Source: Company reports

4Q15 RESULTS

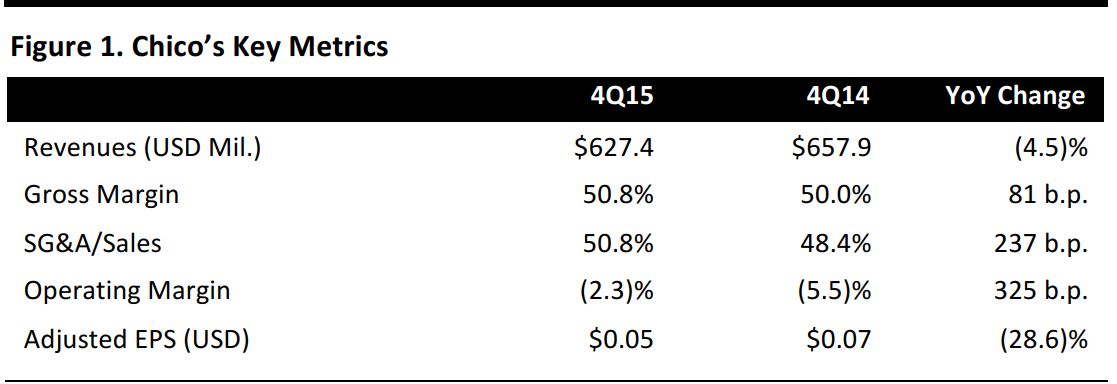

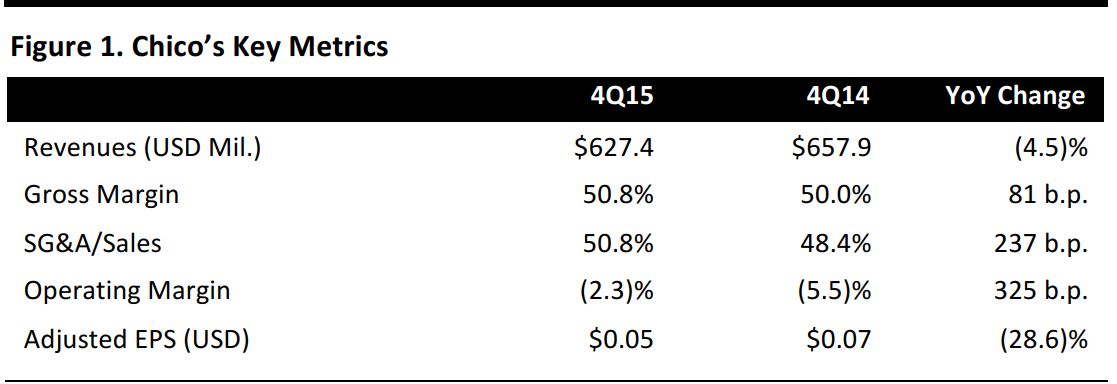

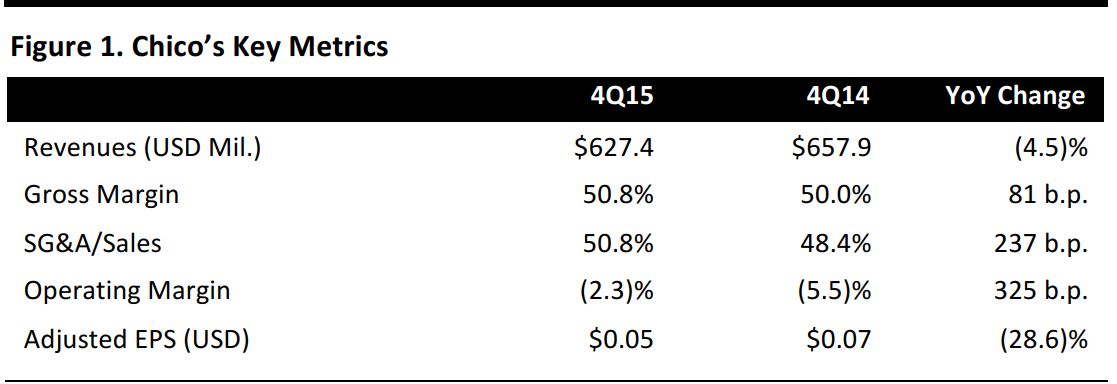

Chico’s reported a GAAP loss per share of $0.16 in the fourth quarter of 2015, a slight improvement from the $0.21 loss per share in the same quarter last year. The GAAP net loss was $21.1 million, and the GAAP net loss for the same period last year was $31.8 million.

Total revenue was $627.4 million versus consensus of $625.9 million, but was down 4.5% from $657.9 million in the same quarter last year. This fall in sales was attributed to a decline in comparable sales and a decline in sales of the company’s Boston Proper online womenswear brand.

In the quarter, comparable sales for the company declined by 3.2% compared to an increase of 4.3% in the same period last year. The Chico’s and White House Black Market brands’ comparable sales fell 1.7% and 7.4%, respectively. Soma’s comparable sales were up 2.1% in the quarter, compared to an increase of 13.7% in the same period last year.

Gross margin improved by 81 basis points year over year, due to better inventory management in the fourth quarter and charges related to non-go-forward inventory in fiscal year 2014.

SG&A expense was 50.8% of sales, up 237 basis points, mainly due to increased store occupancy and marketing costs.

2015 RESULTS

Consolidated net sales for the year amounted to $2.6 billion, and were down 1.2% from $2.7 billion in 2014. A 1.5% drop in comparable sales and a fall in Boston Proper sales were the main contributors to the net sales decline. The opening of new stores in 2015 partially offset the decline. Adjusted net earnings for the year were $105.9 million, or $0.75 per share, down from fiscal 2014’s net earnings of $111.9 million, or $0.73 per share. GAAP EPS was $0.01 for the year, compared to $0.42 in 2014.

GUIDANCE

Chico’s 2016 financial forecast excludes Boston Proper, which it sold earlier this year. The company expects flat to slightly negative comparable sales, and a flat gross margin. The company also stated that the absence of Boston Proper will help it improve its operating margin by 100 basis points and EPS by $0.09. The company expects to incur $75–$80 million in capital expenditure, and to open approximately 25 new stores and close an additional 50 stores this year in order to optimize capital allocation and reduce costs.

The current consensus estimate calls for revenue of $2.6 billion and EPS of $0.78.