Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

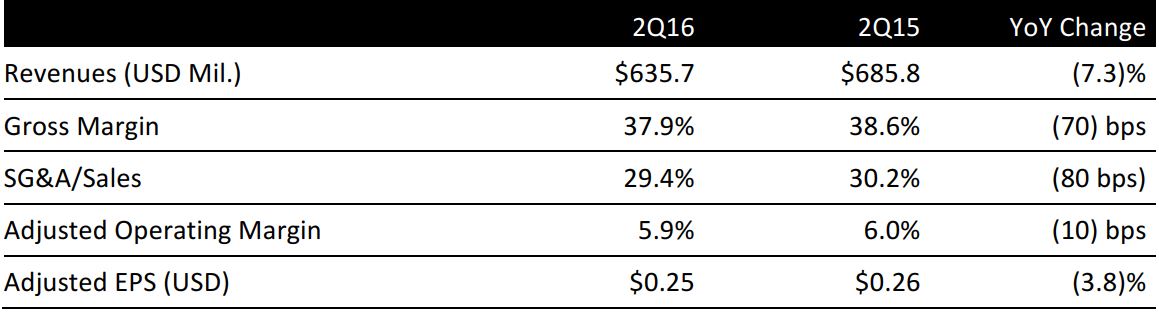

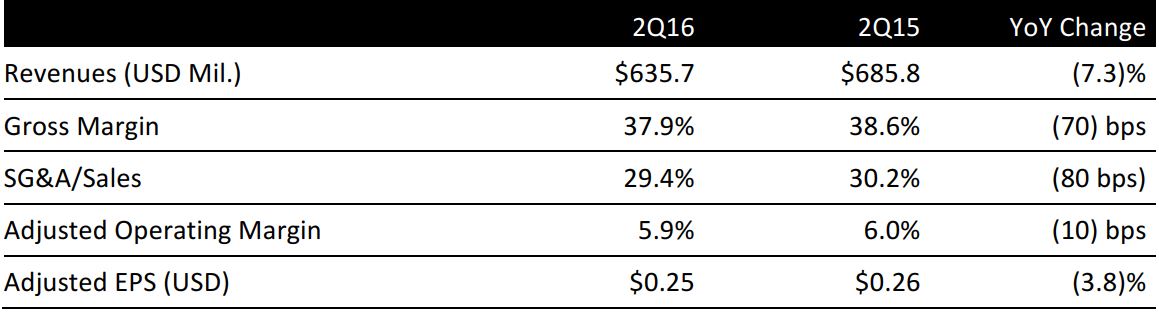

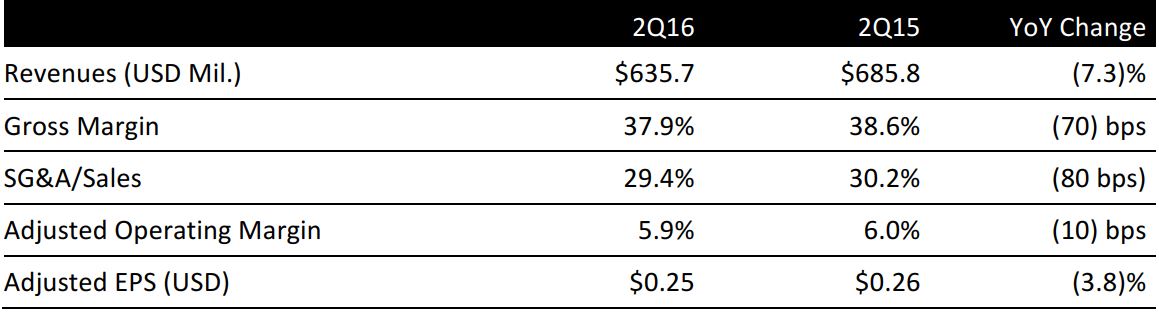

Women’s apparel and accessories group Chico’s FAS reported 2Q16 revenues of $685.8 million, down 7.3% year over year, but beating the consensus estimate of $632.4 million. The revenue decrease included $26.3 million attributable to Boston Proper. Chico’s FAS completed the sale of its Boston Proper business in January, 2016. After excluding Boston Proper, the decline in revenue was 3.6%, which reflected a 3.1% decline in comparable stores and store closures. Brand comps were driven by a reduced transaction count and lower average dollar sales.

Chico’s comparable-store sales were down by 5.1%; reduced promotional selling impacted Chico’s top line.

White House | Black Market (WHBM) sales were down 1.3%. For WHBM, dresses, woven tops, denims and accessories resonated with customers whereas knits, skirts and bottoms were weaker.

Soma sales were up 0.7% due to the Lift Bra, which launched during the second quarter. The Lift Bra has a lower neckline and a strappier look, and is an expanded silhouette option for the brand’s Enticing Lift Bra. Soma's slim collection had positive comps, and bras and sleepwear were also strong. Soma launched a sports collection at the start of the third quarter which is also off to a good start.

The company announced that it will reduce corporate and field leadership by 200 positions, or 13%. The announced organizational redesign clarified roles and said that it will create a flatter organization in order to be more responsive to customers. Chico’s brand President, Cynthia S. Murray, is leaving and there is currently a search for her replacement. These organizational changes are expected to result in $25 million of annualized savings. Approximately 60% of the expense savings will be reflected in selling, general and administrative expenses (SG&A) while the other 40% is related to cost of goods sold. The capital expenditure estimate for the year remains unchanged at $65 million to $70 million.

Chico’s FAS completed the assessment phase of its supply chain initiative and leveraged its customer shopping data to define the optimal frequency of fashion delivery. The company determined 90% of its transactions go through its loyalty program. It analyzed its loyalty-program data and found the loyalty customer wants newness.

Chico’s FAS determined it could reduce the frequency of new floor sets by up to 30% and incorporate more frequent capsules of newness to highlight new merchandise. It found reducing the floor sets will improve the average unit revenue by increasing overall merchandise offered at full price. It will also decrease expenses related to sourcing, design, distribution, marketing and store labor. The company also found it can reduce store count by up to 20%. Taken together, Chico’s estimates the assessment and its combined efforts will generate a further $30–$40 million of annualized savings. The organizational redesign combined with previously announced cost-reduction and operating efficiency initiatives increases expected annualized savings to $90 million to $100 million which is approximately 4% of 2015 net sales.

Chico’s FAS plans to close 35 stores this fiscal year. The company estimates it will close a total of approximately 155 stores through 2017. The closures will be primarily in the Chico’s and White House | Black Market brands. Chico’s FAS plans to open approximately 17 more stores; more than half of the new stores will be Soma locations. The company continues to invest in existing stores and technology to advance the customer experience.

2016 Outlook

The company expects a low-single-digit comparable-sales decline for the second half of the year. Chico’s expects the lower sales will result in a decrease in gross margin rate, which will be partially offset by an increase in the merchandise margin rate. This decrease is expected to be offset by a decline in SG&A as a percent of sales, a result of the previously announced cost reduction and operating efficiency initiatives.

The Chico’s brand is taking steps to improve its merchandise and recently relaunched Zenergy, its athleisure line, and its Travelers collection. The merchandising changes are new, and early indications are positive. Chico's intends to expand its petite offerings to 55 stores. Chico’s will also launch its on-trend denim stores, Denim for Everything, in the fall. The White House | Black Market is also expanding its line so customers can easily transition their outfits from work to evening.