Web Developers

Over the last 10 years, Singles’ Day—also known as the 11.11 Global Shopping Festival or Double 11—has become the world’s biggest shopping holiday. In 2017, Alibaba generated a record $25.3 billion in sales on Singles’ Day, up approximately 40% from the previous year and driving a 56% increase in the company’s fourth-quarter revenues. This compares with the $6.6 billion record for Cyber Monday 2017, according to Adobe Insights, and the $3.6 billion plus that Amazon is estimated to have generated during its 36-hour Prime Day event on July 16 this year(Prime Day spanned the 17 countries where Prime membership has been rolled out).

By all accounts, 11.11 is a retail phenomenon, and this year’s event is likely to generate strong, double-digit sales growth. However, some recent retail and consumer trends in China are attenuating, suggesting that 2017’s Singles’ Day growth rate will not be matched in 2018.

Coresight Research recently attended the Fortune Global Forum in Toronto, where we heard Starbucks CEO Kevin Johnson respond to a question regarding waning consumer confidence and a pullback in consumer spending in China. Johnson acknowledged that Chinese consumer confidence had softened slightly in the quarter ended July 2, 2018, and that this was a factor in Starbucks’ slightly negative same-store sales growth in Mainland China during the period.However, Johnson said that total transactions in the region grew by a mid-teens rate and that revenues grew by a high-teens rate over the quarter.

Recent trends haven’t changed Johnson’s stance on the opportunities that Mainland China represents for Starbucks. He said that China remains one of company’s strategic long-term growth markets and that Starbucks is on track to open 600 stores annually in China for the next five years, or roughly one store every 15 hours.

Starbucks has operated in China for 20 years already and employs a China-centric strategy,“built in China, for China.”Johnson spoke about Starbucks’s trategic partnership with Alibaba and said that Starbucks shared Alibaba’s “New Retail’ vision, which he described as “taking the best software R&D in the way you create experiences, using everything from artificial intelligence to a digital-mobile relationship to delivery and integrating it in the brick-and-mortar experience.”

For Starbucks, that means the in-store experience in China is tactical and mobile, with mobile payments accounting for 60% of transactions, supported by partnerships with Alibaba and Tencent via their respective payment platforms, Alipay and WeChat Pay.

According to economic data aggregator Trading Economics, the most recent (August 2018) Consumer Confidence Index reading for China was 118.6, down 1.1 index points from the July reading and the second-lowest reading in the past 12 months (June 2018’s 118.2 reading was the lowest). The index averaged 109.9 in the 1991–2018 span, and the most recent reading is well above that average.However, the moderating trend of the past 12 months could be followed by weakening sales trends as we head into the 11.11 sales period.

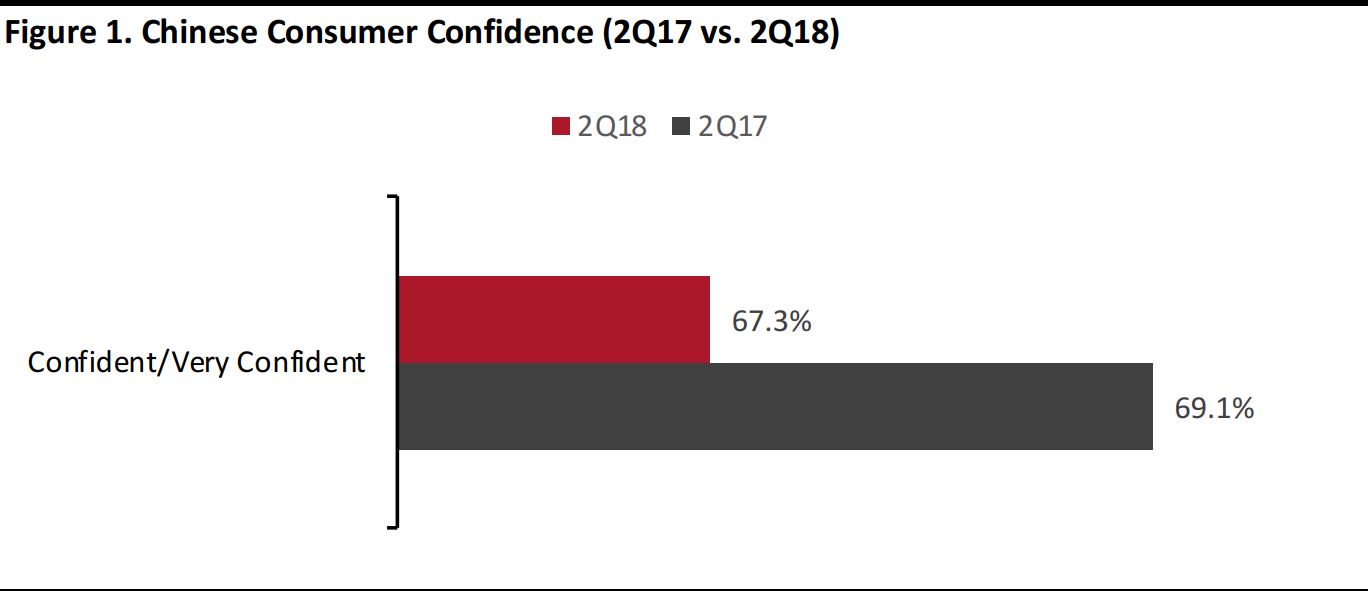

Prosper Insights & Analytics reported that Chinese consumer confidence dropped by 180 basis points from the second quarter of2017 to the second quarter2018. When the firm surveyed Chinese consumers in June 2017, 69.1% of respondents said that they were confident or very confident in the economy; this June, that figure was 67.3%.

The September retail sales figures just released by the National Bureau of Statistics of China show a different picture: Chinese retail sales grew by 9.2% year over year in September, with momentum building since July’s 8.8% year-over-year gain. China’s GDP rose by 6.5% in the third quarter, missing the 6.6% consensus estimate and slowing from 6.7% in the second quarter.

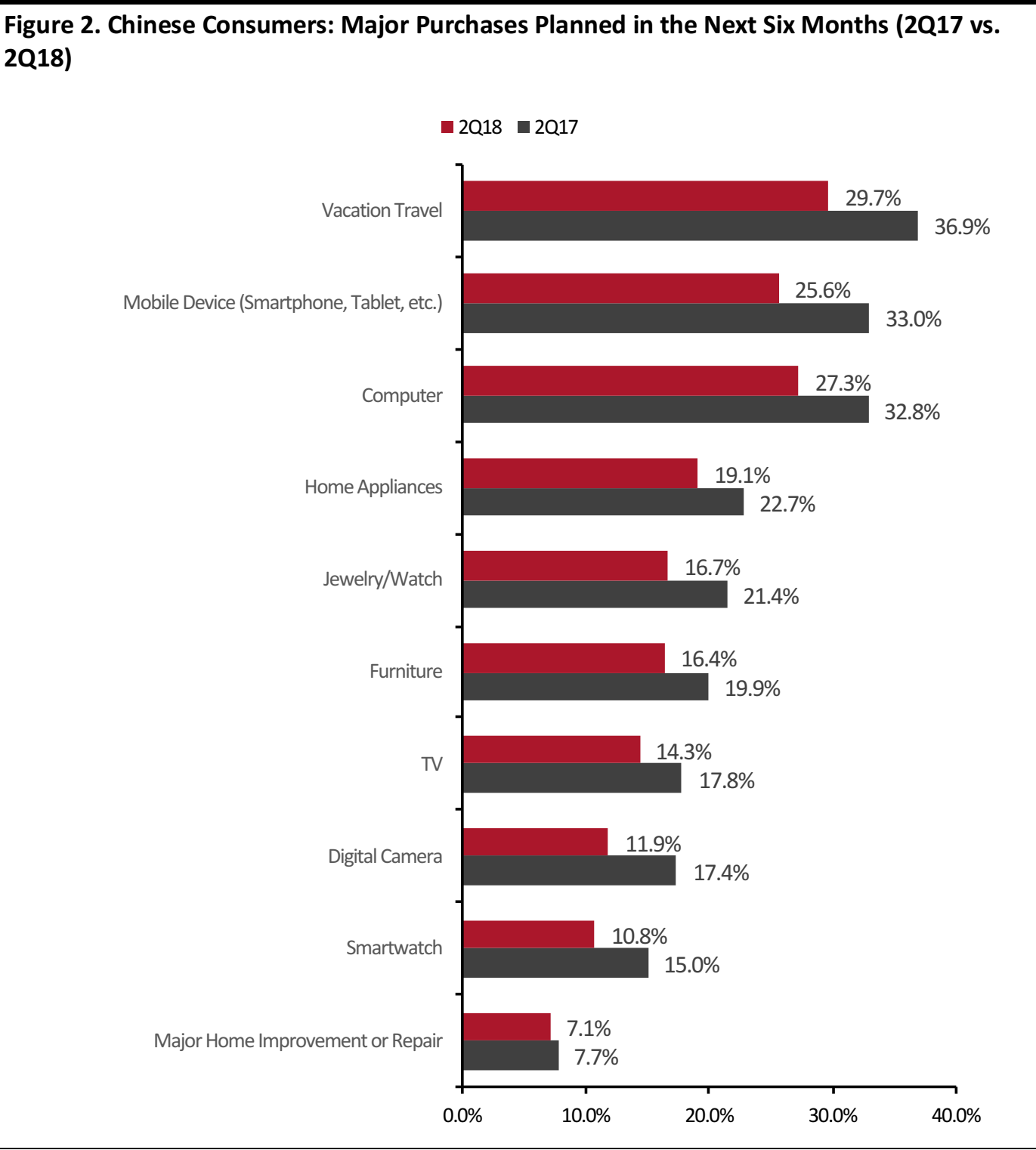

Prosper also provides us with the most recent Chinese consumer planned-spending data, fielded during the second quarter. The survey results reveal a significant drop in Chinese consumers’ intentions to spend on big-ticket items over the next six months. Such expenditures include vacation travel, mobile devices, jewelry and furniture, as charted below. In fact, every big-ticket expenditure listed in Prosper’s survey showed a drop in purchase intent versus the 2017 survey.

The most recently released Chinese economic and consumer data are mixed, with retail sales up, consumer confidence moderating and spending intentions declining. The Chinese economy remains robust, however, growing at a 6.5% annualized pace. Coresight Research will continue to track the data points as we approach Singles’ Day, the biggest retail phenomenon yet.

Base: 5,000+ Chinese consumers ages 18-54, surveyed each quarter

Source: Prosper Insights & Analytics

Base: 5,000+ Chinese consumers ages 18-54, surveyed each quarter

Source: Prosper Insights & Analytics Base: 5,000+ Chinese consumers ages 18-54, surveyed each quarter

Source: Prosper Insights & Analytics

Base: 5,000+ Chinese consumers ages 18-54, surveyed each quarter

Source: Prosper Insights & Analytics