Web Developers

Executive Summary

China’s online fashion recommerce market is in a nascent phase and continues to grow rapidly. Online fashion recommerce is a relatively new business model in China—it began with the integrated online platforms, then moved into niches, such as pre-owned luxury fashion. China’s online luxury fashion recommerce market has a penetration rate of less than 5%—compared to 10%–15% in the US—and is growing rapidly. The huge pool of luxury items that exists in China, combined with the stabilization of the country’s economic growth, is conducive to growth of the luxury fashion recommerce market.VC funding is also fueling the growth of the recommerce industry. Multiple growth drivers of China’s fashion recommerce market: We believe several factors are driving Chinese consumers’ increasing spending on online fashion recommerce platforms. On the demand side, Chinese consumers are embracing digital and younger consumers are expected to fuel the growth of China’s recommerce market. Chinese consumers are increasingly driven by trends that began overseas, such as decluttering and the unlocking of value through recommerce platforms. Last, but not least, online recommerce platforms are well positioned to capture spending by consumers from lower-tier cities where the store network is generally less developed. Integrated platforms make up the lion’s share of the online recommerce market: Alibaba’s Xianyu and 58.com’s Zhuan Zhuan are the two largest integrated recommerce platforms in China, with a combined market share of over 90%. Chinese consumers’ increasing appetite for fashion recommerce has driven the proliferation of online fashion recommerce platforms, such as Real, Secoo and GoShare2. Strategies to winning the hearts of Chinese consumers: We believe online recommerce retailers should create a community for shoppers through social media and experiential stores. Retailers should also offer an end-to-end customer support system for shoppers, including style advisory and maintenance. Concerns for hygiene and authenticity are among the primary challenges to be overcome: To capitalize on the opportunity, the fashion recommerce market will need to change consumers’ perception about pre-owned products, such as authenticity and hygiene concerns. More standardized processes for quality control, customer service and dispute resolution need to be in place for China’s online fashion recommerce market to develop systematically.An Overview of China’s Fashion Recommerce Market

China’s online fashion recommerce market is in a nascent phase and continues to grow rapidly. Online fashion recommerce is a relatively new business model in China—it began with the integrated online platforms, then moved into niches, such as pre-owned luxury fashion. In 2016, pre-owned luxury fashion transactions exceeded ¥8 billion, a year-over-year increase of 20%. To put this figure into context, the total value of luxury items owned in China (and available for secondhand circulation) was¥300 billion in 2016, according to data from the Chinese Association for Secondhand Luxury Working Committee, implying how underpenetrated the fashion recommerce market is in China, and that significant growth opportunities exist.Growth Drivers of China’s Online Fashion Recommerce Industry

Chinese consumers seem more willing to embrace online fashion recommerce platforms, as: 1) Chinese consumers are embracing digital; 2) online can make up for the lack of, or somewhat sparse, store network in the lower-tier cities; 3) recommerce unlocks value; and 4) the decluttering movement has spurred the sharing economy. 1. Chinese consumers are embracing digital: Chinese consumers have long-embraced online shopping, with 467 million Chinese shopping online, as of 2016. Online sales comprised 16.9% of total Chinese consumption in 2016, more than double the 8.1% in the US. Over 60% of Chinese consumers research online before making a purchase.

Source: iStockphoto

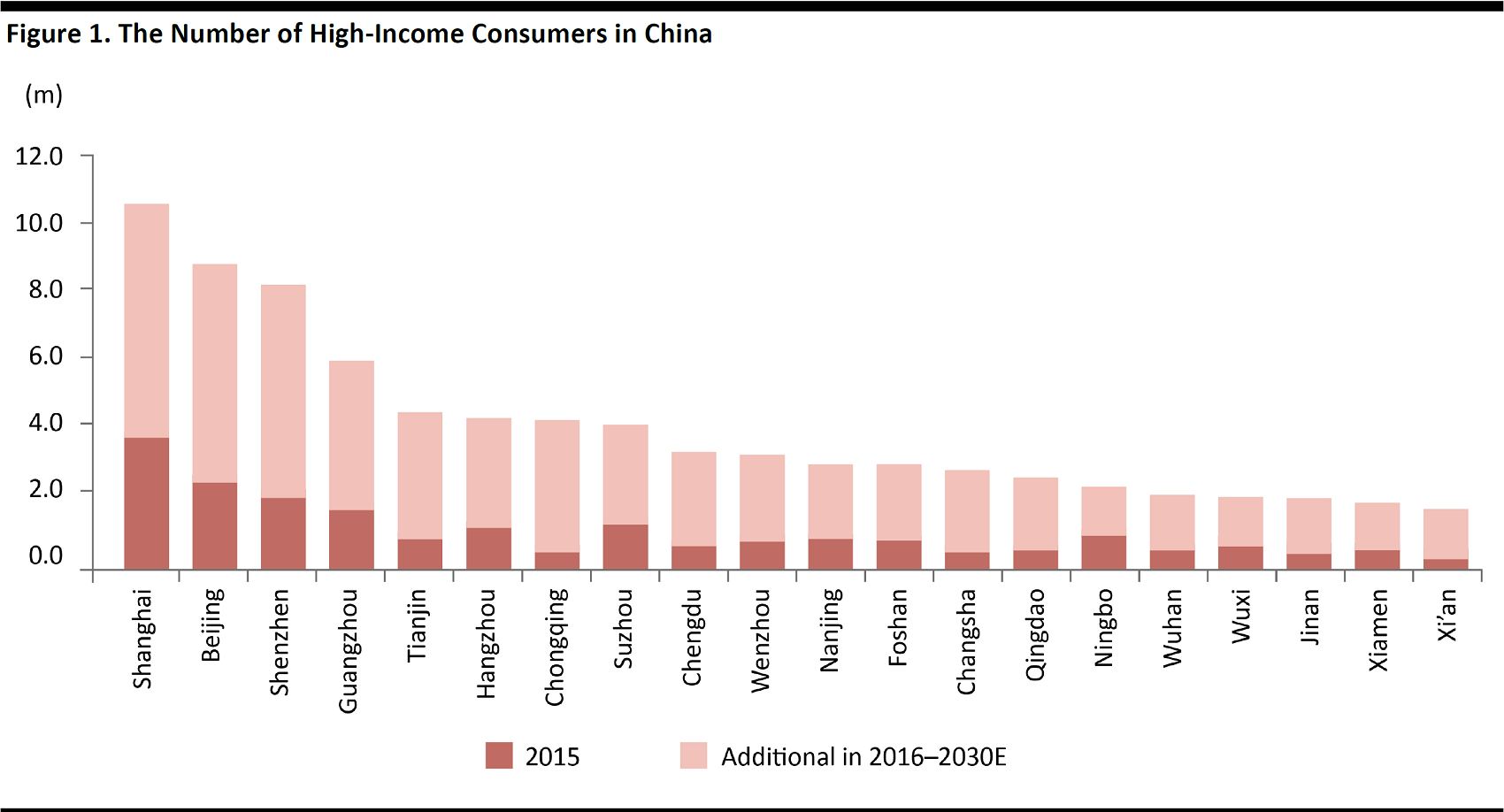

2. E-commerce can compensate for a sparse store network in lower-tier cities: Online fashion recommerce platforms are well positioned to benefit from the growing number of high-income consumers and the consumption upgrade in lower-tier cities where the penetration of luxury brands is lower. By 2030, lower-tier cities will have more “high-income” consumers than Beijing has currently, according to the Economist Intelligence Unit. The proportion of upper-middle-class consumers is estimated to reach 35% of the total population by 2030, from 10% currently. Shanghai, Beijing, Shenzhen and Guangzhou will continue to dominate luxury spending, and smaller cities will transform into luxury epicenters.

Note: high-income consumers refer to individuals with a grey income-adjusted disposable income of above ¥200,000 per yearat 2015 constant prices. Source: Economist Intelligence Unit

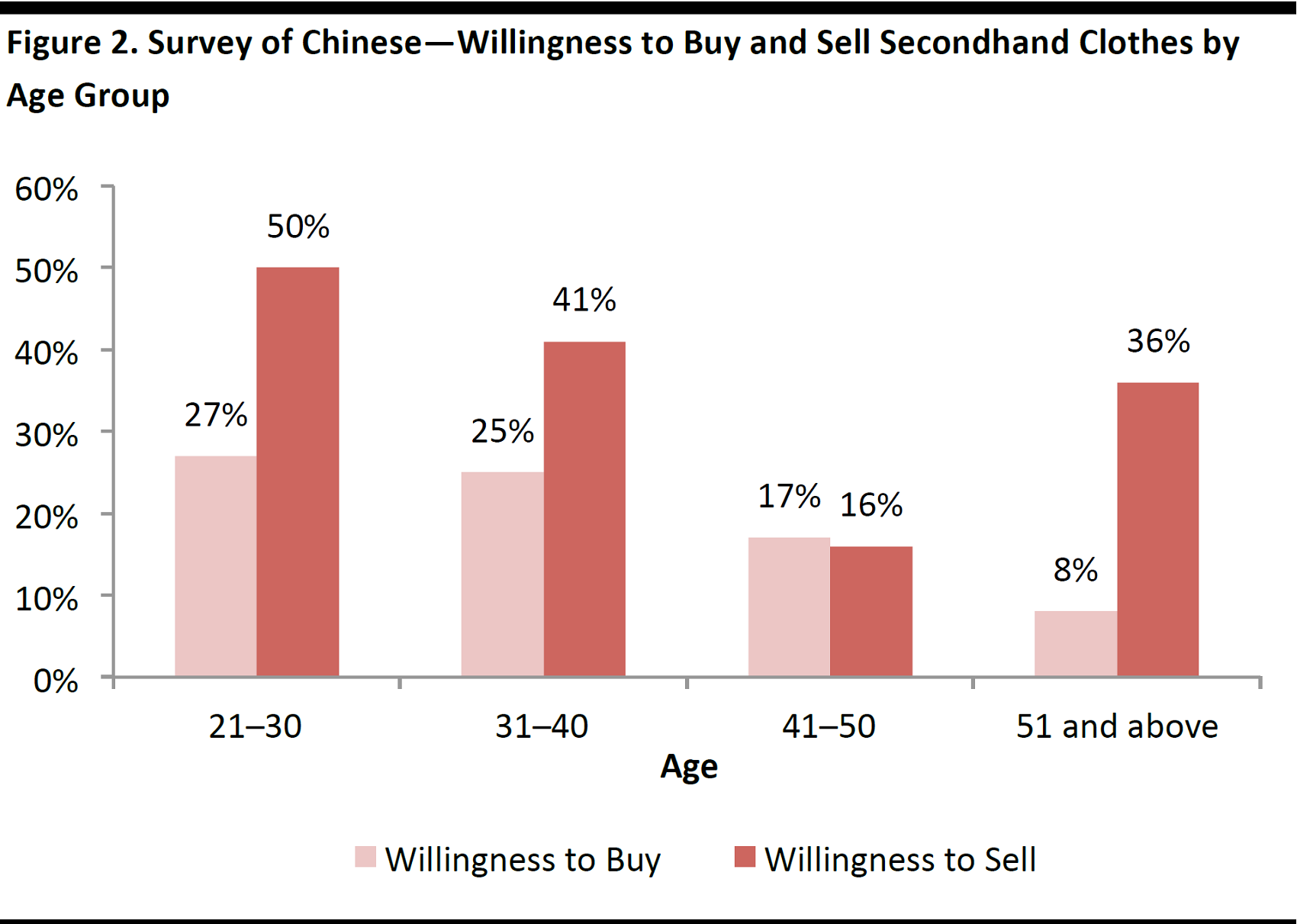

3. Demand from young consumers fuel the growth for China’s recommerce market: The growth of China’s fashion recommerce market has been driven primarily by demand from younger consumers born in the 1990s and 2000s who are more receptive to secondhand clothes.

Note: Conducted in 2013, this survey was based on how 573 Chinese consumers perceive the purchase of secondhand luxury items. A more recent survey was not available; however, we believe Chinese consumers’ intention to purchase has picked up, in particular, among the lower age group. Source: Fortune Character Association/FGRT

4. Recommerce unlocks value: The recommerce market can help unlock the value of pre-owned clothing by matching buyers and sellers. For buyers, fashion recommerce represents good value for the price paid. Sellers can liquidate their luxury items into cash. Some 80% of consumers buy secondhand products because they offer good quality for price, according to 58 Zhuan Zhuan.

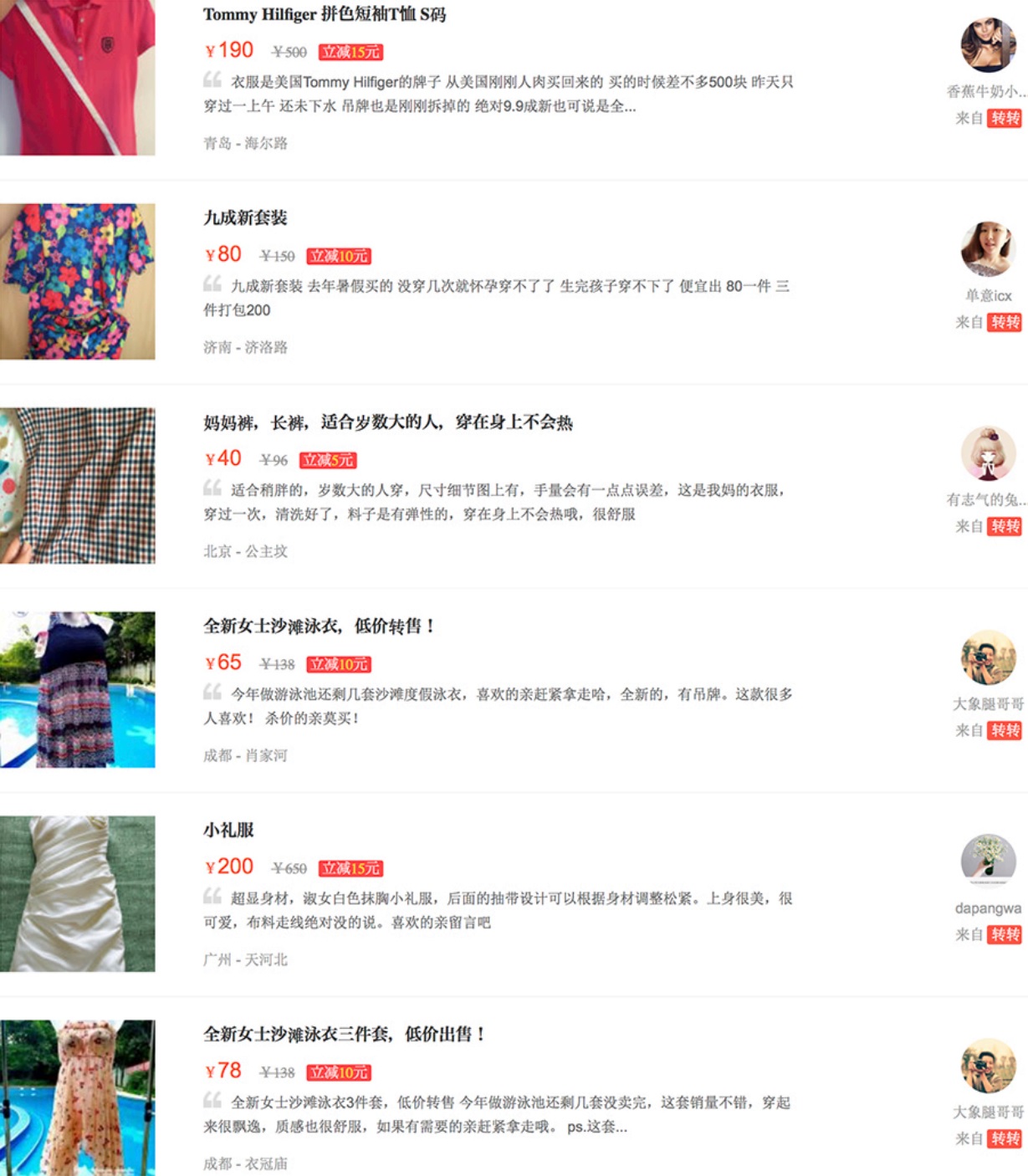

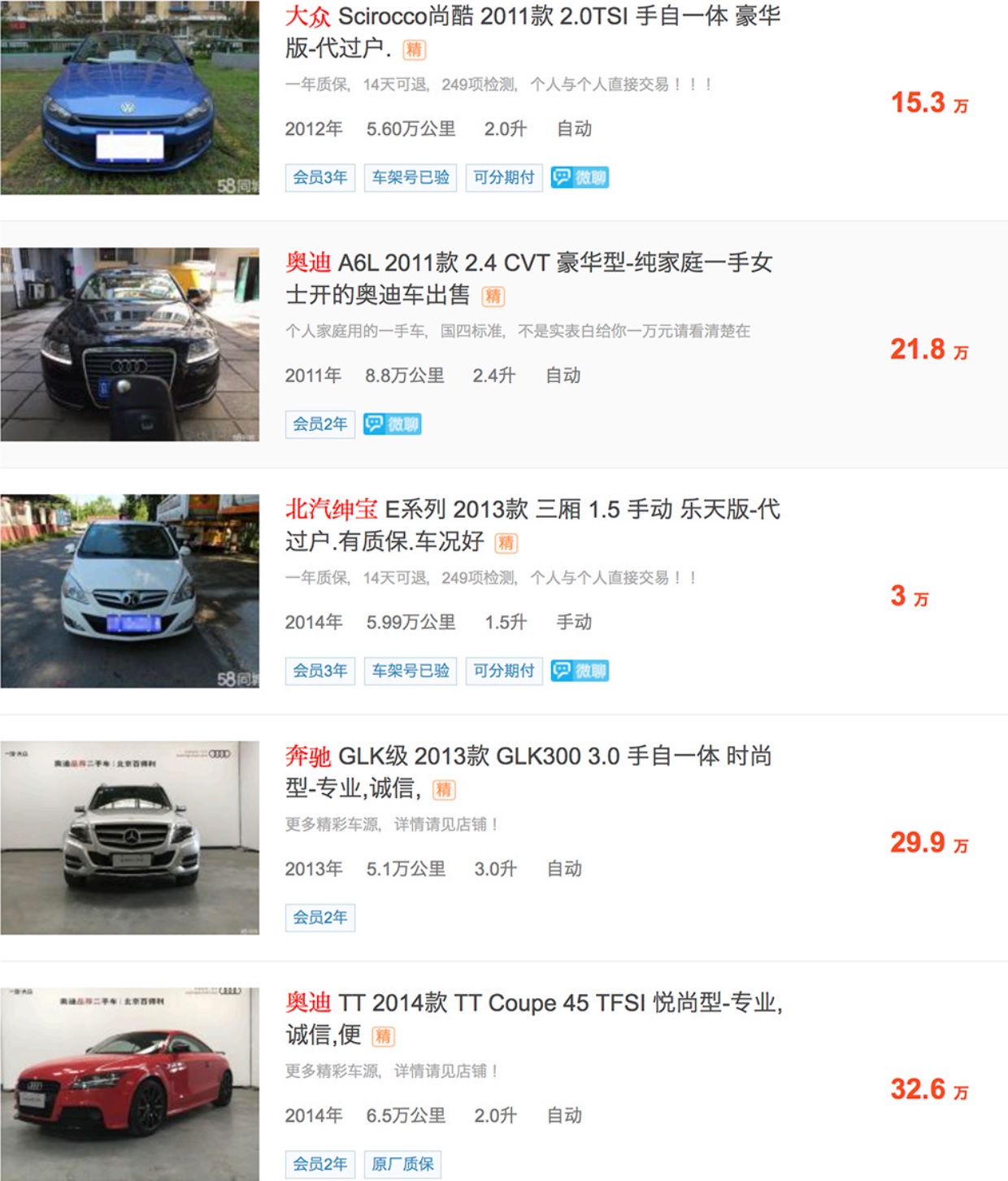

Source: bj.58.com

5. The decluttering movement has spurred a sharing economy: Decluttering, or the process of organizing one’s belongings and keeping only those things that “spark joy,” has been gaining traction around the world, particularly in large cities, and China is no exception. We expect decluttering to be a long-term consumer trend. The ripple effects of the decluttering movement include a boost in the sharing economy, which enables consumers to have access to what they need, without acquiring the product permanently. According to a 2016 US national survey of the usage of sharing platforms, 50% of adults who have used some form of shared online service have purchased used or secondhand goods online.Potential Opportunities for China’s Sizeable Luxury Market

Online fashion recommerce platforms have huge potential in China, and will likely outperform physical secondhand stores because of the wider reach of online retail to China’s consumers. Millennials prefer purchasing pre-owned items online: Because of the anonymity it provides, millennials prefer to purchase pre-owned goods online rather than at a physical store. According to research on high-end consumers, those in China are 20 years younger than their counterparts in the US and Japan.

Source: s.2.taobao.com

Low penetration rate: In particular, we believe there is significant potential for luxury fashion recommerce in China, given the low penetration rate of less than 5% currently, compared to 10%–15% in the US. Luxury goods usually retain a higher value when circulated in the secondhand market. Chinese consumers are expected to make up a very significant 44% of the total global luxury market by 2025, by which time it is estimated it is estimated to surpass $397 billion, according to McKinsey.China’s Recommerce Platforms Attracting Venture Capital Funding

China’s Online Recommerce Startups

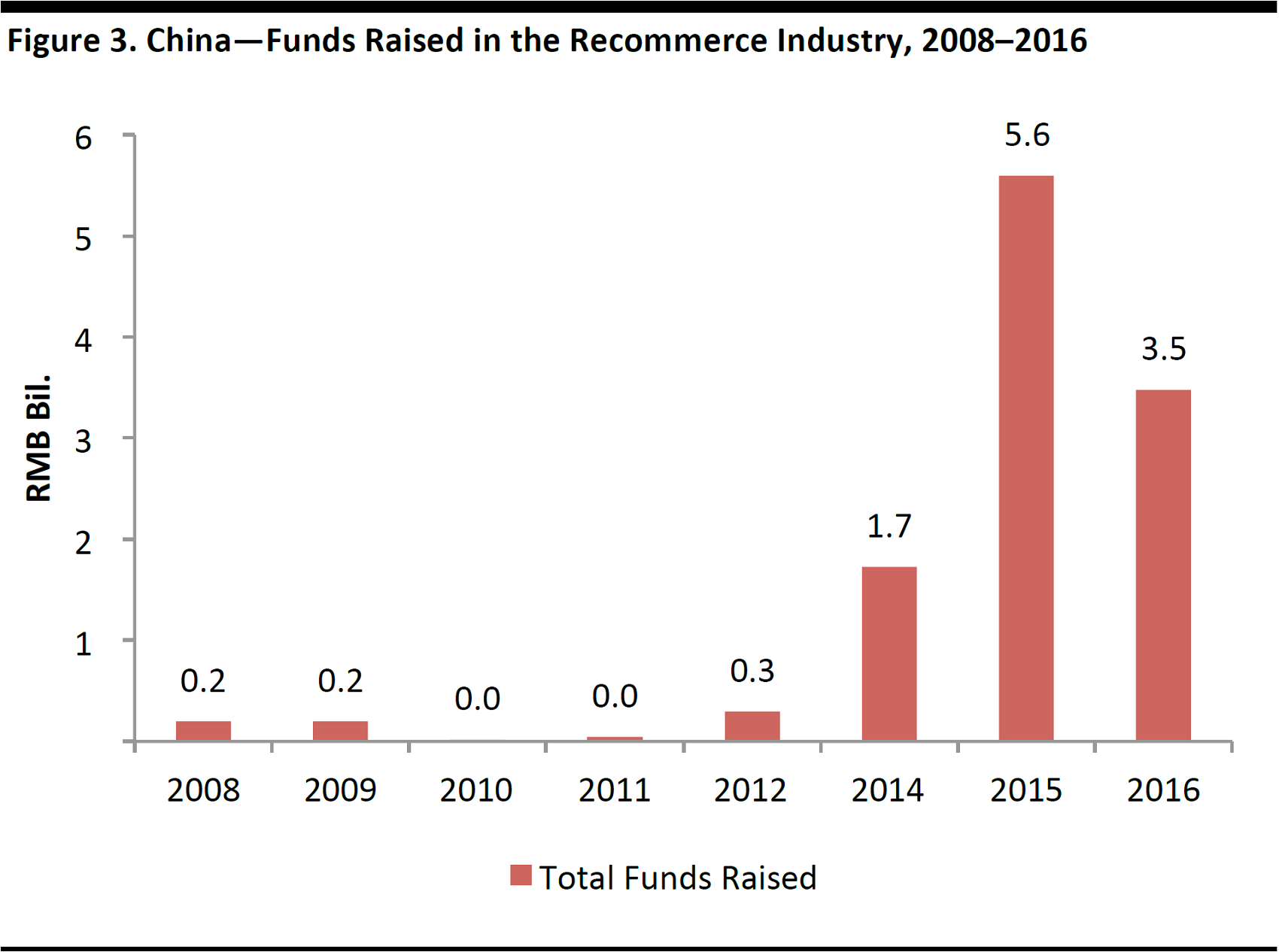

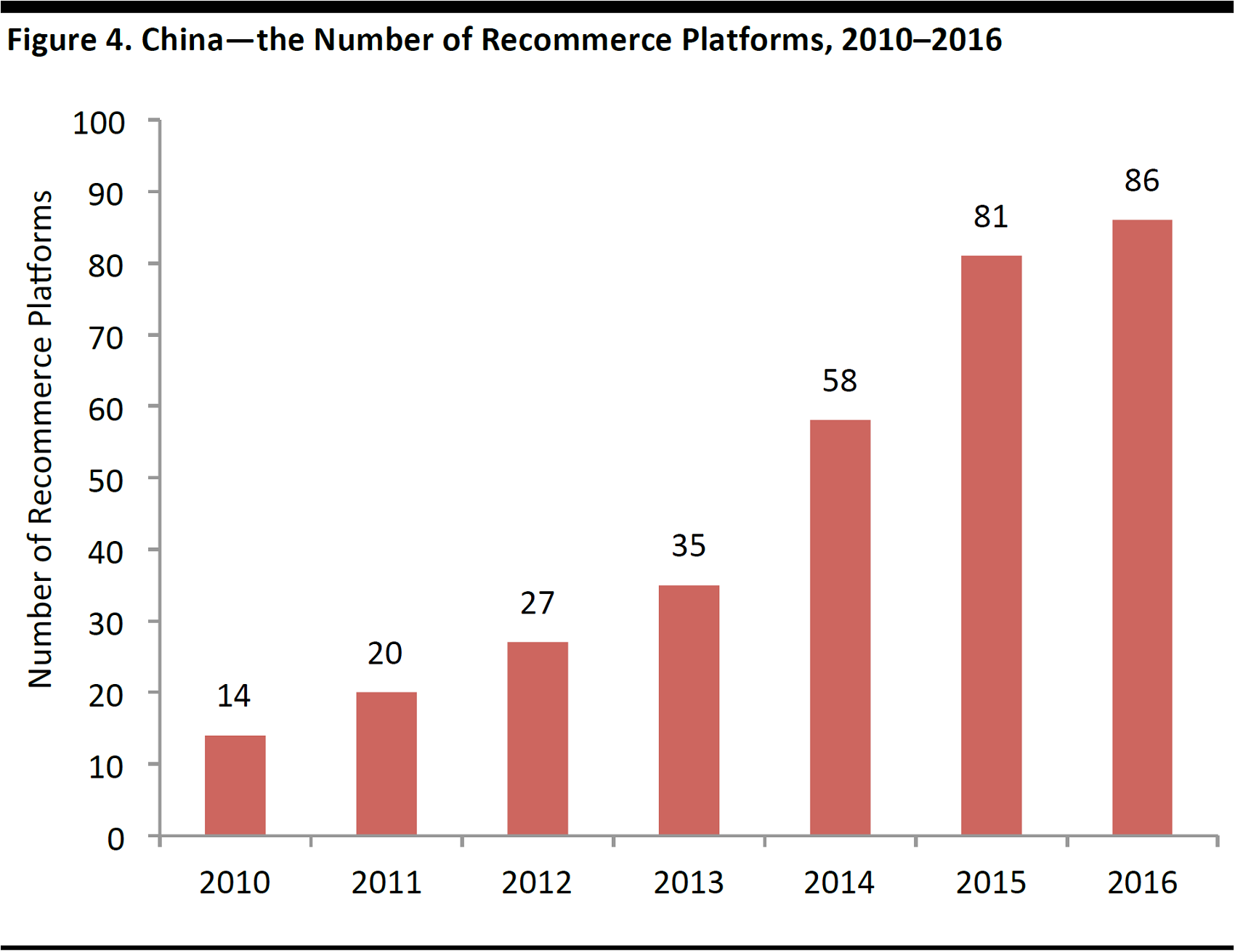

The significant opportunities presented by China’s online recommerce market have attracted venture capital (VC) funding. In 2016, online recommerce startups in China raised aggregate funds of ¥3.5 billion, compared to just ¥40 million in 2011. As a result, the number of online recommerce platforms in China increased to 86 in 2016 from 20 in 2011.

Note: No data available for 2013. Source: Tencent Research/FGRT

Source: Tencent Research/FGRT

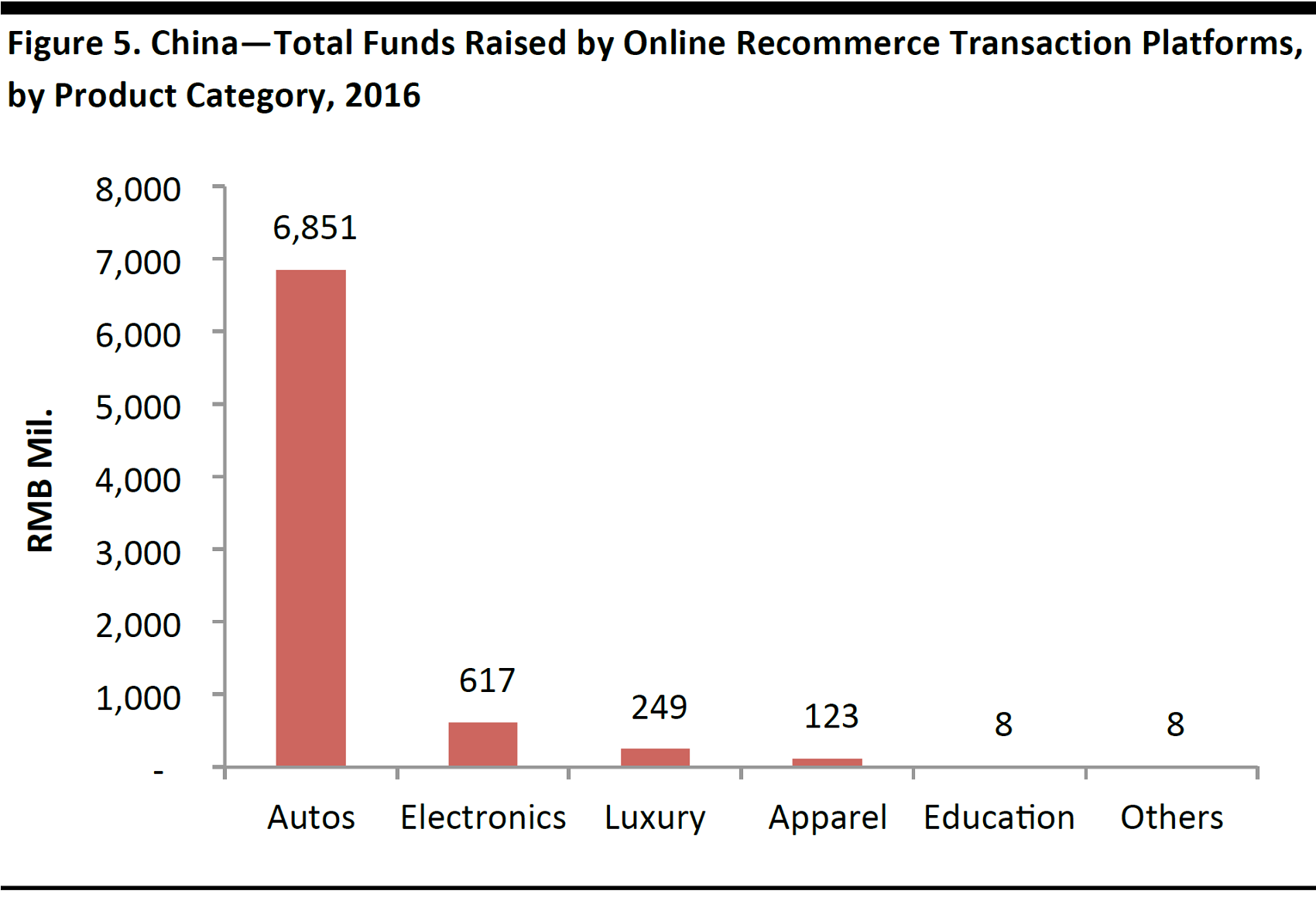

Fundraising by Product Category of Fashion Recommerce Startup

In terms of funds raised (online and offline combined), luxury and apparel have raised ¥372 million, as of 2016. Auto is the category that dominates the recommerce market with the most funds raised.

Source: Tencent Research/FGRT

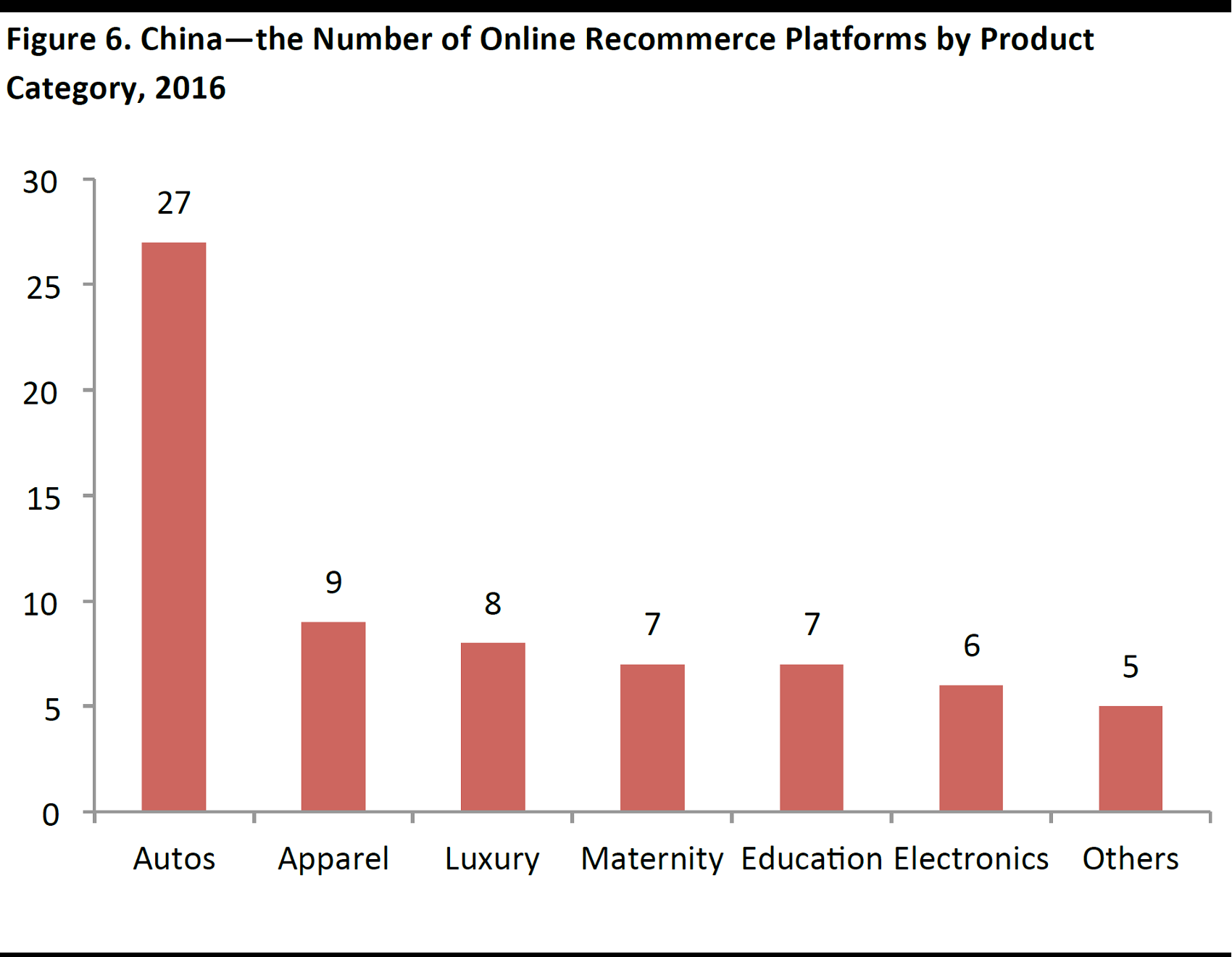

The Number of Online Recommerce Platforms by Product Category

According to Tencent Research, of the 86 online recommerce platforms in 2016, over 80% are product-specific platforms. Auto e-commerce recommerce platforms account for the lion’s share at 27, followed by apparel at 9 and luxury items at 8.

Source: Tencent Research/FGRT

Source: bj.58.com

Apparel: Apparel accounts for 20% of the online secondhand market in China. Luxury: Chinese consumers purchase over ¥800 billion (US$120 billion) worth of luxury products every year. In developed markets, such as the US, trade in pre-owned luxury fashion typically accounts for around 10%–15% of the overall luxury market. In China, however, the penetration rate is currently less than 5%. In 2016, the trade of pre-owned luxury goods exceeded ¥8 billion, growing at 20% year over year.- The most popular brands include Louis Vuitton, Gucci, Prada, Chanel, Coach, Dior, etc.

- The most popular categories include bags, watches, glasses, jewelry, and scarves.

Major Players in China’s Online Recommerce Industry

In China, the two largest integrated recommerce platforms are Alibaba’s Xianyu and 58.com’s Zhuan Zhuan. Chinese consumers’ increasing appetite for fashion recommerce has driven the proliferation of online fashion recommerce platforms. Xianyu

Xianyu (translated asidle fish) is an integrated consumer-to-consumer (C2C) pre-owned goods marketplace operated by Alibaba. sought to differentiate its positioning by introducing virtual communities within the app to increase user engagement.

Xianyu

Xianyu (translated asidle fish) is an integrated consumer-to-consumer (C2C) pre-owned goods marketplace operated by Alibaba. sought to differentiate its positioning by introducing virtual communities within the app to increase user engagement.

58 ZhuanZhuan

Zhuan Zhuan is a C2C marketplace for the sale of pre-owned products that was launched in 2015 by 58.com, one of China’s leading online classifieds and listing platforms. The platform operates similar to Xianyu. The Zhuan Zhuan platform automatically connects with WeChat, which lets users’ import their WeChat contact lists to easily transact with their contacts.

58 ZhuanZhuan

Zhuan Zhuan is a C2C marketplace for the sale of pre-owned products that was launched in 2015 by 58.com, one of China’s leading online classifieds and listing platforms. The platform operates similar to Xianyu. The Zhuan Zhuan platform automatically connects with WeChat, which lets users’ import their WeChat contact lists to easily transact with their contacts.

91xinshang

91xinshang is an online luxury fashion recommerce platform that was launched in November 2015. 91xinshang has a professional team of experts to provide authentication service, and all transactions on the platform are insured.

91xinshang

91xinshang is an online luxury fashion recommerce platform that was launched in November 2015. 91xinshang has a professional team of experts to provide authentication service, and all transactions on the platform are insured.

Real

Real is an online luxury recommerce app which was launched in October 2016. As the name suggests, Real emphasizes the authenticity of the luxury items sold on its platform. The platform provides brand authentication, customization, deluxe care and other value-added services.

Real

Real is an online luxury recommerce app which was launched in October 2016. As the name suggests, Real emphasizes the authenticity of the luxury items sold on its platform. The platform provides brand authentication, customization, deluxe care and other value-added services.

Secoo

Secoo is an online pre-owned luxury platform in China. Sellers can either complete the consignment process online, or visit Secoo’s offline flagship stores called “Secoo club” in Beijing, Shanghai, Chengdu, Hong Kong and Tokyo.

Secoo

Secoo is an online pre-owned luxury platform in China. Sellers can either complete the consignment process online, or visit Secoo’s offline flagship stores called “Secoo club” in Beijing, Shanghai, Chengdu, Hong Kong and Tokyo.

GoShare2

GoShare2 is an online fashion recommerce app for women’s clothing. GoShare2 plays an active role in processing sellers’ items, ranging from cleaning the clothes, taking photographs and carrying out appraisals, to displaying the items on its online platform and handling customer enquiries.

GoShare2

GoShare2 is an online fashion recommerce app for women’s clothing. GoShare2 plays an active role in processing sellers’ items, ranging from cleaning the clothes, taking photographs and carrying out appraisals, to displaying the items on its online platform and handling customer enquiries.

The Recommerce Market—Global Comparisons

The recommerce market in China is at an early growth stage relative to that in the US and Europe.- China: The penetration of luxury fashion recommerce in China is currently less than 5%, compared to 10%–15% in the US.

- US: Clothing, shoes, and accessories comprise 49% of the recommerce market. The US apparel recommerce industry, both online and offline, is valued at $18 billion and is expected to reach $33 billion in 2021, according to ThredUP’s 2017 Annual Recommerce Report.

- Sweden: More than 80% of the entire population has transacted on Blocket, the largest secondhand online marketplace in Sweden.

What Differentiates China’s Online Fashion Recommerce Market from That of the West?

In our view, the value proposition and business model of successful fashion recommerce platforms in China differ from that of their overseas counterparts: 1) China’s online fashion recommerce market is less developed; and 2) the business models are more diversified.1. China’s Online Fashion Recommerce Market Is Less Developed than that of the US

In our view, there are significant opportunities for fashion recommerce platforms in China, as the market is less mature. The fashion recommerce market began to grow in 2015/2016 when startups began to enter the market. The US fashion recommerce industry, on the other hand, is more mature, and major players such as ThredUP (founded in 2009) and Poshmark (founded in 2011) have consolidated their market positions.2. The Business Models of China’s Online Fashion Recommerce Platforms Are More Diversified than those in the US

We believe China’s online fashion recommerce market offers more opportunities for growth, based on their data-centric offering and the more diversified nature of their operations. Most platforms use data technology to map consumers’ behavior and also operate various touch points with consumers:- The online marketplace is an all-in-one destination that houses all secondhand product categories. Xianyu is one of the leading players in China’s fashion recommerce market; it is an offshoot of Taobao’s marketplace.

- Communities are created on online recommerce platforms among users sharing similar interests and provide a venue for them to share news and transact. Examples are Xianyu and 58 Zhuan Zhuan.

- Buyout is a C2B2C business model whereby recommerce platforms buy pre-owned products from sellers and then sell them on their platforms.

- Consignment is a C2C business model whereby recommerce platforms provide delivery, authentication and maintenance services for customers to trade pre-owned products.

- Pop-up stores: Some recommerce platforms such as Secoo have physical pop-up stores where they display pre-owned products instore.

Strategies for China’s Online Fashion Recommerce Players

Retail-tainment

We suggest online recommerce players should make use of social media and experiential stores to increase the attractiveness of their products. Community is a key aspect of China’s recommerce market. Data suggests that community users are more engaged; the average transaction amount within a community is strongly correlated with the level of interaction of its users. For example, retailers can create a social community among consumers based on common interests and location to build trust, foster interactions between celebrities and fans through live broadcasting, and open physical experience stores with a brand authentication service and personalized style consulting.

Source: iStockphoto

Value-Added Services Offering

To create value for pre-owned products, retailers should consider offering an end-to-end customer support system, quality inspection, brand authentication, maintenance, consignment sales, style advisory and other services.Focus on Young Millennials

Target customers of the fashion recommerce market mostly reside in the lower-tier cities. Users in tier-one and tier-two cities make up 64% and 23%, respectively, of the recommerce market consumer base. To grow their business, we suggest fashion recommerce startups focus on young millennials in these tier-1 or tier-2 cities, and also expand their marketing efforts in lower-tier cities.Challenges for Online Fashion Recommerce in China

China’s fashion recommerce platforms are in their early stages of development, compared to those in the US, which are more mature. In the US and Europe, recommerce transactions account for roughly 80% of household consumption patterns, according to China National Radio. However, fashion recommerce has yet to be widely accepted in China. Consumer perceptions: Chinese consumers’ concerns about the authenticity and hygiene of pre-owned fashion items may discourage them from buying secondhand items online. Fashion recommerce players will need to educate their target consumers. Authenticity: Luxury brands’ authentication services often do not cover pre-owned merchandise. Therefore, consumers tend to be more cautious when shopping for secondhand products than for brand new products. According to a committee of the China Secondhand Luxury Association, 60% of luxury products through “daigou”(which refers to an overseas agent buying merchandise on behalf of a customer in China) are counterfeit.