we still expect an increase during January and February driven by an improvement in travel and as consumers buy CNY gifts.

2. Impact of Travel on Retail Sales During CNY

Travel is a major indicator of retail spending for CNY, as Chinese consumers purchase gifts and consume goods during their annual gathering with relatives. For the third year in a row, the Chunyun travel period—which normally sees three billion trips, according to China’s Ministry of Transport—will be affected by China’s “zero-Covid” policy. The close link between travel and retail during CNY is exemplified by the significant dip in 2020, reflecting the strict lockdowns in Wuhan that began in January 2020. We expect that Covid-19 restrictions will be similar to those seen last year, but travel will likely be higher overall: China State Railway, for example, estimates that 2022 will see a 28.5% year-over-year increase in rail travel.

This year’s Chunyun lasts from January 17 to February 25, and will likely see the number of trips rise from 2021's 870 million but remain below 2019’s three billion, according to the Ministry of Transport. Travelers’ plans will be affected by lockdowns in Shenzhen, Tianjin Xi’an—and many may choose not to travel for fear of being stuck in their destination if an outbreak occurs. An estimated 20 million people, or approximately 1.5% of the population, are under lockdown in China as of mid-January.

Under China’s restrictions, people from medium- or high-risk areas are prohibited from travel, with medium-risk areas designated as areas with fewer than 10 reported cases in the last two weeks, and high-risk areas as those with over 10 reported cases, according to the National Health Commission. Alongside these restrictions are concerns around the 2022 Winter Olympics, which will be held in Beijing from February 4 to 20 and overlap CNY celebrations. The event will attract foreign visitors while Covid-19’s Omicron variant is surging around the world; this has led to a government recommendation that Beijing residents avoid leaving the city over CNY. We expect that the resulting uncertainty will be a negative force on CNY 2022 retail spending.

3. China Retail Trends, Spring Festival Gala, and Duty-Free Shopping

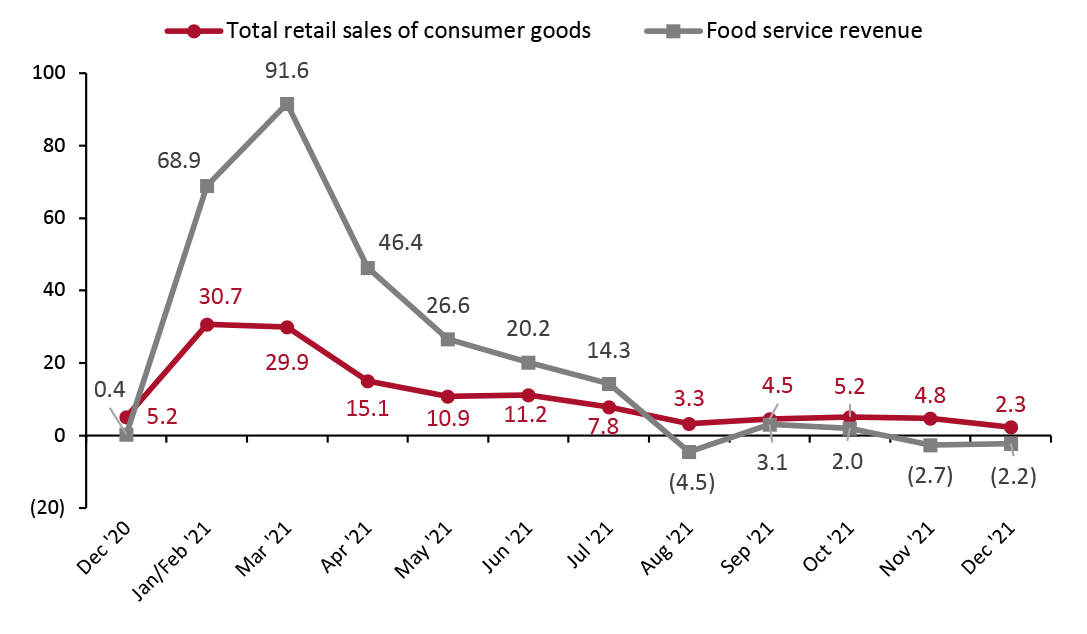

China’s retail sales slowed to 2.3% year over year in December 2021, with Covid-19 restrictions continuing to dampen household consumption. Despite this, consumers appear to be expecting some sense of normalcy during CNY, which is indicated by the rise of non-service food and beverage sales by 11.3% year over year in December 2021, according to the National Bureau of Statistics, which is likely the result of more social gatherings. Likewise, school and office supplies retailers grew at a strong rate of 7.4% year over year, suggesting that consumers and their children are returning to work and school. Consumers appear to be keener on making home improvements before CNY, as spending on the construction and decoration sector rose by 7.5%, perhaps in preparation for guests over the holiday or as part of domestic cleaning traditions. We expect that the food and construction and decoration sectors will continue this high rate of growth during CNY as travel, at-home celebrations and other social activities peak during the holiday.

Source: China Ministry of Transport[/caption]

We predict that 2022 travel will rise above 2021 levels, given that less of China’s population is currently under lockdown. We expect this will contribute to higher retail and food service sales this CNY, although retail and travel will likely not surpass 2019 levels, as many Covid-19 restrictions remain. Recent retail trends are steady, with year-over-year growth in single digits, slightly below 2021 levels. However, we still expect an increase during January and February driven by an improvement in travel and as consumers buy CNY gifts.

2. Impact of Travel on Retail Sales During CNY

Travel is a major indicator of retail spending for CNY, as Chinese consumers purchase gifts and consume goods during their annual gathering with relatives. For the third year in a row, the Chunyun travel period—which normally sees three billion trips, according to China’s Ministry of Transport—will be affected by China’s “zero-Covid” policy. The close link between travel and retail during CNY is exemplified by the significant dip in 2020, reflecting the strict lockdowns in Wuhan that began in January 2020. We expect that Covid-19 restrictions will be similar to those seen last year, but travel will likely be higher overall: China State Railway, for example, estimates that 2022 will see a 28.5% year-over-year increase in rail travel.

This year’s Chunyun lasts from January 17 to February 25, and will likely see the number of trips rise from 2021's 870 million but remain below 2019’s three billion, according to the Ministry of Transport. Travelers’ plans will be affected by lockdowns in Shenzhen, Tianjin Xi’an—and many may choose not to travel for fear of being stuck in their destination if an outbreak occurs. An estimated 20 million people, or approximately 1.5% of the population, are under lockdown in China as of mid-January.

Under China’s restrictions, people from medium- or high-risk areas are prohibited from travel, with medium-risk areas designated as areas with fewer than 10 reported cases in the last two weeks, and high-risk areas as those with over 10 reported cases, according to the National Health Commission. Alongside these restrictions are concerns around the 2022 Winter Olympics, which will be held in Beijing from February 4 to 20 and overlap CNY celebrations. The event will attract foreign visitors while Covid-19’s Omicron variant is surging around the world; this has led to a government recommendation that Beijing residents avoid leaving the city over CNY. We expect that the resulting uncertainty will be a negative force on CNY 2022 retail spending.

3. China Retail Trends, Spring Festival Gala, and Duty-Free Shopping

China’s retail sales slowed to 2.3% year over year in December 2021, with Covid-19 restrictions continuing to dampen household consumption. Despite this, consumers appear to be expecting some sense of normalcy during CNY, which is indicated by the rise of non-service food and beverage sales by 11.3% year over year in December 2021, according to the National Bureau of Statistics, which is likely the result of more social gatherings. Likewise, school and office supplies retailers grew at a strong rate of 7.4% year over year, suggesting that consumers and their children are returning to work and school. Consumers appear to be keener on making home improvements before CNY, as spending on the construction and decoration sector rose by 7.5%, perhaps in preparation for guests over the holiday or as part of domestic cleaning traditions. We expect that the food and construction and decoration sectors will continue this high rate of growth during CNY as travel, at-home celebrations and other social activities peak during the holiday.

Figure 3. China: YoY Growth of Total Retail Sales of Consumer Goods and Food Service Revenue (%) [caption id="attachment_140089" align="aligncenter" width="700"]

Source: National Bureau of Statistics/Coresight Research[/caption]

This year, China Media Group will hold its annual Spring Festival Gala, the country’s most-watched annual show on Chinese New Year's Eve, in partnership with e-commerce giant JD. As part of the celebration, from January 24 to February 15, JD will hand out virtual red envelopes—a digital version of traditional gift envelopes containing money—to viewers across the nation. JD will distribute ¥1.5 billion ($235.5 million), the largest amount to date. In previous years similar red envelope events, such as WeChat Pay’s 2015 debut and Baidu’s 2019 partnership, have been loss-making. Despite this, the event aligns with JD’s advertising needs and remains a key opportunity for the e-commerce giant to promote its products and services, much like Singles’ Day and 6.18. Furthermore, with the Chinese government discouraging overconsumption, many major companies in China are placing more emphasis on generating brand awareness rather than increasing revenues.

We also expect sales to be strong at Hainan Island, China’s duty-free sector, as the government has increased the duty-free buying allowance ahead of the 2022 holiday from ¥30,000 to ¥100,000 ($4,700 to $15,600). During the New Year’s holiday period of January 1–3, 739,000 items were purchased at the island’s various duty-free stores, with a record-breaking ¥600 million ($94.2 million) in sales, a 9.7% year-over-year increase.

4. Brands Capitalize on the Year of the Tiger

The annual CNY celebration is an opportunity for luxury brands to unveil new zodiac-themed products. Brand designers are especially excited for the Year of the Tiger after a succession of less glamorous animals such as the pig, rat and ox. The prevalence of the tiger motif in traditional Chinese art and clothing also helps give these products a relevance above that of previous years’ zodiac-animal gimmicks. Furthermore, this year’s tiger-themed products are more than just an attempt to capitalize around the festive season; brands are actively catering to a Chinese and Southeast Asian audience through the use of Chinese models, allusions to the Spring Festival Gala in advertisements and partnerships with wildlife conservation organizations in China.

Source: National Bureau of Statistics/Coresight Research[/caption]

This year, China Media Group will hold its annual Spring Festival Gala, the country’s most-watched annual show on Chinese New Year's Eve, in partnership with e-commerce giant JD. As part of the celebration, from January 24 to February 15, JD will hand out virtual red envelopes—a digital version of traditional gift envelopes containing money—to viewers across the nation. JD will distribute ¥1.5 billion ($235.5 million), the largest amount to date. In previous years similar red envelope events, such as WeChat Pay’s 2015 debut and Baidu’s 2019 partnership, have been loss-making. Despite this, the event aligns with JD’s advertising needs and remains a key opportunity for the e-commerce giant to promote its products and services, much like Singles’ Day and 6.18. Furthermore, with the Chinese government discouraging overconsumption, many major companies in China are placing more emphasis on generating brand awareness rather than increasing revenues.

We also expect sales to be strong at Hainan Island, China’s duty-free sector, as the government has increased the duty-free buying allowance ahead of the 2022 holiday from ¥30,000 to ¥100,000 ($4,700 to $15,600). During the New Year’s holiday period of January 1–3, 739,000 items were purchased at the island’s various duty-free stores, with a record-breaking ¥600 million ($94.2 million) in sales, a 9.7% year-over-year increase.

4. Brands Capitalize on the Year of the Tiger

The annual CNY celebration is an opportunity for luxury brands to unveil new zodiac-themed products. Brand designers are especially excited for the Year of the Tiger after a succession of less glamorous animals such as the pig, rat and ox. The prevalence of the tiger motif in traditional Chinese art and clothing also helps give these products a relevance above that of previous years’ zodiac-animal gimmicks. Furthermore, this year’s tiger-themed products are more than just an attempt to capitalize around the festive season; brands are actively catering to a Chinese and Southeast Asian audience through the use of Chinese models, allusions to the Spring Festival Gala in advertisements and partnerships with wildlife conservation organizations in China.

- Burberry's celebratory capsule features tiger stripes on popular styles like its Lola and Olympia bags, as well as an assortment of couples’ clothing items and accessories, such as cashmere scarves and sneakers. The campaign featured Chinese models Liu Bingbing, Liu Chunjie, Wang Xiangguo and Yang Ling.

Burberry’s tiger-themed products

Burberry’s tiger-themed products Source: Company website [/caption]

- Prada is donating to and partnering with the “Walking with Tiger and Leopard” Program of the China Green Foundation for its “Action in the Year of the Tiger” campaign. The foundation promotes conservation efforts to preserve the endangered Siberian tiger and helps to raise awareness for wildlife and biodiversity conservation in China. Actor and singer Li Yifeng and actress Chun Xia star in the campaign, wearing Prada’s red-accented collection.

- Balenciaga’s Lunar New Year capsule offers an assortment of T-shirts, fleeces, hoodies, and sneakers centered around orange and black patterns, with each piece featuring either a subtle tiger logo or a full tiger stripe print.

Balenciaga’s tiger-striped fleece

Balenciaga’s tiger-striped fleece Source: Company website [/caption]

- Gucci’s “Gucci Tiger” campaign features real tigers photoshopped into its advertisements featuring tiger-motif items including leather goods, outerwear, dresses and denim. All products from this collection will be wrapped in special tiger print packaging. Gucci also supports the conservation of endangered species through its partnership with the Lion's Share Fund.

Material from the “Gucci Tiger” campaign

Material from the “Gucci Tiger” campaign Source: Company website [/caption]

- Apple is offering a special edition of its AirPods Pro, which have a custom-designed tiger emoji printed on the wireless charging case and a larger red version printed on the AirPods Pro box. In China, the purchase will be coupled with a set of 12 red envelopes with each of the Chinese zodiac signs printed on them in emoji form. This special-edition product is otherwise identical to the standard ones and is offered at the same price. The company also unveiled special-edition Beats Studio Buds for CNY, featuring a red design with gold tiger print accents on the earbuds and charging case as a tribute to the Year of the Tiger.

- Lush has created a bath bomb in the shape of a tiger face, The Lucky Tiger Bath Bomb, which comes in the traditionally lucky golden color. The company is also offering the Lucky Tiger Know Wrap as part of its special packaging, which was inspired by traditional Thai Sak Yant tattoos that use the tiger as a symbol of strength, protection and good luck.

Lush’s Lucky Tiger Bath Bomb

Lush’s Lucky Tiger Bath Bomb Source: Company website [/caption]

- Disney Japan’s 2022 line of New Year’s goods heavily features Tigger, a character in Disney’s Winnie the Pooh franchise. The company will also be offering accessories, stuffed animals, kitchenware and decorations with Pooh characters in Tigger costumes, which was a popular theme in the television series.

- Versace’s CNY collection features the traditional New Year red color and a lunar tiger motif. On the front of the brand’s webpage, the collection is advertised in a video announcement by celebrity actor and dancer Jia Liu, which is followed by a performance by Chinese plate-spinning dancers, which mirrors that of traditional dances often featured in the Spring Festival Gala.