Nitheesh NH

In our China Retail Insights series, we examine issues that affect international brands and retailers in China. We cover areas such as consumer behavior, consumer sentiment, emerging retail trends, government regulations and the competitive landscape—as they affect business operations and the future outlook of retail.

In this report, we explore how emerging offline beauty retailers are achieving success in the China market by enhancing the shopping experience. We discuss the learnings that international brands and retailers can take from the innovative strategies being implemented in China.

Source: The National Bureau of Statistics of China[/caption]

The spike in sales in November (see Figure 1) can be largely attributed to Singles’ Day—the largest shopping festival of the year in China. Beauty was one of the best-performing categories on Alibaba’s e-commerce platform Tmall, with sales jumping 45.8% year over year for the period November 1–11, according to data firm ECdataway.

Sales during Singles’ Day were supported by the pandemic-induced migration to online shopping last year. The e-commerce penetration rate in the beauty category in China is estimated to have increased to 32.8% in 2020 from 30.3% in 2019—and the shift to digital channels is set to maintain momentum, increasing to nearly 40% in 2024, according to Euromonitor International.

The struggles of some traditional beauty retailers amid the pandemic and the growing share of e-commerce in the beauty category do not mean that the offline format will be phased out. On the contrary, with the easing of the pandemic in China, consumers have gradually returned to brick-and-mortar stores to enjoy a hands-on shopping experience. Offline stores remain indispensable in the beauty market, as many shoppers prefer to try new beauty products in-store before making a purchase—to help them choose makeup shades, for example. Physical stores offer experiential shopping, which is particularly appealing to younger consumers.

Many department store chains and beauty companies have recently launched their own multi-brand beauty stores, including Alibaba’s Intime Department Store, Parkson and Shiseido. In addition, a new wave of domestic offline beauty retailers is emerging, and they are gaining popularity among Chinese consumers. We discuss selected examples of such companies below.

Source: The National Bureau of Statistics of China[/caption]

The spike in sales in November (see Figure 1) can be largely attributed to Singles’ Day—the largest shopping festival of the year in China. Beauty was one of the best-performing categories on Alibaba’s e-commerce platform Tmall, with sales jumping 45.8% year over year for the period November 1–11, according to data firm ECdataway.

Sales during Singles’ Day were supported by the pandemic-induced migration to online shopping last year. The e-commerce penetration rate in the beauty category in China is estimated to have increased to 32.8% in 2020 from 30.3% in 2019—and the shift to digital channels is set to maintain momentum, increasing to nearly 40% in 2024, according to Euromonitor International.

The struggles of some traditional beauty retailers amid the pandemic and the growing share of e-commerce in the beauty category do not mean that the offline format will be phased out. On the contrary, with the easing of the pandemic in China, consumers have gradually returned to brick-and-mortar stores to enjoy a hands-on shopping experience. Offline stores remain indispensable in the beauty market, as many shoppers prefer to try new beauty products in-store before making a purchase—to help them choose makeup shades, for example. Physical stores offer experiential shopping, which is particularly appealing to younger consumers.

Many department store chains and beauty companies have recently launched their own multi-brand beauty stores, including Alibaba’s Intime Department Store, Parkson and Shiseido. In addition, a new wave of domestic offline beauty retailers is emerging, and they are gaining popularity among Chinese consumers. We discuss selected examples of such companies below.

Source: Harmay Weibo account[/caption]

The Colorist aims to create an immersive beauty shopping experience. Its stores are designed with bright colors to provide a vibrant and youthful feel that appeals to millennials and Gen Z. The retailer’s stores are spacious, with plenty of product testers. Some stores even feature livestreaming booths to invite consumers to post content about the retailer’s products online, such as makeup tutorials.

One standout feature in each of The Colorist’s stores is an entire wall of makeup sponges or other beauty products displayed in a rainbow of color. This eye-catching wall has become a popular selfie spot for shoppers as it provides an attractive photo backdrop; consumers then share their in-store photos on social media platforms, enhancing the retailer’s reach through digital channels.

[caption id="attachment_123881" align="aligncenter" width="720"]

Source: Harmay Weibo account[/caption]

The Colorist aims to create an immersive beauty shopping experience. Its stores are designed with bright colors to provide a vibrant and youthful feel that appeals to millennials and Gen Z. The retailer’s stores are spacious, with plenty of product testers. Some stores even feature livestreaming booths to invite consumers to post content about the retailer’s products online, such as makeup tutorials.

One standout feature in each of The Colorist’s stores is an entire wall of makeup sponges or other beauty products displayed in a rainbow of color. This eye-catching wall has become a popular selfie spot for shoppers as it provides an attractive photo backdrop; consumers then share their in-store photos on social media platforms, enhancing the retailer’s reach through digital channels.

[caption id="attachment_123881" align="aligncenter" width="720"] Source: The Colorist Weibo account[/caption]

WOW Colour has also set up designated areas within its stores for consumers to take photographs. For example, one store features giant models of lipsticks from popular Chinese makeup brand Colorkey (pictured below). Store décor is also themed to pique shopper interest—and the theme varies between stores. For example, the first eight stores that WOW Colour opened are each themed around one of the eight planets.

Merchandise is displayed in-store by category and brand. WOW Colour also displays the top 20 bestselling items to make it easier for shoppers to understand current beauty trends and popular products. The retailer provides free product testers for all makeup items.

[caption id="attachment_123882" align="aligncenter" width="720"]

Source: The Colorist Weibo account[/caption]

WOW Colour has also set up designated areas within its stores for consumers to take photographs. For example, one store features giant models of lipsticks from popular Chinese makeup brand Colorkey (pictured below). Store décor is also themed to pique shopper interest—and the theme varies between stores. For example, the first eight stores that WOW Colour opened are each themed around one of the eight planets.

Merchandise is displayed in-store by category and brand. WOW Colour also displays the top 20 bestselling items to make it easier for shoppers to understand current beauty trends and popular products. The retailer provides free product testers for all makeup items.

[caption id="attachment_123882" align="aligncenter" width="720"] Source: WOW Colour Weibo account[/caption]

3. Omnichannel Shopping Experiences

Chinese consumers’ shopping journeys typically involve both online and offline channels—researching items online before making a purchase in-store, or vice versa. According to a February 2020 study by BCG and Tencent, 85% of Chinese beauty consumers make their purchasing decisions before entering the sales channel. The emerging offline beauty retailers are combining online and offline retail models to develop a more flexible and satisfying shopping experience.

Harmay, The Colorist and WOW Colour all have their own e-commerce sites. As stores had to be temporarily closed in early 2020 due to the pandemic, the three retailers also began operating via online channels—such as WeChat mini programs—to increase their online presence.

The Colorist’s mini program encourages users to share reviews and photos of products within WeChat to earn rewards if their contacts purchase the products through their posts. Harmay and WOW Colour have gradually built up their private traffic on WeChat, which leads to effective monetization. Beauty advisors regularly send out discounts and promotions, as well as advertising new product launches and in-store events, to engage with consumers.

In stores, Harmay, The Colorist and WOW Colour provide a “do not disturb” service to shoppers, enabling them to browse uninterrupted unless they ask for help. This is appealing to young Chinese shoppers, who tend to prefer an autonomous and relaxed shopping experience—making the consultative model in stores such as Watsons and Sephora (where beauty advisers follow shoppers and explain product ingredients and functions) less relevant. Unlike in department stores, The Colorist and WOW Colour state that they allow consumers try on every makeup item, and they provide a “zero-pressure” testing experience.

Source: WOW Colour Weibo account[/caption]

3. Omnichannel Shopping Experiences

Chinese consumers’ shopping journeys typically involve both online and offline channels—researching items online before making a purchase in-store, or vice versa. According to a February 2020 study by BCG and Tencent, 85% of Chinese beauty consumers make their purchasing decisions before entering the sales channel. The emerging offline beauty retailers are combining online and offline retail models to develop a more flexible and satisfying shopping experience.

Harmay, The Colorist and WOW Colour all have their own e-commerce sites. As stores had to be temporarily closed in early 2020 due to the pandemic, the three retailers also began operating via online channels—such as WeChat mini programs—to increase their online presence.

The Colorist’s mini program encourages users to share reviews and photos of products within WeChat to earn rewards if their contacts purchase the products through their posts. Harmay and WOW Colour have gradually built up their private traffic on WeChat, which leads to effective monetization. Beauty advisors regularly send out discounts and promotions, as well as advertising new product launches and in-store events, to engage with consumers.

In stores, Harmay, The Colorist and WOW Colour provide a “do not disturb” service to shoppers, enabling them to browse uninterrupted unless they ask for help. This is appealing to young Chinese shoppers, who tend to prefer an autonomous and relaxed shopping experience—making the consultative model in stores such as Watsons and Sephora (where beauty advisers follow shoppers and explain product ingredients and functions) less relevant. Unlike in department stores, The Colorist and WOW Colour state that they allow consumers try on every makeup item, and they provide a “zero-pressure” testing experience.

Beauty Remains Resilient in China

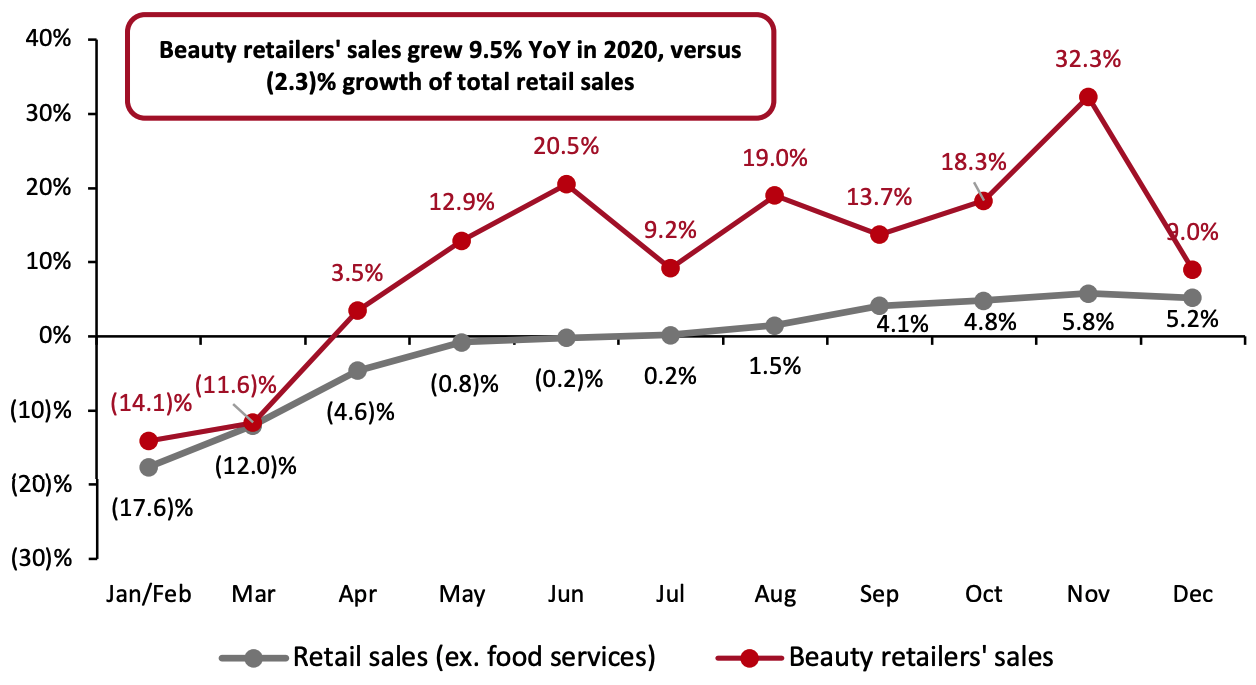

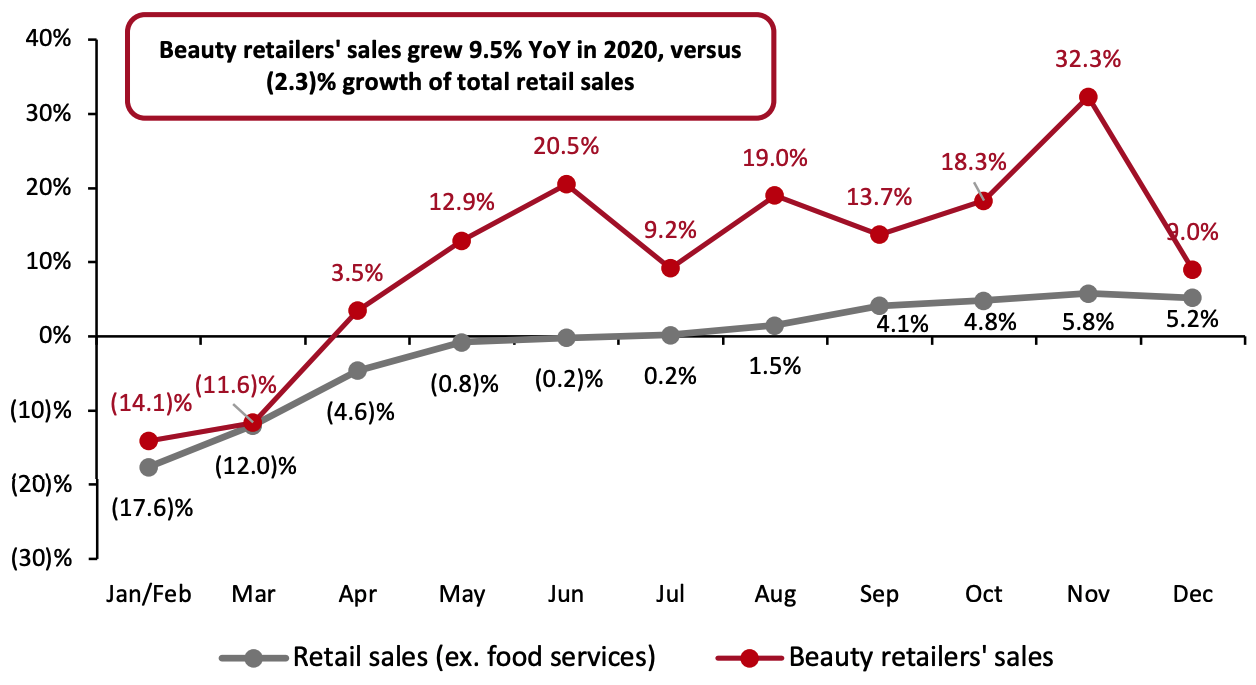

Some traditional offline beauty retailers operating in China have struggled in recent years. For example, Japan-based beauty retailer Isetan Beauty shuttered its store in Shanghai in 2019, and established drugstore chains Mannings and Watsons have been losing appeal among young Chinese consumers—Mannings closed multiple stores in China, and Watsons experienced stagnant sales growth (seeing only a 2% year-over-year increase in sales in 2019). Retailers were then hit hard in 2020 by the Covid-19 pandemic: UK beauty retailer Space NK permanently shuttered all of its retail stores in China last year, following temporary closures amid national lockdowns in February; and Watsons saw its sales decline worsen to 11% in the first half of 2020. However, although most retail sectors have been negatively impacted by Covid-19, China’s beauty market has recovered rapidly from pandemic-led sales declines at the beginning of the year. Beauty was one of the most resilient discretionary categories in 2020, and according to the National Bureau of Statistics, sales through beauty retailers saw 9.5% year-over-year growth in 2020 overall. This compares to a 2.3% decline in total retail sales excluding food services. Figure 1. China’s Total Retail Sales (ex. Food Services) and Sales by Beauty Retailers, 2020 (YoY % Change) [caption id="attachment_123879" align="aligncenter" width="720"] Source: The National Bureau of Statistics of China[/caption]

The spike in sales in November (see Figure 1) can be largely attributed to Singles’ Day—the largest shopping festival of the year in China. Beauty was one of the best-performing categories on Alibaba’s e-commerce platform Tmall, with sales jumping 45.8% year over year for the period November 1–11, according to data firm ECdataway.

Sales during Singles’ Day were supported by the pandemic-induced migration to online shopping last year. The e-commerce penetration rate in the beauty category in China is estimated to have increased to 32.8% in 2020 from 30.3% in 2019—and the shift to digital channels is set to maintain momentum, increasing to nearly 40% in 2024, according to Euromonitor International.

The struggles of some traditional beauty retailers amid the pandemic and the growing share of e-commerce in the beauty category do not mean that the offline format will be phased out. On the contrary, with the easing of the pandemic in China, consumers have gradually returned to brick-and-mortar stores to enjoy a hands-on shopping experience. Offline stores remain indispensable in the beauty market, as many shoppers prefer to try new beauty products in-store before making a purchase—to help them choose makeup shades, for example. Physical stores offer experiential shopping, which is particularly appealing to younger consumers.

Many department store chains and beauty companies have recently launched their own multi-brand beauty stores, including Alibaba’s Intime Department Store, Parkson and Shiseido. In addition, a new wave of domestic offline beauty retailers is emerging, and they are gaining popularity among Chinese consumers. We discuss selected examples of such companies below.

Source: The National Bureau of Statistics of China[/caption]

The spike in sales in November (see Figure 1) can be largely attributed to Singles’ Day—the largest shopping festival of the year in China. Beauty was one of the best-performing categories on Alibaba’s e-commerce platform Tmall, with sales jumping 45.8% year over year for the period November 1–11, according to data firm ECdataway.

Sales during Singles’ Day were supported by the pandemic-induced migration to online shopping last year. The e-commerce penetration rate in the beauty category in China is estimated to have increased to 32.8% in 2020 from 30.3% in 2019—and the shift to digital channels is set to maintain momentum, increasing to nearly 40% in 2024, according to Euromonitor International.

The struggles of some traditional beauty retailers amid the pandemic and the growing share of e-commerce in the beauty category do not mean that the offline format will be phased out. On the contrary, with the easing of the pandemic in China, consumers have gradually returned to brick-and-mortar stores to enjoy a hands-on shopping experience. Offline stores remain indispensable in the beauty market, as many shoppers prefer to try new beauty products in-store before making a purchase—to help them choose makeup shades, for example. Physical stores offer experiential shopping, which is particularly appealing to younger consumers.

Many department store chains and beauty companies have recently launched their own multi-brand beauty stores, including Alibaba’s Intime Department Store, Parkson and Shiseido. In addition, a new wave of domestic offline beauty retailers is emerging, and they are gaining popularity among Chinese consumers. We discuss selected examples of such companies below.

Newcomers in China’s Offline Beauty Market

In China’s brick-and-mortar beauty market, many emerging retailers have raised significant funding in the past few years, demonstrating current interest by venture capital firms. We provide details of recent funding in Figure 2. Figure 2. Funding Raised by Emerging Chinese Offline Beauty Retailers [wpdatatable id=773]Source: Linkshop

Below, we outline three notable examples of new players in China’s brick-and-mortar beauty market—Harmay, The Colorist and Wow Colour—which have gained huge exposure on social media and are proving particularly popular with young Chinese consumers. We explore the strategies that are driving the success of these retailers later in this report. Harmay Although Chinese cosmetics company Harmay began operations on Alibaba’s Taobao e-commerce platform in 2008, it only turned to offline stores in 2018 and has risen in popularity since that strategic move. Today, Harmay has five stores across Beijing, Chengdu, Hong Kong and Shanghai, which all attract attention via social media: Young consumers post about their in-store experiences on platforms such as short-video platform Douyin and social commerce platform RED (Xiaohongshu, also known as Little Red Book)—we discuss the company’s store designs later in this report. In July 2020, Harmay reported that its first three stores were achieving profitability. Harmay offers roughly 4,000 stock-keeping units (SKUs) in its stores, mostly products from international brands. In addition to well-known brands, which account for 60% of all SKUs, Harmay sells a wide range of niche beauty brands that consumers cannot typically find in mainstream channels. The retailer represents over 200 smaller brands, such as US skincare brands Erno Laszlo and Dermalogica, and European brands Paul & Joe and Stenders. The Colorist The Colorist belongs to KK Group, or Guangdong Kuaike E-Commerce. The chain first opened its first two stores in Guangzhou and Shenzhen in October 2019, which quickly drew huge crowds of over 15,000 visitors per day on average. The company has since extended its store presence to Beijing, Changsha, Shanghai and Xi’an, among other locations. On its opening day in January 2020, the Beijing store achieved sales of ¥200,000 (around $31,000), while the Xi’an store achieved sales of ¥230,000 (around $35,600) on its opening day in the same month, according to the retailer. As of November 2020, The Colorist operates 300 stores nationwide. Typically, The Colorist stores are located in shopping malls in downtown areas and are 3,230–8,610 square feet in size. Each store carries around 6,000 SKUs, with products from over 150 domestic and international beauty brands. The company’s target consumers are aged 14–35—both men and women—and its average transaction value is around ¥100–¥200 ($15–$31), according to The Colorist. WOW Colour WOW Colour is owned by MINISO, a low-cost Chinese retail company that sells a variety of household and consumer goods. The first WOW Colour store opened in Guangzhou in January 2020 and had more than 15,000 visits, with sales reaching ¥200,000 ($31,000). The retailer quickly expanded its store portfolio: It now operates over 300 stores, as of September 2020. The stores are 2,150–5,380 square feet in size. MINISO plans to have 1,000 WOW Colour stores by the end of 2022. WOW Colour offers beauty products (primarily makeup) from more than 300 brands, targeting millennial and Gen Z consumers. The retailer focuses on popular online Chinese brands that do not have an offline presence—70% of its products are from domestic brands. For example, products from one of the bestselling Chinese makeup brands on Taobao, Judydoll, are sold in WOW Colour’s physical stores. Accounting for only 4% of total SKUs, Judydoll typically contributes 40% of monthly sales at a WOW Colour store, according to the retailer. Although WOW Colour sells low-priced products, it has reported that its average transaction value falls between ¥200 and ¥300 (around $30–$46). In September 2020, WOW Colour announced that it will expand its offerings to more categories, such as skin care, small beauty tools and fragrances.Decoding the Early Success Behind Emerging Beauty Retailers in China

We believe there are three major factors driving the success of the three emerging beauty retailers we outlined above: differentiated merchandise; innovative and social media-friendly store designs; and an omnichannel shopping experience. 1. Differentiated Merchandise To Excite Young Shoppers New and unique offerings are particularly appealing to young consumers, who are typically open to trying new things and do not have strong brand stickiness. Harmay is known for its large selection of sample/mini-sized products. Beauty product samples are a simple way of enticing consumers to try new brands and products, particularly high-end items: Beauty brands and retailers can offer free product samples to consumers when they buy full-size items or reach a certain purchase amount. At Harmay, consumers can choose to trial high-end products from brands such as Estée Lauder, Helena Rubinstein and La Mer at a fraction of the cost of full-size products—without needing to purchase other full-price items to access the deal. For example, Harmay sells Lancôme’s Hydra Zen cream in 15ml size at ¥65 ($10), compared to the full-size 50ml product at around ¥350–595 ($54–$91) depending on promotions. However, Harmay’s sample economy raises doubt about the origin of its goods and the transparency of supply chains, as samples are typically gifted from brands directly to consumers and are not for resale. Ju Chunmao, Partner at Harmay, told Chinese news outlet 36Kr that Harmay’s products mainly come from upstream distributors and third-party representative agents, and the company has been working on having more direct authorization from brands. The Colorist and WOW Colour both stand out for selling online-only domestic brands in China. For many of the brands it sells, WOW Colour owns exclusive offline retail distribution rights, meaning that shoppers cannot find these brands in other beauty retailers, drugstores or supermarkets. Local brands, known as “C-beauty,” have gradually built up their reputation in recent years. More so than previous generations, young Chinese consumers today show support for domestic brands, especially when their products are typically cheaper than international brands. Both The Colorist and WOW Colour have a “fast beauty” model (the beauty market’s equivalent of “fast fashion”). This means that product assortments are changed or updated often, typically monthly, based on consumer data. By comparison, Sephora and Watsons update product assortments every three or four months. According to Chinese media outlet The People’s Daily, new products account for 18% of The Colorist’s total SKUs in a given month. New products help boost the average number of shopper visits and purchases, resulting in less stock and fewer discounts. The three beauty retailers have also been expanding their merchandise. In July 2020, The Colorist and WOW Colour added products for men, as well as a genderless makeup section, in their stores to ride the growing male beauty wave. Harmay partnered with fashion designer Masha Ma to launch co-branded fashion items in July 2020. 2. Social Media-Friendly Store Designs Harmay, The Colorist and WOW Colour have been innovative with their store designs to resonate with young Chinese consumers—encouraging viral marketing on social media but focusing on initiating word-of-mouth by actual shoppers instead of paid influencers. Harmay’s stores have a warehouse style with industrial elements, designed by award-winning company AIM Architecture. Each store design is based on different inspirations, but all incorporate sleek modern elements: The Hong Kong store is based on the concept of an old apothecary, and the Beijing store tries to bring the digital shopping experience to life. Harmay’s newest store, in Shanghai, is inspired by the local wet markets, with large flip-up windows and products placed in steel cages. [caption id="attachment_123880" align="aligncenter" width="720"] Source: Harmay Weibo account[/caption]

The Colorist aims to create an immersive beauty shopping experience. Its stores are designed with bright colors to provide a vibrant and youthful feel that appeals to millennials and Gen Z. The retailer’s stores are spacious, with plenty of product testers. Some stores even feature livestreaming booths to invite consumers to post content about the retailer’s products online, such as makeup tutorials.

One standout feature in each of The Colorist’s stores is an entire wall of makeup sponges or other beauty products displayed in a rainbow of color. This eye-catching wall has become a popular selfie spot for shoppers as it provides an attractive photo backdrop; consumers then share their in-store photos on social media platforms, enhancing the retailer’s reach through digital channels.

[caption id="attachment_123881" align="aligncenter" width="720"]

Source: Harmay Weibo account[/caption]

The Colorist aims to create an immersive beauty shopping experience. Its stores are designed with bright colors to provide a vibrant and youthful feel that appeals to millennials and Gen Z. The retailer’s stores are spacious, with plenty of product testers. Some stores even feature livestreaming booths to invite consumers to post content about the retailer’s products online, such as makeup tutorials.

One standout feature in each of The Colorist’s stores is an entire wall of makeup sponges or other beauty products displayed in a rainbow of color. This eye-catching wall has become a popular selfie spot for shoppers as it provides an attractive photo backdrop; consumers then share their in-store photos on social media platforms, enhancing the retailer’s reach through digital channels.

[caption id="attachment_123881" align="aligncenter" width="720"] Source: The Colorist Weibo account[/caption]

WOW Colour has also set up designated areas within its stores for consumers to take photographs. For example, one store features giant models of lipsticks from popular Chinese makeup brand Colorkey (pictured below). Store décor is also themed to pique shopper interest—and the theme varies between stores. For example, the first eight stores that WOW Colour opened are each themed around one of the eight planets.

Merchandise is displayed in-store by category and brand. WOW Colour also displays the top 20 bestselling items to make it easier for shoppers to understand current beauty trends and popular products. The retailer provides free product testers for all makeup items.

[caption id="attachment_123882" align="aligncenter" width="720"]

Source: The Colorist Weibo account[/caption]

WOW Colour has also set up designated areas within its stores for consumers to take photographs. For example, one store features giant models of lipsticks from popular Chinese makeup brand Colorkey (pictured below). Store décor is also themed to pique shopper interest—and the theme varies between stores. For example, the first eight stores that WOW Colour opened are each themed around one of the eight planets.

Merchandise is displayed in-store by category and brand. WOW Colour also displays the top 20 bestselling items to make it easier for shoppers to understand current beauty trends and popular products. The retailer provides free product testers for all makeup items.

[caption id="attachment_123882" align="aligncenter" width="720"] Source: WOW Colour Weibo account[/caption]

3. Omnichannel Shopping Experiences

Chinese consumers’ shopping journeys typically involve both online and offline channels—researching items online before making a purchase in-store, or vice versa. According to a February 2020 study by BCG and Tencent, 85% of Chinese beauty consumers make their purchasing decisions before entering the sales channel. The emerging offline beauty retailers are combining online and offline retail models to develop a more flexible and satisfying shopping experience.

Harmay, The Colorist and WOW Colour all have their own e-commerce sites. As stores had to be temporarily closed in early 2020 due to the pandemic, the three retailers also began operating via online channels—such as WeChat mini programs—to increase their online presence.

The Colorist’s mini program encourages users to share reviews and photos of products within WeChat to earn rewards if their contacts purchase the products through their posts. Harmay and WOW Colour have gradually built up their private traffic on WeChat, which leads to effective monetization. Beauty advisors regularly send out discounts and promotions, as well as advertising new product launches and in-store events, to engage with consumers.

In stores, Harmay, The Colorist and WOW Colour provide a “do not disturb” service to shoppers, enabling them to browse uninterrupted unless they ask for help. This is appealing to young Chinese shoppers, who tend to prefer an autonomous and relaxed shopping experience—making the consultative model in stores such as Watsons and Sephora (where beauty advisers follow shoppers and explain product ingredients and functions) less relevant. Unlike in department stores, The Colorist and WOW Colour state that they allow consumers try on every makeup item, and they provide a “zero-pressure” testing experience.

Source: WOW Colour Weibo account[/caption]

3. Omnichannel Shopping Experiences

Chinese consumers’ shopping journeys typically involve both online and offline channels—researching items online before making a purchase in-store, or vice versa. According to a February 2020 study by BCG and Tencent, 85% of Chinese beauty consumers make their purchasing decisions before entering the sales channel. The emerging offline beauty retailers are combining online and offline retail models to develop a more flexible and satisfying shopping experience.

Harmay, The Colorist and WOW Colour all have their own e-commerce sites. As stores had to be temporarily closed in early 2020 due to the pandemic, the three retailers also began operating via online channels—such as WeChat mini programs—to increase their online presence.

The Colorist’s mini program encourages users to share reviews and photos of products within WeChat to earn rewards if their contacts purchase the products through their posts. Harmay and WOW Colour have gradually built up their private traffic on WeChat, which leads to effective monetization. Beauty advisors regularly send out discounts and promotions, as well as advertising new product launches and in-store events, to engage with consumers.

In stores, Harmay, The Colorist and WOW Colour provide a “do not disturb” service to shoppers, enabling them to browse uninterrupted unless they ask for help. This is appealing to young Chinese shoppers, who tend to prefer an autonomous and relaxed shopping experience—making the consultative model in stores such as Watsons and Sephora (where beauty advisers follow shoppers and explain product ingredients and functions) less relevant. Unlike in department stores, The Colorist and WOW Colour state that they allow consumers try on every makeup item, and they provide a “zero-pressure” testing experience.