DIpil Das

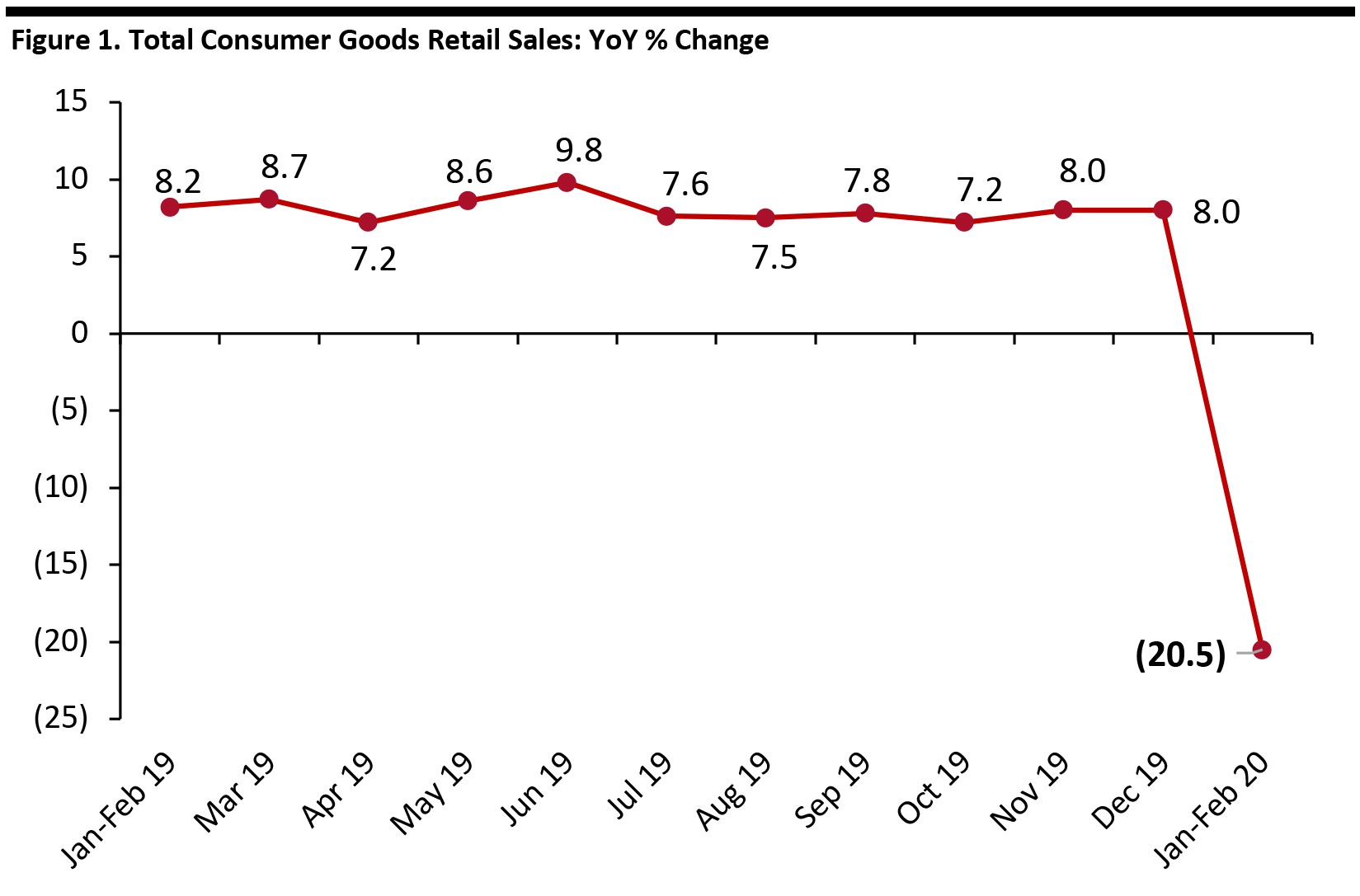

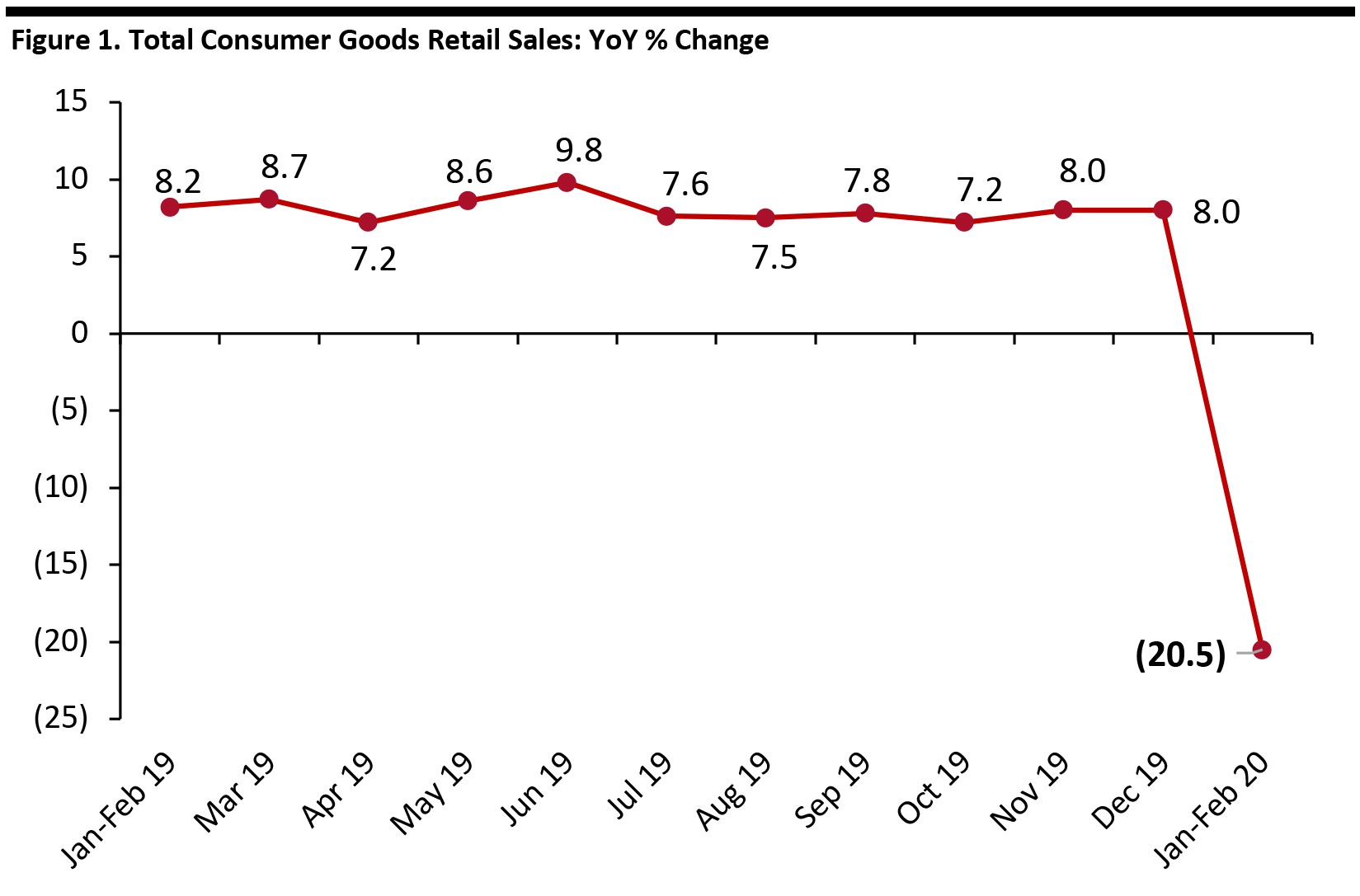

China’s retail sales plunged 20.5% in the January/February 2020 period compared to the same two-month period in 2019 as the coronavirus hammered discretionary demand, according to recently released data from China’s National Bureau of Statistics (NBS). This represented a 28.5-percentage-point swing from the 8% growth reported in December. Prior to the coronavirus outbreak, retail sales growth had levelled off in the high single digits.

The NBS reported January and February statistics in aggregate as it did in prior years, due to the impact of the Chinese New Year holiday.

[caption id="attachment_105623" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Food sales rose almost 10% in the January/February period, broadly in line with growth in December, but discretionary sectors were hit hard as shoppers stayed home and prioritized essentials.

Apparel and footwear sales plunged 30.9% year over year during the two-month period, a sharp downturn following low-single-digit growth in December; cosmetics sales were down 14.1% year on year in the two-month period, compared to 12.6% growth in December. Sales of household appliances and electronics fell 30% compared to 5.6% growth in December, furniture sales were down by over one-third versus 5.1% growth in December while gold and silver jewelry sales were down 41.1% versus 0.4% growth in December. Sports and recreational articles escaped with a relatively minor slide of 4.0%, likely reflecting exercise and fitness equipment purchases by those stuck at home.

Source: National Bureau of Statistics of China[/caption]

Food sales rose almost 10% in the January/February period, broadly in line with growth in December, but discretionary sectors were hit hard as shoppers stayed home and prioritized essentials.

Apparel and footwear sales plunged 30.9% year over year during the two-month period, a sharp downturn following low-single-digit growth in December; cosmetics sales were down 14.1% year on year in the two-month period, compared to 12.6% growth in December. Sales of household appliances and electronics fell 30% compared to 5.6% growth in December, furniture sales were down by over one-third versus 5.1% growth in December while gold and silver jewelry sales were down 41.1% versus 0.4% growth in December. Sports and recreational articles escaped with a relatively minor slide of 4.0%, likely reflecting exercise and fitness equipment purchases by those stuck at home.

Source: NBS [/caption]

Implications:

Looking to the US as it braces for continued drastic steps to slow the spread of the disease, we saw total retail sales excluding gas and automobiles climb 7.4% year over year in February, according to Coresight Research analysis of US Census Bureau data, but we expect steep declines in March as retailers close shop and consumers avoid crowds.

While the situations in China and the US are very different in terms of government ability to enforce certain measures, we expect US retail to experience similar pain points, specifically:

Source: NBS [/caption]

Implications:

Looking to the US as it braces for continued drastic steps to slow the spread of the disease, we saw total retail sales excluding gas and automobiles climb 7.4% year over year in February, according to Coresight Research analysis of US Census Bureau data, but we expect steep declines in March as retailers close shop and consumers avoid crowds.

While the situations in China and the US are very different in terms of government ability to enforce certain measures, we expect US retail to experience similar pain points, specifically:

Source: National Bureau of Statistics of China[/caption]

Food sales rose almost 10% in the January/February period, broadly in line with growth in December, but discretionary sectors were hit hard as shoppers stayed home and prioritized essentials.

Apparel and footwear sales plunged 30.9% year over year during the two-month period, a sharp downturn following low-single-digit growth in December; cosmetics sales were down 14.1% year on year in the two-month period, compared to 12.6% growth in December. Sales of household appliances and electronics fell 30% compared to 5.6% growth in December, furniture sales were down by over one-third versus 5.1% growth in December while gold and silver jewelry sales were down 41.1% versus 0.4% growth in December. Sports and recreational articles escaped with a relatively minor slide of 4.0%, likely reflecting exercise and fitness equipment purchases by those stuck at home.

Source: National Bureau of Statistics of China[/caption]

Food sales rose almost 10% in the January/February period, broadly in line with growth in December, but discretionary sectors were hit hard as shoppers stayed home and prioritized essentials.

Apparel and footwear sales plunged 30.9% year over year during the two-month period, a sharp downturn following low-single-digit growth in December; cosmetics sales were down 14.1% year on year in the two-month period, compared to 12.6% growth in December. Sales of household appliances and electronics fell 30% compared to 5.6% growth in December, furniture sales were down by over one-third versus 5.1% growth in December while gold and silver jewelry sales were down 41.1% versus 0.4% growth in December. Sports and recreational articles escaped with a relatively minor slide of 4.0%, likely reflecting exercise and fitness equipment purchases by those stuck at home.

- The catering industry has been on a roller coaster ride, with high demand just before Chinese New Year that was suddenly halted as cities locked down, driving a decline of 43.1% year over year during the two-month period.

- Automobile sales slid 37.0% in January/February as car dealerships also closed. Only 310,000 cars sold nationwide in February, down 83.9% from January and 79.1% year over year, according to the China Association of Automobile Manufacturers.

- Sales of large household furniture or goods that rely heavily on brick-and-mortar stores and shopping malls were also impacted heavily. Furniture sales fell 33.5% year over year in the two-month period, compared to the 5.1% growth it enjoyed in December; sales of household appliances were down 30.0%.

- Sales of communication appliances (such as mobile phones) dropped 8.8% during the two-month period compared to the same period in 2019.

- Food sales, which grew 9.7%, while beverage sales expanded 3.1% compared with the same period of last year.

- Traditional Chinese and Western medicine sales grew a modest 0.2% year over year.

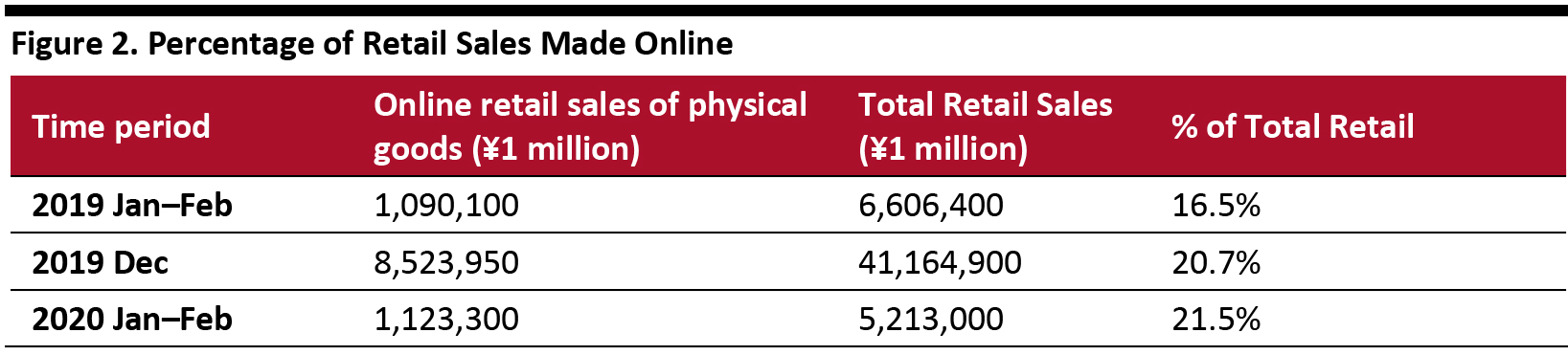

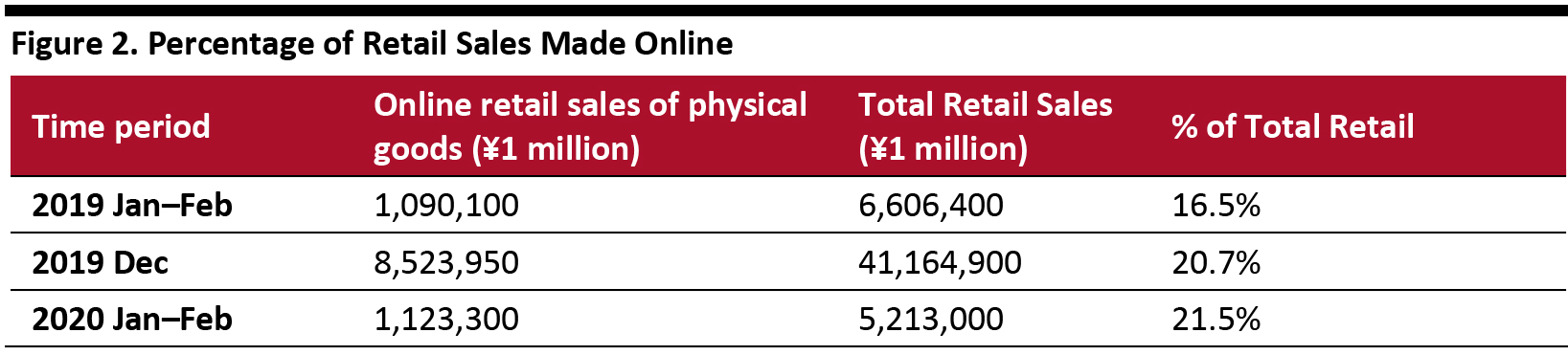

- Online food sales increased 26.4% year over year, roughly in line with 30.9% growth in December.

- Online sales of other consumer goods and necessities increased 7.5% year over year, slowing from 19.8% growth in December.

- Online clothing sales slid some 18.1%, versus 15.4% growth in December.

Source: NBS [/caption]

Implications:

Looking to the US as it braces for continued drastic steps to slow the spread of the disease, we saw total retail sales excluding gas and automobiles climb 7.4% year over year in February, according to Coresight Research analysis of US Census Bureau data, but we expect steep declines in March as retailers close shop and consumers avoid crowds.

While the situations in China and the US are very different in terms of government ability to enforce certain measures, we expect US retail to experience similar pain points, specifically:

Source: NBS [/caption]

Implications:

Looking to the US as it braces for continued drastic steps to slow the spread of the disease, we saw total retail sales excluding gas and automobiles climb 7.4% year over year in February, according to Coresight Research analysis of US Census Bureau data, but we expect steep declines in March as retailers close shop and consumers avoid crowds.

While the situations in China and the US are very different in terms of government ability to enforce certain measures, we expect US retail to experience similar pain points, specifically:

- Food and beverage sales grew 8.5% year over year in February, and we expect this to continue near-term as consumers prioritize necessities. The New York Times recently reported rice sales jumped more than 50%, canned meat 40% and other essentials such as beans, pasta, peanut butter and bottled water have also surged. Kroger recently told its suppliers demand had surged 30% across all categories, while orders for hot dogs at Walmart and Costco increased as much as 300%, according to the New York Times.

- Furniture and home furnishing store sales climbed 7.3% year over year in February, but we expect this sector to take a heavy hit in March.

- We expect cosmetics sales to fall significantly as discretionary spending dries up and stores close. Sephora closed all its US and Canada retail stores, and Ulta will shutter 1,254 shops from March 19–31.

- Electronics and appliance stores, which saw sales increase 2.1% year over year in February, accelerating from January’s 0.1% increase, will also likely see declines in March.

- Sporting goods, hobby, musical instrument and book stores, it should be correct. res, which grew sales 6.6% in February, will also likely suffer if these retailers close stores, but they could experience a rise in online business as homebound consumers shop for entertainment.