albert Chan

Introduction: China’s Diverse Landscape of E-Commerce Platforms

In the past 20 years, we have seen rapid growth in the quantity and diversity of e-commerce platforms in China. Since Alibaba debuted its consumer-to-consumer (C2C) e-commerce platform Taobao in 2003, JD.com, VIP.com and Suning.com have all launched e-commerce platforms of their own—in 2004, 2008 and 2009, respectively. In the 2010s, we saw the emergence of vertical e-commerce platforms, such as Babytree’s Meitun Mama in 2015 and Alibaba’s recommerce platform Idle Fish in 2011.

With more and more consumers in China desiring products of good quality, we have seen the emergence of cross-border e-commence platforms, such as Alibaba’s Tmall Global and JD.com’s JD Worldwide. Social media platforms—including Kwai and TikTok—have also actively added e-commerce functions.

We discuss the different types of e-commerce platforms in China, the products they sell and their consumer bases. We also highlight the actions that these major players are taking to better reach consumers, such as introducing livestreaming and group-buying functions. Finally, we detail how brands and retailers can leverage these e-commerce platforms for future growth.

An Overview of E-Commerce Platforms in China

China’s different types of e-commerce platforms present brands and retailers with a wide range of choices to sell their products.

[caption id="attachment_103805" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Multi-Category E-Commerce Platforms

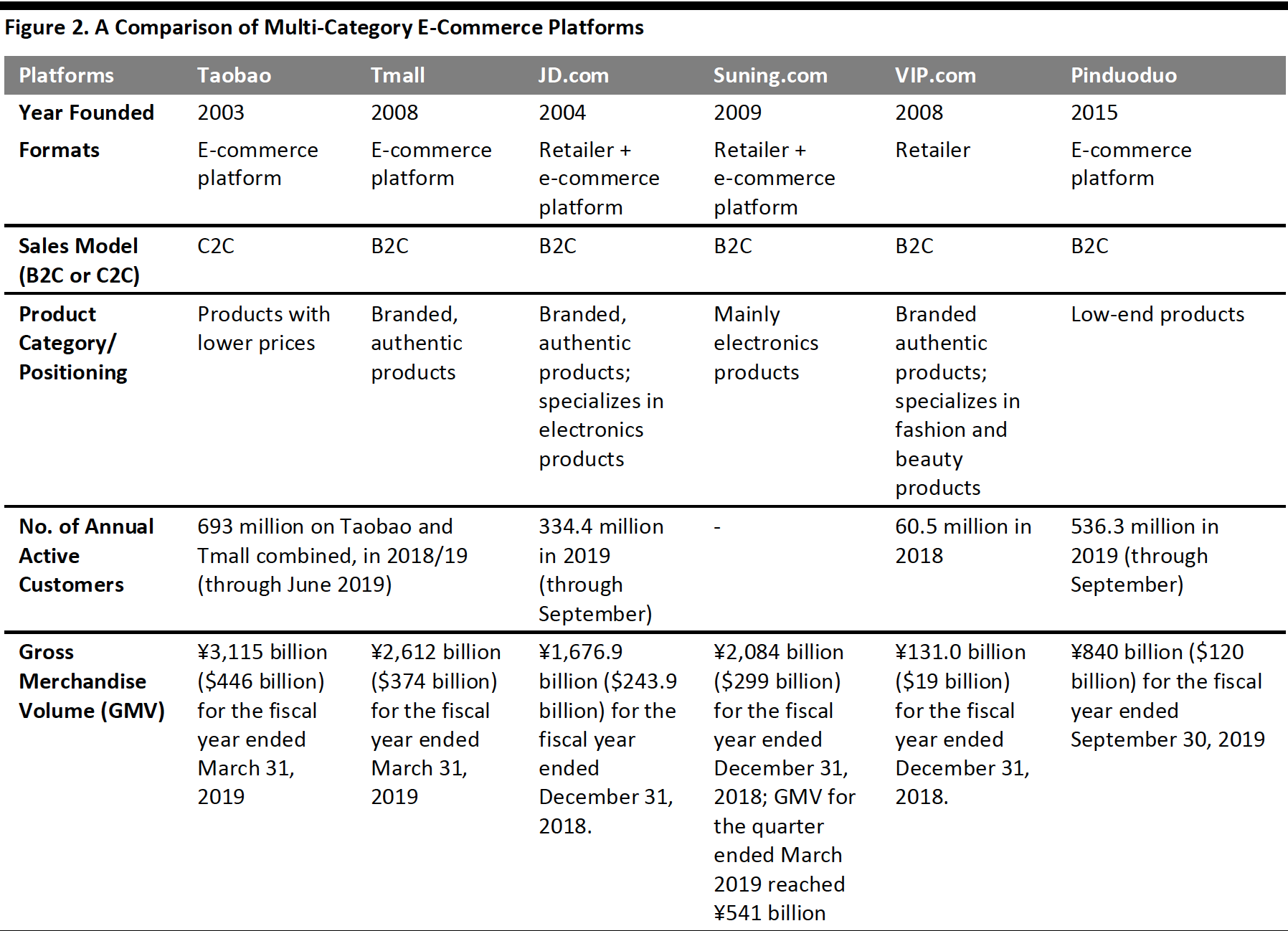

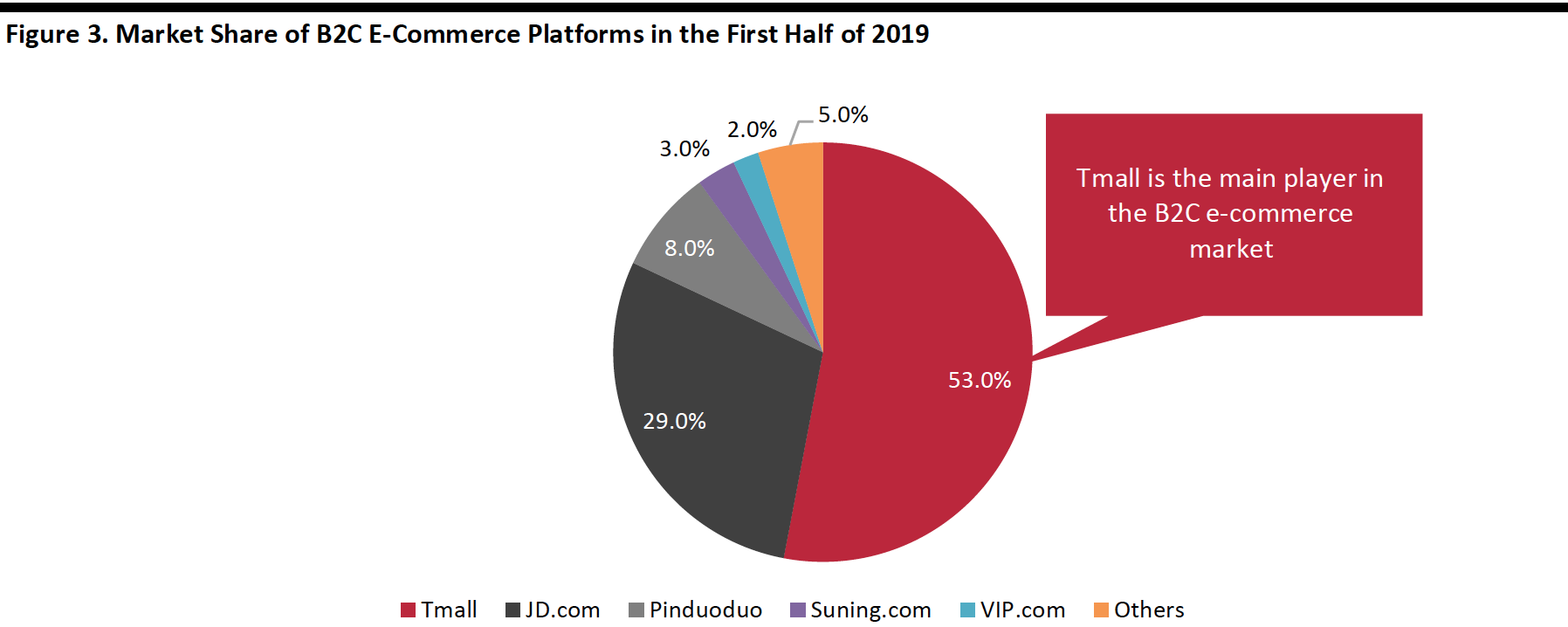

Multi-category e-commerce platforms sell a wide range of products, including fashion, grocery and electronics. They represent the earliest members of the e-commerce community, beginning with Alibaba, which launched Taobao in 2003. As we can see in figure 2, although Taobao is a C2C platform, other major players in the multi-category space operate a business-to-consumer (B2C) sales model.

[caption id="attachment_103777" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103778" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103778" align="aligncenter" width="700"] Source: Syntun[/caption]

Source: Syntun[/caption]

Taobao

Taobao focuses on selling products at a lower price to target price-sensitive customers. It is the largest C2C e-commerce platform in China, acounting for around 95% of the C2C e-commerce market share, according to Alibaba. However, some brands criticize the platform for selling imitations and counterfeit goods—Coach even withdrew from selling its products partly due to the higher number of imitations sold on the platform.

[caption id="attachment_103779" align="aligncenter" width="245"] Taobao page

Taobao pageSource: Company website[/caption]

Tmall

In 2008, Alibaba launched Taobao Mall, separate from Taobao, to meet the needs of customers who wanted to buy products of assured quality. The company then changed the platform’s name to Tmall in 2012. Tmall is a marketplace of third-party sellers; it is not a retailer and does not hold inventory. The platform sells branded products from Chinese and international brands.

The reach of Alibaba’s e-commerce platforms is growing: The combined number of annual active consumers on Taobao and Tmall reached 693 million in September 2019, compared to 674 million for the 12-month period ended June 30, 2019. The number of monthly active users (MAUs) on these two platforms reached 785 million in September 2019, an increase of 30 million over June 2019.

[caption id="attachment_103780" align="aligncenter" width="700"] Tmall page

Tmall pageSource: Company website[/caption]

JD.com

JD.com, founded by Liu Qiangdong in 2004, originally sold electronics products of guaranteed quality and has evolved to become a multi-category marketplace that hosts a number of sellers. However, it is different from Taobao and Tmall in that JD.com also operates as a retailer, whereby it controls the entire supply chain, including sourcing. The number of annual active consumers on the platform reached 334.4 million in the 12 months ended September 30, 2019, from 321.3 million in the 12 months ended June 30, 2019.

[caption id="attachment_103782" align="aligncenter" width="700"] JD.com page

JD.com pageSource: Company website[/caption]

Suning.com

Suning.com, founded in 2009, operates as a marketplace and retailer under Suning Commerce, a leading retailer of consumer electronics in China. The company has made efforts to evolve the platform to sell a wide range of categories beyond electronics. For example, it acquired Carrefour China in June 2019, increasing Suning.com’s capacity to sell fast-moving consumer goods (FMCG) and grocery categories.

[caption id="attachment_103783" align="aligncenter" width="700"] Suning.com page

Suning.com pageSource: Company website[/caption]

VIP.com

Founded in 2008, VIP.com is an online discount retailer in categories such as fashion and beauty. The platform sells high-quality and popular, branded products to consumers, usually at a big discount. The number of active customers for the third quarter ended September 30, 2019 was 32 million, representing a 21% year-over-year increase. GMV for the quarter increased by 17% year over year to ¥31.7 billion (around $4.5 billion).

[caption id="attachment_103784" align="aligncenter" width="700"] VIP.com page

VIP.com pageSource: Company website[/caption]

Pinduoduo

Pinduoduo was founded in 2015 and is the fastest-growing e-commerce platform in China. It is now the fifth-largest Internet company in terms of market capitalization after Alibaba, Tencent, Meituan and JD.com, surpassing Baidu as of November 29, 2019.

Pinduoduo operates a group-buying model, encouraging users to form groups so that they can purchase products at cheaper prices. Users can receive steep discounts of up to 90% on certain products if they invite enough friends to buy together.

[caption id="attachment_103785" align="aligncenter" width="500"] Pinduoduo page

Pinduoduo pageSource: Company website[/caption]

Vertical E-Commerce Platforms

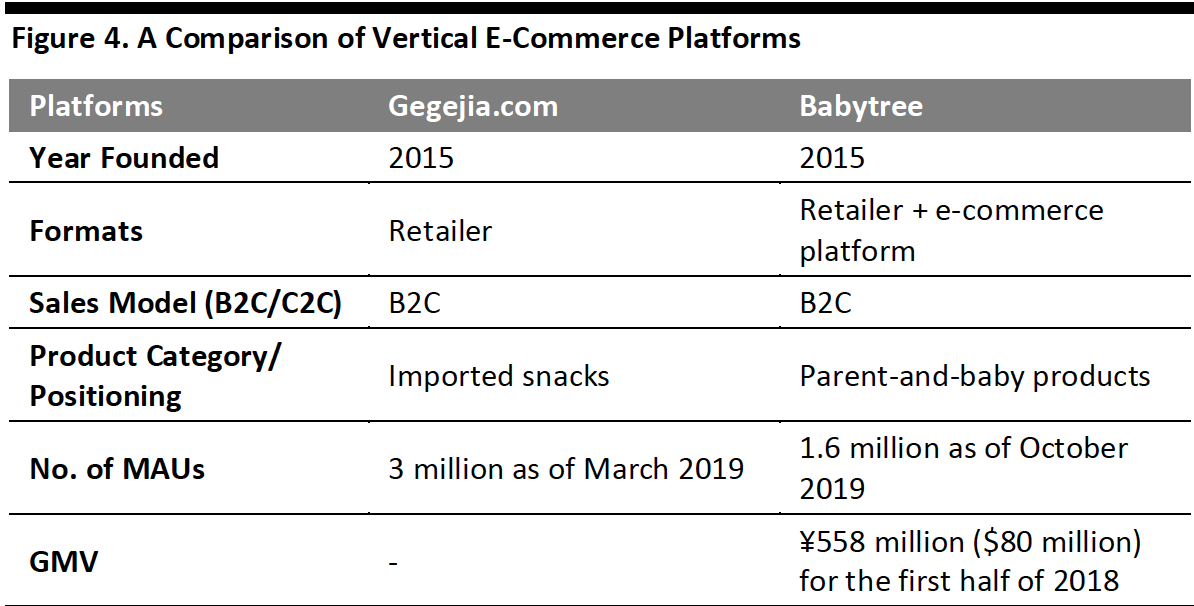

Vertical marketplaces are targeted e-commerce platforms through which goods and services are sold to specific groups of customers, who can then engage with each other through the online community. Websites and apps such as Babytree (which focuses on parent-and-baby products) and Gegejia.com (a global food importer that targets the female market) are examples of successful vertical markets.

Vertical platforms naturally bind like-minded consumers together and lead to strong social communities that are centered around a particular sector or product. For instance, Babytree’s users share parenting tips and recommendations for baby products.

Vertical platforms provide content that helps users to make buying decisions: According to a 2019 survey by Mckinsey, two-thirds of China’s digital consumers use the information they collect from vertical websites to influence their purchasing decisions.

[caption id="attachment_103786" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Gegejia.com

Gegejia.com sells imported snacks to consumers, including nuts from Korea, coffee from Japan and fruit juice from the US. The company imports products through general trade or from brands’ distributors in China. Founded in 2015, Gegejia.com’s total MAUs reached 3 million as of March 2019, and 90% of its customers are female.

[caption id="attachment_103787" align="aligncenter" width="500"] Gegejia.com page

Gegejia.com pageSource: Company website[/caption]

Babytree

Babytree started as an online forum for parents to discuss parenting tips in 2007, and it added an e-commerce function in 2015 to sell parent-and-baby products. The company conducts its e-commerce business under two models—direct sales and marketplace. With the former, Babytree acquires products from suppliers and sells them to customers. Through its marketplace model, the company invites third-party vendors to sell on its platform. Babytree’s MAU count reached 1.6 million as of October 2019, according to data company Trustdata.

[caption id="attachment_103788" align="aligncenter" width="700"] Babytree page

Babytree pageSource: Company website[/caption]

Recommerce Platforms

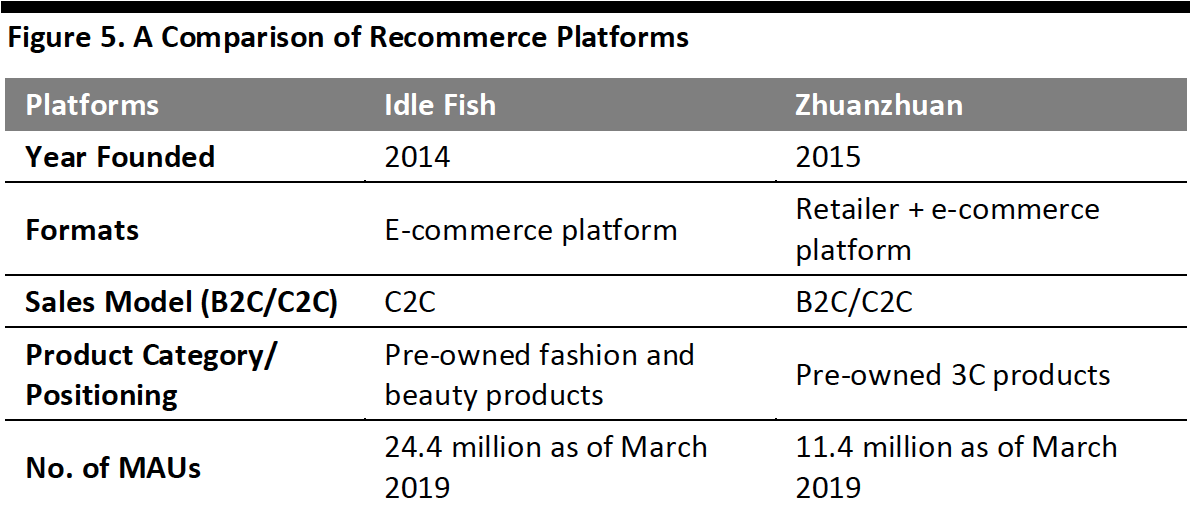

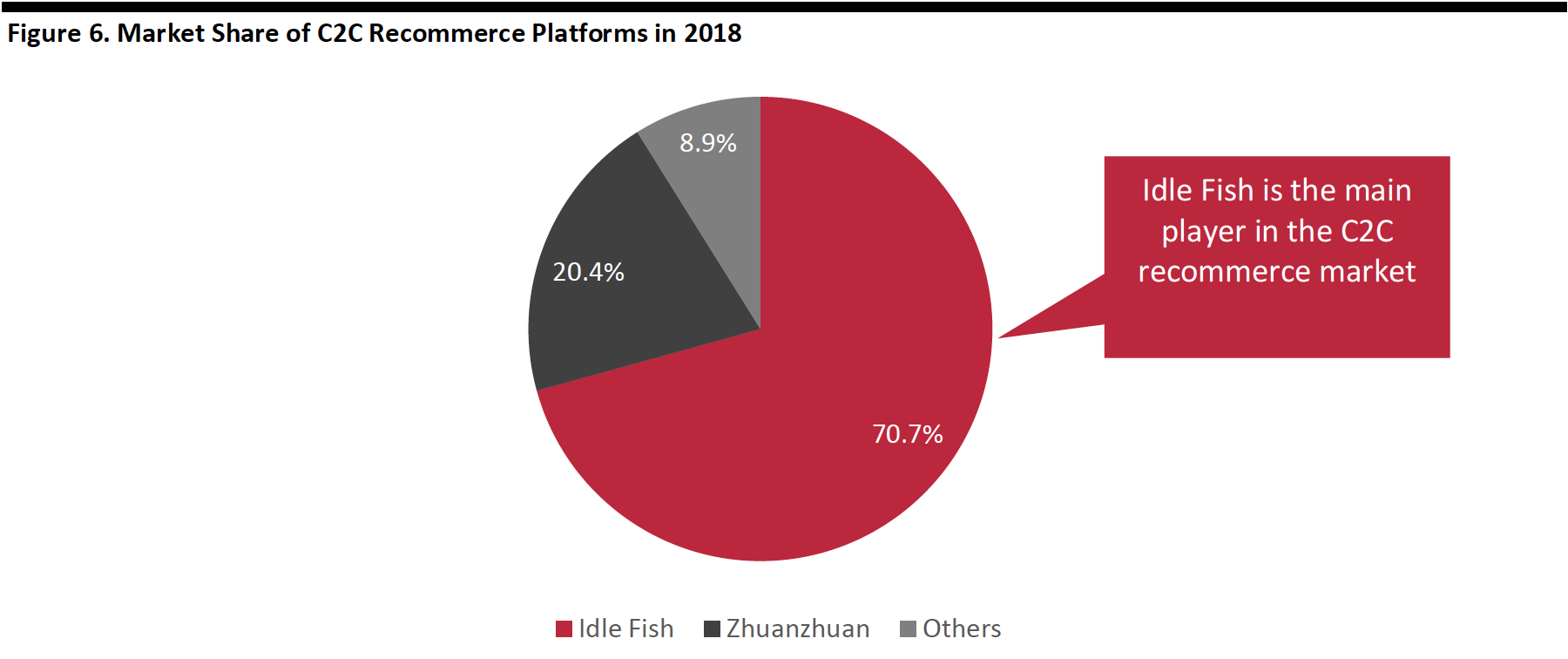

Recommerce platforms, where consumers buy pre-owned goods, look set to become increasingly popular in China. The China recommerce market will reach ¥1.25 trillion (around $178 billion) in 2020, rising by 70% from ¥742 billion ($106 billion) in 2018, according to data firm MobData. This equates to almost 46% of the total sharing economy market in China in 2020, which will be worth an estimated ¥2.7 trillion according to the Sharing Economy Work Committee of the China Internet Association. (The sharing economy market includes ride sharing (e.g., taxi), co-working space and apartment renting.)

The increasing popularity of recommerce is being driven by growing customer demand for product variety, sustainability and affordability: Consumers want to possess the latest in clothing trends; there is a growing emphasis on reusing and recycling; and budget constraints are an ongoing consideration for most shoppers. Over 60% of respondents said they would buy pre-owned goods to take advantage of cheaper prices, according to survey results released on January 9, 2019 by research company CBNData. Recommerce is also particularly prevalent in e-commerce compared to physical retail, as shoppers can access a greater range of previously owned merchandise online.

There are around 99 million users of resale-focused apps as of August 2019, according to data firm Getui and the China Internet Network Information Center. Leading apps include Alibaba’s Idle Fish and Tencent-backed Zhuanzhuan, with MAUs totaling around 24.4 million and 11.4 million, respectively, as of March 2019, according to research firm Bida. China Beijing Environment Exchange reported that transactions on Idle Fish helped to reduce 100,000 tons of carbon emissions between 2014 and 2018.

[caption id="attachment_103789" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103790" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103790" align="aligncenter" width="700"] Source: 100ec[/caption]

Source: 100ec[/caption]

Idle Fish

Taobao launched Idle Fish in 2014. It is an integrated C2C pre-owned goods marketplace operated by Alibaba. The platform mainly features apparel and beauty products.

Users on Idle Fish can exchange ideas and information about pre-owned goods that they are looking to buy, as well as posting pre-owned items for sale. Alibaba reported there were 1.3 million interest-based communities active on Idle Fish and 60 million active sellers for the 12 months ended September 30, 2019. The platform shares the user base of Alibaba’s other platforms, Taobao and Tmall. Currently, users can buy or sell on the platform without paying commission.

Beyond its C2C marketplace, Idle Fish also provides an auction service for secondhand jewellery, luxury goods and art.

[caption id="attachment_103791" align="aligncenter" width="250"] Idle Fish page

Idle Fish pageSource: Company website[/caption]

Zhuanzhuan

58.com, one of China’s online classifieds and listing platforms, launched the Zhuanzhuan C2C marketplace in 2015. Zhuanzhuan sells mainly 3C (computer, communication and consumer electronics) products. It primarily operates a direct sales model—the platform sources pre-owned goods from users, as well as providing cell phone quality inspection services to improve the user experience. Zhuanzhuan also cooperates with home appliance company Haier to provide quality inspection and maintenance solutions for household electrical appliances that are sold on the platform. However, Zhuanzhuan also works as a marketplace, allowing individual users and businesses to list and sell their pre-owned goods to other users.

The Zhuanzhuan platform gives users the option of importing their WeChat contact list. Users can then see what their WeChat friends are selling on the platform. This function aims to help establish trust among the user community.

[caption id="attachment_103792" align="aligncenter" width="250"] Zhuanzhuan page

Zhuanzhuan pageSource: Company website[/caption]

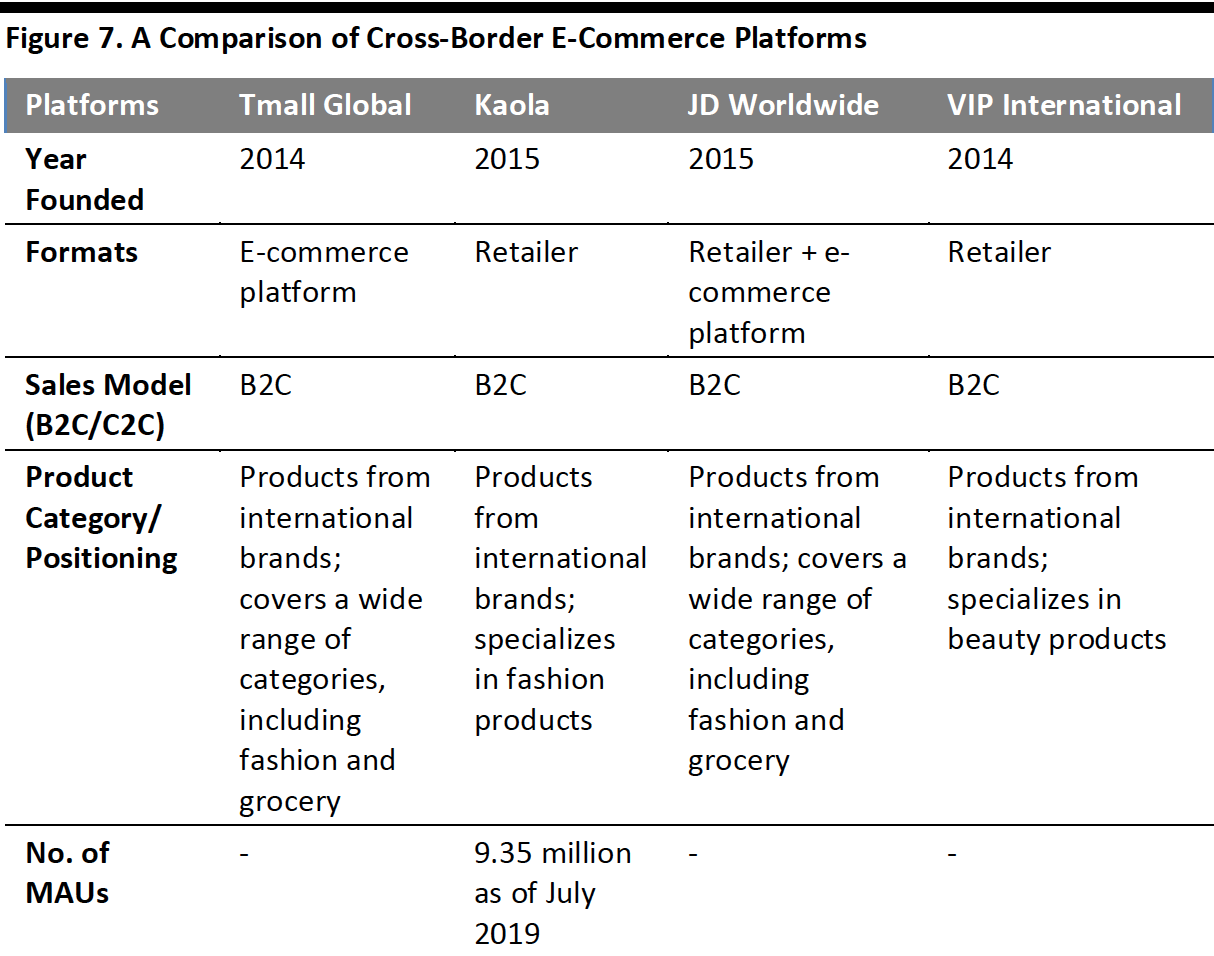

Cross-Border E-Commerce Platforms

Cross-border e-commerce platforms are a common way for Chinese consumers to shop imported products. Consumers often perceive foreign products to meet higher standards of quality and safety, such as in the parent-and-baby sector, particularly following the melamine milk scandal in 2008.

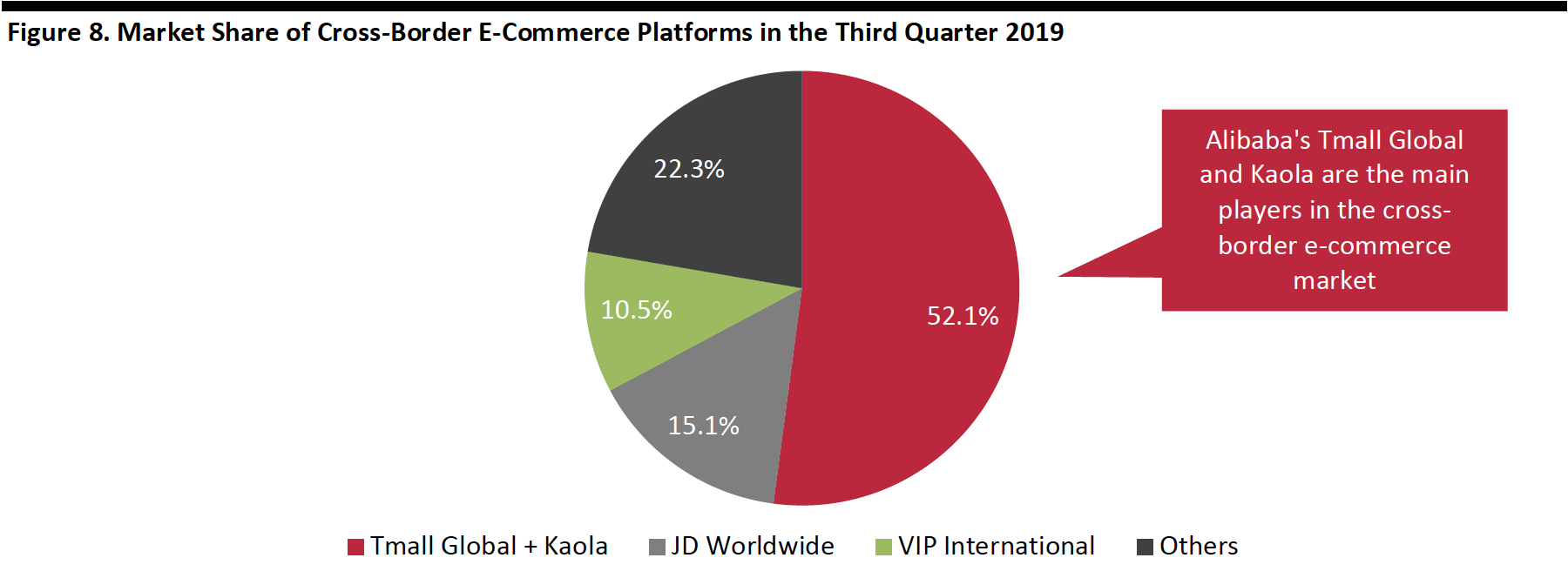

With Alibaba acquiring one of China’s biggest cross-border e-commerce platforms—Kaola—in September 2019, the cross-border e-commerce landscape in China will become more consolidated in 2020. Although they operate as separate platforms, Alibaba’s Tmall Global and Kaola together accounted for 52.1% of the cross-border e-commerce market share in China in the third quarter of 2019 (as shown in figure 8), according to research company iMedia Research Group.

[caption id="attachment_103793" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103794" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103794" align="aligncenter" width="700"] Source: iMedia Research[/caption]

Source: iMedia Research[/caption]

Tmall Global and Kaola

Tmall Global is a cross-border platform that was launched by Alibaba in 2014. It works directly with international distributors such as Costco, Metro, Shiseido and Uniqlo to launch online shops on its site.

Kaola.com—launched in 2015 by gaming company NetEase before being acquired by Alibaba—sells a wide range of products, including parent-and-baby, healthcare and beauty products. The platform operates as a retailer: It purchases a variety of goods directly from foreign merchants in bulk and then resells them to Chinese consumers.

[caption id="attachment_103795" align="aligncenter" width="700"] Tmall Global (left) and Kaola.com (right)

Tmall Global (left) and Kaola.com (right)Source: Company websites[/caption]

JD Worldwide

JD Worldwide, the cross-border service of JD.com, uses both the online marketplace and direct sales models to sell products across a wide range of sectors, including apparel, grocery and electronics. The marketplace model allows brands to open individual storefronts to sell directly to Chinese consumers, while JD Worldwide also buys inventory from overseas distributors that it sells to Chinese customers through its direct retail sales model.

[caption id="attachment_103796" align="aligncenter" width="700"] JD Worldwide

JD WorldwideSource: Company website[/caption]

VIP International

Launched in 2014, VIP International is the cross-border platform of VIP.com. It focuses on selling international fashion products—including beauty, cosmetics, apparel and jewelry—to Chinese consumers. The platform adopts the direct retail sales approach, whereby it purchases products and then resells them.

[caption id="attachment_103797" align="aligncenter" width="700"] VIP International

VIP InternationalSource: Company website[/caption]

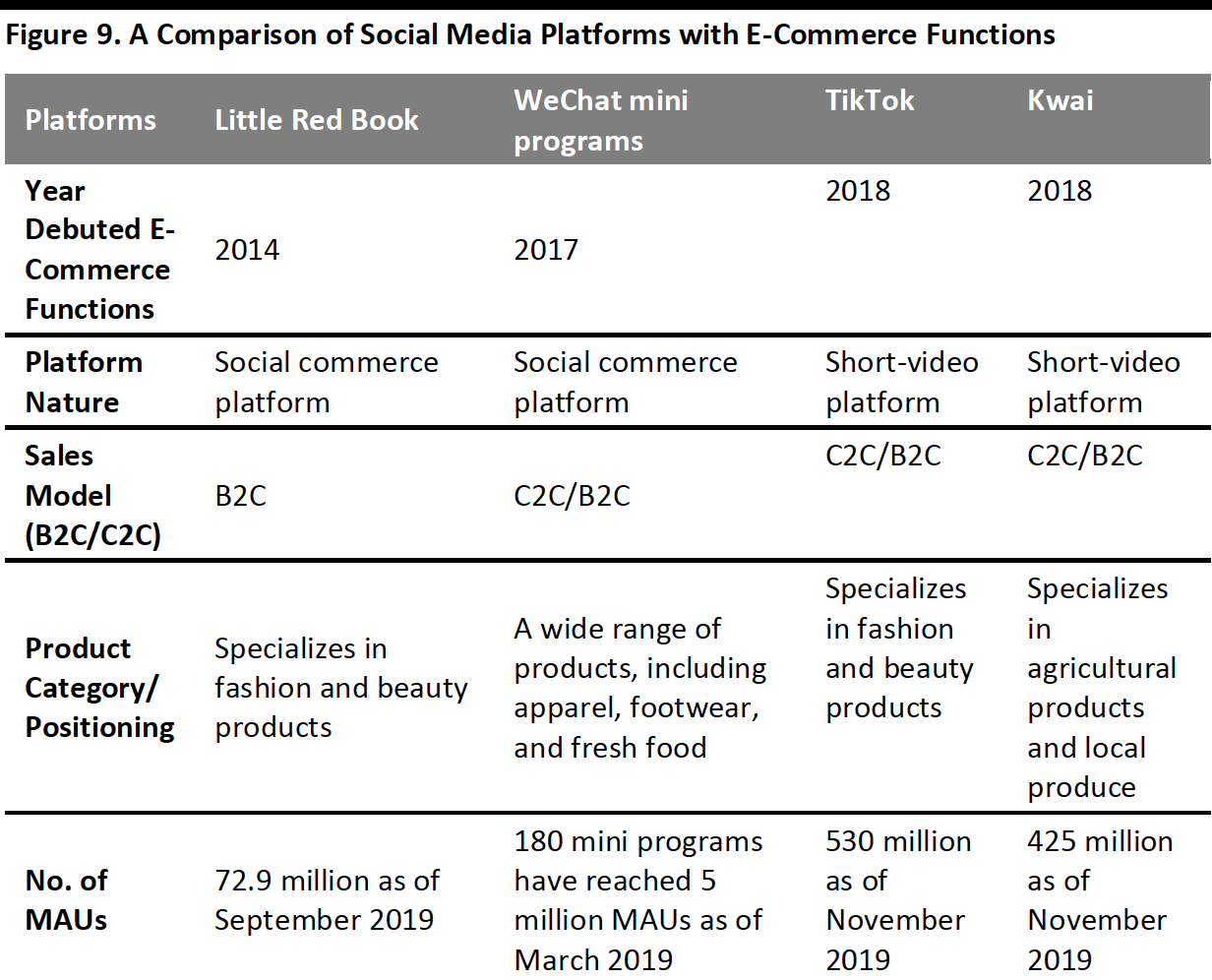

Social Media Platforms with E-Commerce Functions

Social media platforms—such as Little Red Book, TikTok and WeChat—are enjoying strong user traffic as they increase functionality and provide a diverse user experience. For instance, WeChat is a “super app” through which users can do a variety of things, from messaging to shopping to paying utility bills.

[caption id="attachment_103798" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Little Red Book

Little Red Book was launched in 2013 as a social sharing site for Chinese tourists to share their experiences of discovering and buying luxury products from overseas and exchange fashion ideas. In December 2014, the platform integrated e-commerce functionality and has now become one of the most popular sites for users to find and buy products from overseas markets. Little Red Book has disrupted the e-commerce industry in China by providing access to authentic and trustworthy recommendations from Chinese tourists and by leveraging powerful influencers to promote brands.

Fashion and beauty bands—such as NuFACE—have stores on the platform to enable them to reach out to Chinese consumers. Little Red Book had 72.9 million MAUs as of September 2019, according to data firm QuestMobile. Around 86% of users are female, and 52% are 25–35 years old , according to research firm iResearch.

[caption id="attachment_103799" align="aligncenter" width="644"] NuFACE flagship store on Little Red Book

NuFACE flagship store on Little Red BookSource: Little Red Book[/caption]

WeChat Mini Programs

WeChat mini programs operate within WeChat. They offer brands an additional online channel to market and sell their products, and users can use the functions without having to download a separate app. Both international and Chinese brands have WeChat mini-program stores, such as in the beauty sector, with Estée Lauder, Giorgio Armani and Perfect Diary using this channel.

Brands can use mini programs as supplements to, but not substitutes for, large-scale e-commerce platforms. Used as a secondary sales channel, mini programs can list in-demand items that sell quickly through flash sales promotions.

Mini programs offer advantages for brands looking to penetrate lower-tier markets, as they are likely to be used by shoppers that have cheaper data plans and lower storage on their phones so are therefore more reluctant to download new apps. Brands can also incorporate mini programs with group-buying discounts to appeal to WeChat users in lower-tier cities.

[caption id="attachment_103800" align="aligncenter" width="570"] Giorgio Armani’s WeChat mini-program store

Giorgio Armani’s WeChat mini-program storeSource: WeChat app[/caption]

Short-Video Platforms Kwai and TikTok

TikTok (called Douyin in Chinese), launched in 2016 as a video-sharing platform that lets users create and post “short” videos—originally, these videos were restricted to 15 seconds in length, but the platform has now expanded this limit to 5 minutes and 15 minutes for accounts from media outlets, governmental organizations and celebrities. TikTok offers tools to add music and special effects to videos, such as dazzling filters and superimposed stickers.

Another popular app in China is Kwai, which was launched as a GIF-making app in 2011 and then evolved to become a short-video app in 2012. The content on the platform is about everyday life, such as cooking and gardening.

The short-video industry is thriving in China, where the number of users exceeds 821 million, as of June 2019: TikTok reaches 486 million users and Kwai reaches 341 million. This total reflects an increase of 32% year over year, according to business intelligence provider QuestMobile, which also found that short-video apps are used by an average of 7.2 out of 10 mobile Internet users in China. The amount of time spent on these platforms has increased by 8.6% year over year from June 2018, totaling more than 22 hours per month, according to QuestMobile.

To capitalize on their increasing popularity, short-video apps added e-commerce functions to monetize their user traffic:

- In November 2019, TikTok extended its restrictions to allow all users to sell products through the platform. Previously, the social app had stipulated a minimum requirement of 3,000 followers for a user to access the e-commerce function. TikTok sees 3.2 billion daily active users, and this move could help the platform to transform into a video-based e-commerce site.

- In June 2019, Kwai integrated with JD.com and Pinduoduo to boost its e-commerce capabilities, after a similar integration with Tmall and Taobao previously. The added functionality allows users to sell goods to other users and lets them demonstrate products listed on these sites via a channel called Kuaishou Small Store.

HomeFacialPro’s store on TikTok (left) and Lining’s store on Kwai (right)

HomeFacialPro’s store on TikTok (left) and Lining’s store on Kwai (right)Source: TikTok/Kwai[/caption]

What Are E-Commerce Platforms Doing To Better Reach Their Consumers?

We have seen various efforts from e-commerce platforms to better serve consumers, such as launching livestreaming capabilities, adding group-buying functions, upgrading logistics and creating synergies within their respective ecosystem.

Introducing Livestreaming

With short-video platforms introducing e-commerce functions to their sites, Taobao and JD.com have introduced livestreaming functions to their platforms in 2016 and 2018, respectively. This sales medium is similar to television shopping—think QVC—but upgraded for the 21st century. Livestreaming sessions host real-time broadcasting of video content by presenters such as social media influencers, which model or try out products. Viewers are able to purchase featured items while watching a video through embedded online links. Just like presenters on QVC, livestreaming hosts sell a wide range of products, from apparel and cosmetics to electronics and cars.

Livestreaming offers brands a means to boost sales and increase brand awareness. The platform of choice is dependent on the retail category—for instance, JD.com is the most appropriate for specifically targeting 3C consumers, whereas Taobao Live offers greater range across the apparel, beauty and parent-and-baby sectors.

Over 100,000 brands used livestreaming on Taobao Live as a sales method during Singles’ Day 2019. The GMV generated from livestreaming within the first hour of the shopping holiday exceeded the full-day total GMV from livestreaming in 2018. In total, on November 11, 2019, GMV reached ¥20 billion ($2.85 billion), accounting for around 7.5% of Alibaba’s overall ¥268.4 billion in sales.

Embracing Group Buying

Seeing group-buying giant Pinduoduo’s growing business, e-commerce platforms are increasingly adding group-buying functions, whereby products and services are offered at significantly reduced prices if consumers buy in large quantities. This shopping model is attractive for shoppers with a limited budget, especially those in China’s lower-tier cities, as consumers can join together to take advantage of the lower prices.

Major e-commerce players are launching group-buying platforms to tap into this segment of shoppers:

- JD.com started its group-buying mini program on WeChat in June 2018 and launched its group-buying app Jingxi in April 2019.

- Suning established its own group-buying app in July 2018.

- Alibaba launched its flash-sale and group-buying platform Juhuasuan in 2010. To better compete with Pinduoduo, Alibaba’s Alipay also launched a function named Pingou in March 2018, which is an addition to Juhuasuan.

These players performed well during the Singles’ Day shopping festival in 2019: Juhuasuan reported that 576 products received more than 10 million orders within the first two hours; and JD.com said that 40% of its new customers came from Jingxi.

Upgrading Logistics Infrastructures

Alibaba and JD.com work with their respective delivery arms—Cainiao and JD Logistics—to offer faster delivery for orders via their e-commerce platforms. Alibaba’s Cainiao aims to digitalize and accelerate the entire delivery process by helping logistics firms to deploy Internet of Things (IoT) solutions on a large scale. Cainiao plans to connect 100 million smart devices to its IoT technologies between 2020 and 2022, including its warehouses, delivery robots and algorithm-backed management systems.

Cainiao will also set up 100,000 pickup stations through “Cainiao Post”—a last-mile delivery business of Cainiao—to increase delivery options. Cainiao Post offers services such as scheduled deliveries, smart lockers and delivery outlet pickups.

Through the adoption of 5G technology, logistics providers will be able to provide more efficient and faster deliveries. JD Logistics opened its first 5G-powered smart logistics park in Beijing on October 28, 2019. It uses the latest-generation connectivity to conduct real-time monitoring of locations and routes for forklifts, as well as to provide pre-emptive alerts of abnormal situations.

Creating Synergies within Their Own Ecosystems

Alibaba uses its own video-sharing platform Youku and content partner Bilibili—a video-sharing platform that is focused on anime, comics and gaming—to drive traffic to its e-commerce sites. Content creators on Bilibili are increasing their presence on Taobao by opening stores. Taobao will also provide opportunities for these content creators to launch their own products on the platform and do co-branding with other brands.

Furthermore, Alibaba leverages its paid loyalty program 88VIP to retain users within its ecosystem. In August 2019, Alibaba enhanced benefits for members of its loyalty program by expanding the range of brands and services that offer discounts. Members can access year-round discounts from the 388 brands participating in the 88VIP program (just 88 brands joined when the program debuted last August). Members also received 5% off when shopping at participating brands’ Tmall or Taobao stores during Singles’ Day 2019.

Opportunities for Brands and Retailers

E-commerce platforms collect shopping behavior data, which brands and retailers can leverage to better serve their consumers.

Leveraging C2M Model To Better Address Consumers’ Needs

Brands can use e-commerce platforms’ consumer-to-manufacturer (C2M) model to better address consumer needs and achieve sales growth. In the C2M model, retailers and manufacturers collect data about customers from e-commerce platforms and use big data to create customer profiles, analyze consumption characteristics and plan production. This helps manufacturers to anticipate product demand and reduce inventory and supply chain risks, which also benefits brands and retailers.

During the 2019 Singles’ Day shopping festival, users on Tmall snapped up 170 million C2M products. Guangdong Luoman Intelligent Technology reported that sales of its “Roaman Xiaoguoshua” electric toothbrush reached 25,000 on November 11. The company used consumer insights from Tmall to influence the design of the toothbrush, such as the size of the brush head and the product’s dark-green color.

[caption id="attachment_103802" align="aligncenter" width="700"] Roaman Xiaoguoshua electric toothbrush

Roaman Xiaoguoshua electric toothbrushSource: Company website[/caption]

Using E-Commerce Platforms To Penetrate Lower-Tier Markets

Brands can leverage e-commerce platforms to penetrate China's lower-tier cities for future growth. In China, cities of Tier 3 and below have a total of 670 million mobile Internet users, which is over three-quarters of the nation’s 854 million total as of June 30, 2019, according to China Internet Network Information Center and mobile data research firm QuestMobile. Of these 670 million, 72% are below the age of 35, according to QuestMobile.

China’s lower-tier cities are full of consumption potential, with total consumption reaching $3.3 trillion in 2017 and expected to hit $8.4 trillion in 2030, according to Morgan Stanley. Consumers from lower-tier cities are more willing to shop, as living costs are lowerso young buyers enjoy higher disposable incomes. Furthermore, consumers generally have a more relaxed working schedule—it is more common to work a 9:00 a.m. to 5:00 p.m. schedule in smaller cities)—meaning that they have more time for shopping.

On Singles’ Day 2019, 70% of JD.com’s new customers were from lower-tier cities. In addition, Tmall said that more than 50% of its smartphone orders (such as iPhone 11 and Huawei Mater 30 Pro) were from lower-tier cities during the shopping festival.

Key Insights

China’s landscape of e-commerce platforms has become more diversified, with major players launching multi-category, vertical, re-commerce and cross-border e-commerce platforms, as well as social media platforms also integrating e-commerce functions. We are seeing these platforms actively looking for ways to extend their consumer reach and thus increase their market share. For example, Alibaba and JD.com integrated livestreaming and group-buying functions into their sites to offer more excitement for shoppers in addition to lower prices.

Brands and retailers can also leverage the huge amounts of data available through e-commerce platforms to develop products that cater to consumers’ needs, such as by adopting a C2M model. Brands can also use e-commerce platforms to penetrate China’s lower-tier cities and capitalize on the potential they offer.