DIpil Das

What’s the Story?

In this report, we discuss our expectations for Chinese tourism during the National Day holiday, as well as how tourist sites and travel agencies are preparing for the upcoming long holiday.Why It Matters

China’s National Day is usually a seven-day holiday, running October 1–7 every year. The holiday is popularly known as “Golden Week,” during which millions of people travel. However, this year, the holiday will be longer due to the overlap of two Chinese festivals—National Day and Mid-Autumn Festival—creating an eight-day holiday from October 1 to October 8. This holiday is worth watching; it is one of the most important holidays in China and is one of the first to take place following the lifting of Covid-19 lockdowns.- As of September 2, the country has fully resumed cross-provincial travel—tourists can travel from one province to another. China suspended tourism at the peak of the epidemic at the beginning of the year, and only allowed tourists to travel between certain provinces from July 17. This was because a few places saw a second wave of the coronavirus, such as Beijing, Shenyang and Xinjiang.

- The National Day holiday will serve as a good opportunity for domestic tourism to rebound. The number of domestic tourists in the first half of the year was down 62% year over year to 1.2 billion, with domestic tourism revenue down 77% year over year to ¥640 billion (around $94.5 billion), according to China Tourism Academy.

- The Mid-Autumn Festival and National Day holiday are the last statutory holidays of 2020, potentially prompting tourists to travel during the long holiday.

- Ongoing international travel restrictions could benefit domestic tourism.

China National Day Golden Week 2020 Preview: In Detail

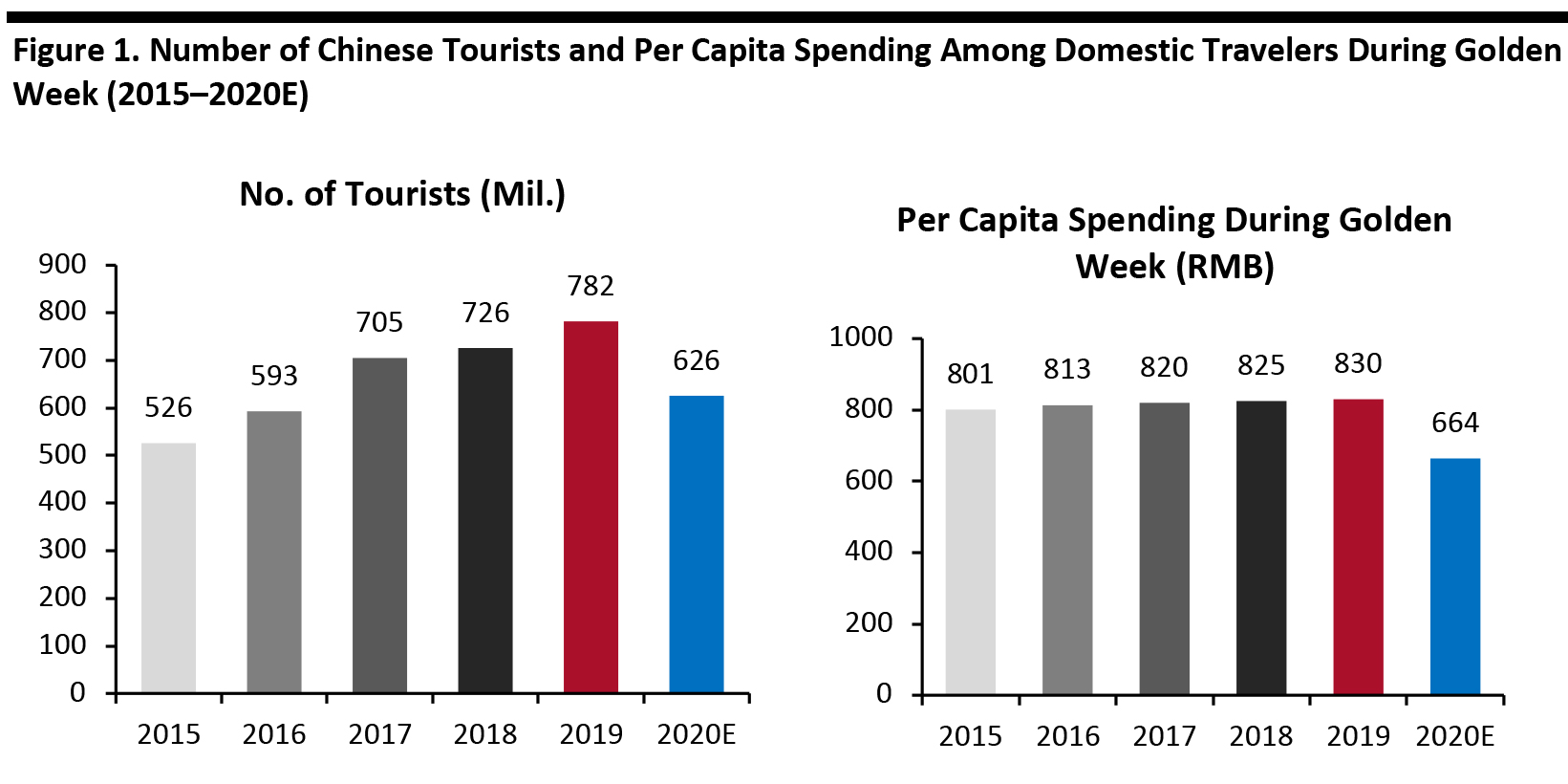

Outbound International Travel Will Remain Stagnant We expect that this year’s National Day holiday will see very low outbound international tourism. Although international airlines have begun to increase flights to and from China, the current travel market is mainly overseas Chinese nationals returning home and outbound travel for business but not for leisure, according to travel platform PanTravel. Outbound tourism has effectively been on pause since March 2020, according to travel firm Tong Cheng Travel. Outbound travel revenue during May Day Holiday was approximately zero, according to financial firm Futunn. Outbound travel will still take some time to recover. Domestic Travel and Spending Will See Declines for the First Time We expect that this year’s National Day holiday will see around 626 million Chinese tourists travel domestically, down 20% from 782 million in 2019—based on the 41.0% pace of decline in domestic travel during the May Day Holiday this year, offset by the resumption of cross-provincial travel from September 2. We estimate per capita spending among those who travel domestically over Golden Week to decline by around 20% year over year to ¥664 ($98)—based on the per capita spending during May Day Holiday among domestic travelers being down 31.1% year over year, as well as the move by major online travel platforms such as Ctrip, Fliggy and Tongcheng Travel to introduce subsidy policies to facilitate consumption during the holiday. For instance, Alibaba’s Fliggy announced a subsidy program worth ¥10 billion (around $1.5 billion) on September 9. Fliggy will provide discounts on hotel bookings, covering 100,000 hotels in hundreds of cities across the country, as well as coupons for transportation. [caption id="attachment_116599" align="aligncenter" width="700"] Source: China’s Ministry of Culture and Tourism/CYTS/Coresight Research[/caption]

According to the data from China’s Ministry of Culture and Tourism, the number of Chinese tourists and per capita spending during Golden Week grew steadily from 2015 to 2019, reaching 782 million tourists and per capita spending of ¥830 ($123).

A Variety of Domestic Traveling Plans

According to data from Chinese travel company CYTS, around 37% of survey respondents said they were willing to extend their holidays by taking annual leave before or after the National Day holiday. Travelers can take a vacation of more than 10 days if they take leave from September 26. The peak travel time is estimated to be September 30 to October 1, according to travel platform Mafengwo.

Around 47% of respondents said that they would like to take a short-distance trip of three to five days within China, according to CYTS. Those tourists are likely to choose to travel on October 3 to avoid the crowds, according to Mafengwo.

Preferential Policies To Attract Tourists Post Crisis

While outbound tourism remains stagnant, domestic tourism has become popular. Many provinces and cities across the country have introduced favorable policies and preferential measures to promote domestic tourism: Hundreds of well-known tourist sites across the country have implemented preferential policies since August, including discounts on entrance tickets.

[caption id="attachment_116600" align="aligncenter" width="700"]

Source: China’s Ministry of Culture and Tourism/CYTS/Coresight Research[/caption]

According to the data from China’s Ministry of Culture and Tourism, the number of Chinese tourists and per capita spending during Golden Week grew steadily from 2015 to 2019, reaching 782 million tourists and per capita spending of ¥830 ($123).

A Variety of Domestic Traveling Plans

According to data from Chinese travel company CYTS, around 37% of survey respondents said they were willing to extend their holidays by taking annual leave before or after the National Day holiday. Travelers can take a vacation of more than 10 days if they take leave from September 26. The peak travel time is estimated to be September 30 to October 1, according to travel platform Mafengwo.

Around 47% of respondents said that they would like to take a short-distance trip of three to five days within China, according to CYTS. Those tourists are likely to choose to travel on October 3 to avoid the crowds, according to Mafengwo.

Preferential Policies To Attract Tourists Post Crisis

While outbound tourism remains stagnant, domestic tourism has become popular. Many provinces and cities across the country have introduced favorable policies and preferential measures to promote domestic tourism: Hundreds of well-known tourist sites across the country have implemented preferential policies since August, including discounts on entrance tickets.

[caption id="attachment_116600" align="aligncenter" width="700"] Source: Government websites [/caption]

With outbound tourism remaining sluggish, companies are making efforts to encourage domestic tourism—with many offering lower prices for travel packages, flights and hotels to attract travelers. Travel agencies have launched lower-cost domestic travel packages, at least 20–30% lower than what has been offered in previous years, according to tourism service provider China Tourism Group. Although the average price of travel packages for the National Day holiday is high compared to prior months, it is still lower than previous years. For instance, Alibaba’s travel platform Fliggy reported that during the National Day holiday, the average hotel price increased by 65% compared with August, but it was 30% lower than the same period last year.

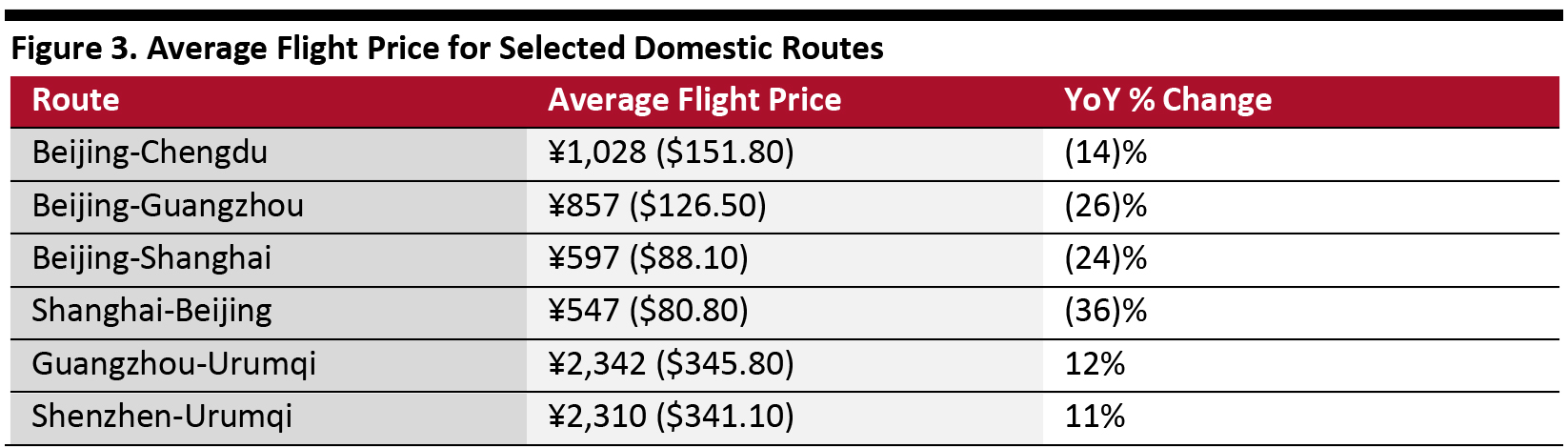

The average flight price for many popular domestic routes is also lower than last year, according to travel platform Qunar. Passengers who depart from Beijing to Chengdu, Guangzhou, Shanghai and Shenzhen could find flights priced at up to 36% lower than 2019 prices.

[caption id="attachment_116601" align="aligncenter" width="700"]

Source: Government websites [/caption]

With outbound tourism remaining sluggish, companies are making efforts to encourage domestic tourism—with many offering lower prices for travel packages, flights and hotels to attract travelers. Travel agencies have launched lower-cost domestic travel packages, at least 20–30% lower than what has been offered in previous years, according to tourism service provider China Tourism Group. Although the average price of travel packages for the National Day holiday is high compared to prior months, it is still lower than previous years. For instance, Alibaba’s travel platform Fliggy reported that during the National Day holiday, the average hotel price increased by 65% compared with August, but it was 30% lower than the same period last year.

The average flight price for many popular domestic routes is also lower than last year, according to travel platform Qunar. Passengers who depart from Beijing to Chengdu, Guangzhou, Shanghai and Shenzhen could find flights priced at up to 36% lower than 2019 prices.

[caption id="attachment_116601" align="aligncenter" width="700"] Source: Qunar[/caption]

Flight prices to Urumqi (capital city in Xinjiang) have seen growth due to the travel ban in Xinjiang lifting on September 2. Xinjiang is located in the Northwest, and data on search keywords on Ctrip show that the search term “Northwest” has recently seen a year-over-year surge of 475%.

With flight prices going down overall, the number of domestic flight passengers is estimated to increase by 10% year over year to more than 15 million during the holiday, according to Mafengwo.

A Focus on Safe Travel This Year

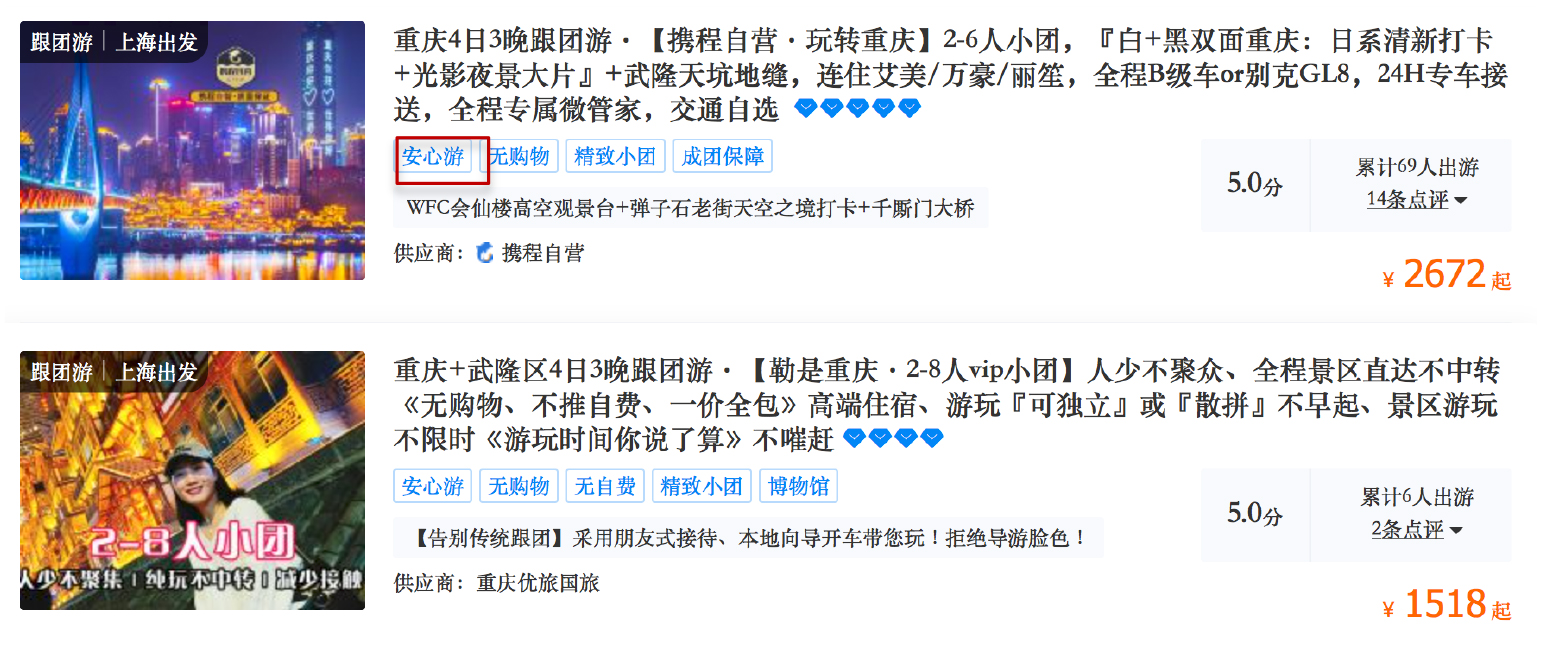

We have seen domestic tourism post crisis place a greater focus on “safe travel”—with travelers requiring tourism packages to have measures in place that minimize the risk of contracting the coronavirus. On the Ctrip platform, many travel products have a “safe travel” label displayed to reassure tourists that measures such as health-code verification, temperature measurement and disinfection are in place. We estimate that around 65.7% of the travel packages listed on Ctrip have the “safe travel” label.

[caption id="attachment_116602" align="aligncenter" width="700"]

Source: Qunar[/caption]

Flight prices to Urumqi (capital city in Xinjiang) have seen growth due to the travel ban in Xinjiang lifting on September 2. Xinjiang is located in the Northwest, and data on search keywords on Ctrip show that the search term “Northwest” has recently seen a year-over-year surge of 475%.

With flight prices going down overall, the number of domestic flight passengers is estimated to increase by 10% year over year to more than 15 million during the holiday, according to Mafengwo.

A Focus on Safe Travel This Year

We have seen domestic tourism post crisis place a greater focus on “safe travel”—with travelers requiring tourism packages to have measures in place that minimize the risk of contracting the coronavirus. On the Ctrip platform, many travel products have a “safe travel” label displayed to reassure tourists that measures such as health-code verification, temperature measurement and disinfection are in place. We estimate that around 65.7% of the travel packages listed on Ctrip have the “safe travel” label.

[caption id="attachment_116602" align="aligncenter" width="700"] Travel products featuring the “safe travel” label

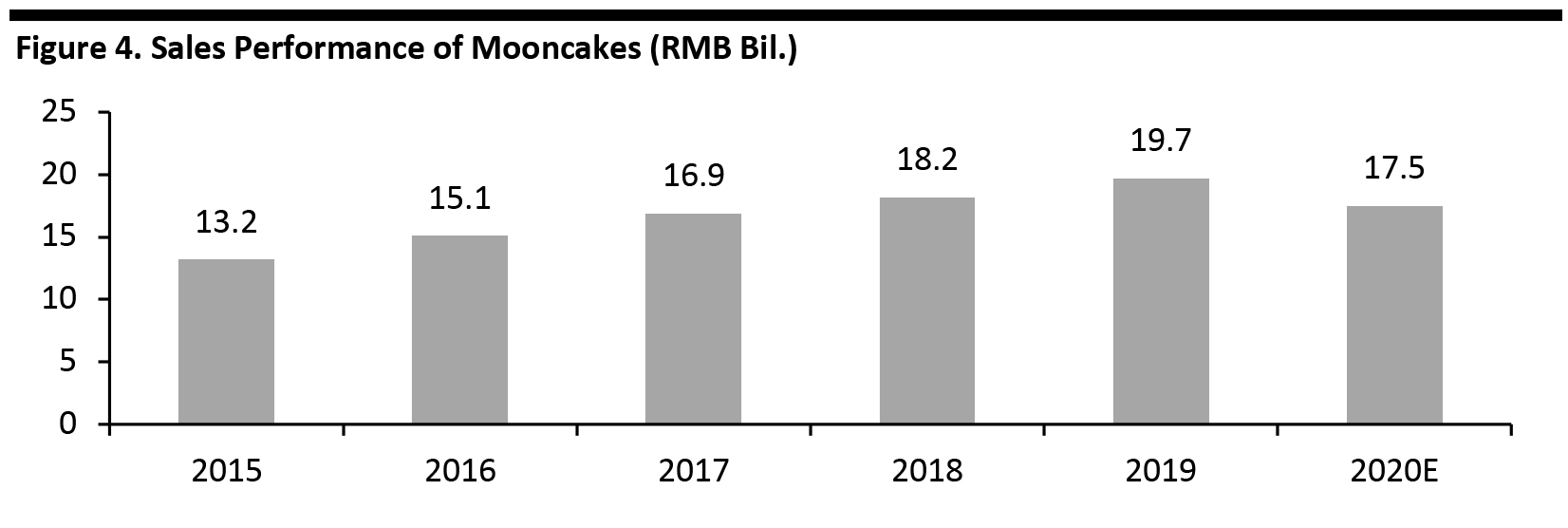

Travel products featuring the “safe travel” label Source: Ctrip [/caption] In order to create a safe, reassuring and comfortable travel environment for tourists, tourism sites are also strictly implementing hygiene and safety protocols, including traffic monitoring and control. For instance, Leshan has placed a tourist maximum capacity restriction of 50% during the Golden Week holiday. Tourist sites are also asking travelers to register online first to reserve tickets, ensuring that each tourist is trackable if a case of coronavirus appears. Car Rentals Will Gain Traction Car rentals—usually one family renting one car, and featuring private cars with little contact from other tourists—will gain traction during the National Day holiday this year. The number of car rental reservations on Ctrip for the National Day holiday has increased by 150% month over month, as of September 3. Bookings for popular car models, such as luxury cars and SUVs, in popular provinces (such as Hainan) are already in short supply on Ctrip. To better meet such demands, Ctrip teamed up with more than 2,000 car rental companies across the country. The number of rentable cars totals over 200,000, covering more than 700 cities. Smaller-Sized Group Travel Will Boom Small-scale, private and personalized group travel packages are gaining traction. The average size of a small group traveling is usually about three to five people. The increasing popularity of such packages partly lies in the fact that the group tour provides travelers with a full service and peace of mind. Small groups can also offer tourists more confidence about not contracting coronavirus compared to large groups. Small groups accounted for more than two-thirds of all group travel bookings for the National Day holiday, as of September 2, according to Ctrip. Customized travel packages are also booming. The percentage of customized tour orders for Golden Week saw a year-over-year increase of 24% as of September 11, according to Mafengwo. With customized tours, travelers can enjoy a more personalized travel experience as well as a flexible itinerary. Consumers can also save time in doing research, such as finding information about the best travel routes. Mid-Autumn Festival Falls on October 1, Colliding with National Day China’s Mid-Autumn Festival is a major holiday for Chinese families to gather, eat festive foods prepared especially for this holiday and enjoy the sight of the full moon, indicating the start of fall. The holiday falls on the 15th day of the eighth month in the Chinese lunar calendar, so it varies each year—but this year, it is on October 1, which is the same day as National Day. The most iconic aspect of the holiday is eating mooncakes, a baked sweet made of dough and filled with a variety of ingredients from bean paste to lotus seed, and almost always with a whole egg yolk in the center. Mooncakes are offered to friends and family and often brought into the workplace. The sales of mooncakes are estimated to see a year-over-year decline of 11.2% to ¥17.5 billion ($2.6 billion) in 2020, according to research company iiMedia. Affected by the pandemic, companies are likely to cancel or reduce the number of mooncake vouchers they distribute to employees, to save costs. [caption id="attachment_116603" align="aligncenter" width="700"]

Source: iiMedia[/caption]

According to iiMedia, the top 10 mooncake brands include Suzhou Daoxiang Village Mooncake, Huamei Mooncake, Maxim Mooncakes, Xinghualou Mooncakes, Guangzhou Restaurant Mooncakes, Wufang Ramadan Mooncakes, Beijing Daoxiangcun Mooncakes, Yuanzu Mooncakes, Peninsula Mooncakes and Haagen-Dazs Mooncakes.

Source: iiMedia[/caption]

According to iiMedia, the top 10 mooncake brands include Suzhou Daoxiang Village Mooncake, Huamei Mooncake, Maxim Mooncakes, Xinghualou Mooncakes, Guangzhou Restaurant Mooncakes, Wufang Ramadan Mooncakes, Beijing Daoxiangcun Mooncakes, Yuanzu Mooncakes, Peninsula Mooncakes and Haagen-Dazs Mooncakes.

What We Think

The Golden Week holiday presents a great opportunity for companies to capture sales post crisis. The theme of safe travel is evident, with travel companies featuring “safe travel” labels on many packages. Implications for Brands/Retailers- Brands and retailers in China can provide product offerings that focus on safe travel. For instance, they could offer health-care products for smaller group travels.

- Brands and retailers could provide products that are easy to carry by flight, as more consumers are taking domestic flights during the holiday this year.

- Retailers outside of China that traditionally see a strong Golden Week should expect very muted demand from Chinese travelers this year.

- Global brands and retailers that traditionally would have benefited from international tourist demand during Golden Week should continue to encourage domestic purchases within China, whether through in-country stores or online.