DIpil Das

What’s the Story?

Golden Week 2021 began on China’s National Day, on October 1, and ran through October 7. The negative year-over-year growth trends in tourism spending in China continued during Golden Week, which saw spending down 4.7% on a comparative basis compared to 2020 levels. We assess the reasons for this decline, how the top tourist destinations fared, and where tourism spending was redistributed.Why It Matters

Golden Week is the most important annual holiday after the Lunar New Year and one of the busiest times for travel, but due to the Covid-19 pandemic and associated stringent restrictions, tourism has declined significantly even from 2020’s lows, according to China’s Ministry of Culture and Tourism.Golden Week Wrap-Up: Coresight Research Analysis

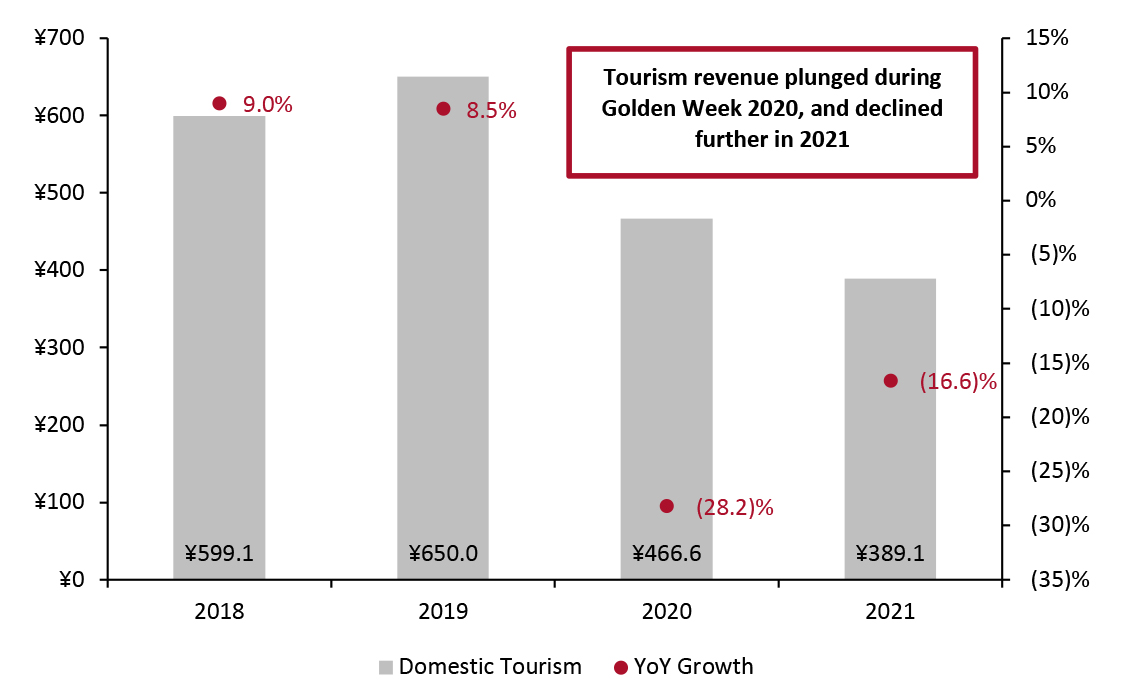

Explaining the Decline in Tourism Spending Consumer spending on tourism declined this Golden Week as authorities discouraged consumers from traveling and maintained strict Covid-19 restrictions. Tourism spending totaled ¥389.1 billion ($60.4 billion) during Golden Week (October 1–7), which represents a 4.7% year-over-year decline from 2020 on a comparative basis (the holiday lasted eight days last year compared to seven days in 2021) and a 34.1% decline on a two-year basis, according to China’s Ministry of Culture and Tourism. There were 515 million tourist trips, which is approximately 70.1% of pre-pandemic levels and a 1.5% decline from 2020, according to the same source. The low tourism and travel spending is likely to have been driven by both Covid-19 restrictions and recent hits to the consumer wallet. A recent Covid-19 outbreak in Fujian, for example, saw over 400 infections in September and led to the cancelation of all flights from the province. Travel advisories issued by China’s provincial authorities likely also convinced many consumers to stay put during Golden Week. Furthermore, the recent Evergrande Group crisis may have created a negative wealth effect among homeowning consumers: The incident spotlighted China’s actions to curb house price inflation by introducing price ceilings on the housing market that may cause mortgage holders to lose equity in their homes, leading them to reduce their discretionary spending. Meanwhile, surging energy prices, caused by high coal prices and factory shutdowns, have already diminished many consumers’ spending power. We chart tourism revenue growth trends during Golden Week in Figure 1.Figure 1: China’s Golden Week: Domestic Tourism Revenue (Left Axis; RMB Bil.) and YoY Growth* (Right Axis; %) [caption id="attachment_134574" align="aligncenter" width="726"]

*Based on total revenue, rather than on a comparable basis (Golden Week 2020 lasted eight days, versus seven days in 2021)

*Based on total revenue, rather than on a comparable basis (Golden Week 2020 lasted eight days, versus seven days in 2021) Source: China’s Ministry of Culture and Tourism [/caption] Popular Destinations Among consumers who did travel, the top destinations during Golden Week were Beijing, Shanghai, Chengdu and Hainan, according to Ctrip. Beijing’s popularity was boosted by the new Universal Studios Beijing Resort, as well as its proximity to other traditional tourist attractions, including the Great Wall and Summer Palace. Total revenue generated in Beijing (based on data from major businesses including department stores, supermarkets, restaurants and e-commerce stores), reached ¥6.3 billion ($980 million), representing a 7.6% year-over-year increase and a 20.5% increase on a two-year basis, according to the Beijing Municipal Commerce Bureau. Country house rentals in Beijing increased by 560% during the holiday weekend compared to a month prior, while hotel reservations increased by nearly 400%, according to Fliggy—showing that despite year-over-year spending declines, Golden Week travel remains significant. Hainan, another top travel destination, saw revenues across its nine duty-free shops rise to ¥1.64 billion ($253.3 million) during the holiday, representing 75% year-over-year growth and 359% growth on a two-year basis, according to supply chain management company Steel Connect. This indicates that consumers’ appetite for affordable luxury goods—something Hainan is known for—has grown this year, perhaps as a result of the negative wealth effect. Sanya, a popular resort city in Hainan, also saw a 37% year-over-year increase in tourist footfall, according to the Sanya Tourism Promotion Board. However, regions like Fujian, Guangdong and Guizhou are facing a decline in both tourist footfall and revenue, according to China’s International Travel Service. Guangdong saw a ¥12 billion ($1.9 billion) decline in travel revenue and 5 million fewer tourists compared to 2020’s Golden Week. Guizhou’s travel revenue also declined by ¥11.94 ($1.9 billion), and travel to Fujian was non-existent due to a Covid-19 outbreak and resulting restrictions just before the start of the holiday, according to the same source. The decline of travel in these less popular regions indicates that travel spending this year, reduced though it was, was more concentrated in the top few destinations. Upswing in Local Spending and E-Commerce Despite declines in tourism travel, Golden Week 2021 saw a rise in short-distance travel, showing that many consumers chose to spend their holiday week closer to home. Short-distance travel increased by 56% year over year, according to data from TravelGo, and accounted for nearly 60% of bookings on Fliggy.com. The online travel agency also reported a car rental increase of 150% compared to the prior month, with car rentals nationwide rising 43% on a two-year basis, according to Trip.com. Meanwhile, China’s public transport service handled 400 million passenger trips, according to China’s Ministry of Transport, indicating again the popularity of local travel, since this accounts for the bulk of public transport usage. Local sightseeing was also popular, as local tours accounted for nearly 60% of trip orders on National Day (October 1), according to Fliggy. New, local activities emerged to entertain consumers unable to travel, such as going to the movies. Cinema ticket sales reached ¥3 billion ($465 million) during the first five days of Golden Week, representing 10% year-over-year growth but an 8.3% decline on a two-year basis, according to data from ticketing company Maoyan. Consumers are also spending more online, which may be a sign that consumers are shifting their travel and services spending toward retail. China’s UnionPay system handled an estimated ¥2.31 trillion ($360 billion) during Golden Week, with average daily transactions increasing by 32% year over year, according to the company. This high online spending is reflected by food delivery e-commerce platform Meituan, which reported a total spending increase of 30% year over year, and 50% on a two-year basis. According to the platform, 80% of consumers ate at home, which bolstered consumer spending on the site. Apart from food, other popular products during Golden Week included home appliances, office equipment and digital devices, according to JD.com.

What We Think

Golden Week tourism revenue and footfall declined this year, despite a greater concentration of consumers flocking to traditionally popular tourism locations and spending on tax-free goods in Hainan. Spending has shifted toward local trips and e-commerce as consumers face Covid-19 restrictions and wield less spending power. Implications for Brands/Retailers- Chinese consumers that did not travel this year shifted their spending toward movies and online sales of food and products that can be used at home.

- Tax-free shopping for luxury goods was increasingly popular during Golden Week 2021, which is reflected by the rise of shopping at Hainan’s duty-free stores. We encourage retailers to explore duty-free options when selling products in China.