Web Developers

Key economic data from November show the once break-neck pace of China’s economic growth has continued to slow.

Economic Data Show a Slowing Chinese Economy

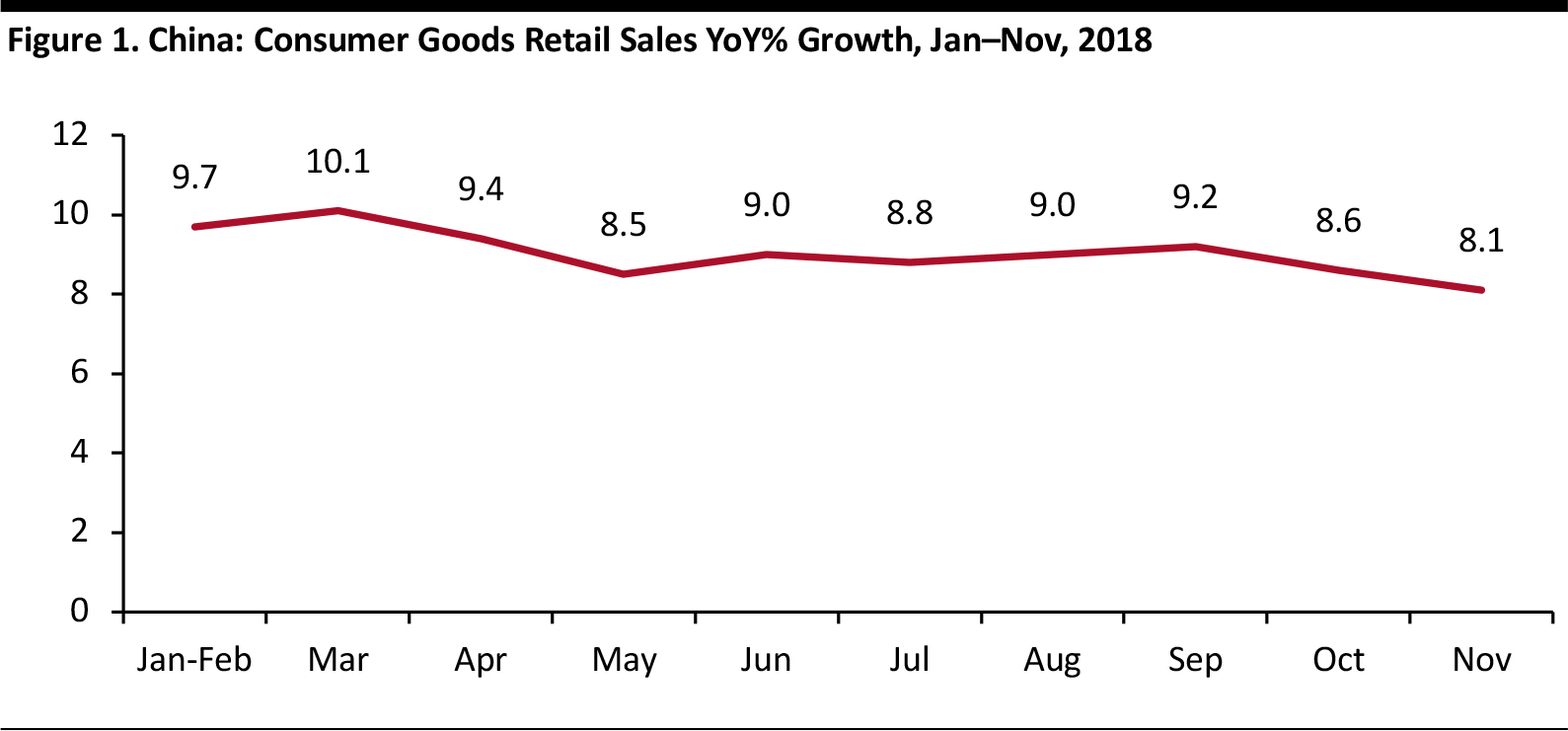

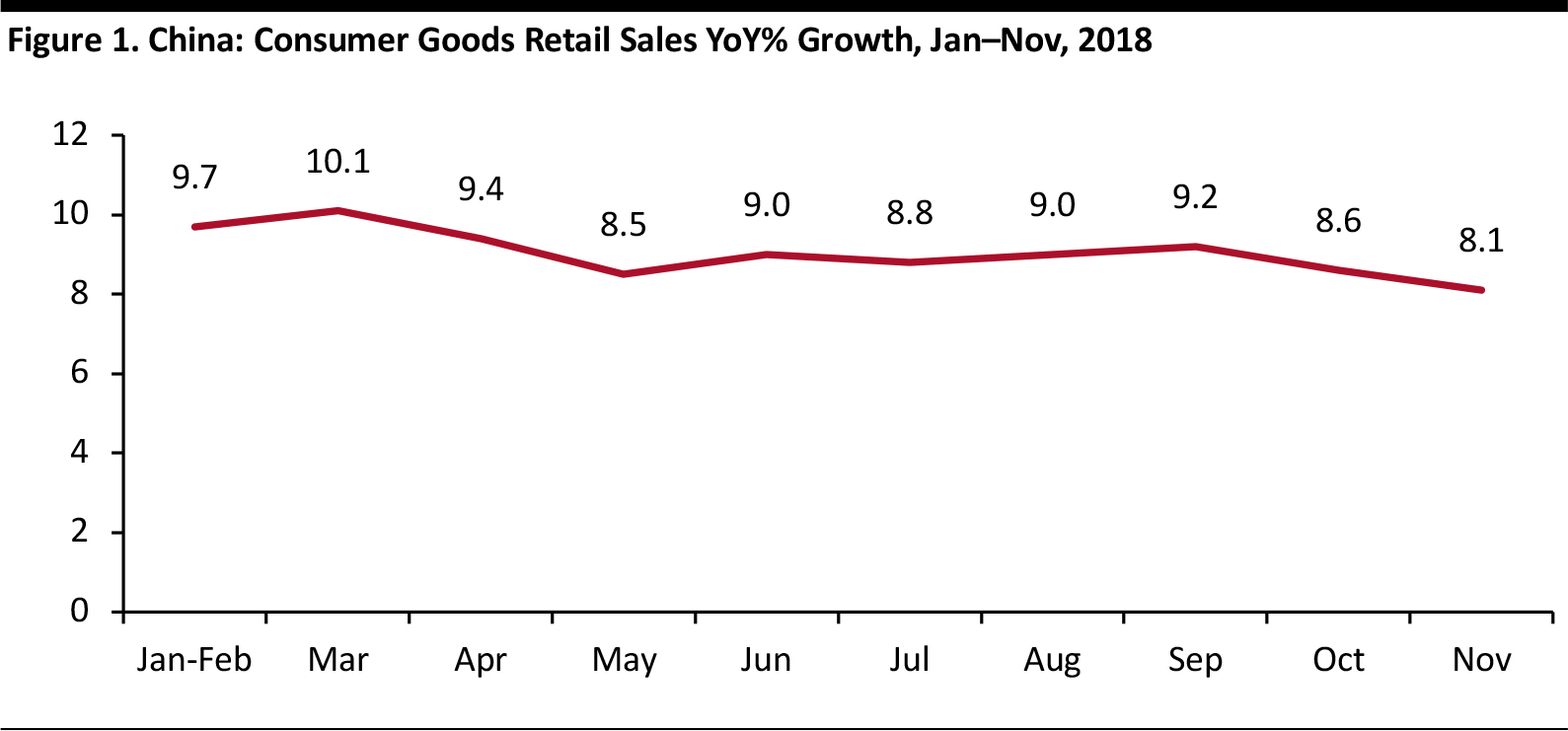

The latest economic data from November shows that the pace of China’s economic growth has continued to slow. Retail sales grew 8.1% in November, the slowest rate of growth in 15 years, according to data from the National Bureau of Statistics. Export growth slumped to 5.4% in November, from 15.5% in October, according to China’s General Administration of Customs. Sluggish demand for Chinese products in export markets slowed industrial production growth, which expanded only 5.4% in November – the slowest rate of growth in a decade. Domestic sales of automobiles also fell 18% year-over-year in November. The China Association of Automobile Manufacturers expects domestic sales to stop expanding in 2019, further slowing retail sales growth as spending on big-ticket items shrinks. Given that leading economic indicators (retail sales and industrial activity) are growing more slowly, and the effects of the China-US trade war, which we expect to continue into the coming quarters, we expect the pace of economic growth in China will continue to slow in the first half of 2019. Government-led think tank Chinese Academy of Social Sciences estimated China’s economy will grow more slowly, at 6.3% next year, compared with this year’s target of 6.5%.

Source: National Bureau of Statistics/Coresight Research

Consumption Become Less Effective in Propelling Growth

China has for years been pursuing a policy of stimulating domestic demand to drive economic growth and this has been working. Consumer goods sales as a share of the country’s GDP has risen steadily from 38.3% in 2010 to 44.3% in 2017, according to the National Bureau of Statistics. With China’s economy now more dependent on domestic consumption, slowing retail sales can have a real impact on the overall economy.Mixed Effects of Curbing Debts

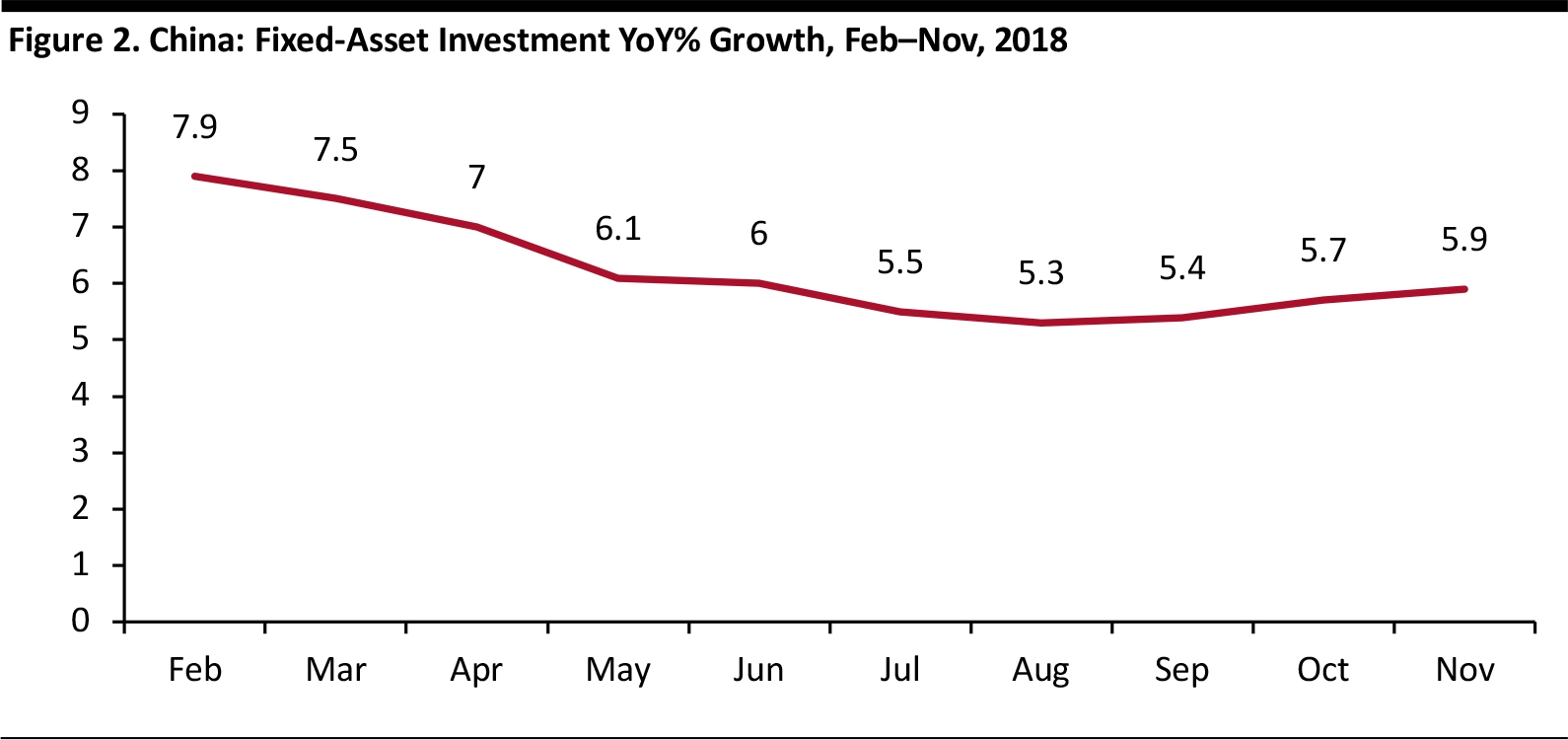

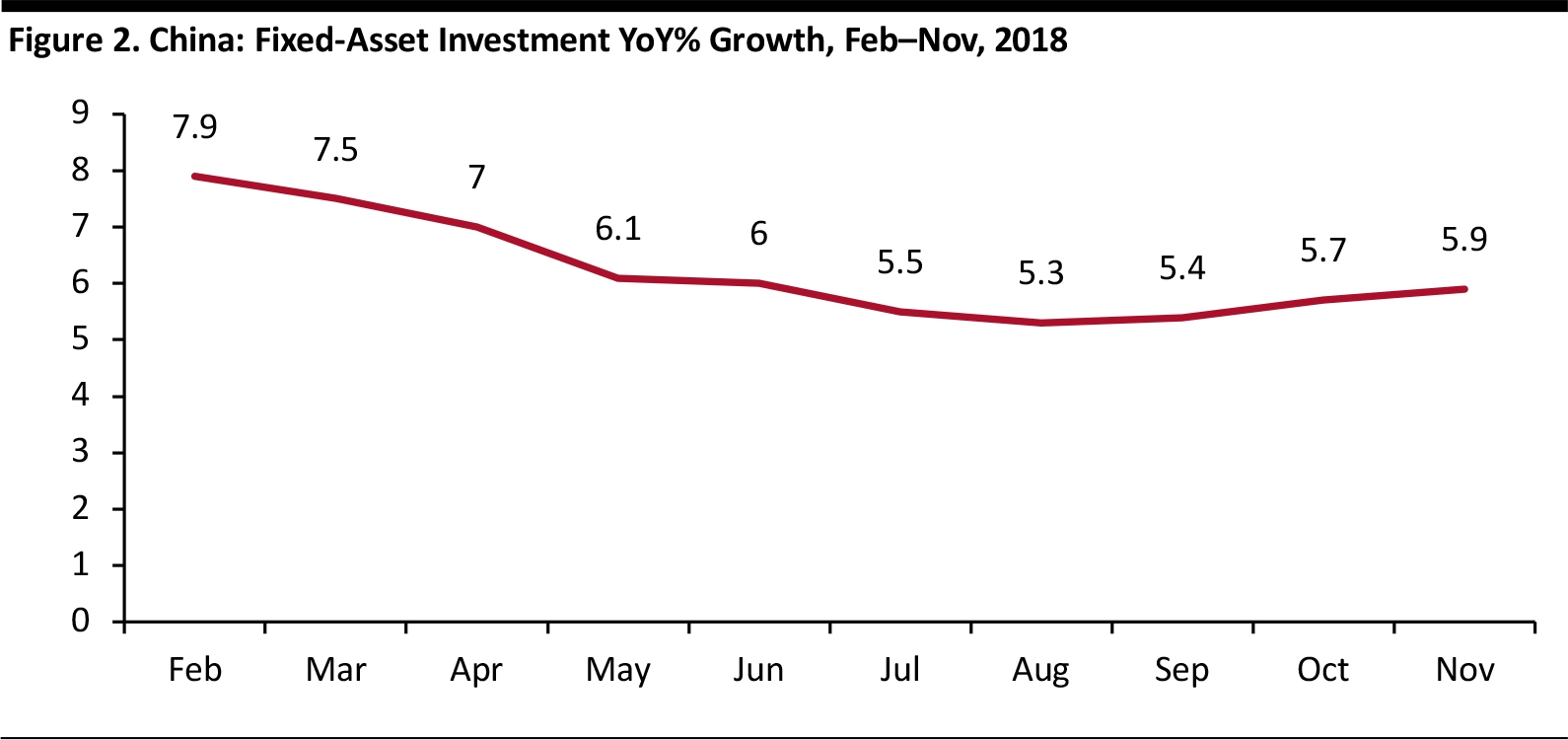

The slowing pace of economic growth is also the result of China’s efforts to curb debt, which has slowed spending on infrastructure investment – which has historically been used as a tool to grow GDP. Tightened credit policies have hindered growth by slowing fixed-asset investment. China’s year-over-year fixed-asset investment growth slowed to 5.9% in November, compared to 7.9% growth in February.