DIpil Das

What’s the Story

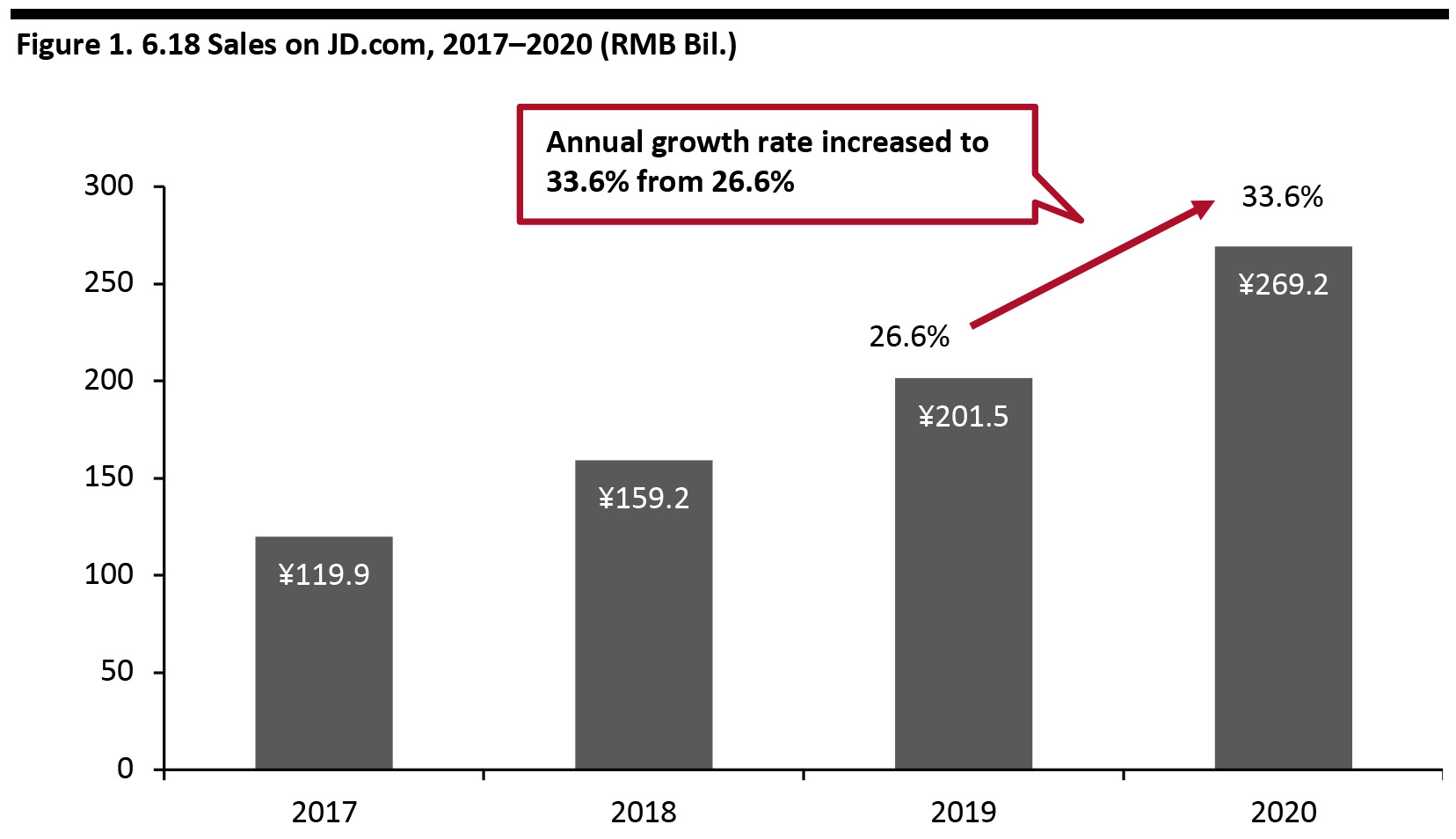

Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Why It Matters

The 6.18 Shopping Festival represented a significant sales rebound in China following the coronavirus crisis. 6.18 sales outpaced Labor Day (May 1–5, 2020; also known as “May Day”), which is considered a significant shopping event. The Labor Day event achieved $8.2 billion in sales across online channels, according to data released by the Ministry of Commerce. This is just a small fraction of the transaction volumes during JD.com’s 6.18 Shopping Festival. Western e-commerce platforms could learn from how their Chinese counterparts drove sales after lockdowns lifted. This may be particularly relevant should retailers find consumers are more cautious in making buying decisions.- Coresight Research’s US consumer survey conducted on June 10 showed that one-quarter of respondents expect to shop less overall after the crisis ends. Among consumers who buy less of certain products, 31.8% expect it to be more than six months from now before their spending patterns return to normal.

6.18 Wrap-Up: In Detail

Explosive Growth across Different E-Commerce Platforms Transaction volumes on JD.com reached around ¥269.2 billion (around $38.1 billion) during the 6.18 Shopping Festival (June 1–18).- Transaction volumes saw a year-over-year growth rate of 33.6%, which is higher than that of the 2019 event, at 26.6%.

- A total of 187 brands reached transaction volumes of ¥100 million (around $14.1 million) during 6.18 in 2020.

Source: Company reports[/caption]

Alibaba’s Tmall saw the total value of orders on the platform reach ¥698.2 billion (around $98.6 billion) between June 1 and 18, which is 2.6 times the sales it achieved on Singles' Day 2019 (albeit over a much longer period). This is the first time that the e-commerce giant has reported 6.18 sales data. Apple, Adidas, Huawei, NIKE and home-appliances brands Haier and Midea reached ¥100 million (around $14.1 million) in the first hour of sales on Tmall on June 1. It took Estée Lauder only nine hours to match its 6.18 sales from last year on Tmall.

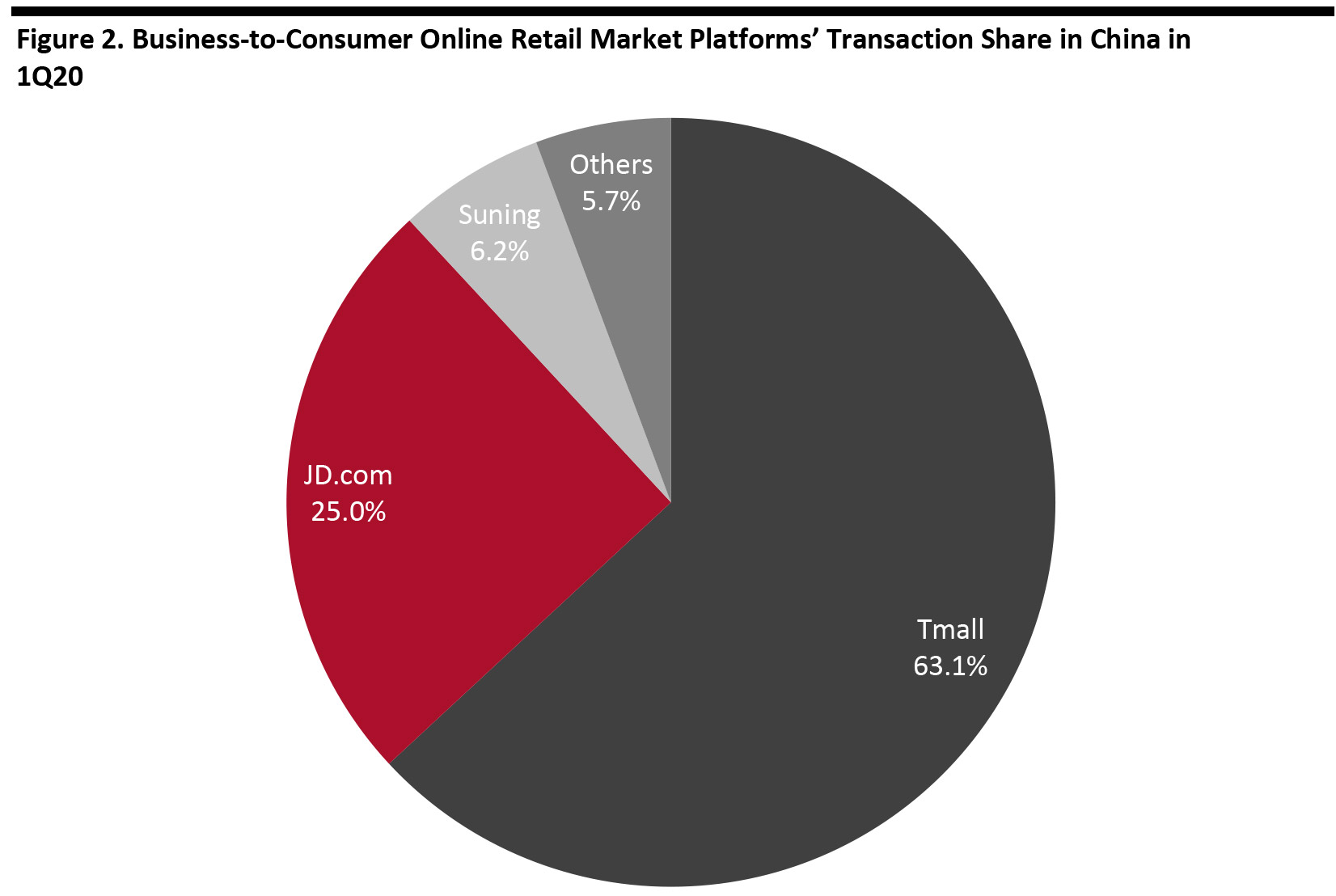

Other e-commerce platforms—such as Pinduoduo and electronics retailer Suning, which runs e-commerce site Suning.com—did not disclose their sales data for the event. We estimate sales revenue across all platforms to be around $155.2 billion, based on Alibaba and JD.com’s 2020 market share (according to Statista; see Figure 2).

[caption id="attachment_111908" align="aligncenter" width="700"]

Source: Company reports[/caption]

Alibaba’s Tmall saw the total value of orders on the platform reach ¥698.2 billion (around $98.6 billion) between June 1 and 18, which is 2.6 times the sales it achieved on Singles' Day 2019 (albeit over a much longer period). This is the first time that the e-commerce giant has reported 6.18 sales data. Apple, Adidas, Huawei, NIKE and home-appliances brands Haier and Midea reached ¥100 million (around $14.1 million) in the first hour of sales on Tmall on June 1. It took Estée Lauder only nine hours to match its 6.18 sales from last year on Tmall.

Other e-commerce platforms—such as Pinduoduo and electronics retailer Suning, which runs e-commerce site Suning.com—did not disclose their sales data for the event. We estimate sales revenue across all platforms to be around $155.2 billion, based on Alibaba and JD.com’s 2020 market share (according to Statista; see Figure 2).

[caption id="attachment_111908" align="aligncenter" width="700"] Source: Statista [/caption]

JD.com’s Top-Performing Product Categories

On JD.com, several product categories saw significant growth during 6.18. Video-conferencing devices achieved the largest increase in sales, with 400% year-over-year growth. This is perhaps unsurprising given that, in the post-lockdown world, businesses are trying their best to avoid face-to-face contact—particularly with Beijing recently having experienced another wave of the coronavirus outbreak.

As people continue to buy more groceries online, sales of essential consumer packaged goods saw huge growth: Milk products and shampoo and conditioner saw 360% and 300% year-over-year growth, respectively. Furthermore, with health and wellness remaining a key focus for consumers in the wake of the crisis, sales of healthcare products increased significantly, with 173% year-over-year growth.

[caption id="attachment_111927" align="aligncenter" width="700"]

Source: Statista [/caption]

JD.com’s Top-Performing Product Categories

On JD.com, several product categories saw significant growth during 6.18. Video-conferencing devices achieved the largest increase in sales, with 400% year-over-year growth. This is perhaps unsurprising given that, in the post-lockdown world, businesses are trying their best to avoid face-to-face contact—particularly with Beijing recently having experienced another wave of the coronavirus outbreak.

As people continue to buy more groceries online, sales of essential consumer packaged goods saw huge growth: Milk products and shampoo and conditioner saw 360% and 300% year-over-year growth, respectively. Furthermore, with health and wellness remaining a key focus for consumers in the wake of the crisis, sales of healthcare products increased significantly, with 173% year-over-year growth.

[caption id="attachment_111927" align="aligncenter" width="700"] Source: Company reports [/caption]

Livestreaming Continues To Be a Winning Sales Tool

To enhance its livestreaming capacity, JD.com teamed up with popular short-video platform Kuaishou on June 16. Around 100 KOLs on Kuaishou promoted JD.com’s products. Users on Kuaishou could purchase JD.com's products without leaving the Kuaishou app as well as enjoy quick delivery and after-sales services provided by JD.com.

E-commerce platforms invited celebrities and company executives to join livestreaming sessions in order to create more excitement for shoppers. On June 17, Xu Lei, CEO of JD Retail, together with actress Zheng Shuang, singer Da Zhangwei and actor Guo Qilin, generated sales of ¥475 million (around $67.1 million) in their six-hour livestreaming show, “JD.com 6.18 Livestreaming Party” (around $11.2 million per hour). Popular KOL Austin Li (Li Jiaqi, known as the “Lipstick King”) also hosted a four-hour livestreaming session on June 18 on Taobao Live, generating sales of ¥223 million ($31.5 million)—around $7.9 million per hour.

[caption id="attachment_111910" align="aligncenter" width="700"]

Source: Company reports [/caption]

Livestreaming Continues To Be a Winning Sales Tool

To enhance its livestreaming capacity, JD.com teamed up with popular short-video platform Kuaishou on June 16. Around 100 KOLs on Kuaishou promoted JD.com’s products. Users on Kuaishou could purchase JD.com's products without leaving the Kuaishou app as well as enjoy quick delivery and after-sales services provided by JD.com.

E-commerce platforms invited celebrities and company executives to join livestreaming sessions in order to create more excitement for shoppers. On June 17, Xu Lei, CEO of JD Retail, together with actress Zheng Shuang, singer Da Zhangwei and actor Guo Qilin, generated sales of ¥475 million (around $67.1 million) in their six-hour livestreaming show, “JD.com 6.18 Livestreaming Party” (around $11.2 million per hour). Popular KOL Austin Li (Li Jiaqi, known as the “Lipstick King”) also hosted a four-hour livestreaming session on June 18 on Taobao Live, generating sales of ¥223 million ($31.5 million)—around $7.9 million per hour.

[caption id="attachment_111910" align="aligncenter" width="700"] JD.com 6.18 Livestreaming Party

JD.com 6.18 Livestreaming Party Source: Weibo [/caption] No Complicated Promotions, Low Price Is the Key Compared with previous 6.18 events, this year's festival was more straightforward in terms of marketing and promotions. Previously, consumers had to play games or engage in other ways to win coupons. For example, on JD.com, users had to watch videos and answer questions. This year, shoppers could access coupons directly by clicking a buttons on an e-commerce platforms’ promotion page. In terms of discounts, Tmall offered subsidies worth ¥10 billion (around $1.4 billion) on over 10 million discounted products—level with those offered in 2019. The subsidies were in the form of coupons that provided ¥40 (around $5.70) discounts on orders of over ¥300 (around $42.40), for example. JD.com and Kuaishou gave out ¥20 billion (around $2.8 billion). Suning.com tried to beat its competition on pricing. The platform launched a “J-10%” plan, selling products at prices that were 10% lower than on JD.com. This initiative covered several categories, including home appliances, mobile phones, computers and groceries. A Huawei Mate 30 smart phone cost ¥3,289 (around $464.90) on JD.com and ¥3,599 (around $508.30) on Tmall. On Suning, it cost ¥3,149 (around $444.80) with a free pair of earphones. [caption id="attachment_111911" align="aligncenter" width="700"]

Huawei Mate 30 on JD.com

Huawei Mate 30 on JD.com Source: JD.com [/caption] [caption id="attachment_111912" align="aligncenter" width="700"]

Huawei Mate 30 on Suning

Huawei Mate 30 on Suning Source: Suning.com [/caption] [caption id="attachment_111913" align="aligncenter" width="700"]

Huawei Mate 30 on Tmall

Huawei Mate 30 on Tmall Source: Tmall [/caption] Such pricing wars follow sharply decreased per capita consumption expenditure in China amid lockdowns. In the first quarter, per capita consumption expenditure fell 12.5% year over year to ¥5,082 (around $717.80), according to the National Bureau of Statistics. Urban residents spent ¥6,478 ($915.00), down 13.5% year over year, while rural residents spent ¥3,334 (around $470.90), falling 10.7% in the same time period. C2M Products Attract Price-Sensitive Shoppers As shoppers become more cautious in making purchase decisions due to uncertainties caused by the pandemic, sales of customized products are increasing. The C2M model, which leverages consumer data to produce tailored products at low price points, is becoming increasingly popular among brands in China, to meet consumers' needs and provide good value for money. During 6.18, sales of C2M desktop computers increased by 400% year over year on JD.com. On Taobao Deals (Taobao's designated app for direct-from-factory deals), sales of C2M products saw 500% year-over-year growth during the shopping festival. [caption id="attachment_111914" align="aligncenter" width="377"]

Taobao Deals app

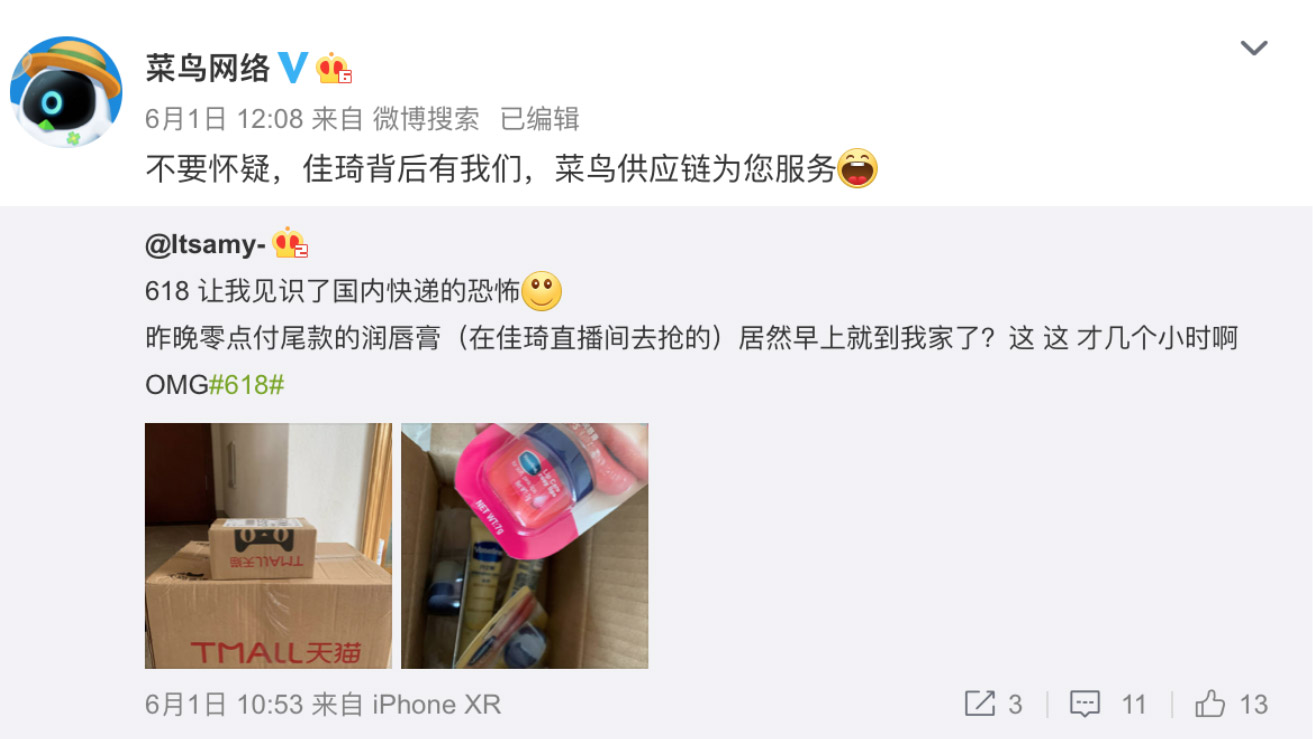

Taobao Deals app Source: Taobao [/caption] Upgraded Logistics for Faster Delivery Services Alibaba’s logistics arm, Cainiao, used a fleet of automated delivery vehicles and set up new pick-up stations to achieve faster delivery. The company also chartered more than 100 flights and 20 freight trains to ship goods during the shopping festival. The strategy worked: Around 70% of orders on Tmall had already been delivered to consumers by midday on June 18. Consumers came to Cainiao's official Weibo account to provide positive feedback about its service. One user commented that she could not believe that she ordered lipsticks at midnight on June 1 and received the product at noon the next day. [caption id="attachment_111915" align="aligncenter" width="700"]

A Tmall user reviewed Cainiao's fast delivery service

A Tmall user reviewed Cainiao's fast delivery service Source: Weibo [/caption] JD Logistics upgraded its logistics network to serve consumers in Tier 4 and Tier 6 cities. The company estimates the growth rate of delivery orders in Tier 6 cities is 150% that of Tier 1 cities. The upgrade included JD Logistics linking its 12 highly automated logistics parks to its 13 local warehouses to form an integrated network. The 12 highly automated logistics parks, known as “Asia No.1,” feature automated sorting machines and a smart warehousing software system, which uses algorithms to perform scheduling, coordination and optimization. [caption id="attachment_111916" align="aligncenter" width="700"]

Automatic sorting machine

Automatic sorting machine Source: JD.com [/caption]