albert Chan

In our China Retail Insights series (formerly Insights from China), we examine issues that affect international brands and retailers in China. We cover areas such as consumer behavior, consumer sentiment, emerging retail trends, government regulations and the competitive landscape—as they affect business operations and the future outlook of retail.

In this report, we take a look at China’s rising recommerce market, covering the major market players, current challenges and how brands and retailers can capitalize on the growing recommerce trend.

Recommerce Market Gains Momentum in China

The secondhand market had faced years of resistance from Chinese consumers due to its associations with poverty in a status-conscious culture. However, in recent years, consumers have been increasingly embracing used goods, driven by demand for more product variety, sustainability and affordability. According to a 2019 survey by market research firm Mintel, over half of Chinese urban consumers reported being willing to rent or buy secondhand goods for environmental reasons. The Covid-19 pandemic has further boosted this trend: Stay-at-home measures spurred the decluttering movement, and consumers are now more wary about their discretionary spending.

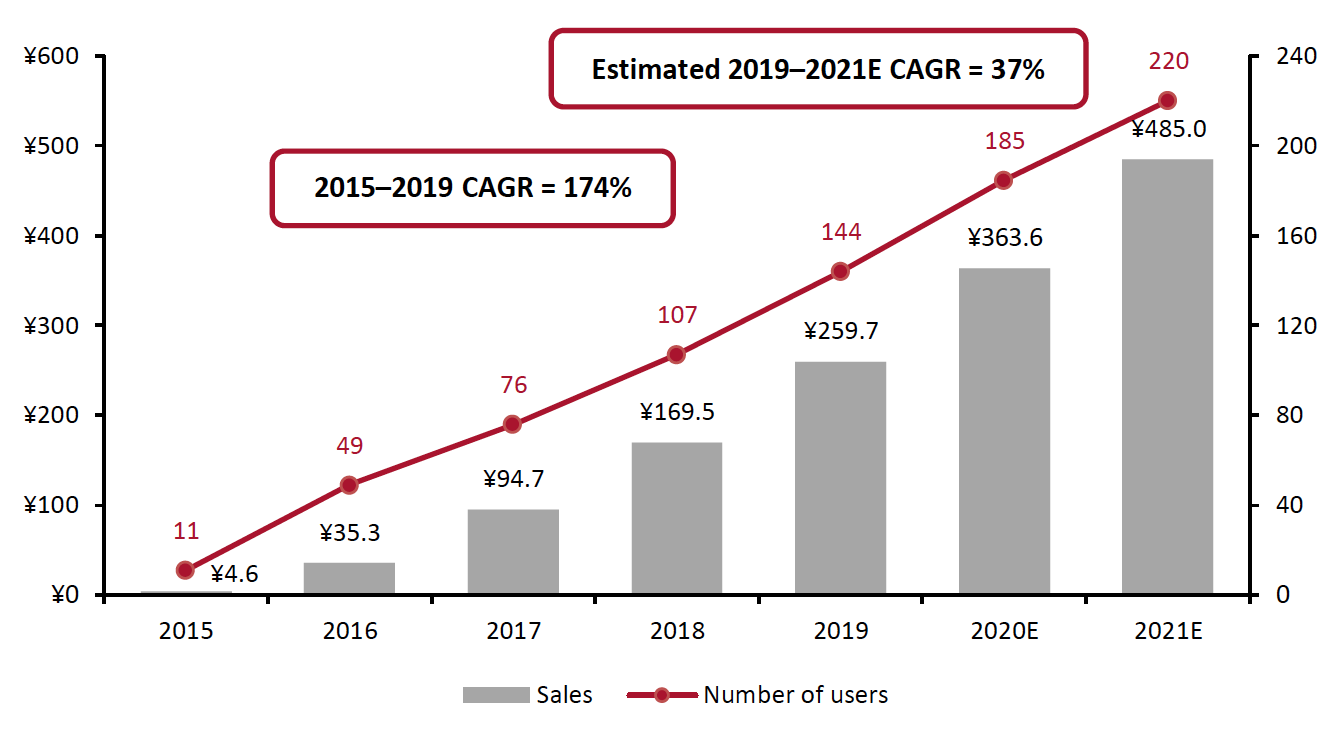

As digital-savvy consumers, Chinese shoppers are increasingly turning to the online channel to purchase secondhand products, driving the digital recommerce market. According to Chinese research firm 100EC, the online secondhand market (excluding big-ticket items such as cars and houses) in China totaled ¥259.7 billion (around $39.5 billion) in 2019, having grown at a CAGR of 174% from 2015. Coresight Research estimates that the market maintained strong growth of around 40% in 2020 to reach ¥363.6 billion (around $55 billion) and will grow by one-third in 2021 to ¥485 billion (around $74 billion).

In line with this growth, e-commerce penetration of the total secondhand market in China has been creeping higher in recent years—from 23% in 2018 to 29% in 2019—according to 100EC, and we expect penetration to have hit the 35% mark in 2020 and increase to 41% in 2021.

Furthermore, 100EC reported that the number of users on Chinese recommerce platforms reached 144 million in 2019, representing year-over-year growth of 34.6%. We estimate that total users increased by 28% year over year in 2020, to 185 million, and will reach 220 million in 2021 (see Figure 1).

Figure 1. China’s Online Secondhand Market: Total Sales (Left Axis; RMB Bil.) and Number of Users (Right Axis; Mil.)

[caption id="attachment_122069" align="aligncenter" width="700"] Source: 100EC/Coresight Research[/caption]

Source: 100EC/Coresight Research[/caption]

Major Players

The digital recommerce market is dominated by Chinese tech giants, thanks to their expertise in e-commerce and social networking. Alibaba Group’s Idle Fish and Tencent-backed Zhuan Zhuan together account for roughly 90% of the market, according to 100EC.

Idle Fish

Launched in 2014, Idle Fish is an integrated consumer-to-consumer (C2C) pre-owned goods marketplace. The platform mainly features fashion, beauty and baby products. Alibaba reported that in fiscal 2020, Idle Fish had 30 million registered sellers and 90 million monthly active users, with 60% of these being younger, “post-90s” consumers, born on or after 1990. The platforms also recorded over ¥200 billion in GMV during the period.

One of Idle Fish’s biggest competitive advantages is its integration with Alibaba’s ecosystem, which includes Alipay, Taobao and Tmall. Idle Fish users can link and display their items for sale on Taobao or Tmall to boost visibility and transaction. Sellers can also leverage Alibaba’s logistics arm Cainiao to mail products, as well as using Alipay to ensure the security of the transaction.

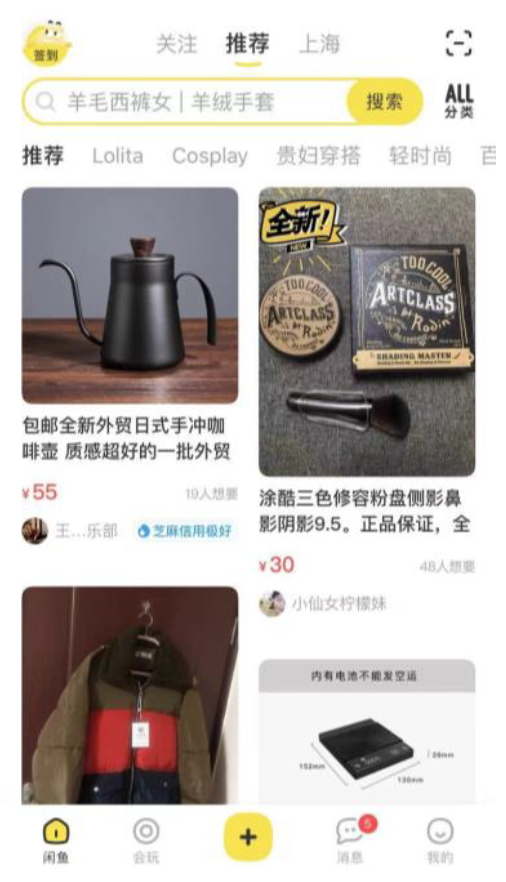

[caption id="attachment_122070" align="aligncenter" width="300"] Idle Fish’s main page is a recommendation feed, featuring products that consumers might be interested in based on what they have browsed in the app, as well as in Alibaba’s e-commerce app Taobao and Tmall

Idle Fish’s main page is a recommendation feed, featuring products that consumers might be interested in based on what they have browsed in the app, as well as in Alibaba’s e-commerce app Taobao and TmallSource: Idle Fish[/caption]

Unlike similar apps in the West, such as eBay or Poshmark, Idle Fish adds more social and gamification functions to enhance user engagement. Users on the platform can exchange ideas and information about pre-owned goods that they are looking to buy, as well as posting items for sale in different interest-based online communities.

Beyond its C2C marketplace, Idle Fish also provides clothing recycling services and an auction service for secondhand jewelry, luxury goods and art.

Zhuan Zhuan

Zhuan Zhuan was launched by China’s online classifieds and listing platform 58.com in 2015 and received investment from Tencent in 2017. Although it began as a C2C marketplace, Zhuan Zhuan has since established a direct sales model, which sources pre-owned goods from users and provides quality-inspection services on selected high-priced products. The platform focuses on 3C (computer, communication and consumer electronics) products. In May 2020, it acquired Zhaoliangji, an online platform for used mobile phones and accessories in China.

Zhuan Zhuan provides users with the option of importing their contact list from social media app WeChat, so they can see what their WeChat friends are selling on the platform, fostering trust among the user community.

According to third-party data firm BigData Research, the Zhuan Zhuan app had 15.3 million monthly active users as of October 2020. The platform also operates a mini program on WeChat, which had 12.7 million monthly active users as of October 2020.

[caption id="attachment_122071" align="aligncenter" width="300"] As Zhuan Zhuan focuses on direct sales, its main page is similar to traditional e-commerce apps, with fewer content-sharing features than Idle Fish

As Zhuan Zhuan focuses on direct sales, its main page is similar to traditional e-commerce apps, with fewer content-sharing features than Idle FishSource: Zhuan Zhuan[/caption]

Recommerce Platforms Attract Capital Funding

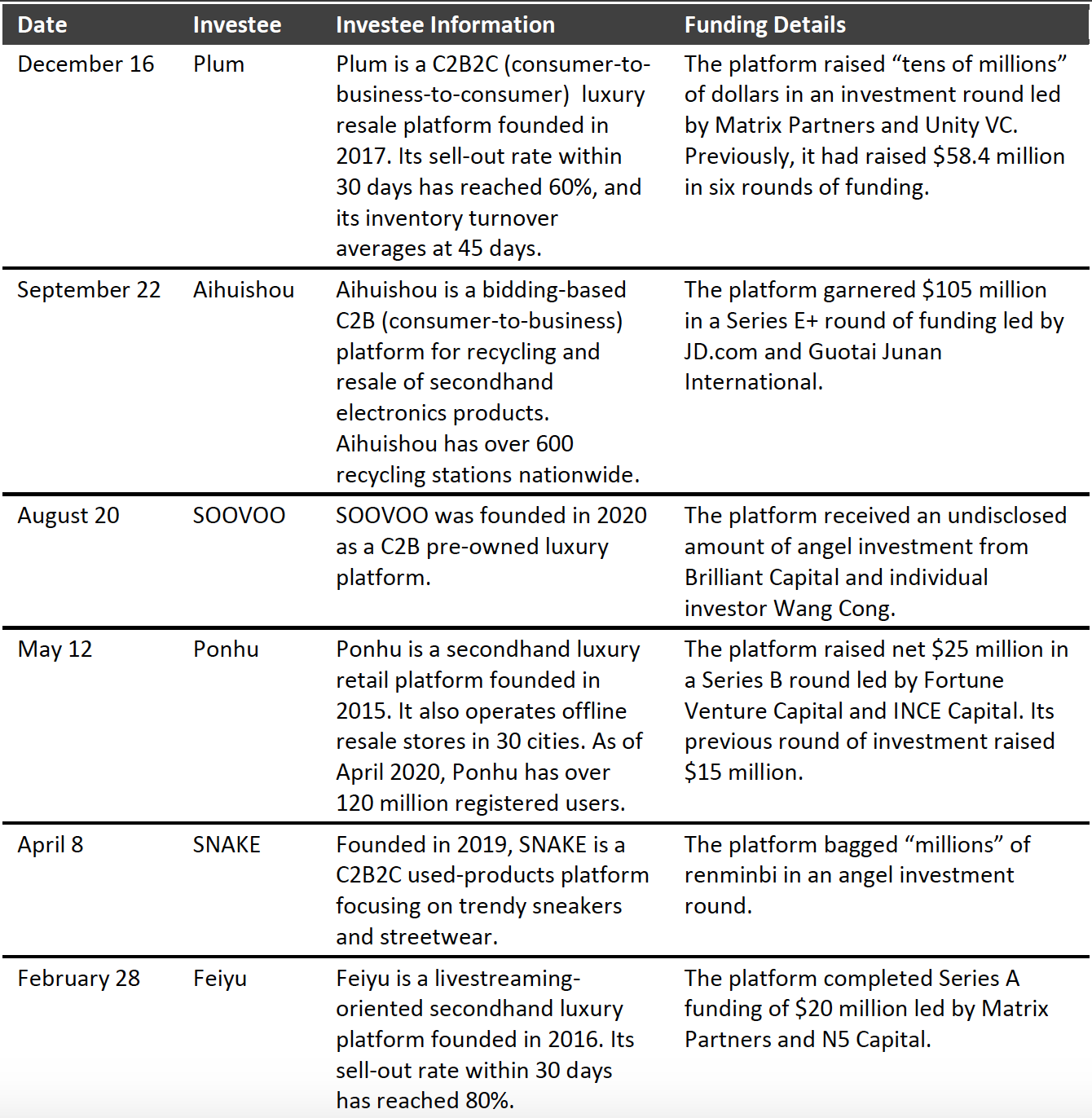

Venture capital firms have shown strong interests in China’s digital secondhand market in recent years. Funding raised by recommerce platforms totaled ¥7.36 billion (around $1.1 billion) in 2019, an increase of 223.5% year over year, according to 100EC. In 2020, several platforms still raised an impressive amount of funds, despite the negative impact of Covid-19.

Figure 2. Funding Raised by Chinese Online Secondhand Platforms in 2020

[caption id="attachment_122072" align="aligncenter" width="700"] Source: 100EC/Crunchbase/DealStreet Asia[/caption]

Source: 100EC/Crunchbase/DealStreet Asia[/caption]

Opportunities in China’s Secondhand Luxury Market

The luxury market in China has shown resilience post Covid-19 crisis, with consumer demand rapidly bouncing back in 2020. Management consultancy Bain & Company estimated that the domestic luxury market in China grew 48% in 2020. The booming luxury industry is also fueling growth in secondhand luxury platforms, led by millennials and Gen Z consumers, whose income had been negatively affected by Covid-19.

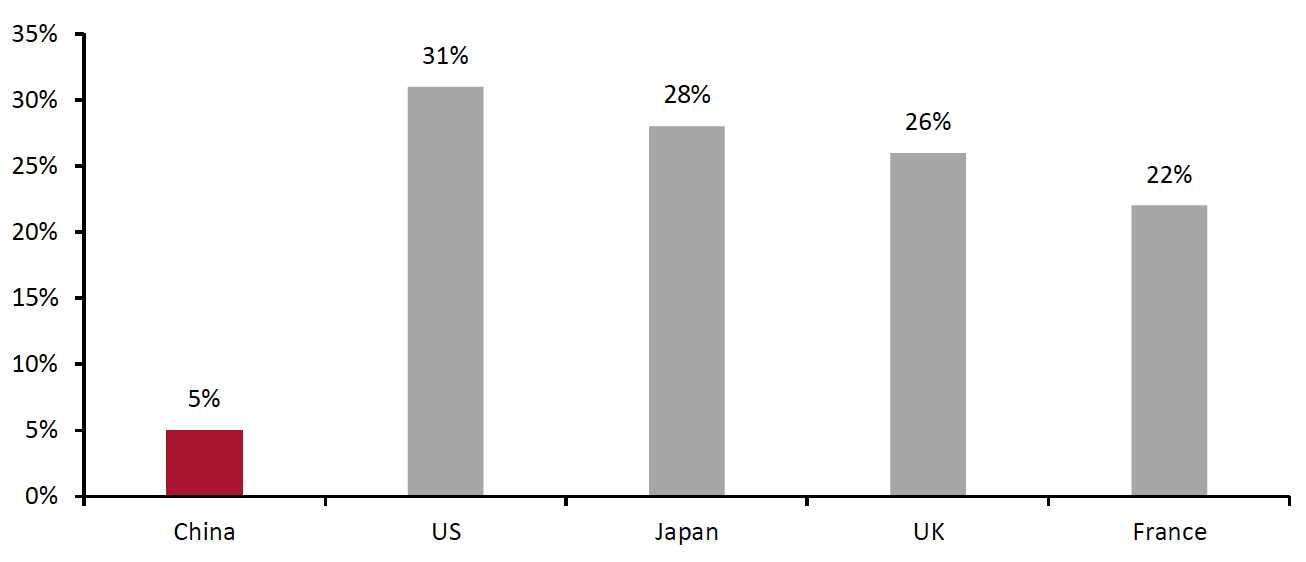

However, secondhand luxury products still remain a niche market in China. According to a 2020 joint report by the University of International Business and Economics and luxury authentication service provider and resale platform Isheyipai, sales of secondhand luxury products only accounted for 5% of the overall luxury market in China last year, compared to 20–30% penetration in developed countries such as Japan and the US. This provides opportunities for digital recommerce platforms—especially vertical ones focusing on luxury, such as Feiyu, Plum, Ponzu and Secoo—to increase their user base and expand their businesses.

Figure 3. Penetration of Secondhand Sales in the Luxury Market, 2020 (% of Total Luxury Sales)

[caption id="attachment_122073" align="aligncenter" width="700"] Source: Isheyipai/University of International Business and Economics[/caption]

Source: Isheyipai/University of International Business and Economics[/caption]

Recommerce Platforms Face Challenges

As the secondhand market still in an early stage of development in China, digital recommerce platforms need to tackle three primary challenges to stand out in the increasingly competitive landscape.

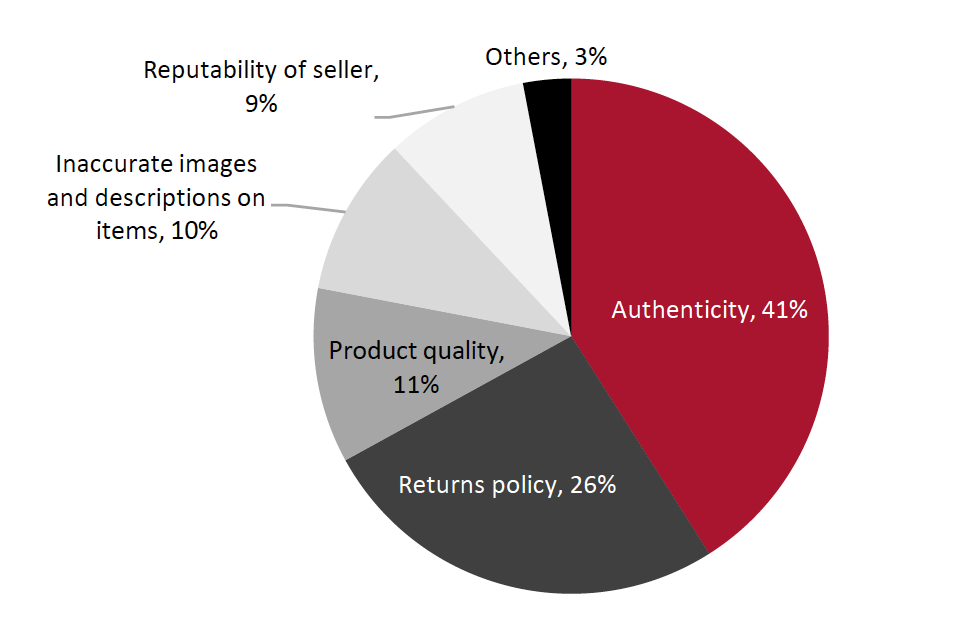

1. AuthenticityProduct authenticity has been the number-one concern for consumers in making purchases via resale platforms—especially on C2C resale sites, where shoppers tend to be more cautious when buying branded or high-priced products. According to the 2020 joint report by Isheyipai and the University of International Business and Economics, some 41% of respondents cited authenticity as their top concern when buying secondhand luxury products online. Counterfeiting remains a major problem in China: In 2019, Isheyipai reported that only 33.6% of the luxury products it appraised were authentic. As such, many luxury resale platforms emphasize their authentication services and have partnered with appropriate authorities to ensure product credibility for buyers.

Figure 4. Chinese Consumers’ Top Concern When Buying Secondhand Luxury Products Online (% of Respondents)

[caption id="attachment_122074" align="aligncenter" width="550"] Source: Isheyipai/University of International Business and Economics[/caption]

2. Quality Control

Source: Isheyipai/University of International Business and Economics[/caption]

2. Quality Control

With resale platforms continuing to build an expansive base of sellers, quality control is a key issue. The lack of standardized benchmarks to appraise pre-owned products can lead to many transaction conflicts in the recommerce business. Digital recommerce platforms need to strengthen their quality-control process to improve the shopping experience. For example, Zhuan Zhuan works with electronics brand Haier to offer quality inspection and maintenance solutions for household appliances sold on its platform.

3. Customer ServiceAfter-sales service has been a pain point among resale platforms. Most of the Chinese recommerce platforms have very strict returns policies—typically not allowing returns at all. Plum has received consumer complaints about being unable to return defective products. Unlike brand-new items, used products vary in quality and newness, thus complicating the handling of returns.

What We Think

The development of the digital recommerce market in China is still in the early stages, but we believe that this underpenetrated market will see strong growth, driven by consumer demand for product variety, sustainability and affordability. We estimate that the online secondhand market reached $55 billion in 2020 and will grow by one-third in 2021.

To capitalize on this growing trend, we see opportunities for brands and retailers to create their own resale channels, although there could be potential cannibalization on sales of new products. For example, H&M-owned brand COS launched its own resale platform, Resell, in September 2020, and luxury Swiss watchmaker Richard Mille started selling its own pre-owned vintage watches in selected countries in November 2020. Brand-owned resale channels give brands control over the secondhand market, with the potential to be perceived by shoppers as a more trustworthy destination than third-party resale platforms.

Brands and retailers can also partner with resale platforms to take advantage of their already-developed users, infrastructure and services. In 2019, Idle Fish launched a new premium channel that allows brands to operate their own official resale storefronts on the app.

For luxury brands, recommerce could be a complementary channel that offers access of luxury to budget-conscious consumers, enabling brands to extend their customer base to include secondhand buyers.