Web Developers

On October 6, China’s two largest online-to-offline service providers agreed to a merger that would create the country’s biggest local-services platform. Often compared to Groupon, Meituan is the leading player in the group-buying market in China, accounting for 51.9% of the ¥77 billion ($12.1 billion) market in the first half of the this year. Dianping, a consumer review service similar to Yelp, accounted for 29.5% of the market, according to research firm Analysys International. Zhang Tao and Wang Xing, the respective chief executives of Dianping and Meituan, will become co-CEOs of the yet-to-be-named new company, which will have dual headquarters, one in Beijing and one in Shanghai, Dianping’s home. The two companies will retain their respective brands and management structures, and independently operate their businesses, the companies said in a statement. Meituan’s shareholders will own 60% of the combined company, people with knowledge of the matter said. The deal is speculated to be worth as much as $15 billion.

Meituan and Dianping have been competing to attract merchants and consumers, pouring money into China’s booming, $1.6 trillion online-to-offline market, where consumers use the web and smartphones to book offline services ranging from restaurant reservations to movie tickets to other leisure deals. With Meituan backed by e-commerce giant Alibaba and Dianping by social media and gaming group Tencent, the merger marks a decision to forgo an expensive price and subsidy war and focus on creating scale. This echoes the $6 billion combination in February of car-hailing apps Didi Dache and Kuaidi Dache to form Didi Kuaidi. Didi Dache was backed by Tencent and Kuaidi Dache by Alibaba. The deal reflects the growing significance of local services for Alibaba and Tencent over the past year.

Meituan Chief Executive Wang Xing cofounded the Beijing-based company in 2010. The platform has expanded from group discounts into a marketplace for local merchants, such as hotels and entertainment venues. The online-to-offline provider attracts 20 million daily users across more than 1,000 cities in China. In January, Meituan.com raised $700 million, putting its valuation at $7 billion. The company said that, in the first half of the year, it generated transactions worth ¥47 billion ($7.4 billion), already surpassing its full-year volume for 2014. Meituan aims to increase that number to ¥100 billion ($15.8 billion) by the end of the year.

Meituan Chief Executive Wang Xing cofounded the Beijing-based company in 2010. The platform has expanded from group discounts into a marketplace for local merchants, such as hotels and entertainment venues. The online-to-offline provider attracts 20 million daily users across more than 1,000 cities in China. In January, Meituan.com raised $700 million, putting its valuation at $7 billion. The company said that, in the first half of the year, it generated transactions worth ¥47 billion ($7.4 billion), already surpassing its full-year volume for 2014. Meituan aims to increase that number to ¥100 billion ($15.8 billion) by the end of the year.

Dianping was founded by Zhang Tao in 2003. In addition to merchant information and consumer reviews, it offers group buying, online reservations, e-coupon promotions and other offline services. The company said that it had more than 200 million monthly active users in the second quarter, 14 million merchants on its platform and a presence in more than 1,100 cities across China. In the second quarter, 85% of page views came from mobile users. In April, Dianping closed an $850 million round of funding, which valued the company at $4.05 billion.

The merger will allow Meituan and Dianping to better leverage their respective advantages in order to accelerate product innovation, deepen their service offerings and speed up industry expansion. In a statement, Zhang effectively said pulling together is better than competing. “It will create more value for our consumers and merchants, foster a better O2O ecosystem, and facilitate broader industry development,” he said. Wang added that the merger will enable both companies to “focus on better serving our consumers and merchants, and [allow] us to concentrate on developing new businesses and driving product innovation.” A Meituan-Dianping combination would pose a threat to Baidu, which is investing $3.2 billion in its local-services platform, Nuomi, and currently accounts for 13.6% of the group-buying industry.

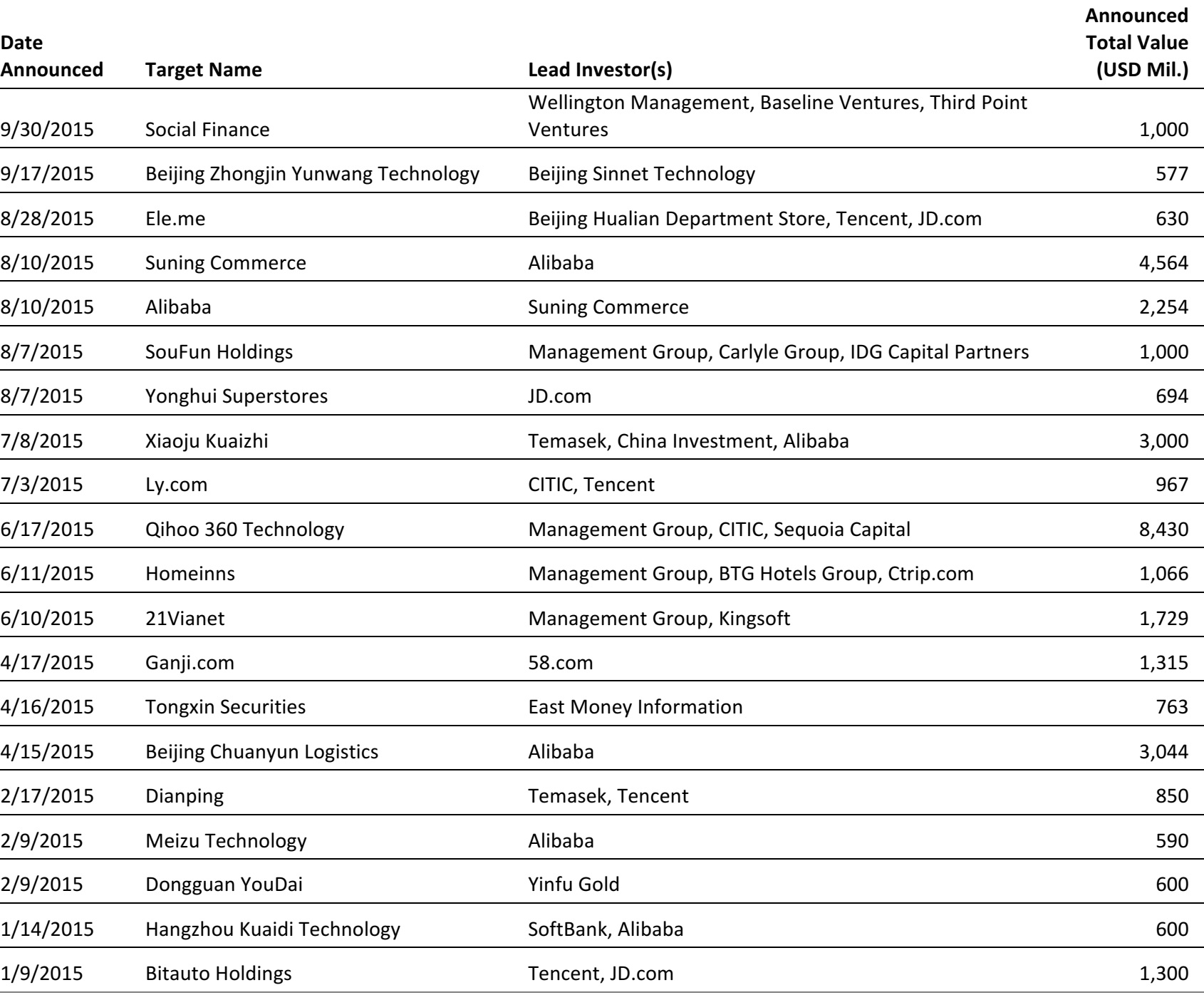

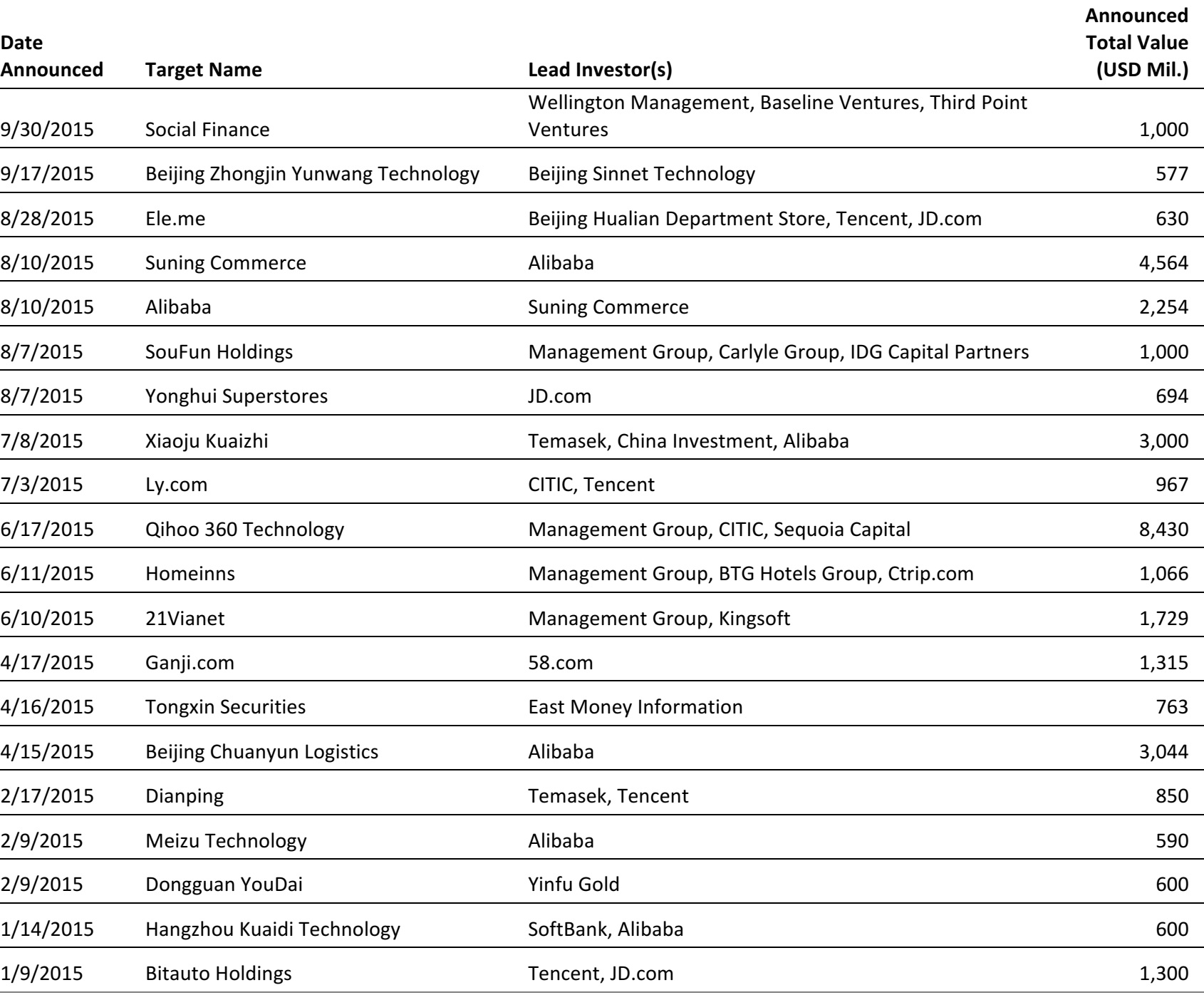

There have been $58.4 billion worth of Internet deals involving Chinese companies this year, nearly double the value in 2014, as the table below shows.

Dianping was founded by Zhang Tao in 2003. In addition to merchant information and consumer reviews, it offers group buying, online reservations, e-coupon promotions and other offline services. The company said that it had more than 200 million monthly active users in the second quarter, 14 million merchants on its platform and a presence in more than 1,100 cities across China. In the second quarter, 85% of page views came from mobile users. In April, Dianping closed an $850 million round of funding, which valued the company at $4.05 billion.

The merger will allow Meituan and Dianping to better leverage their respective advantages in order to accelerate product innovation, deepen their service offerings and speed up industry expansion. In a statement, Zhang effectively said pulling together is better than competing. “It will create more value for our consumers and merchants, foster a better O2O ecosystem, and facilitate broader industry development,” he said. Wang added that the merger will enable both companies to “focus on better serving our consumers and merchants, and [allow] us to concentrate on developing new businesses and driving product innovation.” A Meituan-Dianping combination would pose a threat to Baidu, which is investing $3.2 billion in its local-services platform, Nuomi, and currently accounts for 13.6% of the group-buying industry.

There have been $58.4 billion worth of Internet deals involving Chinese companies this year, nearly double the value in 2014, as the table below shows.

Meituan Chief Executive Wang Xing cofounded the Beijing-based company in 2010. The platform has expanded from group discounts into a marketplace for local merchants, such as hotels and entertainment venues. The online-to-offline provider attracts 20 million daily users across more than 1,000 cities in China. In January, Meituan.com raised $700 million, putting its valuation at $7 billion. The company said that, in the first half of the year, it generated transactions worth ¥47 billion ($7.4 billion), already surpassing its full-year volume for 2014. Meituan aims to increase that number to ¥100 billion ($15.8 billion) by the end of the year.

Meituan Chief Executive Wang Xing cofounded the Beijing-based company in 2010. The platform has expanded from group discounts into a marketplace for local merchants, such as hotels and entertainment venues. The online-to-offline provider attracts 20 million daily users across more than 1,000 cities in China. In January, Meituan.com raised $700 million, putting its valuation at $7 billion. The company said that, in the first half of the year, it generated transactions worth ¥47 billion ($7.4 billion), already surpassing its full-year volume for 2014. Meituan aims to increase that number to ¥100 billion ($15.8 billion) by the end of the year.

Dianping was founded by Zhang Tao in 2003. In addition to merchant information and consumer reviews, it offers group buying, online reservations, e-coupon promotions and other offline services. The company said that it had more than 200 million monthly active users in the second quarter, 14 million merchants on its platform and a presence in more than 1,100 cities across China. In the second quarter, 85% of page views came from mobile users. In April, Dianping closed an $850 million round of funding, which valued the company at $4.05 billion.

The merger will allow Meituan and Dianping to better leverage their respective advantages in order to accelerate product innovation, deepen their service offerings and speed up industry expansion. In a statement, Zhang effectively said pulling together is better than competing. “It will create more value for our consumers and merchants, foster a better O2O ecosystem, and facilitate broader industry development,” he said. Wang added that the merger will enable both companies to “focus on better serving our consumers and merchants, and [allow] us to concentrate on developing new businesses and driving product innovation.” A Meituan-Dianping combination would pose a threat to Baidu, which is investing $3.2 billion in its local-services platform, Nuomi, and currently accounts for 13.6% of the group-buying industry.

There have been $58.4 billion worth of Internet deals involving Chinese companies this year, nearly double the value in 2014, as the table below shows.

Dianping was founded by Zhang Tao in 2003. In addition to merchant information and consumer reviews, it offers group buying, online reservations, e-coupon promotions and other offline services. The company said that it had more than 200 million monthly active users in the second quarter, 14 million merchants on its platform and a presence in more than 1,100 cities across China. In the second quarter, 85% of page views came from mobile users. In April, Dianping closed an $850 million round of funding, which valued the company at $4.05 billion.

The merger will allow Meituan and Dianping to better leverage their respective advantages in order to accelerate product innovation, deepen their service offerings and speed up industry expansion. In a statement, Zhang effectively said pulling together is better than competing. “It will create more value for our consumers and merchants, foster a better O2O ecosystem, and facilitate broader industry development,” he said. Wang added that the merger will enable both companies to “focus on better serving our consumers and merchants, and [allow] us to concentrate on developing new businesses and driving product innovation.” A Meituan-Dianping combination would pose a threat to Baidu, which is investing $3.2 billion in its local-services platform, Nuomi, and currently accounts for 13.6% of the group-buying industry.

There have been $58.4 billion worth of Internet deals involving Chinese companies this year, nearly double the value in 2014, as the table below shows.

Selected Internet Deals Involving Chinese Companies