albert Chan

What’s the Story?

In this report, we discuss domestic tourism data from China’s National Day holiday and highlight consumption patterns and behaviors among Chinese tourists. With the ongoing international travel restrictions, we mainly focus on domestic tourism, although we consider data around travel from mainland China to Macau. Macau is a special administrative region of China for which mainland Chinese residents need authorization to travel. Since September 23, Macau has reinstated travel visas to tourists from mainland China.

Why It Matters

China’s National Day is usually a seven-day holiday, running October 1–7 every year. The holiday is popularly known as “Golden Week,” during which millions of people travel. However, the 2020 holiday was longer due to the overlap of two Chinese festivals—National Day and Mid-Autumn Festival—creating an eight-day holiday from October 1 through October 8.

- National Day holiday served as a good opportunity for domestic tourism to rebound, as it is one of the most important holidays in China and one of the first taking place following the lifting of Covid-19 lockdowns.

- In the past few years, we have seen the steady growth of sales of retail goods and dining in China during the holiday. This year, performance was less certain due to the coronavirus pandemic, making the holiday one to watch.

Golden Week Wrap-Up: In Detail

Travel Revenue Declines

During the eight-day holiday, domestic tourism revenue—covering tourists’ total spending, including retail and food-service spending—declined by 28.2% year over year, reaching ¥466.6 billion (around $68.7 billion), according to the Ministry of Culture and Tourism. The sharp decline is down from an 8.5% increase in 2019, a 9.0% increase in 2018 and 13.9% growth in 2017.

Driving this decline, we saw a decreasing number of Chinese tourists travel across the nation in Golden Week—637 million domestic tourists traveled, representing an 18.5% year-over-year decrease from 782 million in 2019, according to the Ministry of Culture and Tourism. The steeper decline in total spending implies that travelers cut their average spend.

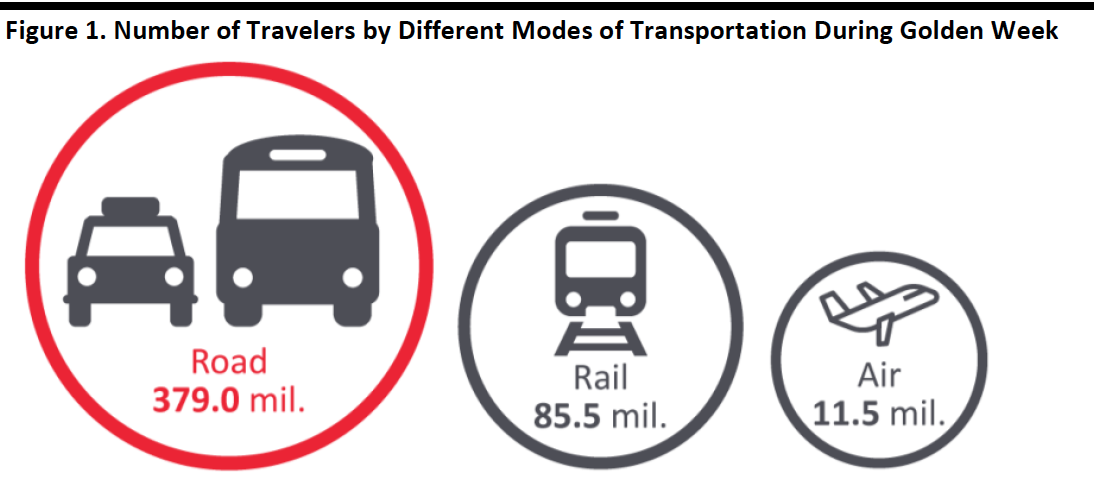

The number of rail passengers reached 85.5 million, down 16.9 % year over year. The number of people who traveled by road reached 379 million, down 30.9% year over year. Around 11.5 million passengers took flights during the period, up 3.8% year over year—although slowing from last year’s 4.5% increase, according to the Ministry of Transport. This growth in number of passengers by air is partly due to the lower average flight price for many popular domestic routes.

[caption id="attachment_117546" align="aligncenter" width="550"] Source: Ministry of Transportation[/caption]

Source: Ministry of Transportation[/caption]

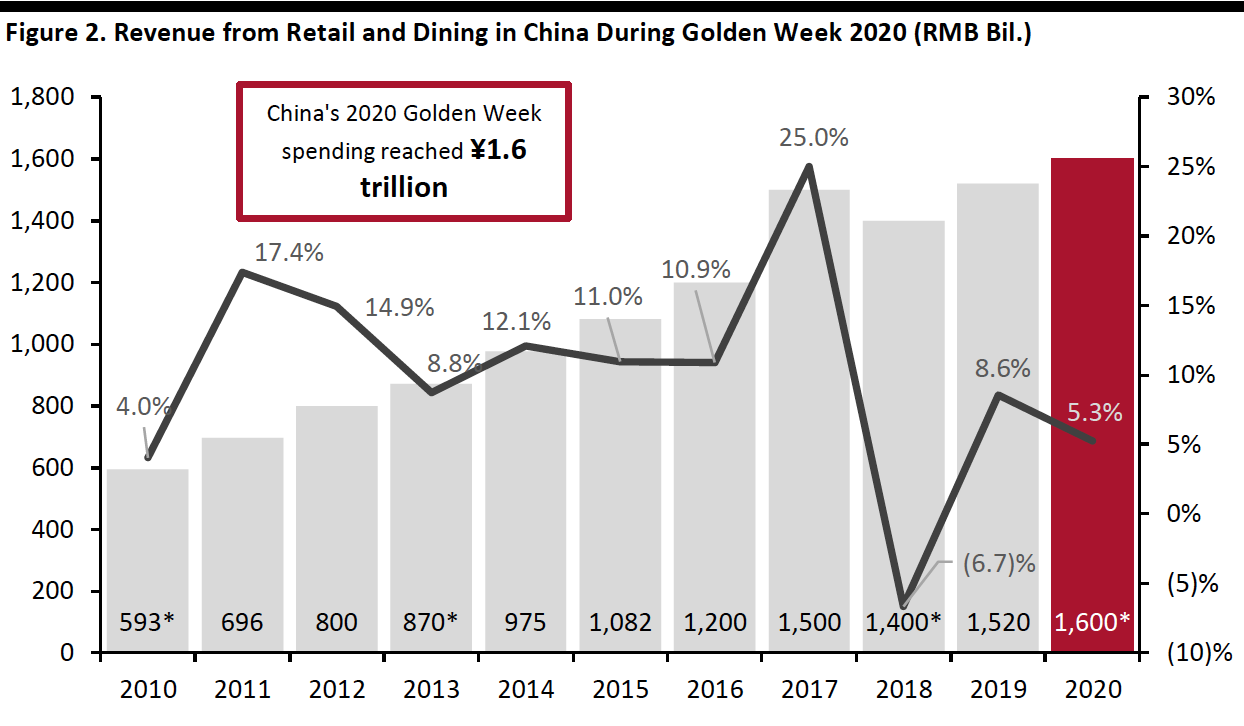

Sales of Retail Goods and Dining Grow 5.3% Year over Year

In Golden Week 2020, overall revenue from retail and dining in China reached ¥1.6 trillion ($237.6 billion), up 5.3% year over year, according to the Ministry of Commerce. This was lower than the 8.6% growth rate of last year’s Golden Week.

However, data from Golden Week showed a pickup trend compared with monthly retail sales data: Retail sales of consumer goods including catering grew 0.5% year over year in August, according to the National Bureau of Statistics. This is the first time that the growth rate has been positive since January 2020. The better performance in retail sales than the previous month is partly due to preferential measures provided by provinces and cities, and a longer holiday.

The solid rise in retail and food-service sales contrasts with the deep, 18.5% decline in the number of domestic travelers and their 28.2% cut in spending—suggesting that those that did not travel increased their spending versus last year, perhaps in place of trips.

[caption id="attachment_117547" align="aligncenter" width="700"] *Reported National Day holiday periods longer than October 1–7, which included the Mid-Autumn Festival.

*Reported National Day holiday periods longer than October 1–7, which included the Mid-Autumn Festival.Source: China’s Ministry of Commerce/Coresight Research[/caption]

Apparel, Appliances and Jewelry Categories See Growth During the Holiday

Sales in discretionary categories—such as clothing and footwear, appliances, gold, silver and jewelry, as well as automobiles—increased during the National Day holiday. The Ministry of Commerce provided data for the strongest performing cities and provinces:

- Apparel saw 14.2% year-over-year growth in Jilin province, and footwear and hats sales in Liaoning province increased by 15.8% year over year during the holiday.

- During the first three days of the National Day holiday, smart home appliances on Tmall saw sales increase by 377% year over year. Sales of home appliances on Suning.com experienced 207% year-over-year growth.

- Gold, silver and jewelry from major firms in the strongest performing areas, Beijing and Fujian province, saw sales increase by 25.3% and 10.2% year over year, respectively.

- Sales of automobiles in major auto companies in Beijing, Zhejiang and Yunnan increased by 23.5%, 20.3% and 14.1% year over year, respectively.

Growth in Food-Service Revenue During the Holiday

Dining in restaurants and ordering food for delivery were popular activities during the eight-day holiday. According to the Ministry of Commerce, major restaurants in the strongest performing provinces saw significant year-over-year revenue increases: Sichuan (43.0% growth), Zhejiang (23.4%), Inner Mongolia (21.7%) and Xiamen (18.3%).

Food orders on delivery platform Meituan also spiked during October 1–4, especially for foreign cuisines: Orders of Southeast Asian food saw 42.8% year-over-year growth, and other strong cuisines were Korean (36.2% growth), Middle East (30.0%) and Japanese (22.3%). This is likely due to the fact that consumers cannot travel abroad, so they turn to foreign cuisine to help them have the feeling of being abroad.

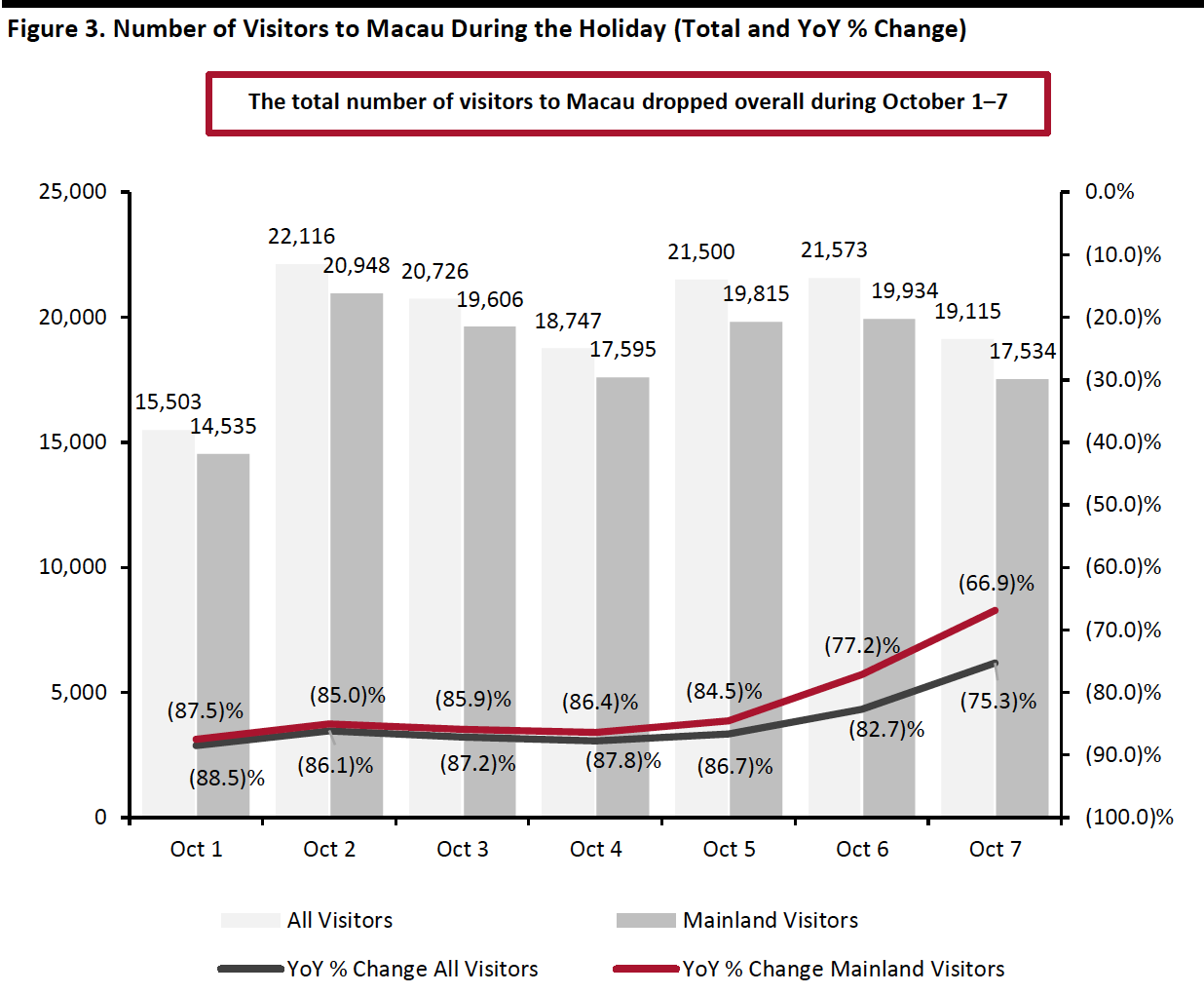

Number of Mainland Visitors to Macau Remains Low

During the first seven days of the holiday, the number of mainland visitors to Macau declined by 83.6% year over year, according to the Macao Government Tourism Office. The total number of visitors to Macau dropped by 85.7% year over year. Unlike other provinces in China, mainland Chinese residents have to apply for an entry permit to enter Macau; only since September 23 has Macau reinstated travel visas to tourists from mainland China.

Looking specifically at each day of the holiday, the number of mainland visitors to Macau dropped 87.5% year over year on the first day and then gradually warmed up to a drop of 66.9% year over year on the seventh day (see Figure 3).

[caption id="attachment_117548" align="aligncenter" width="700"] Source: Macao Government Tourism Office/ Coresight Research[/caption]

Source: Macao Government Tourism Office/ Coresight Research[/caption]

Duty-Free Shopping Becomes a Hit

Consumers turned to domestic duty-free shops during the holiday when international travel was restricted. The Ministry of Commerce selected and tracked four offshore duty-free stores in Hainan province:

- Haikou Meilan International Airport Duty Free Shop

- Haikou Riyue Plaza Duty Free Shop

- Sanya Haitang Bay International Shopping Centre

- Qionghai Boao Duty Free Shop

The number of consumers who made purchases in these four stores grew by 64% year over year during October 1–7. Retail sales increased by 167% year over year to ¥1.03 billion ($152.9 million) during the same period, according to the Ministry of Commerce. The steeper growth in retail sales implies that the average basket size must be much bigger—more than double compared to the same period last year.

The four monitored duty-free outlets opened before 2020, and another four new duty-free outlets have opened this year. Hainan is the only province in China that operates offshore duty-free stores. Passengers who depart the island (excluding departing national border) by plane, train or ship can purchase duty-free products in a limited value and in limited quantities and varieties.

However, compared to previous months, the growth rate of sales from duty-free stores in Hainan decreased. Duty-free sales in Hainan saw 228% year-over-year growth between July 1 and September 30, reaching ¥8.6 billion ($1.3 billion), according to the Hainan Free Trade Port. This high growth is partly due to the implementation of duty-free policy in Hainan, effective July 1, which allows consumers to buy more duty-free products. Under the new policy:

- The annual tax-free shopping quota for each customer has been raised from ¥30,000 ($4,370) to ¥100,000 ($14,570), with no limit to the number of store visits.

- The number of duty-free product categories has also expanded from 38 to 45, with the seven newly added categories including liquor, mobile phones and laptops.

- The previous ¥8,000 ($1,165) limit for a single item has been removed, and the number of categories with a single-purchase quantity limit has also been reduced. Taking cosmetics as an example, the single purchase limit has been increased from 12 to 30 items.

What We Think

This year’s National Day Golden Week saw mixed performance: Domestic tourism revenue declined, but sales of retail goods and dining in China saw growth. We saw a rebound in consumers’ spending on discretionary categories, such as gold, silver and jewelry, as well as apparel.

Implications for Brands/Retailers

- Consumers in China are willing to increase their spending at retail and in food-service businesses, and in some cases, this is in place of spending on trips. As domestic and overseas travel is likely to remain subdued, retailers can seek to capture this displaced spending.

- Increasing sales of gold, silver and jewelry reflect a switch of luxury spending from international to domestic. Retailers can capitalize on this trend to market luxury products to Chinese consumers.

- Retailers outside of China should continue to encourage domestic purchases within China, whether through in-country stores or online, given the number of Chinese tourists starting to travel abroad remains low—the number of mainland visitors to Macau saw an 85.7% year-over-year decline.

- Brands and retailers can focus on promoting the kinds of discretionary categories that Golden Week spending patterns suggest are in demand.

- Brands and retailers can leverage the duty-free channel to sell their products.