What’s the Story?

China’s National Day is a government holiday commemorating the nation’s founding in 1949. It is usually a seven-day holiday, running October 1–7 every year. The holiday is popularly known as “Golden Week,” characterized by family reunions, travel and tourism. In this report, we present our expectations for Golden Week 2021.

Why It Matters

During Golden Week, many airline companies, railway operators and shipping companies typically close business or scale down to a skeleton crew as workers go on vacation, which complicates retail supply chains. Brands and retailers must be particularly mindful of this for the 2021 holiday, as supply chains are already being pressured by Covid-19 impacts, such as port congestion.

The holiday is typically an opportunity for domestic tourism, and this year, we expect that domestic travel spending will increase disproportionately compared to international travel spending, as China’s borders remain closed. However, with recent Covid-19 outbreaks in prominent Chinese provinces, there remains a chance that travel restrictions will further tighten and obstruct domestic travelers.

During the eight-day holiday in 2020 (which saw the overlap of National Day and Mid-Autumn Festival), domestic tourism revenue—covering tourists’ total spending, including retail and food-service spending—declined by 28.2% year over year, reaching ¥466.6 billion (around $68.7 billion), according to the Ministry of Culture and Tourism. The sharp decline is down from an 8.5% increase in pre-pandemic 2019.

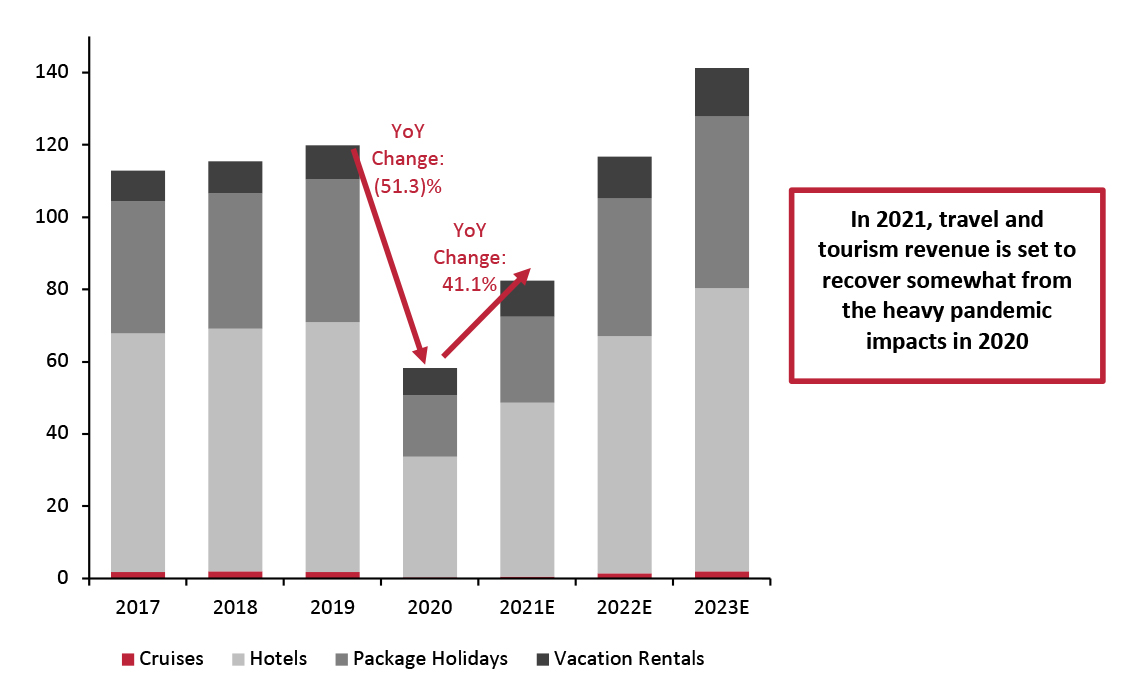

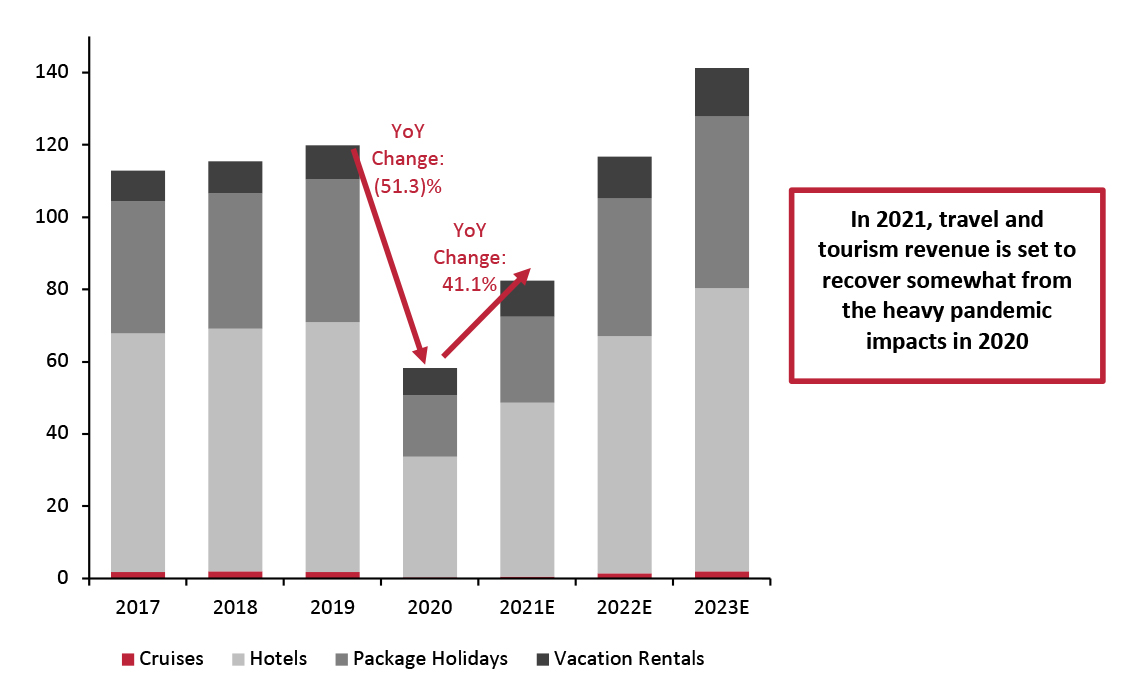

The heavy impacts of the pandemic are evident in the huge 51.3% decline in China’s overall travel and tourism market last year (covering cruises, hotels, package holidays and vacation rentals), according to data from Statista. Although travel and tourism revenue is set to recover somewhat this year, it is not expected to exceed pre-pandemic levels until 2023, according to Statista (see Figure 1).

Figure 1. China: Travel and Tourism Market Revenue (USD Bil.)

[caption id="attachment_133608" align="aligncenter" width="726"]

Source: Statista

Source: Statista[/caption]

China National Day Golden Week 2021: A Preview

Supply Chain Strains

In addition to the typical slowdown of China’s trading activities during the holiday—with essential airports, railways and ports kept running with a skeleton crew—we expect pandemic-led port congestion and resulting shipping container shortages to lead to further delays in deliveries during Golden Week this year.

Such supply chain pressures are likely to remain beyond Golden Week in the lead-up to Christmas, according to international shipping giant Maersk, so should remain top-of-mind for brands and retailers as they plan for the holiday season.

The Impact of Covid-19 on Travel

Domestic Travel Concerns and Restrictions

Chinese authorities are attempting to discourage travelers given recent Covid-19 outbreaks. The potential for pandemic-led restrictions to be implemented in China is at the forefront of domestic travel concerns.

In July 2021, the highly transmissible Delta variant was detected in Nanjing, and has since spread to at least 12 provinces, including popular tourist destination Zhangjiajie (in central Hunan province) and Wuhan, in which authorities ordered all 12 million residents be tested. More recently, a new surge of cases was linked to a Fujian-province primary school, with over 100 cases being reported in four days—leading to the suspension of public venues such as cinemas, museums, libraries and restaurants.

Domestically, all 31 of China’s provincial-level jurisdictions have issued advisories against domestic travel, particularly to medium- and high-risk regions, and even in relatively unaffected regions, local authorities have pre-emptively shut down entertainment facilities and tightened social-distancing measures. Another travel deterrent in China’s zero-tolerance Covid-19 policy requires any close contacts to a confirmed case to quarantine for up to 21 days.

However, China has so far administered 1.5 billion doses of Covid-19 vaccines, with some Chinese virology experts suggesting that the nation may reach herd immunity as early as the end of 2021, according to the National Health Commission of the People’s Republic of China. That said, vaccination may not be a sufficient condition for lifting restrictions, meaning that domestic travel to many prominent Chinese cities may be limited during Golden Week.

Opportunity Remains

Even though there are concerns about domestic Covid-19 outbreaks, domestic travel is likely to reap benefits from China’s international borders remaining closed, with consumers instead likely to travel and spend within the country during Golden Week.

The holiday presents an opportunity for the domestic tourism industry to make up for some of the losses incurred in the first half of 2021, which saw the total number of domestic trips fall by 40%, or an estimated $290 million in revenue, compared to the same period in 2019, according to the Ministry of Culture and Tourism. Last year, Golden Week saw 637 million people travel within China, representing an 18.5% year-over-year decrease from 782 million in 2019, according to the Ministry of Culture and Tourism.

Signs of the revitalization of the domestic travel industry in the second half of 2021 could be seen ahead of Golden Week, during the Mid-Autumn Festival on September 19–21, 2021: Ministry of Culture and Tourism data showed that total travel over the three-day holiday amounted to 87% of total travel volume in the same period of 2019 (pre-pandemic). On the first day of the holiday, 10.5 million passengers were expected to use China’s railways, according to the Ministry of Culture and Tourism—leading railway departments to strengthen safety inspections and increase disinfection frequency to improve services for traveling passengers. In addition, Beijing Capital International Airport was expected to handle about 307,500 passengers on September 19, 2021, according to The State Council of The People’s Republic of China. Passengers were required to take temperature measurements, present travel-code and health-code verification and wear masks. This suggests that domestic travel may be strong during Golden Week, although safety measures will be a priority and travel volumes are unlikely to reach pre-pandemic levels.

What We Think

We expect that businesses will experience supply chain congestion during Golden Week, resulting in delays for goods that pass through China. We advise brands and retailers to prepare for heavy port congestion and shipping container shortages to continue through the 2021 holiday season.

We recommend that brands and retailers focus on sales within China, as pandemic-led international travel restrictions present an opportunity for increased domestic travel and related spending this holiday.

Source: Statista[/caption]

Source: Statista[/caption]