Web Developers

This year, the China National Day Golden Week is from October 1 to 7. Ctrip predicts that over 700 million Chinese will travel within China and 7 million will travel to foreign destinations during these holidays and the total number of tourists will be almost 10% of the world’s population. Millennials—those born in the 1980s and 1990s—will account for 54% and those born in the 1970s will account for 13% of the total number of tourists, according to Ctrip.

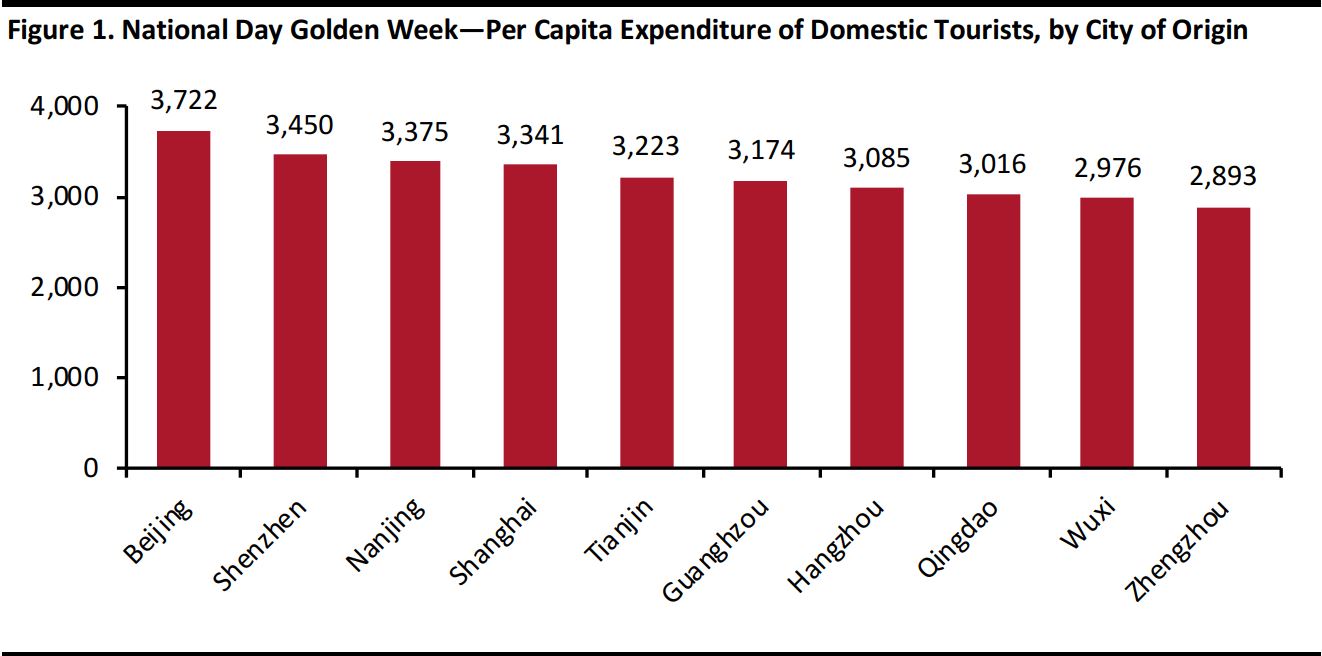

During these holidays, per capita expenditure is expected to be ¥3,100 for domestic tourists and ¥7,300 for tourists traveling overseas. With per capita expenditure of ¥3,722, tourists from Beijing are expected to spend the most, according to Ctrip. (Figure 1)

According to Spring Tour—a leading Chinese travel agency—48% of Chinese tourists travel for 4–6 days during the National Day Golden Week holidays, 31% travel for less than three days and 8% travel for 7–10 days.

Relaxed visa application procedures are also an incentive for the Chinese to travel abroad. Chinese passport holders now benefit from visa-free or visa-on-arrival access to 73 countries and regions around the world, up from 65 last year (Figure 3.) According to Ecwalk—one of China’s leading travel agencies, the top 10 popular destinations that offer relaxed visa benefits to Chinese passport holders are: Myanmar, Indonesia, Vietnam, Thailand, Maldives, UAE, Sri Lanka, Morocco, Mauritius and Fiji.

Source: Ctrip

Source: Ctrip

Mid- to Long-Haul Trips Become the Norm, Thanks to the Long Holiday and Relaxed Visa Requirement

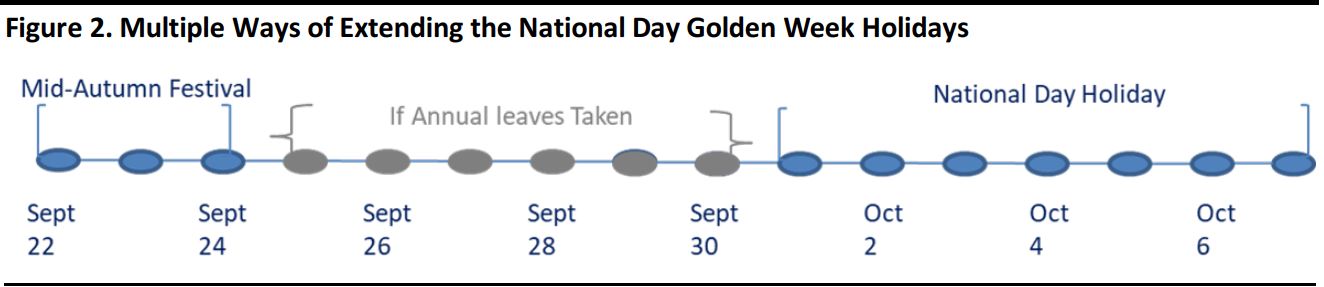

Because it is one of the longest holidays in China, the National Day Golden Week holidays is the time when Chinese tourists are most likely to travel abroad. Also, the Mid-Autumn Festival and National Day can further extend it into a 16-day holiday for people who apply for leave between September 25 and September 30. (Figure 2) Source: Tuniu/ Coresight Research

Source: Tuniu/ Coresight Research

According to Spring Tour—a leading Chinese travel agency—48% of Chinese tourists travel for 4–6 days during the National Day Golden Week holidays, 31% travel for less than three days and 8% travel for 7–10 days.

Relaxed visa application procedures are also an incentive for the Chinese to travel abroad. Chinese passport holders now benefit from visa-free or visa-on-arrival access to 73 countries and regions around the world, up from 65 last year (Figure 3.) According to Ecwalk—one of China’s leading travel agencies, the top 10 popular destinations that offer relaxed visa benefits to Chinese passport holders are: Myanmar, Indonesia, Vietnam, Thailand, Maldives, UAE, Sri Lanka, Morocco, Mauritius and Fiji.

Source: Ctrip

Source: Ctrip

Ctrip: National Day Golden Week Travel Trends Report 2018

Ctrip released the “Mid-Autumn Day and National Day Golden Week Travel Trends Report 2018,” which is based on this year’s holiday-package bookings during the National Day holidays. Listed below are the three key points in the Ctrip report and these are quite similar to the trends reported by other players in the Chinese tourism sector:- There will be two peak travel times—one around Mid-Autumn Festival (September 22) and the other during the National Day holidays (October 1-3.)

- The top overseas holiday destinations this year are expected to be Japan, Thailand, Hong Kong, Korea, Singapore, in order of preference. In contrast, the most popular destinations during Golden Week 2017 were Thailand, Japan, Singapore, the US and Vietnam.

- The most popular destinations within China in order of preference for Chinese tourist groups are: Beijing, Guilin, Kunming, Zhangjiajie, Lanzhou, Sanya, Urumqi, Xiamen, Lijiang and Guiyang. The most popular destinations for self-planned trips in order of preference are Sanya, Beijing, Xiamen, Chengdu, Guangzhou, Shanghai, Zhuhai, Xian, Hangzhou and Chongqing.

Winners and Losers

We see Hong Kong, South Korea, Turkey and Russia as the biggest beneficiaries of outbound travel during this year’s China’s National Day Golden Week, and the US as the biggest loser.Winners

1. Hong Kong During the National Day Golden Week this year, Hong Kong is expected to be the third-most-popular destination for Chinese tourists, three places up from number six last year. This is partly due to the opening of Express Rail (on September 23) that links Hong Kong to 44 mainland cities. Ctrip reported that Chinese tourists travelling to Hong Kong during Golden Week have seen a year-over-year increase of 70%. 2. South Korea South Korea has returned as the fourth-most-popular destination for Chinese tourists, according to Ctrip. Travel to South Korea has resumed gradually since the THAAD crisis in 2017 when Chinese travel agencies stopped tour groups to South Korea.- The number of Chinese tourists who visited South Korea in July 2018 was 410,337, up 45.9% from July 2017, according to Yonhap—a government funded South Korean news agency.

- Shinsegae Duty Free Store has teamed up with UnionPay—a major bank card service provider in China—to allow payment by Chinese tourists using UnionPay’s QR code. Shinsegae now also has a premium lounge for UnionPay VIP users at its Gangnam branch to better serve Chinese tourists.

- The largest duty-free shop operator—Lotte has resumed its partnerships with three of China’s largest online payment platforms—Alipay, WeChat Pay, and UnionPay—which were suspended following the THAAD crisis. Customers who pay in this shop using Alipay receive a 5% discount along with VIP benefits.

- New flights and flight routes between China and South Korea have been added and the frequency of flights has also been increased. Jeju Air launched direct flights from Incheon to Haikou on September 19 and will also open a new route from Gimhae to Yantai on October 28. Asiana airlines will add one more airplane to its current fleet of four that flies between Incheon and Shanghai.

- Chinese passport holders can get visas to Turkey within a day of applying.

- The number of Chinese tourists visiting Turkey is 159,000 year-to-date May 2018, which is a year-over-year growth of 96.1%, according to the Republic of Turkey Ministry of Culture and Tourism.

- Russia witnessed a boost in tourism boost thanks to the FIFA World Cup. Russian Travel Association “World Without Borders” reported that the number of Chinese tourists visiting Russia is 374,000 year-to-date June 2018, which is a year-over-year growth of 20%.

- Ctrip has included the World Cup stadiums in Russia in its itinerary for Chinese group tours, and it is expected that thousands of Chinese tourists will visit Russia during the National Day Golden Week.

- As a special offer, UnionPay cardholders can take Aero express trains in Moscow for just one rouble.

Losers

The US Likely to Lose Out on Chinese Tourists Spending This year, the US fell off the league table for the top-10 most-popular overseas holiday destinations for Chinese tourists, according to Ctrip. Since the US–China trade war that started earlier this year, the number of Chinese tourists who booked trips to the US from September through December 2018 has fallen 9.6% year over year, according to traveler data intelligence firm ForwardKeys. In the same period, the total number of Chinese outbound bookings to other countries increased by 5.5% year over year. This drop in the number of Chinese tourists to the US will lead to loss of US$500 million for the US tourism economy, said ForwardKeys. According to ForwardKeys, two of the several factors that have contributed to the decline of Chinese tourists to the US are:- The lower exchange rate of the yuan versus the US dollar—year-to-date July 2018, the yuan has depreciated over 8% against the US dollar.

- A security warning that was issued in July 2018 by the China’s embassy in the US had warned Chinese tourists visiting the US against expensive medical bills, threats of public shootings and robberies, searches and seizures by customs agents, telecommunications fraud and natural disasters.