Executive Summary

In Part 2 our China Fashion Recommerce series, we analyze the two leading integrated recommerce platforms—Alibaba’s Xianyu and Tencent-backed Zhuan Zhuan. We also look at the platforms focused on the fashion vertical such as Secoo, 91xinshang, Real, and GoShare2.

Overview of China’s Fashion Recommerce Landscape

China’s recommerce market was estimated to be worth ¥400 billion (US$60 billion) in 2016, according to CBNData, almost three times larger than the country’s transport-sharing economy. Part 1 of our China Fashion Recommerce series discussed the huge potential for China’s luxury fashion recommerce industry, driven by increasing penetration among young consumers and the large pool of pre-owned products in China.

Key Players in China’s Fashion Recommerce Market

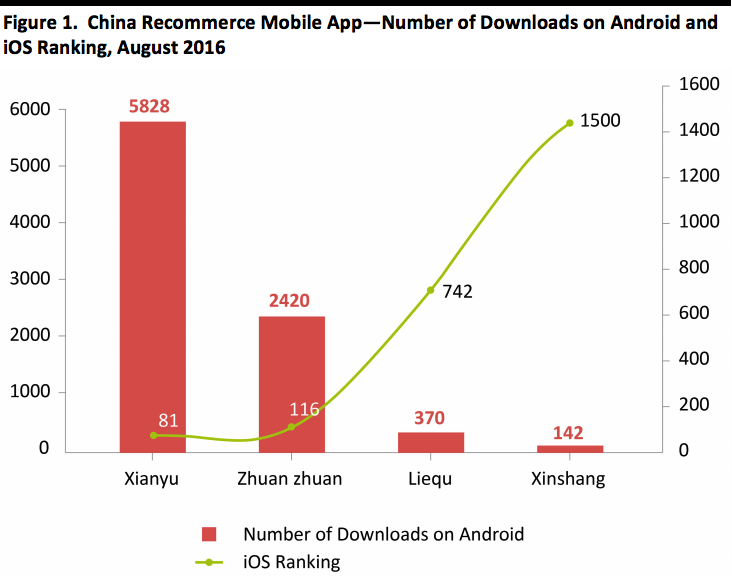

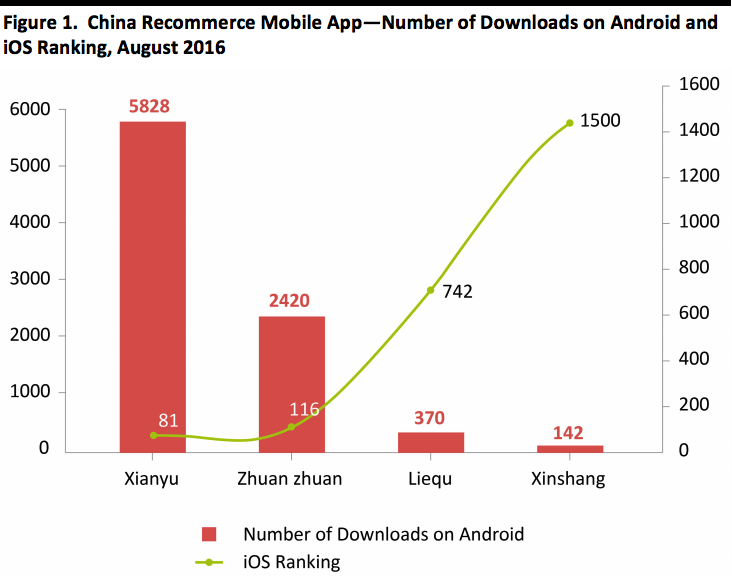

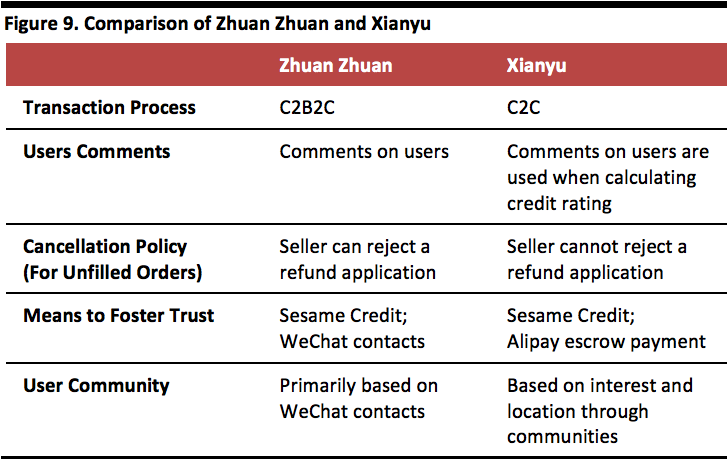

China’s otherwise fragmented online recommerce market is dominated by two giant players: Alibaba’s Xianyu and 58.com’s Zhuan Zhuan (backed by Tencent). Together Xianyu and Zhuan Zhuan accounted for almost 90% of the total market in 2016. According to leading big data service provider QuestMobile, Xianyu has 23 million monthly active users (MAU) and its mobile app is ranked 118th among the top mobile apps in China, as of December 2016, while Zhuan Zhuan has 13 million MAU and its mobile app is ranked 180th.

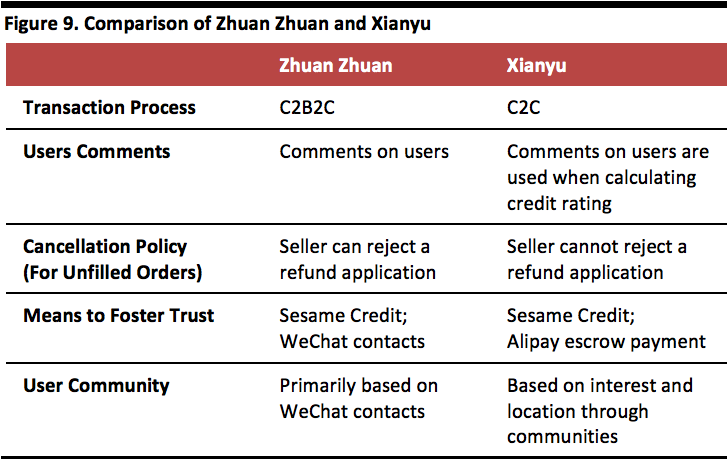

The majority of China’s fashion recommerce players operate via one of two platforms: a consumer-to-consumer (C2C) marketplace or a consumer-to-business-to-consumer (C2B2C) consignment platform.

[caption id="attachment_86620" align="aligncenter" width="720"]

Source: Chandashi/FGRT

Source: Chandashi/FGRT[/caption]

Key Players in China’s Online Recommerce Market—Integrated

China’s online recommerce market is dominated by two key players: Alibaba’s Xianyu and 58.com’s Zhuan Zhuan (backed by Tencent). Together, they accounted for almost 90% of the total market in 2016.

Xianyu

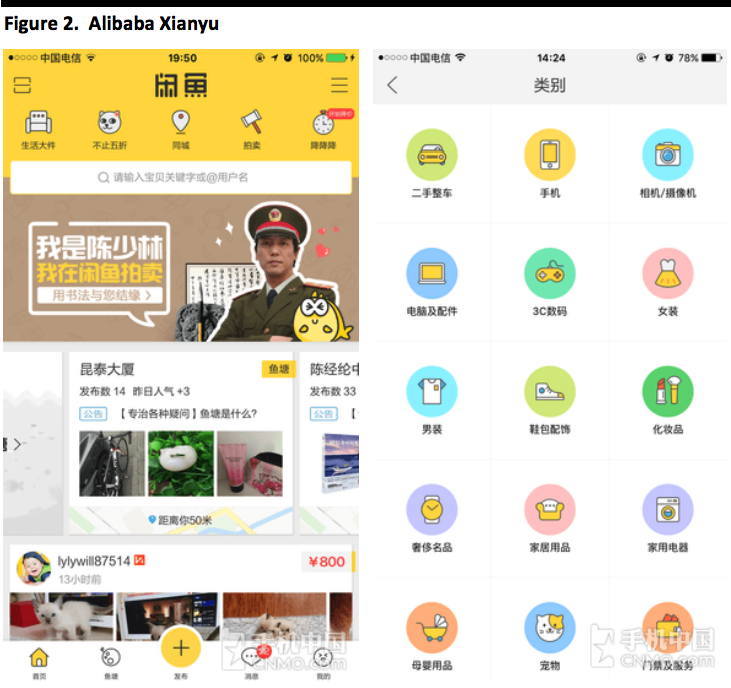

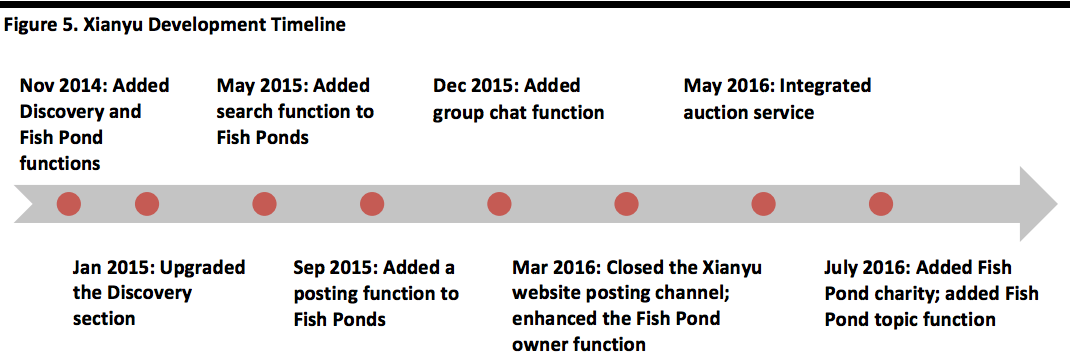

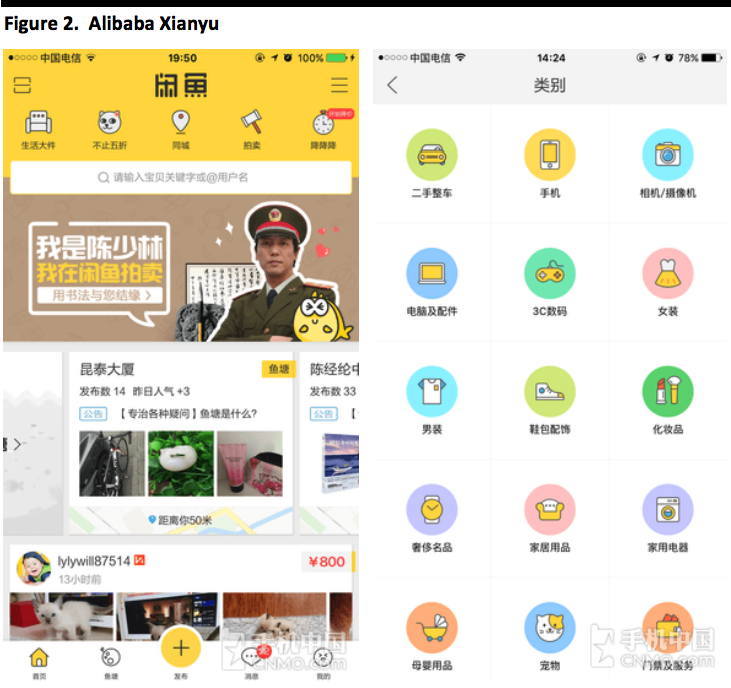

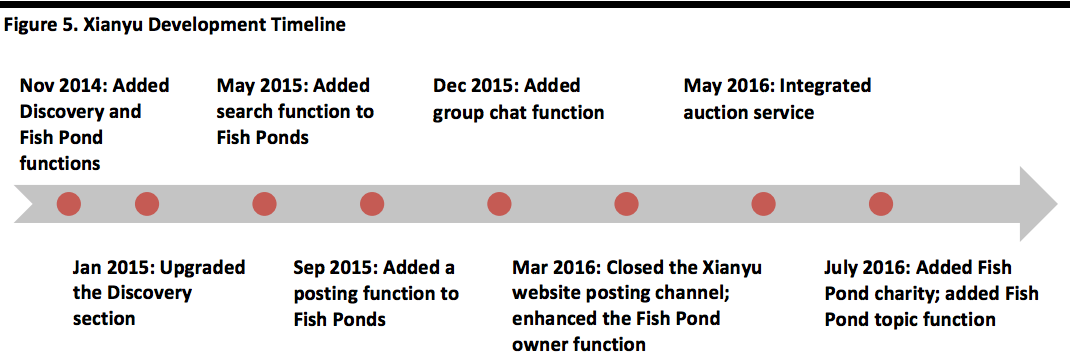

Xianyu (translated as idle fish) is an integrated consumer-to-consumer (C2C) secondhand goods marketplace operated by Alibaba. This online recommerce marketplace was first launched by Alibaba’s Taobao Marketplace in 2011, and was subsequently rebranded to Xianyu in 2014.

How Does It Work?

- Sellers can set up a store where they can post and promote pre-owned products for buyers to browse on Xianyu’s website and on its mobile app. Xianyu is connected to the user base of Taobao and Tmall. Transactions are conducted online, with payment escrowed on Alipay until the buyer receives and is satisfied with the item(s). Currently, users can buy or sell on the platform free of commission.

- Beyond the C2C marketplace, Xianyu also provides an auction service for secondhand jewelry, luxury goods and artwork.

[caption id="attachment_86622" align="aligncenter" width="720"]

Source: Sohu

Source: Sohu[/caption]

Key Differentiating Features

- Virtual communities to promote social commerce “fish ponds”: Xianyu sought to differentiate its offering from other e-commerce players by introducing virtual communities. Xianyu lets users create “fish ponds”—communities that share the same interests, location or institution—within the app, allowing them to mingle, share news and transact. “Fish ponds” have proven to be effective in increasing user engagement: the total number of fish ponds has surpassed 410,000, as of March 2017.

- Connection to China’s largest C2C marketplace: Taobao is the primary source of pre-owned product listings on Xianyu. Taobao provides an entry point into Xianyu for users to trade their pre-owned items with ease. Customers who wish to sell the products they bought on Taobao will be redirected to Xianyu by clicking a hyperlink on Taobao’s interface.

- Well positioned to leverage Alibaba’s ecosystem: As part of Alibaba’s e-commerce ecosystem, Xianyu provides users with common functions such as an escrow payment service, a data-driven logistics network and a credit-rating system, which ensure the security of recommerce transactions.

- Incentives for users to trade: Xianyu launches occasional promotion campaigns that rewards users for trading on its platform. In September 2016, Xianyu introduced rewards for those users who posted pre-owned items on the platform. Users can claim a cash reward that can be used within Xianyu after the activity period.

[caption id="attachment_86624" align="aligncenter" width="720"]

Source: Jianshu

Source: Jianshu[/caption]

User Response

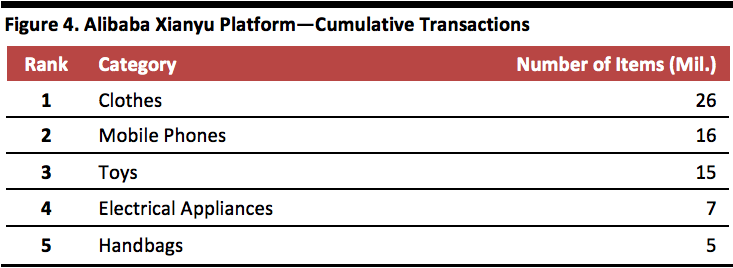

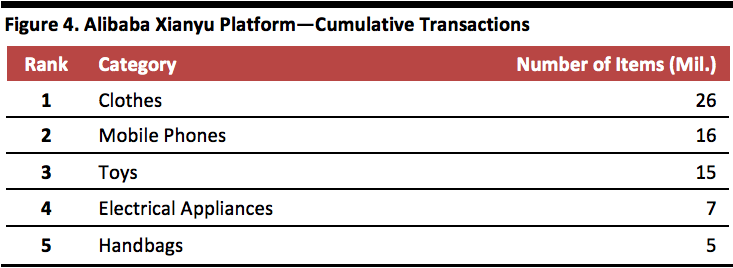

Xianyu has gained more than 100 million members since it was established in 2014 and its gross merchandise volume (GMV) has grown 15.6 times since 2015, according to Alibaba. Apparel is the bestselling category, accounting for nearly 20% of the 170 million items sold on Xianyu, as of March 2016.

Below is a summary of the key statistics from a report “The Sharing Economy for Consumption—Perspectives of Those Born After the 1990s” that was jointly published by CBNData and Xianyu in March 2017.

- 55% of all of Xianyu’s users reside in first- and second-tier cities.

- Over 52% of its users are born after the 1990s.

- Users born after the 1990s spend an average of 53 minutes on Xianyu for each transaction.

- They join an average of four communities (fish ponds), higher than the total average of 3.29.

- Each user posts 17 items on average.

[caption id="attachment_86629" align="aligncenter" width="720"]

Source: Alibaba Xianyu/FGRT

Source: Alibaba Xianyu/FGRT[/caption]

[caption id="attachment_86630" align="aligncenter" width="720"]

Source: Company data/Woshipm/FGRT

Source: Company data/Woshipm/FGRT[/caption]

Positioning

The core focus of Xianyu’s future strategy includes:

- Further enhance the “fish pond” community concept: Xianyu will continue to expand its core differentiating feature “Fish pond.” Some 38% of Xianyu’s updates in the past have been focused on its “fish pond” community concept.

- Expand product categories and functionalities: Xianyu will further expand on the auction service and its product categories.

- Shift to mobile and offline: Xianyu will increasingly step up its mobile and offline presence through various themed activities.

Zhuan Zhuan

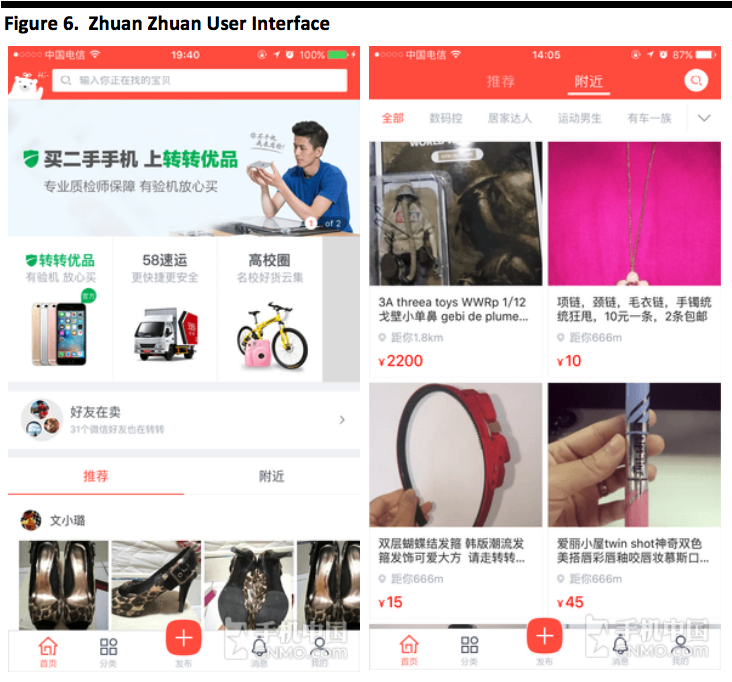

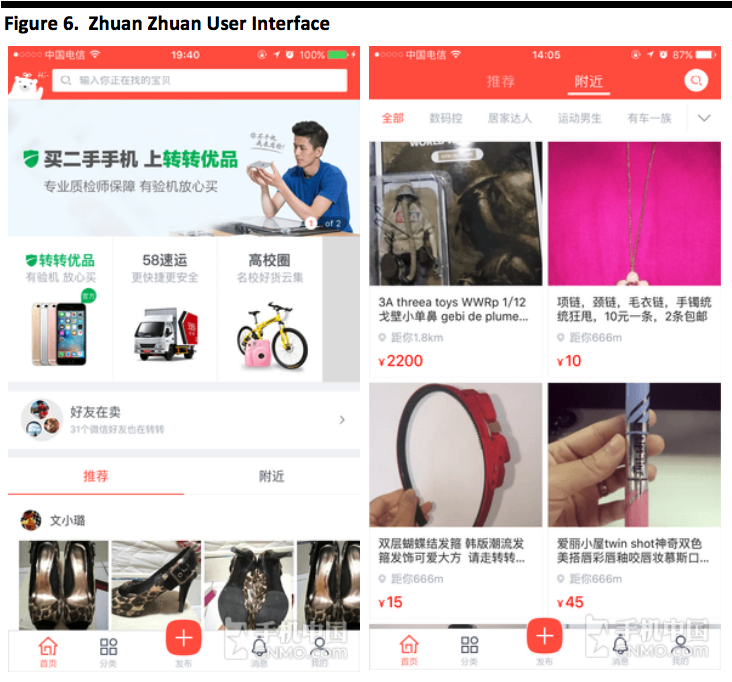

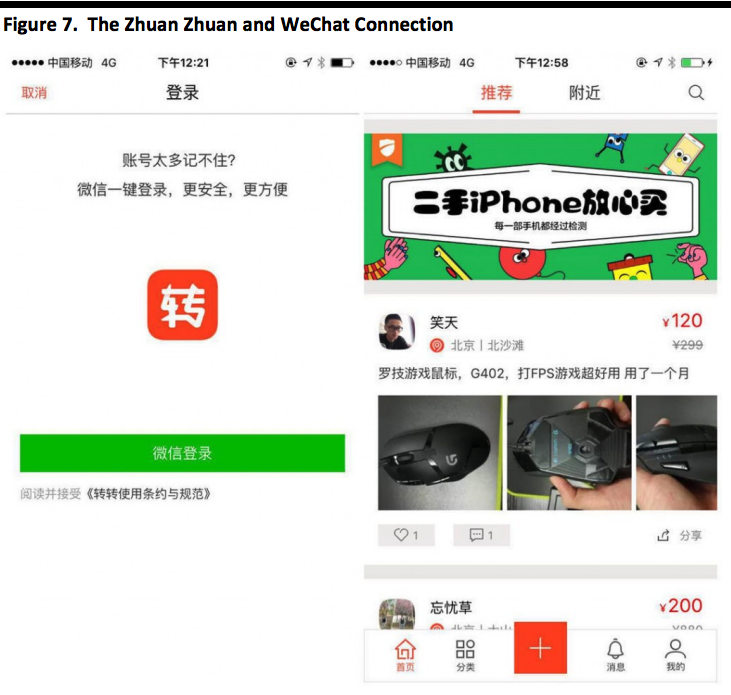

Zhuan Zhuan is one of the leading C2C marketplaces for the sale of pre-owned products in China. The online marketplace and its mobile app were launched in 2015 by 58.com, one of China’s online classifieds and listing platforms. Zhuan Zhuan is backed by Tencent, which invested $200 million in the platform in April 2017 to gain exposure to the online recommerce market and to increase its competitiveness relative to Alibaba’s Xianyu .

How Does It Work?

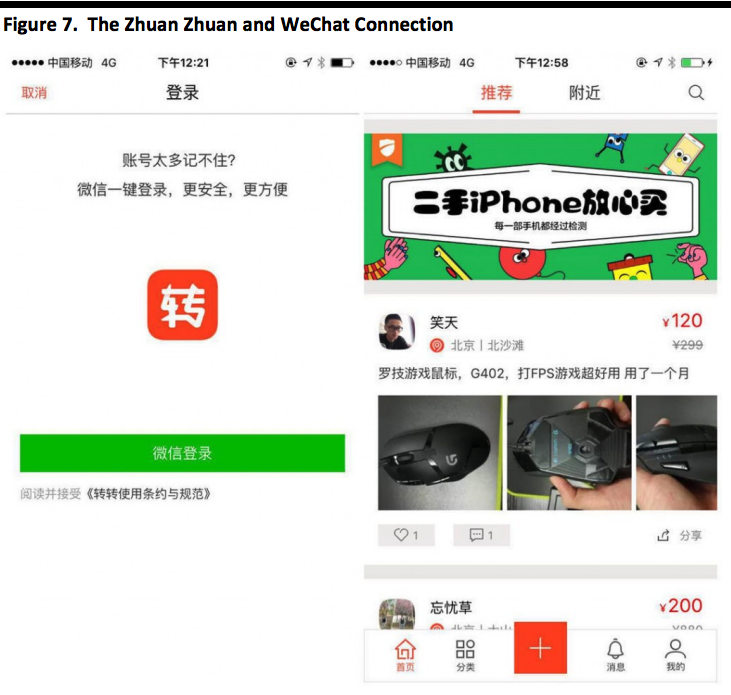

Sellers can upload product listings on Zhuan Zhuan through the mobile app for buyers to then search. The platform introduces an acquaintance system, which encourages users to trade with their WeChat contacts.

[caption id="attachment_86636" align="aligncenter" width="720"]

Source: Sohu

Source: Sohu[/caption]

Differentiating Features

- Leverage WeChat’s user community: The Zhuan Zhuan platform gives users the option of importing their WeChat contact list. The function of automatically importing WeChat contacts aims to help establish trust among the user community.

- Incorporates a credit rating system to foster trust: Buyers and sellers can check their counterparts’ track record on Zhuan Zhuan based on a Sesame credit rating system to determine the credibility of their counterpart.

- Offers upgraded services for pre-owned mobile phones and household appliances: Zhuan Zhuan provides quality inspection services and guarantees for mobile phones to improve the user experience. The platform also cooperates with Haier to provide quality inspection and maintenance solutions for household electrical appliances sold on the platform.

[caption id="attachment_86637" align="aligncenter" width="720"]

Source: technode

Source: technode[/caption]

Positioning

Zhuan Zhuan plans to further optimize its transaction process, strengthen quality controls and consolidate user relationships as the next steps to improve users’ in-app experience.

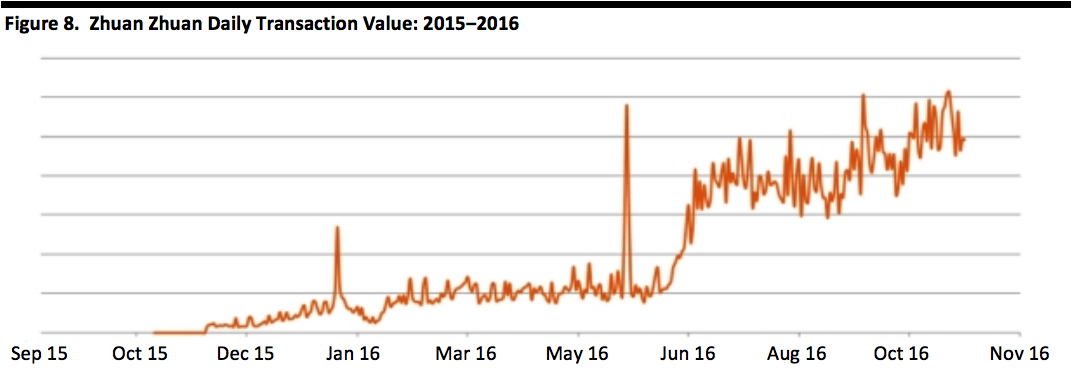

[caption id="attachment_86638" align="aligncenter" width="720"]

Source: Company data

Source: Company data[/caption]

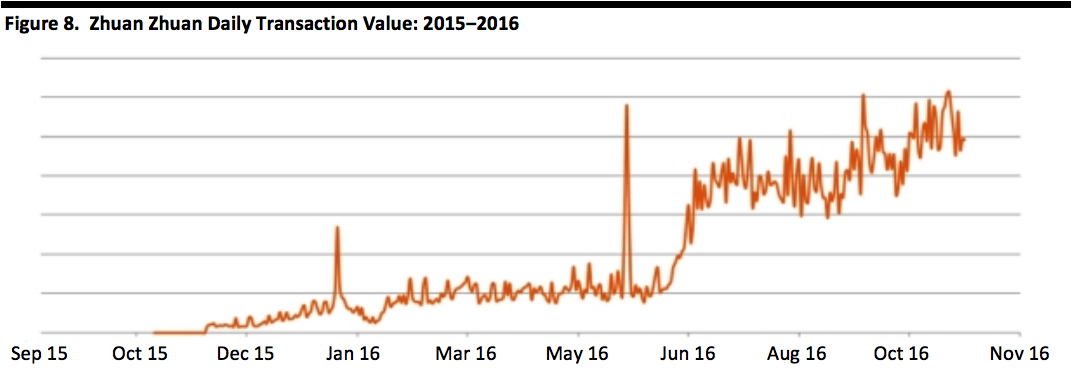

User response: In the first year since the platform’s launch in November 2015, over 24 million users have posted more than 40 million secondhand items on the platform. Total transaction value exceeded ¥7 billion and the number of transactions exceeded 15 million within one year.

[caption id="attachment_86641" align="aligncenter" width="720"]

Source: Company data

Source: Company data[/caption]

[caption id="attachment_86642" align="aligncenter" width="720"]

Source: 100EC/FGRT

Source: 100EC/FGRT[/caption]

Secoo

Secoo is an online platform for pre-owned luxury items and is headquartered in Beijing. It has physical stores in Beijing, Shanghai, Chengdu, Hong Kong, Tokyo, New York, Milan and Johor Bahru (Malaysia). The company’s vision is to operate a trustworthy pre-owned luxury recommerce platform for high-income consumers.

How Does It Work?

Secoo is an online consignment platform for pre-owned luxury items. It derives revenue from consignment fees. The consignment process spans appraisal, valuation and selling. Secoo provides quality appraisal and storage, and the sellers are responsible for delivery.

Differentiating Features

- Focus on omnichannel offering: Sellers can either complete the consignment process online, or visit Secoo’s offline flagship stores called “Secoo Club” in major cities.

- Global market scope: Secoo has global reach in the secondhand market for its inventory of pre-owned items. Unlike most of the other platforms that focus on the domestic secondhand market, Secoo allows local customers to purchase from overseas without paying a delivery fee.

- Professionalism in luxury authentication: Secoo has several qualified jewelry and luxury goods appraisers responsible for determining the value and verifying the authenticity of luxury items.

- Leverages big data analytics to offer personalized services: Big data is one of the key methods Secoo uses to increase user stickiness. Secoo adopts big data analysis to provide targeted marketing and after-sales services. In 2014, the company cooperated with Exane BNP Paribas to analyze data on users’ shopping behavior and preferences. The data was published in a report on China’s luxury industry.

- Provides value-added services: Secoo provides a one-stop shop for services, including one-on-one customer service, personalized consultation and maintenance services to improve users’ shopping experience.

User Response

Secoo had 340,000 total buyers in 2016, an 89% increase from 2015. Total transactions increased by 187% in 2016, according to company data.

[caption id="attachment_86644" align="aligncenter" width="720"]

Source: Company data

Source: Company data[/caption]

Other Fashion Recommerce Platforms in China

Chinese consumers’ increasing appetite for fashion recommerce has driven the proliferation of online fashion recommerce platforms. Below, we discuss some of the other recommerce platforms that have burst onto the scene.

91xinshang

91xinshang is an online luxury fashion recommerce platform. It was launched in November 2015, and received round B financing in December 2016.

How Does It Work?

91xinshang is a C2C fashion recommerce platform, similar to Xianyu and Zhuan Zhuan. It charges a 5% commission for its “White Gloves” consignment service, and also derives revenue from its luxury products maintenance service.

Differentiating Features

91xinshang has a professional team of experts to provide an authentication service. All transactions on the platform are insured by the People’s Insurance Company of China (PICC) to guarantee the authenticity of every product. The platform emphasizes the efficiency of matching buyers and sellers. On average, it takes 5–7 days to process a transaction, from a seller posting a product to the buyer receiving the goods.

User Response

The app has more than 200 million registered users, 100,000 daily average users (DAU) and averages monthly transactions of over ¥15 million, as of June 2017.

[caption id="attachment_86646" align="aligncenter" width="720"]

Source: 91xinshang.com

Source: 91xinshang.com[/caption]

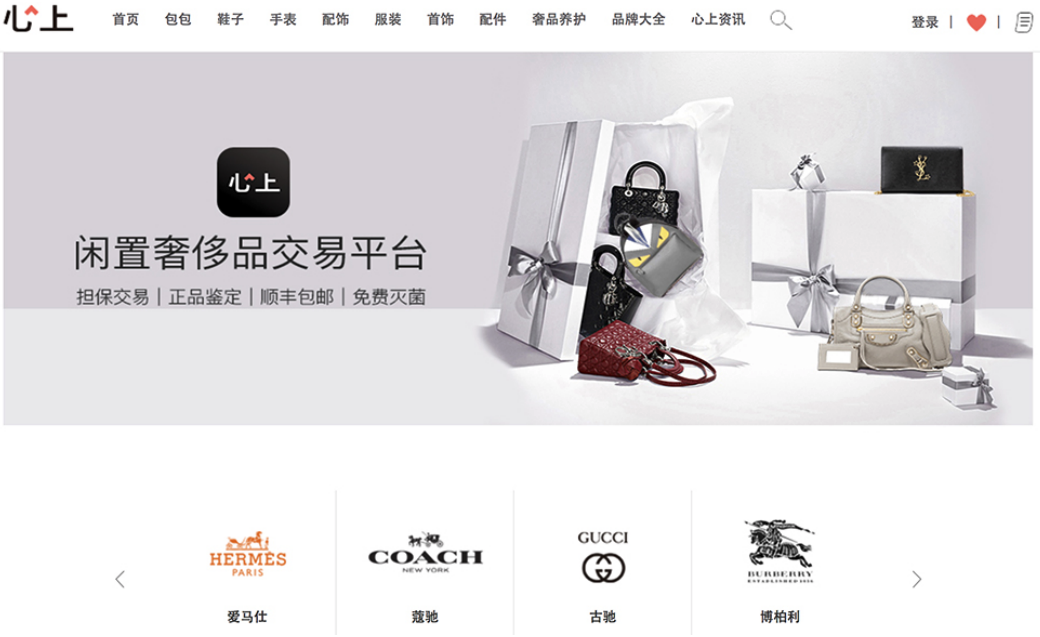

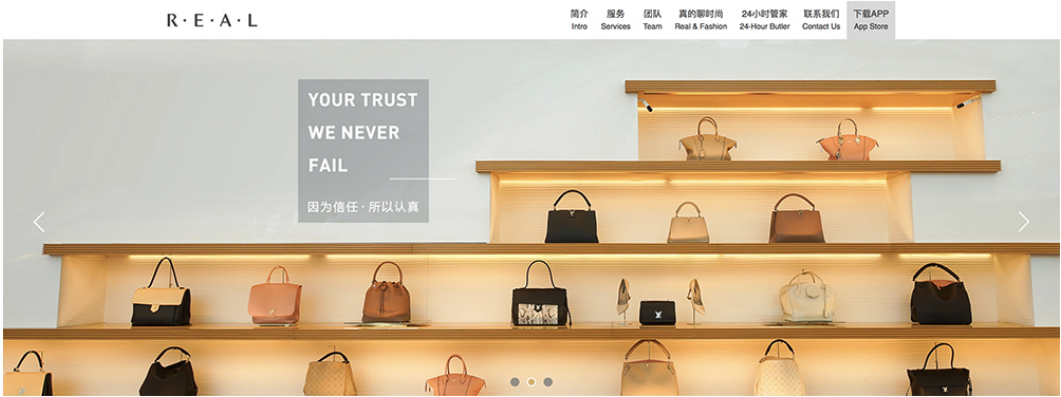

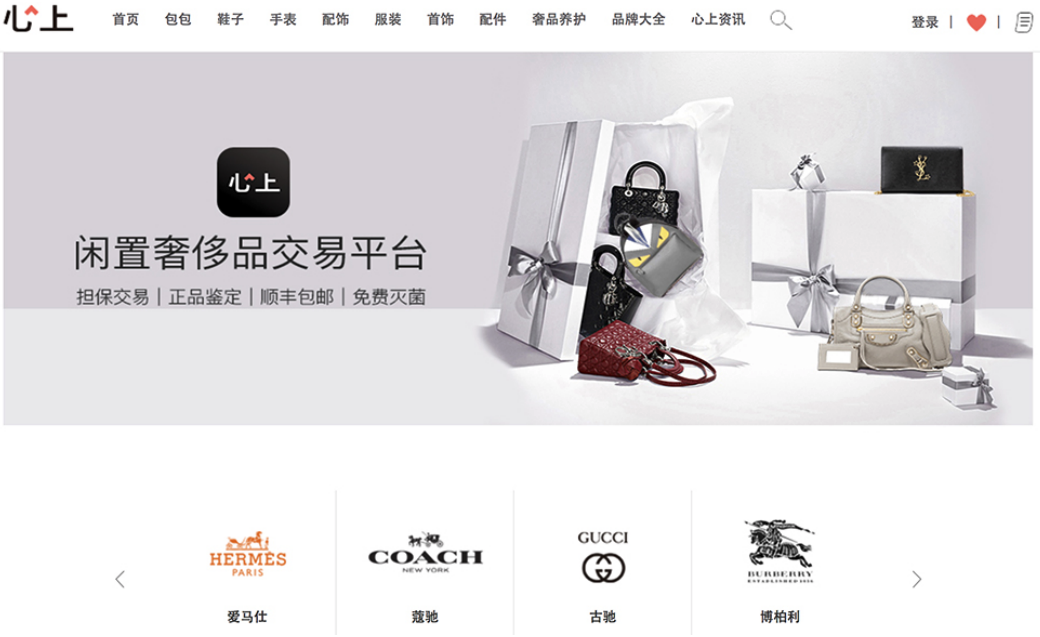

Real

Real is an online luxury recommerce mobile app. Real launched an IOS App in October 2016.

How Does It Work?

Real supports three types of transactions: buyout, consignment and free sell.

- Buyout is a C2B2C model, the platform buys the pre-owned luxury item from the seller, keeps the inventory and is responsible for selling to users.

- Consignment lets those sellers who are less time-sensitive to sell at prices that they set. Sellers first send their item(s) to the platform for authentication.

- Free sell, similar to the business model of Xianyu and Zhuan Zhuan, needs sellers to send their items to the platform only when buyers confirm their interest.

[caption id="attachment_86650" align="aligncenter" width="720"]

Source: www.zhen-de.com

Source: www.zhen-de.com[/caption]

Differentiating Features

As the name suggests, Real emphasizes the authenticity of the luxury items sold on its platform. The platform has a professional team to authenticate each item. It is also partnering with the China Certification & Inspection Group to guarantee a counterfeit-free shopping environment. The platform also provides customization, deluxe care and other value-added services.

[caption id="attachment_86651" align="aligncenter" width="720"]

Source: www.zhen-de.com

Source: www.zhen-de.com[/caption]

GoShare2

GoShare2 is an online fashion recommerce app that specializes in women’s clothing.

How Does It Work?

The fashion recommerce app supports a buyout and consignment model for sellers. With the buyout model, a seller first receives a buyout price offer from the platform. Once the seller confirms the offer, they receive the proceeds within two days. With the consignment model, the platform is responsible for the logistics and maintenance, and sellers can adjust prices as they like.

Differentiating Features

GoShare2 plays an active role in processing sellers’ items, ranging from cleaning the clothes, taking photographs and carrying out appraisals, to displaying the items on its online platform and handling customer enquiries. The platform features a 7-day returns policy and provides insurance to ensure the authentication of products.

User Response

Since its launch in January 2016, GoShare2 has served over 100,000 clients. The platform receives more than 10,000 secondhand products every month. More than 60% of products are sold within 30 days.

[caption id="attachment_86652" align="aligncenter" width="720"]

Source: Company data

Source: Company data[/caption]

Conclusion

China’s online fashion recommerce industry is currently in its nascent growth stage. The two leading integrated recommerce platforms – Alibaba’s Xianyu and Tencent-backed Zhuan Zhuan – commanded almost 90% of the total market in 2016. Increased venture capital investments have fueled the growth of luxury fashion recommerce platforms, such as 91xinshang, Real and Goshare2. We believe cooperation with social media platforms, guarantee of authenticity, application of big data technologies and comprehensive aftersales services are the key drivers of success for online fashion recommerce platforms in China.

Source: Chandashi/FGRT[/caption]

Source: Chandashi/FGRT[/caption]

Source: Sohu[/caption]

Source: Sohu[/caption]

Source: Jianshu[/caption]

Source: Jianshu[/caption]

Source: Alibaba Xianyu/FGRT[/caption]

[caption id="attachment_86630" align="aligncenter" width="720"]

Source: Alibaba Xianyu/FGRT[/caption]

[caption id="attachment_86630" align="aligncenter" width="720"] Source: Company data/Woshipm/FGRT[/caption]

Positioning

The core focus of Xianyu’s future strategy includes:

Source: Company data/Woshipm/FGRT[/caption]

Positioning

The core focus of Xianyu’s future strategy includes:

Source: Sohu[/caption]

Differentiating Features

Source: Sohu[/caption]

Differentiating Features

Source: technode[/caption]

Positioning

Zhuan Zhuan plans to further optimize its transaction process, strengthen quality controls and consolidate user relationships as the next steps to improve users’ in-app experience.

[caption id="attachment_86638" align="aligncenter" width="720"]

Source: technode[/caption]

Positioning

Zhuan Zhuan plans to further optimize its transaction process, strengthen quality controls and consolidate user relationships as the next steps to improve users’ in-app experience.

[caption id="attachment_86638" align="aligncenter" width="720"] Source: Company data[/caption]

User response: In the first year since the platform’s launch in November 2015, over 24 million users have posted more than 40 million secondhand items on the platform. Total transaction value exceeded ¥7 billion and the number of transactions exceeded 15 million within one year.

[caption id="attachment_86641" align="aligncenter" width="720"]

Source: Company data[/caption]

User response: In the first year since the platform’s launch in November 2015, over 24 million users have posted more than 40 million secondhand items on the platform. Total transaction value exceeded ¥7 billion and the number of transactions exceeded 15 million within one year.

[caption id="attachment_86641" align="aligncenter" width="720"] Source: Company data[/caption]

[caption id="attachment_86642" align="aligncenter" width="720"]

Source: Company data[/caption]

[caption id="attachment_86642" align="aligncenter" width="720"] Source: 100EC/FGRT[/caption]

Source: 100EC/FGRT[/caption]

Source: Company data[/caption]

Source: Company data[/caption]

Source: 91xinshang.com[/caption]

Source: 91xinshang.com[/caption]

Source: www.zhen-de.com[/caption]

Differentiating Features

As the name suggests, Real emphasizes the authenticity of the luxury items sold on its platform. The platform has a professional team to authenticate each item. It is also partnering with the China Certification & Inspection Group to guarantee a counterfeit-free shopping environment. The platform also provides customization, deluxe care and other value-added services.

[caption id="attachment_86651" align="aligncenter" width="720"]

Source: www.zhen-de.com[/caption]

Differentiating Features

As the name suggests, Real emphasizes the authenticity of the luxury items sold on its platform. The platform has a professional team to authenticate each item. It is also partnering with the China Certification & Inspection Group to guarantee a counterfeit-free shopping environment. The platform also provides customization, deluxe care and other value-added services.

[caption id="attachment_86651" align="aligncenter" width="720"] Source: www.zhen-de.com[/caption]

Source: www.zhen-de.com[/caption]

Source: Company data[/caption]

Source: Company data[/caption]